Our Innovation Analysts recently looked into emerging technologies and up-and-coming startups working on solutions for the financial services sector. As there is a large number of startups working on a wide variety of solutions, we want to share our insights with you. This time, we are taking a look at 5 promising fraud prevention Startups.

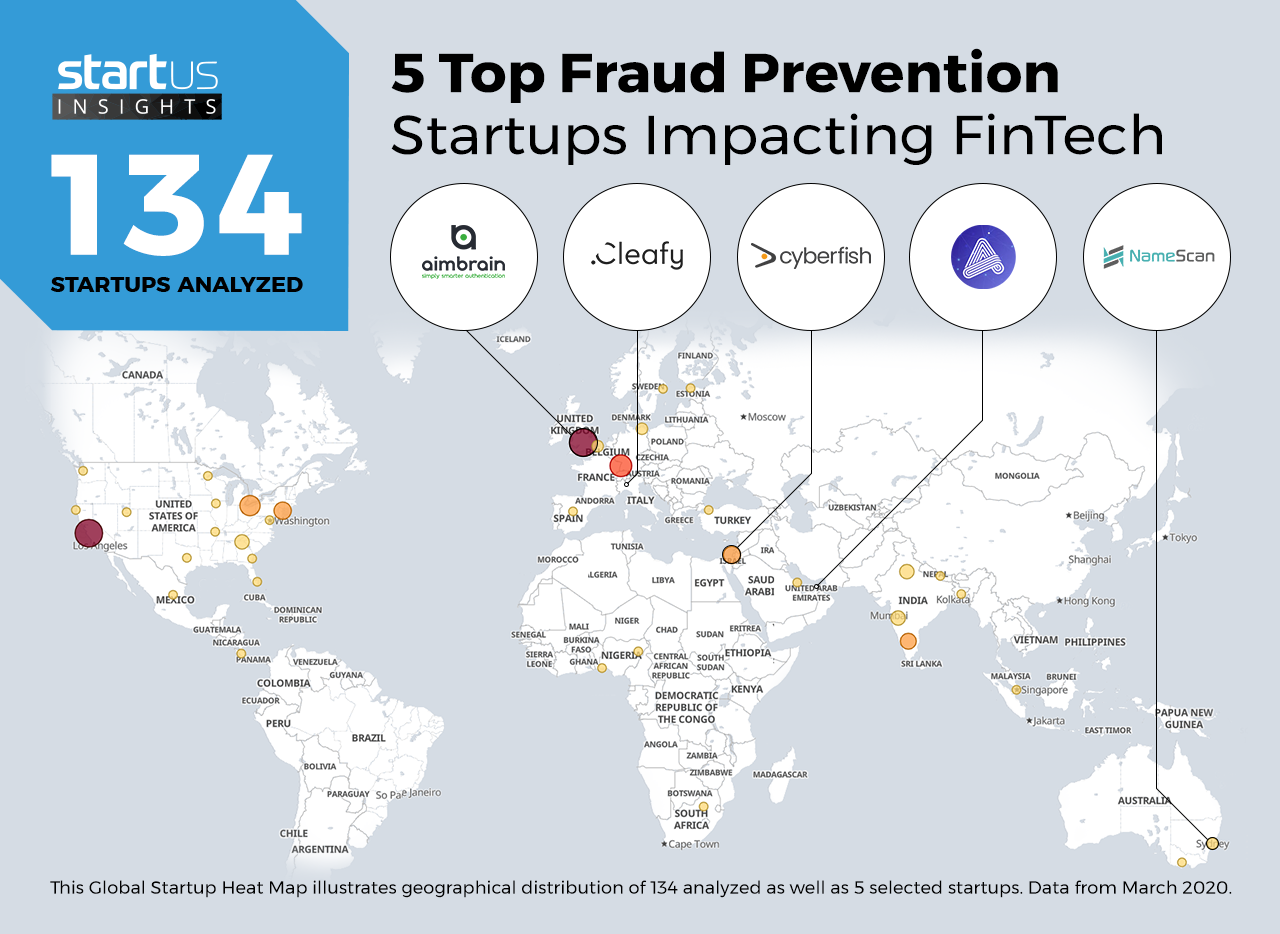

Heat Map: 5 Top Fraud Prevention Startups

For our 5 top picks, we used a data-driven startup scouting approach to identify the most relevant solutions globally. The Global Startup Heat Map below highlights 5 interesting examples out of 134 relevant solutions. Depending on your specific needs, your top picks might look entirely different.

AimBrain – New Account Fraud Detection

Newly-registered bank account users need some basic onboarding to use the service, making them relatively easy prey for fraudsters. In order to avoid important data breaches, financial organizations implement behavioral authentication algorithms, smart alerts, risk assessments, and deep learning technologies.

The British company AimBrain, which was recently acquired by BioCatch, uses deep learning to target new account fraud and account takeover threats. The company’s authentication software blends patented passive behavioral ID data with active voice, mimics, and movement modules to establish a complex safeguard for new and existing users.

Cleafy – Anti-Fraud Surveillance

Anti-fraud surveillance focuses on the continuous monitoring of financial transactions to discover unusual or suspicious activity. Besides, anti-fraud observation systems ensure that financial organizations pinpoint and eliminate threats immediately, while securely maintaining their patrons’ accounts. As a result, startups across the world develop fraud monitoring tools that comprise advanced rule-based engines, anomaly detection algorithms, and powerful big data analytics.

The Italian company Cleafy develops a continuous fraud detection and risk assessment application for the financial services and other industries. The scalable platform monitors operational traffic and cumulative risk scoring while protecting data in an adaptive and robust manner. In addition, the software incorporates real-time deterministic algorithms for threat diagnosis.

Cyberfish – Anti-Phishing

Another technique popularly employed by fraudsters includes hacking financial and banking systems through phishing. This method concentrates on stealing financial credentials by means of malicious emails, fake phone calls, and exploitation of social media information. Contemporary anti-phishing software operates to comprehensively analyze user content, target and block suspicious alarms, as well as provide general anti-virus and anti-spam safeguard.

The Israeli startup Cyberfish builds a platform to eliminate phishing and spearfishing by using a combination of artificial intelligence (AI), computer vision, and contextual training. The platform employs proactive detection, in addition to cloud email integration, to analyze fake profiles or accounts to avoid user impersonation.

Amani – Identity Verification

Every day, individuals and financial institutions handle numerous transactions online. An increasing number of cases related to identity theft and fraud, worldwide, undermines trust and confidence in terms of the security of financial accounts. Consequently, startups work to strengthen an identity verification process with the power of biometric analysis, artificial intelligence, and machine learning.

The UAE-based startup Amani develops an AI-enhanced risk management ID verification platform for finance, eCommerce, and other industries. The platform involves an auto-capture ID module, 4D biometric detection, and fraud analysis algorithms. Moreover, it is based on specific criteria and secure document management.

NameScan – Anti-Money Laundering (AML)

Banks and financial companies have to comply with various anti-money laundering requirements in order to protect their customers. These requirements also help identify potential chains of cybercriminals. Unfortunately, conventional AML systems create a lot of false alarms and waste valuable resources. Contemporary anti-money laundering software, mediated by Blockchain and machine learning, aims to distinguish between legal and criminal activity with greater accuracy and with lesser time spent by AML teams.

The Australian startup NameScan offers an anti-money laundering and anti-terrorism financing compliance software for financial institutions. The software allows for real-time secure checking of clients against lists of politically-exposed, sanctioned, or special-interest persons. Besides, the platform supports financial history scanning and streamlines the due diligence process.

What About The Other 129 Solutions?

While we believe data is key to creating insights it can be easy to be overwhelmed by it. Our ambition is to create a comprehensive overview and provide actionable innovation intelligence for your Proof of Concept (PoC), partnership, or investment targets. The 5 fraud prevention startups showcased above are promising examples out of 134 we analyzed for this article. To identify the most relevant solutions based on your specific criteria and collaboration strategy, get in touch.