Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked robotic process automation solutions.

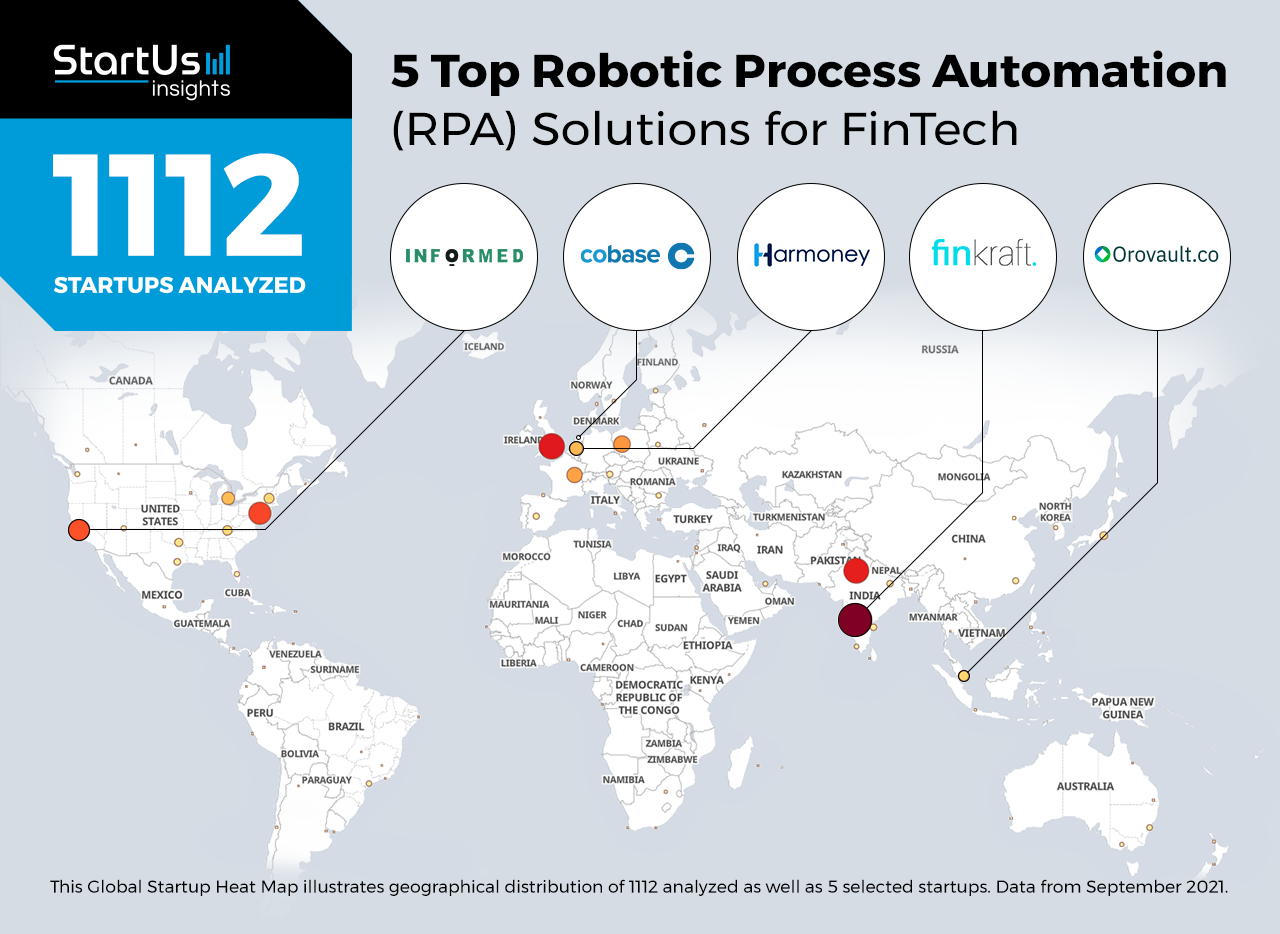

Global Startup Heat Map highlights 5 Top Robotic Process Automation Solutions impacting Financial Services out of 1 112

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 1 112 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 1 097 robotic process automation solutions for FinTech, get in touch.

Harmoney enables Compliance Workflow Automation

Financial companies face massive administrative tasks and compliance requirements which take up a lot of employee work hours in monitoring and auditing tasks. This is why startups are leveraging robotic process automation and artificial intelligence (AI) to automate compliance workflows. Such solutions eliminate human error, save time and costs, and allows financial companies to stay flexible and updated.

Belgian startup Harmoney provides a compliance workflow automation platform. Its business process engine uses RPA to deliver fully automated and high-speed workflows across channels and products. It also provides deep insights into the onboarding and compliance processes, enabling managers to optimize workflows. Further, the startup offers Financial Passport, a secure and centralized customer vault that automates digital onboarding and compliance processes.

Informed.IQ provides Verification Automation

Banks and lenders process large amounts of paper-based documents for purposes such as credit assessments. The unstructured and complex nature of this data means that employees spend long hours manually verifying these documents. To automate and speed up verifications, startups utilize RPA. This also improves the efficiency of know-your-customer (KYC) and anti-money laundering (AML) compliance.

Informed.IQ is a US-based startup that delivers verification automation for banks and government institutions. The startup’s solution uses RPA to automatically process documents in consumer credit applications, verifying their details. It detects fraudulent documents by comparing them with verified fraudulent data from its database and the dark web. By digitizing the verification process, the startup improves productivity and return on investments (ROI) for banks.

Finkraft offers Invoice Validation

In many jurisdictions, e-invoices are becoming mandatory for corporate taxation. However, companies often receive invoices from a large number of vendors, each in a different format. Validating these invoices and reconciling them with other data is a time-consuming task. This is why FinTech startups offer RPA-based invoice validation platforms.

Finkraft is an Indian startup offering invoice validation solutions. The startup scans invoices from manual and bulk uploads as well as auto-fetches them from corporate mail servers. It then identifies and escalates missing data points as well as validates the eligibility of invoices for particular purposes. Finkraft’s solutions further simplify corporate finance by validating vendor compliance and enabling real-time reconciliation between records.

Cobase builds a Multibanking Platform

Companies often have multiple bank accounts spread across different operations and jurisdictions. Managing these accounts and then reporting to managers is an uphill task for in-house finance teams. To make this easier, FinTech startups provide multibanking solutions. In addition to central financial data management, this approach offers real-time liquidity insights and seamless in-house transfers.

Dutch startup Cobase develops a multibanking platform. The platform links multiple bank accounts, allowing companies to monitor all of their transactions in a single place. It also features modules for payments, cash management, in-house banking, liquid forecasting, and treasury. These features, along with the integration of enterprise resource planning (ERP) and transaction reporting systems, further increase financial operational efficiency.

Orovault provides Intelligent Process Automation (IPA)

Filing taxes is a challenging task for everyone, but even more so for wealthy individuals and fund managers. Due to the complex documentation, the process is prone to human errors and inaccuracies. This is why FinTech startups are leveraging robotic process automation for tax reporting. By automating the process, such solutions prevent potentially expensive mistakes as well as late fees and penalties.

Singaporean startup Orovault provides intelligent process automation solutions for tax reporting and wealth management. The startup combines RPA and domain experts to assist high-net-worth individuals (HNWI) in meeting tax regulations. It offers both generic and country-specific reports to simplify tax return filing for both income and capital gains. The startup also provides private and secure tax reporting-as-a-service solutions to family offices, asset managers, and investment accountants.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on blockchain, biometrics, and cybersecurity as well as cryptocurrencies. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.