Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover five hand-picked digital insurance startups.

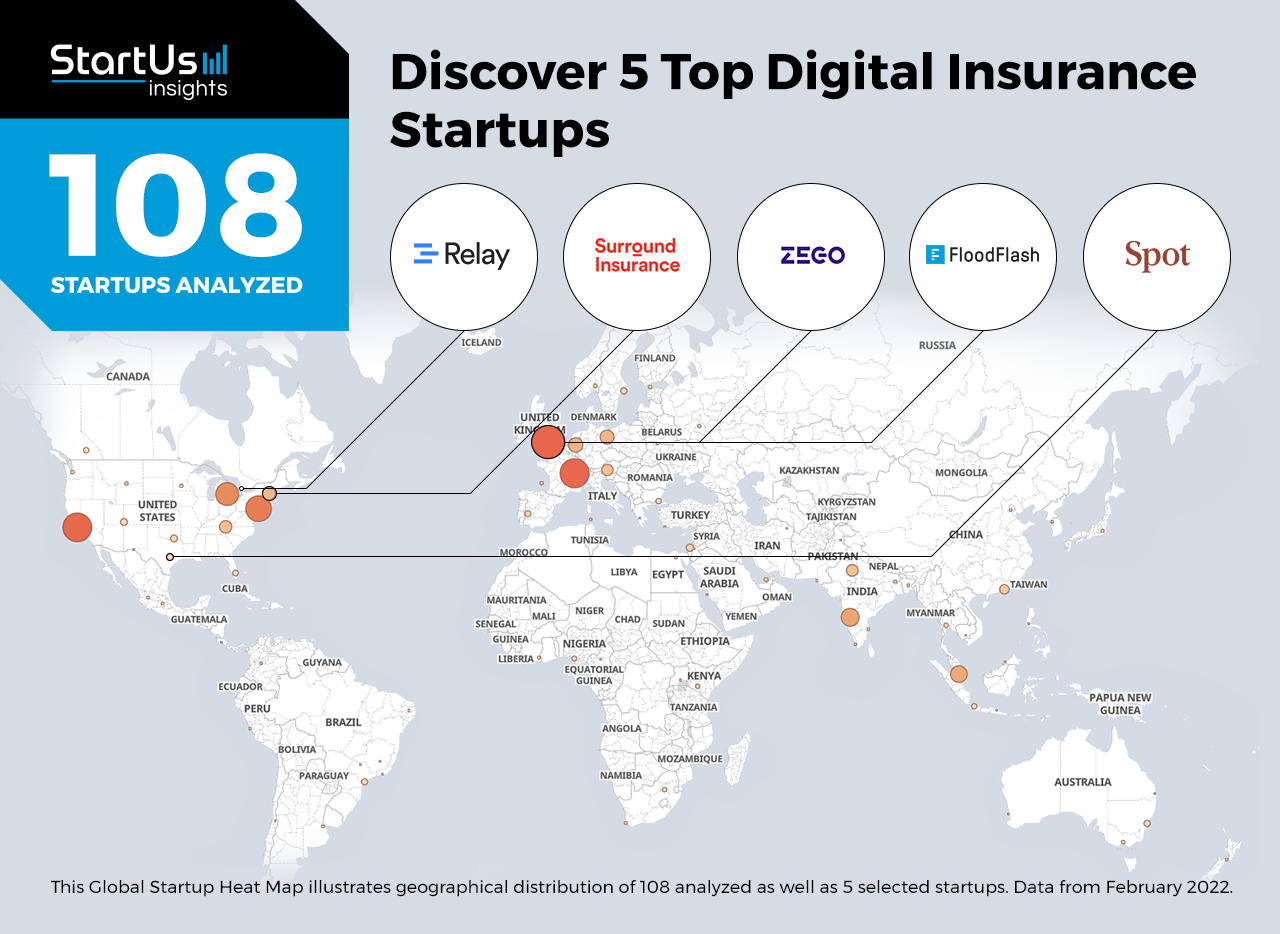

Out of 108, the Global Startup Heat Map highlights 5 Top Digital Insurance Startups

The insights of this data-driven analysis are derived from the Big Data and Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups and scaleups globally. The platform gives you an exhaustive overview of emerging technologies and relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 108 exemplary startups and scaleups we analyzed for this research. Further, it highlights five InsurTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups and scaleups in this report. For insights on the other 103 digital insurance solutions, get in touch with us.

Relay Platform provides a Reinsurance Platform

Founding Year: 2018

Location: Toronto, Canada

Funding: USD 8,1 M

Partner for: Insurance Digitization

Canadian startup Relay Platform develops a software platform for insurance and reinsurance. The startup’s platform connects users electronically to carriers and reinsurers to generate quotes and client proposals in just a few minutes. Additionally, it enables process digitization and augments users’ connections through direct electronic quoting as well as better manage underwriters. The platform supports larger, complex deals using an intuitive and visual format, and is useful for insurance brokers, insurance underwriters, and insurance cedents. This reduces the time for negotiating, updating, and closing client proposals that are currently paper-based.

Spot Insurance simplifies Injury Insurance

Founding Year: 2017

Location: Austin, US

Funding: USD 23,3 M

Partner for: Sports Injury Insurance

US-based startup Spot Insurance provides digital insurance for sports-related and accidental injuries. The insurance covers a person’s injuries sustained during adventurous trips or in the kitchen. The startup also offers family-wide insurance coverage for peace of mind and financial protection. Users are able to purchase and claim their insurance through Spot Insurance’s mobile application. Moreover, unlike other tedious and long insurance claim processes, the startup’s customers need only a photo of their medical bill to start the claim process and receive assistance from an agent.

Surround Insurance offers Customizable Insurance Policies

Founding Year: 2018

Location: Cambridge, US

Funding: USD 2,7 M

Partner for: Auto & Bike Insurance

Surround Insurance is a US-based startup that offers custom property and casualty insurance products. The insurance customization process begins with potential buyers specifying their lifestyles such as if they rent or own vehicles, problems surrounding their homes, or job type. The startup then checks the buyer’s insurance qualification and provides recommendations. This allows working professionals to quickly purchase insurance while offering flexibility to the insurance policies.

Zego provides Insurance for Vehicle Fleets

Founding Year: 2016

Location: London, UK

Funding: USD 201,7 M

Partner for: Fleet Insurance

UK-based startup Zego provides commercial motor insurance for both businesses and self-employed drivers. Its fleet insurance offers flexible coverage for all types of vehicles, irrespective of the fleet size. The solution provides bonuses through reduced policy renewal amount for good fleet driving metrics and offers a live view of all claims continuously. The digital solution thus enables fleet managers to always access and manage their policy online, facilitating fleet management.

FloodFlash advances Connected Insurance

Founding Year: 2017

Location: London, UK

Funding: USD 2,7 M

Partner for: Flood Insurance

FloodFlash is a UK-based startup that provides parametric insurance different from traditional indemnity cover. The startup uses smart sensors that are equipped with high accuracy, ultrasonic depth measurement technology with mobile connectivity to send up-to-date flood data. When the sensor detects a flood at the user-defined trigger depth, a text notification is sent to confirm that the user has been affected. The data processed from the sensor is used to validate and pay claims as soon as possible. Such solutions allow business owners to provide tamper-free proof and bypass the tedious process of manually applying for claims.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on subscription-based insurance, process digitization, real-time asset monitoring as well as the Internet of Things (IoT). While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore financial technologies in more detail, simply let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.