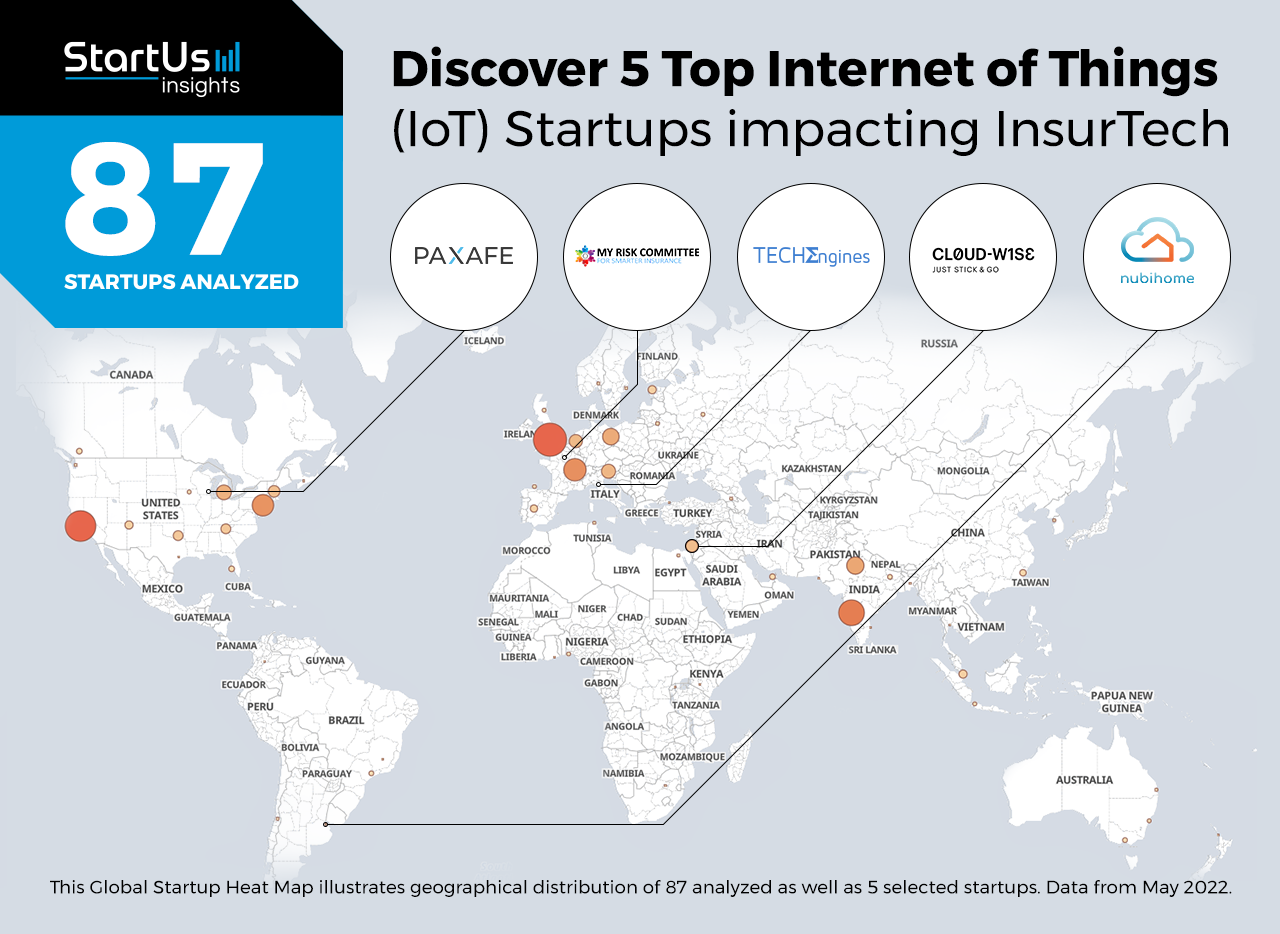

Out of 87, the Global Startup Heat Map highlights 5 Top Internet of Things Startups impacting InsurTech

Startups such as the examples highlighted in this report focus on asset monitoring and optimization, risk management, insurance fraud prevention as well as artificial intelligence (AI) and predictive maintenance. While all of these technologies play a significant role in advancing the insurance industry, they only represent the tip of the iceberg. This time, you get to discover five hand-picked internet of things startups impacting InsurTech.

The Global Startup Heat Map below reveals the geographical distribution of 87 exemplary startups & scaleups we analyzed for this research. Further, it highlights five IoT startups that we hand-picked based on scouting criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other internet of things solutions impacting InsurTech, get in touch with us.

Cloud-Wise facilitates Insured Vehicles Monitoring

Founding Year: 2016

Location: Kfar Sava, Israel

Innovate with Cloud-Wise for Accident Claim Fraud Identification

Israeli startup Cloud-Wise develops an IoT device for vehicle monitoring. It is a stick-and-go multi-sensor device to track vehicle location with minimal dependence on the global positioning system (GPS). The device’s sensors also log data related to vehicle dynamics and driver behavior, including speed, routes, and accidents. This allows insurance companies to mitigate fraud claims and save time by identifying real accidents and actual damages.

Techengines accelerates Claim Processing

Founding Year: 2016

Location: Florence, Italy

Collaborate with Techengines for Tariff Analysis & Claims Assistance

Techengines is an Italian startup that offers an artificial intelligence of things (AIoT) platform that aids tariff analysis and claims assistance. It enables accident reconstruction and validation, damage estimation, as well as home, health, and pet claim processing. InsurEngines is the startup’s cloud-based platform that accelerates insurance product realization and better satisfies personalized consumer needs using the embedded AIoT algorithms. Techengines’ algorithms set up a backend data processing unit that takes in photos, IoT sensor data, and other insurance data to automatically produce claim estimates and speed up settlements.

Nubihome offers Customer Risk Analysis

Founding Year: 2016

Location: Buenos Aires, Argentina

Partner with Nubihome for Insurance Risk Management

Nubihome is an Argentina-based startup that provides a smart home-as-a-service informatics platform for insurance companies to assess home asset risks. The startup’s smart devices, like wifi cameras, smart bands, and smoke detectors, connect with its cloud-based platform. The platform then controls the devices as well as collects and analyzes contextual data to identify customer behavior and provide insights for risk mitigation. This way, Nubihome allows insurance companies to better understand the customer risk levels and identify fraud patterns.

My Risk Committee allows Industrial Insurance Optimization

Founding Year: 2020

Location: Paris, France

Reach out to My Risk io for Industrial Risk Management

French startup My Risk Committee develops an IoT risk management platform that captures data from industrial assets using IoT devices. It continuously monitors assets for real-time management and data-driven decision-making. The platform leverages real-time sensor data to prompt emergency responses and enables predictive maintenance of equipment. This improves risk management by preventing mishaps which enhances insurance underwriting accuracy as well as prevents downtime for industrial assets.

Paxafe simplifies Insurance Risk Tracking

Founding Year: 2018

Location: Milwaukee, USA

Innovate with Paxafe for Faster Package Insurance Claims

Paxafe is a US-based startup that provides an IoT solution that tracks shipments along the supply chain. The startup’s tracking devices are applicable across all ranges of shipments irrespective of product and package type, transit time, or mode. Paxafe’s solution provides real-time visibility into supply chain operations by providing a precise estimated time of arrival of shipments. Its AI-driven online platform identifies historical trends to prevent future excursions and optimize the supply chain through prescriptive analytics. This information allows insurance providers to improve loss ratio, data-driven underwriting models, and risk selection.

Where is this Data from & how to Discover More InsurTech Startups?

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the insurance industry. The insights of this data-driven analysis are derived from our Big Data & AI-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & lets you scout relevant startups within a specific field in just a few clicks. To explore insurance technologies in more detail, let us look into your areas of interest. For a more general overview, download our free InsurTech Innovation Report to save your time and improve strategic decision-making.