Understanding where investments are flowing is more than a measure of current financial activity; it’s a window into future growth and market confidence. That’s why this article recognizes the latest venture capital trends, exploring the most funded sectors and industries of 2023, and offering insights into the forces driving venture capital attention. From sustainability’s impressive strides to the solid foundations of real estate, we’ll navigate through the significant investments of the past year and cast an eye toward the trends shaping 2024. Join us as we unravel the complex tapestry of financial currents powering innovation today and sculpting the landscapes of tomorrow:

- 10 Most Funded Sectors 2023

- Outlook: Sectors to Receive Most Funding in 2024

- The Future of VC Funding and How to Stay Ahead

The insights in this article are provided by the Discovery Platform, an AI- and Big Data-powered tool designed specifically to keep venture capitalists at the forefront of the industry. Featuring detailed data on over 3.7 million startups and scaleups globally, alongside an extensive collection of 20,000 technologies and trends, the platform is an invaluable resource for those eager to stay informed and one step ahead of emerging trends. Whether you’re looking to refine your investment strategy or explore new market opportunities, the Discovery Platform offers the insights you need to make informed decisions. Book a demo today to see how it can transform your approach to venture capital.

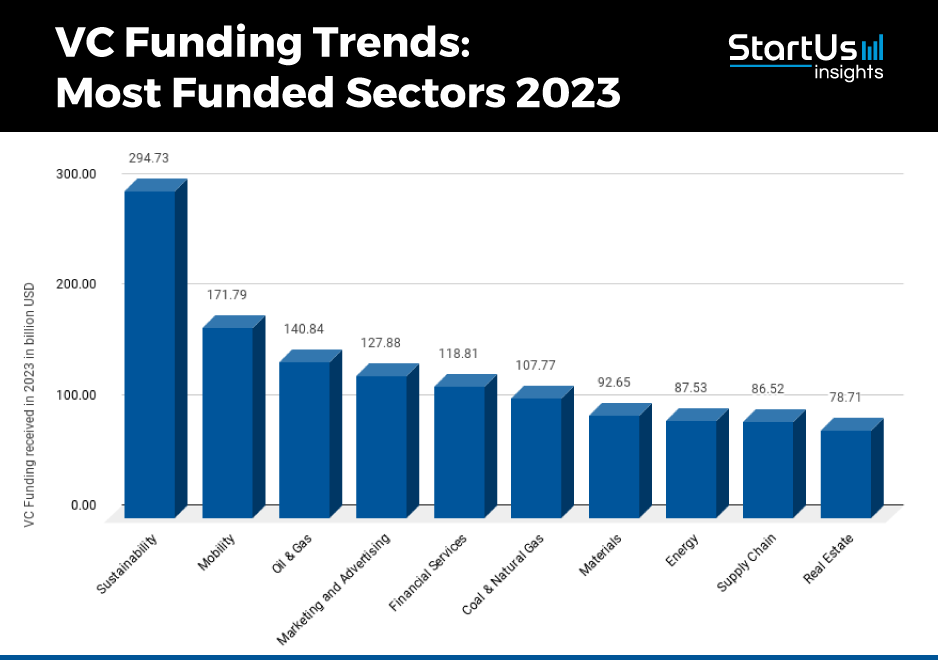

VC Funding Review: 10 Most Funded Sectors 2023

In 2023, global VC investments, totaling approximately $1.207 trillion for the top 10 industries, were shaped by a diverse array of sectors, each attracting significant investments due to their unique interplay of innovation, market demands, and societal shifts. Below, we look at these sectors, revealing the technologies that received the most funding and discussing the reasons behind their appeal to VCs:

1. Sustainability (US$ 294.73B)

Standing at the forefront of VC funding trends, the sustainability sector’s substantial capital intake is a testament to the growing global urgency for environmental stewardship and the promising opportunities within emerging green technologies. This massive investment underscores the sector’s potential for high returns and societal impact.

2. Mobility (US$ 171.79B)

As the fabric of urban life transforms, the mobility sector has captured investors’ attention with its innovative solutions to transportation challenges. This significant funding reflects its pivotal role in redefining how people and goods move in an increasingly connected world.

3. Oil and Gas (US$ 140.84B)

Despite a global push towards renewables, the oil and gas sector continues to draw substantial investments. This trend highlights the industry’s ongoing relevance and the market’s interest in technologies that promise more efficient and environmentally sensitive extraction and processing methods.

4. Marketing and Advertising (US$ 127.88B)

With the digital revolution reshaping consumer engagement, the marketing and advertising sector has seen a surge in funding. This reflects the industry’s critical role in driving business growth and the high potential for innovative strategies and tools.

5. Financial Services (US$ 118.81B)

As FinTech reshapes financial interactions, venture capital has flowed generously into this sector. Investments here indicate confidence in the continued evolution and impact of financial technologies on global markets and consumer behavior.

6. Coal & Natural Gas Industry (US$ 107.77B)

Investment in this sector suggests a strategic focus on energy resources that remain critical to the global economy. It highlights the balance VCs are striking between traditional energy investments and the shift towards renewable sources.

7. Materials (US$ 92.65B)

Reflecting the fundamental need for innovative materials in various industries, this sector’s venture capital funding underscores its importance in driving technological advancements and supporting sustainable solutions.

8. Energy (US$ 87.53B)

The broad energy sector continues to attract attention with its blend of traditional and emerging technologies. Funding here signals the industry’s integral role in shaping a sustainable future and the diverse opportunities it presents.

9. Supply Chain (US$ 86.52B)

As global commerce evolves, so does the importance of efficient, resilient supply chains. The investments in this sector reflect its critical role in supporting global trade, technological advancements, and response to consumer demands.

10. Real Estate (US$ 78.71B)

With urbanization and technological integration, the real estate sector’s considerable funding points to its potential for innovation in how people live, work, and interact with their environments.

These sectors not only garnered the most venture capital in 2023 but also represent key areas where technology and market needs intersect, offering a glimpse into the future of innovation and investment.

Outlook: Sectors to Receive Most Funding in 2024

As we peer into the future of 2024, certain sectors stand out as likely candidates for substantial venture capital investment. Driven by ongoing technological advancements, societal shifts, and market needs, these areas are poised to shape the next wave of innovation and economic growth. Here’s where we predict the focus of global venture funding will be:

1. Energy

Anticipated to remain a powerhouse in attracting investments, the energy sector’s focus is shifting towards more sustainable and efficient technologies. As the world continues to demand cleaner energy solutions, this sector is expected to see robust funding, reflecting its critical role in a greener future.

2. Telecommunications

With the world becoming increasingly interconnected, telecom is set to maintain its appeal to investors. The sector’s continuous evolution, driven by 5G, IoT, and other emerging technologies, promises enhanced connectivity and new opportunities, making it a magnet for 2024’s funding.

3. Industrial Processes

As industries seek to become more efficient and environmentally friendly, innovative industrial processes are becoming crucial. Investments are likely to surge in technologies that promise to revolutionize manufacturing, waste management, and resource utilization.

4. Pharmaceuticals

The pharmaceutical sector is expected to continue its growth trajectory as it responds to global health challenges and demographic changes. Funding will likely focus on areas like personalized medicine and the development of new treatments and vaccines.

5. Biotechnology

BioTech stands at the forefront of potential investment due to its role in addressing health, agricultural, and environmental issues. The sector’s innovative applications in genetics, biofuels, and disease treatment make it an attractive prospect for future funding.

6. Oil & Gas

While transitioning to renewables, the oil and gas sector will still attract significant investment, particularly in technologies aimed at making extraction and processing cleaner and more efficient.

7. Media and Entertainment

The demand for content and evolving modes of consumption will drive investments in media and entertainment. This sector is likely to see growth in funding for innovative platforms, content creation tools, and immersive technologies.

8. Chemistry

As a fundamental science impacting numerous industries, the chemistry sector is poised for investment, particularly in sustainable materials and innovative chemical processes that align with environmental goals.

9. Materials

Continuing its essential role, the materials sector is expected to attract funding for developing advanced materials that are stronger, lighter, and more sustainable – driving innovation across industries.

10. Clothing

With a growing focus on sustainability and technology integration, the clothing industry is set to receive considerable investment. Areas like smart fabrics, sustainable manufacturing, and supply chain innovation will likely be focal points.

These predictions for 2024’s VC Trends not only highlight where capital is expected to flow but also reflect the broader trends shaping society and the global economy. As these sectors evolve, they offer venture capitalists opportunities to invest in the technologies and companies that will define the future.

Also read: Most funded Trends & Technologies 2023 & Outlook 2024

The Future of VC Funding and How to Stay Ahead

As the venture capital landscape continues to evolve, staying ahead means more than just following trends; it involves anticipating them. Recognizing and understanding emerging sectors and technologies early is crucial for capitalizing on these opportunities effectively. A reliable, comprehensive source of information becomes an invaluable tool, enabling VCs to navigate this complex terrain with confidence and strategic foresight.

![AI in Automotive: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Automotive-SharedImg-StartUs-Insights-noresize-420x236.webp)

![AI in Healthcare: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Healthcare-SharedImg-StartUs-Insights-noresize-420x236.webp)