In this 2024 Data Center Industry Report, we delve into an ecosystem at the forefront of digital transformation. Data centers stand resilient amidst global challenges and this report unpacks the year’s milestones, analyzing trends from liquid cooling solutions to the surging demand for green data infrastructure. We present firmographic data and insights that capture the industry’s pulse, highlighting innovation, sustainability, and efficiency that redefine data management.

This report was last updated in July 2024.

This data center market report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Data Center Industry Report 2024

- Executive Summary

- Introduction to the Data Center Industry Report 2024

- What data is used in this Data Center Report?

- Snapshot of the Global Data Center Industry

- Funding Landscape in the Data Center Industry

- Who is Investing in Data Centers?

- Emerging Trends in the Data Center Industry

- 5 Data Center Startups impacting the Industry

Executive Summary: Data Center Industry Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 2000+ data center startups developing innovative solutions to present five examples from emerging data center industry trends.

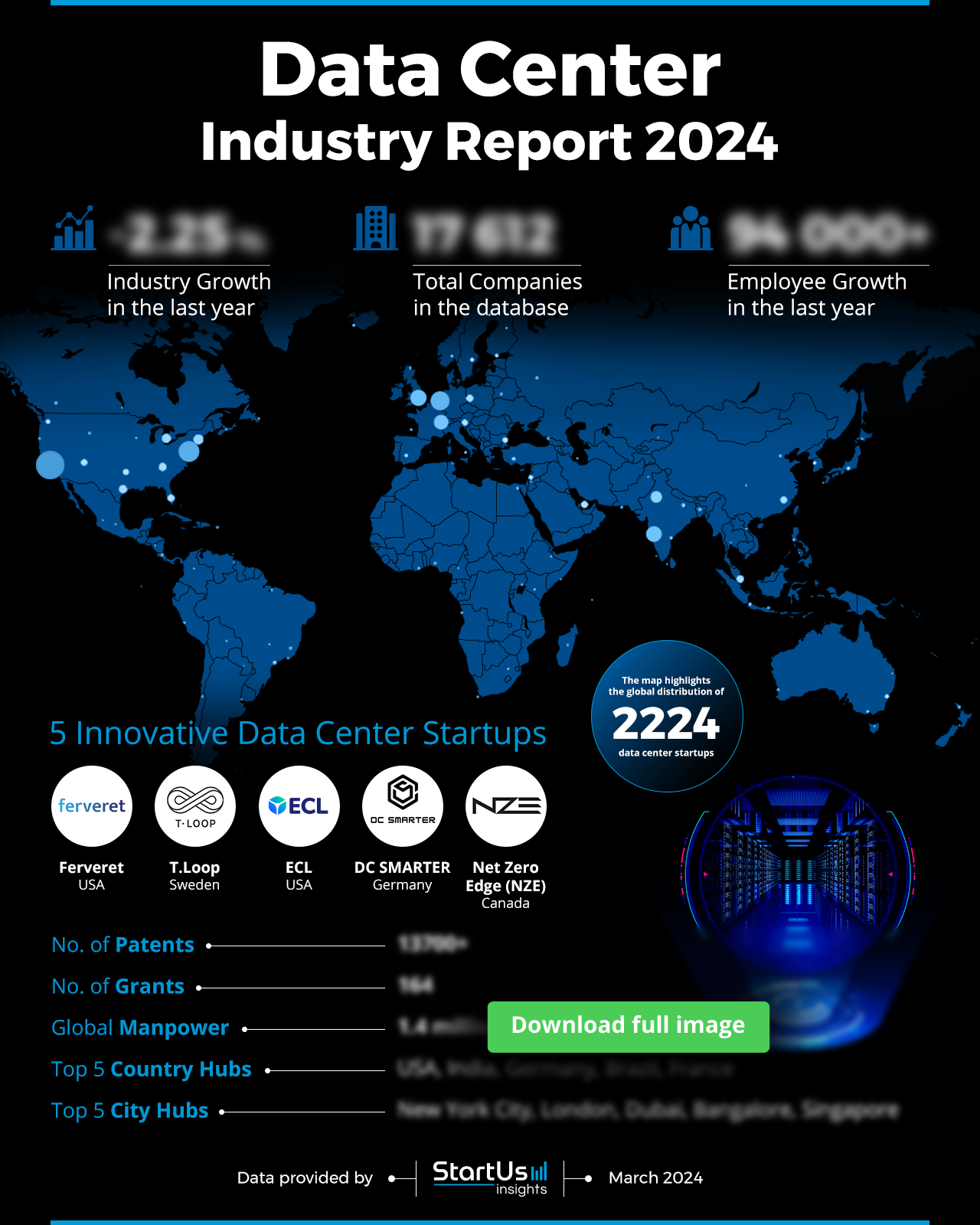

- Industry Growth: Despite a slight decline in overall industry growth (-2.25%), the data center sector demonstrates resilience with key advancements in technology and operations.

- Manpower & Employment Growth: The industry has reached a manpower strength of 1.5 million workers and has seen an increase of over 92000 employees in the last year alone.

- Patents & Grants: Over 13700 patents and 164 grants have been secured, signifying a strong commitment to innovation and development.

- Global Footprint: A global network is growing with the USA, India, Germany, Brazil, and France emerging as top country hubs. Cities like New York City, London, Dubai, Bangalore, and Singapore lead as key nodes for innovation.

- Investment Landscape: The industry has attracted substantial investments with an average investment round of USD 135 million and involvement from over 1400 investors.

- Top Investors: Major financial contributions have been made by Goldman Sachs, Deutsche Bank, and Brookfield Corporation, amongst others, amounting to over USD 4.7 billion in combined investment value.

- Startup Ecosystem: Five innovative startups showcased include Ferveret (Liquid Cooling), T.Loop (Data Energy Center), ECL (Green Data Center), DC SMARTER (Data Center Management), and Net Zero Edge (Subsea Data Center).

- Recommendations for Stakeholders: Stakeholders should continue to invest in areas showing significant trend growth, such as energy efficiency and sustainable operations. Supporting innovation through funding and resource development is also key.

Explore the Data-driven Data Center Report for 2024

The data center industry report uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Despite a 2.25% decrease in industry growth over the past year, the sector boasts substantial employee growth, adding over 94000 jobs. With 17612 data center companies cataloged, the report highlights the growth of the industry. Together, these startups contribute over 13700 patents and 164 grants, signaling a vibrant climate of research and innovation.

The global manpower supporting data centers has reached 1.5 million, indicative of the industry’s vast scale and its pivotal role in global data management. The USA, India, Germany, Brazil, and France are recognized as the top five country hubs, reflecting their strategic investments in technology infrastructure. Cities spearheading innovation include New York City, London, Dubai, Bangalore, and Singapore, which serve as critical city hubs for the industry.

What data is used to create this data center report?

Based on the data provided by our Discovery Platform, we observe that the data centers industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The data center industry is gaining media presence, with over 80000 news publications covering it in the last year.

- Funding Rounds: With access to data from over 2500 funding rounds, the industry stands at the top for investment activities.

- Manpower: The manpower strength in data centers exceeds 1.5 million workers, with an impressive addition of 92000 new employees last year.

- Patents: Innovation thrives in the data center sector, evidenced by the filing of over 13000 patents, a number that puts it at the forefront of technological advancement.

- Grants: The industry has received over 100 grants, highlighting its commitment to research and development.

A Snapshot of the Global Data Center Industry

The data center industry stands as a colossus in the tech sector with a substantial workforce of 1.5 million. The past year saw a surge, welcoming over 92000 new employees, showcasing the industry’s robust expansion and vitality. This surge underlines the industry’s resilience and its critical role in supporting the digital economy.

With over 168000 companies operating within the data center realm, the industry’s vastness and diversity are apparent. Such breadth suggests a dynamic and competitive market where the demand for data management solutions is continuously rising.

Explore the Funding Landscape of the Data Center Industry

The financial interest in the industry is significant. An average investment round injects a substantial USD 135 million, demonstrating high investor confidence and the anticipated profitability of the data sphere.

Over 1400 investors actively participate, culminating in more than 2500 funding rounds—a testament to the sector’s attractiveness and potential for high returns. Investments have spread across more than 1000 companies, underscoring the investors’ strategy to diversify and the growing opportunities within the industry. This spread also mitigates risk and fosters innovation across various niches within the data center sector.

Who is Investing in Data Centers?

The data center industry has witnessed a combined investment value exceeding USD 4.7 billion from its top investors. This financial influx underscores the industry’s significant impact on technology and infrastructure development.

- Leading the pack, Goldman Sachs has infused USD 1.1 billion into 5 companies. It demonstrates its commitment to driving innovation in digital solutions.

- Deutsche Bank follows, with investments totaling USD 786 million across 4 companies, reinforcing its strategic stakes in data management.

- Brookfield Corporation’s targeted investment approach has resulted in USD 775 million being allocated to 2 companies, indicating confidence in their chosen ventures.

- With USD 773 million invested in 3 companies, Natixis underscores the industry’s allure to diverse financial institutions.

- Equinix has also made a substantial impact, directing USD 581 million into 3 companies, actively shaping the data center landscape.

- Intel Capital has invested USD 92 million across 7 companies, betting on a range of potential innovators.

- BPI France’s contribution stands at USD 20 million, distributed among 5 companies, reflecting a dedication to nurturing growth within the sector.

- Techstars, with a keen eye for nascent potential, has invested USD 480000 thousand in 6 companies, backing the early stages of development.

- Telefonica rounds out the list, having invested USD 125 thousand in 4 companies, showcasing support for emerging players in the industry.

Explore Firmographic Data for All Data Center Industry Trends

These trends, coupled with their substantial mentions and the number of companies invested, highlight the industry’s prioritization of efficiency, sustainability, and the handling of large data inflows. Explore some details about top emerging trends:

- Liquid Cooling in data centers is gaining traction, as evidenced by the 96 companies specializing in this technology. With a workforce of 8000 and an addition of 450 new employees over the last year, this niche showcases a healthy annual growth rate of 2.91%. This trend points to the industry’s response to the need for more efficient cooling methods.

- The Green Data Center trend is marked by a growing consciousness towards eco-friendly operations, with 304 companies leading the charge. These companies employ over 32000 individuals, having expanded by 1500 new employees in the last year. Although the trend has a modest annual growth rate of 0.75%, it emphasizes renewable energy sources and energy-efficient practices within the industry.

- Modular Data Centers reflect an innovative shift towards flexibility and scalability, with 308 companies at the forefront of this trend. Employing 41000 people and growing by 2900 in the last year. It shows an annual growth rate of 0.16%. This steady increase indicates a strategic move by the industry towards pre-fabricated, mobile data center solutions that can adapt to changing needs and rapid deployment requirements.

5 Top Examples from 2200+ Innovative Data Center Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Ferveret develops Liquid Cooling Solutions

US-based startup Ferveret develops innovative liquid cooling technologies for data centers. Its solution utilizes subcooled boiling to remove high heat fluxes from processors, enhancing system performance. This approach allows for a significant reduction in energy waste and footprint size. It also doubles the performance of CPUs and GPUs, offering a sustainable alternative to traditional cooling methods. Ferveret’s technology supports various applications, including data centers, AI, and autonomous vehicles. This cooling solution optimizes chip performance, cuts electricity use, and reduces environmental impacts.

T.Loop integrates Data Centers & Energy Plants

Swedish startup T.Loop specializes in transforming data centers into efficient energy plants to significantly reduce carbon emissions. Its Data Energy Centers optimize energy use, integrating IT, real estate, and power grid needs. It also provides a platform that employs a heat recovery system and hydrogen fuel backup. Liquid cooling technologies in these centers facilitate lesser electricity consumption. Smart-UPS and batteries further support grid balancing and peak shaving, enhancing grid reliability. T.Loop also offers tailored colocation services, adapting to various cloud computing needs.

ECL builds Green Data Centers

US-based startup ECL builds and operates modular data centers globally. These centers prioritize sustainability, boasting off-grid, zero-emission, water-free operations with high efficiency. The ECL Block design ensures modularity, allowing scalability and adaptability across various locations. For clients, this approach significantly reduces the total cost of ownership by optimizing power and maintenance costs. Its data centers feature an innovative hydrogen power generation system, contributing to a zero-emissions goal. ECL’s platform also enhances visibility and control to ensure efficient and reliable data center operations.

DC SMARTER offers Data Center Management Tools

German startup DC Smarter introduces DC Vision, a data center management tool combining Augmented Reality (AR) and AI. This product enhances operational efficiency, reduces downtime, and integrates seamlessly with leading DCIM platforms. It offers real-time equipment status visualization, AI-driven object detection, and global collaboration via its Remote Assist. Users also benefit from instant access to asset information, device manuals, and work orders, streamlining maintenance and troubleshooting. DC Vision’s heat-mapping feature allows for real-time monitoring of server rack temperatures, facilitating proactive management.

Net Zero Edge specializes in Subsea Data Centers

Net-Zero Edge (NZE) is a Canadian startup that specializes in ocean-cooled subsea data centers. These data centers utilize the ocean’s natural cooling properties, significantly reducing energy consumption. The company’s approach negates the need for traditional energy-intensive cooling methods, promoting environmental efficiency. By situating data centers underwater, NZE leverages the ocean’s consistent temperatures for optimal operation. This strategy also results in a decrease in cooling energy costs. The technology also eliminates the use of fresh water for cooling, addressing a major industry challenge.

Gain Comprehensive Insights into Data Center Trends, Startups, or Technologies

The data center industry in 2024 reflects an ecosystem at the intersection of growth and innovation. The past few years have seen a substantial increase in manpower and investment, fueling advancements in liquid cooling, green infrastructure, and modular designs. As companies continue to prioritize energy efficiency and sustainability, the industry is poised to meet the global data demand with smarter, more efficient solutions. Get in touch to explore all 2000+ startups and scaleups, as well as all industry trends impacting data centers.