The 2024 Electric Vehicle (EV) Industry Report provides an in-depth analysis of a year marked by increasing market penetration and technological advancement. This report analyzes significant developments, such as autonomous driving capabilities, new battery technology, and the growth of charging infrastructure. Further, it investigates how market dynamics, regulatory ramifications, and competitive tactics influence the industry.

This report was last updated in July 2024.

This EV report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Electric Vehicle Report 2024

- Executive Summary

- Introduction to the EV Industry Report 2024

- What data is used in this EV Industry Report?

- Snapshot of the Global EV Industry

- Funding Landscape in the EV Industry

- Who is Investing in the EV Industry?

- Emerging Trends in the EV Industry

- 5 EV Startups impacting the Industry

Executive Summary: Electric Vehicle Outlook Report 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 1300+ EV startups developing innovative solutions to present five examples from emerging EV industry trends.

- Industry Growth Overview: The EV sector expands and develops in response to a shift in consumer preference toward sustainable products and stricter international environmental regulations.

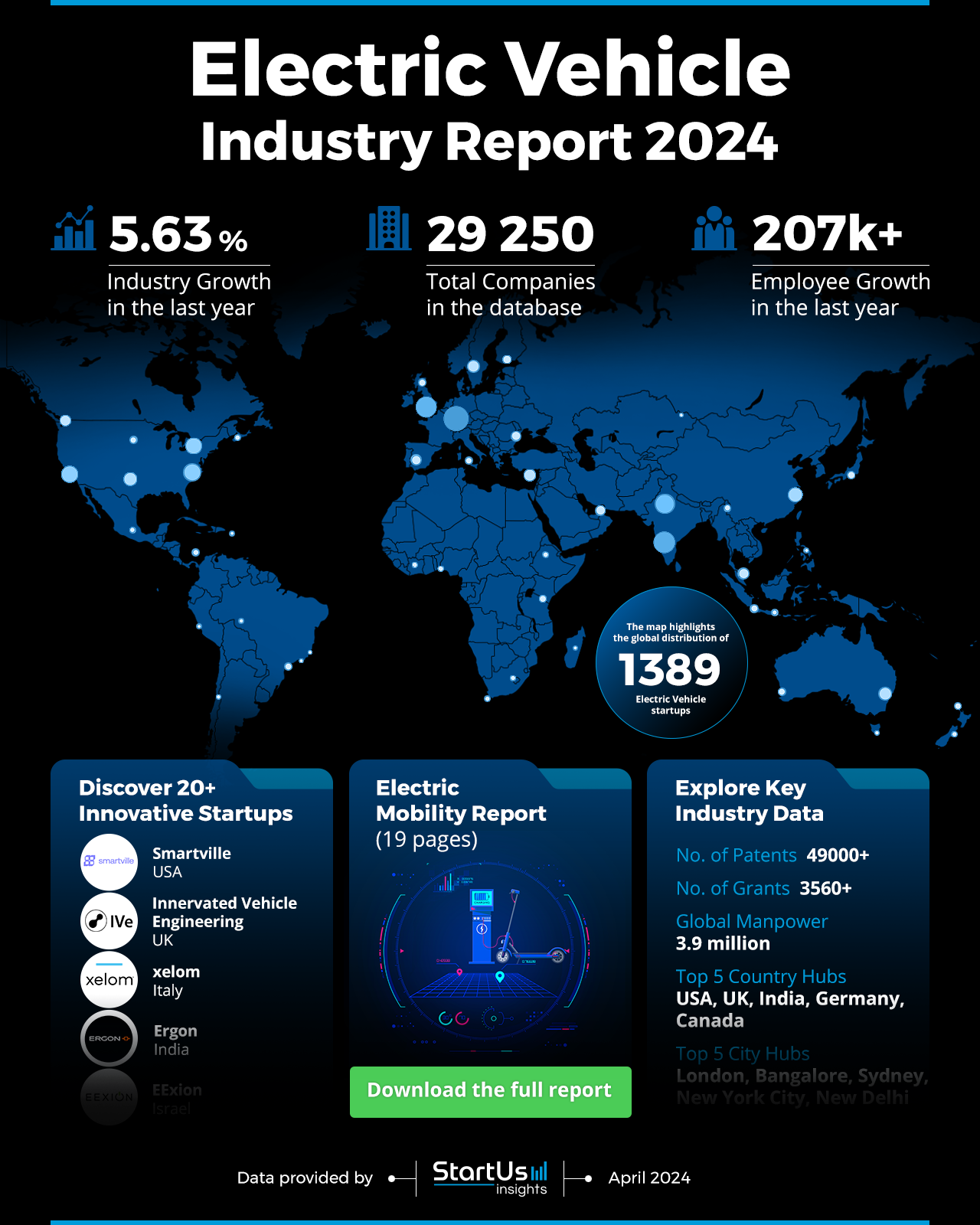

- Manpower & Employment Growth: The sector currently supports a global workforce of over 3.9 million employees, reflecting an increase of 207000 employees over the past year.

- Patents & Grants: The substantial number of granted grants of over 3560 and submitted patents of over 49000 demonstrates the strength of innovation.

- Global Footprint: Key global hubs include the United States, United Kingdom, India, Germany, and Canada, with major city hubs like London, Bangalore, Sydney, New York City, and New Delhi driving startup growth and innovation.

- Investment Landscape: The industry secured capital through 9000+ fundraising rounds and a total investment exceeding USD 9 billion, with an average investment value of USD 93.6 million per funding round.

- Top Investors: Major investors include Blackrock (USD 1.7 billion), European Investment Bank (USD 1.6 billion), and Ant Group (USD 1.2 billion), among others, all contributing to the sector’s expansive growth.

- Startup Ecosystem: Five innovative startups include Smartville (sustainable energy storage), Ive Engineering (hydrogen-powered vehicles), xelom (all-terrain electric mobility), Ergon (integrated charging solutions), and EExion (supercapacitor technology).

- Recommendations for Stakeholders: To capitalize on the momentum of the electric vehicle revolution, stakeholders should focus their attention on surmounting supply chain and cost obstacles, as well as exploiting developments in battery technology and charging infrastructure.

Explore the Data-driven Global EV Outlook for 2024

The EV Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap provides a graphical illustration of the worldwide startup ecosystem for electric vehicles. The analysis pertains to innovation centers and identifies the United States, the United Kingdom, India, Germany, and Canada as the top five country hubs. Specifically, the industry expanded at a rate of 5.63% over the past year.

The total count of patent applications submitted surmounted 49000, while the number of granted patents surpassed 3500. Supporting the sector’s positive growth trend involves the 3.9 million workforce worldwide and the annual increase in employees of more than 207000.

London, Bangalore, Sydney, New York City, and New Delhi stand as prominent urban centers on a global scale due to their strategic importance. These cities foster innovation in the sector and facilitate the growth of firms. The database contains a catalog of 1300+ emerging companies with this growth concentration in particular regions underscoring the significance of regional clusters that propel the sector forward.

What data is used to create this EV report?

Based on the data provided by our Discovery Platform, we observe that the EV industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The electric vehicle industry featured over 70000 news publications last year.

- Funding Rounds: The industry has 9000+ recorded funding rounds.

- Manpower: With a workforce exceeding 3.9 million, it included over 207000 new employees last year.

- Patents: Over 49000 patents are filed in the EV sector.

- Grants: The industry has further secured 3560 grants.

- Global Search Growth: Showcasing surging public interest, the EV industry saw a yearly global search growth of 23.13%.

A Snapshot of the Global EV Industry

The industry report’s data illustrates the sector’s expansion and investment endeavors. The labor force, consisting of 3.9 million individuals, drives the productivity in the industry.

Regarding expanding opportunities, the past year saw an addition of 207000 new employees. The sector is also diverse, with 29000+ companies operating within the industry’s ecosystem.

Explore the Funding Landscape of the EV Industry

Capital stages contributed an average of USD 93.6 million to the industry’s finances. The investment community comprises over 3400 investors who actively participate in the expansion of the industry.

Further, the financing landscape reflects the conclusion of over 9480 funding rounds, which financed over 3740 companies. These figures illustrate the current financial health of the sector in addition to its potential for growth in the coming years.

Who is Investing in the EV Industry?

Top investors contributed more than USD 9 billion to the EV industry. These elite investors spread out their holdings across a variety of businesses.

- BlackRock stands at the forefront with about USD 1.7 billion invested across 13 companies, underscoring its strategic bets on high-potential players.

- The European Investment Bank closely follows, channeling USD 1.6 billion into 10 companies, reflecting its support for innovation in Europe.

- Ant Group, with a focused investment approach, placed USD 1.2 billion into a single company.

- Geely’s contribution amounts to USD 1.1 billion, spread over 7 companies, indicating a broad and supportive stance in the industry.

- The Bank of China has made inroads with USD 896 million invested in 2 companies.

- Matching the Bank of China’s investment, China Citic Bank committed USD 896 million across 2 companies.

- Parallel to their counterparts, the Agricultural Bank of China invested USD 896 million in 2 companies

- China Construction Bank also injected USD 896 million into 2 companies.

Gain Access to Top EV Innovations & Industry Trends with the Discovery Platform

Explore some details about the top EV industry trends in the last year:

- Charging Infrastructure involves 769 companies, with 116.4K workers and 8.4K new hires in the last year. This signifies the sector’s growing impact on the labor market. As the sector gradually and steadily accepts environmentally friendly transit options, the yearly trend growth rate is 12.33%. The expansion of this trend suggests a deliberate shift in the sector toward a more sustainable framework that strikes a balance between environmental stewardship and development.

- Energy Management exhibits an annual growth rate of 21.89% with the involvement of 41 specialized companies. This domain added 272 personnel in the previous year, bringing its workforce to 3.3K. This demonstrates the industry’s commitment to advancing battery technology, maximizing performance, and enhancing sustainability.

- Zero Emissions comprises approximately 4778 organizations with 794.2K employees and 45.8K new workers last year. The annual trend growth rate of 13.04% emphasizes the sector’s effort to greener energy sources transitioning.

5 Top Examples from 1300+ Innovative EV Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Smartville repurposes Electric Vehicle Batteries

Smartville recycles electric car batteries to provide environmentally friendly energy storage options. Its product, Smartville 360, incorporates battery management technology to offer a low carbon footprint. This ensures its energy storage system functions consistently, effectively scales, and upholds high standards of safety. The design of Smartville 360 possesses modular construction, enabling its utilization in applications, including large-scale grid services and commercial energy initiatives.

Ive Engineering facilitates Sustainable Transportation

Ive Engineering produces hydrogen-powered, sustainable light goods vehicles. Its H2lix powertrain converts diesel vehicles into zero-emission transports, focusing on operational efficiency for commercial use. The company’s other vehicle, Indigo, reduces refueling time and extends vehicle life, aligning with the need for high-efficiency commercial fleets. Features that support driver comfort and safety include the adjustable rest area and distinctive cabin. The car comprises a skeleton safety cell and enhanced danger detection integrated for occupant protection.

xelom develops All-Terrain Electric Mobility Solutions

xelom develops all-terrain electric mobility solutions. Its Snow Cat offers autonomy and performance for snow-covered landscapes. The Dust Cat uses an electric platform to combat dust suppression. It includes a large-capacity tank, a supercharger with quick-charge capability, and an advanced turbine for extensive reach. In agriculture, xelom’s ALPIN 10 electric mower ensures efficient land management, even on challenging terrains. All xelom vehicles involve zero emissions, aligning with environmental conservation efforts while providing operational torque and low maintenance needs.

Ergon creates an Integrated Power Converter

Ergon develops an integrated fast charger and motor controller. This power converter integrates an 8kW controller and a 3kW charger into a small package to support powertrain architecture. The technology is compatible with 48-72V lithium battery chemistry packs, and its advanced charging algorithms prolong battery life. The technology expands for two and three-wheelers, featuring customizable drive modes and automatic motor identification for diverse motor types. Thermal management and a compact battery design offer more range and lower production costs.

EExion makes Manipulated Supercapacitor Technology

EExion introduces energy storage technology, Energize N’ Go, to address the electric vehicle industry’s sustainability and efficiency needs. This technology, based on chemically manipulated supercapacitor principles, charges up to 100 times faster than traditional rechargeable batteries. The Energize N’ Go cells offer an ultra-fast charging capability, supporting up to 30,000 charging cycles. Using non-flammable and fully recyclable materials, these cells ensure safety and environmental control in urban settings.

Gain Comprehensive Insights into EV Trends, Startups, or Technologies

The EV industry report for 2024 shows an industry driven by innovation and regulatory support. As the sector moves towards mainstream adoption, challenges such as supply chain optimization, raw material availability, and cost reduction remain. This year’s developments underscore the industry’s potential to overcome these challenges, promising clean and efficient transportation solutions. Contact us to explore all 1300+ startups and scaleups, as well as all industry trends impacting EV companies.

![Explore the Future of AI in the Automotive Industry [2025 & Beyond]](https://www.startus-insights.com/wp-content/uploads/2024/10/Future-of-AI-in-Automotive-Industry-SharedImg-StartUs-Insights-noresize-420x236.webp)