The 2024 Genomics Industry Report presents an overview of the latest trends, technological advancements, and investment patterns shaping the global genomics sector. This report highlights key growth areas, including computational genomics, functional genomics, and genomic analysis, while providing valuable insights into workforce and firmographic data.

This report was last updated in July 2024.

This genomics report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Genomics Industry Report 2024

- Executive Summary

- Introduction to the Genomics Report 2024

- What data is used in this Genomics Report?

- Snapshot of the Global Genomics Industry

- Funding Landscape in the Genomics Industry

- Who is Investing in Genomics?

- Emerging Trends in the Genomics Industry

- 5 Innovative Genomics Startups

Executive Summary: Genomics Report 2024

This report uses data from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 800+ genomics startups developing innovative solutions to present five examples from emerging industry trends.

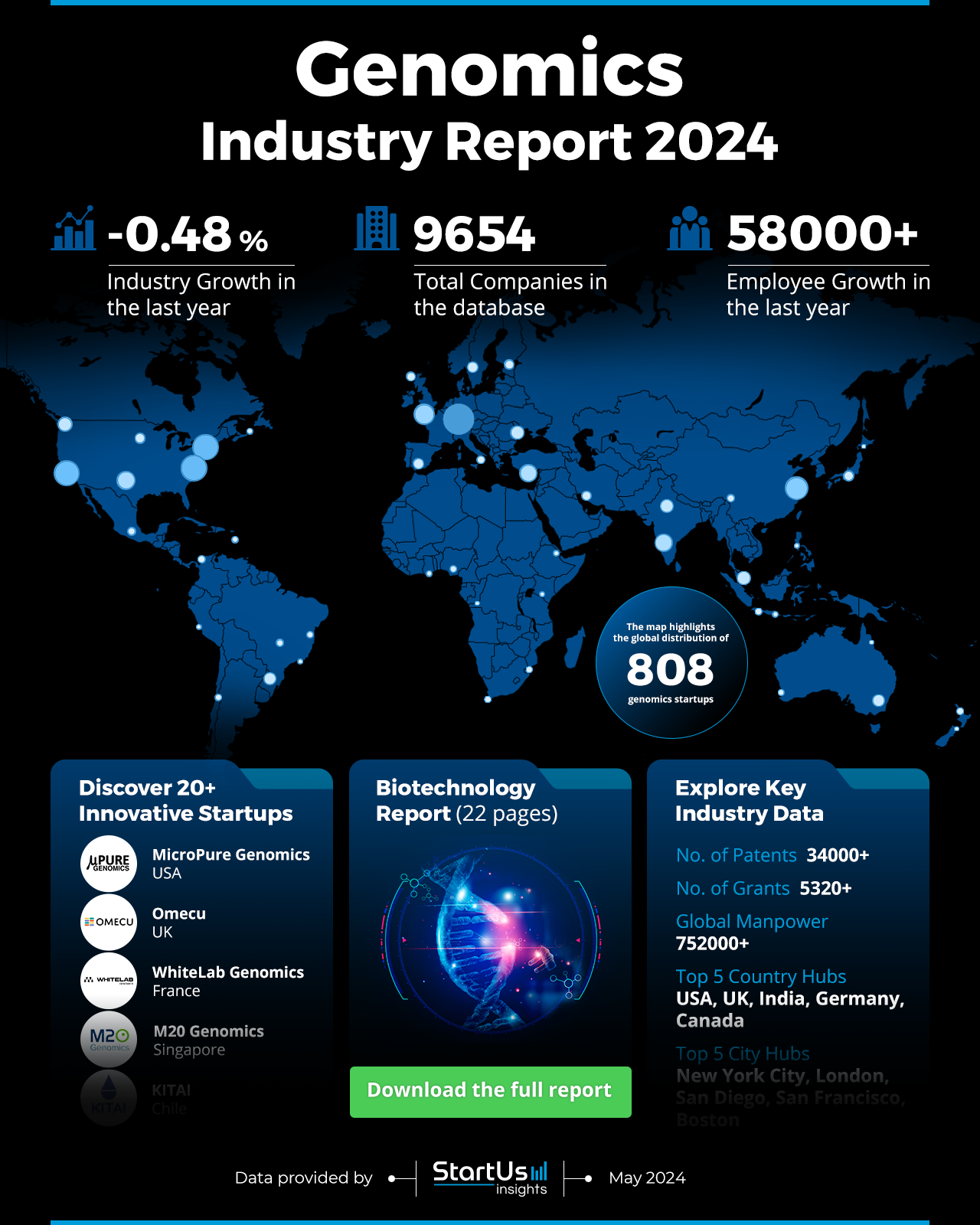

- Industry Growth: Despite a slight growth decline, the genomics industry remains robust with over 800 startups and 9600 companies, indicating substantial activity.

- Manpower & Employment Growth: The global workforce in the genomics sector surpasses 752000, with 58000 new employees added in the past year.

- Patents & Grants: Over 34000 patents and 5320 grants support the genomics sector, highlighting its innovation and technological advancements.

- Global Footprint: Key hubs include the USA, UK, India, Germany, and Canada, with notable cities like New York City and London.

- Investment Landscape: Robust investment activity with an average round value of USD 32 million underscores investor confidence and growth potential.

- Top Investors: Notable investors like Arch Venture Partners and SoftBank Vision Fund contribute to the sector’s growth with substantial financial backing.

- Startup Ecosystem: Five innovative startups showcased include MicroPure Genomics (Sample Preparation Technology), Omecu (Genomics Analysis Platform), WhiteLab Genomics (AI for Gene Therapies), M20 Genomics (Single-cell and Spatial Technologies), and KITAI (Environmental Microbiological Analysis).

- Recommendations for Stakeholders: Investors are encouraged to diversify portfolios and support startups focusing on computational genomics, functional genomics, and genomic analysis. Entrepreneurs should emphasize strategic partnerships and invest in AI-driven solutions to enhance drug discovery and personalized medicine. Governments are urged to implement safe and supportive policies and allocate funding for research and development.

Explore the Data-driven Genomics Industry Outlook for 2024

The Genomics Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The genomics industry, despite a slight decline with a 0.48% decrease in growth last year, remains robust. The database includes over 800 startups and 9600 companies, indicating substantial activity. Innovation is evident with over 34000 patents and 5320 grants supporting the sector.

The global workforce encompasses over 752000 individuals, with an addition of 58000 employees in the last year. Key hubs include the USA, UK, India, Germany, and Canada, with leading cities being New York City, London, San Diego, San Francisco, and Boston. The heatmap above visualizes these data points, offering a comprehensive overview of the industry’s landscape, growth, and key hubs.

What data is used to create this genomics industry report?

Based on the data provided by our Discovery Platform, we observe that the genomics industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The industry saw 57000+ publications last year, reflecting extensive news coverage and research interest.

- Funding Rounds: Our database includes data on over 7200 funding rounds, indicating strong investment activity within the sector.

- Manpower: With a workforce exceeding 752000, the industry has added over 58000 new employees in the past year.

- Patents: The sector holds over 34000 patents, highlighting its innovation and technological advancements.

- Grants: More than 5320 grants have been awarded to support ongoing research and development in the industry.

- Yearly Global Search Growth: The industry experienced a 4.33% growth in yearly global search interest, reflecting increased public and professional attention.

A Snapshot of the Global Genomics Industry

The genomics industry demonstrates strong investment and growth, highlighting its significant potential and innovation. The industry experienced an employee growth of 58000 in the last year, contributing to a global workforce of over 752000. With more than 9650 companies, the industry’s scale is substantial.

Explore the Funding Landscape of the Genomics Industry

Investment activity is robust, with an average investment value of USD 32 million per round. The sector has attracted over 2100 investors who participated in more than 7200 funding rounds and supported over 2600 companies. This strong financial backing underscores the industry’s potential and investor confidence in its future growth.

Who is Investing in Genomics?

The combined investment value by the top investors in the genomics industry exceeds USD 10 billion, reflecting significant financial commitment and confidence in the sector. Notable investors and their contributions include:

- Arch Venture Partners: USD 2.3 billion invested across 18 companies

- SoftBank Vision Fund: USD 3.2 billion invested in 8 companies

- GlaxoSmithKline: USD 1.1 billion invested in 3 companies

- IDG Capital: USD 1 billion invested in 7 companies

- RA Capital Management: USD 955 million invested in 15 companies

- Quest Diagnostics: USD 810 million invested in 5 companies

- IQVIA: USD 765 million invested in 3 companies

Strategic investments from these key players help advance cutting-edge research, promote technological advancements, and facilitate the commercialization of innovative genomics solutions.

Access Top Genomics Innovations & Trends with the Discovery Platform

Computational Genomics is a rapidly growing trend within the genomics industry, with 43 companies identified. This sector employs over 1,800 people, with 220 new employees added in the last year, reflecting steady workforce expansion. The annual growth rate for computational genomics is 8%, indicating increasing importance. This approach enhances the understanding of complex genetic information and supports advancements in personalized medicine, drug discovery, and genetic research.

Functional Genomics remains a significant segment of the genomics industry, with 156 companies identified. This sector employs around 19,000 people, with 1,100 new employees added in the past year. Despite its size, the annual growth rate for functional genomics is -2.43%, reflecting challenges in the sector. Companies in this area focus on understanding gene functions and interactions.

Genomic Analysis is a vital and expanding trend within the genomics industry, with 244 companies identified. This sector employs over 11,000 people, with 1,000 new employees added in the last year, showcasing workforce growth. The annual growth rate for genomic analysis is 5.91%, demonstrating steady development. Companies in this sector specialize in sequencing, interpreting, and analyzing genomic data. This trend supports advancements in precision medicine, diagnostics, and genetic research.

5 Top Examples from 800+ Innovative Genomics Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

MicroPure Genomics builds Novel Sample Preparation Technology

US startup MicroPure Genomics develops advanced sample preparation technology for genomic sequencing. The company’s μPrep instrument automates genomic sample preparation, reducing time, labor, and costs. Using Electro-Hydrodynamic (EH) Trapping, it purifies and concentrates genomic material within a microfluidic channel. This technology enables rapid, bead-less sample prep for ultra-long DNA sequences. The μPrep system ensures reliable, high-quality sequencing results. It provides unprecedented insights into the genome, enhancing research and clinical applications.

Omecu builds a Genomics Analysis Platform

UK startup Omecu specializes in secure genomic data analysis. The platform allows researchers to query multiple genomic datasets interactively. Omecu provides lifetime permissions control for data holders, ensuring secure data interactions. The platform facilitates rapid access to multiple genomic cohorts without direct data access. Data is pre-prepared and structured, requiring no technical experience for querying. Omecu offers clear usage guidance and a uniform approval process for all datasets. The platform significantly reduces computing environment costs and ensures data security and visibility.

WhiteLab Genomics advances AI for Gene Therapies

French startup WhiteLab Genomics specializes in AI-driven solutions for genomic medicine development. Its proprietary AI platform accelerates target discovery and drug design for DNA and RNA therapies. The platform leverages extensive curated and validated datasets to enhance predictive capabilities. It integrates advanced in-silico predictions to streamline the design process. The AI suite supports efficient and accurate identification of therapeutic targets.

M20 Genomics provides Single-cell and Spatial Technologies

M20 Genomics is a Singaporean startup that offers a comprehensive single-cell sequencing solution called M20 Seq. This platform captures full-length RNA using a random-primer principle, unlike traditional oligo dT methods. M20 Seq handles diverse sample types, including fresh, frozen, and FFPE tissues, and works across various species. It provides ultra-high throughput, capturing millions of cells, and offers high sensitivity, enhancing gene detection. The technology ensures compatibility with both droplet-based and microwell-based platforms.

KITAI provides Environmental Microbiological Analysis

Chilean startup KITAI specializes in environmental microbiological analysis using AI and metagenomics in advanced microfluidic systems. Its platform features lab-on-a-chip technology for environmental assessments. It performs biovolume percentage analysis, cell counting, pest identification, and microbiome classification based on cyanotoxins. The startup’s system supports environmental intelligence, applied microbiology, genetic analysis, and disease control in marine fauna

Gain Comprehensive Insights into Genomics Trends, Startups, or Technologies

The 2024 Genomics Industry Report highlights significant trends, investment patterns, and technological advancements shaping the sector. Despite a slight decline in growth, robust investments and workforce expansion underscore its resilience. Key areas such as computational genomics, functional genomics, and genomic analysis show potential future R&D areas. Get in touch to explore all 800+ startups and scaleups, as well as all industry trends impacting biotech, pharma, healthcare, and agritech companies worldwide.