The 2025 Electronics Industry Outlook explores the growing landscape of the electronics sector. This report highlights the key trends, emerging technologies, and the global distribution of startups and established companies. The report offers insights into the industry’s current state and potential by examining the latest developments in patents, investments, and workforce growth.

The report was last updated on January 2025.

This electronics report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

Executive Summary: Electronics Report 2025

- Industry Growth Overview: The electronics industry comprises over 52 000 companies, with 3174 startups and an annual growth rate of -3.75%. The global consumer electronics market is projected to reach USD 1.07 trillion in 2025, growing 3% from 2024.

- Manpower & Employment Growth: The sector supports a global workforce of 4.6 million employees. Employment grew by 220 000+ workers annually.

- Patents & Grants: It holds 2.5+ million patents with 457 000+ applicants and a yearly patent growth rate of 2.05%. Key patent issuers include the USA with about 837K+ patents and China with about 358 000+ patents. Also, it received over 6410 grants.

- Global Footprint: Top country hubs include the USA, China, Germany, India, and the UK. Key city hubs are Shenzhen, Singapore, Bangalore, Mumbai, and Shanghai.

- Investment Landscape: The average investment value per round stands at USD 39 million. The industry attracted over 3200 investors, closed more than 10 430 funding rounds, and benefited more than 3370 companies.

- Top Investors: Some top investors are Pacific Equity Partners, BTG Pactual, and Ossur. The combined investment totals about 925 million.

- Startup Ecosystem: The leading startups include SixLine Semiconductor (carbon nanotube processing), NeoLogic (quasi-CMOS technology), FlexiiC (organic integrated circuit), InfiniLink (SerDes & optical transceivers), and Rapid Photonics (lithium niobate PICs).

Methodology: How we created this Electronics Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports. Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies and market trends.

For this report, we focused on the evolution of the electronics market over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the electronics market

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the electronics market.

What data is used to create this electronics industry report?

Based on the data provided by our Discovery Platform, we observe that the electronics industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: More than 134 000 news articles have been published on the electronics industry in the last year.

- Funding Rounds: Our database contains data on over 10 430 funding rounds and showcases the investment activity.

- Manpower: The industry employs 4.6+ million workers. In the last year, it added over 220 000 new employees.

- Patents: The electronics industry received patents for 2.5+ million patents.

- Grants: Over 6410 companies received grants.

- Yearly Global Search Growth: Despite its impressive metrics, the industry experienced a slight decline in global search growth, with a rate of -0.37%. Further, North America is experiencing growth due to a vibrant startup ecosystem and government programs to boost domestic electronics manufacturing.

Explore the Data-driven Electronics Market Report for 2025

The heat map presented in this report provides an overview of the global distribution of startups and their associated metrics. It visually represents the density and distribution of startups within the global database, which contains a total of 3174 startups and over 52 000 companies. This visualization highlights the geographical hotspots and the concentration of innovation and entrepreneurial activity.

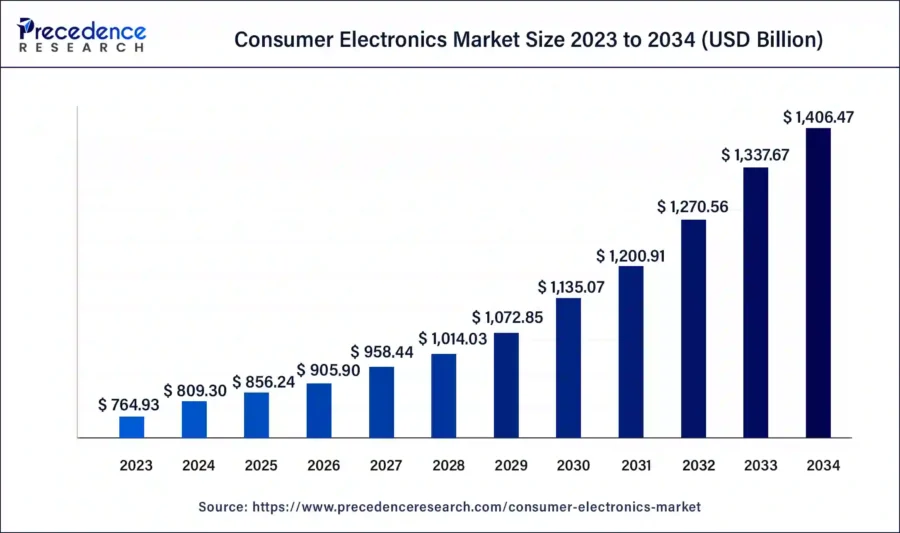

The compound annual growth rate (CAGR) of the consumer electronics market is 5.68%. It is set to reach USD 1406.47 billion by 2034.

Credit: Precedence Research

The industry experienced a slight contraction with an annual growth rate of -3.75%. Despite this decline, the number of patents and grants indicates innovation and financial support in key regions. The industry supports a global manpower of 4.6 million. In the last year, it saw a growth of 220 000 employees, which indicates the expansion of the workforce despite the overall negative growth in the industry.

The top five country hubs—USA, China, Germany, India, and the UK— drive industry trends and developments. Additionally, the top five city hubs, including Shenzhen, Singapore, Bangalore, Mumbai, and Shanghai, advance innovation and support startups. The Asia Pacific dominates the global Industrial Electronics market with a 42% share.

A Snapshot of the Global Electronics Industry

The electronics industry experienced a dip of 3.75% in its annual growth rate. Despite this decline, the sector remains dynamic, with a number of startups and extensive patent activity.

The industry houses about 3174 startups and showcases its entrepreneurial ecosystem. Over 2410 companies in the early stages indicate a pipeline of emerging companies. Over 770 startups reached the merger and acquisition (M&A) stage and demonstrated consolidation and strategic growth within the industry.

Patents reach a total of 2.5+ million. This intellectual property is driven by 457 000 applicants to reflect a diverse and innovative community.

The industry experienced a yearly patent growth rate of 2.05% for showcasing ongoing advancements and inventions. The USA leads as the top issuer with 837 000 patents, followed by China with 358K patents. Additionally, the global venture capital investment market is projected to reach USD 364.19 billion in 2025, up from USD 301.78 billion in 2024.

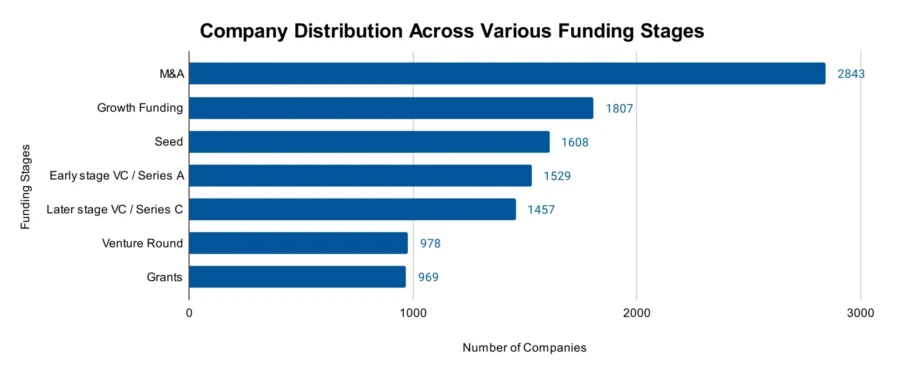

Explore the Funding Landscape of the Electronics Industry

Investment in the electronics industry stands with an average investment value of USD 39 million per round. The sector attracted over 3200 investors who participated in more than 10 430 funding rounds. This level of financial support benefited more than 3370 companies.

Overall, while the electronics industry faces growth challenges, it remains a critical hub of innovation and investment. This is driven by a large number of startups, significant patent activity, and robust financial support. The industry’s ability to attract investments and continue patent growth highlights its potential for future growth.

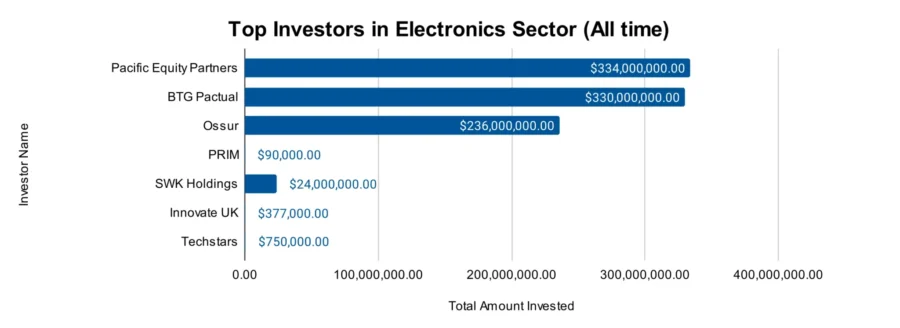

Who is Investing in Electronics Solutions?

The combined investment value of the top investors in the electronics industry exceeds USD 925 million. Here is a detailed look at the leading investors, their invested amounts, and the number of companies they backed:

- Pacific Equity Partners funded 2 companies with a total of USD 334 million. It also signed an agreement to acquire ATOM, an Australian distributor of industrial electronics components.

- BTG Pactual contributed USD 330 million to 2 companies.

- Ossur allocated USD 236 million to 3 companies.

- PRIM channeled USD 90K into 4 companies.

- SWK Holdings dispensed USD 24 million to 3 companies.

- Innovate UK dedicated USD 377K to 3 companies.

- Techstars has directed USD 750K towards 3 companies.

Access Top Electronics Innovations & Trends with the Discovery Platform

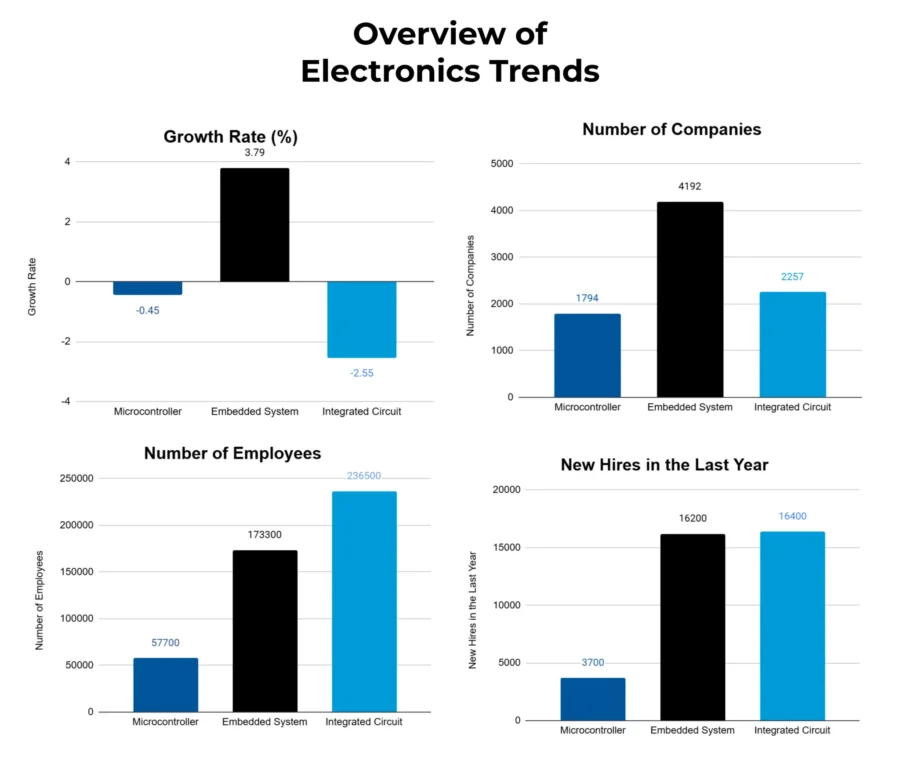

- The Microcontroller sector includes over 1794 companies and employs more than 57 700 individuals. This segment saw the addition of 3700+ new employees in the last year despite an overall annual trend growth rate of -0.45%.

- The Embedded System industry encompasses over 4192 companies and a workforce of 173 300 employees. Its annual trend growth rate of 3.79% highlights its role in various high-tech applications. In the past year, this sector added 16 200+ new employees.

- The Integrated Circuit trend includes 2200+ companies and a workforce of 236 500+ employees. Despite an annual trend growth rate of -2.55%, the industry added 16 400 new employees in the last year.

5 Top Examples from 3170+ Innovative Electronics Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

SixLine Semiconductor processes Carbon Nanotubes

US-based startup SixLine Semiconductor processes carbon nanotubes to create high-performance, cost-effective semiconductor devices.

Its technology enables room-temperature deposition of semiconductor-grade carbon nanotubes on any substrate to ensure compatibility with legacy process nodes. These nanotubes provide high packing density and tight alignment that result in efficient and selective deposition processes. They address the challenges of bandwidth congestion in radio-frequency (RF) communication devices by operating at higher frequencies with low noise factors.

In logic and computing, SixLine Semiconductor’s carbon nanotube devices provide superior charge carrier mobility to enhance performance and reduce power consumption. For chemical sensors, the technology offers sensitivity and real-time feedback and integrates with organic chemistry.

NeoLogic develops Quasi-CMOS Technology

Israel-based startup NeoLogic develops the Quasi-complementary metal oxide semiconductor (Quasi-CMOS) technology to reduce transistor count in digital cores at any technology node.

Quasi-CMOS technology achieves a reduction in power dissipation and saving in area to enhance performance-per-watt. The technology integrates standard CMOS circuits with modified topologies for high fan-in single-stage logic gates and power-efficient flip-flops.

These semiconductors reduce circuit complexity, improve transistor packing density, and save cost. It also received USD 8 million in seed funding to transform computing using the emerging AI.

FlexiiC builds an Organic Integrated Circuit

Spanish startup FlexiiC develops organic and flexible technology for sensors and logic circuits. The technology uses solution-deposited functional inks at low temperatures on low-cost substrates to create organic integrated circuits.

It replaces costly conventional materials with solvent-based and additive deposition techniques like printing. The circuits integrate into thin-film electronic components and provide products, including organic chips and a sensor acquisition platform.

InfiniLink provides SerDes & Optical Transceivers

Egyptian startup InfiniLink develops ultra-high-speed connectivity solutions for hyperscale data centers using advanced analog mixed-signal design, integrated photonics, and advanced packaging. The startup’s high-speed serializer/deserializer technologies cater to ethernet, high-performance computing (HPC), AI, and automotive applications with power, performance, and area (PPA) metrics.

InfiniLink’s analog transceivers provide energy-efficient, ultra-high-speed optical communication by integrating trans-impedance amplifiers, equalizers, video graphics arrays (VGAs), and optical modulator drivers. Its silicon photonics technology addresses complex challenges, featuring photonic modulator architectures and integrated wavelength division multiplexers and demultiplexers.

The technology supports both external and internal laser sources with hybrid integration.

Rapid Photonics makes Lithium Niobate PICs

Dutch startup Rapid Photonics builds lithium niobate photonic integrated circuits (PICs) with its Direct Etch-less photonic integrated circuits Technology (DEpicT) technology. DEpicT overcomes the fabrication challenges of lithium niobate on insulators (LNOI) to provide low-loss waveguides with high yields and short lead times.

This CMOS-compatible technology enables scale-up in conventional silicon PIC foundries. Rapid Photonics integrates both passive and active photonic components, including modulators and ring resonators. Moreover, DEpicT extends to silicon nitrate PICs and offers competitive costs and short lead times.

It also received funding from Innovation Fund North Holland for the development of an etchless production process of photonic chips based on Lithium niobate.

Gain Comprehensive Insights into Electronics Trends, Startups, or Technologies

The 2025 Electronics Industry Report highlights the sector’s adaptability in overcoming challenges such as market contraction and regulatory hurdles. Growth in areas like IoT, AI, and advanced materials drives innovation and competitive advantage. These address issues of scalability, efficiency, and market diversification. The insights provided herein empower stakeholders to make informed decisions, increasing sustained growth and technological progress in the electronics industry. Contact us to explore all 3170+ startups and scaleups, as well as all industry trends impacting electronics companies.