The 2025 Financial Services Industry Report analyzes current trends, growth metrics, and technological advancements in the sector. It focuses on digital innovation, with AI, blockchain, and automation reshaping operations, customer experience, and financial inclusion. The report examines patent filings, investment activities, and workforce statistics to provide an overview of the industry’s health and future prospects. Financial institutions must adapt rapidly to maintain compliance as regulatory frameworks tighten around data privacy and cybersecurity. The rise of fintech and embedded finance solutions, along with sustainability efforts in green finance, drives further competition and innovation.

This report highlights key investors and emerging startups to explore the dynamic landscape and innovative solutions shaping the financial services sector. This financial services report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Financial Services Outlook 2025

- Executive Summary

- Introduction to the Financial Services Report 2025

- What data is used in this Financial Services Report?

- Snapshot of the Global Financial Services Industry

- Funding Landscape in the Financial Services Industry

- Who is Investing in Financial Services?

- Emerging Trends in the Financial Services Industry

- 5 Innovative Financial Services Startups

Executive Summary: Financial Services Industry Outlook 2025

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 3200+ financial services startups developing innovative solutions to present five examples from emerging financial services industry trends.

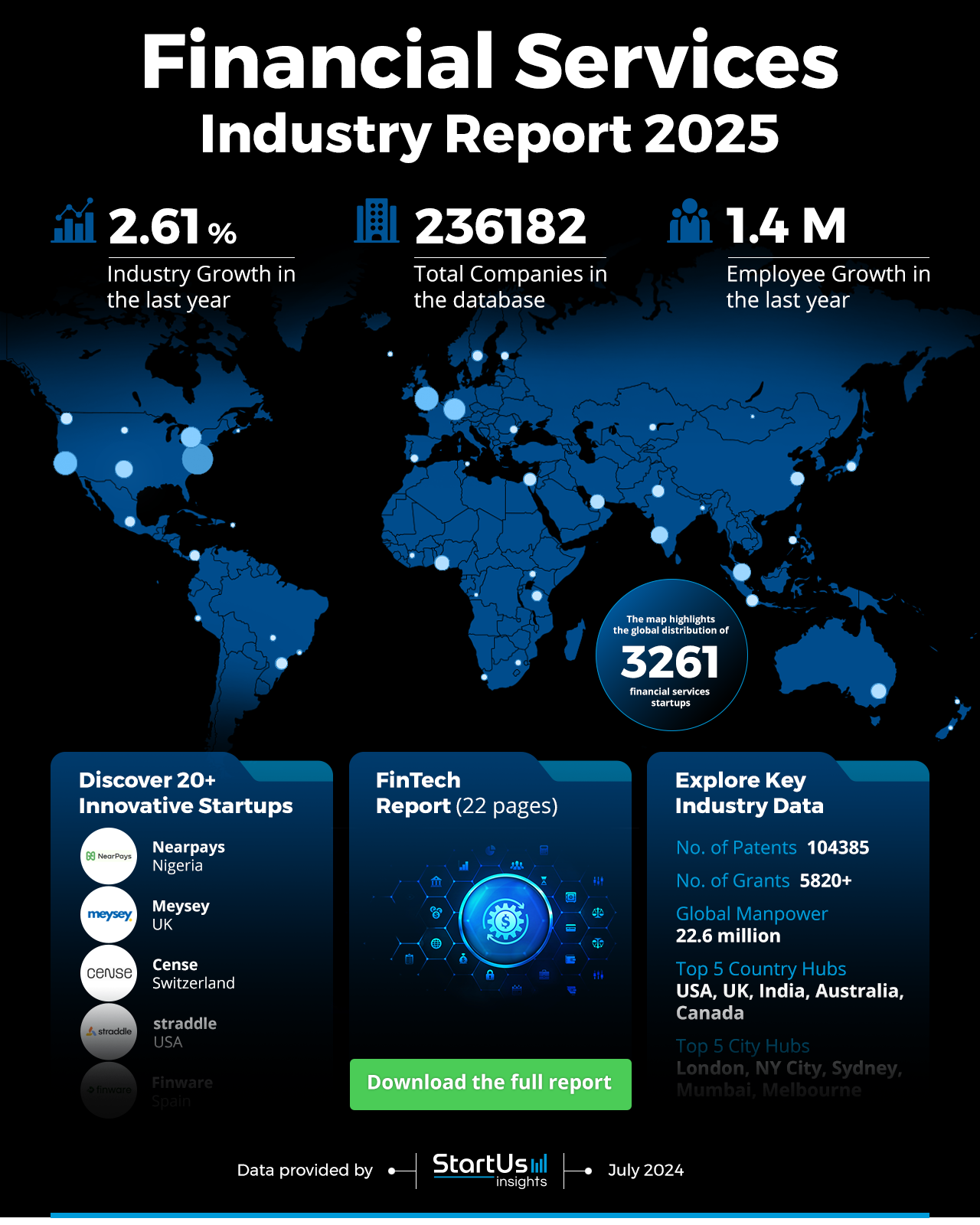

- Industry Growth: The financial services market report highlights a steady annual growth rate of 2.61% and includes over 230000 companies.

- Manpower & Employment Growth: The industry employs 22.6 million workers globally, with an increase of 1.4 million new employees last year.

- Patents & Grants: The sector has over 104000 patents and 5820 grants, showcasing innovation and research efforts.

- Global Footprint: Major hubs include the USA, UK, India, Australia, and Canada, with key city hubs in London, New York City, Sydney, Mumbai, and Melbourne.

- Investment Landscape: Investment activity is strong, with an average investment value of USD 54 million per round and more than 57200 funding rounds closed.

- Top Investors: Leading investors including International Finance, General Atlantic, Softbank Vision Fund, and more have collectively invested more than USD 23 billion.

- Startup Ecosystem: Five innovative startups featured in this report include Nearpays (Secure Cashless Payments & Analytics), Meysey (Fraud Prevention for Small Businesses), Cense (Anti Money Laundering for Blockchain Networks), straddle (Open Banking), and Finware (Embedded Finance).

- Recommendations for Stakeholders: Entrepreneurs must leverage emerging trends like digital wallets and open banking to create competitive, customer-centric solutions. Governments should support the industry by implementing favorable regulations, providing grants, and promoting cybersecurity initiatives.

Explore the Data-driven Financial Services Sector Outlook for 2025

The Financial Services Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Our database comprises 3200+ startups and 236000+ companies, highlighting extensive industry activity. The annual growth rate stands at 2.61%, which indicates a steady development. Innovation remains evident with 104385 patents and over 5820 grants awarded. This showcases the sector’s commitment to research and technological advancement.

The industry’s global workforce totals 22.6 million, with an employee growth of 1.4 million last year. This growth reflects the increasing demand for skilled professionals in financial services. Major country hubs include the USA, UK, India, Australia, and Canada, each playing a vital role in the industry’s expansion. The top city hubs, London, New York City, Sydney, Mumbai, and Melbourne, demonstrate significant concentrations of financial activity and expertise.

This information, visualized through our heatmap, highlights key areas of activity and growth within the financial services industry. The data underscores the industry’s dynamic nature and its crucial role in the global economy. By analyzing these trends, stakeholders better understand the sector’s landscape and identify opportunities for investment and development.

What data is used to create this financial services report?

Based on the data provided by our Discovery Platform, we observe that the financial services industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The financial services industry generated more than 360,000 publications in the last year.

- Funding Rounds: Our database contains data on over 57200 funding rounds, which highlight extensive investment activity.

- Manpower: The industry employs more than 22 million workers, with over 1.4 million new employees added in the last year.

- Patents: It holds over 104000 patents, showcasing innovation and intellectual property development.

- Grants: The industry has secured more than 5820 grants, reflecting strong support for research and development initiatives.

- Yearly Global Search Growth: The yearly global search growth for the sector is 5.32%, indicating rising interest and engagement.

A Snapshot of the Global Financial Services Industry

The financial services industry shows a robust annual growth rate of 2.61%, reflecting steady expansion. The sector includes 3254 startups, contributing to its dynamic nature. With over 9740 early-stage companies and more than 13200 mergers and acquisitions recorded, the industry demonstrates significant activity in terms of business development and consolidation. This data indicates a thriving ecosystem where new ventures and established firms coexist and evolve.

Innovation within the financial services industry remains strong, with over 104000 patents filed by more than 38400 applicants. The yearly patent growth rate stands at 0.70%, showcasing a consistent drive towards technological advancement. The USA leads in patent issuances with 30000 patents, followed by the European Patent Office with over 11000 patents. This highlights the industry’s focus on securing intellectual property and fostering innovation through rigorous research and development efforts.

Explore the Funding Landscape of the Financial Services Industry

Investment activity in the financial services sector is substantial, with an average investment value of USD 54 million per round. There are over 14500 investors actively engaged in funding, resulting in more than 57240 funding rounds closed. The number of companies that have received investments exceeds 19900, which indicates a vibrant and supportive investment landscape. This extensive financial backing underscores the confidence investors have in the sector’s growth and potential.

Who is Investing in Financial Services?

The combined investment value of the top investors in the financial services industry exceeds USD 23 billion. Here is a detailed breakdown of the top investors, including the number of companies they have invested in and the total invested value:

- International Finance Corporation has invested USD 6.7 billion in 81 companies.

- General Atlantic has committed USD 4.1 billion across 32 companies.

- SoftBank Vision Fund has allocated USD 3.3 billion to 12 companies.

- Goldman Sachs has invested USD 3.2 billion in 47 companies.

- European Investment Bank has contributed USD 3 billion to 30 companies.

- Tencent has allocated USD 3 billion to 27 companies.

Access Top Financial Services Innovations & Trends with the Discovery Platform

Explore the emerging trends within the financial services landscape along with the firmographic data:

- Fraud Prevention is growing in the financial services industry, with 2900+ companies employing 463000 individuals. The sector added 26000 new employees last year. The annual trend growth rate for fraud prevention is 17%, indicating rising demand for advanced security measures. This trend highlights the importance of safeguarding financial transactions and protecting against cyber threats. Companies focus on developing technologies to detect and prevent fraud to ensure financial system integrity.

- Digital Wallets are a key trend in financial services, with 2500+ companies employing 198000 individuals. The industry added 22000 new employees last year, reflecting employment growth. The annual trend growth rate for digital wallets is 27.97%, showing a rapidly expanding market. Digital wallets are popular for their convenience and security, which facilitates seamless transactions. This trend highlights the shift towards cashless economies and the adoption of mobile payment solutions worldwide.

- Open Banking is an emerging trend, with 1700+ companies employing 220000 individuals. The sector added 21000 new employees last year. The annual trend growth rate for open banking is 64.42%, indicating rapid expansion. Open banking enables secure and transparent data sharing between financial institutions, fostering innovation and competition. This trend drives the development of new financial products and services to enhance customer experiences and promote financial inclusion.

5 Top Examples from 3200+ Innovative Financial Services Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Nearpays provides Secure Cashless Payments & Analytics

Nigerian startup Nearpays offers a cashless payment solution through its virtual POS system that allows businesses and individuals to accept digital payments. It uses NFC technology for quick and secure contactless transactions. For those without NFC-enabled devices, its scan card to pay feature provides a convenient alternative. The platform includes a real-time transaction tracking system that enables businesses to monitor financial activities and gain insights via its corporate dashboard. The startup supports underbanked communities with its USSD-based Rural virtual POS, eliminating the need for traditional bank accounts and promoting financial inclusion. Nearpays enhances operational efficiency, ensures transaction security, and enables businesses to scale their operations while contributing to economic growth through accessible financial technology.

Meysey offers Fraud Protection to Businesses

UK startup Meysey provides AI-powered fraud prevention solutions for small to medium-sized enterprises (SMEs). Its platform analyzes thousands of data points in cloud accounting systems to identify financial errors, risks, or deliberate wrongdoing. It integrates with data sources to validate and highlight irregular activity through real-time governance checks. These features streamline fraud detection to offer SMEs enhanced financial security and reduce exposure to fraudulent transactions.

Cense supports Anti Money Laundering for Blockchain Networks

Swiss startup Cense develops a blockchain-based compliance platform that simplifies and automates digital asset assessments for financial institutions. It provides risk scoring, source-of-funds verification, and on-chain sanctions screening to ensure AML/CFT compliance. The startup’s platform collects, analyzes, and reports data to generate transparent, auditable reports confirming the legitimacy of digital assets and their holders. Cense’s solution reduces compliance risks, streamlines decision-making, and supports secure asset transfers while adhering to regulatory standards.

straddle facilitates Open Banking Payment

US startup straddle offers an open-banking payment platform for account-to-account (A2A) transactions. It enables businesses to onboard and verify customers, connect to their bank accounts, and process payments through a secure API. The platform integrates identity verification and fraud prevention into the payment flow to reduce the need for multiple vendors. straddle’s Paykeys link a user’s verified identity to their payment method to enhance security and enable real-time balance checks. straddle’s platform also includes AML screening and real-time fraud detection to ensure compliant transactions.

Finware delivers Embedded Finance

Spanish startup Finware offers an embedded finance platform to simplify global financial operations. Its API enables multi-currency wallets, real-time foreign exchange, global payments, and card issuance that allows companies to integrate financial services. The platform supports various currencies and provides IBAN accounts for easier reconciliation that enables real-time transactions in many countries. It also offers features including unlimited virtual and physical cards and low-cost currency exchange. Finware connects businesses to a global financial infrastructure to streamline international financial management.

Gain Comprehensive Insights into Financial Services Trends, Startups, or Technologies

The 2025 financial services industry report shows growth, innovation, and investment. Key trends include fraud prevention, digital wallets, and open banking, which demonstrate advancements and strong employment figures. The industry’s focus on security, efficiency, and transparency shapes its evolving landscape. As the industry innovates and expands, it promotes economic stability and growth globally. Get in touch to explore all 3200+ startups and scaleups, as well as all industry trends impacting financial services companies.