The 2025 Microfinance Industry Report analyzes the evolving sector focused on providing financial services to underserved and low-income populations. With rising global demand for financial inclusion, microfinance institutions (MFIs) leverage technology to expand their reach and improve service delivery. Digital platforms, mobile banking, and AI-driven credit assessments drive innovation, which enables MFIs to meet client needs while improving operational efficiency. The report examines key trends, investment flows, and emerging startups shaping the industry’s future.

This global microfinance industry report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Microfinance Industry Report 2025

- Executive Summary

- Introduction to the Microfinance Report 2025

- What data is used in this Microfinance Report?

- Snapshot of the Global Microfinance Industry

- Funding Landscape in the Microfinance Industry

- Who is Investing in Microfinance Solutions?

- Emerging Trends in the Microfinance Industry

- 5 Innovative Microfinance Startups

Executive Summary: Microfinance Industry Outlook 2025

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 1200+ microfinance startups developing innovative solutions to present five examples from emerging microfinance industry trends.

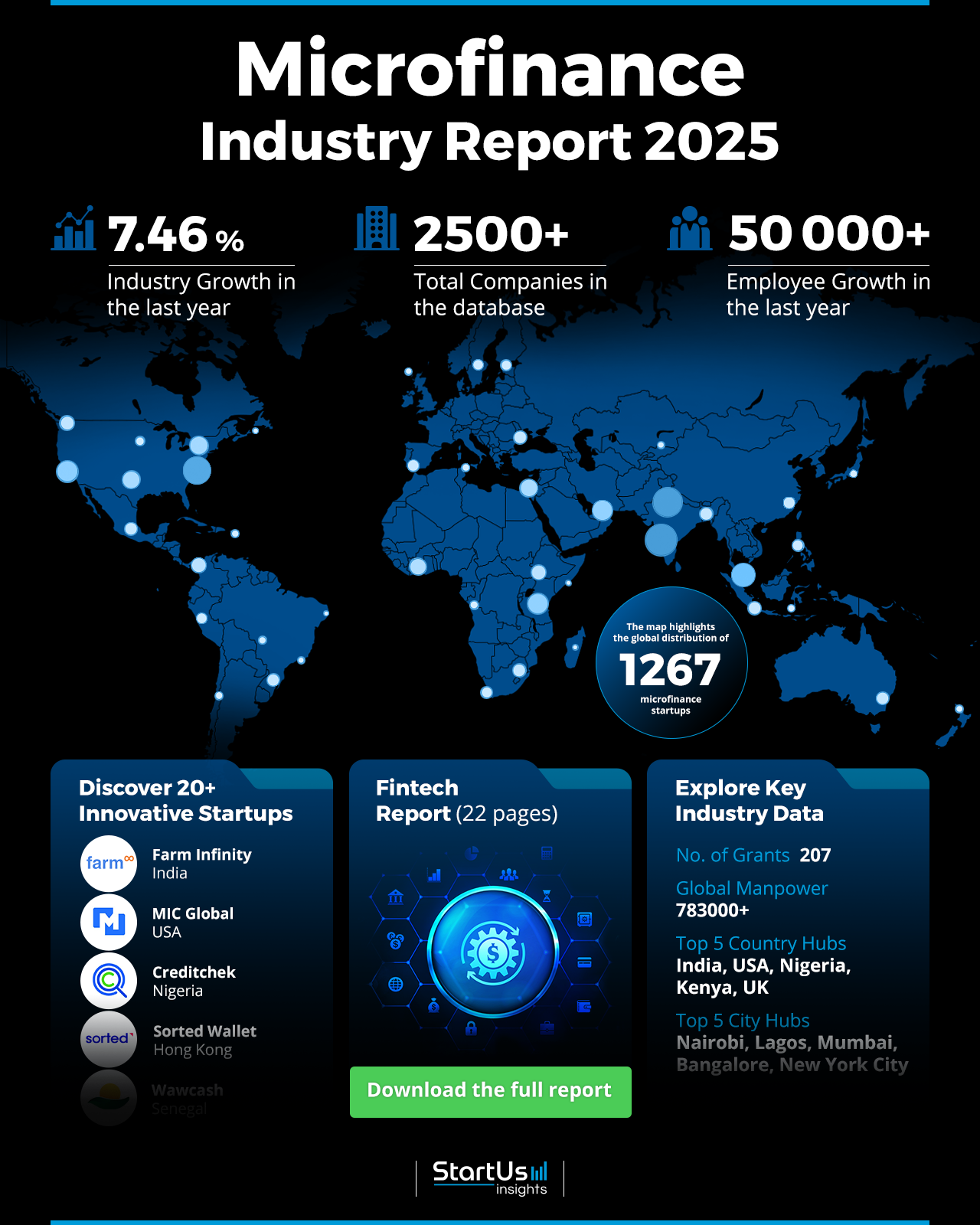

- Industry Growth Overview: The microfinance industry grows at 7.46% annually, with over 1200 startups and 2500 companies in the sector.

- Manpower & Employment Growth: The sector employs over 783K people globally, with 50K new employees added last year. This shows a steady workforce growth.

- Grants: Supported by 207 grants, the industry innovates and expands through financial backing for new developments and services.

- Global Footprint: Key hubs include India, the USA, Nigeria, Kenya, and the UK, with top city hubs in Nairobi, Lagos, Mumbai, Bangalore, and New York City, highlighting its global diversity.

- Investment Landscape: The average investment per funding round is USD 17.5 million. Over 430 investors have participated in more than 1260 funding rounds, investing in over 400 companies.

- Top Investors: International Finance Corporation, TPG, IndusInd Bank, and more have invested over USD 1 billion combined.

- Startup Ecosystem: Five startups— Farm Infinity (financial inclusion for farmers), MIC Global (embedded microinsurance), Creditchek (credit assessment tools), Sorted Wallet (non-custodial crypto wallet), and Wawcash (daily micro-loans for drivers)—highlight the sector’s global reach and entrepreneurial spirit.

- Recommendations for Stakeholders: Governments should implement regulations that promote financial inclusion while safeguarding against over-indebtedness. Entrepreneurs should leverage microfinance to innovate and expand access to underserved markets and ensure transparent financial practices. Companies should also prioritize digital financial services to increase efficiency and reach, and form partnerships that strengthen ecosystems supporting small businesses and low-income borrowers.

Explore the Data-driven Microfinance Sector Outlook 2025

The Microfinance Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap based on these metrics illustrates the microfinance industry’s global footprint. With 1200+ startups and over 2500 companies, the sector grows at an annual rate of 7.46%. The industry employs 783000 people globally, adding 50000 employees last year. It is supported by 207 grants, with top country hubs including India, the USA, Nigeria, Kenya, and the UK. The leading city hubs are Nairobi, Lagos, Mumbai, Bangalore, and New York City, showcasing the geographical diversity of microfinance innovation.

What data is used to create this microfinance report?

Based on the data provided by our Discovery Platform, we observe that the microfinance industry ranks among the top 10% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The microfinance industry attracted over 1600 media publications last year.

- Funding Rounds: Our database covers data from 1260 funding rounds, highlighting active investments.

- Manpower: Employing 783000 workers globally, the sector added 50000 new employees last year, showing steady growth.

- Grants: The industry has financial backing for expansion and innovation as evidenced by 207 grants.

- Yearly Global Search Growth: The yearly global search growth for microfinance is 10.69%, making it one of the most searched industries worldwide.

A Snapshot of the Global Microfinance Industry

The microfinance industry grows at an annual rate of 7.46%. Over 1200 startups operate in the sector, with 120 in early development stages. Also, 115 companies have undergone mergers and acquisitions within this sector.

Explore the Funding Landscape of the Microfinance Industry

The average investment per round is USD 17.5 million, showing strong financial backing in the industry. More than 430 investors participated in 1260 funding rounds, where they invested in more than 400 companies. This investment level highlights the industry’s importance and potential for further expansion.

Who is Investing in Microfinance?

The combined investment value by the top investors in the microfinance industry exceeds USD 1 billion, which indicates a strong backing for sector growth and innovation.

- International Finance Corporation has invested USD 418.4 million across 11 companies.

- TPG has invested USD 398 million in 2 companies.

- IndusInd Bank has invested USD 340 million across 3 companies.

- U.S. International Development Finance Corporation has contributed USD 279.7 million to 5 companies.

- European Investment Bank has invested USD 251.2 million in 5 companies.

- Commercial International Bank has invested USD 153.2 million across 2 companies.

- FMO has invested USD 143.7 million in 5 companies.

Access Top Microfinance Innovations & Trends with the Discovery Platform

Explore the emerging trends shaping the future of financial inclusion and digital transformation along with the firmographic data:

- Payment Processing plays a key role in microfinance, with over 6100 companies improving transaction efficiency. The sector employs 357K people and added 38K new employees last year. It grows at an annual rate of 4.40%. This trend reflects the rising demand for efficient, low-cost financial transactions, especially for underserved communities.

- Fraud Prevention is essential to secure financial ecosystems within microfinance. With over 3K companies and 492K employees, the sector grows annually at 17.18%. As the industry expands, preventing fraud is crucial to maintaining trust and protecting low-income clients’ and financial institutions’ assets.

- Digital Wallets changes how individuals in underserved markets access and manage financial services. Over 2500 companies are involved in this growing trend, with an annual growth rate of 27.99%. It employs 212K individuals and saw the addition of 23K new employees last year. This shift highlights mobile-based financial services’ increasing role in offering easier access to savings, payments, and credit for those without traditional banking infrastructure.

5 Top Examples from 1200+ Innovative Microfinance Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Farm Infinity advances the Financial Inclusion of Farmers

Indian startup Farm Infinity develops a platform to facilitate financial inclusion for smallholder farmers. It offers affordable financial services, including farm and crop loans, livestock insurance, and creditworthiness assessments. The startup’s algorithm evaluates a farmer’s financial health by analyzing multiple data points. This generates a credit score that allows banks and financial institutions to make informed lending decisions. Farm Infinity’s Banking-as-a-Service (BaaS) model supports real-time portfolio monitoring for its financial partners.

MIC Global delivers Embedded Micro Insurance

US startup MIC Global offers embedded microinsurance solutions through MiIncome, a digital reinsurance platform for short-term income loss. It uses parametric triggers within everyday services to protect against involuntary job loss, natural hazards, and accidents that disrupt earnings. The startup’s platform automates claims for quick payouts that enable customers to cover essential expenses. It provides coverage for rent, gadgets, mobility, and porch package theft to focus on affordability and ease of use. MIC Global enhances financial security by providing accessible microinsurance through global digital platforms.

Creditchek builds Credit Assessment Infrastructure

Nigerian startup Creditchek provides credit assessment tools to verify customer identities and evaluate creditworthiness across Africa. Its platform aggregates structured data from multiple sources, including national credit bureaus, to deliver credit and identity insights. These insights enable financial institutions, fintechs, microfinance organizations, and retail businesses to create tailored financial products for underserved populations. The startup’s tools, like Credit Insight and Income Insight, automate the analysis of transaction data, predict default risk, and identify performing or non-performing loans. Its RecovaPRO solution facilitates debt repayment by enabling businesses to recover funds faster and manage risk through a web dashboard or API integration.

Sorted Wallet offers a Non-custodial Crypto Wallet

Hong Kong startup Sorted Wallet provides a non-custodial crypto wallet for feature phones and low-powered smartphones for financial inclusion in emerging markets. It allows to store, send, and receive digital assets securely across multiple blockchains, including Ethereum, Polygon, and Tron, without needing high-end smartphones. The wallet’s interface, designed for non-touch screens, ensures accessibility for over a billion unbanked individuals in regions like Africa and South Asia. Its features include multi-blockchain support, real-time crypto price tracking, and AI chat integration for instant assistance. Sorted Wallet allows underserved populations to access decentralized finance and facilitate cross-border payments, stablecoin transactions, and staking opportunities to promote financial independence and inclusion.

Wawcash provides Daily Credits for Drivers

Senegal startup Wawcash offers daily micro-loans to moped taxi drivers to provide quick access to fuel credit so they start their workday without delays. The startup’s technology allows access to small loans through a platform that integrates with local partners like EDK Oil and Kpay. It offers benefits like transparent terms, quick approval, and access to financial services such as savings accounts and insurance. Wawcash addresses the critical challenge of fuel access for drivers in the informal sector and supports their daily operations.

Gain Comprehensive Insights into Microfinance Trends, Startups, or Technologies

In 2025, the microfinance industry will grow, driven by digital adoption and expanding financial inclusion. Trends like digital wallets, fraud prevention, and payment processing will reshape service delivery to enhance security and accessibility. The future will leverage technology to empower underserved communities and scale sustainable financial solutions globally. Get in touch to explore all 1200+ startups and scaleups, as well as all industry trends impacting microfinance companies.