The 2025 Wearable Technology Industry Report explores the market’s growth, showcasing advancements in healthcare, fitness, workplace safety, and AR applications. It highlights key trends, investments, startups, and partnerships shaping the industry, offering valuable insights for stakeholders to track innovation and future opportunities.

This report was last updated in January 2025.

Executive Summary: Wearables Industry Report 2025

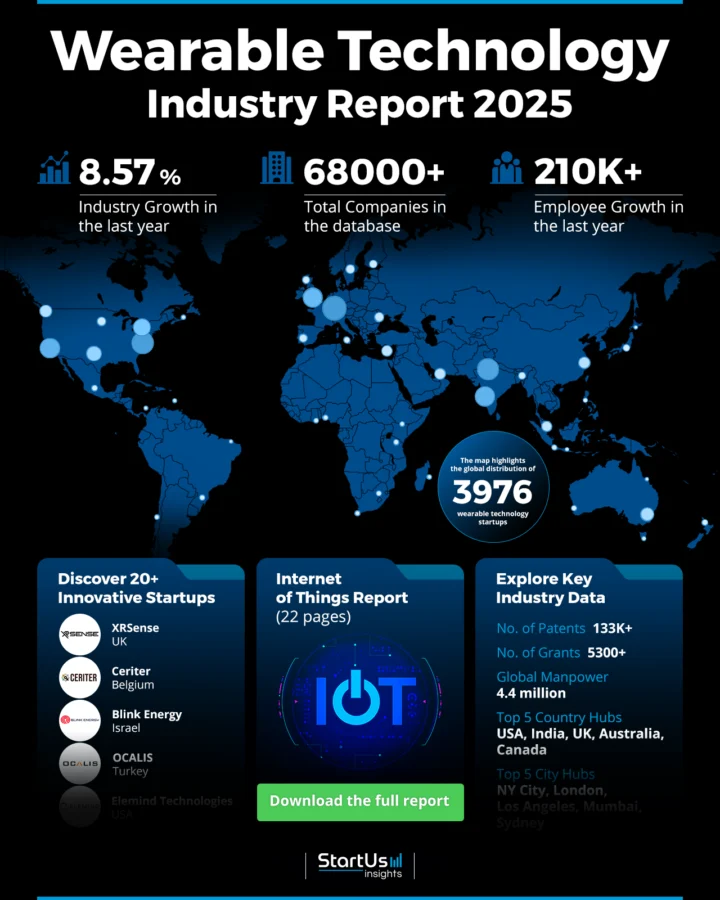

- Industry Growth Overview: The smart wearable market size is expected to grow from USD 29.12 billion in 2025 to USD 39.19 billion in 2029 at a compound annual growth rate of 7.7%. On a granular level, the wearable technology market is growing at an annual rate of 8.57% as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: The market employs 4.4 million people globally, adding over 210K new employees last year.

- Patents & Grants: Wearable technology companies hold over 133K patents and have secured more than 5300 grants. This highlights strong intellectual property protection and research funding.

- Global Footprint: Key country hubs include the USA, India, the UK, Australia, and Canada. Leading cities such as New York, London, Los Angeles, Mumbai, and Sydney drive innovation.

- Investment Landscape: The market has drawn over 14500 investors, completing 27K funding rounds. The average investment per round stands at USD 25.7 million, which indicates financial interest.

- Top Investors: General Atlantic, SoftBank Vision Fund, Tiger Global Management, and more contribute to a combined investment value exceeding USD 8 billion.

- Startup Ecosystem: Notable startups driving innovation include XRSense (heavy industry extended reality), Ceriter (rehabilitation wearable device), Blink Energy (connected ocular devices), OCALIS (industrial exoskeletons), and Elemind Technologies (wearable neurotechnology for sleep).

Methodology: How We Created This Wearable Technology Industry Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of wearable technology over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within wearable technology

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the wearable technology industry.

What Data is Used to Create This Wearable Technology Report?

Based on the data provided by our Discovery Platform, we observe that the wearable technology industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The industry generated over 73K publications last year.

- Funding Rounds: Our database includes data from over 27K funding rounds, highlighting substantial investment interest.

- Manpower: The wearable technology workforce comprises over 4.4 million employees, with an increase of 210K workers in the past year.

- Patents: The sector holds more than 133K patents, which indicates a strong emphasis on innovation and intellectual property.

- Grants: Over 5300 grants have been awarded to wearable technology companies.

- Yearly Global Search Growth: The global search interest in wearable technology grows at an annual rate of 23.11%.

Explore the Data-driven Wearables Market Report for 2025

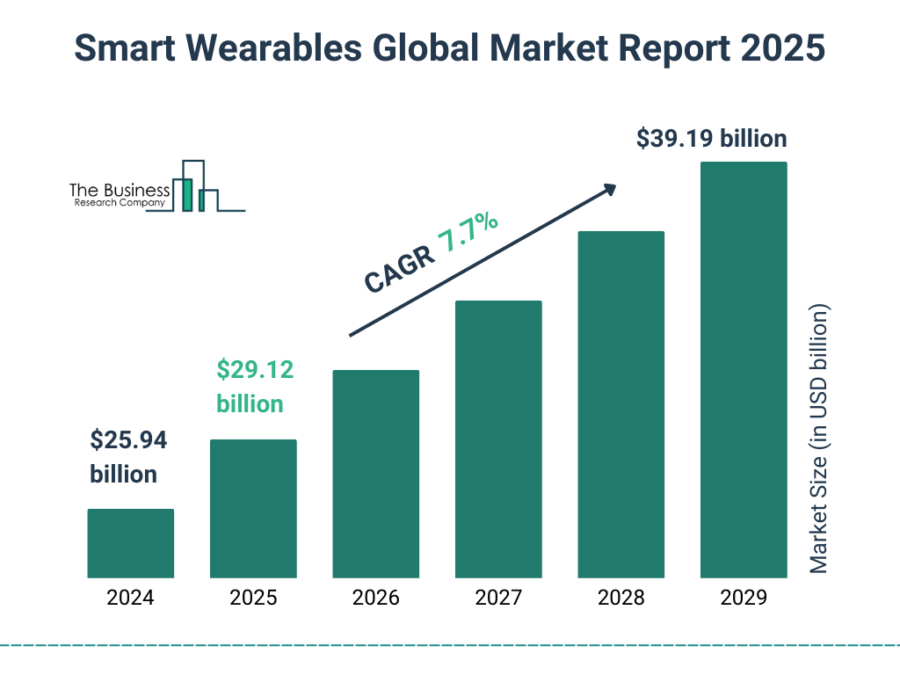

As per the Business Research Company, the smart wearable market size is expected to grow from USD 29.12 billion in 2025 to USD 39.19 billion in 2029 at a compound annual growth rate of 7.7%.

The Mordor Intelligence report suggests that the wearable technology market size is estimated at USD 219.30 billion in 2025, and is expected to reach USD 493.26 billion by 2030, at a compound annual growth rate of 17.6% during the forecast period 2025-2030.

The markets and markets report suggests that the global wearable technology market size is expected to grow from USD 70.30 billion in 2024 to USD 152.82 in 2029 at a CAGR of 16.8% during the forecast period.

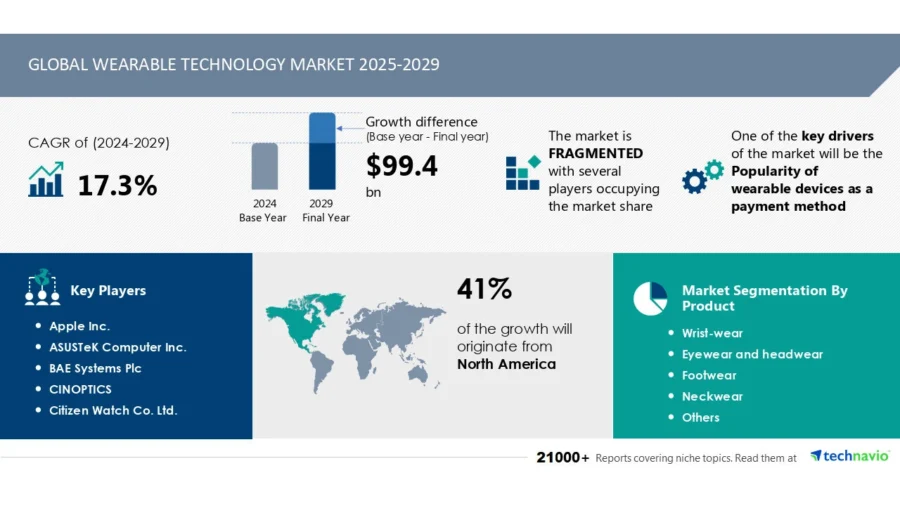

The global wearable technology market size is estimated to grow by USD 99.4 billion from 2025-2029, according to Technavio.

Credit: PR Newswire

The wearable technology sector has a strong presence with over 3900 startups among more than 68K companies worldwide. The market grows steadily at an annual rate of 8.57%.

Companies in this sector hold over 133K patents and have received more than 5300 grants that show active innovation and substantial support.

Credit: The Business Research Company

Additionally, the global workforce in wearable technology amounts to 4.4 million people, with an increase of over 210K employees last year.

The sector’s most prominent hubs are in the USA, India, UK, Australia, and Canada. Key cities driving wearable technology innovation include New York City, London, Los Angeles, Mumbai, and Sydney, all major centers for talent, resources, and investment.

Moreover, Technavio’s report suggests that North America is estimated to contribute 41% to the growth of the global market during the forecast period 2025-2029.

A Snapshot of the Global Wearable Technology Industry

The wearable technology industry grows at an annual rate of 8.57%, with over 3900 companies in its startup ecosystem.

This ecosystem includes more than 2300 early-stage startups, while mergers and acquisitions account for over 2400 companies, which reflects active development and consolidation.

In terms of intellectual property, the industry holds more than 133K patents globally, with over 33K unique applicants contributing to technological advancements.

Patent activity is growing yearly by 2.62%. The USA leads patent issuance with over 36K patents, followed closely by China with more than 33K.

Explore the Funding Landscape of the Wearable Technology Industry

The investment in the wearable technology industry averages USD 25.7 million per funding round. The sector has attracted over 14 500 investors, showing broad interest and financial support.

To date, more than 27K funding rounds have been closed, which reflects consistent investment activity.

Over 6500 companies have received investment, indicating widespread opportunities and a strong startup ecosystem.

Who is Investing in Wearable Technology?

Top investors in the wearable technology industry have invested over USD 8 billion, emphasizing strong financial backing for innovation.

- General Atlantic has invested USD 1.6 billion across 11 companies. General Atlantic acquired Actis, improving its investment platform to USD 97 billion in assets under management.

- SoftBank Vision Fund holds stakes in 16 companies with investments totaling USD 1.5 billion. SoftBank, OpenAI, Oracle, and MGX launched Stargate, a USD 500 billion project to build AI data centers across the US in four years.

- Tiger Global Management has invested USD 924.4 million in 11 companies. Tiger Global plans to join a funding round valuing OpenAI at USD 150 billion.

- Eurazeo has invested USD 875.9 million across 14 companies. Eurazeo and Kurma Partners invested USD 101 million in PanTera to scale Actinium-225 production for cancer therapies.

- JP Morgan supports the industry with USD 867 million invested in 7 companies.

- Abu Dhabi Investment Authority has committed USD 813.2 million across 5 companies. ADIA invested USD 750 million in GMR Group’s debt to expand India’s growing aviation market.

- Silver Lake has invested USD 787 million in 3 companies. Silver Lake and GIC acquired billing software firm Zuora for USD 1.7 billion.

- Alibaba Group invested USD 694.6 million in 9 companies. Alibaba partnered with South Korea’s E-Mart to merge AliExpress Korea and Gmarket into a USD 4 billion joint venture.

- Fidelity Investments backs 10 companies with USD 673.4 million. Fidelity plans to convert its USD 178 million Municipal Bond Index Fund into an ETF by April 2025.

- Bridgepoint has invested USD 608.4 million across 5 companies. Bridgepoint Development Capital IV acquired Capita’s 75% stake in Fera Science for USD 101 million.

Top Wearable Technology Innovations & Trends

Explore the wearable technology trends, each marked by unique growth dynamics and firmographic insights:

- Sensor Technology includes over 14K companies and employs more than 530K people. Last year, the sector added 32K new hires, reflecting ongoing demand for advanced sensor applications. With an annual trend growth rate of 2.20%, sensor technology drives innovation in data collection and precision capabilities.

- Fitness Tracking comprises over 900 companies and 55K employees. The trend added 3K employees last year and has an annual growth rate of 19.01%, driven by the popularity of health-conscious wearables. This rapid growth underscores the focus on personal fitness and health monitoring.

- Extended Reality (XR) includes over 3K companies and employs 90K individuals, with 10K new hires last year. With an annual trend growth rate of 17.27%, XR is a dynamic segment of wearable technology that enables immersive experiences and expands applications in consumer and enterprise markets

5 Top Examples from 3900+ Innovative Wearable Technology Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

XRSense delivers Heavy Industry Extended Reality

UK startup XRSense develops a wearable platform with monitoring features to enhance safety and efficiency in industrial environments.

The platform uses sensors and an AI-powered dashboard to track location, detect ambient noise, and provide real-time hazard alerts on a dashboard for supervisors.

It offers features like privacy mode, ambient noise capture, and GPS-enabled geo-zoning to maintain awareness and streamline communication. This allows workers to receive and respond to prioritized alerts instantly.

XRSense improves situational awareness and operational safety to minimize risks and enhance productivity in industries such as construction, oil and gas, and logistics.

Ceriter develops Rehabilitation Wearable Devices

Belgian startup Ceriter designs Stride One, a smart insole system with eight pressure sensors to monitor foot roll-off and gait parameters.

The insoles transmit data via a Bluetooth-connected Cericom box to the Stride One mobile app, which delivers real-time audio cues based on walking data. It is available in multiple sizes and is easy to clean, the insoles fit most footwear to ensure versatility.

The system includes an online portal for detailed data analysis and visualization that supports therapists and researchers in optimizing gait correction strategies and improving mobility and rehabilitation outcomes.

Blink Energy creates Connected Ocular Devices

Israeli startup Blink Energy develops BlinkIT, a compact energy and communication platform for smart ocular devices.

It sits within the epicanthic fold on the eyelid and uses an ASIC solution to wirelessly power and connect contact lenses or eye implants to a mobile app for energy transfer and data communication.

Its minimal design ensures comfort and easy integration with ocular devices to support real-time health monitoring through an app or cloud-based server.

Blink Energy advances the autonomy of intelligent ocular devices, reducing costs and expediting their adoption for improved ocular health and monitoring.

OCALIS produces Industrial Exoskeletons

Turkish startup OCALIS designs exoskeletons to reduce physical strain for workers in demanding environments.

Its products, the OCALIS Shoulder Pro and the OCALIS Back Lite, prevent shoulder injuries and provide back support in industrial settings. These exoskeletons support key muscle groups, allowing workers to perform repetitive tasks with less fatigue and injury risk.

OCALIS also focuses on industries such as manufacturing and logistics to offer practical solutions that increase productivity and promote worker well-being.

Elemind Technologies advances Wearable Neurotechnology for Sleep

US startup Elemind Technologies develops a wearable neurotechnology headband to improve sleep by measuring EEG brain signals and delivering personalized acoustic feedback.

This device responds to individual brainwaves and modulates them to reduce wakefulness and encourage deep, restorative sleep.

The startup’s AI-driven Sleep Tailor personalizes the experience by adapting to each user’s sleep patterns to enhance effectiveness with every use.

Further, Elemind offers a non-drug solution to aid in falling asleep faster and provide high-quality, on-demand sleep.

Gain Insights into Wearable Technology Trends, Innovations, or Startups

The wearable technology industry is set for continued growth in 2025, with adoption increasing across health, fitness, and immersive experiences. Emerging trends in advanced sensor technology, fitness tracking, and extended reality (XR) will expand applications and enrich user experiences.

Get in touch to explore all 3900+ startups and scaleups, as well as all industry trends impacting wearable technology companies.

![Explore the 10 Top Startups to Watch in Stuttgart [2025]](https://www.startus-insights.com/wp-content/uploads/2025/02/SharedImg-StartUs-Insights-noresize-420x236.webp)

![Explore the 10 Top Startups to Watch in Dublin [2025]](https://www.startus-insights.com/wp-content/uploads/2025/02/Dublin-Startups-SharedImg-StartUs-Insights-noresize-420x236.webp)

![Explore the 10 Top Tech Startups to Watch in Hong Kong [2025]](https://www.startus-insights.com/wp-content/uploads/2025/02/Hong-Kong-Tech-Startups-SharedImg-StartUs-Insights-noresize-420x236.webp)