The 2025 Data Analytics Market Report highlights the sector’s growth as businesses adopt AI, ML, and big data technologies for strategic decision-making, operational efficiency, and customer insights. The key trends include predictive analytics, real-time data processing, and self-service tools expanding data access, while the report also examines investments and startups shaping the market’s future.

This report was last updated in January 2025.

Executive Summary: Data Analytics Market Outlook 2025

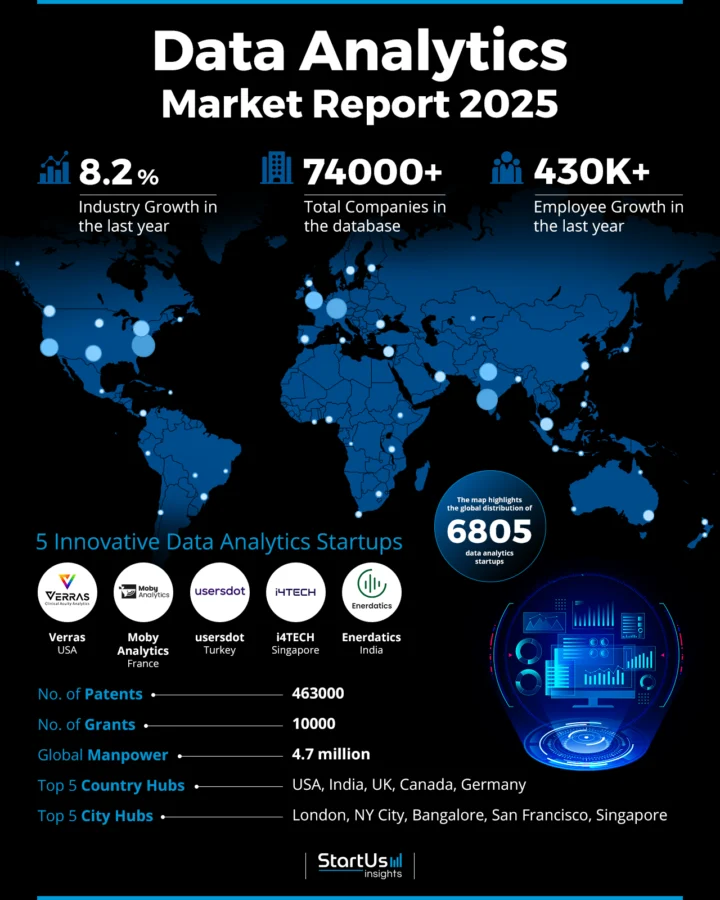

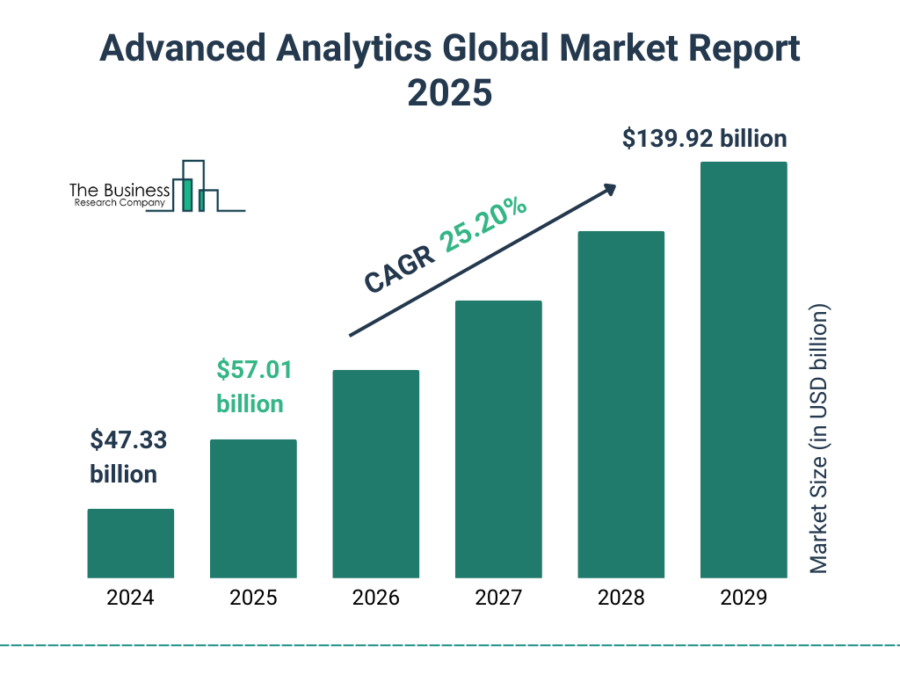

- Industry Growth Overview: The advanced analytics market size is projected to grow from USD 57.01 billion in 2025 to USD 139.92 billion in 2029 at a compound annual growth rate of 25.2%. On a granular level, the data analytics market grew by 8.2% annually as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: The sector employs 4.7 million individuals globally, adding 430 000 new employees last year. This growth reflects expanding adoption across industries and a strong demand for skilled talent.

- Patents & Grants: Innovation drives the market, with 463 000 patents and 10 000 grants supporting technological advancements. The yearly patent growth reached 10.03%, with the United States and China as leading issuers.

- Global Footprint: Key country hubs include the United States, India, the United Kingdom, Canada, and Germany. Prominent city hubs are London, New York City, Bangalore, San Francisco, and Singapore.

- Investment Landscape: The market saw investment activity, with over 57 000 funding rounds closed and more than 30000 investors participating. The average investment value per round is USD 20.7 million.

- Top Investors: Goldman Sachs, Sequoia Capital, Citi, and more are among the top investors, contributing to a combined investment value exceeding USD 9 billion across the market.

- Startup Ecosystem: The sector includes startups such as Verras (healthcare data analytics), Moby Analytics (AI-driven audit analytics), usersdot (AI-powered e-commerce data intelligence), i4TECH (Industry 4.0 data solutions), and Enerdatics (energy data analytics).

Methodology: How We Created This Data Analytics Market Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of data analytics over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within data analytics

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the data analytics market.

What Data is Used to Create This Data Analytics Report?

Based on the data provided by our Discovery Platform, we observe that the data analytics market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The data analytics market generated over 50 000 publications last year.

- Funding Rounds: Our database includes 57 000 funding rounds, highlighting significant investment activity and financial support for companies.

- Manpower: With over 4.7 million workers globally, the sector added 430 000 new employees last year. This demonstrates its expanding workforce and employment opportunities.

- Patents: A total of 463 000 patents underscores innovation and technological advancements.

- Grants: The field secured 10 000 grants, which reflects consistent government and institutional funding support for various initiatives.

- Yearly Global Search Growth: A 47.99% yearly global search growth illustrates growing curiosity and attention toward data analytics across multiple sectors and demographics.

Explore the Data-driven Data Analytics Report for 2025

As per the Business Research Company report, the advanced analytics market size is projected to grow from USD 57.01 billion in 2025 to USD 139.92 billion in 2029 at a compound annual growth rate of 25.2%.

According to the Hyperight report, the global data analytics market is projected to exceed USD 140 billion by 2025.

The Data Analytics Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

Our database includes 6800+ startups and 74 000+ companies. The field grew by 8.2% last year, supported by 463 000 patents and 10 000 grants.

Credit: The Business Research Company

Moreoever, the global manpower reached 4.7 million, with 430 000 new employees added. Regional hubs driving innovation include the United States, India, the United Kingdom, Canada, and Germany.

Further, the prominent city hubs are London, New York City, Bangalore, San Francisco, and Singapore.

In the USA, the data analytics market is expected to reach approximately USD 14.72 billion in 2024, with a compound annual growth rate of 20.7% from 2025 to 2030, leading to a projected market size of USD 43.52 billion by 2030.

A Snapshot of the Global Data Analytics Market

The data analytics market shows annual growth of 8.2%, reflecting its expanding influence across industries. The ecosystem comprises 6800+ startups, which includes more than 5000 early-stage ventures.

Further, mergers and acquisitions total 3400, indicating consolidation trends.

Innovation drives the sector, with 463000 patents filed by 25000 applicants, reflecting yearly growth of 10.03%.

The United States leads with over 146 000 patents, closely followed by China with 132 000+ patents.

Explore the Funding Landscape of the Data Analytics Market

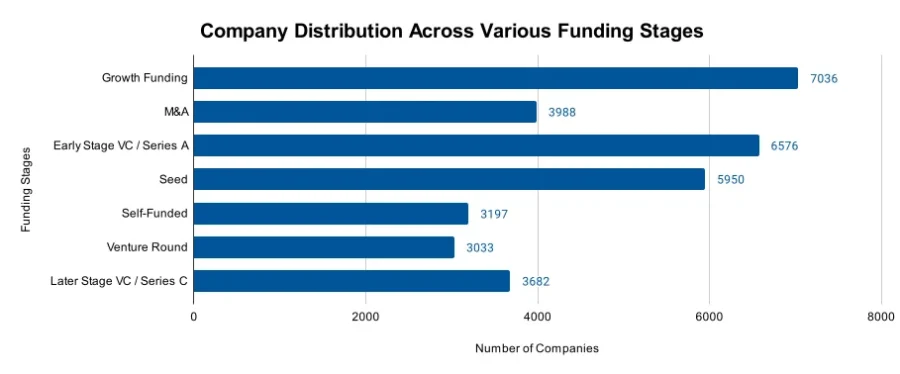

The data analytics domain shows significant investment activity, with an average investment value of USD 20.7 million per round. The field has attracted over 30 000 investors, which is a reflection of confidence in its growth potential.

More than 57 000 funding rounds have been closed that support company expansion and innovation in this sector. Investments have been directed toward over 13 000 companies.

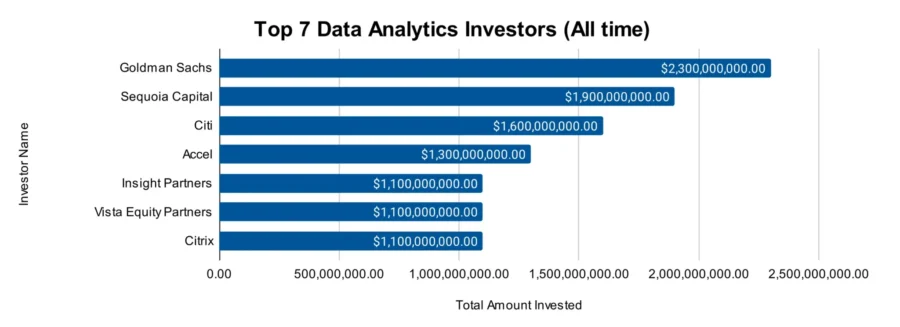

Who is Investing in Data Analytics Solutions?

Top investors in the data analytics industry have contributed over USD 9 billion. It reflects concentrated funding by leading financial institutions and venture capital firms.

- Goldman Sachs has invested USD 2.3 billion across 30 companies. Goldman Sachs invested approximately USD 200 million to acquire seven last-mile logistics properties in Australia.

- Sequoia Capital has directed USD 1.9 billion into 82 companies. Sequoia Capital led a USD 150 million funding round for Vanta, an online security and compliance management platform.

- Citi has committed USD 1.6 billion to 28 companies. Citi announced a collaboration with Apollo Global Management to establish a USD 25 billion private credit and direct lending program.

- Accel has allocated USD 1.3 billion to 64 companies. Accel announced the closing of its USD 650 million Fund VIII, dedicated to early-stage startups in India and Southeast Asia.

- Insight Partners has invested USD 1.1 billion across 64 companies. Insight Partners participated in a substantial USD 10 billion growth investment in Databricks.

- Vista Equity Partners has provided USD 1.1 billion to 16 companies. Vista Equity Partners led a majority investment in Nasuni, a cloud storage firm, valuing the company at approximately USD 1.2 billion.

- Citrix has invested USD 1.1 billion in two companies. Citrix acquired Unicon, provider of the secure endpoint OS eLux and enterprise management platform Scout.

Moreover, data analytics firm Databricks secured a USD 10 billion funding round, with participation from Meta Platforms.

Top Data Analytics Innovations & Trends

The data analytics market is shaped by emerging trends, each driving growth and innovation. These trends highlight unique areas of specialization and development.

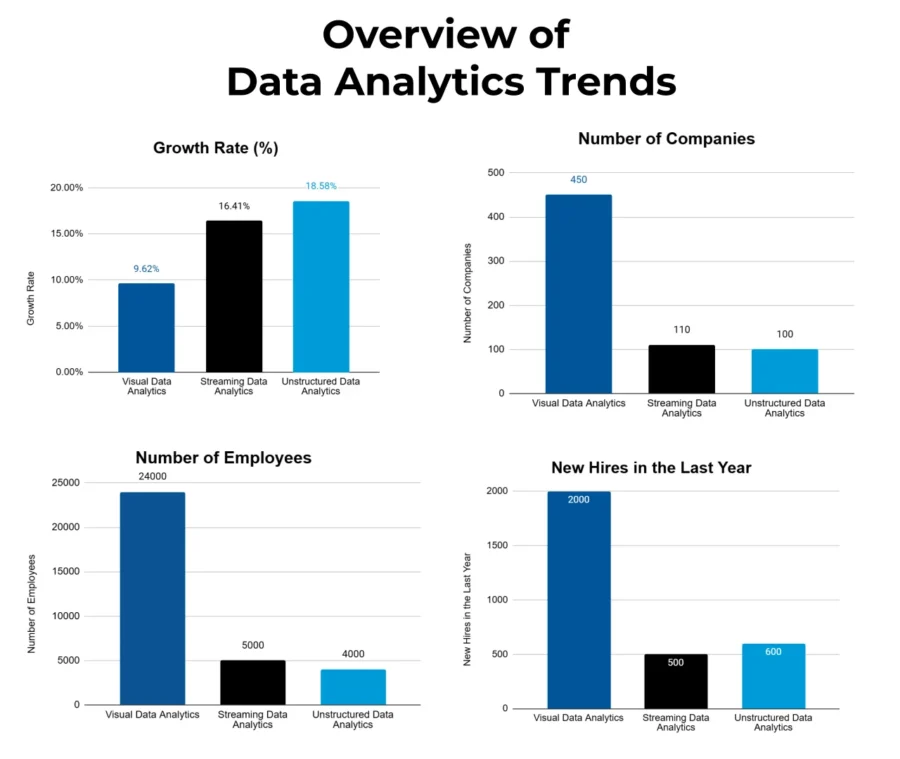

- Visual Data Analytics encompasses 450 companies and employs 24000 individuals, with 2000 new hires last year. This trend has an annual growth rate of 9.62%. It indicates a steady interest in data visualization solutions that improve decision-making.

- Streaming Data Analytics includes 100 companies with 5000 employees, of which 500 were new hires last year. With an annual growth rate of 16.41%, this trend reflects the rising importance of real-time data processing in finance, media, and IoT.

- Unstructured Data Analytics features 110 companies employing 4000 individuals, with 600 new hires last year. Its growth rate of 18.58% showcases increasing demand for technologies that analyze unstructured data, like text and multimedia, driving advancements in AI and machine learning.

Did you know that the incorporation of AI and machine learning into data analytics is expected to improve predictive capabilities and operational efficiencies?

A partnership involving OpenAI, Oracle, and SoftBank, supported by the US government, has announced an initial investment of USD 100 billion in AI infrastructure, with plans to scale up to USD 500 billion.

5 Top Examples from 6800+ Innovative Data Analytics Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Verras provides Healthcare Data Analytics

US startup Verras develops tools to leverage healthcare data and enhance service quality and value. Its Acuity Index Method system assesses clinical and cost-efficiency outcomes by adjusting for patient severity.

The Verras Sherlock tool offers insights into resource utilization across cost centers to identify deviations from norms.

Verras Watson uses electronic medical records to refine clinical pathways and tailor interventions based on patient acuity.

The startup’s Medical Value Index evaluates hospital performance using six metrics, including quality measures, readmission rates, and resource consumption, to compute an overall value score.

Verras enables healthcare providers to optimize resource use, reduce clinical variation, and deliver higher-quality, cost-effective care.

Moby Analytics delivers AI-driven Audit Analytics

French startup Moby Analytics offers an AI-driven platform that automates document collection and analysis for auditors.

It integrates with SharePoint to store documents in designated folders and match received documents with specific requests using AI.

The users program extraction tasks for various documents such as invoices, delivery notes, contracts, or reports— with a few clicks. This allows the AI to extract key information and present it in a simple table.

A streamlined dashboard provides real-time updates on document requests, receipts, and processing status that enables users to monitor audit progress across the organization.

Moby Analytics’ platform allows auditors to create and share AI workflows that automate tasks and unlock insights for enhancing audit productivity and enabling professionals to focus on strategic decision-making.

usersdot offers AI-powered E-commerce Data Intelligence

Usersdot delivers AI-powered e-commerce data intelligence solutions for brands and e-retailers to optimize their digital shelf performance.

Its technology detects critical consumer-facing touchpoints, analyzes large-scale e-commerce data, and provides actionable insights to drive data-driven decisions instantly.

The platform consolidates essential metrics like buy box performance, ratings, reviews, price, promotion, availability, and product content into a single, real-time dashboard.

This all-in-one solution enables businesses to monitor and optimize their performance, saving time and maximizing sales across multiple retailer platforms.

i4TECH specializes in Industry 4.0 Data Solutions

Singaporean startup i4TECH develops ActivaSuite, a manufacturing application suite built on the Mendix Low Code Platform.

It integrates services like AWS IoT Sitewise and IoT Greengrass for connectivity, data processing, and ingestion. This suite includes applications for performance management, quality inspection, computerized maintenance, production energy management, lean daily management, and material traceability.

Manufacturers leverage these tools to monitor equipment effectiveness in real-time, control quality through immediate checks, and plan maintenance proactively.

They also manage energy consumption, oversee daily operations visually, and trace materials throughout the production process.

i4TECH enables manufacturing companies to optimize operations, increase productivity, and adopt data-driven practices.

Enerdatics focuses on Energy Data Analytics

Indian startup Enerdatics offers specialized data analytics platforms that provide insights into the renewable energy sector.

Its Renewable Energy M&A platform grants access to transactions that enable users to analyze deal metrics across sectors and asset life cycles.

The Renewable Energy Finance database encompasses financing transactions by many companies and banks in various countries, detailing capital instruments ranging from fixed-income securities to tax equity investments.

The startup’s Renewable Energy PPA tracker includes data on corporate power purchase agreements signed by off-takers and suppliers in many countries to offer insights into contract specifics and market trends.

The Renewable Energy Projects platform provides profiles on utility-scale wind and solar projects that cover aspects such as origination, investments, operational milestones, and contractors.

Enerdatics’ platforms allow stakeholders to make informed decisions, optimize investment strategies, and navigate the evolving renewable energy landscape.

Gain Comprehensive Insights into Data Analytics Trends, Startups, or Technologies

The data analytics market will continue to grow in 2025, driven by advancements in real-time analytics, unstructured data processing, and AI integration. Emerging trends in visual and streaming analytics will redefine decision-making across industries to enhance speed and accuracy.

Get in touch to explore all 6800+ startups and scaleups, as well as all industry trends impacting data analytics companies.