The 2025 Healthcare Software Market Report highlights the role of digital solutions in improving healthcare. AI, big data analytics, and cloud technologies are making an impact on how providers, payers, and patients interact. The report also provides stakeholders, investors, policymakers, and analysts with a snapshot of the market’s health and growth trajectory.

Executive Summary: Health Care Software Market Report 2025

- Industry Growth Overview: The healthcare software market has more than 3180 companies and 1770+ startups. It is expected to grow at a compound annual growth rate (CAGR) of 10.50% from 2024 to 2034. On a granular level, the market has experienced a growth rate of 10.30% over the past year as per our platform’s latest data.

- Manpower & Employment Growth: The market employs over 181K individuals globally, with an increase of 17K+ new jobs added in the last year.

- Patents & Grants: The healthcare software market features more than 60 patents and 360+ grants. The patent growth rate is 3.47% yearly, with the US and South Korea leading in patent issuance.

- Global Footprint: Key hubs for healthcare software include the US, India, the UK, Germany, and Canada, showcasing a diverse global infrastructure supporting market growth. Major city hubs encompass New York City, London, San Francisco, Bangalore, and Pune.

- Investment Landscape: The average investment value per funding round exceeds USD 16 million, with over 2130 funding rounds closed. More than 1K investors are actively engaged in the healthcare software market.

- Top Investors: Major investors include Roper, Greenoaks, Green Sands Equity, Lux Capital, Wesfarmers, and more are collectively investing over USD 1.23 billion across numerous companies.

- Startup Ecosystem: Five innovative startups, Graylight Imaging (medical imaging software), Nia Health (personalized patient support), Caare (telehealth for rural, senior, and urban), Caribou Health Technologies (healthcare planning software)and Medea Mind (digital copilot for psychology) showcase the market’s global reach and entrepreneurial spirit.

What Data is Used to Create This Medical Software Market Report?

Based on the data provided by our Discovery Platform, we observe that the healthcare software market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The healthcare software market has been featured in over 3420 publications in the last year which showcase a major media attention.

- Funding Rounds: There have been more than 2130 funding rounds recorded in our database for this domain.

- Manpower: The global workforce in the healthcare software market exceeds 181K, with an additional 17K+ employees added in the past year alone.

- Patents: The healthcare software market holds more than 60 patents.

- Grants: Over 360 grants have been awarded to companies within the healthcare software domain.

- Yearly Global Search Growth: The healthcare software market has experienced a yearly global search growth of 3.50%.

Methodology: How We Created This Health Care Software Report

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of healthcare software over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within healthcare software

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the healthcare software market.

Explore the Data-driven Healthcare Software Market Outlook for 2025

According to Precedence Research, the global healthcare software as a service market was valued at USD 34.84 billion in 2024 and is expected to grow to USD 38.50 billion in 2025. It is predicted to surpass USD 94.56 billion by 2034 with a CAGR of 10.50% from 2024 to 2034.

The healthcare software market outlook 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

Our database includes 1770+ startups, with a total of over 3180 companies contributing to the medical software market’s growth. Despite a modest market growth of 10.30% in the past year, the healthcare software market continues to thrive.

Credit: Precedence Research

Grand View Research reports that the healthcare IT market is expected to expand at a CAGR of 15.8% from 2024 to 2030. However, on a micro level, the market grew by a rate of 10.30% last year as per our platform’s latest data.

Additionally, the global workforce for these companies exceeds 181K, with an employee growth of 17K over the last year.

The key hubs driving innovation within the healthcare software market are located in the United States, India, United Kingdom, Germany, and Canada, with top cities including New York City, London, San Francisco, Bangalore, and Pune.

A Snapshot of the Global Healthcare Software Market

Over the past year, the healthcare software market has experienced a modest annual growth of 10.30%. Our database includes 1770+ startups, with over 220 early-stage companies.

Additionally, more than 180 mergers and acquisitions (M&A) have occurred – which indicate consolidation and growth within the healthcare market.

The patent landscape reveals 60+ patents filed, with a yearly patent growth rate of 3.47%.

Further, the top issuer of patents is the USA, accounting for over 40 patents, followed by South Korea with 5+ patents, highlighting the technological advancements in healthcare software.

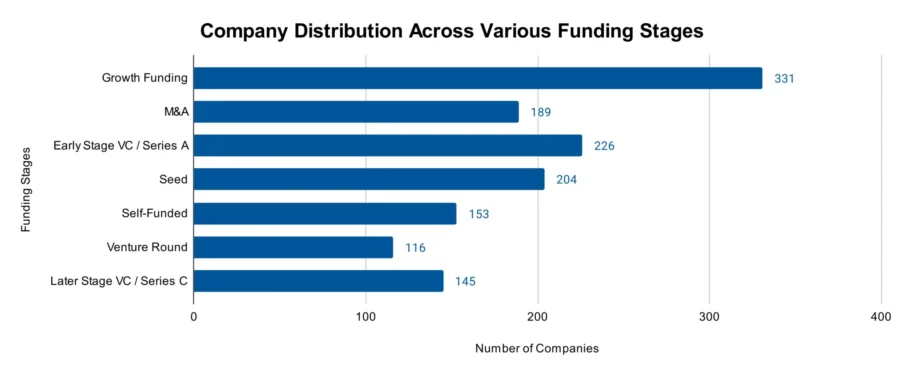

Explore the Funding Landscape of the Medical Software Market

The average investment value per round exceeds USD 16 million which showcases the major financial backing the healthcare software market attracts. With over 2130 funding rounds closed, more than 1K investors have actively contributed to shaping the market’s growth and innovation. Additionally, these investments span across 530+ companies which highlight the broad appeal and diverse opportunities within the health care software market.

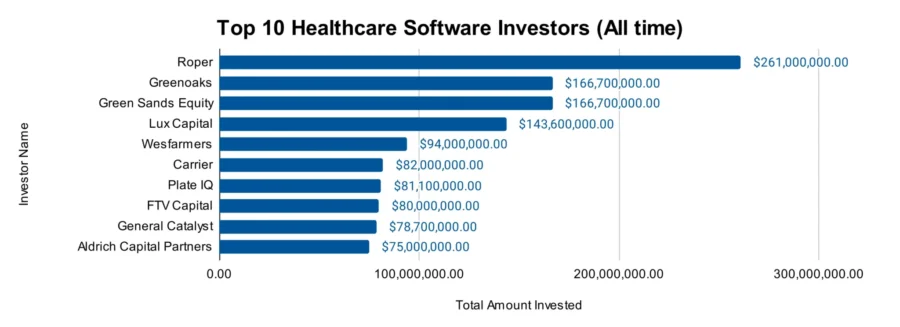

Who is Investing in the Healthcare Software Market?

The combined investment value of the top investors in the healthcare software market exceeds USD 1.23 billion. Here is a breakdown of their contributions:

- Roper has invested USD 261 million in at least 1 company.

- Greenoaks has backed at least 1 company with USD 166.7 million. It announced the acquisition of 2250 199 shares of Coupang, an e-commerce company known for its fast delivery services.

- Green Sands Equity has invested USD 166.7 million in at least 1 company.

- Lux Capital has funded at least 1 company with USD 143.6 million. The company led a USD 191 million financing round for eGenesis.

- Wesfarmers has committed USD 94 million to at least 1 company.

- Carrier has invested USD 82 million in at least 1 company.

- Ottimate has allocated USD 81.1 million to at least 1 company. It committed over USD 4 billion by 2030 to develop intelligent climate and energy solutions.

- FTV Capital has contributed USD 80 million to at least 1 company. SilverTree Equity along with FTV Capital announced a major growth equity investment in Orbus Software.

- General Catalyst has diversified its portfolio by investing USD 78.7 million across 4 companies. Venture Highway, after merging with General Catalyst, plans to invest USD 800 million -1 billion in Indian startups over three years.

- Aldrich Capital Partners has invested USD 75 million in at least 1 company. Plus, it announced a USD 53 million investment in SpinSci Technologies, which is a healthcare IT company specializing in patient engagement solutions.

Top Healthcare Software Innovations & Trends

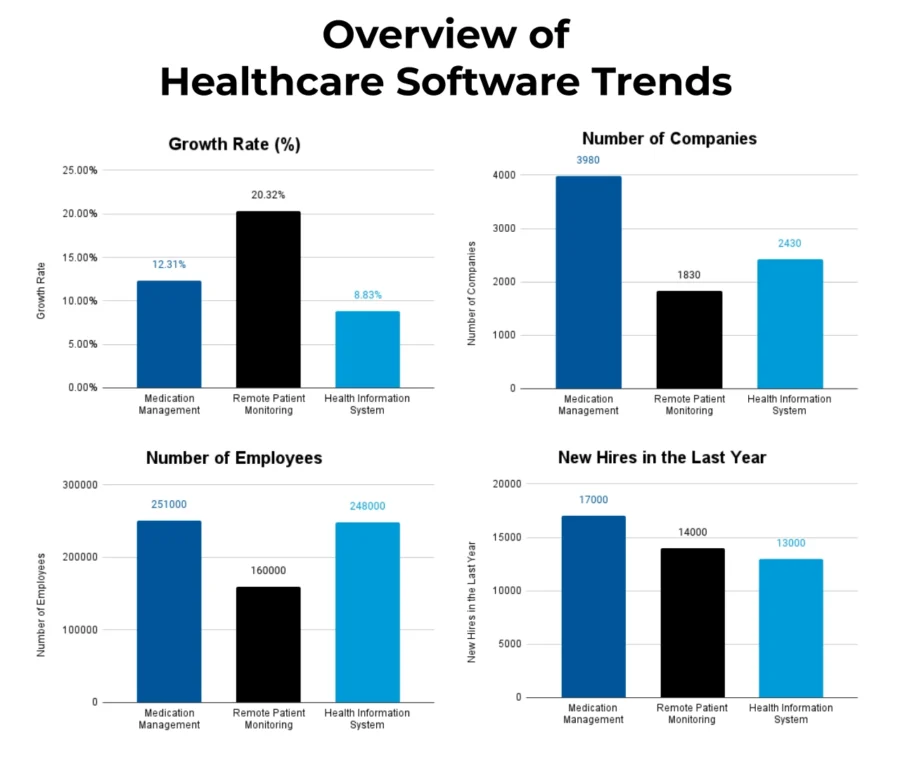

Following are the emerging trends in the healthcare software market along with their firmographic details:

- The Medication Management segment is a vital part of healthcare innovation with over 3980 companies and a workforce of 251K+. The addition of 17K+ employees in the past year reflects its steady expansion, supported by an annual growth rate of 12.31%. This domain is crucial for addressing medication errors, adherence, and supply chain inefficiencies through solutions that improve patient outcomes and operational efficiency.

- Remote Patient Monitoring (RPM) is improving healthcare delivery with 1830+ companies and 160K+ employees in this domain. Its annual growth rate of 20.32% and the addition of 14K+ employees highlight the demand for technologies that enable real-time health tracking and remote care. This market allows healthcare providers to extend their reach, reduce hospital readmissions, and improve patient engagement, all while managing resources effectively.

- Health Information Systems (HIS) provide the basis of modern healthcare, with 2430+ companies employing 248K+ professionals. Although the growth rate stands at 8.83%, the addition of 13K+ employees last year signals ongoing investments in data integration and interoperability. HIS solutions play a critical role in improving patient record management, and care coordination, and supporting data-driven decision-making.

5 Top Examples from 1770+ Innovative Healthcare Software Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Graylight Imaging develops Medical Imaging Software

Graylight Imaging is a Polish startup that uses medical image analysis to provide actionable insights from medical images. The startup’s solution utilizes AI-powered measurements for automated and precise analysis of CT, MRI, PET, and Angio-CT scans. Its radiomics capabilities extract hidden features from medical images to create new biomarkers and improve clinical decision-making.

Graylight Imaging offers AI-driven tools that support cardiac analysis by accurately delineating coronary arteries and other critical structures. The startup also specializes in generating 3D medical models from scans that facilitate surgical planning, educational purposes, and personalized medicine. Additionally, its data visualization solutions provide interactive displays that aid in treatment planning and image interpretation.

Further, through computational fluid dynamics, Graylight Imaging simulates blood flow and plaque formation which provides valuable insights for designing medical devices and improving disease management.

Nia Health offers Personalized Patient Support

Nia Health is a German startup that develops personalized medical software for patient engagement and clinical outcomes. Its platform offers digital therapeutics (DTx) solutions, such as Nia for eczema, Sorea for psoriasis, and Milderma for acne.

These solutions are tailored to the individual needs of patients, primarily in dermatology and allergology. Additionally, Nia Health’s DTx applications consistently meet the standards for data security and quality management.

The startup also specializes in remote patient monitoring (RPM), which provides clinicians with real-time access to patient data for better decision-making. Plus, the digital trial tools improve compliance and streamline data collection while engaging patients effectively.

Caare provides AI-powered Telehealth Services

Caare is an Indian startup that offers telemedicine services by combining local health workers with AI screening to provide accessible care in rural, senior, and urban areas. Its phygital clinic model merges physical clinics with telehealth to ensure rural communities receive specialist consultations remotely.

The startup’s AI-powered tools, including Heart AI and Oral AI, facilitate vital health monitoring and dental diagnoses via smartphone or tablet for patients in remote locations. Caare’s services also extend to elderly care, mental health, and pharma, supporting patients and healthcare providers through continuous access to specialists and data-driven insights.

In addition, Caare incorporates healthcare software as a service (SaaS) to streamline patient management, appointments, medical records, and real-time data sharing. This SaaS model provides healthcare providers with tools to manage patient interactions and care delivery while offering easy access to medical information across regions.

Caribou Health Technologies develops Healthcare Planning Software

US-based startup Caribou Health Technologies develops healthcare planning software that allows financial advisors to improve client healthcare costs and create financial plans. The company’s healthcare planning software platform, HealthPlanner, aligns clients’ healthcare needs, budgets, and preferences with suitable health plan options for the marketplace and medicare.

Additionally, the software identifies tax-saving opportunities, including premium tax credits, medical deductions, and health savings account (HSA) benefits. It also summarizes current coverage, expenses, and future scenarios. Moreover, HealthPlanner allows advisors to mitigate financial risks, strengthen client relationships, and offer personalized, unbiased insights at different life stages.

Medea Mind builds Digital Copilot for Psychology

Medea Mind is a Spanish startup that offers clinical software to optimize psychological care management. The platform automates and improves clinical processes, from patient screening and evaluation to ongoing treatment monitoring. It uses algorithms and data-driven insights to assess biopsychosocial factors, identify common symptoms across clinical conditions, and provide real-time results.

Additionally, the startup provides a smart matching tool for the right patient-professional alignment and automates patient progress tracking to support treatment adjustments. With Medea Mind, healthcare facilities and professionals improve clinical workflows, treatment outcomes, and data security.

Gain Comprehensive Insights into Healthcare Software Trends, Startups, or Technologies

By 2025, the healthcare software market will continue to grow as AI-driven analytics, interoperability solutions, and patient-centric platforms redefine care delivery. Organizations will use these technologies to streamline workflows and improve clinical accuracy, and patient engagement.

Get in touch to explore all 1770+ startups and scaleups, as well as all market trends impacting 3180+ companies.