The Electric Mobility Outlook 2025 gives a glimpse of the developments toward making electric vehicles more consumer-inclusive. Electric mobility contributes negligibly to emissions, which makes it more preferred among automotive and sustainability enthusiasts.

Major innovations in the sector include improving battery technologies like graphene batteries, solid-state batteries, and silicon anodes. Further, autonomous driving, vehicle-to-grid optimization, and integrated solar panels are making electric vehicles more future-ready. The report explores firm demographic data, investment patterns, and emerging startups that are shaping the electric mobility landscape.

Executive Summary: Electric Mobility Outlook 2025

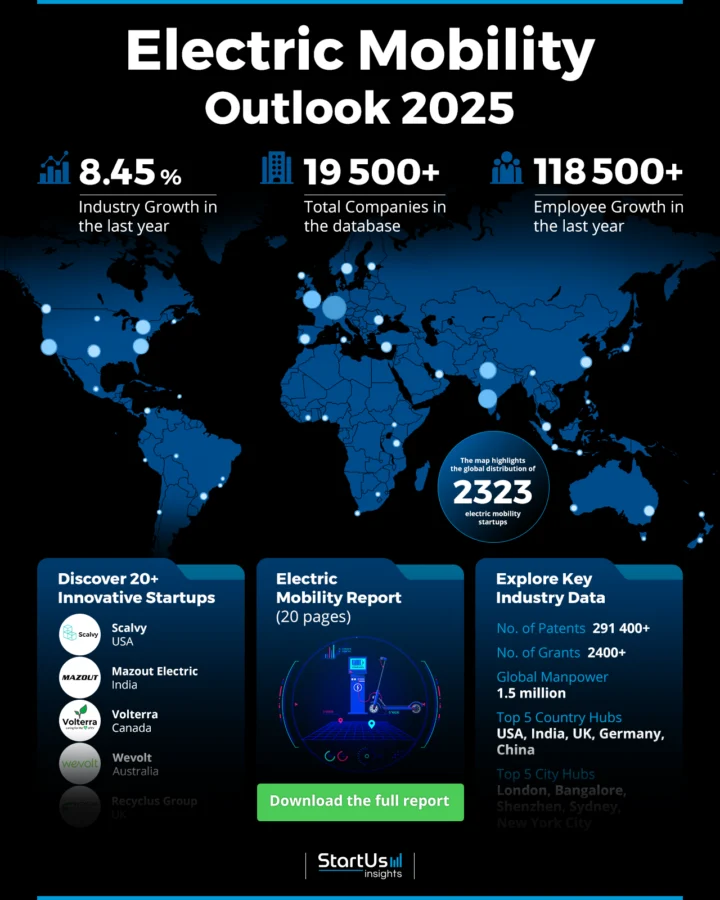

- Industry Growth Overview: The electric mobility market has more than 19 500 companies and 2300+ startups. It accounted for USD 597.27 billion market share in 2024 and is predicted to reach around USD 4719.79 billion by 2034, growing at a CAGR of 22.96% from 2024 to 2034. On a granular level, the market grew by a rate of 8.45% last year as per our platform’s latest data.

- Manpower and Employment: The sector provides employment to more than 1.5 million people. Last year, the number of people who joined was 118 500+.

- Patents and Grants: More than 9000 applicants file over 291 400 patents. Additionally, there are 2400+ grants in the field.

- Global Footprint: The top countries for researching and developing the electric mobility sector are the United States, India, the United Kingdom, Germany, and China. Top cities include London, Bangalore, Shenzhen, Sydney, and New York City.

- Investment Landscape: The electric mobility sector raises an average of USD 53.4 million per round from 13 100+ funding rounds. More than 3100 companies received this funding.

- Top Investors: Investors like the European Investment Bank, Tesla, the US Department of Energy, and more invest over USD 24 billion in the electric mobility sector.

- Startup Ecosystem: Emerging startups like Scalvy (smart integrated modules for EV production), Mazout Electric (powertrain electronics solutions), Volterra (real-time e-mobility battery health insights), Wevolt (EV charging and billing software), Recyclus Group (lithium-ion battery recycling facility) represent the upcoming technological developments in the field.

What Data is Used to Create This Electric Mobility Report?

Based on the data provided by our Discovery Platform, we observe that the electric mobility market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction.

- News Coverage & Publications: There are 5900+ articles regarding the electric mobility sector in the newspaper and magazine.

- Funding Rounds: Our database records more than 13 100 fundraising rounds for electric mobility startups.

- Manpower: Over 1.5 million people are employed worldwide in the electric mobility sector. More 118 500 people joined the workforce last year.

- Patents: The domain has over 291 400 patents, which hints towards a future of more innovations.

- Grants: More than 2400 grants in the sector are a sign of strong support from the government for its development.

- Yearly Global Search Growth: People around the world are getting more interested in the electric mobility sector as evident by the 19.15% growth in the global search.

Methodology: How We Created This Electric Mobility Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of electric mobility over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the electric mobility sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the electric mobility market.

Explore the Data-driven Electric Mobility Outlook for 2025

The domain received 2400+ grants and filed 291 400+ patents, which hints towards major developments in the future. The current centers for the majority of research and developments are the United States, India, the United Kingdom, Germany, and China. The major cities include London, Bangalore, Shenzhen, Sydney, and New York City.

A Snapshot of the Global Electric Mobility Market

Over 2300 startups are working in the electric mobility sector. Additionally, 1000 startups are in merger and acquisition and 1100 more are in the early stage.

The sector witnessed a yearly growth of 8.45%, which is a positive sign for the eco-friendly movements around the world.

More than 9000 applicants file over 291 400 patents and the patent ecosystem is expanding at a rate of 8.87% per year.

China issues the highest number of patents, which is 87 400 patents. The United States ranks second with 59 600 patents.

Explore the Funding Landscape of the Electric Mobility Market

The electric mobility sector received an average of USD 53.4 million per funding round. More than 8900 investors take part in 13 100+ investment rounds. 3100+ companies received support because of this funding.

Who is Investing in the Electric Mobility Market?

The top investors in the field are providing USD 24 billion+ to the upcoming startups.

- The European Investment Bank (EIB) invested USD 4.1 billion across 20 companies. One of the major automotive companies Volvo is backed by EIB for going fully electric.

- Tesla spent USD 3.5 billion on two companies.

- The US Department of Energy (DOE) spent USD 2.8 billion on eight companies. US DOE has approved a loan of USD 9.63 billion to BOSK, a joint venture between Ford Motor and SK On for manufacturing three electric vehicle battery plants in Tennessee and Kentucky.

- Agricultural Bank of China contributed USD 2.6 billion to three companies. It was one of the investors that participated in the funding rounds and assisted in raising USD 1.1 billion for IM Motor.

- Geely spent USD 2.4 billion on nine companies. Geely has invested USD 784.7 million in London Electric Vehicle Company (LEVC), a company that manufactures electric black cabs.

- Tencent spent USD 2.1 billion on seven companies. NIO, a Chinese electric vehicle manufacturer, received multiple funding from Tencent, including a USD 1 billion funding round in 2017 and a USD 240 million funding round in 2020.

- KKR spent USD 1.7 billion on six companies. It additionally invested USD 750 million in Zenobe, a transport electrification and battery storage company.

- BlackRock divided USD 1.7 billion among 12 companies. It further invested USD 785 million in IONITY, a European high-power charging network joint venture.

- Stonepeak contributed USD 1.6 billion to at least one company. Stonepeak further partnered with Nuvve Holding Corp. and Evolve Transition Infrastructure to form Levo Mobility. It is a USD 750 million joint venture focused on electrifying transportation.

- JP Morgan contributed USD 1.6 billion to three companies. It partnered with 50five Group to manage its e-mobility solutions for customers.

Top Electric Mobility Innovations & Trends

Explore the major trends in the domain along with their firmographic details:

- The Hybrid Electric Vehicles sector has more than 2600 companies which employ over 496 200 employees. More than 22 000 new professionals joined the workforce last year. The domain is growing by -4.24% annually. The hybrid electric vehicle has improved fuel economy in the electric mobility sector. It is at the top of consumer preferences as it makes the vehicle more economical, introduces additional safety features, and makes it fuel efficient.

- Electric Vehicle Charging is a major trend that is supporting electric mobility. Currently, there are 9000+ companies and 770 600+ professionals working in the sector. More 53 700 professionals joined the workforce last year. The sector is growing at a rate of 11.8% every year. The latest innovations in this sector include wireless charging, fast charging networks, smart charging, bidirectional charging, etc.

- Power Electronics, another important trend is growing at a rate of 4.57% every year. This growth is supported by 2000+ companies working in the sector. More than 168 000 people are working in the sector and 9300 more professionals joined the workforce. Currently, researchers are introducing advanced materials for improving the thermal efficiency of power trains in electric mobility. The materials include silicon carbide, gallium nitride, and integrated power circuits among others.

5 Top Examples from 2300+ Innovative Electric Mobility Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Scalvy provides Smart Integrated Modules for EV Production

US-based startup Scalvy builds Smart Integrated Modules (SIMs) that streamline the electric vehicle production process. The SIMs feature an inverter, software (SW), battery management system (BMS), onboard chargers (OBC), and converter. The onboard charger ensures fast charging and compatibility with global infrastructures.

The BMS further ensures optimum battery health, extended lifespan, and efficient monitoring and management. The motor drive unit has DC-AC inverters to ensure efficient power conversion. It enables precise control over the vehicle’s motor and energy efficiency.

The auxiliary DC-AC converters further provide power to the vehicle’s electronics and ensure safety in all driving conditions. The integrated module is cost-efficient and makes electric vehicles ready for use within less time.

Mazout Electric manufactures Powertrain Electronics Solutions

Indian startup Mazout Electric builds iCommuteX, which integrates drivetrain electronics with a software stack and an operating system. This enables computations on the cloud and at the edge, which ensures safe and secure driving. iCommuteX builds an Android-like ecosystem for electric vehicles for accessing functions through subscription-based methods.

The powertrain consists of an onboard charger, motor controller, DC-AC converter, and a BMS. The product is certified for automotive use and offers the end user updated features, optimizations, and an improved user interface (UI). The plug-and-play solution integrates into any powertrain and is easy to use, install, diagnose, and maintain. The data-centric solution also enables real-time data collection and allows analytics, optimization, targeting user behavior, and mapping of the riding environment.

Volterra delivers Real-Time e-Mobility Battery Health Insights

Canadian startup Volterra provides real-time EV fleet management solution EVCAre. The solution offers actionable insights into the battery health of fleets and individual vehicles. The dashboard provides alerts and reports using metrics and colors to identify the current status of the battery.

EVCare accesses the battery’s health in real time and provides actionable insights into the battery’s health. It also provides predictive analytics to recommend operational optimization and maintenance to fleet managers.

There are multiple dashboards for different purposes. For example, FleetAccess provides a system-wide review of the battery specifications, FitStar is an intuitive scoreboard, and Warranty Management System (WMS) provides warranty support.

Managers use these predictive insights and active control strategies to solve EV battery problems. It also reduces asset downtime, and underutilization, and improves return on investment (ROI).

Wevolt offers an EV Charging and Billing Software

Australian startup Wevolt builds an app for charging electric vehicles. The EV drivers use the app to find chargers, use them, and pay for them. It provides options for AC or DC charging points near the driver.

They also get information like charging location, charging costs, and real-time availability of the charger. The charging is done using the app or an RFID card. The residential buildings rent out their home chargers using the app. Further, enterprise and businesses that have a network of chargers monetize their charging facilities by renting them out.

Recyclus Group provides Lithium-Ion Battery Recycling Facility

UK-based startup Recyclus Group designs the LiBox, a storage and transportation solution for lithium-ion batteries. It is a pallet-sized, steel-fabricated box, which is UN-certified and ADR compliant. The box also transports other hazardous goods besides lithium-ion batteries.

LiBox controls thermal conditions up to 2000 degrees celsius. It contains lithium battery fire protection pillows containing and extinguishing fires. The box is modular, which allows easy replacement of any part. The box is suitable for sectors like automotive, portable devices, and industrial logistics. After receiving the lithium-ion battery, Recyclus Group recycles the battery, which reduces the carbon footprint of the hazardous material.

Gain Comprehensive Insights into Electric Mobility Trends, Startups, or Technologies

The electric mobility outlook reveals that the current focus of the market is on improving the vehicle design, and performance, and making it cost-effective for consumers. Further, trends like hybrid electric vehicles, power electronics, and electric vehicle charging are developing the landscape of electric mobility. With developments and integrations of technologies like artificial intelligence, 3D fabrication, and solid batteries, the sector is set to witness more innovations in the future.

Get in touch to explore all 2300+ startups and scaleups, as well as all market trends impacting electric mobility companies.