The 2025 Sharing Economy Market Report examines how the sector is reshaping business models by prioritizing access over ownership. Driven by digital platforms, mobile connectivity, and changing consumer preferences, it impacts transportation, real estate, retail, and professional services.

Key trends include the rise of peer-to-peer platforms, the expansion of ride-sharing and mobility solutions, and the adoption of shared workspaces and short-term rentals. Sustainability drives growth as consumers and businesses embrace sharing to reduce waste and optimize resources.

Innovations like blockchain and AI enhance platform efficiency and trust. The report highlights emerging startups, investment trends, and market opportunities, offering insights into the sharing economy’s transformation of consumer behavior and business practices.

Executive Summary: Global Sharing Economy Report 2025

- Industry Growth Overview: The sharing economy grew by 22.07% last year, with over 25000 companies and 1800 startups driving innovation and market expansion. The global market size was valued at USD 387.1 billion in 2022 and is projected to reach USD 827.1 billion by 2032, growing at a CAGR of 7.7%

- Manpower & Employment Growth: The sector employs over 1.5 million people globally, adding 112000 new employees last year.

- Patents & Grants: The field secured over 22 000 patents and 1500 grants, highlighting investment in innovation and R&D, with a 2.29% yearly patent growth rate.

- Global Footprint: Key country hubs include the United States, India, the United Kingdom, Germany, and France. Major city hubs are London, New York City, San Francisco, Bangalore, and Mumbai.

- Investment Landscape: The average investment per funding round is USD 40.6 million. There have been over 16000 closed funding rounds, and 12000 investors support 3800 companies.

- Top Investors: Key investors include SoftBank Vision Fund, Grab, Goldman Sachs, and more with a combined investment value of over USD 16 billion.

- Startup Ecosystem: Notable startups include Flambu (Web3 Sharing Economy), Autohost (Identity Verification & Fraud Prevention), TollSpot (Automated Fleet Management), PopulStay (Decentralized Home-sharing), and Porty (Rentable Powerbank).

What Data is Used to Create This Sharing Economy Report?

Based on the data provided by our Discovery Platform, we observe that the sharing economy market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the market’s short-term future direction.

- News Coverage & Publications: The news coverage includes over 3600 publications reported last year. This reflects substantial media interest and ongoing discourse on the sharing economy.

- Funding Rounds: More than 16 000 funding rounds highlight investor engagement and financial activity within the market.

- Manpower: The sector employs over 1.5 million workers globally, with an addition of 112 000 employees in the past year.

- Patents: Innovation efforts are evident through the availability of over 22 000 patents.

- Grants: More than 1500 grants have been awarded, supporting research and development initiatives.

- Yearly Global Search Growth: The global search interest in the market has grown by 35.86% yearly, showcasing increasing public curiosity and awareness.

Methodology: How We Created This Sharing Economy Report

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of automation software over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the sharing economy

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the sharing economy market.

Explore the Data-driven Sharing Economy Report for 2025

The sharing economy is on track to generate over USD 1 trillion in revenue by 2031. This growth underscores the revolutionary impact of digital platforms and peer-to-peer models. Traditional industries, such as transportation with Uber and housing through Airbnb, have been redefined.

Even niche services, from dog-sitting to tool-sharing, thrive within this ecosystem, showcasing the versatility and reach of collaborative consumption.

The Sharing Economy Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth. The heatmap highlights the sharing economy’s global spread and innovation potential. Our database includes over 1800 startups and 25000 companies. Market growth reached 22.07% last year, showcasing increasing activity.

According to Verified Market Research, the sharing economy market is projected to grow from USD 387.1 billion in 2024 to USD 827.1 billion by 2031, at a CAGR of 7.7% during this period.

Credit: Verified Market Research

Our Discovery Platform highlights over 22 000 patents and 1500+ grants supporting innovation. This growth parallels the rise of the gig economy, which is projected to expand significantly. By 2023, 52% of workers globally had spent part of their careers as independent workers.

Global manpower stands at 1.5 million employees, with an increase of 112 000 workers last year. Key country hubs include the United States, India, the United Kingdom, Germany, and France. Prominent city hubs — London, New York City, San Francisco, Bangalore, and Mumbai — underscore the domain’s urban-centric evolution.

A Snapshot of the Global Sharing Economy Market

The sharing economy grows at an annual rate of 22.07%, which indicates significant momentum. Our database includes over 1800 startups and highlights entrepreneurial activity and innovation. Of these, more than 1300 are early-stage startups, while over 800 have undergone mergers and acquisitions, reflecting consolidation and scaling.

Patent data highlights the market’s innovative efforts, with over 22 000 patents filed by more than 1500 applicants globally. The sector’s yearly patent growth rate is 2.29%, showing steady advancements in proprietary technologies and methods.

China leads with 8200 patents, followed by the United States with 4800 patents. This underscores the sharing economy’s role in technological and business evolution.

Explore the Funding Landscape of the Sharing Economy Market

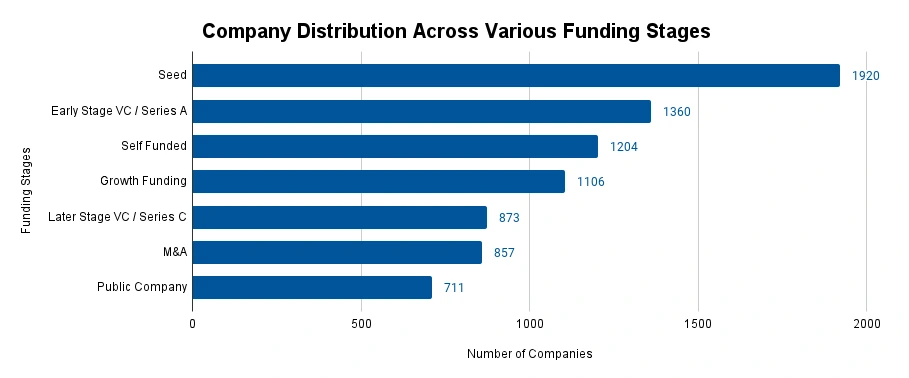

The sharing economy attracts significant investor interest, with an average investment value of USD 40.6 million per funding round. Our database records over 16 000 closed funding rounds, showing a consistent influx of capital to support innovation and expansion.

More than 12 000 investors actively contribute to the growth of sharing economy companies, resulting in investments in over 3 800 companies. These figures underscore the sharing economy’s appeal as a high-growth, investment-friendly market.

Who is Investing in Sharing Economy Solutions?

The combined investment value contributed by the top investors in the sharing economy exceeds USD 16 billion.

- SoftBank Vision Fund invested USD 5.2 billion in 16 companies.

- Grab contributed USD 2.4 billion across 3 companies, leveraging its super-app platform for ride-sharing, food delivery, and financial services.

- Goldman Sachs played a vital role with investments totaling USD 1.7 billion in 18 companies.

- Citi allocated USD 1.4 billion to 6 companies.

- HSBC invested USD 1.3 billion across 5 companies.

- Tencent actively participated with USD 1.2 billion in funding for 10 companies, emphasizing gaming, social media, and technology innovators.

- Toyota focused on mobility-related investments contributed USD 1.2 billion to 4 companies.

- Sequoia Capital demonstrated broad engagement with USD 1.2 billion invested in 21 companies.

- T. Rowe Price supported innovation with USD 1.2 billion distributed across 5 companies.

- Didi invested USD 1 billion in 5 companies.

Access Top Sharing Economy Innovations & Trends with the Discovery Platform

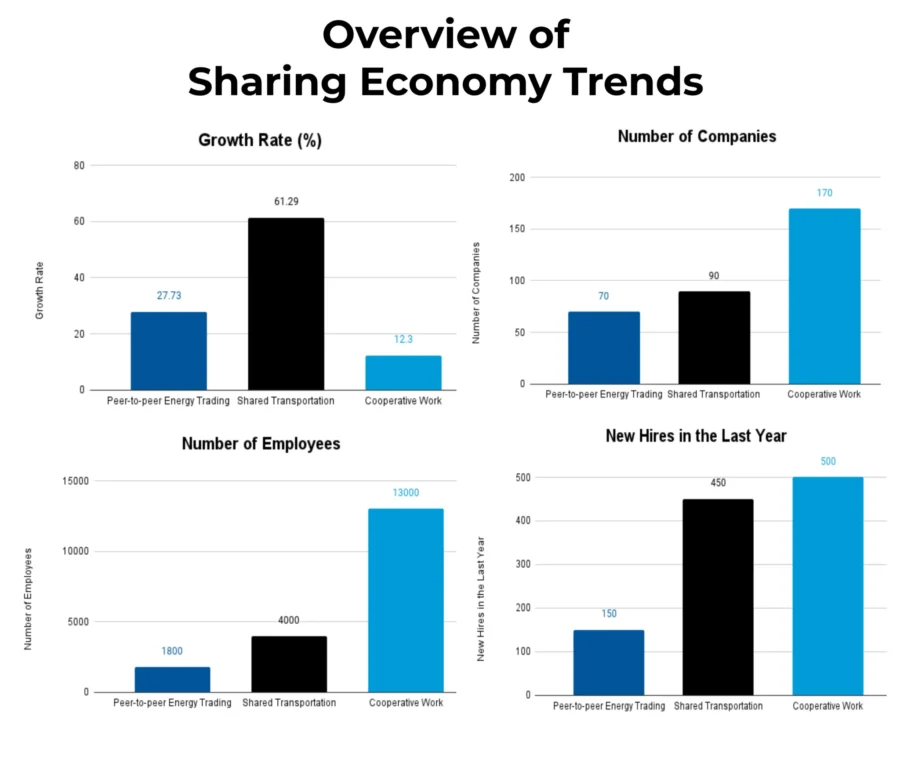

The sharing economy market shows dynamic growth, with key trends shaping its path. These trends emphasize innovation, workforce expansion, and rapid adoption rates.

- Peer-to-Peer Energy Trading: This trend involves over 70 companies employing more than 1800 people, with 150 new employees added last year. The annual growth rate is 27.73%, reflecting interest in decentralized energy systems and renewable energy optimization.

- Shared Transportation: With over 90 companies and a workforce of more than 4000, this trend saw an addition of 450 new employees last year. Its annual growth rate of 61.29% highlights growing consumer preference for shared mobility solutions and reduced carbon footprints.

- Cooperative Work: Comprising over 170 companies employing more than 13 000 people, this trend saw 500 new hires last year. The annual growth rate of 12.3% reflects the demand for collaborative and flexible working environments, driven by evolving workforce dynamics.

5 Top Examples from 1800+ Innovative Sharing Economy Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Flambu enables Web3 Sharing Economy

Israeli startup Flambu develops a community-centric marketplace that enables individuals to share and borrow items locally, using blockchain for secure transactions. Its mobile application allows users to list underutilized possessions for others to rent, while those in need borrow items short-term. This reduces the need for new purchases.

The platform uses a dual-token system: FLAM, a utility token for loyalty, protection, and governance, and FBX, a stable token pegged to the U.S. dollar to ensure fast, low-cost payments. Flambu integrates gamification elements, incentivizes user participation, and promotes trust within the community.

Autohost offers Identity Verification & Fraud Prevention

Canadian startup Autohost provides a guest-screening platform that automates verification for hospitality businesses in the sharing economy. When a guest reserves through platforms like Airbnb or Booking.com, the startup syncs with the property’s management system to analyze the booking with a proprietary risk algorithm. The guest completes an online check-in via a digital portal, where its AI performs a comprehensive assessment, including ID verification and background checks.

This workflow allows property managers to customize verification steps based on the assigned risk score to ensure that only verified guests receive check-in instructions. Autohost enhances security, reduces fraud risk, and streamlines operations to promote a safer and more efficient ecosystem for hosts and guests.

TollSpot delivers Automated Fleet Management

US-based startup TollSpot develops automated fleet management software that streamlines cost recovery and administrative tasks for fleet managers. The platform integrates with existing workflows to automate data collection on tolls, fuel charges, excess mileage, and parking fines. It links these expenses to the appropriate user and generates automated invoices.

It offers secure payment options, including integration with existing payment providers and secure URLs for customers to enter payment details and ensure compliance with payment card industry data security standards (PCI DSS). TollSpot’s dashboards enable operators in the sharing economy to monitor fleet expenses, payment details, and customer interactions efficiently.

PopulStay facilitates Decentralized Home-sharing

Singaporean startup PopulStay develops a decentralized home-sharing platform using blockchain for direct transactions between hosts and guests. The platform validates user information, establishes trust, and streamlines the user experience.

It features a profit-sharing model that rewards users with global bounties, discounts, or bonuses based on their contributions and a ranking mechanism to enhance community engagement. PopulStay maximizes host profits and elevates customer experiences by eliminating intermediaries and promoting a transparent, efficient, and secure home-sharing environment.

Porty provides a Rentable Powerbank

Turkish startup Porty offers rentable and portable power bank-sharing services to ensure continuous mobility for users with on-the-go charging solutions. It develops a mobile application for individuals to locate nearby Porty stations, scan a QR code to rent a power bank, and return it to any station when finished.

This system eliminates the need to carry personal chargers and reduces downtime due to low battery. Porty leverages the sharing economy to enhance user convenience and prevent carbon emissions annually, contributing to environmental sustainability.

Gain Comprehensive Insights into Sharing Economy Trends, Startups, or Technologies

The sharing economy market will continue to grow in 2025, driven by innovations in peer-to-peer platforms, shared transportation, and cooperative workspaces. Trends like decentralized energy trading and advanced mobility solutions will reshape business models, with a focus on sustainability and accessibility. Get in touch to explore all 1800+ startups and scaleups, as well as all market trends impacting sharing economy companies.