The Emergency and Disaster Management Market Report 2025 reflects the expanding nature of the sector due to an increase in natural disaster rates, man-made disasters, and various emergencies.

Industries like healthcare, critical infrastructure, and transportation, are also contributing to emergency and recovery management.

Artificial intelligence, the Internet of Things, cloud-based solutions, and updated communication systems are some of the key technologies influencing the sector.

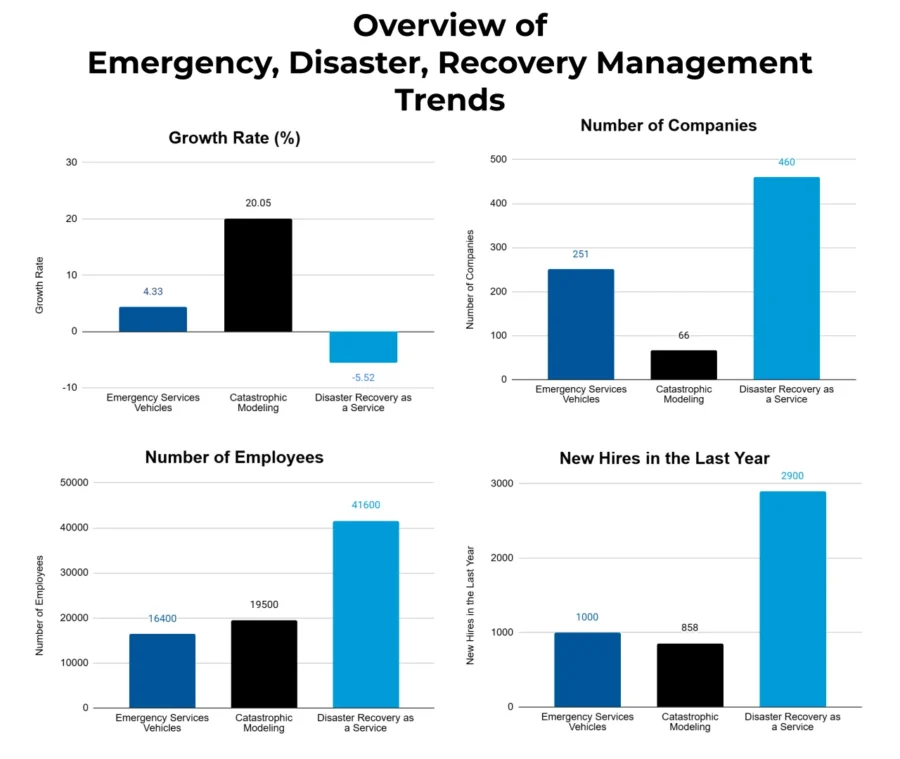

The report also explores the impact of major trends like emergency services vehicles, catastrophe modeling, and disaster recovery-as-a-service. It further covers the employment scenario, investment pattern, startup landscape, global standing, and more.

Executive Summary: Emergency, Disaster, Recovery Management Market Outlook 2025

- Industry Growth Overview: The emergency, disaster, and recovery management sector is growing at a rate of 4.43% annually. Currently, there are 930+ startups and 26 200+ companies working in the field. According to Mordor Intelligence, the emergency and disaster response market is expected to reach USD 177.70 billion in 2025 and grow at a CAGR of 6.58% to reach USD 244.38 billion by 2030.

- Manpower and Employment Pattern: Currently, the emergency and disaster management sector employs 2.2 million professionals. Additionally, 97 800+ people joined the workforce last year.

- Global Footprint: The top cities leading the developments in the sector are the United States, the United Kingdom, Canada, Australia, and India. At the city level, London, New York City, Sydney, Melbourne, and Houston have the highest number of companies working in emergency and disaster management.

- Grants and Patents: More than 1500 applicants applied for 14 700+ patents, which are accelerating the research and development in the sector. Additionally, the government rewarded more than 2800 grants to the disaster and incident management sector.

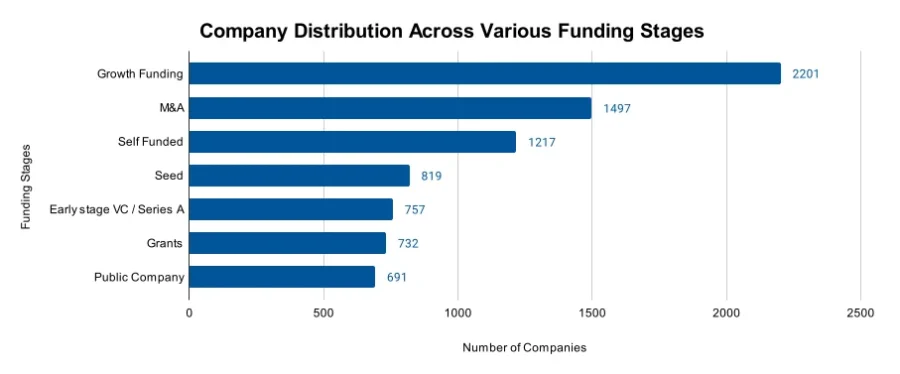

- Investment Landscape: Companies in the emergency management sector held more than 6600 funding rounds. These funding rounds raised an average of USD 49.2 million per round and support more than 2500 companies.

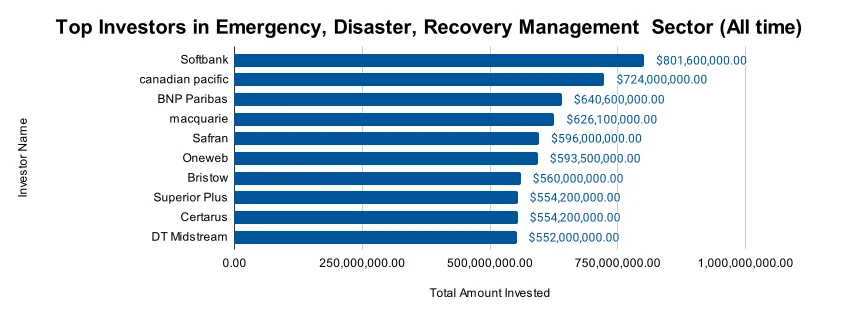

- Top Investors: Key investors like SoftBank, Canadian Pacific Railway, and BNP Paribas, along with other investors contribute more than USD 6 billion to the emergency and disaster management sector.

- Startup Environment: Top startups in the disaster, recovery, and emergency management sector include Ladris (AI-driven disaster impact prediction), Flashgroup (VR simulation for first responders), FxUAV (disaster management drones), Heed (IoT-based water overflow disaster prevention), and ForestSAT (forest fire prevention app).

What Data is Used to Create This Emergency, Disaster, Recovery Management Market Report?

- News Coverage and Publications: With 8900+ publications covering the field in the last 12 months, the emergency, disaster, and recovery management sector attracted a lot of media attention.

- Funding Rounds: Our database records more than 6600 investment rounds supporting the companies along with research and development.

- Manpower: There are more than 2.2 million workers employed in the sector. Additionally, 97 800+ people joined last year.

- Patents: More than 14 700 registered patents in the field demonstrate how intellectual property is driving the research and development in the emergency management sector.

- Grants: The government is supporting the disaster, emergency, and recovery management sector with more than 2800 grants.

Methodology: How We Created This Emergency, Disaster, Recovery Management Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of emergency, disaster, and recovery management over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within emergency, disaster, and recovery management

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the emergency, disaster, and recovery management market.

Explore the Data-driven Emergency, Disaster, Recovery Management Market Report for 2025

The field of emergency, disaster, and recovery management is growing at a rate of 4.43%, with 26,200+ companies and 9,30+ startups working in it.

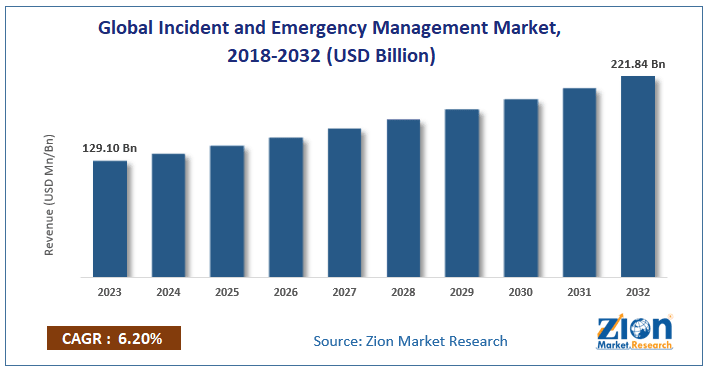

As per Zion Market Research, the market size is projected to reach USD 221.84 billion by 2032, with a CAGR of 6.20% from 2024 to 2032. These companies employ more than 2.2 million people, and 97,800+ people joined the workforce last year.

Projects like OVERWATCH are exploring the use of holographic solutions to improve emergency response and crisis management activities for wildfires and floods.

Credit: Zion Market Research

Applicants from these companies filed for more than 16 900 patents. Additionally, the sector received 2800+ grants. This increase in employment, companies, and support from the government reflects the growing global need for emergency management services and solutions.

The leading nations for research and development in the disaster, recovery, and disaster management sector are the United States, United Kingdom, Canada, Australia, and India.

London, New York City, Sydney, Melbourne, and Houston are the major cities at the forefront of major research and innovations.

A Snapshot of the Global Emergency, Disaster, Recovery Management Market

With an annual growth rate of 4.43%, the emergency, disaster, and recovery management sector is showing consistent growth.

With over 930 startups, the sector is undergoing continuous research and development. There are 700+ startups in the early stages and 1400 more in merger and acquisition.

The innovations in the sector are further supported by 14 700+ patents filed by 1500+ applicants. The patent activity is further growing at a rate of 6.52%. With 10 000+ patents, China leads in patent issuing, followed by the United States with 2900+ patents.

Explore the Funding Landscape of the Emergency, Disaster, and Recovery Management Market

The emergency, disaster, and recovery management sector raises an average of USD 49.2 million in each funding round. More than 4500 investors participate in the funding rounds, which assist 2500+ companies.

The support for the emergency and incident management sector is evident from 6600+ funding rounds, which support the existing and upcoming companies

Who is Investing in the Emergency, Disaster, and Recovery Management Market?

Top investors have contributed USD 6.2 billion to the emergency, disaster, and recovery management sector.

- SoftBank invested USD 801.6 million in 3 companies. Ratan Tata and Softbank together invested USD 7 million in ClimaCell, a weather forecasting startup that uses micro weather technology to warn about upcoming floods.

- Canadian Pacific Railway contributed USD 724 million to at least one company. It invested in the emergency management software Hexagon to ensure public safety and manage major incidents and emergency responses.

- BNP Paribas spent USD 640.6 million on two companies. After the Covid-19 pandemic, BNP Paribas launched an emergency support plan with a commitment of USD 50.99 million.

- Macquarie distributed USD 626.1 million among the two companies. It also acquired National Gas, which provides emergency repair and response services to Britain’s gas industry.

- Safran invested USD 596 million in at least one company. Its division Safran Aerosystems developed systems for emergency evacuation systems for aircraft.

- Eutelest Oneweb contributed USD 593.5 million to at least one company. It also provides satellite services to ensure operation continuity during emergency situations.

- Bristow spent USD 560 million on at least one company.

- Superior Plus invested USD 554.2 million in at least one company.

- Certarus invested USD 554.2 million in at least one company.

- DT Midstream invested USD 552 million in at least one company.

Top Emergency, Disaster, and Recovery Management Innovations & Trends with the Discovery Platform

Discover the emerging trends in the emergency, disaster, and recovery management sector market along with their firmographic details:

- Emergency Services Vehicles sector provides employment to 16 400+ people in more than 250 companies. Further, 1000+ people joined the workforce last year. The domain is further growing at a rate of 4.33%. The emergency services vehicles are multi-functional, specialized, autonomous, and connected. Additionally, they are equipped with GPS technology, telemedicine capabilities, and artificial intelligence for predictive approaches.

- Catastrophe Modeling trend is growing at an annual rate of 20.05%. Currently, there are 66 companies in this sector, which employ more than 19 500+ professionals. Additionally, 850+ people joined the workforce last year. The modeling is essential for risk assessment and pricing, scenario analysis, urban safety, real-time monitoring, and more.

- Disaster Recovery-as-a-service is a growing trend in the emergency management sector. The domain is growing at a rate of -5.52%. Despite a negative growth rate, the sector is employing 41 600+ people. Additionally, over 2900 people joined the workforce last year. More than 460 companies are employing this workforce. The DRaaS sector utilizes cloud computing for data storage and backup and software-defined network (SDN) or wide area network (WAN) for connectivity and communications.

5 Top Examples from 930+ Innovative Emergency, Disaster, and Recovery Management Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Ladris offers AI-driven Disaster Impact Prediction

US-based startup Ladris builds an AI software platform for predicting the impact of climate and man-made disasters. The platforms refer to multiple data sources, apply proprietary AI modeling, produce quantitative metrics, and predict operational outcomes.

The EVAC-1 platform provides what-if simulations and measurable results to plan for possible evacuations. Additionally, the FIRE-1 platform produces a fire spread model for emergency management and response, while CORE-1 tracks infrastructure and risk conditions for continuous situational intelligence.

Emergency management offices use the platforms to forecast disaster impacts, optimize emergency response, and simulate evacuations. The platform also assists in multi-agency drills for dynamic hazard planning, timely insights and data, recovery analysis, and critical infrastructure investment ROI.

Flashgroup develops VR Simulations for First Responders

Dutch startup Flashgroup provides extended reality (XR) for training in emergency services. The XR solutions combine real-world equipment, multiplayer simulations, portable plug-and-play solutions, and customized content for the situation.

Flashover is suitable for firefighting training and Flashpoint is used for de-escalation training. Flashaid offers first aid training to first responders with a simulated environment containing multiple victims in various conditions.

Police, security, defence, firefighters, and ambulance personnel use the solutions to ensure efficiency and safety in emergency responses.

FxUAV builds Disaster Management Drones

Indian startup FxUAV builds unmanned aerial systems (UAS) for use in surveillance, mapping, emergency response, disaster management, and agriculture.

The Rakshak UAV 1.0 is a drone that contains three payloads in a single payload system. It ensures a timed release of life jackets and life buoys.

The drone also consists of a fireball drop system that launches a fireball in the middle of the fire and extinguishes it. It further uses 5G for connectivity.

The startup also provides drones for agricultural spray and crop health monitoring. It focuses on solutions to ensure uninterrupted productivity by replacing humans in low-value-added and dangerous operations.

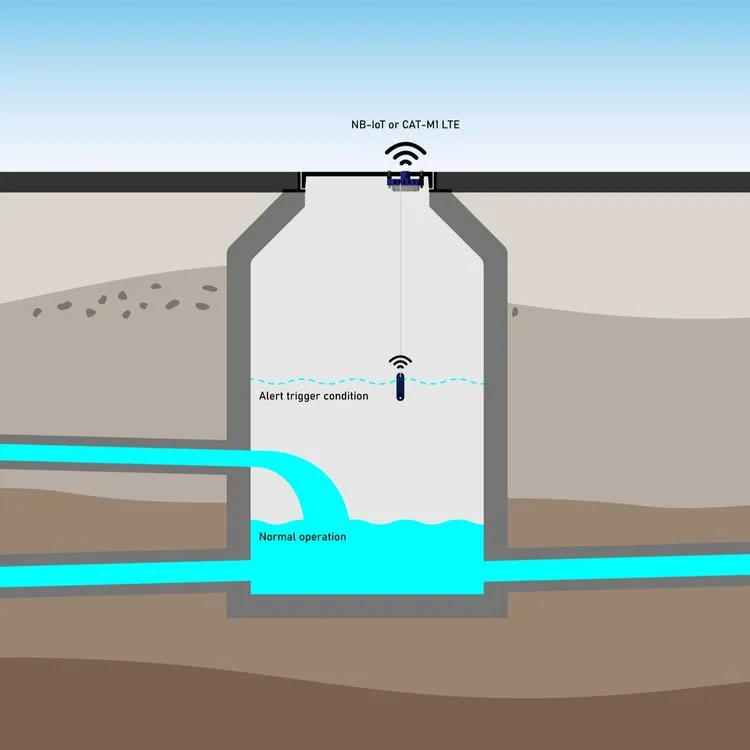

Heed prevents Water Overflow Disaster with IoT-based Solutions

New Zealand-based startup Heed builds IoT-based smart sensor technology for wastewater and stormwater infrastructure monitoring. The sensors are hermetically sealed and tested in fluid with optimum properties.

It also comes with a swappable, military-grade, lithium-thionyl chloride (LiSOCl2) battery with 5 years of warranty. The batteries are equipped with a Catm1/ NBIoT mobile network to send information about the unit to the server.

The information collected by the sensor is transferred to data lakes, cloud servers, power BI, and third-party providers using the Heed-API.

The data about the current status of the network is visible on the intuitive user interface (UI). It also contains historical data, which assists in tracking trends and identifying patterns.

Users automate custom emails and text alerts to team members, which ensures timely intervention and prevents spills. The scalable solution is customizable and fits multiple water infrastructures.

ForestSAT develops a Forest Fire Prevention App

Norwegian startup ForestSAT develops FRIDA, an AI app, which combines AI and satellite data for monitoring and preventing forest fires. The app collates the data from 12 earth observation satellites to provide satellite images, data, and analysis for forest fire prevention.

The app analyzes satellite images of more than 10 years using machine learning to locate high-risk areas, send alerts, and ensure faster intervention. This decreases the risk of wildfire ignition.

FRIDA does not require any specialized GIS software and plays the role of a decision support system (DSS) for forest regeneration. It additionally engages communities in fire risk mitigation and encourages long-term conservation. Furthermore, local experts, scientists, and data providers collaborate on the app to make it information-rich and more useful.

Gain Comprehensive Insights into Emergency, Disaster, Recovery Management Trends, Startups, or Technologies

The report highlights how diversified support from different industries and governments are encouraging the ongoing and upcoming developments in the disaster and recovery management sector.

It also explores how trends like disaster recovery-as-service, catastrophe modeling, and emergency services vehicles are transforming the current scenarios of the sector.

Get in touch to explore all 930+ emergency, disaster, and recovery management startups and scaleups, as well as all market trends impacting emergency, disaster, and recovery management companies.