Climate Tech Market Report 2025 highlights how innovation and rapid growth are developing global sustainability efforts, with progress in energy transition, carbon management, and environmental monitoring. Backed by strong funding, patent activity, and a growing workforce, climate technology is impacting industries and driving sustainable economic growth.

Executive Summary: Climate Tech Market Outlook 2025

- Industry Growth Overview: The climate tech market is projected to grow from USD 32.49 billion in 2025 to USD 79.45 billion in 2029, reflecting a compound annual growth rate (CAGR) of 25.0%. On a micro level, the climate tech sector is growing quickly, with an annual growth rate of 4.33% as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: The market employs over 2.8 million people and added 159 400 new employees last year.

- Patents & Grants: With more than 1.95 million patents and 6900 grants, as well as a 2.58% annual patent growth rate, innovation is thriving. Strong worldwide innovation efforts are reflected in the dominance of leading nations in patent issuance, such as the US and China.

- Global Footprint: London, New York City, Washington, San Francisco, and Melbourne are a few of the major cities that demonstrate the market’s global reach, as are nations like the US, UK, India, Canada, and Australia.

- Investment Landscape: The market’s financial ecosystem is strong, backed by more than 12 200 investors, with an average investment value of USD 61.5 million per round and over 19 900 fundraising rounds completed.

- Top Investors: The sector is greatly advanced by top investors such as Societe Generale, BNP Paribas, the European Investment Bank, and more. They have invested around USD 28.0 billion in the market.

- Startup Ecosystem: Five innovative startups The Surpluss (greenhouse gas emissions reduction), NaturAll Carbon (carbon credits trading), Sangti (logistics-focused climate tech), decarbAI (AI-led energy optimization and decarbonization), and Bluebird Climate (product environmental performance calculation) showcase the sector’s entrepreneurial spirit and global reach.

Methodology: How We Created This Climate Tech Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports.

Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies, and market trends.

For this report, we focused on the evolution of climate tech over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within climate tech

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the climate tech market.

What Data is Used to Create This Climate Tech Market Report?

Based on data provided by the StartUs Insights Discovery Platform, we observe that the climate tech market stands out in the following categories relative to the 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the future direction of the market.

- News Coverage & Publications: With over 70 200 publications in the past year, the climate tech 2025 market has received a lot of attention and is one of the most covered industries worldwide.

- Funding Rounds: The market is among the top performers in obtaining financial investments, with over 19 900 funding rounds recorded in the database.

- Manpower: With a workforce of more than 2.8 million professionals, the market has had strong manpower expansion, adding 159 400 new workers in the last year.

- Patents: The market’s 1.95 million patents demonstrate its commitment to innovation, positioning it as a leader in intellectual property worldwide.

- Grants: To support its developments and initiatives, the sector also obtained more than 6900 grants.

- Yearly Global Search Growth: Climate technology is one of the fastest-growing fields in terms of public and investor interest, as seen by its 19.16% yearly search growth worldwide. As per AP News, Google expects to spend USD 16 billion through 2040 globally to purchase clean energy.

Explore the Data-driven Climate Tech Market Report for 2025

The Business Research Company reports suggest that the climate tech market is projected to grow from USD 32.49 billion in 2025 to USD 79.45 billion in 2029, reflecting a compound annual growth rate (CAGR) of 25.0%.

The Climate Tech 2025 heatmap shows that the market is expanding quickly, with over 2180 startups and 26 800 companies.

With the help of a strong innovation ecosystem comprising more than 1.95 million patents and 6900 grants, the market growth in the last year was 4.33%.

Credit: The Business Research Company

Over 2.8 million employees are employed worldwide, including 1 59 400 new employees in the past year alone.

The top city hubs including London, New York City, Washington, San Francisco, and Melbourne drive innovation and activity, while important country hubs include the US, UK, India, Canada, and Australia.

The global climate tech market size is projected to grow from USD 25.32 billion in 2024 to USD 149.27 billion by 2032, exhibiting a CAGR of 24.8%.

Credit: Bloomberg Finance

As per Bloomberg’s report, the US emerged as the top climate-tech financing market in 2024, with USD 6.7 billion mobilized in the first half of the year.

A Snapshot of the Global Climate Tech Market

With an annual growth rate of 4.33%, the market demonstrated consistent growth and growing importance on a global scale. With a focus on innovation and market expansion, the climate tech ecosystem comprises over 2180 startups.

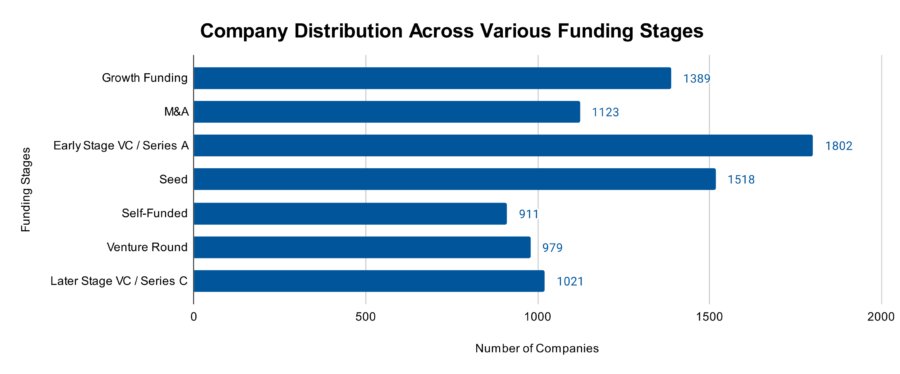

There are more than 1800 early-stage startups, indicating a strong pipeline of new business initiatives, and more than 1100 startups have merged or acquired, indicating market consolidation and strategic alliances.

With more than 251 100 applicants, the market has 1.95 million patents with advanced technology.

The sector’s emphasis on intellectual property is further highlighted by the ongoing growth in patent issuance, which has a 2.58% yearly increase.

With more than 555 800 patents, China is at the forefront of this field, followed by the US with 339 450.

As per The Wall Street Journal, Chinese companies have committed over USD 100 billion in outbound foreign direct investments, focusing on the global deployment of energy-transition technologies, despite facing geopolitical challenges.

Explore the Funding Landscape of the Climate Tech Market

Climate tech has demonstrated its ability to draw significant cash, with an average investment value of USD 61.5 million each round, indicating investor confidence in the sector’s potential.

According to TechCrunch’s report, the market’s median deal size was USD 7 million in 2024, while median pre-money valuations soared to USD 44.5 million from USD 31.5 million the prior year.

More than 19 900 financing rounds have been sponsored by this broad network of backers, demonstrating the ongoing interest in and dedication to advancing climate-focused solutions.

As per CTVC’s report, venture and growth investment totaled USD 30 billion in 2024, down 14% from the previous year, a smaller decrease than the previous year’s 24% drop.

Additionally, in the sector 5000 startups received investment, highlighting its scope and the variety of projects being created. With more than 12 200 investors actively involved in the sector, the funding environment is broad.

Who is Investing in the Climate Tech Market?

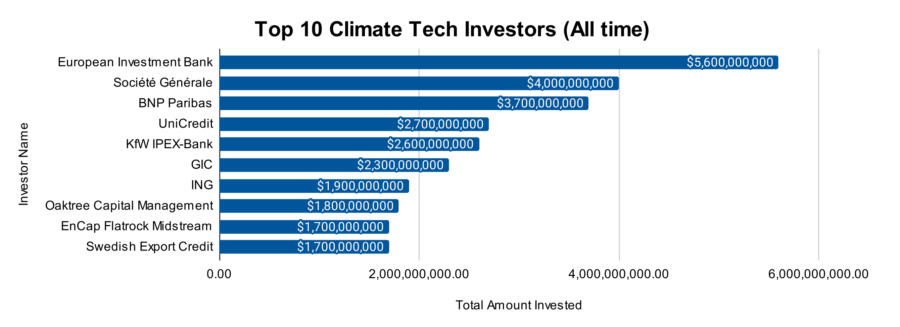

With a total investment value of USD 28.0 billion, the Climate Tech 2025 study emphasizes the significant contributions of leading investors, highlighting their critical role in driving the sector forward.

- The European Investment Bank invested in 18 companies, contributing USD 5.6 billion. As per Mission Innovation, the EIB also committed to increasing investment in climate action and environmental sustainability to more than 50% of the EIB’s annual lending by 2025.

- Societe Generale invested in 15 companies, contributing USD 4 billion. The EIB and Societe Generale also announced an initiative to unlock up to USD 8.72 billion in investments to support European wind energy manufacturers.

- BNP Paribas invested in 16 companies, contributing USD 3.7 billion. As per PR Newswire, H2 Green Steel raised around USD 4.36 billion in debt financing from a group of over 20 lenders including BNP Paribas.

- UniCredit invested in 5 companies, contributing USD 2.7 billion.

- KfW IPEX-Bank invested in 6 companies, contributing USD 2.6 billion. It is providing heating technology provider Vaillant with financing of around USD 128.62 million for its research and development activities.

- GIC invested in 9 companies, contributing USD 2.3 billion. Further, GIC, in partnership with Silver Lake, agreed to acquire billing software firm Zuora for USD 1.7 billion, aiming to take the company private.

- ING invested in 9 companies, contributing USD 1.9 billion.

- Oaktree Capital Management invested in 8 companies, contributing USD 1.8 billion. Oaktree also launched a USD 250 million commercial real estate debt partnership with Formida Capital.

- EnCap Flatrock Midstream invested in 3 companies, contributing USD 1.7 billion.

- Swedish Export Credit invested in at least 1 company, contributing USD 1.7 billion. Swedish Export Credit Corporation (SEK) initiated its USD 8.32 billion funding program by issuing its inaugural 10-year euro-denominated benchmark bond.

Top Climate Tech Innovations & Trends

Discover the emerging trends in the climate tech market along with their firmographic details:

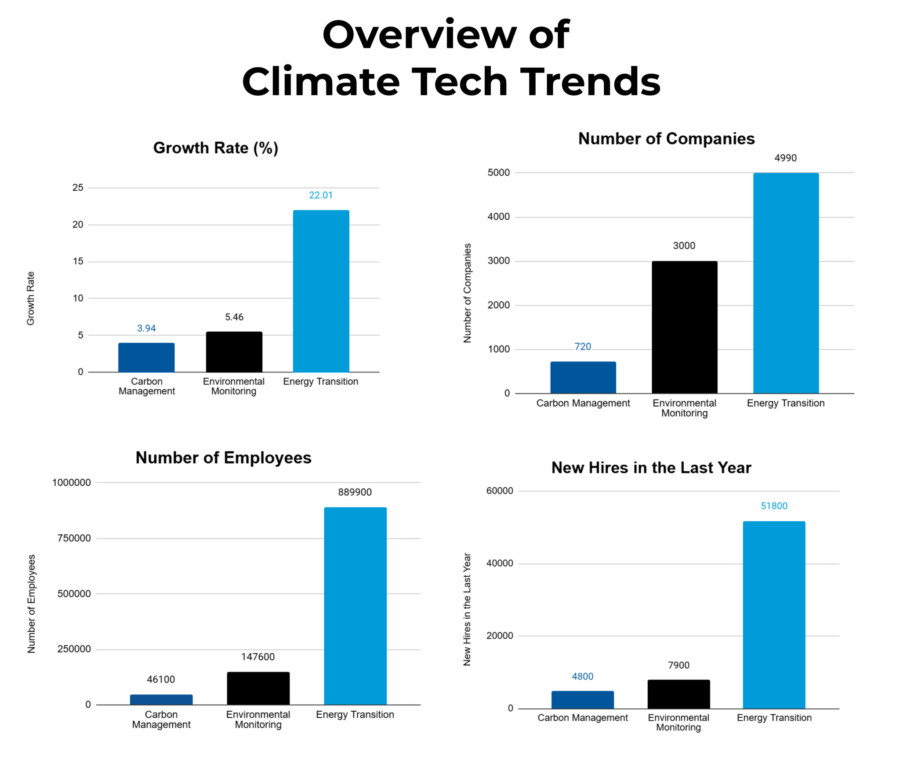

- Carbon Management domain has more than 720 companies and 46 100 employees. Last year, the domain gained 4800 new workers, demonstrating its rising relevance. The development of carbon capture, storage, and reduction solutions has advanced steadily, as evidenced by an annual growth rate of 3.94%. As per Research and Markets report, the carbon management system market size is estimated at USD 14.37 billion in 2024 and is expected to reach USD 25.42 billion by 2029, growing at a CAGR of 12.09% during 2024-2029.

- Environmental Monitoring employs 147 600 employees, including 7900 new hires in the last 12 months, with over 3000 startups. The trend’s 5.46% yearly growth rate indicates that there is a growing need for environmental monitoring and management systems that ensure sustainability and compliance. Further, according to Grand View Research, the global environmental monitoring market size is expected to reach USD 20.1 billion by 2030, registering to grow at a CAGR of 5.7% from 2025 to 2030.

- Energy Transition is a critical trend in terms of scale, with 4990 startups and a workforce of 889 900 employees. Moreover, with 51 800 new hires in the past year and a 22.01% annual growth rate, this domain indicates the quick uptake of electrification, decarbonization, and renewable energy technology.

5 Top Examples from 2180+ Innovative Climate Tech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

The Surpluss Reduces Greenhouse Gas Emissions

UAE-based startup The Surpluss creates an industrial symbiosis platform driven by AI to assist businesses in locating and selling excess resources. The platform links companies to trade these excesses through the analysis of underutilized resources, materials, and assets across industries.

It offers safe channels of communication for uninterrupted cooperation and integrates a proprietary diagnostic system to evaluate resource availability. This platform further enables lowering greenhouse gas emissions which aids businesses in minimizing resource waste and saving money.

The platform also ensures adherence to environmental requirements by monitoring resource swaps and their effects on sustainability criteria by converting surplus resources into useful inputs for other companies.

NaturAll Carbon enables Carbon Credits Trading

UK-based startup NaturAll Carbon creates, measures, and exchanges nature-based voluntary carbon credits through collaborations with farms and conservation initiatives.

The startup creates high-integrity carbon credits by bio-sequestering CO₂ in farmland soils using conservation agriculture practices.

Its blockchain technology and patented geospatial intellectual property platform ensure transparency, scalability, and integrity throughout the carbon credit lifetime.

Moreover, NaturAll Carbon links farmers and credit purchasers, allowing businesses to offset emissions and promote regenerative farming methods.

Sangti offers a Logistics Focused Climate Tech Platform

Indian startup Sangti offers a logistics-specific climate technology platform that enables businesses to track, cut, and optimize carbon emissions related to shipping.

The platform offers accurate emission calculations for each shipment to help firms decarbonize their logistics operations.

Sangti encourages the use of low-carbon alternatives, such as electric or fuel-efficient delivery systems to reduce the impact on the environment.

The platform’s tools enable easy adoption without interfering with daily operations by integrating with current supply chain systems.

Moreover, the startup aids companies in monitoring their progress toward sustainability objectives and ensures adherence to environmental requirements by emphasizing data-driven decision-making.

Recently Mahindra Logistics and Sangti Solutions announced a technology collaboration to drive carbon emissions reduction in the supply chain.

DecarbAI offers AI-led Energy Optimization and Decarbonization

Swedish startup DecarbAI provides an AI-powered platform to maximize energy efficiency and lower carbon emissions in commercial and building activities.

The platform interfaces with energy systems to track usage trends, anticipate inefficiencies, and carry out optimization tactics instantly.

It is beneficial in a wide range of building types, energy infrastructures, and businesses, offering customized suggestions for enhancing energy efficiency.

The solution also promotes the integration of renewable energy sources and speeds up the process of achieving net-zero objectives by reducing energy waste and operating expenses.

Bluebird Climate provides a Product Environmental Performance Calculation Platform

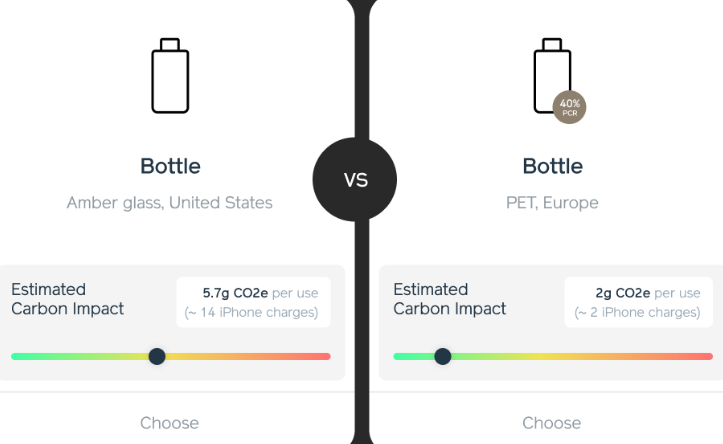

US-based startup Bluebird Climate develops a software platform that enables consumer product companies to measure and improve the environmental performance of their products.

The platform offers detailed insights into the sustainability of products by analyzing important lifecycle elements such as the sourcing of materials, manufacturing procedures, transportation, and packaging.

These insights aid businesses make data-driven decisions that lower emissions and increase the effectiveness of supply chains.

Additionally, Bluebird Climate’s solutions assist brands in communicating their environmental initiatives to consumers in a transparent manner and adhering to sustainability requirements.

The platform also provides businesses with a clear view of their environmental performance, which helps them gain customers’ trust and meet their desire for greener products.

Gain Comprehensive Insights into Climate Tech Trends, Startups, and Technologies

The Climate Tech Industry Report 2025 highlights the sector’s vital role in driving sustainability and mitigating climate challenges. With strong growth, innovation, and investment, climate tech is reshaping industries and accelerating the shift to a low-carbon future.

Get in touch to explore 2180+ startups and scaleups and all market trends impacting 26 800+ companies.