As industries face mounting pressure to reduce emissions and meet net-zero commitments, carbon capture technology (CCT) is emerging as a critical solution. By capturing and storing CO2 from industrial processes and the atmosphere, CCT enables businesses to decarbonize operations, comply with regulations, and unlock new economic opportunities.

This guide explores the leading carbon capture technologies, real-life industry applications, key players, strategies for successful implementation, and more!

Key Takeaways

- Most Popular Carbon Capture and Storage Technologies:

- Emerging Technologies:

- Sector-Specific Applications: Power plants, steel, cement, oil & gas, and shipping industries are integrating carbon capture to decarbonize operations and comply with regulatory frameworks.

- Overcoming Barriers: High costs, scalability challenges, regulatory uncertainty, and technology selection remain key issues.

- Implementation Guide: Companies must define clear carbon capture goals, evaluate the right technologies, secure funding, and implement robust measurement frameworks to maximize ROI.

- Future Outlook (2025–2030): Global CCUS capacity is expected to reach 1.2 billion tons per year by 2035, with offshore CO₂ storage hubs in the North Sea and Gulf of Mexico playing a pivotal role in long-term sequestration. Future trends will include a circular carbon economy and CO2-to-products.

- Strategic Guidance for Decision Makers

How Do We Research and Where is This Data From?

We reviewed 3100+ industry innovation reports to extract key insights and construct a comprehensive guide for carbon capture technologies. To increase accuracy, we cross-validated this information with external industry sources.

Additionally, we leveraged the StartUs Insights Discovery Platform – an AI and Big Data-powered innovation intelligence tool covering over 4.7 million startups and more than 20K+ technologies & trends worldwide to:

- Confirm our findings using the Trend Intelligence feature.

- Gather market statistics for each technology.

- Identify startups for the “Spotlighting an Innovator” sections.

Cutting-Edge Carbon Capture Technologies Redefining the Sector [2025-2030]

Dominant Carbon Capture Solutions

1. Direct Air Capture

Key Impact

- Carbon-Negative Potential: DAC enables carbon removal rather than just emission reduction.

- Decoupled from Emission Sources: Unlike point-source capture technologies, DAC can be deployed anywhere.

- Scalability: Modular designs allow facilities to scale from pilot projects to gigaton-scale removal quickly.

- Integration with Carbon Utilization: Supports carbon-to-fuel, chemicals, and concrete industries.

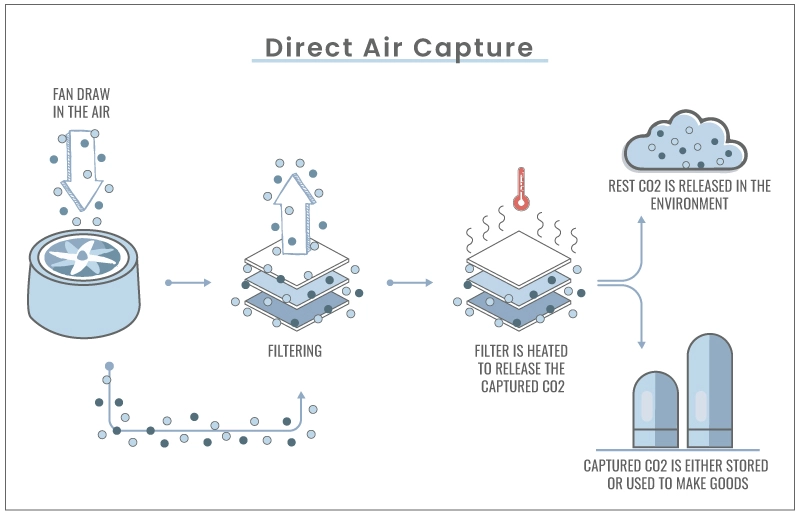

Direct air capture extracts CO2 directly from ambient air. Unlike traditional carbon capture methods that focus on industrial emissions, DAC operates independently of specific pollution sources.

The captured CO2 is either permanently stored underground or repurposed for industrial applications like synthetic fuels and carbon-based materials.

Source: Ingenious e-Brain

Market Insights

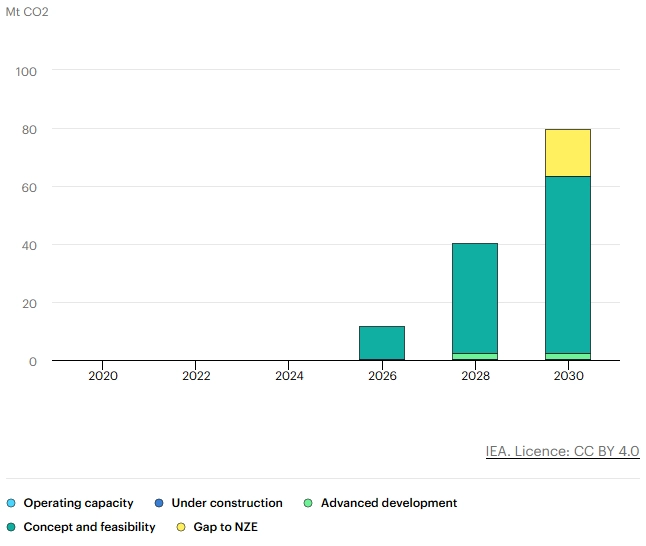

The global DAC market is projected to reach USD 1.72 billion by 2030, growing at a compound annual growth rate (CAGR) of 60.9%.

Source: MarketsandMarkets

The two biggest DAC projects are:

- Iceland: Climework’s Mammoth Plant is set to capture 36 000 tons of carbon dioxide annually. It became operational in 2024.

- United States: Expected to be operational in 2025, 1PointFive’s STRATOS DAC facility is expected to capture 500 000 metric tons CO2 annually.

CO2 capture by direct air capture, planned projects, and in the Net Zero Emissions by 2050 Scenario, 2020-2030

Source: IEA

Investments

The US Department of Energy (DOE) Office of Clean Energy Demonstrations (OCED) recently announced up to USD 1.8 billion in new funding for DAC technologies.

Further, an ASU-led collaboration received USD 11.2 million from the US DOE to build a Southwest Regional Direct Air Capture Hub.

Private investments include Climeworks securing over USD 650 million to expand DAC operations and Deep Sky receiving USD 40 million from Breakthrough Energy to establish a DAC testing facility in Canada.

Three Key Players in this Domain

1PointFive

A subsidiary of Occidental Petroleum, its STRATOS facility in Texas aims to capture 500 000 metric tons of CO2 annually, with plans to scale to 1 million metric tons per plant. It is backed by a USD 500 million US DOE grant and is developing multiple DAC hubs along the Gulf Coast.

Carbon Engineering (CE)

Developed the liquid solvent-based system used in 1PointFive’s projects. CE’s cost estimates of USD 94 – 233 per ton for DAC have driven industry credibility, while partnerships with Airbus and Microsoft highlight its role in hard-to-abate sectors like aviation.

Deep Sky

Canada’s first gigaton-scale carbon removal developer, Deep Sky integrates multiple DAC and ocean capture technologies. Its Alpha facility in Alberta is supported by a USD 40 million Breakthrough Energy Catalyst grant.

Core Technologies Connected to Direct Air Capture

- Air Contactors: Often modeled after industrial cooling towers. They use giant fans to pull in atmospheric air and maximize contact between the air and the capture medium.

- Capture Medium: Liquid solvents – like potassium hydroxide – chemically bind with CO2 molecules while solid sorbents are physical filters that chemically bind with CO2 molecules.

- CO2 Concentrators and Purifiers: In liquid solvent systems, pellet reactors separate the carbonate solution into small pellets. Calciners are high-temperature units that release pure CO2 gas from the captured compounds.

Spotlighting an Innovator: AIRMYNE

AIRMYNE is a US-based company that develops a direct air capture solution. It leverages a liquid solvent capture agent to capture carbon from the air.

The solution’s air-liquid contactor utilizes high-efficiency fans to draw in the air. The solvent absorbs the CO2 and the air is released back. The liquid solvent then passes through pressurized steam in a stripping column where carbon dioxide is released while the solvent is recycled back into the process.

2. Bioenergy with Carbon Capture & Storage

Key Impact

- Major Contributor to Climate Goals: By 2030, BECCS is expected to contribute ~15% of the cumulative CO2 reductions.

- Job Creation & Economic Growth: Sweden’s BECCS potential of 30 million tons of negative CO2 emissions per year could create 28 000 jobs.

- Renewable Energy Integration: Biomass-based power plants accelerate the transition to cleaner energy sources while maintaining a stable supply.

- BECCS in Carbon Markets: In Q2 2024, BECCS projects accounted for 90% of all global carbon dioxide removal (CDR) credits, totaling 4.3 million metric tons of CO2 traded.

Source: CDR.fyi

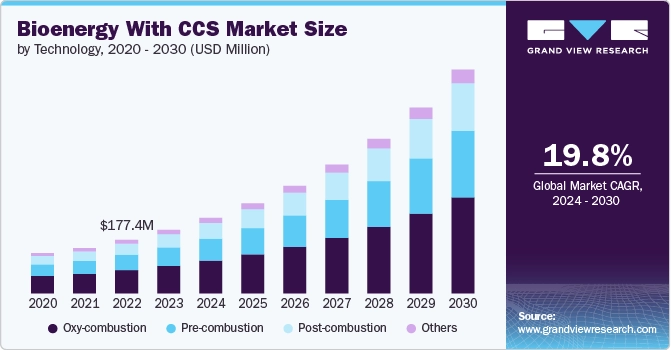

Bioenergy with carbon capture and storage technology combines biomass-based energy production with carbon capture technology.

By capturing and storing CO2 emissions from bioenergy production, BECCS generates renewable energy and results in net-negative emissions. This means it removes more CO2 from the atmosphere than it emits.

This approach is considered essential in achieving global net-zero targets and is expected to play a key role in long-term decarbonization efforts.

Market Insights

The global BECCS market is projected to grow at a CAGR of 19.8% from 2024 to 2030.

Source: Grand View Research

The sector is increasingly backed by governments and private entities due to its role in achieving net-negative emissions goals.

Investments

The European Commission approved EUR 3 billion to support Sweden’s efforts to reduce emissions and achieve climate objectives over 15 years.

Major corporate investments include Microsoft’s purchase of carbon credits in 2024. 80% of the purchased credits were BECCS-based and at an average price of USD 189 per credit.

Further, approximately 70 additional bioethanol facilities are planned to be launched globally before 2030 as bioethanol is currently leading among BECCS applications.

Drax is building 2 sites in the US to remove over 20 million tons of carbon by 2030, while Orsted’s Kalundborg Hub will capture 430 000 tons of biogenic CO2 annually from 2026.

Three Key Players in this Domain

Drax

Aims to become carbon-negative by 2030 through its UK power station conversion. It targets capturing 8 million metric tons of CO2 annually from two biomass units by 2030. The company generates 9% of the UK’s renewable power, with BECCS ensuring reliable baseload energy.

1PointFive

Primarily focuses on DAC but supports BECCS through parent-company ventures. It partners with projects like Velocys’ Bayou Fuels, which converts woody biomass into low-carbon fuels with CO2 storage.

Orsted

Its Avedore Power Station in Denmark pioneers BECCS using agricultural waste by converting locally sourced straw into electricity and district heating. This avoids open-field burning while reducing reliance on imported biomass and supporting rural economies.

Core Technologies Connected to BECCS

- Biomass Sourcing & Processing: Feedstock – like dedicated energy crops, agricultural and forestry residues, and waste biomass – is dried, pelletized, or thermally degraded to improve energy density and handling characteristics

- Bioenergy Conversion: The feedstock is converted to energy using combustion, gasification, pyrolysis, or fermentation while creating high-value byproducts.

- Carbon Capture: Relies on pre-combustion capture in case of gasification processes while burning the biomass in pure oxygen yields a concentrated CO2 stream.

Spotlighting an Innovator: Biorecro

Biorecro is a Swedish startup that specializes in large-scale carbon removal using BECCS.

The startup retrofits pulp and paper mills, bioethanol plants, municipal waste facilities, and combined heat and power (CHP) plants to capture carbon.

As a result, the company does not require virgin biomass or dedicated crops.

3. Enhanced Weathering

Key Impact

- Scalable Carbon Sequestration: EW has the potential to remove 2-4 billion metric tons of CO2 annually by 2050.

- Contribution to CDR Goals: Scientists estimate that EW could increase global carbon removal to 0.5–2 billion metric tons per year.

- First Verified ERW Carbon Credits: In 2025, the first independently verified ERW carbon removal credits were issued, totaling 235.53 credits.

- Agricultural Benefits: By enriching soils with silicate minerals, EW enhances soil pH, crop yields, and nutrient availability.

Enhanced weathering techniques accelerate the natural process of rock weathering to capture and store atmospheric carbon dioxide.

By spreading finely ground silicate minerals such as basalt on soil, EW solutions enhance chemical reactions that permanently sequester CO2.

Source: AGU

For instance, InPlanet spread 111 000 metric tons of silicate rock over 9000 hectares. This move resulted in a cumulative carbon capture of 63 136 metric tons spread across 340 farms from three continents.

Market Insights

Kenyan startup Flux recently sold Africa’s first ERW carbon credits to the Milkywire Climate Transformation Fund at a price of USD 370 per credit.

In terms of innovation, Eion was awarded the first patent for a direct carbon removal measurement methodology in EW and US DOE awarded USD 5.1 million to Northwestern University for EW research.

Investments

Terradot raised USD 58.2 million, including USD 4.2 million in seed funding and USD 54 million in Series A. It signed agreements to remove 300 000 metric tons of CO2 – the largest ERW deal to date.

Eion closed a USD 3 million Series A extension funding round to expand operations.

Three Key Players in this Domain

Terradot

A leader in scaling enhanced rock weathering (ERW). Its operations in Brazil leverage tropical soils and partnerships with EMBRAPA to deploy basalt rock on farmland. Terradot’s deals include a USD 27 million commitment from Frontier buyers.

Eion

Specializes in ERW replacing agricultural lime with crushed olivine to improve soil health while capturing CO2. Partnerships with Microsoft (8000 tons) and Stripe (50 tons delivered in 2023) underscore their credibility. Eion also projects a path to 10 million metric tons/year of removal by 2030.

InPlanet

Focused on tropical ERW, InPlanet pioneered the first verified ERW carbon credits via its Serra da Mantiqueira project in Brazil. Its work with local farmers restores degraded soils and reduces synthetic inputs while targeting 1 million metric tons/year by 2026.

Core Technologies Connected to Enhanced Weathering

- Rock Pulverization: Finely grinding silicate rocks like basalt increases their surface area and enhances CO2 sequestration.

- Soil Application Methods: Optimized spreading techniques ensure maximum mineral absorption in farmlands.

- Ocean-based Application: Some EW approaches deposit rock particles into rivers and oceans to enhance alkalinity and carbon storage capacity.

Spotlighting an Innovator: ClimeRock

ClimeRock is a French company that offers enhanced rock weathering. It applies silicate rocks to agricultural lands to accelerate the natural weathering of rocks.

Additionally, this improves soil health and crop yield while capturing carbon from the air.

ClimeRock sells CO2 credits to companies seeking to neutralize emissions and aims to deploy ERW hubs in France and other high-potential countries.

4. Membrane Capture

Key Impact

- Energy-Efficient & Low Environmental Impact: Unlike solvent-based methods, membrane systems operate without chemicals or heat input.

- Modularity & Scalability: Membrane units are easily integrated into existing industrial facilities and scaled up for large applications.

- High CO2 Purity & Capture Rates: Advanced membrane systems achieve 90% CO2 capture efficiency and produce 99.9% pure liquid CO2, suitable for storage or industrial reuse.

- Cost Reduction: Combining membranes with cryogenic or adsorption technologies enhances efficiency and purity.

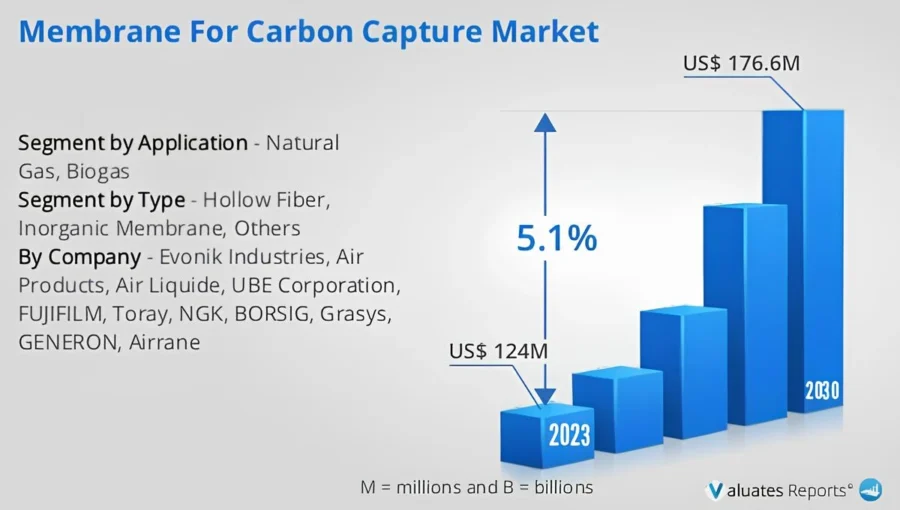

Membrane capture uses selective membranes to separate CO2 from gas streams. These membranes act as semi-permeable barriers that allow CO2 to pass through while blocking others.

The technology is increasingly used in industrial emissions, flue gas treatment, and hydrogen purification. It features high efficiency, modularity, and chemical-free operation.

Market Insights

The global membrane-based carbon capture market was valued at USD 124 million in 2023 and is projected to grow to USD 176.6 million by 2030, at a CAGR of 5.1%.

Source: Valuates.com

Innovations driving this sector include Membrane Technology & Research (MTR)’s Polaris technology. It features a 90% CO2 capture rate and 99.9% pure liquid CO2 generation.

Further, emerging hybrid systems combine membranes with cryogenic or adsorption technologies to increase capturing efficiency.

Investments

MTR recently received USD 4.6 million for a front-end engineering design (FEED) study of its Polaris membrane system at Dry Fork Station, Wyoming. This project is the second DOE award for MTR Carbon Capture at Dry Fork Station.

MTR’s Polaris membrane system will also be installed at TSMC’s facility in Taiwan, marking its first installation in the region.

Further, Compact Membrane Systems secured USD 16.5 million in Series A funding to develop scalable membrane-based carbon capture solutions.

Three Key Players in this Domain

Membrane Technology & Research

A pioneer in industrial-scale membrane carbon capture, its Polaris technology powers the world’s largest membrane-based plant at Wyoming’s Dry Fork Station. The station captures 150 metric tons of CO2 daily from coal-fired flue gas with 90% efficiency.

Ardent Technologies

Focused on Optiperm carbon membranes, it targets heavy industries like cement and steel with fully electrified, modular solutions. This technology uses less energy than solvent-based systems and converts CO2 into industrial feedstocks like chemicals and biofuels.

Air Products

The company operates the first large-scale CO2 capture system at Valero’s refinery in Port Arthur, Texas. It captures more than 1 million tons/year using amine-coated membranes licensed from NTNU.

Core Technologies Connected to Membrane Capture

- Polymeric Membranes: Common materials like polyimides and cellulose acetates provide a balance between permeability and selectivity.

- Inorganic Membranes: Zeolites and metal-organic frameworks offer high thermal stability and chemical resistance.

- Facilitated Transport Membranes: Utilize carriers that selectively bind to CO2 to enhance separation efficiency.

Spotlighting an Innovator: Cool Planet Technologies

Cool Planet Technologies is a UK-based startup that provides a modular, membrane-based carbon capture system.

The company pre-processes flue gas and passes it through a proprietary passive membrane to separate CO2. The high-purity CO2 stream is sold or injected back.

It is building a 10 000 tons/year capture plant at a Holcim cement facility in Germany and is backed by Series A funding from ENI Next and others.

5. Direct Ocean Capture

Key Impact

- Greater Absorption Capacity: Allows the ocean to absorb more atmospheric CO2 and reinforce its role as a global carbon sink.

- Cost Advantage over DAC: DOC is projected to be more cost-effective than DAC.

- Dual Benefits: DOC removes CO2 while producing valuable byproducts such as green hydrogen. This makes it an attractive sustainability solution for industrial sectors.

- Reduction of Ocean Acidification: Lowering CO2 levels in seawater speeds up the restoration of marine ecosystems and mitigates ocean acidification.

Direct ocean capture solutions extract dissolved carbon dioxide directly from seawater. Since the ocean absorbs ~30% of global CO2 emissions, removing CO2 from seawater increases its ability to absorb more from the atmosphere.

DOC is also considered a cost-effective alternative to direct air capture and generate valuable byproducts such as green hydrogen.

Direct ocean capture technology is considered more cost-effective than direct air capture.

Market Insights

The ocean carbon removal market, which includes DOC, was valued at USD 564.35 million in 2023 and is projected to reach USD 1.75 billion by 2030, growing at a CAGR of 17.5%.

Source: Virtue Market Research

Investments

Captura raised USD 45.3 million in Series A funding backed by Japan Airlines and National Grid Partners to scale DOC technology.

At the same time, SeaO2 secured approximately USD 2.2 million to move its prototype to a pilot phase – targeting a CO2 removal capacity of 250 tons annually.

Mitsubishi Electric also partnered with Finland’s VTT Technical Research Centre to develop DOC technologies to combat ocean acidification.

In terms of government support, the US DOE allocated USD 10 million for ocean-based carbon removal research.

Three Key Players in this Domain

Captura

Its electrochemical DOC systems remove CO2 from seawater using renewable energy and proprietary hollow-fiber membranes. The company plans to operate a 1000 tons/year pilot in Hawaii. Partners include Equinor and Deep Sky.

SeaO2

Pioneering chemical-free DOC, the company’s system splits seawater into acidic/alkaline streams to extract CO2 without additives. It operates intermittently using renewable power and launched a 250 tons/year pilot in 2024 to target 1 megaton/year by 2030.

Mitsubishi Electric & VTT

Mitsubishi’s partnership with Finland’s VTT focuses on DOC to address ocean acidification and achieve corporate net-zero goals by 2051. It combines Mitsubishi’s engineering scale with VTT’s carbon capture expertise for fisheries and coastal industries.

Core Technologies Connected to Direct Ocean Capture

- Electrochemical Systems: Utilize electrolysis to separate CO2 from seawater while generating green hydrogen as a byproduct.

- Membrane Technologies: Hollow fiber membranes enhance CO2 removal efficiency while reducing energy consumption.

- Renewable Energy Integration: Many DOC plants operate entirely on solar, wind, or marine energy sources to ensure low-carbon operations.

Spotlighting an Innovator: Brineworks

Brineworks is a Dutch company that develops a proprietary electrolysis technology to extract CO2 from seawater.

The company’s modular electrolyzer splits the seawater into acidic and alkaline streams. The acid-treated seawater liberates dissolved CO2, which is captured for storage or utilization. Since the acidified seawater is neutralized by the base stream, it prevents ecosystem disruption.

Further, the company raised USD 2.2 million to advance seawater electrolysis and targets USD 100/ton CO2 capture costs.

6. Molten Salt Capture

Key Impact

- Ultra-High Capture Efficiency: MSC has demonstrated the ability to capture over 99.9% of incoming CO2 – making it one of the most efficient carbon capture methods.

- Industrial Decarbonization: Designed for high-temperature industries, molten salt-based systems significantly reduce emissions from steel, cement, and petrochemical plants.

- Carbon Capture & Energy Storage Synergy: MSC integrated with molten salt thermal energy storage has the potential to reduce emissions.

Molten salt capture leverages molten salts as a medium to absorb and sequester CO2 from industrial emissions. This is suited for high-temperature industries such as steel, cement, and chemicals, where traditional carbon capture methods face efficiency challenges.

MSC is gaining traction due to its high capture efficiency, energy savings, and potential for integration with renewable energy storage systems.

Market Insights

The global molten salt market, integral to MSC, was valued at USD 1.2 billion in 2023 and is projected to reach over USD 2.3 billion by 2032, with a CAGR of 7.4%.

Investments

MSC is attracting strong investment from governments and corporations due to its high efficiency and cost-effectiveness compared to traditional CCS methods.

Mantel raised USD 30 million in a Series A funding round from investors – like Shell and Eni – to develop molten salt-based carbon capture technology.

At the same time, the US Department of Energy requested USD 8.58 billion for the Office of Science, a 6% increase in budget allocation over financial year (FY) 2023. This highlights government support for carbon capture research.

Key Players in this Domain

Mantel Capture

Its technology uses molten borates to capture CO2 directly from high-temperature industrial emissions like cement kilns and steel furnaces. The tech was lab-tested at 0.5 metric tons/day and secured USD 30 million in funding for demonstrating an 1800 metric tons/year plant.

Shell & Eni

As strategic investors in Mantel via Shell Ventures and Eni Next, their USD 30 million Series A funding accelerates molten borate technology. This way, it supports pilot-to-commercial scaling, aligning with net-zero targets for fossil fuel-dependent industries.

Core Technologies Connected to Molten Salt Capture

- Fluidized Bed Reactor: The molten salt mixture comes into contact with the CO2-containing flue gas in this chamber for efficient absorption.

- Thermal Energy Storage Integration: Captured CO2 can be utilized in combination with molten salt energy storage for renewable power generation.

- Electrochemical Conversion: Research is exploring electrochemical methods to split CO2 into carbon and oxygen further enhancing carbon utilization potential.

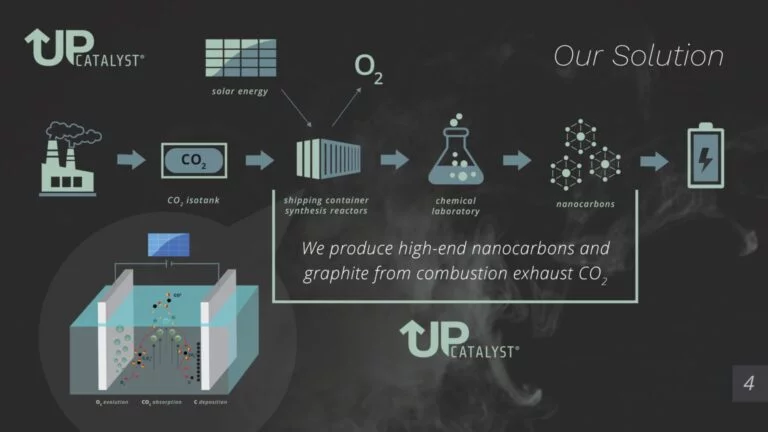

Spotlighting an Innovator: UP Catalyst

UP Catalyst is an Estonian startup that specializes in molten salt carbon capture and electrochemical transformation (MSCC-ET) to make carbon materials.

Moreover, the process is powered by renewable energy and results in carbon-negative production.

The company secured EUR 4 million to produce CO2-derived graphite for EV batteries and reduce Europe’s reliance on Chinese imports. It aims to supply 20% of Europe’s EV battery carbon needs by 2030.

Emerging Innovations

1. Cryogenic Carbon Capture

Key Impact

- Ultra-High CO2 Capture Rates: CCC has the potential to reduce CO2 emissions by 95–99%.

- Lower Cost & Energy Consumption: Compared to major carbon capture methods, CCC operates at 30% less cost and energy requirements.

- Scalability for Industrial Applications: CCC is deployed in fossil fuel power plants, steel plants, and chemical industries for widespread adoption.

Cryogenic carbon capture separates carbon dioxide from industrial emissions by cooling the gas stream to extremely low temperatures. This causes CO2 to condense and separate from other gases.

This method offers high CO2 purity without the need for chemical solvents.

The global cryogenic equipment market, which includes CCC technology, is projected to grow from USD 24.45 billion in 2024 to USD 42.23 billion in 2032, representing a 7.07% CAGR growth.

An example of recent innovation is Carbon America’s FrostCC technology which completed 1000 hours of testing at the National Carbon Capture Center.

Research institutions and private companies are also developing new cryogenic separation methods to improve energy efficiency and cost-effectiveness.

Key Players in this Domain

Air Liquide

Offers Cryocap – a technology that combines cryogenic and membrane technologies for efficient gas separation. It reduces CO2 emissions by up to 99% and valorizes other molecules. The technology is also selected for multiple engineering studies and implementations in four continents.

Carbon America

Develops a cryogenic CO2 separation process – FrostCC. It is currently testing the technology at the National Carbon Capture Center and claims to be a low-cost, mass-manufacturing solution with modular, scalable components.

Core Technologies Connected to Cryogenic Capture

- CO2 Separation: Uses extreme cooling to condense and isolate CO2 from other gases.

- Energy-Optimized Systems: New developments reduce the energy requirements of CCC technology and improve economic viability.

- Hybrid Capture Models: Combining CCC with other carbon capture technologies enhances overall efficiency and reduces operational costs.

Spotlighting an Innovator: REVCOO

REVCOO is a French company that develops CarbonCloud, a patented technology consisting of two simultaneous approaches to capture CO2 even at low concentrations.

REVerse Sublimation deals with cryogenic trapping of CO2 by direct contact while REVerse Energy handles temperature recycling. In this technology, CO2 is converted to ice and then into high-purity carbon dioxide.

2. Algae-based Sequestration

Key Impact

- High Absorption Efficiency: Some algae species sequester up to 30 times more CO2 per year than rainforests.

- Large-Scale Carbon Removal Potential: Brilliant Planet estimates that its algae-based system could remove up to 3 billion tons of CO2 annually – supporting gigaton-scale carbon sequestration.

- Economic & Industrial Benefits: Algae-based sequestration also supports industries such as biofuels, food, pharmaceuticals, and bioplastics.

Algae-based sequestration leverages the natural photosynthetic capabilities of algae to capture and store atmospheric carbon dioxide.

Both microalgae and macroalgae (seaweed) play significant roles in this process. This provides additional environmental and economic benefits.

The global algae products market is projected to grow from USD 15.12 billion in 2025 to USD 21.91 billion by 2029, at a CAGR of 9.7%.

Source: The Business Research Company

Growing corporate and government investments in algae farming and carbon sequestration are driving market expansion.

Brilliant Planet estimates its algae-based system could sequester 30 times more carbon per year than rainforests and could potentially remove 3 billion tons of CO2 per year.

Key Players in this Domain

Alcarbo

It provides microalgae cultivation technology for carbon capture and utilization. Alcarbo established a 150-square-metre pilot facility in San Tin, Yuen Long district, and uses shipping containers to house algae cultivation and harvesting equipment. It then employs a wall of 12 algae photobioreactors that absorb half a metric ton of CO2 annually.

Helios-NRG

Developed a novel multi-stage continuous (MSC) algae-based system for carbon capture. It was tested at the National Carbon Capture Center and achieved over 80% capture efficiency and productivity exceeding 25 grams per square meter per day.

Core Technologies Connected to Algae-based Sequestration

- Large-Scale Algae Cultivation: Leverages open-pond and photobioreactor systems for industrial-scale carbon dioxide absorption.

- AI-powered Bio-Reactors: Optimize algae growth to maximize CO2 absorption and algae’s carbon sequestration potential.

- Genetically Enhanced Algae Strains: Engineered algae strains increase CO2 uptake efficiency and improve biomass conversion rates.

Spotlighting an Innovator: CO2SaaS

CO2SaaS is an Israeli startup that grows algae in closed ponds to capture CO2 from the ocean.

The algae consumes CO2 from the air and seawater. It then decomposes and sinks to the depth and the collected carbon dioxide is sequestered as algae flocculation.

3. Modular Carbon Capture Systems

Key Impact

- Scalability & Flexibility: MCCS allows companies to incrementally expand carbon capture capabilities as regulatory requirements or emission goals evolve.

- Cost-Efficiency: Standardized, factory-built modules reduce manufacturing and deployment costs. This makes carbon capture more accessible.

- Reduced Footprint: MCCS solutions minimize land and infrastructure requirements. This ensures easier integration into existing industrial sites.

Modular carbon capture systems are an emerging approach to decentralized, scalable, and cost-effective carbon capture.

MCCS offers pre-fabricated, standardized units that are installed and expanded incrementally. They are beneficial for medium and small-scale industrial facilities, waste-to-energy (WTE) plants, and distributed carbon capture applications.

For instance, SLB Capturi’s modular carbon capture plant commissioned in Hengelo, Netherlands captures 100 000 metric tons of CO2 annually. The captured CO2 is repurposed for industries like horticulture and food processing.

Key Players in this Domain

SLB Capturi

A joint venture between SLB and Aker Carbon Capture recently commissioned its first modular carbon capture plant at Twence’s WTE facility in Hengelo, Netherlands. It has a capacity to capture up to 100 000 metric tons of CO2 per year.

Carbon Clean

Launched CycloneCC, a combination of advanced solvent technology and rotating packed beds. It is a fully modular, prefabricated system that is approximately 50% smaller than conventional plants and captures CO2 at a cost up to 50% lower per metric ton.

Aker Carbon Capture

Offers a modular carbon capture system. It was deployed for Orsted’s BECCS Project in Denmark and captures up to 280 000 metric tons of CO2 annually. The company also completed a project for Twence in the Netherlands.

Core Technologies Connected to Modular Carbon Capture Systems

- Capture Units: Absorber modules use specialized solvents or adsorbents to separate CO2 from flue gas or ambient air while regeneration modules release the concentrated CO2 using heat or electrical stimulation.

- Rotating Packed Beds (RPBs): Leverage centrifugal force to increase the efficiency of the carbon capture process.

- Heat Management: Many systems incorporate waste heat recovery and heat integration solutions to optimize energy performance and reduce operating costs.

Spotlighting an Innovator: Entropy

Entropy is a Canadian company that offers retrofittable modular carbon capture systems. They support emissions sources like reciprocating engines, boilers, and natural gas turbines.

The company received USD 200 million from Canada Growth Fund for scaling operations and signed the first Carbon Credit Offtake Commitment (CCOC) at 185 000 metric tons/year of credits at USD 86.50/metric ton for 15 years.

4. Advanced Chemical Absorption & Adsorption

Key Impact

- Improved Capture Efficiency: Recent developments in materials and processes offer higher CO2 capture rates and improved energy efficiency.

- Enhanced Flexibility: Adsorption technologies offer greater operational flexibility and are easily integrated into existing industrial processes.

- Reduced Operating Costs: Adsorption-based processes reduce energy consumption. For instance, pressure swing adsorption reduces consumption by up to 40% compared to traditional amine-based absorption.

Advanced chemical absorption and adsorption technologies enable cost-effective and scalable solutions for industrial applications.

Chemical absorption involves reactive solvents that chemically bind to CO2, while adsorption uses solid materials to capture CO2 on their surface.

Recent advances in solvent chemistry, metal-organic frameworks, and covalent organic frameworks (COFs) have significantly improved the efficiency and economics of these techniques.

Key Players in this Domain

Linde Engineering

Develops HISORP, an adsorption-based carbon capture technology. It combines pressure swing adsorption with cryogenic separation and compression to achieve CO2 capture rates exceeding 99%. Moreover, it does not require steam for regeneration.

Zero Carbon Systems

Specializes in direct air capture technology that uses a proprietary amine-based adsorbent system to capture CO2 directly from the atmosphere.

Core Technologies Connected to Advanced Chemical Absorption & Adsorption

- High-Performance Chemical Solvents: Amine-based, ionic liquid, and hybrid absorption solutions designed for low-cost, high-efficiency CO2 removal.

- Nanoporous Adsorbents: MOFs, COFs, and zeolite-based materials provide ultra-high surface area for carbon sequestration.

- Hybrid Capture & Regeneration Processes: Innovations in low-energy CO2 stripping and solvent regeneration for cost-effective operations.

Spotlighting an Innovator: Banyu Carbon

Banyu Carbon is a US-based startup that provides a photochemical process to capture carbon dioxide.

The company utilizes sunlight to drive chemical reactions that cause CO2 to be released from seawater. The liberated CO2 is stored in geologic formations or used as a feedstock for other industries.

Sector-Specific Applications of Carbon Capture

Energy

Impact: Implementing carbon capture in power generation substantially reduces carbon emissions and slows down climate change.

Industry Example: Southern Company is testing Carbon America’s FrostCC cryogenic CO2 separation process through the National Carbon Capture Center. This demonstrates the technology’s potential to reduce emissions by up to 99%.

Cement & Construction

Impact: Given that cement production accounts for approximately 8% of global CO2 emissions, integrating carbon capture significantly cuts down the industry’s carbon footprint.

Industry Example: Heidelberg Materials’ cement plant in Brevik, Norway installed a CCS system from Brevik CCS, which is a part of the Norwegian government’s Longship program. It significantly reduces emissions during cement production

Steel Manufacturing

Impact: Implementing carbon capture leads to substantial reductions in emissions, aiding in the industry’s transition to more sustainable practices.

Industry Example: ArcelorMittal, along with BHP and Mitsubishi, has been exploring carbon capture and utilization technologies to reduce emissions.

Chemical Production

Impact: Capturing CO2 in chemical production reduces emissions while providing a source of CO2 for utilization in other industrial applications.

Industry Example: BASF is actively developing and implementing carbon capture technologies to enhance sustainability in its chemical production processes.

Oil and Gas

Impact: Implementing CCUS in oil and gas refining reduces emissions associated with fuel production and contributes to overall emission reduction goals.

Industry Example: ExxonMobil has been investing in carbon capture technologies to mitigate emissions from its refining operations.

Shipping & Maritime

Impact: Carbon capture onboard ships could enable existing vessels to reduce CO2 emissions by up to 90% and make compliance with regulations feasible.

Industry Example: Mitsubishi Shipbuilding separated and captured carbon dioxide from the exhaust gas. This is a significant step to implement on on-board capture systems.

Overcoming Barriers to Decarbonization

Widespread adoption of carbon capture technologies includes high costs, regulatory uncertainty, and technological trade-offs. Addressing these barriers is critical for scaling up solutions and achieving global decarbonization goals.

Cost Reduction Strategies

Scaling production could replicate solar photovoltaic (PV)’s cost trajectory, with direct air capture projected to fall below USD 150/ton at gigaton capacity.

Hybrid solutions, like Sustaera integrating DAC with renewable energy, further enhance efficiency.

Circular business models also play a critical role in achieving cost-effectiveness. For example, CarbonFree converts CO2 into commercial baking soda and Carbonaide embeds it in construction materials to create revenue streams that offset capture costs.

Shared CO2 pipelines and storage hubs, like the UK’s East Coast Cluster (27M tons/year by 2030), reduce transportation and storage costs.

Policy Support and Global Regulations

Direct Government Funding & Incentives

The US Inflation Reduction Act (IRA) provides USD 3.5 billion for DAC hubs and USD 85/ton in 45Q tax credits for carbon capture projects.

At the same time, the EU Innovation Fund is Investing in industrial CCUS and negative emissions projects. Sweden is allocating EUR 3 billion for BECCS over 15 years.

Regulatory Mandates Driving Adoption

EU Carbon Border Adjustment Mechanism (CBAM) forces exporters to pay for carbon emissions. This incentivizes industries to integrate carbon capture.

Similarly, US Clean Hydrogen Tax Credits encourage low-carbon hydrogen production using captured CO2 from fossil fuel plants.

International Collaboration on CO2 Storage

North Sea & Gulf of Mexico storage hubs are emerging as key offshore CO2 storage sites due to favorable geological conditions and policy backing.

Countries are also collaborating on cross-border CO2 pipelines and shipping solutions to facilitate large-scale carbon capture deployment and implement global transport networks.

Evaluation of Technologies

Selecting the right carbon capture technology depends on several factors, including:

- Industry-Specific Emissions Profile: For example, cement and steel plants require high-temperature carbon capture, while shipping needs compact onboard solutions.

- CO2 Concentration in Emissions: Post-combustion capture suits power plants, while DAC works best for atmospheric CO2 removal.

- Energy & Infrastructure Requirements: Technologies like cryogenic separation and membrane-based capture require different energy inputs and storage solutions.

Comparing Capture Technologies by Cost & Suitability

| Technology | Best For | CO2 Capture Efficiency | Estimated Cost (USD/ton CO2) |

|---|---|---|---|

| Post-Combustion Absorption (Amine-Based) | Power Plants, Cement | 85 – 95% | USD 45-85 |

| Cryogenic Carbon Capture | Steel, Fossil Fuel Refining | 90 – 99% | ~ USD 35 |

| Direct Air Capture | Atmospheric Removal | 91.19 – 93.9% | USD 125-335 |

| BECCS | Bioethanol, Biomass Energy | 85 – 95% | USD 15-400 |

With billions in investments into CCUS, staying ahead requires a deep understanding of the evolving technological landscape.

Data-driven decision-making tools, like the StartUs Insights Discovery Platform, enable businesses to sift through thousands of carbon capture companies, startups, and patents to pinpoint the right technologies and collaborations.

How Companies Can Implement Carbon Capture Solutions

Implementing carbon capture solutions requires clear goal-setting, technological assessment, financial planning, and long-term scalability considerations. Below is a step-by-step guide to successfully adopting carbon capture technologies.

1. Define Goals

Companies must clearly define their objectives and align them with business, regulatory, and sustainability goals before investing in carbon capture:

- Compliance & Risk Management: Meeting emission reduction mandates like EU CBAM, and US 45Q tax credits.

- Operational Decarbonization: Reducing CO2 from core industrial processes, power generation, or transportation.

- Carbon Credit Monetization: Generating voluntary or compliant carbon credits by capturing and storing CO2.

- Enhancing Brand Value & ESG Performance: Strengthening corporate sustainability commitments and improving investor confidence.

By setting a clear strategic direction, businesses can choose the right technology and investment structure.

2. Finding the Right Carbon Capture Technology

Each carbon-intensive sector faces unique challenges like high-temperature emissions in steel production, intermittent emissions from shipping, or diluting CO2 streams in power generation.

Additionally, costs, scalability, and regulatory compliance play a crucial role in determining the most effective solution. The carbon capture ecosystem is also rapidly evolving led by startups, industrial leaders, and research institutions.

Leveraging Data to Find the Right Carbon Capture Technology

Businesses must leverage data-driven platforms, such as the StartUs Insights Discovery Platform. They allow you to identify the most relevant carbon capture technologies tailored to their industry.

Such solutions also monitor emerging startups and trends in carbon capture as well as analyze investment and regulatory trends to make informed strategic decisions.

3. Strategic Case Studies – Lessons from Industry Leaders

Carbfix: Mineralizing CO2 for Permanent Storage

What They Do: Carbfix captures CO2 and injects it into basalt rock formations to permanently mineralize it within two years.

Impact: Partnered with Climeworks and Iceland’s Hellisheidi power plant to create one of the first commercial-scale carbon storage projects.

Climeworks: Scaling Direct Air Capture

What They Do: Climeworks uses modular DAC systems to capture CO2 from the air. It is either stored underground (via Carbfix) or used for commercial applications.

Impact:

- Launched Mammoth DAC plant in Iceland.

- Signed multi-million-dollar carbon removal agreements with companies like Microsoft and Stripe.

These case studies demonstrate how carbon capture can be commercially viable and integrated into different industries.

4. Measurement, Reporting & Verification (MRV)

Accurate MRV frameworks are critical to ensure that captured CO2 is properly accounted for and meets regulatory or carbon credit certification standards.

- ISO 14064-2 & GHG Protocol: These are international standards for quantifying and reporting emissions reductions.

- Verified Carbon Standard (VCS) & Gold Standard: Certification programs for CDR projects seeking carbon credit monetization.

- Blockchain & IoT-Based MRV Systems: New technologies that track captured CO2 in real time to improve transparency and trust in carbon markets.

5. Return on Investment (ROI) Considerations

While CCUS technologies require upfront investment, businesses can achieve long-term financial returns through:

Cost Savings & Regulatory Compliance

EU CBAM and carbon taxes can cost businesses USD 100+ per ton of CO2 emitted. Carbon capture mitigates these costs.

Emerging solvents and waste heat recovery also reduce carbon capture operating expenses (OPEX).

Revenue Generation from Carbon Credits

BECCS and DAC-based carbon credits sell for USD 150–200 per ton in voluntary markets. Moreover, companies like Microsoft, Stripe, and Shopify are pre-purchasing large volumes of carbon removal credits.

Enhancing ESG & Investor Confidence

Sustainability-linked financing and green bonds can be secured with strong CCUS commitments.

Moreover, carbon capture adoption signals industry leadership as well as attracts investors and corporate partnerships.

6. Scaling for the Future: Roadmap for Integrating CCUS into Business Operations

To future-proof carbon capture investments, businesses should develop a long-term integration roadmap:

| Phase | Key Actions | Timeframe |

|---|---|---|

| Pilot Projects | Deploy small-scale capture systems, test technologies | 1–3 years |

| Scaling to Full Operations | Expand to high-emission facilities, integrate into supply chains | 3–7 years |

| Industry-Wide Collaboration | Join carbon capture clusters, leverage CO2 utilization markets | Ongoing |

Expanding CCUS Beyond Capture Alone

CO2-to-Products Innovation: Carbon capture companies are developing CO2-based fuels, chemicals, and construction materials.

Cross-Sector Integration: CCUS solutions are becoming viable for steel, cement, shipping, and agriculture.

Digital Transformation & AI: AI-driven analytics are optimizing CCUS efficiency and operational costs.

The Road Ahead: 2025–2030 Outlook

Projected Market Growth

To align with net-zero targets, studies suggest that global CCUS capacity needs to expand over 100 times, reaching 4 to 6 billion metric tons of CO2 by 2050. This will decarbonize around 15-20% of today’s energy-related emissions.

Global Carbon Pricing Models: Cap-and-Trade vs. Carbon Tax

Effective carbon pricing is pivotal in incentivizing emission reductions and fostering CCUS adoption. Two primary models are prevalent:

Cap-and-Trade Systems enable governments to set a cap on total greenhouse gas emissions and issue allowances that can be traded. This market-driven approach rewards companies that reduce emissions.

Carbon Tax is a direct tax on the carbon content of fossil fuels that provides a clear economic signal to emitters to reduce their carbon footprint.

Expansion of Carbon Capture Capacity

Projections indicate that global carbon capture capacity could reach approximately 424 million metric tons per annum by 2035.

The development of offshore CO2 storage hubs is also gaining momentum, particularly in regions like the North Sea and the Gulf of Mexico. These hubs offer substantial storage potential due to favorable geological formations.

For instance, the UK’s East Coast Cluster aims to leverage North Sea sites for CO2 storage, with construction expected to commence in mid-2025 and start-up in 2028.

Government Initiatives

Governments worldwide are making substantial investments to advance CCUS technologies. The UK government has committed up to GBP 21.7 billion over 25 years to support carbon capture and storage projects.

International accords, notably the Paris Agreement, play a crucial role in shaping CCUS deployment. By setting ambitious emission reduction targets, these agreements encourage nations to integrate CCUS into their climate strategies.

Key Future Trends to Watch in Carbon Capture and Utilization

As the global community intensifies efforts to mitigate climate change, several key trends are shaping the future of carbon capture, utilization, and storage (CCUS).

1. Circular Carbon Economy (CCE)

The circular carbon economy applies circular economy principles to carbon management to reduce, reuse, recycle, and remove carbon emissions. This approach minimizes waste and maximizes the value derived from carbon resources.

By integrating CCE strategies, industries convert CO2 from a waste product into a valuable input for various processes to contribute to sustainable economic growth.

2. Artificial Intelligence (AI)-Driven Capture Optimization

Through predictive modeling and optimization algorithms, AI identifies patterns and optimizes operations of CCS plants and units to save energy and improve capture rates.

For instance, machine learning algorithms predict optimal operating conditions and reduce energy consumption in post-combustion carbon capture plants.

3. CO2-to-Products Market

Technologies that convert captured CO2 into valuable products reduce greenhouse gas emissions and create economic incentives for carbon capture.

Innovations in this space include the production of synthetic fuels, building materials, and chemicals from CO2. This contributes to a growing market for CO2-derived products.

4. Hydrogen and CCUS Integration

By capturing CO2 emissions during hydrogen production, industries produce low-carbon hydrogen, this integration supports the development of a hydrogen economy while addressing carbon emissions.

Strategic Takeaways for Decision-Makers

As carbon capture technologies evolve and global climate policies tighten, executives, policymakers, and industry leaders must adopt strategic, forward-thinking approaches to remain competitive and compliant. Below are key actionable insights for you to integrate CCUS into your operations.

1. Partner with Modular Carbon Capture Providers for Faster Deployment

Time-to-market is critical in carbon capture adoption. Modular carbon capture systems offer a scalable, cost-effective alternative to large-scale CCUS facilities.

This allows companies to implement plug-and-play carbon capture solutions without significant retrofits.

Key Actions:

- Engage with industry leaders like Carbon Clean and Aker Carbon Capture which specialize in modular, solvent-based capture systems.

- Consider CycloneCC from Carbon Clean, which reduces unit height by 70% and steel requirements by 35%.

- Leverage modular systems to incrementally scale carbon capture, reduce CAPEX risks, and ensure quicker regulatory compliance.

2. Leverage Tax Credits & Incentives to Improve ROI on Carbon Capture Investments

Government funding and tax incentives play a critical role in making carbon capture financially viable. For example, the US Inflation Reduction Act and the EU Innovation Fund provide billions in funding to accelerate CCUS adoption.

Key Actions:

- Take advantage of 45Q tax credits in the US (USD 85/ton CO2 stored, USD 60/ton for utilization).

- Explore EU subsidies, including the EUR 3 billion Swedish BECCS funding and the UK’s GBP 22 billion CCUS investment.

- Monetize carbon removal credits in voluntary markets, where DAC and BECCS credits command prices of USD 150–200 per ton.

3. Monitor CBAM Compliance Timelines for Businesses Exporting to Regulated Markets

The EU Carbon Border Adjustment Mechanism is poised to reshape global trade by penalizing carbon-intensive imports into the EU. Exporters from non-EU regions must adapt quickly or risk financial and market access losses.

Key Actions:

- Monitor CBAM compliance deadlines. Even though full implementation begins in 2026, mandatory emissions reporting is already in effect.

- Assess your carbon footprint exposure if exporting steel, cement, fertilizers, electricity, or aluminum to the EU.

- Implement carbon capture solutions to mitigate CBAM tariffs and maintain competitive pricing.

- Explore partnerships with EU-based CCUS projects to secure compliant supply chains.

4. Leverage Data-Driven Platforms to Identify Carbon Capture Technologies & Partners

With thousands of emerging carbon capture technologies and startups, navigating the right investment and partnership opportunities is challenging.

That’s where our AI and Big Data-powered Discovery Platform comes in. With access to over 4.7 million emerging companies and 20K+ technologies & trends globally, it equips you with the actionable insights you need to stay ahead of the curve.

Leverage this powerful tool to spot the next big thing before it goes mainstream. Stay relevant, resilient, and ready for what’s next.

![Essential Guide to Digital Transformation in the Automotive Industry [2025 & Beyond]](https://www.startus-insights.com/wp-content/uploads/2024/12/Digital-Transformation-in-Automotive-SharedImg-StartUs-Insights-noresize-420x236.webp)

![Digital Transformation in Construction: Trends, Benefits, and Future Insights [2025 & Beyond]](https://www.startus-insights.com/wp-content/uploads/2024/12/Digital-Transformation-in-Construction-SharedImg-StartUs-Insights-noresize-420x236.webp)