The 2025 Aluminum Technology Market Report highlights the impact of innovative technologies and investment trends on the aluminum market.

From advancements in digitalization and automation to the increasing shift towards secondary aluminum production, these developments are reshaping how producers, manufacturers, and stakeholders operate and collaborate.

The aluminum technology outlook provides insights into the market’s current landscape, projected growth trajectory, key regional hubs, and emerging startups, serving as a valuable resource for market participants, investors, and policymakers.

Executive Summary: Aluminum Technology Market Outlook 2025

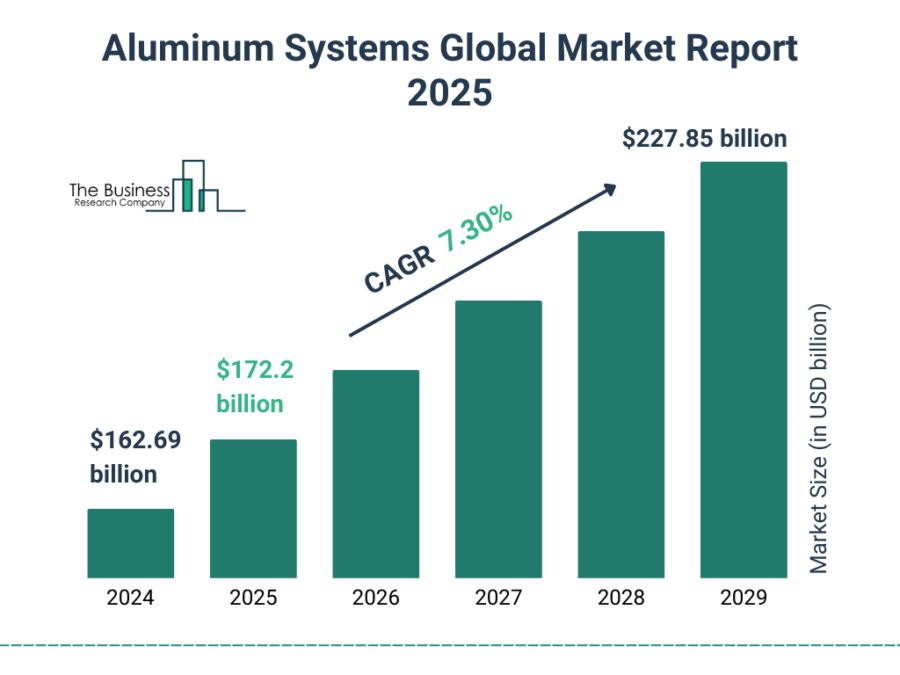

- Industry Growth Overview: The aluminum systems market size will grow from USD 172.2 billion in 2025 to USD 227.85 billion in 2029 at a compound annual growth rate (CAGR) of 7.3%. On a granular level, the aluminum technology market has experienced a declining growth rate of 2.82% over the past year as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: The market employs over 1 million individuals globally, with an increase of 49K new jobs added in the last year.

- Patents & Grants: The aluminum technology market features more than 788 590+ patents and 930 grants. The patent growth rate is 0.36% yearly, with China and the US leading in patent issuance.

- Global Footprint: Key hubs for aluminum technology include the US, Germany, India, China, and the UK, showcasing a diverse global infrastructure supporting market growth. Major city hubs encompass Mumbai, Istanbul, Sydney, Dubai, and Melbourne.

- Investment Landscape: The average investment value per funding round exceeds USD 52 million, with over 1540 funding rounds closed. More than 1K investors are actively engaged in the aluminum technology market.

- Top Investors: Major investors include RBC Capital Markets, Oaktree Capital Management, JP Morgan Chase and more are collectively investing over USD 3.69 billion across numerous companies.

- Startup Ecosystem: Five innovative startups, Flow Aluminum (aluminum-CO2 gas battery), Lukss Pack (monolucid sheets for food packaging), Allsea Boats (high-end fishing boats manufacturing), Meadow (packaging and containers manufacturing), and Speira (aluminum rolling and recycling) showcase the market’s global reach and entrepreneurial spirit.

Methodology: How we created this Aluminum Technology Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 150M patents, news articles, and market reports. This data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this exhaustive database, we provide actionable insights for startup scouting, trend discovery, and technology landscaping.

For this report, we focused on the evolution of aluminum technologies over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within aluminum technology

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the aluminum technology market.

What Data is Used to Create This Aluminum Technology Market Report?

Based on the data provided by our Discovery Platform, we observe that the aluminum technology market ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The aluminum technology market has been featured in over 570 publications in the last year which showcase major media attention.

- Funding Rounds: There have been more than 1540 funding rounds recorded in our database for this sector.

- Manpower: The global workforce in aluminum technology exceeds 1 million, with an additional 49K+ employees added in the past year alone.

- Patents: The aluminum technology market has more than 788 590 patents.

- Grants: Over 930 grants have been awarded to companies within the aluminum technology market.

- Yearly Global Search Growth: The aluminum technology market has experienced a yearly global search growth of 131.45%.

Explore the Data-driven Aluminum Technology Market Report for 2025

According to The Business Research Company, the aluminum systems market size will grow from USD 172.2 billion in 2025 to USD 227.85 billion in 2029 at a CAGR of 7.3%.

The aluminum technology market report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

Our database features 1710+ startups and over 19 510 companies which reflect the market’s vast scope despite an annual growth decline of 2.82%. It also highlights over 788 590 patents and 930 grants.

Credit: The Business Research Company

Additionally, with a global workforce exceeding 1 million and 49K new employees added last year, the aluminum technology market’s talent pool remains robust.

Major hubs include the US, Germany, India, China, and the UK, while cities like Mumbai, Istanbul, Sydney, Dubai, and Melbourne stand out as vibrant epicenters of aluminum technology activity.

A Snapshot of the Global Aluminum Technology Market

Over the past year, the aluminum technology market has experienced a declining annual growth rate of 2.82%.

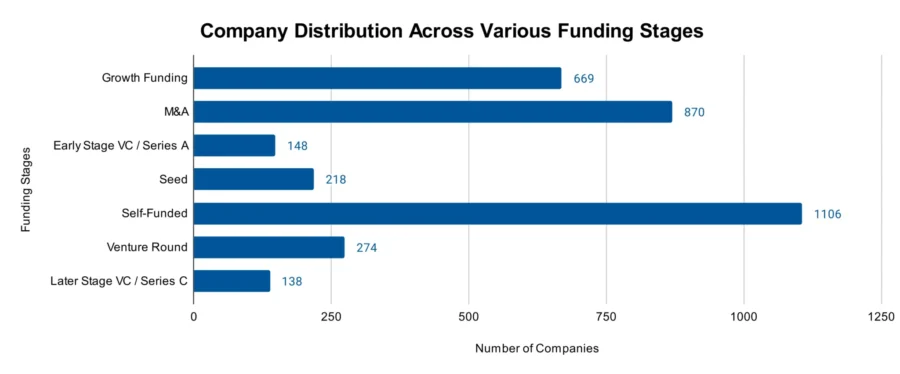

Among 1710+ startups, over 140+ are in the early stages, while more than 870 have progressed to mergers and acquisitions which signal a mix of innovation and consolidation.

Over 788 590+ patents have been filed, representing contributions from 103 700+ applicants globally.

Further, the market sees steady innovation, with a yearly patent growth rate of 0.36%. China leads as the top patent issuer, accounting for over 253 030+ filings, followed by US with 144 850+ patents.

Explore the Funding Landscape of the Aluminum Technology Market

With an average investment value exceeding USD 52 million per round, the aluminum technology market demonstrates major financial commitment. Over 1K investors have participated in more than 1540 funding rounds and are collectively supporting over 960 companies.

Who is Investing in the Aluminum Technology Market?

The combined investment value of the top investors in the aluminum technology market exceeds USD 3.69 billion. Here is a breakdown of their contributions:

- RBC Capital Markets has invested USD 784.8 million in at least 1 company. RBC, in collaboration with the RBC Foundation in Canada and the US, has pledged USD 2 billion in community investments by 2035.

- Oaktree Capital Management has invested USD 425 million in at least 1 company. Oaktree agreed to acquire the appraisal and valuations unit of B. Riley, known as Great American, for approximately USD 400 million.

- JP Morgan Chase has invested USD 425 million in at least 1 company. JPMorgan Chase has partnered with Cliffwater, FS Investments, and Shenkman Capital Management to expand its presence in the USD 1.7 trillion private credit market.

- Crestview Partners has invested USD 424 million in at least 1 company. The Gersh Agency, a leading talent representation firm, and a Crestview portfolio company acquired You First, a global sports and entertainment agency.

- First Abu Dhabi Bank has invested USD 362.5 million in 2 companies. FAB partnered with Microsoft to launch an AI Innovation Hub focused on financial services.

- Mashreq has invested USD 300 million in at least 1 company. Mashreq’s business banking division partnered with NEO PAY to introduce a Point-of-Sale (PoS) lending solution.

- Kohlberg Kravis Roberts has invested USD 292 million in at least 1 company. KKR and Energy Capital Partners (ECP) have formed a USD 50 billion partnership to invest in data centers and power infrastructure.

- Glencore has invested USD 225 million in at least 1 company. Glencore invested USD 75 million in Li-Cycle which is a battery recycling company.

- Trafigura has invested USD 225 million in at least 1 company. Trafigura, in partnership with GenZero, committed over USD 100 million to expand the Brújula Verde project in Colombia’s Orinoco River Basin.

- RBC Dominion Securities has invested USD 225 million in at least 1 company. RBC Wealth Management-US. expanded its partnership with TIFIN AG, an AI-driven fintech platform.

Top Aluminum Technology Innovations & Trends

Discover the emerging trends in the aluminum technology market along with their firmographic details:

- Aluminum Die Casting domain, comprising 1605 companies with over 175K employees, is increasingly adopting automation and AI to improve aluminum production efficiency and precision. The integration of AI-driven predictive maintenance and process optimization tools is reducing operational costs and improving product quality. This domain further aligns with the aluminum tech market’s annual growth rate of 4.93% which reflects a steady expansion driven by technological innovation.

- Aluminum Electrolytic Capacitors segment, which encompasses 197 companies and 38K employees, is focusing on miniaturization to meet the demands of modern electronic devices. Innovations in capacitor design are enabling more compact and efficient components, addressing space constraints in advanced electronics. Moreover, this focus on innovation is contributing to the segment’s annual growth rate of 4.25%.

- Welding Aluminum domain with 411 companies and over 15K employees, is witnessing rapid development in welding technologies to improve joint strength and reduce defects. Techniques such as friction stir welding and laser welding are becoming more prevalent which improves the structural integrity of aluminum assemblies. These technological innovations support the segment’s annual growth rate of 2.47%, indicating a positive trajectory influenced by the adoption of welding methods.

5 Top Examples from 1710+ Innovative Aluminum Technology Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Flow Aluminum builds Aluminum-CO2 Gas Battery

Flow Aluminum is a US-based startup that develops aluminum-CO₂ battery technology to improve energy storage solutions.

Its product, the PowerCore Capsule, utilizes a rechargeable aluminum anode and a CO₂-based cathode to achieve a theoretical specific capacity.

The startup also offers the PowerBlock Cube, which is a unit comprising multiple PowerCore Capsules and an energy management system to provide better performance with minimal maintenance.

For grid-scale needs, the PowerGrid Center integrates PowerBlock Cubes to deliver stability and flexibility to grid operators which improve energy storage capacity.

Additionally, the PowerBank C serves as a stand-alone or grid-connected battery that combines energy storage with carbon capture and concentration. This further enables participation in both energy storage and carbon credit trading markets.

Lukss Pack offers Monolucid Sheets for Food Packaging

Lukss Pack, a Spanish startup, provides monolucid aluminum sheets for flexible food-grade packaging. These sheets, available in alloys 1235 and 8079 for lamination, and 8021 for yogurt applications, offer excellent barrier properties to protect food products from external factors.

In addition to aluminum solutions, Lukss Pack offers biaxially oriented polyester (BOPET) films, biaxially oriented polypropylene (BOPP) films, polyolefin shrink wrap (POF) films, polylactic acid (PLA) films derived from sustainable resources, and more designed for recyclability.

Allsea Boats provides High-End Fishing Boats Manufacturing

Allsea Boats is a Chinese startup that manufactures high-end aluminum fishing boats.

The startup integrates research, development, production, sales, and service to deliver premium vessels. Utilizing aluminum technology, Allsea Boats constructs durable and lightweight hulls that improve performance and fuel efficiency.

Their product line includes models like the bladecraft aluminum fishing boat that is designed for long-range game fishing, the aluminum center console boat that features pontoons for increased buoyancy and safety, and more.

Meadow enables Packaging and Containers Manufacturing

Meadow is a Swedish startup that introduced the MEADOW KAPSUL technology, to improve standard aluminum beverage cans into versatile pre-fill containers.

This technology involves a precision-engineered modification to the can’s end that creates a unique twist-to-open mechanism. It also improves user convenience while maintaining full recyclability.

Notably, the design eliminates the traditional pull tab, reducing raw material usage and lightening the can.

Moreover, Ball Corporation announced a minority investment in Meadow to support the production of fully recyclable aluminum cans.

Speira enables Aluminium Rolling and Recycling

Speira is a German startup that offers ORBIS and RIVOS, two aluminum product lines emphasizing sustainability and efficiency.

ORBIS products incorporate external scrap and promote resource efficiency and circularity. RIVOS products combine external scrap with low-carbon primary metal while utilizing regional renewable energy to minimize carbon footprints.

Moreover, the startup supplies automotive, packaging, and construction and offers high strength, corrosion resistance, and excellent formability solutions.

Gain Comprehensive Insights into Aluminum Technology Trends, Startups, and Technologies

In 2025, the aluminum technology market is driven by advancements in recycling technologies, demand from the automotive and aerospace sectors, and the integration of artificial intelligence (AI) in production processes.

Innovative recycling methods will promote a sustainable circular economy and reduce reliance on primary aluminum production. These developments will position the aluminum sector to effectively meet global industrial challenges.

Get in touch to explore all 1710+ startups and scaleups, as well as all market trends impacting 19 510+ companies.