Packaging 4.0 is driving significant improvements in efficiency, customization, and sustainability. The global packaging market is projected to reach USD 1.45 trillion by 2032 at a compound annual growth rate (CAGR) of 3.78%.

This guide explores the top 9 digital technologies optimizing packaging operations – offering strategies for effective implementation, real-world examples, emerging trends, and insights into the future of packaging.

Key Takeaways

- The Time to Act Is Now: Packaging digitalization is driven by sustainability mandates, rising e-commerce customization demands, and automation needs amid supply chain disruptions.

- Top 9 Packaging 4.0 Technologies Driving Digital Transformation

- Key Benefits: Improved operational efficiency, cost reduction, product quality, sustainability, customization, customer experience, and more.

- Roadmap for Successful Digitization: This digitization roadmap covers goal setting, digital maturity assessment, technology adoption, and data infrastructure.

- Future Trends: Fiber-based packaging, hyper-personalization, and technology integration are shaping the future of packaging.

How do we research, and where is this data from?

We reviewed over 3100 industry innovation reports to extract key insights and construct the comprehensive Technology Matrix. To increase accuracy, we cross-validated this information with external industry sources.

Additionally, we leveraged the StartUs Insights Discovery Platform – an AI and Big Data-powered innovation intelligence tool covering over 5 million startups and more than 20K+ technologies & trends worldwide to:

- Confirm our findings using the Trend Intelligence feature.

- Gather market statistics for each technology.

- Identify startups for the “Spotlighting an Innovator” sections.

Why the Time to Act is Now

Escalating Sustainability Pressures

European Union’s extended producer responsibility (EPR) laws and France’s anti-waste law mandate plastic reduction through precise recycling metrics, and transparency in material sourcing. By the end of 2025, 65% of all packaging waste is to be recycled throughout the EU and 20% of single-use plastic packaging must be reduced.

Surging Demand for Customization in E-Commerce

Consumers prefer transparency, personalization, and interactivity in packaging.

Interactive technologies like NFC and AR-powered labels are driving new levels of consumer interaction. Companies also embed smart labels in bottles for consumers to access brand stories and cocktail recipes via their smartphones.

Supply Chain Disruptions and Labor Shortages Necessitate Automation

The global supply chain remains volatile due to labor shortages, raw material fluctuations, and increased demand for agile logistics. Nestlé has reduced production downtime by using AI-driven packaging lines that autonomously adapt to product variations.

Meanwhile, robotic palletizers and automated guided vehicles (AGVs) are filling labor gaps by automating packaging tasks. Companies that invest in automation now will gain a significant competitive advantage in operational resilience and cost efficiency.

Data-Driven Compliance and Transparency Are No Longer Optional

The global trade in counterfeit goods could reach USD 1.79 trillion by 2030. Therefore, adopting blockchain-enabled traceability ensures supply chain authenticity.

On the sustainability front, real-time data platforms streamline compliance with extended producer responsibility (EPR) regulations by generating instant sustainability reports rather than relying on outdated estimates.

Top 9 Packaging 4.0 Technologies Driving Digital Transformation [2025]

1. Artificial Intelligence

AI is utilized to optimize material usage. For instance, Amazon uses its machine learning models to optimize packaging dimensions without wasting excess material. This has reduced 24% shipment damage and 5% shipping costs.

Source: Towards Packaging

AI-powered inspection systems implemented in packaging facilities achieve a 99.9% defect detection rate while reducing manual inspection costs by 80% and customer complaints by 50%.

Concerns about sustainability are pushing packaging companies to adopt AI. Research by McKinsey reports that 67% of global consumers prefer products with recyclable or reusable packaging.

For instance, EcoPackAI has partnered with major beverage companies to redesign plastic bottles using AI-driven optimization. This resulted in an 18% reduction in plastic usage while maintaining structural integrity and a 25% decrease in carbon footprint.

Market Insights & Growth Metrics for AI

Scale and Magnitude

According to StartUs Insights, there are currently 107 584 AI-focused companies worldwide. This explains AI’s widespread adoption in various industries.

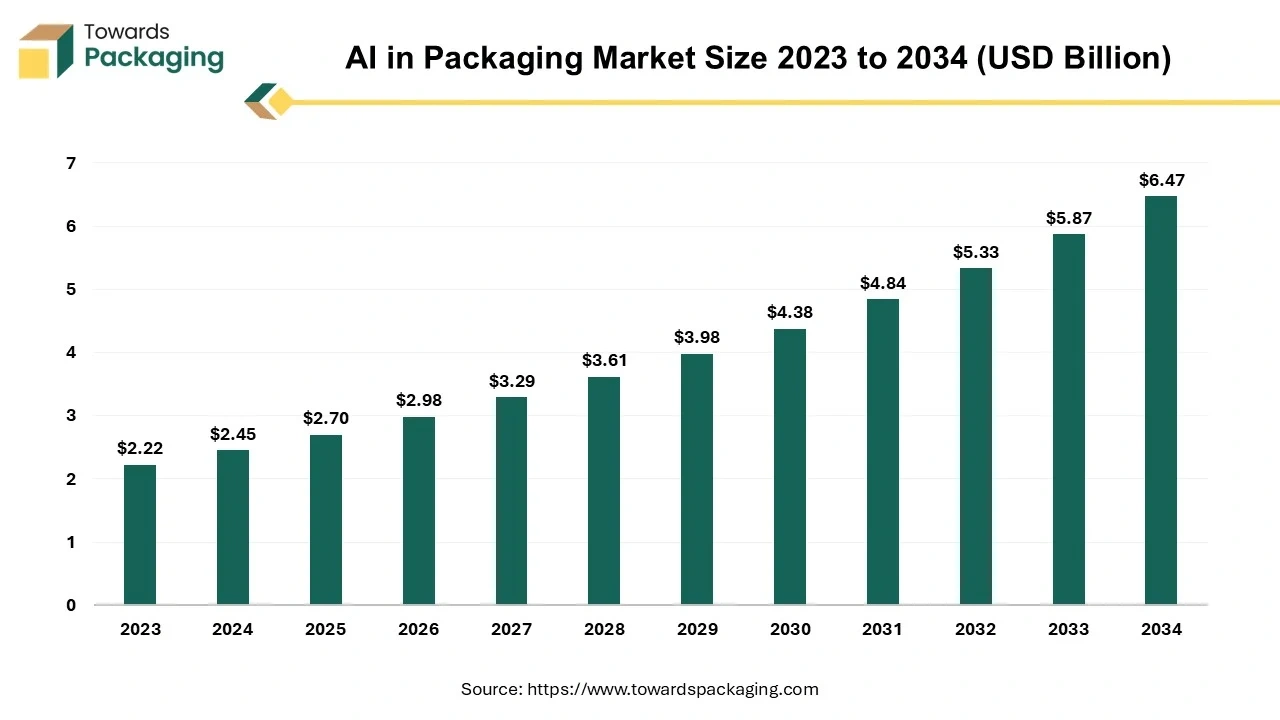

The AI-driven packaging sector is projected to reach USD 6.47 billion by 2034, at a CAGR of 10.28%.

Source: Towards Packaging

In terms of media coverage and public attention, AI ranks 16th among all emerging technologies according to StartUs Insights.

Growth Indicators

AI has seen a notable increase in global interest, with annual search interest rising by 28.09%, as reported by StartUs Insights.

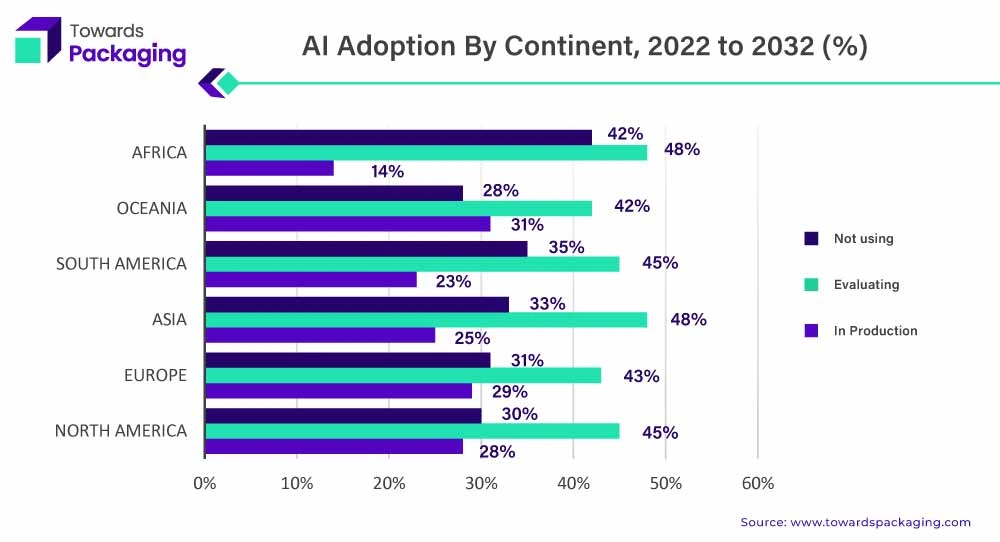

Region-wise, North America dominates the global market of AI within the packaging industry. Some of the established players are Broadcom, Skyworks, and Qualcomm.

Source: Towards Packaging

Innovation and Novelty

According to StartUs Insights, there have been more than 841 390 AI-related patents filed worldwide and 23 191+ grants awarded for AI research. AI-powered companies like SustaPack received USD 1.3 million UKRI grant to refine paper-based liquid bottle tech.

Top Use Cases of AI in the Packaging Industry

- Dynamic Packaging: AI enables smart and adaptive packaging that responds to environmental conditions. For example, temperature-sensitive labels or interactive QR codes that update product information in real time.

- Personalized Packaging Experiences: AI-driven consumer insights allow brands to create customized packaging designs, promotional materials, and product recommendations.

- Automated Quality Control: AI-powered vision systems detect defects, inconsistencies, and contamination in packaging lines. This ensures high-quality standards, reduced waste, and improved efficiency.

Noteworthy Advancements

- Amazon’s AI for Right-Sizes Packaging: Amazon’s package decision engine optimizes packaging for customer orders. By analyzing product characteristics and leveraging machine learning, the engine has helped avoid over 2 million tons of packaging material since 2015.

- Flowcode and LOVE CORN’s AI-Enabled QR Code Integration: Flowcode’s partnership with snack brand LOVE CORN introduced AI-enabled QR codes on consumer packaged goods. These custom QR codes direct consumers to dynamic landing pages featuring unique brand activations. This builds direct relationships and converts product interactions into meaningful experiences.

Core technologies Connected to AI

- Computer Vision Libraries: Utilize advanced image processing algorithms to automate quality control in packaging. These libraries enable real-time defect detection, label verification, and ensure packaging integrity.

- Natural Language Processing (NLP): Employs AI-driven text analysis to interpret and analyze customer feedback, maintenance logs, and production notes. NLP facilitates predictive maintenance and aids in optimizing packaging designs based on consumer sentiment analysis.

- Deep Learning Architectures: Improve the accuracy of computer vision systems in defect detection and optimize supply chain processes through predictive analytics. This contributes to developing intelligent packaging solutions.

Spotlighting an Innovator: GREYSCALE AI

GREYSCALE AI is a US-based company that develops high-performance inspection systems utilizing high-resolution x-ray imaging and advanced artificial intelligence algorithms.

Its technology captures detailed images of seals, which are then processed through proprietary software employing deep learning to detect anomalies indicative of damage. The system features cloud-based data collection that enables real-time analysis and over-the-air (OTA) updates to maintain optimal performance.

This approach ensures precise and efficient seal damage detection that enhances product package quality and operational efficiency.

2. Internet of Packaging

IoT integrates with digital technologies to enhance product transparency, supply chain efficiency, and consumer engagement. The Internet of Packaging market is projected to reach around USD 30 billion by 2034, exhibiting a CAGR of 9.2% from 2025 to 2034.

The rise of e-commerce and a focus on supply chain efficiency have led companies to adopt IoP solutions. This resulted in a reported 30% reduction in supply chain costs due to improved visibility and control.

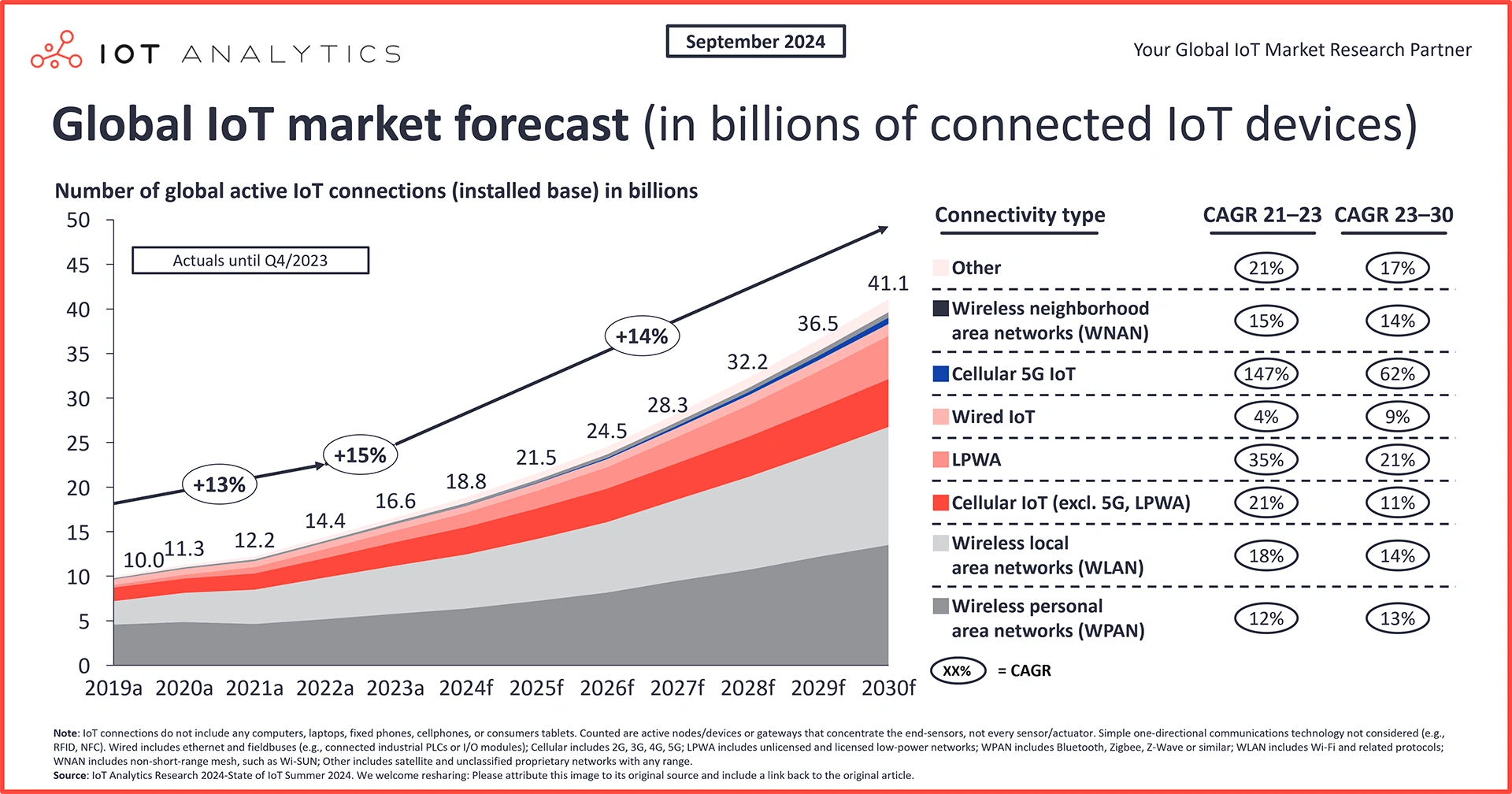

Market Insights & Growth Metrics for Internet of Things

Scale and Magnitude

Based on our data, there are over 56 000 companies globally operating in the IoT sector.

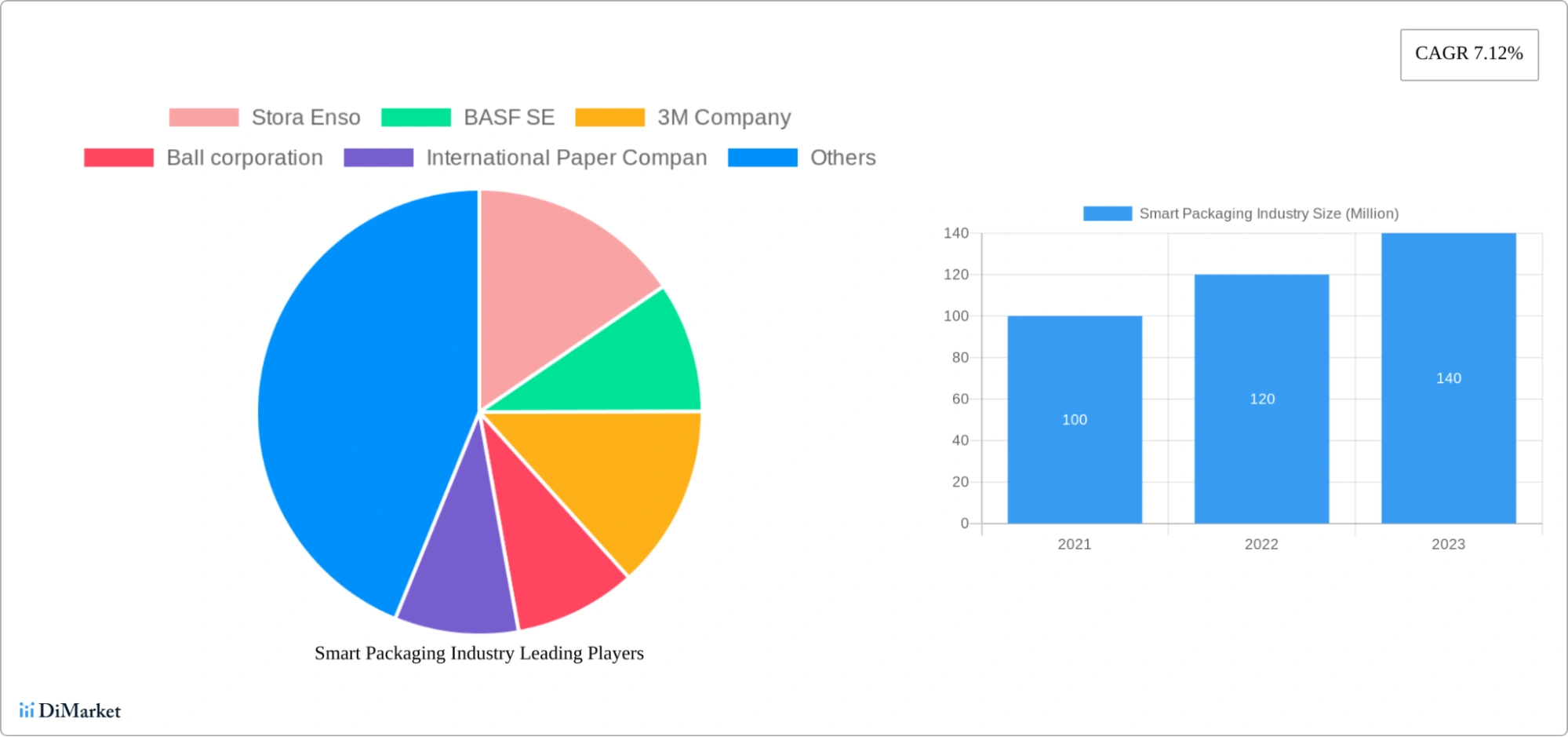

The global smart packaging industry is estimated to be valued at USD 22.67 million in 2025, projected to reach USD 37.94 million by 2033, exhibiting a CAGR of 7.12% during this period.

Source: DiMarket

IoT holds the 93rd position in media coverage among emerging technologies in our database.

Growth Indicators

StartUs Insights reports that IoT has experienced a 31.55% annual increase in search interest.

Source: IoT Analytics

Europe is a significant player in the IoP market as it projects to grow at a CAGR of 8% until 2034.

Innovation and Novelty

The IoT sector has seen significant innovation, with over 129 000 patents filed globally based on our data.

StartUs Insights also reports that IoT-focused research has received 7000+ grants.

Top Use Cases of IoT in the Packaging Industry

- Smart Inventory Management: IoT-enabled sensors and RFID tags track real-time inventory levels to prevent stockouts and overstocking.

- Supply Chain Traceability and Visibility: IoT devices monitor shipments, environmental conditions, and location data to ensure product quality, compliance, and real-time logistics insights.

- Connected Packaging: Smart packaging integrates IoT sensors and QR codes to enhance consumer engagement, provide authentication, and deliver dynamic product information.

Noteworthy Advancement

- Alshaya and Ericsson’s Connected Recycling Platform: This initiative diverts over 50% of Alshaya’s waste from landfills by providing real-time tracking of waste streams and facilitating the integration of recycled materials back into packaging. The platform enhances digital transparency of waste flows, ensures efficient repurposing, and promotes circular material usage.

- Giesecke+Devrient’s Reusable Smart Label: Giesecke+Devrient’s G+D Smart Label is an ultra-thin, reusable IoT-enabled label for precise asset tracking. The label offers features such as location tracking with sub-10-meter accuracy, tamper protection through open-close sensors, and temperature monitoring for perishable goods.

Core technologies Connected to IoT

- Sensors and Actuators: Utilize IoT-enabled devices to monitor and control packaging processes. Sensors collect real-time data on parameters and actuators respond to sensor inputs by adjusting machinery operations.

- Connectivity Protocols: Enable seamless data exchange between packaging equipment and central control systems to ensure interoperability among diverse devices. It supports real-time monitoring and facilitates efficient data transmission that optimizes packaging workflows.

- Edge Computing: Analyzes sensor data in real time and allows edge devices to make immediate decisions, such as halting production upon detecting defects. This approach reduces latency, minimizes reliance on centralized cloud systems, and enhances responsiveness.

Spotlighting an Innovator: impacX

impacX is an Israel-based company that develops a smart packaging platform to convert ordinary bottles into interactive, connected devices. Its patented technology incorporates sensors into bottle caps to monitor content without direct contact. It measures liquid levels and tracks consumption.

These sensors communicate with a mobile app, which builds user profiles, sends personalized reminders, and offers relevant content. impacX includes a brand dashboard that collects real-time data to analyze customer behavior and engage directly through targeted notifications.

3. Robotics

In the US, online sales alone are projected to constitute 20.6% of total retail sales by 2027. This rise of e-commerce drives the increased adoption of automation in packaging to meet the demand for faster and in more efficient processes.

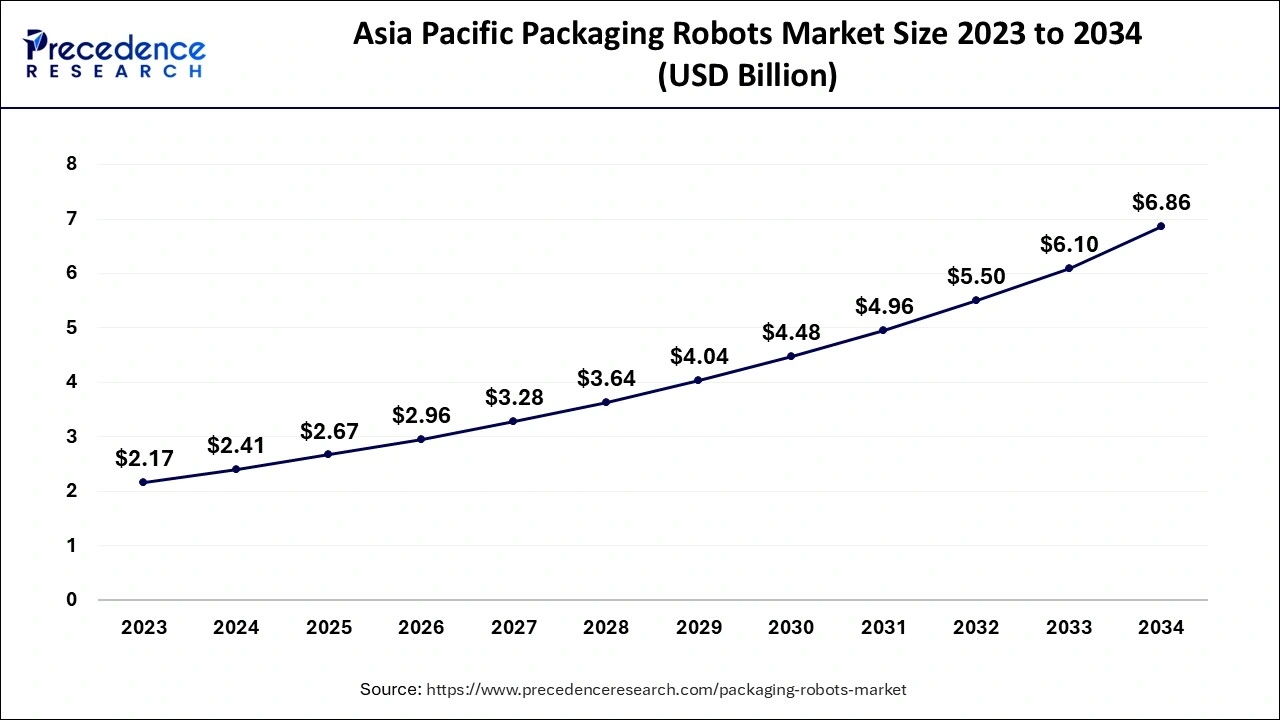

Asia Pacific leads the robotics market, with North America expected to grow substantially in the forecast period.

Source: imarc

The clamp and claws gripper dominates, while the pick & place service segment is anticipated to see significant growth. The food and beverage industry was the largest end-user segment for robotics.

Notable implementations include Coca-Cola Amatil‘s adoption of Swisslog’s ACPaQ robotic order-picking system in New Zealand to improve palletizing efficiency to up to 1000 cases per hour.

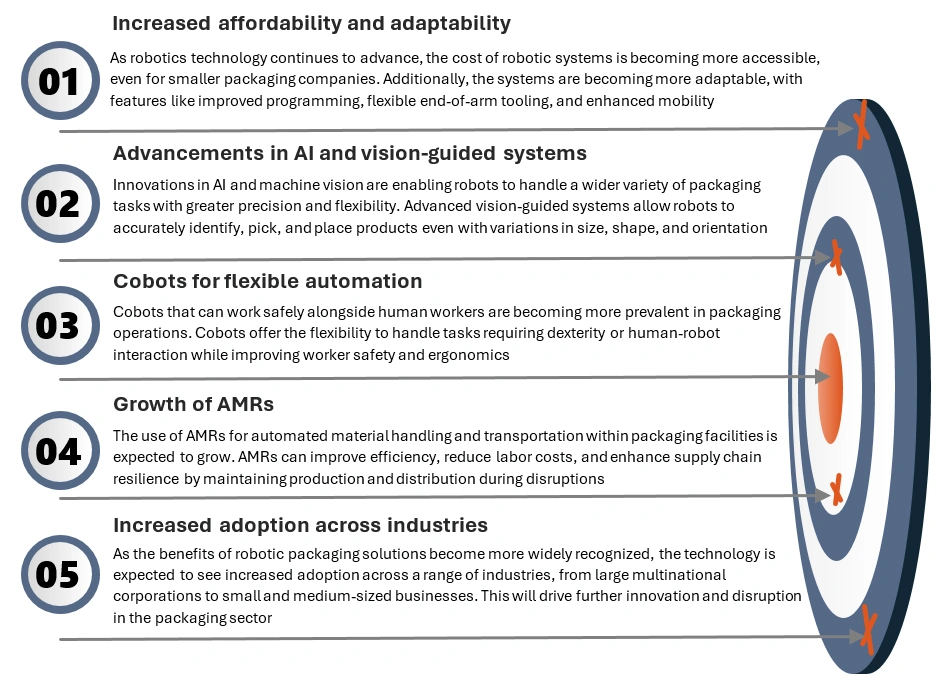

Future Robotics Trends

Source: SpendEdge

Similarly, Coca-Cola Canada Bottling invested over USD 70 million in a robotic warehouse in Calgary. It features an automated storage and retrieval system to consolidate local storage.

Market Insights & Growth Metrics for Robotics

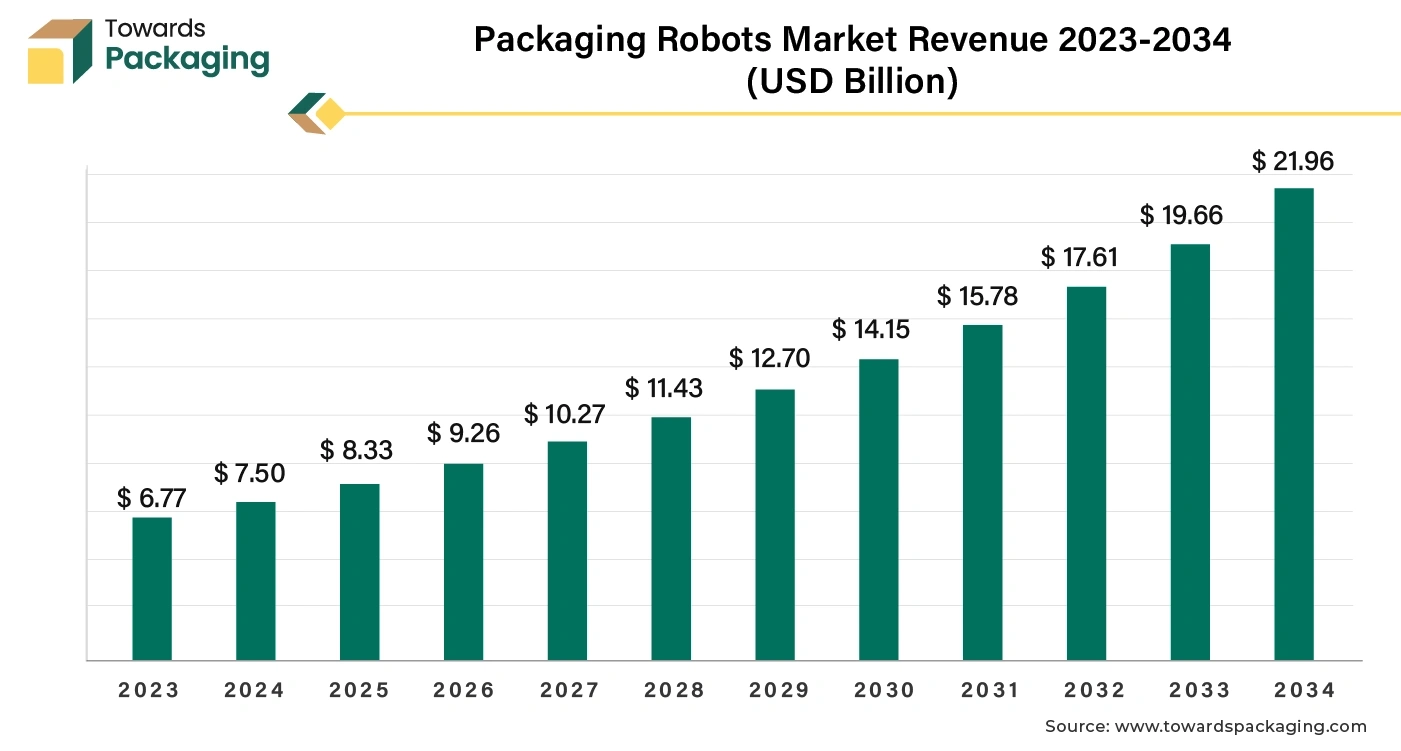

Scale and Magnitude

Based on our data, there are over 75 042 companies globally operating in the robotics sector.

The packaging robots market is projected to expand from USD 8.33 billion in 2025 to USD 21.96 billion by 2034, at a CAGR of 11%.

Source: Towards Packaging

Robotics holds the 30th position in media coverage among emerging technologies in our database. This indicates moderate attention compared to other tech domains.

Growth Indicators

StartUs Insights reports that Robotics has experienced a 3.85% annual increase in search interest. Asia Pacific packaging robots market size is projected to be worth around USD 6.86 billion by 2034.

Source: Precedence Research

Robotics’ five-year funding growth has increased by 24.57%, according to our database. Moreover, robotics startups collectively raised over USD 4.2 billion in funding.

Increasing demand for automation across multiple sectors is further driven by labor shortages, increasing competitiveness, and a shift from mass production to mass customization.

Innovation and Novelty

The robotics sector has seen significant innovation, with over 424 465 patents filed globally based on our data.

Leading companies in the robotics in packaging market are ABB Ltd, FANUC Corporation, KUKA Roboter, and Mitsubishi Electric Corporation. StartUs Insights reports that robotics-focused research has received 11 223 grants.

Top Use Cases of Robotics in the Packaging Industry

- Pick and Place Operations: Robotic arms enhance efficiency in high-speed picking and placing of products onto conveyors, trays, or packaging lines. This significantly reduces manual labor and increases throughput.

- Case Packing and Boxing: Automated robotic systems precisely arrange products into cases or boxes to optimize packaging consistency while handling various product sizes.

- Automated Sealing and Labeling: Robotics streamline the sealing and labeling process by ensuring accuracy, speed, and compliance with industry standards.

Noteworthy Advancements

- Unique Gripper’s Cookie Multi-Pack Automation System: ZoRoCo Packaging has implemented a robotic system featuring ten delta-style robots equipped with easily changeable end-of-arm tooling (EOAT). This setup enables the efficient stacking of cookies into slugs and their precise placement into plastic trays at a rate of 700 cookies per minute.

- KUKA Robotics’ Packaging and Processing Solutions at Pack Expo: KUKA Robotics showcased four robotic cells designed to enhance packaging and processing operations. Demonstrations included robotic palletizing and depalletizing systems, a robotic bottle capping operation, and a food handling system.

Core Technologies Connected to Robotics

- Sensors and Perception Systems: Utilize sensors to enable robots to accurately detect and interpret packaging materials and products. These sensors facilitate real-time quality inspection and identify inconsistencies like misprints or structural flaws.

- Actuators and Locomotion: Precise actuators, such as electric linear actuators, to convert energy into controlled movements. These actuators enable accurate positioning and handling of products.

- End-of-Arm Tooling: Design specialized end effectors, including grippers and suction cups, to handle diverse packaging materials and product shapes.

Spotlighting an Innovator: LYRO Robotics

LYRO Robotics is an Australian company that develops intelligent robotic pick-and-pack solutions for the food and household goods industries. Its intelligent vision software enables robots to identify and adapt to various items with different shapes, colors, and sizes.

The system handles a wide range of products – including perishable goods and irregularly shaped items. Therefore, it improves throughput rates and reduces costs per unit.

Additionally, the company’s pattern-packing feature optimizes box layouts for transport. This ensures secure and efficient packing that minimizes waste.

4. 3D Printing

3D printing in packaging is largely driven by the increasing demand for customized and sustainable packaging solutions.

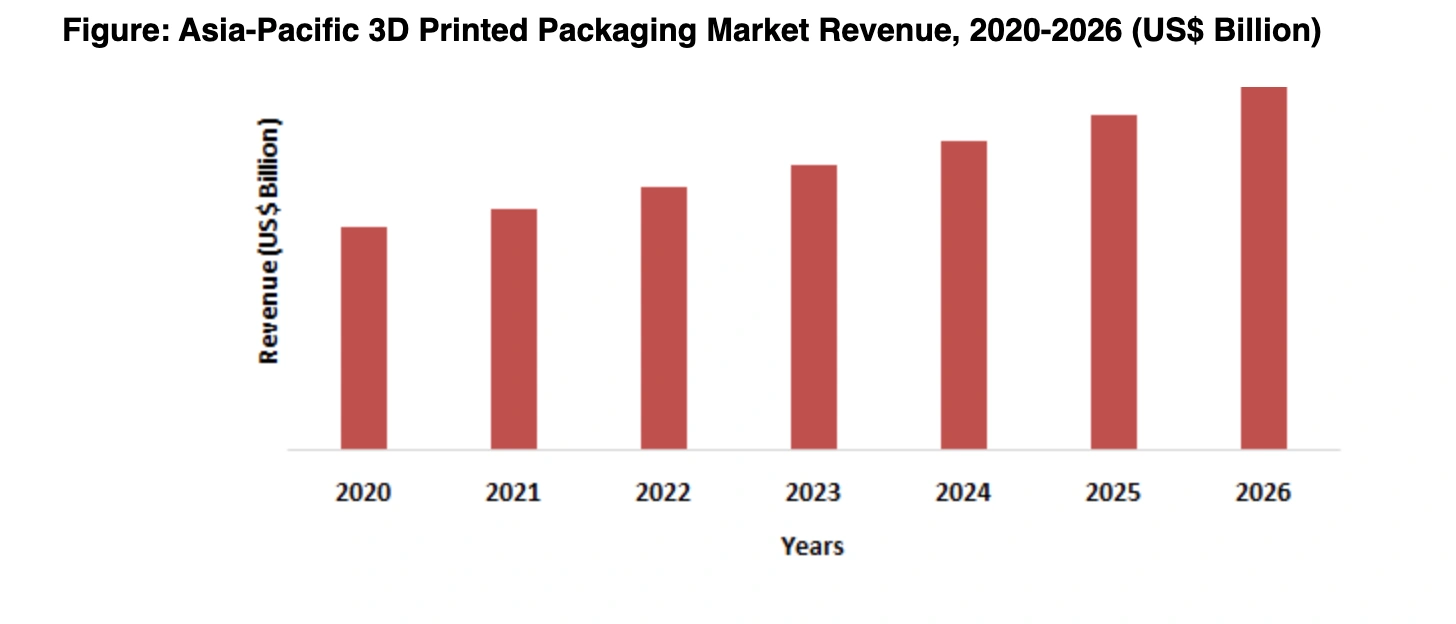

Asia-Pacific currently dominates the 3D printed packaging market due to the region’s burgeoning FMCG sector.

Source: IndustryARC

In the beverage industry, Heineken’s facility in Seville has adopted 3D printing to produce custom parts and safety equipment. This led to an 80% reduction in production costs and a 70-90% decrease in delivery times for printed components.

Additionally, companies like Lonypack Global have optimized their food packaging processes by incorporating 3D printing. This helped them achieve a 70% reduction in both costs and delivery times for replacement parts.

Another application of 3D printing by Smart Cups, for example, has developed biodegradable cups embedded with beverage ingredients that activate upon adding water.

Market Insights & Growth Metrics

Scale and Magnitude

According to StartUs Insights, 3D printing has seen substantial growth, with 17 360+ companies operating globally. The 3D-printed packaging market is anticipated to grow at a CAGR of over 5% till 2032.

Source: GMinsights

It ranks 156th among emerging technologies. This reflects a fair level of public and media attention.

Growth Indicators

According to our data, interest in 3D printing continues to grow with a 42.84% annual increase in search interest. Funding in additive manufacturing has also risen significantly, showing a 67.54% growth over the past five years.

The 3D printed packaging market will reach approximately USD 3.7 billion by 2026, growing at a CAGR of 17.3% between 2021 and 2026.

Innovation and Novelty

Based on our database, the 3D printing sector stands out as a center of innovation, demonstrated by over 179 470 patents filed worldwide. Patent filings in 3D printing grew eight times faster than the average of all technologies in the last decade. Moreover, 3D printing research has been supported by only 4625 grants.

Top Use Cases of 3D Printing in the Packaging Industry

- Rapid Prototyping: 3D printing accelerates packaging design iterations by enabling quick production of prototypes.

- Smart Packaging Components: Integrating RFID tags, sensors, and interactive elements into packaging enables enhanced tracking, authentication, and user engagement.

- Personalized Packaging: Allows for customized shapes, textures, and branding elements tailored to specific products or consumer preferences.

Noteworthy Advancements

- Baralan and Stratasys’ PolyJet 3D Printing for Cosmetic Packaging: This collaboration utilizes PolyJet 3D printing to produce intricate, multi-color, and multi-effect designs directly on glass and plastic cosmetic containers. It allows cost-effective customization and reduces waste.

- Unilever and Serioplast’s 3D-Printed Packaging Molds: Unilever, in partnership with Serioplast and Formlabs, has adopted SLA 3D printing to produce blow molding tools for plastic bottle packaging prototypes. This approach has significantly reduced product development cycles by six weeks and cut tooling costs by up to 90%.

Core Technologies Connected to 3D printing

- Fused Deposition Modeling (FDM): Employs a layer-by-layer extrusion of thermoplastic filaments to create packaging prototypes and custom components.

- Stereolithography (SLA): Utilizes a laser to cure liquid photopolymer resin into solid structures with high precision. SLA is ideal for producing detailed packaging prototypes and molds.

- Powder Bed Fusion (PBF): Uses a laser or electron beam to fuse powdered materials layer by layer and create complex and durable packaging components.

Spotlighting an Innovator: Nexa3D

Nexa3D is a US-based company that develops ultrafast 3D printing technology for packaging prototyping. Its Lubricant Sublayer Photo-curing (LSPc) technology enables rapid production of large prototypes, such as 2-liter bottle-sized prints.

The system delivers smooth surfaces with 4K antialiasing and sub-pixel resolution that reduces the need for post-processing.

Moreover, Nexa3D offers materials like xABS and xPP, which closely replicate common packaging plastics that allow for functional testing of prototypes. This technology accelerates packaging design and enables companies to move from concept to molded part within a week.

5. Blockchain

The market for anti-counterfeiting, brand protection, and security packaging is projected to reach over USD 4.61 billion by 2028, growing at a CAGR of 4.9%.

This growth is fueled by the increasing adoption of innovative packaging technologies designed to combat the proliferation of counterfeit goods.

A notable trend in this sector is the integration of blockchain technology with QR codes and near-field communication tags to verify product authenticity. By embedding these features into packaging, consumers are able to access immutable records of a product’s origin and reduce counterfeit sales.

Luxury brands, in particular, are leveraging blockchain to safeguard their products against imitation and maintain brand integrity.

Market Insights & Growth Metrics for Blockchain

Scale and Magnitude

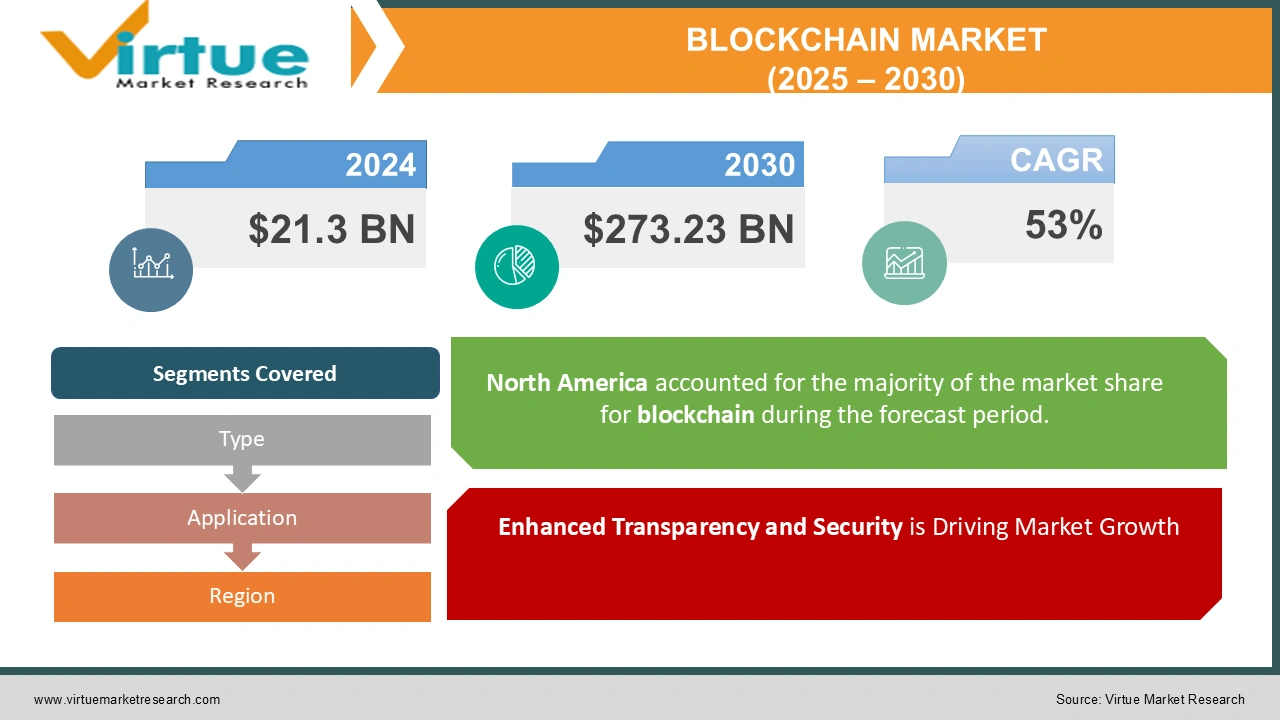

Blockchain technology has grown significantly with 42 100+ companies currently operating in the domain based on our data.

StartUs Insights reports that blockchain ranks 111th in media coverage among 20K+ emerging technologies.

Source: Virtue Market Research

Further, global blockchain spending is projected to grow at a 53% CAGR, reaching USD 273.23 billion by 2030.

Growth Indicators

Based on our analysis, blockchain demonstrates remarkable growth with a 78.23% annual rise in search interest. This reflects increasing adoption across industries.

The volume of institutional crypto investments is expected to surpass USD 500 billion in 2025.

Over the past five years, blockchain has achieved a 97.41% funding growth based on our data.

Innovation and Novelty

As per our data, blockchain remains a highly innovative domain with 86 100+ patents filed globally. Blockchain-related research is also supported by 2120+ grants.

In early 2025, 20 blockchain funding deals were completed that raised USD 187.76 million. Eight of these fundraising rounds exceeded USD 5 million each.

Top Use Cases of Blockchain in the Packaging Industry

- Product Traceability: Blockchain ensures end-to-end visibility in the supply chain by securely recording product movements, raw material origins, and environmental conditions. This enables real-time verification of authenticity and compliance.

- Anti-Counterfeiting Measures: Blockchain-powered digital ledgers provide tamper-proof authentication for packaged goods. This allows consumers and businesses to verify product legitimacy.

- Process Automation: Smart contracts streamline packaging workflows by automating compliance checks, supplier transactions, and quality assurance.

Noteworthy Advancements

- The GrowHub’s Blockchain Traceability Platform: GrowHub’s blockchain-powered traceability platform hosted on the Polygon network to enhance transparency in the Asia Pacific agricultural sector. This platform records every stage of the supply chain in an immutable digital ledger. This allows consumers to access real-time information about product origins, production methods, and transportation routes by scanning a QR code on the packaging.

- ROAR Organic Partners with Plastic Bank: Their ‘One Bottle at a Time’ initiative combats plastic pollution. For every bottle of ROAR Organic sold, one plastic bottle is removed from the environment. To date, this collaboration has prevented 4.8 million bottles from entering the ocean and extracted 96 000 kg of plastic.

Core Technologies Connected to Blockchain

- Smart Contracts: Utilize self-executing digital agreements encoded on a blockchain to automate and enforce terms between parties in the packaging supply chain.

- Cryptography: Employ advanced cryptographic techniques to secure data within the packaging supply chain. This protects sensitive data related to product specifications, proprietary designs, and transactional records from unauthorized access and tampering.

- Distributed Ledger Technology (DLT): Implements decentralized databases maintained across multiple nodes to provide a transparent and immutable record of transactions.

Spotlighting an Innovator: Luxtag

Luxtag is a Malaysian company that develops blockchain-based product authentication solutions to combat counterfeiting and enhance brand transparency. Its BrandTag platform assigns unique, immutable blockchain certificates to each product.

This allows users to verify authenticity by scanning QR codes or NFC tags. The platform also offers features such as anti-counterfeit measures, product transparency, and consumer engagement modules. Brands utilize this solution to share detailed product information and interact directly with customers.

6. Cloud Computing

In the packaging industry, cloud-based allow companies to reduce IT overhead while providing real-time data access.

Such platforms analyze product attributes and order data in real time to optimize packaging. These solutions also support environmental goals by tracking carbon emissions and reducing waste that helps packaging companies achieve sustainability targets.

For instance, as packaging companies intensify their focus on sustainability, cloud technology facilitates energy monitoring and environmental impact assessments. Leading cloud service providers are Microsoft, Google, SAP, and Salesforce, which offer carbon emission monitoring tools as part of their cloud packages.

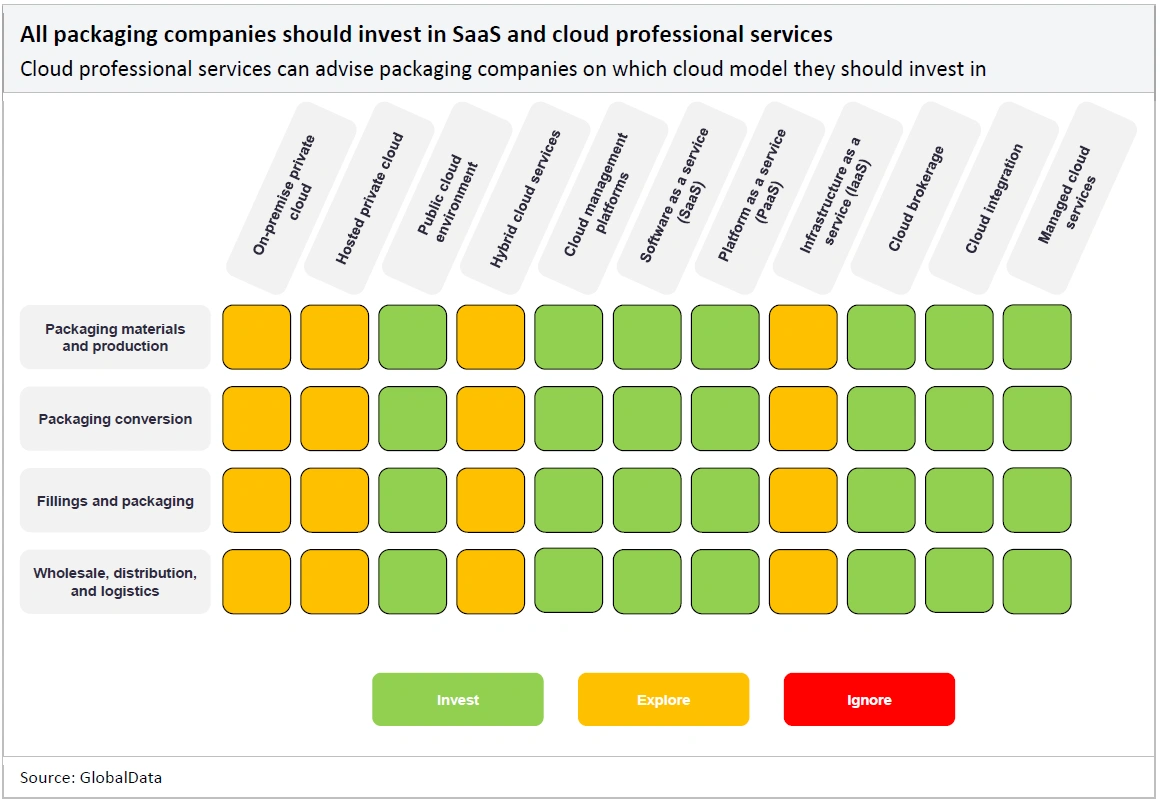

Cloud Models That Packaging Companies Should Invest In

Source: Inside Packaging

The cloud technology empowers packaging companies to track and manage their energy consumption effectively. For instance, Tetra Pak utilized Oracle’s Transportation Management system to optimize its logistics operations and reduce carbon emissions from distribution vehicles.

Additionally, cloud-supported data analysis enhances the efficiency of production processes and leads to decreased energy and resource usage.

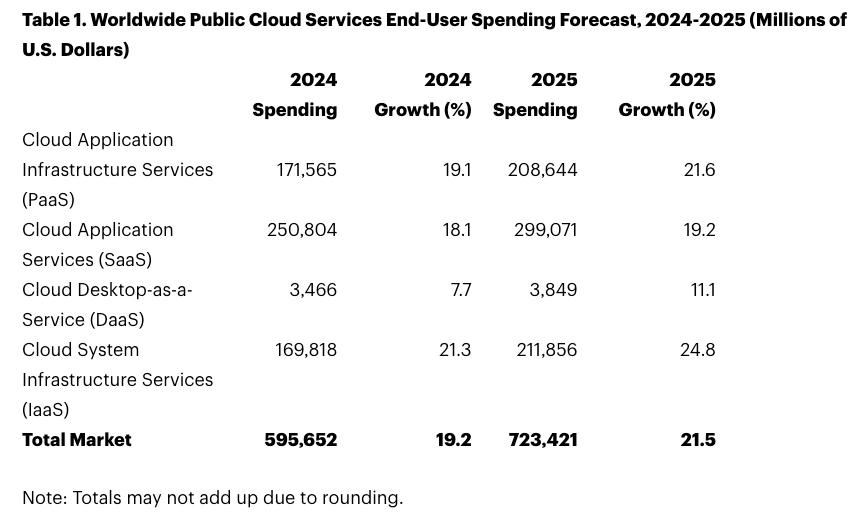

Market Insights & Growth Metrics in Cloud Computing

Scale and Magnitude

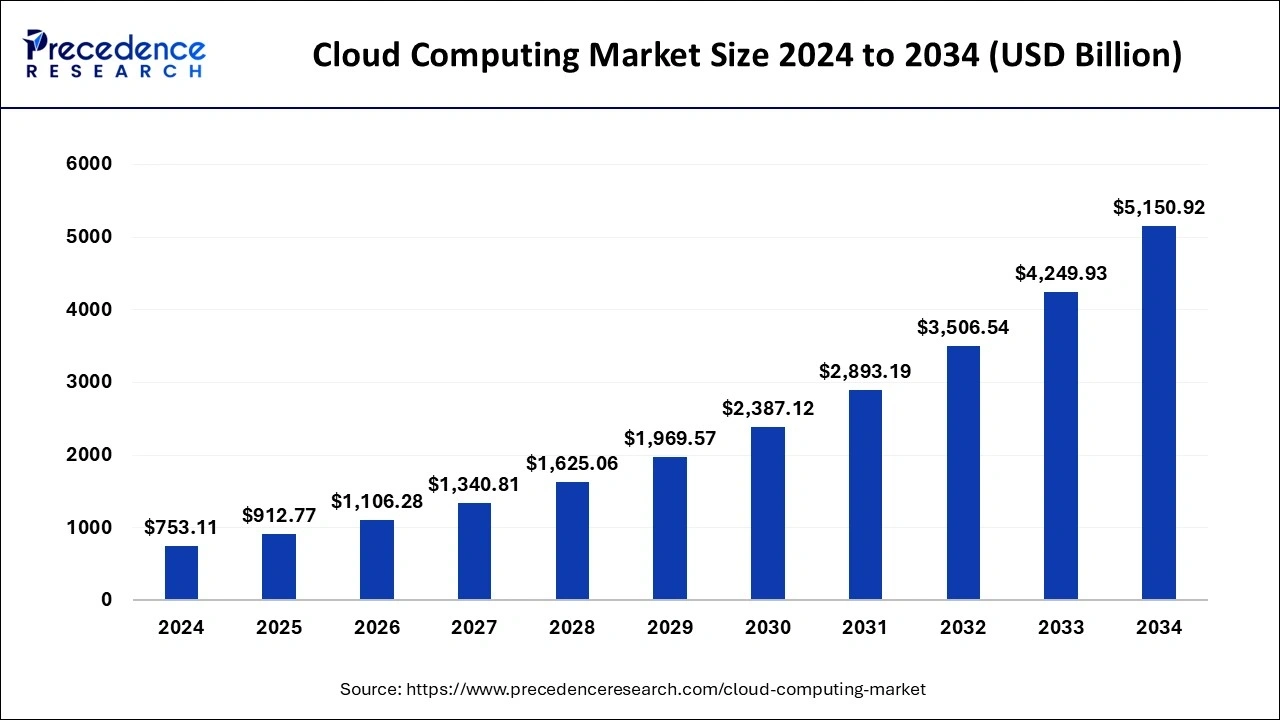

Based on our database, there are over 105 000 companies globally operating in the cloud computing sector.

The global cloud computing market is projected to grow to USD 5150.92 billion by 2034, reflecting a CAGR of 21.20% from 2025 to 2034.

Source: Precedence Research

Cloud computing holds the 58th position in media coverage among emerging technologies based on our data. This indicates significant attention in both industry and public domains.

Growth Indicators

StartUs Insights reports there has been a 20.05% annual increase in search interest for cloud computing. This reflects growing curiosity and adoption across various sectors.

Worldwide spending on public cloud services is also expected to reach USD 723.4 billion in 2025.

Source: Gartner

Over the past five years, funding for cloud computing ventures has grown by 55.18% according to our data.

Innovation and Novelty

StartUs Insights reports that the cloud computing sector has witnessed substantial innovation with over 77 000 patents filed globally.

Over the past 18 months alone, IBM alone secured 1200 patents related to general cloud processes and operations.

Cloud computing research has been supported by 6600+ grants based on our data.

Top Use Cases of Cloud Computing in the Packaging Industry

- Smart Inventory Management: Cloud-based platforms optimize inventory tracking by integrating real-time data from suppliers, warehouses, and production lines to reduce stockouts and overstocking.

- Predictive Maintenance: Cloud-enabled analytics process IoT sensor data from packaging equipment to predict failures, schedule proactive maintenance, and minimize downtime.

- Real-Time Quality Control: Cloud-based AI models analyze production data to detect defects. This also ensures compliance with quality standards and enhances process efficiency.

Noteworthy Advancements

- Amazon’s Cloud-Hosted Multimodal AI for Packaging Optimization: Amazon’s Package Decision Engine determines the most efficient packaging for each product. It utilizes deep machine learning, natural language processing (NLP), and computer vision to analyze product characteristics and select appropriate packaging. Since its implementation, the engine has saved over 2 million tons of packaging materials.

- Schaeffler Group’s Returnable Packaging Management: The Schaeffler Group has partnered with SAP to implement the SAP Returnable Packaging Management solution to reduce costs associated with returnable packaging. This cloud-based system automates container management and improves transparency. By integrating AI capabilities, Schaeffler performs returnable account matching and automates reconciliation.

Core Technologies Connected to Cloud Computing

- Virtualization: Utilizes hypervisor technology to create multiple virtual machines (VMs) on a single physical server. This enables packaging companies to run diverse applications and operate systems independently.

- Distributed Computing: Leverages interconnected computer networks to process and analyze large datasets collaboratively to facilitate real-time decision-making.

- Containerization: Employs lightweight, portable containers to encapsulate applications and their dependencies for consistent performance across various environments.

Spotlighting an Innovator: Vossle

Vossle is a startup based in India that offers a cloud-based no-code AR platform for businesses to create web-based AR experiences. It’s AI-driven software allows users to develop various AR applications like advertisements, games, virtual try-ons.

Both markerless and marker-based AR applications are accessible through standard web browsers without app downloads. The platform features an intuitive interface to facilitate rapid deployment of immersive content. It includes tools like Inline AR for seamless website integration and plugins for WordPress and Magento.

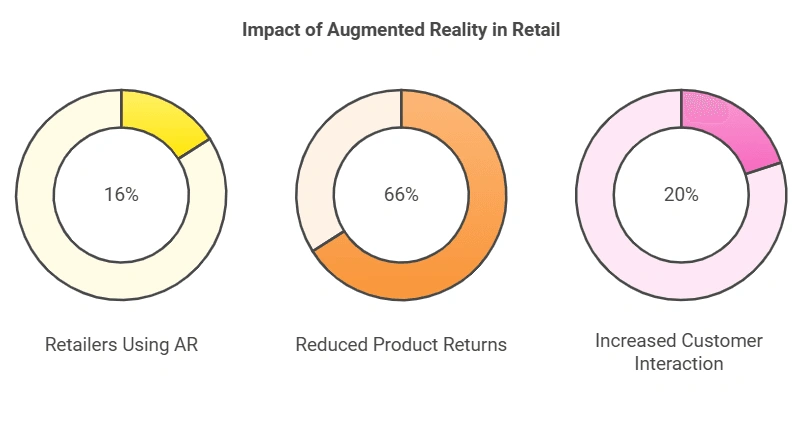

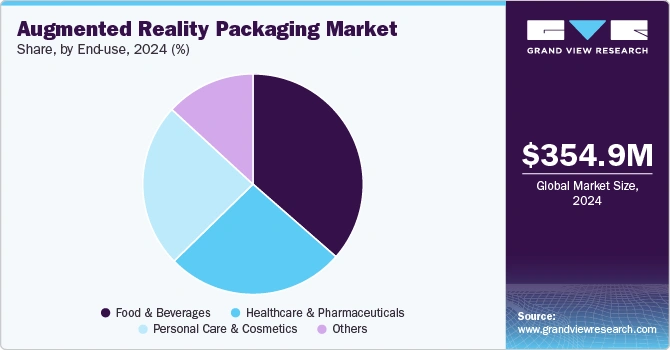

7. Augmented Reality (AR)

AR- enhanced packaging increases average engagement time from 30 seconds to over 2 minutes. Consumers’ interaction rises up to 40% with AR features. Moreover, brands are utilizing AR to increase the recall rate from 10% to 70%.

Source: FLAM

The food and beverages sector dominates the AR packaging market with a market share of 36.4%.

Source: Grand View Research

Market Insights & Growth Metrics for AR

Scale and Magnitude

Based on our data, the AR market is steadily growing with 21 800+ companies globally. The global AR packaging market is estimated to reach approximately USD 510.0 million by 2030 with a CAGR of 6.3% from 2025 to 2030.

North America leads the market with the largest revenue share of 36.9% and the United States contributes around 78% of this regional revenue.

Source: Grand view Research

StartUs Insights reports that AR ranks 169th in media coverage based on its database.

Growth Indicators

StartUs Insights reports that AR shows consistent growth with an annual search interest rise of 17.8%.

AR funding also increased by 45% compared to the previous year.

European spending on AR/VR is expected to grow at a CAGR of 21.9%, reaching USD 10.2 billion by 2028.

Innovation and Novelty

In the AR sector, 67 200+ patents have been filed globally. Additionally, AR-related research is supported by 4360+ grants.

Top Use Cases of AR in the Packaging Industry

- Interactive Product Information: AR-enabled packaging allows consumers to scan labels and access real-time product details, usage instructions, or ingredient sourcing through immersive visuals and animations.

- Training and Simulation: AR enhances workforce training by simulating packaging line operations, safety protocols, and equipment handling.

- Storytelling and Brand Narratives: Brands leverage AR to create interactive storytelling experiences such as bringing product origins, sustainability efforts, or company history to life through AR overlays.

Noteworthy Advancements

- Chobani Yogurt’s AR-Enhanced Halloween Packaging: Chobani introduced limited-edition Flip yogurt multipacks that feature QR codes for AR experiences. Consumers can scan the codes to access interactive Halloween-themed animations and participate in virtual trick-or-treat activities.

- BODYARMOR’s AR-Enabled Collector Bottles: BODYARMOR Sports Drink launched limited-edition collector bottles with AR functionalities. Each bottle, representing athletes from various sports, offers unique AR experiences. For example, virtual pit stops or home run derbies that allows consumers to engage interactively with their favorite sports figures.

Core Technologies Connected to AR

- Spatial Computing: Overlays virtual elements onto physical products to enhance consumer engagement. It also facilitates virtual try-ons, and provides dynamic product information for interactive marketing.

- AI and Machine Learning (ML): Enable the personalization of content by adapting virtual experiences based on user preferences and behaviors.

- High-Performance Graphics Processing Units (GPUs): Render complex and high-quality visuals in AR applications to enable real-time rendering of detailed 3D models and animations. This ensures smooth and responsive AR experiences in interactive packaging solutions.

Spotlighting an Innovator: Immertia

Immertia is an Australian company that offers interactive product packaging solutions. It utilizes AR to convert traditional packaging into immersive consumer experiences.

It’s technology enables consumers to scan product packaging using their smartphones and activate lifelike, 3D holographic assistants. These assistants provide detailed product information and brand narratives.

Additional features such as interactive content, virtual links, and engaging animations further enhance customer engagement and facilitate direct interaction with brands.

8. Robotic Process Automation

In packaging manufacturing, production schedulers often face challenges in managing materials, machines, and labor across multiple production lines. This leads to potential bottlenecks and errors.

RPA addresses these issues by streamlining scheduling tasks, improving decision-making, and integrating with existing enterprise resource planning (ERP) and advanced planning and scheduling (APS) systems.

By automating data entry and reconciliation across ERP and APS systems, RPA provides real-time production schedules. It also monitors machine availability and reports to stakeholders without manual intervention. This reduces human errors, increases operational efficiency, and improves agility.

RPA-driven data synchronization further ensures accurate and up-to-date data across platforms. This reduces manual input and prevents scheduling errors.

Leading RPA providers include PlanetTogether, SAP, Oracle, Microsoft, Kinaxis, and Aveva.

Market Insights & Growth Metrics for RPA

Scale and Magnitude

RPA technology has grown significantly – with 7796 companies currently operating in the domain based on our data.

The RPA and hyperautomation market size is to reach USD 38.11 billion in 2029 with a CAGR of 22.6%.

StartUs Insights reports that RPA ranks 760th in media coverage among emerging technologies.

Growth Indicators

Based on our analysis, RPA witnessed a significant surge in global interest, with annual search interest rising by 64.02%.

Over the past five years, RPA has achieved a 255.03% funding growth based on our data.

Major RPA companies have secured substantial funding in recent years. For example, UiPath has raised USD 1.2 billion across six rounds, while Automation Anywhere has secured USD 840 million over four funding rounds.

Innovation and Novelty

Robotic process automation has demonstrated significant innovation, as evidenced by the filing of 80 407 patents globally, according to data from StartUs Insights.

There have been 2525 grants awarded globally for RPA-related studies. 43% of manufacturers were employing RPA in 2024, with an additional 43% planning to launch new RPA projects.

Top Use Cases of RPA in the Packaging Industry

- Production Scheduling: RPA optimizes production scheduling by automating data collection, demand forecasting, and workflow coordination to enhance efficiency and minimize downtime.

- Order Processing and Compliance: Streamlining order management by automating data entry, validation, and compliance checks ensures accuracy in invoices, shipping documents, and regulatory adherence.

- Reporting: RPA enhances reporting by aggregating real-time production, inventory, and quality control data to generate automated insights for decision-making and operational improvements.

Noteworthy Advancements

- PlanetTogether’s Advanced Planning and Scheduling (APS) System: PlanetTogether offers an APS platform to optimize production planning and scheduling in packaging manufacturing. By integrating with ERP systems, it provides real-time insights into production processes. This enables manufacturers to balance workloads, reduce lead times, and improve on-time delivery.

Core Technologies Connected to RPA

- Artificial Intelligence: Enables the handling of complex tasks like predictive maintenance of packaging machinery to identify patterns and anomalies in packaging processes.

- Natural Language Processing (NLP): Facilitates the automation of customer service inquiries, streamlines order processing by extracting relevant information, and assists in managing compliance documentation.

- Optical Character Recognition (OCR): Automates the extraction of information from labels, invoices, and shipment documents. This reduces manual data entry errors along with accelerated processing time.

Spotlighting an Innovator: PIX Robotics

PIX Robotics is a UAE-based startup that offers an ecosystem of software solutions to digitize business processes. Its suite includes RPA and business intelligence (BI) products that work cohesively to automate complex tasks, analyze data, and streamline workflows.

The RPA platform comprises PIX Studio for developing software robots, PIX Robot for executing automated tasks, and PIX Master for monitoring and managing these processes. These tools enable rapid deployment of automation solutions and enhance operational efficiency.

By providing a comprehensive, AI-driven automation ecosystem, PIX Robotics empowers enterprise clients to optimize their business operations and achieve faster returns on investment (ROI).

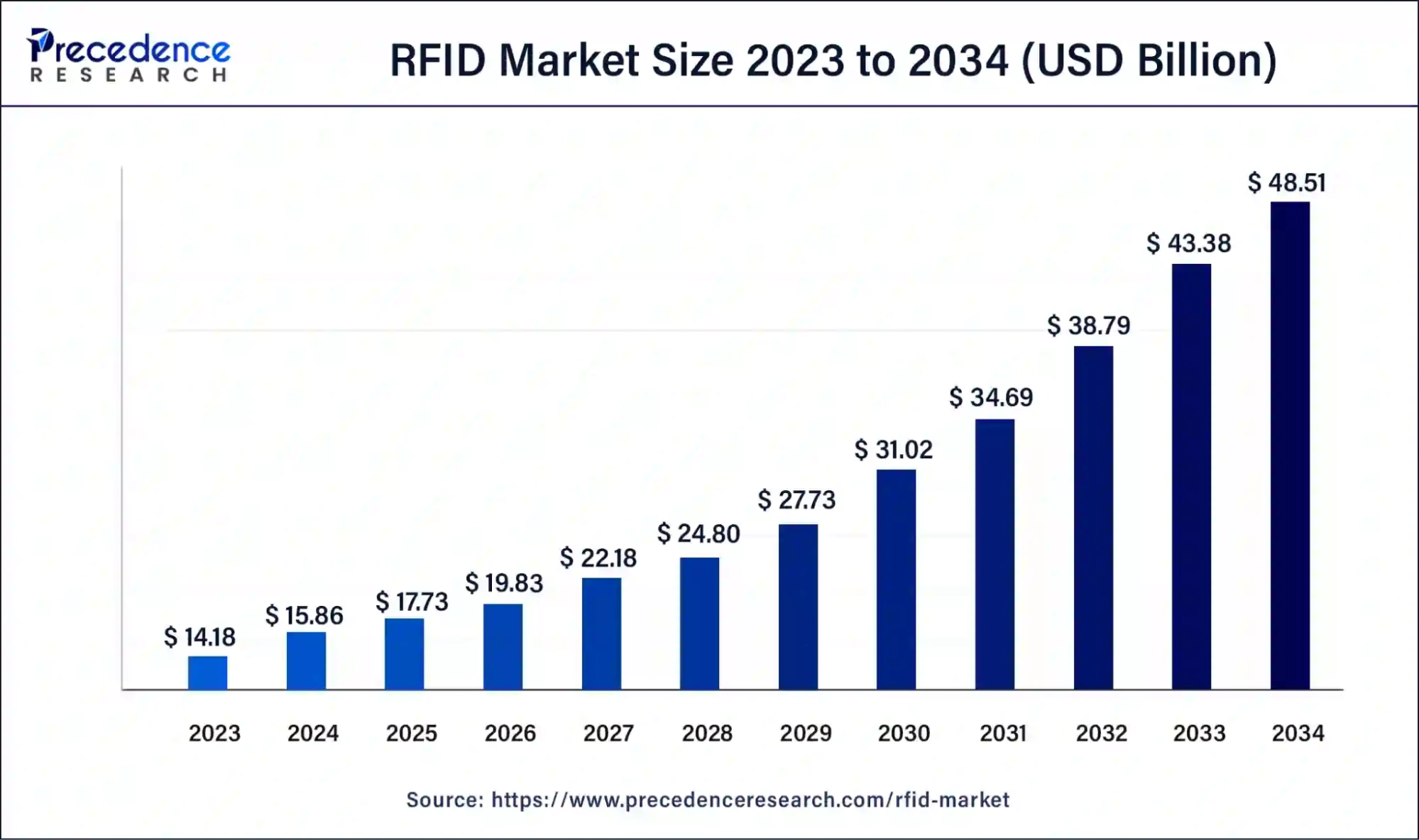

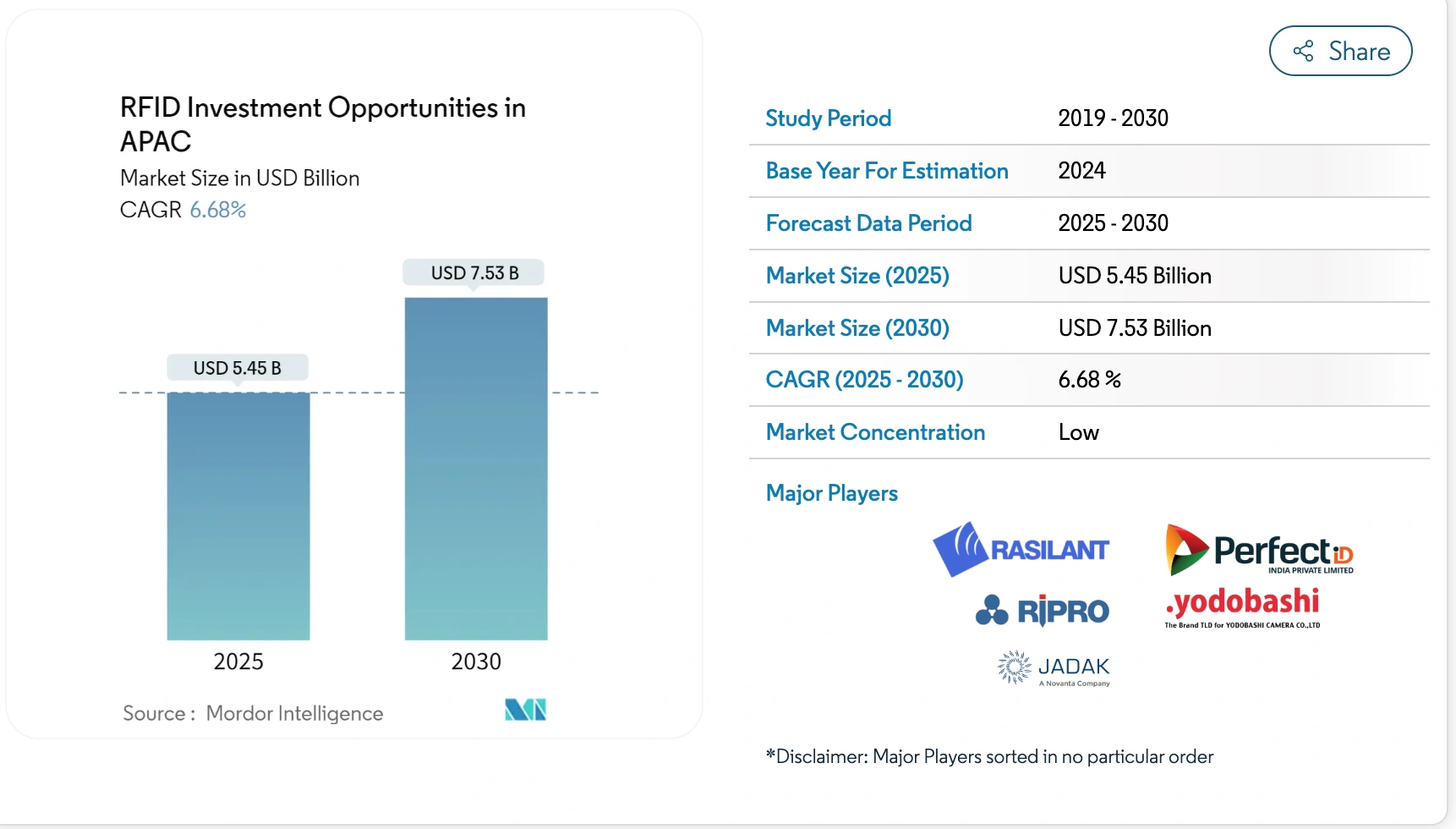

9. Connectivity Technologies

RFID tags enable smarter tracking solutions. By embedding RFID tags, brands are able to better track packages and products. For example, Walmart mandates its suppliers to tag home goods, sporting goods, electronics, and toys with RFID to achieve higher inventory accuracy.

Oliver’s RFID solutions integrate into packaging to reduce manual scanning labor while enabling granular tracking from production to point-of-sale (POS).

The average cost of RFID tags has decreased by roughly 80 percent. RFID reader accuracy has doubled and range quintupled, and the price of RFID readers has fallen by almost 50 percent in the past decade.

Further, LoRaWAN-enabled IoT sensors monitor temperature, humidity, and equipment performance in food transport and packaging facilities

Market Insights & Growth Metrics for Connectivity Technologies

Scale and Magnitude

The global RFID market size is to reach around USD 48.51 billion by 2034, growing at a solid CAGR of 11.83%.

Source: Precedence Research

The global LoRaWAN market is projected to grow at a CAGR of 41.1% between 2025 and 2034. According to StartUs Insights, 1016 companies operate in the LoRaWAN domain.

Source: Global Market Insights

As per our data, LoRaWAN is ranked 1543rd, and RFID stands at 1081st.

Growth Indicators

RFID is slowly but steadily growing with search interest growing by 1.22% and the funding increased by 622.15% in the last five years.

Source: Modor Intelligence

LoRaWAN is also gaining traction, with search interest increasing by 68.68% annually. However, five-year funding growth declined by 44.28% as per our data.

Innovation and Novelty

Innovation remains strong in this domain, with 76 200+ patents filed globally for 5G. Huawei leads with 13 474 patents, followed by Qualcomm (12 719 patents ), LG (7694 patents), and Samsung (9299 patents).

Research and development in 5G is backed by 1500+ grants, emphasizing institutional support for technological advancements.

In contrast, the LoRaWAN domain has seen 410+ patents filed globally and received 80+ grants, with a 2023 review analyzing 71 patents focused on performance improvements.

Top Use Cases of Connectivity Technology in the Packaging Industry

- Intelligent Packaging: Connectivity technologies enable smart packaging solutions that integrate sensors, RFID, and NFC tags to enhance product interaction. It provides real-time data on usage and improves consumer engagement.

- Quality Assurance & Condition Monitoring: IoT-enabled packaging continuously monitors environmental factors to ensure product integrity, especially for perishable goods and pharmaceuticals.

- Supply Chain Traceability: Connected packaging facilitates end-to-end visibility by leveraging blockchain, RFID, and GPS tracking. This enables real-time monitoring of product movement and reduces counterfeiting risks.

Noteworthy Advancements

- Xeikon’s Partnership with Kurz and Scribos: They collaborated to develop a digital label printing solution that integrates metallic embellishments and interactive features. It combines Xeikon’s Titon dry toner printing, Kurz’s Digital Metal embellishment, and Scribos’ ValiGate technology. This single-pass label application offers high-level security through protected QR codes.

- Walmart’s RFID Mandate Expansion: This initiative enhances inventory management, reduces stockouts, and improves overall operational efficiency by ensuring item-level intelligence across a broader range of products. Suppliers are required to comply with these mandates.

Core Technologies Connected to Connectivity Technologies

- Bluetooth Low Energy (BLE): Uses low-power wireless communication to enable real-time tracking and monitoring of packaged goods.

- LoRaWAN: Employs a long-range, low-power wireless protocol to connect packaging assets over extensive areas. LoRaWAN enables continuous monitoring of environmental conditions and ensures product quality during transit and storage.

- Radio-Frequency Identification: Utilizes electromagnetic fields to automatically identify and track tags attached to packaging materials. RFID systems reduce manual scanning and provide real-time data on product location and status.

Spotlighting an Innovator: RFID Paper

RFID Paper is a Malaysian startup that produces ready-to-print materials embedded with NFC microchips. This enables the creation of interactive products using existing printing equipment.

The company’s patented technology integrates RFID and NFC chips into various substrates for manufacturing tags, business cards, event badges, and more.

These materials are compatible with standard digital and offset printers and require no additional investment in equipment. The product range features different combinations of substrates, chip types, antenna layouts, thicknesses, and sizes to cater to diverse industry applications.

Key Benefits of Digitizing Packaging Technology in 2025

Operational Efficiency and Cost Reduction

Automated production processes optimize machine utilization and reduce material waste. In the manufacturing industry, the average cost of downtime is about USD 260 000 per hour. IoT-enabled predictive maintenance helps reduce this by minimizing equipment failure risks. Real-time monitoring in smart factories also enhances production accuracy and resource allocation.

Improved Product Quality

Automated quality control systems ensure that products meet stringent technical standards. AI-driven simulations, for instance, refine packaging designs and achieve a balance between material efficiency and durability. Another example – Procter & Gamble utilized AI and machine learning in packaging design to reduce material usage by 15% while maintaining product quality.

Sustainability Advancements

Digital printing technology facilitates small-batch production to eliminate overruns and excess inventory waste. Material optimization tools simulate eco-friendly designs that reduce resource consumption.

Moreover, sustainable packaging is on the rise as 72% of global shoppers influenced by environmental claims prefer sustainable products. 85% of Gen Z also actively seek eco-friendly products, and 30% of consumers now see themselves as actively supporting sustainable practices.

Customization and Market Responsiveness

Digital printing allows for rapid design modifications through personalized packaging without extensive production line changes. Data analytics further provides insights into consumer trends for companies to swiftly adjust to shifting market demands.

Enhanced Customer Experience

Smart packaging solutions, such as QR codes and NFC chips, offer consumers information on product authenticity, usage instructions, and sustainability certifications. AR integrations also provide interactive experiences.

Data-Driven Decision-Making

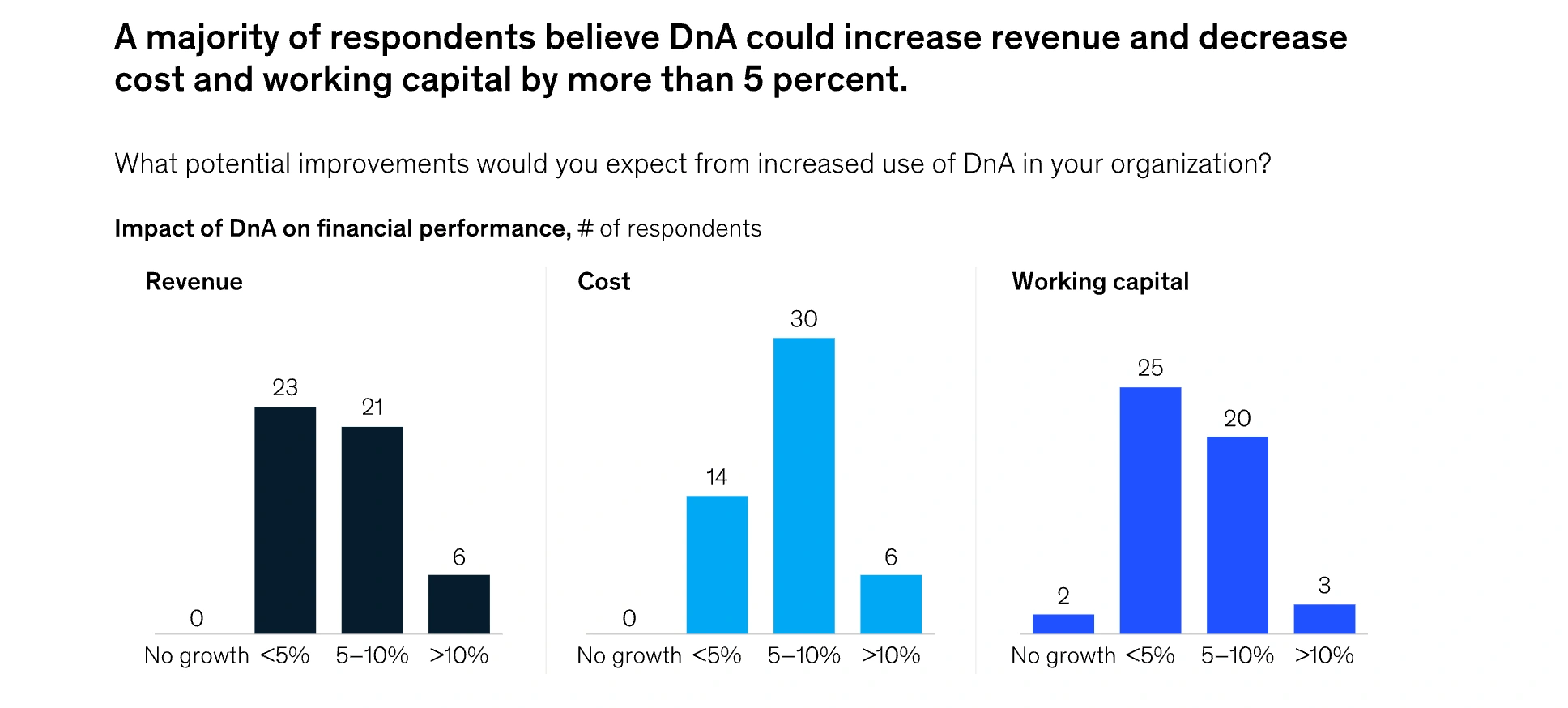

The utilization of big data and AI enables comprehensive analysis of production processes, supply chains, and consumer behavior. A McKinsey survey, about 70% of respondents believe digital and analytics (DnA) tools in the packaging industry adoption could reduce costs by over 5%.

Source: McKinsey & Company

Further, half of the respondents see potential for a minimum 5% increase in revenue and working capital.

Step-by-Step Guide: A Roadmap for Successful Digitization in the Packaging Industry

1. Define the Vision and Goals

- Establish a Clear Vision: Align the digital transformation strategy to packaging industry objectives. This will allow packaging companies to focus on operational efficiency, sustainability, and supply chain optimization.

- Set Measurable Objectives: Define quantifiable goals like reducing material waste to improve production efficiency, enhance traceability, and optimize logistics.

2. Conduct a Digital Maturity Assessment

- Evaluate Current Capabilities: Assess existing packaging technologies, automation levels, and data management infrastructure to identify strengths and gaps in digital readiness.

- Benchmark Against Industry Leaders: Compare digital adoption levels with top packaging manufacturers to understand competitive positioning and identify best practices for modernization.

3. Identify Key Technologies

- Prioritize Investments: Focus on high-impact technologies such as AI-driven quality control, smart packaging, IoT-enabled supply chain tracking, and blockchain for transparency.

- Ensure Scalability: Choose solutions that can adapt to evolving industry demands, regulatory changes, and new sustainable packaging innovations.

- Use Technology Scouting: Leverage platforms like StartUs Insights’ Discovery Platform to track emerging technologies in the packaging industry.

4. Build a Robust Data Infrastructure

- Leverage Big Data: Implement systems to collect, store, and analyze vast amounts of production and supply chain data to improve efficiency, waste reduction, and predictive maintenance.

- Integrate Systems: Ensure seamless communication between ERP systems, production management software, and supply chain platforms to enhance data accuracy and traceability.

5. Develop a Detailed Roadmap

- Plan Incremental Implementation: Break down the digital transformation journey into manageable phases, starting with pilot programs to validate technological effectiveness.

- Set Realistic Timelines: Establish achievable deadlines for each phase while maintaining flexibility to adapt to emerging trends and regulatory requirements.

6. Foster Collaboration and Ecosystem Partnerships

- Engage Stakeholders: Involve suppliers, manufacturers, logistics providers, and technology partners early in the process to ensure alignment and commitment.

- Form Strategic Alliances: Partner with packaging tech firms, startups, and research institutions to access cutting-edge innovations and expertise in digital packaging solutions.

7. Upskill the Workforce

- Invest in Training: Provide packaging professionals with training in digital tools, automation, data analytics, and AI-driven process optimization to enhance productivity.

- Cultivate a Digital Culture: Foster an environment of continuous learning and innovation that encourages employees to embrace new technologies and drive transformation.

8. Implement Cybersecurity Measures

- Protect Critical Assets: Establish comprehensive cybersecurity protocols to safeguard production data, packaging designs, and supply chain networks against cyber threats.

- Comply with Regulations: Ensure adherence to industry standards and legal requirements related to data security, sustainability regulations, and traceability compliance.

9. Monitor, Measure, and Optimize

- Track Key Performance Indicators (KPIs): Regularly assess performance metrics such as production efficiency, defect rates, supply chain visibility, and cost savings to measure digitization success.

- Adapt Strategies: Use data-driven insights to refine strategies, address inefficiencies, and respond to emerging trends in digital packaging technology.

10. Scale and Innovate Continuously

- Expand Successful Pilots: Scale up proven digital initiatives across production lines and ensure they remain adaptable and sustainable.

- Embrace Continuous Improvement: Stay updated on evolving digital technologies, regulatory shifts, and best practices to foster a culture of continuous innovation.

Future Trends in the Packaging Industry: Top 2 Emerging Trends

Hyper-Personalized Packaging

Customization is becoming a core strategy for brands. Digital printing advancements enable cost-effective, small-batch runs tailored to individual customers or regional markets.

AI further enables the creation of smart labels tailored to consumer engagement and product appeal. For example, Nutella created an advertising campaign where they enlisted AI to generate 7 million unique labels for jars.

Technology-integrated Packaging

Technology-integrated packaging is set to redefine brand-consumer relationships. QR codes, NFC tags, and AR elements will see large-scale adoption across industries. They offer interactive experiences that enhance engagement and transparency.

For example, coffee brands are using compostable cups with QR codes linking to sourcing details and recycling tutorials. Many premium packaging is expected to incorporate AR to visualize product usage, access sustainability insights, or engage with digital loyalty programs.

Act Now to Stay Ahead of the Technology Curve

Staying competitive means more than just being aware of technological advancements. Every industry faces unique challenges and opportunities, and a one-size-fits-all approach isn’t enough.

That’s where our AI and Big Data-powered Discovery Platform comes in. With access to over 5 million emerging companies and 20K+ technologies & trends globally, it equips you with the actionable insights you need to stay ahead of the curve. Leverage this powerful tool to spot the next big thing before it goes mainstream. Stay relevant, resilient, and ready for what’s next.

![Packaging 4.0 : Top 9 Digital Transformation Technologies to Watch [2025]](https://www.startus-insights.com/wp-content/uploads/2025/02/Packaging-4.0-SharedImg-StartUs-Insights-noresize-420x236.webp)