Military technology is advancing in 2025 due to innovations in artificial intelligence (AI), connectivity, and autonomous systems. AI integration changes defense operations from battlefield decision-making to surveillance and predictive analytics.

Further, autonomous systems reshape modern warfare, with autonomous weapon systems (AWS) and counter-drone technology playing key roles in combat strategies. Meanwhile, electronic warfare evolves to counter adversarial threats, and biotechnology and human augmentation improve soldier performance and resilience.

What are the Top 10 Trends & Innovations in Military Technology in 2025?

- AI Integration

- Cybersecurity and Cyberwarfare

- Energy Efficiency and Sustainability

- Autonomous Weapon Systems (AWS)

- Immersive Technologies

- Internet of Military Things (IoMT)

- 5G Connectivity

- Electronic Warfare

- Biotechnology and Human Augmentation

- Counter-Drone Technology

Methodology: How We Created the Military Technology Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 5M+ global startups, 20K technologies & trends plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the military industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the military innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 10 Military Technology Trends & 20 Promising Startups

For this in-depth research on the Top Military Tech Trends & Startups, we analyzed a sample of 320+ global startups & scaleups. The Military Technology Innovation Map created from this data-driven research helps you improve strategic decision-making by giving you a comprehensive overview of the military industry trends & startups that impact your company.

Tree Map reveals the Impact of the Top 10 Military Technology Trends

The Tree Map below highlights the latest trends in military technology in 2025, focusing on warfare strategies, cybersecurity, and connectivity. AI integration enhances decision-making and surveillance, while 5G connectivity and the internet of military things (IoMT) improve battlefield communication and operational efficiency.

Further, cybersecurity and cyber-warfare are critical in defending against digital threats as electronic warfare capabilities evolve. Moreover, sustainability gains importance as energy efficiency initiatives optimize resource use in military operations. These advancements shape the future of defense technology to make military forces more intelligent, resilient, and adaptive.

Global Startup Heat Map covers 320+ Military Technology Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 320+ exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the United States and Western Europe, followed by India. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Military Tech Innovations & Trends?

Top 10 Emerging Military Technology Trends [2025 and Beyond]

1. AI Integration

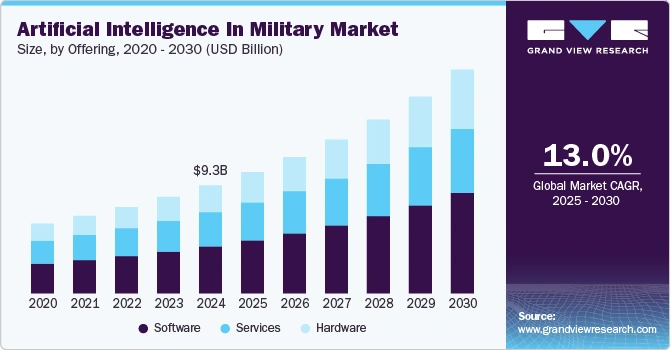

The global AI in the military market was valued at USD 9.31 billion in 2024 and is projected to grow at a CAGR of 13.0% from 2025 to 2030. Increased defense investments, autonomous systems, and AI-driven predictive analytics fuel the adoption of AI in military operations worldwide.

Credit: Grand View Research

The US Department of Defense (DoD) has allocated USD 1.8 billion for AI and ML initiatives in the fiscal years 2024 and 2025. This funding supports the development of secure AI platforms, workforce training, and modernization efforts to ensure the US military remains at the forefront of AI-driven warfare.

Further, AI-powered systems enhance decision-making at strategic, operational, and tactical levels. By analyzing complex datasets, they predict enemy movements, optimize logistics, and automate surveillance tasks.

AI-driven predictive maintenance reduces downtime for critical equipment to ensure mission readiness. Autonomous systems, such as drones and unmanned ground vehicles, are increasingly deployed for reconnaissance, logistics, and high-risk combat missions. This reduces human involvement in dangerous scenarios while improving operational efficiency.

Moreover, command and control (C2) systems leverage AI for real-time data analysis and enable faster and more informed battlefield decisions. AI-driven training solutions reduce training time by up to 40%, improving force readiness and recruitment efficiency.

RobotEye builds Smart Surveillance Systems

Turkish startup RobotEye develops AI-driven unmanned surveillance solutions with edge processing and satellite connectivity. Its technology autonomously detects activities in remote areas without GSM coverage. Using electro-optic and thermal cameras, it records data, analyzes it on-device with edge AI, and transmits alerts via satellite communication.

The startup’s border security solutions provide real-time monitoring in challenging environments to secure national borders and sensitive areas against unauthorized entry. Its Central command and control platform integrates with commercial trail cameras, where leveraging AI, it detects humans, vehicles, and animals to send alerts through web and mobile applications.

Solo offers a compact surveillance system with dual-function optic and thermal cameras for ensuring reliable data transmission. Further, Hub extends border security by analyzing media from LoRa Node cameras and relaying detection results via satellite, which enables surveillance over large, network-limited regions. Lastly, Eye enhances real-time response capabilities with node-to-hub communication to keep field staff informed for immediate action.

Moreover, RobotEye AI secures a USD 12.5 million investment from ARZ Portfoy.

Nextria provides On-premise Generative AI and ML

Canadian startup Nextria delivers on-premise, secure generative AI solutions through its CastleGuard AI platform. This platform offers applications for translation, transcription, document Q&A, chat, and code generation to operate within an organization’s existing data repositories. The startup deploys these tools on-premise to ensure that sensitive data remains within the client’s infrastructure to enhance security and compliance.

It offers features such as integration with familiar applications, preservation of document formatting during translation, and customization to recognize specific terminologies, such as Government of Canada acronyms and phrases. Further, it provides Sentinel Server, an AI-in-a-box solution for offline AI capabilities in a secure, military-spec GPU-based server. This system ensures rapid deployment and security, which is crucial for defense operations.

2. Cybersecurity and Cyberwarfare

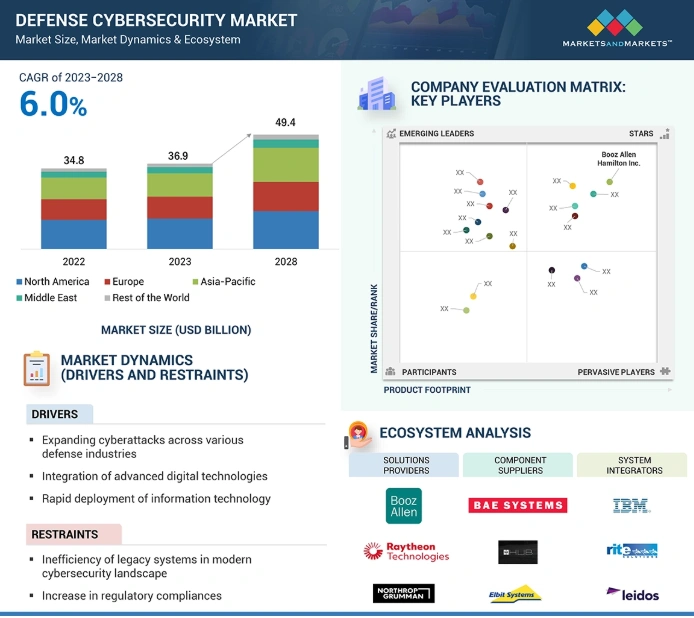

The defense cybersecurity market is projected to reach USD 49.4 billion by 2028, growing at a CAGR of 6.0% from 2023 to 2028. Geopolitical tensions, state-sponsored cyberattacks, and reliance on digital infrastructure in military operations drive demand for advanced cybersecurity solutions.

Credit: Markets and Markets

The US Department of Defense has allocated USD 64.1 billion for information technology and cyberspace activities in its fiscal year 2025 budget, which highlights a focus on cybersecurity resilience.

Geopolitical conflicts, such as the Russia- Ukraine war, have intensified cyberwarfare strategies, with nations increasingly using cyberspace as a battleground. In India, state-sponsored cyberattacks surged by 278% over three years, underscoring the shift toward non-kinetic warfare and the growing need for defensive and preemptive cybersecurity measures.

Militaries worldwide are adopting AI, machine learning (ML), and IoT for real-time threat detection and rapid response mechanisms. The integration of zero-trust security frameworks and cloud-based solutions accelerates to protect critical military infrastructure from evolving cyber threats.

Moreover, Germany has established a dedicated cyberspace branch within its military to focus on countering hybrid threats, such as disinformation campaigns and cyber espionage. Meanwhile, Japan has begun drafting legislation for an active cyber defense system designed to execute preemptive actions against cyberattacks.

As modern warfare becomes increasingly digitized, constant updates to vulnerability management systems are essential due to rapid advancements in both offensive and defensive cybersecurity technologies.

Intellectra offers Intelligent Spectrum Analytics

Cyprus-based startup Intellectra develops embedded security solutions to safeguard military systems and critical infrastructure. Its product, FinalMile, is a modular cybersecurity solution for wireless IoT environments, which analyzes wireless signals in real time on wireless-enabled devices to identify and neutralize threats as they arise. This ensures real-time threat detection and neutralization for preventing attacks before they cause damage.

Further, FinalMile integrates across infrastructures, adapting to various hardware and backend systems. It scales from small networks to extensive IoT ecosystems to provide comprehensive protection regardless of infrastructure size. Moreover, its continuously evolving machine learning algorithms keep security measures ahead of emerging threats.

RizeForce provides Tactical Defense & Intelligence

US-based startup RizeForce accelerates the adoption of technologies in defense and military sectors by integrating AI, cybersecurity, and drone systems. Its Platform Ontology of Cybersecurity (POC) enhances big data analytics and enables early detection of cybersecurity incidents, which is achieved by defining hierarchical ontologies and correlating data from various monitoring systems.

The startup develops expertise in AI, IoT, and edge computing to provide advanced information and data management systems that ensure data availability, accuracy, and security. It also addresses the growing need for counter-drone measures by offering technologies that detect and neutralize unauthorized unmanned aerial systems.

3. Energy Efficiency and Sustainability

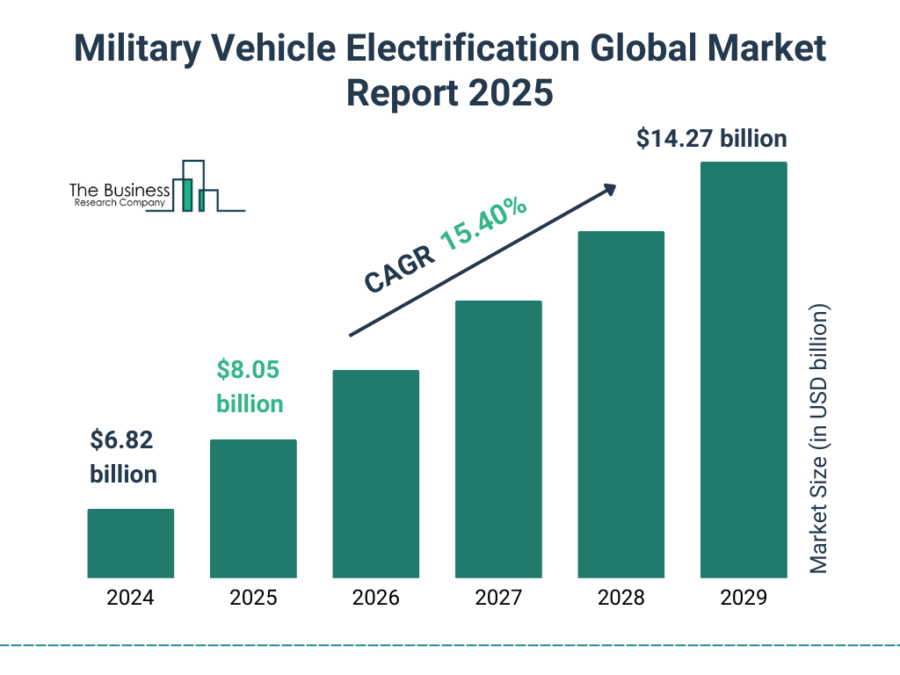

The military vehicle electrification market is projected to reach USD 14.27 billion by 2029, growing at a CAGR of 15.4% from 2024 to 2029.

Credit: The Business Research Company

The US Department of Defense aims to source at least 25% of its energy from renewable sources by 2025, which reinforces its commitment to sustainable energy integration in military operations.

In Europe, the German government has prioritized sustainable defense investments through its National Security and Defence Industrial Strategy to ensure that ESG criteria do not hinder financing for military technologies.

The urgency for decarbonization in defense operations is underscored by the defense industry’s contribution of approximately 5.5% to global greenhouse gas emissions.

Moreover, technological advancements in high-capacity batteries, compact power units, and renewable energy systems enhance operational efficiency for military forces. These technologies support unmanned vehicles, communication systems, and portable devices while reducing logistical challenges in remote areas.

Emerging trends in military electrification include hybrid platforms, hydrogen fuel cells, adaptive charging infrastructure, and AI-driven autonomous features, which optimize battlefield mobility and reduce fuel dependency.

Further, energy efficiency measures improve working conditions for troops to offer better lighting, effective heating/cooling systems, and reliable power through solar, wind, and geothermal technologies.

In addition, microgrid solutions are deployed to ensure a continuous electricity supply in forward-operating bases. The military supply chains are also incentivized to adopt lower-carbon products through procurement policies that align with sustainability goals.

Uplift360 enables Body Armor Recycling

UK-based startup Uplift360 develops eco-friendly, low-energy chemical recycling processes to reclaim high-performance materials from military equipment, notably body armor. Its technology converts waste aramid fibers into renewed continuous fibers for high-value applications.

Its process uses sustainable chemicals to depolymerize waste para-aramid fibers, transforming them into a liquid state, which is then respun into high-performance materials with properties comparable to virgin fibers. This reintegrates valuable materials into the supply chain to reduce reliance on virgin resources.

Further, the startup’s technology selectively removes resin matrices from composite materials to preserve the integrity of high-value reinforcing fibers for reuse. Uplift360 extracts petrochemical feedstocks from waste polymers and composites to offer an eco-friendly alternative to traditional disposal methods.

H3X Technologies builds Electric Propulsion Systems

US-based startup H3X Technologies makes electric motors, inverters, and hybrid powerplant systems for defense applications. It designs compact, high-performance solutions that integrate motors with co-optimized inverters to meet aerospace and MIL-SPEC standards.

The startup’s HPDG-15 is a 15 kWe hybrid powerplant for unmanned aerial systems (UAS), unmanned surface vehicles (USV), and other unmanned applications. The HPDM-30 and HPDM-140 integrated motor drives provide 33 kW and 140 kW, respectively, for high-speed power generation, aircraft propulsion, and auxiliary systems. Further, the HPDI-190 is a compact 190 kW silicon carbide (SiC) inverter that efficiently drives motors and other three-phase AC loads.

4. Autonomous Weapon Systems

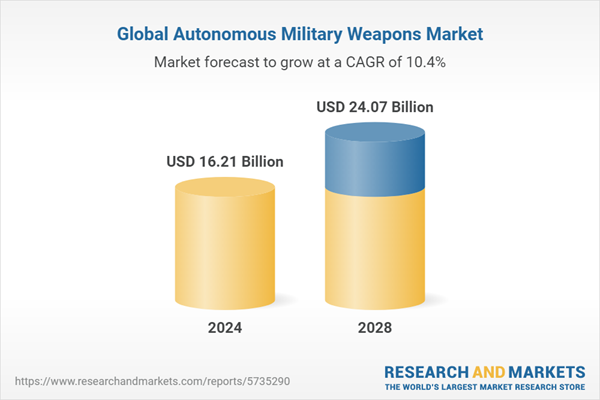

The autonomous military weapons market is projected to reach USD 24.07 billion by 2028, growing at a CAGR of 10.4% from 2024 to 2028.

Credit: Research and Markets

The deployment of autonomous systems, including UAVs, autonomous ground vehicles (AGVs), and lethal autonomous weapons systems (LAWS) is driving market expansion to enhance operational efficiency and reduce risks to soldiers.

AI integration into AWS improves precision, decision-making, and response times during combat. These systems perform high-risk tasks, such as surveillance, target identification, and combat operations, without direct human intervention.

Acting as force multipliers, autonomous weapons reduce the number of personnel needed for missions while increasing operational effectiveness.

The use of autonomous weapons raises concerns about ethics, accountability, and compliance with international law. In December 2024, the United Nations General Assembly adopted a resolution on LAWS, reflecting global concerns over their potential misuse and legal implications under International Humanitarian Law (IHL).

Further, reports from conflicts in Ukraine, Israel and Palestine, and Libya suggest that autonomous-capable weapons may already be in use. These issues raise concerns about system errors and potential deployment by non-state actors.

Unmanned Defense Systems makes Battlefield Automated Systems

Lithuanian startup Unmanned Defense Systems develops UAVs and swarm technologies for defense operations. Its ISR-focused PARTISAN UAV conducts intelligence, surveillance, and reconnaissance missions, and the MESSENGER UAV provides long-range communication support.

Further, the CATFISH electronic warfare decoy disrupts adversary systems, and the BLASTER 4 multirotor loitering munition delivers precision strikes. The AVENGER 2 and AVENGER 5 UAVs function as mid-range and long-range loitering munitions, respectively, to ensure tactical adaptability.

Moreover, the startup’s SwarmC2 system integrates all platforms into battle management systems, such as SitaWare HQ and ATAK BMS, to enhance real-time situational awareness and autonomous mission execution.

Airvolute builds an Open-architecture Autopilot Platform

Slovakian startup Airvolute builds open-architecture UAS with modular designs using NVIDIA Jetson technology. Its DroneCore Suite integrates the Cube flight controller with Jetson modules to create a unified autopilot system adaptable to multiple applications.

The startup’s Stribog UAS is a quadcopter that features an open modular architecture and GNSS-denied capabilities and supports payloads such as Dragoneye2 and FLIR Hadron. It offers 60-minute flight endurance without payload and integrates with ground control stations, including SteamDeck.

Moreover, the Patron FPV is an AI-driven first-person-view (FPV) drone that incorporates a terminal guidance algorithm, ELRS or digital radio, and a continuous zoom camera for precision operations. Its compact 10-inch frame supports a kg payload, and its integrated PCB design simplifies assembly.

Airvolute offers scalable, software-driven UAVs with modular configurations to enhance mission flexibility and reduce development time for commercial and defense applications.

5. Immersive Technologies

The immersive technology in the military and defense market is projected to grow from USD 12.80 billion in 2025 to USD 92.17 billion by 2034, at a CAGR of 24.52%.

Credit: Market Research Future

Increasing adoption of virtual reality (VR), augmented reality (AR), and simulation-based training is transforming military operations. These technologies enhance situational awareness, mission planning, and training efficiency.

Moreover, the military simulation and virtual training market, valued at USD 12.18 billion in 2024, is expected to grow to USD 13.07 billion in 2025, at a CAGR of 7.4%.

Immersive technologies like VR and AR provide realistic, repeatable, and safe environments for combat simulations, mission rehearsals, and equipment training. This reduces costs and minimizes risks associated with live training exercises.

AR-based systems improve battlefield situational awareness by delivering real-time overlays of critical data to enable faster decision-making and tactical superiority. These technologies are also deployed for mission planning using 3D terrain maps and simulated environments. It allows soldiers to assess potential challenges before deployment.

Also, the Asia-Pacific defense immersive technology market is projected to reach USD 3.1 billion by 2033. The growing demand for enhanced situational awareness and soldier lethality is driving this growth. The rising need for cost-effective training solutions, maintenance process optimization, and network-centric warfare strategies further fuels adoption.

HAVIK builds Military Training System

US-based startup HAVIK develops portable, high-fidelity, accredited training systems for military ground operators. Its HAVIK Joint Fires Trainer is a self-contained virtual reality system enabling joint terminal attack controllers (JTACs) to conduct immersive call-for-fire training. This system operates on commercial off-the-shelf (COTS) hardware, including two Dell laptops, a VIVE Elite VR headset, and a Galaxy Tablet running ATAK, all housed in a rugged 45-pound case for easy transport and setup.

The startup’s software features realistic 3D models and environments built on the Unity gaming engine to provide users with customizable scenarios that replicate real-world terrains and conditions. The system adheres to Distributed Interactive Simulation (DIS) and Common Image Generator Interface (CIGI) standards for ensuring interoperability with existing Department of Defense simulation systems.

EODynamics facilitates AR-based EOD and Mine Action Training

Swedish startup EODynamics makes solutions for explosive ordnance disposal (EOD) and mine action training. Its product, the Augmented 3D Reality Ordnance system (A3RO), combines 3D-printed ordnance models with digital training materials to provide an exceptional educational experience. This approach allows trainees to interact with realistic replicas while accessing comprehensive information through augmented reality to enhance engagement and retention.

Further, the startup offers the Explosive Hazard Awareness Recognition Training (EHART) program to transform organizational training capabilities into safer, more efficient, and cost-effective solutions.

6. Internet of Military Things

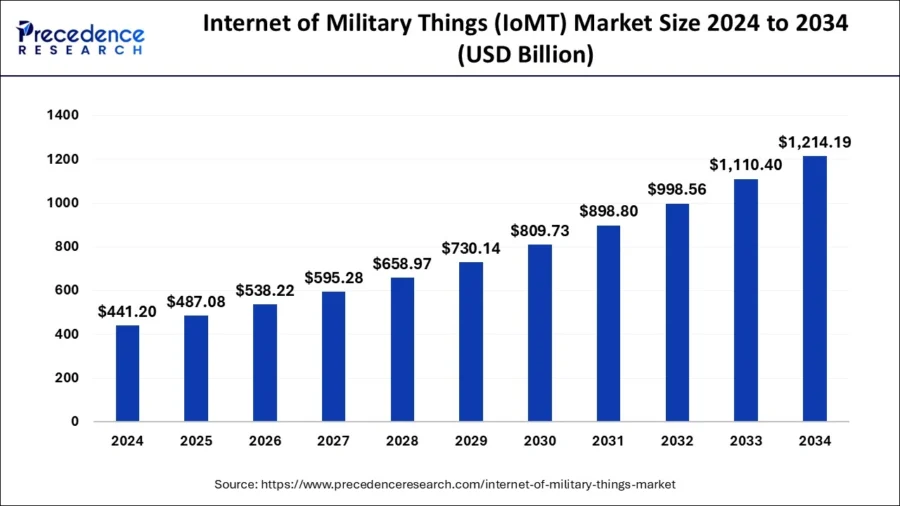

The IoMT market is projected to grow from USD 487.08 billion in 2025 to approximately USD 1214.19 billion by 2034, expanding at a CAGR of 10.65%. The adoption of IoT-driven technologies in defense operations enhances situational awareness, automation, and predictive maintenance.

Credit: Precedence Research

Global defense forces are investing in IoT-driven solutions like real-time analytics, remote monitoring, and network management to improve battlefield efficiency and operational decision-making.

A significant portion of funding is directed toward integrating 5G technology with IoT systems. It enables high-speed, low-latency communication for applications like autonomous military systems, cyber warfare, and advanced sensor networks.

Besides, the integration of IoT in defense enhances situational awareness by leveraging sensors, UAVs, and surveillance systems that provide real-time intelligence for battlefield management.

Automation reduces human intervention in hazardous environments, with autonomous vehicles, drones, and robotic systems optimizing resource allocation and mission effectiveness. In addition, predictive maintenance powered by IoT devices improves military equipment reliability by minimizing downtime and ensuring operational readiness.

North America dominates the IoMT market, benefiting from advanced IT infrastructure and high defense spending on IoT-based military applications. Meanwhile, the Asia-Pacific region, led by China and India, is experiencing rapid growth. This growth is driven by increased defense budgets and the adoption of cloud computing for military operations.

SWARMIOS manufactures the Swarm Intelligence Orchestration System

Romanian startup SWARMIOS offers military-grade swarm technology solutions that enhance operational effectiveness through coordinated and autonomous unmanned systems. Its swarm intelligence algorithms enable real-time decision-making, adaptive mission planning, and strategic disruption of enemy forces by engineering unpredictable swarm behaviors.

The startup’s technology facilitates the swarming of nano-satellites for enhanced surveillance and communication, while its ad-hoc communication umbrella ensures uninterrupted connectivity in dynamic environments. SWARMIOS’ solutions optimize indoor operations by enabling precise navigation in confined spaces. It supports small units with real-time air coverage and enhances breaching operations through coordinated sensor-driven attacks.

The swarm’s adaptive area reconnaissance and pulsing strategies strengthen area defense to prevent enemy advancements and secure critical assets. Its ISR capabilities provide resilient intelligence gathering across contested environments, while its parallel warfare approach disrupts enemy systems by engaging multiple targets simultaneously.

Future Infantry Training Systems builds AIoT Multiple Integrated Laser Engagement System

Indian startup Future Infantry Tactical Systems develops ground warfare training solutions using in-house artificial intelligence of things (AIoT) technology. Its system integrates over 15 AIoT devices and drone technology to create customizable, immersive simulations for various training scenarios. This allows military, police, and private security personnel to engage in realistic threat, crisis, and battlefield training as needed.

The startup offers the Mobile Rifle Range Simulator (MRRS), which immerses shooters in virtual shooting ranges, and the Mine Training Simulation System (MTSS), which provides lifelike scenarios for mine detection and neutralization. The Digital Sniper Training Kit offers high-resolution augmented reality overlays for diverse environments, while the Combat Range Stress Simulator (CRSS) replicates high-stress combat situations to enhance soldier readiness.

In addition, the Advanced Firearm Force on Force Training Kit (AFFFTK) delivers customizable scenarios with real-time monitoring, and the Advanced Tactical Arenas (ATA) use AI-driven modules for dynamic battlefield simulations.

7. 5G Connectivity

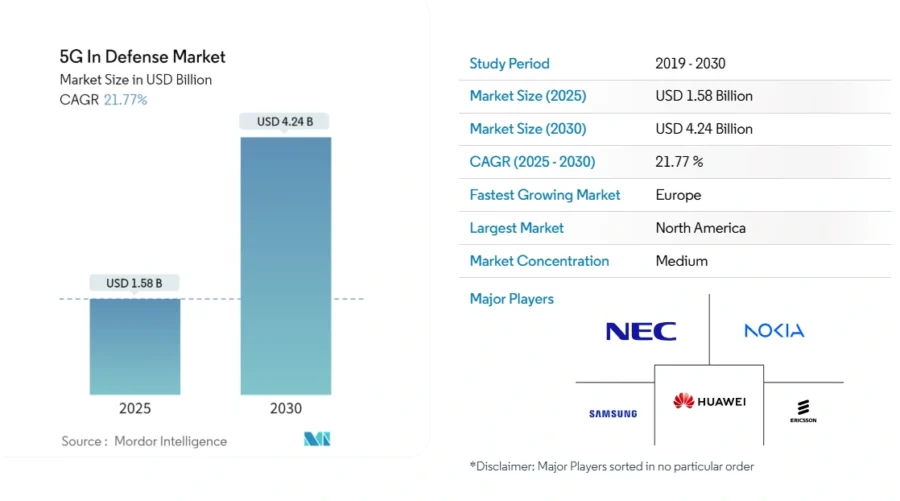

The 5G in the defense market is projected to grow from USD 1.58 billion in 2025 to USD 4.24 billion by 2030, expanding at a CAGR of 21.77%. The adoption of private 5G networks, enhanced battlefield connectivity, and AI-driven autonomous systems drives market growth as militaries seek high-speed, low-latency communication solutions.

Credit: Mordor Intelligence

Private 5G networks for defense are gaining traction, with cumulative spending estimated at USD 1.5 billion between 2024 and 2027. The US Department of Defense has invested over USD 650 million in the past three years to deploy Open RAN-compliant 5G networks at military bases for supporting experimental and operational defense applications.

The key applications of 5G in defense include enhanced battlefield connectivity, enabling real-time data transmission, situational awareness, and improved command and control systems.

Autonomous systems, such as UAVs, robotic ground vehicles, and connected sensors, benefit from 5G’s high-speed, low-latency networks for coordination. In addition, 5G-powered cybersecurity enhancements strengthen military data protection against cyber threats.

Moreover, technological advancements in 5G enable ultra-fast speeds (up to 10 Gbps), low latency (less than 1 ms), and high bandwidth. These support applications like remote weapon systems, real-time video surveillance, and edge computing for faster response times in combat scenarios.

Besides, the integration of 5G with IoT accelerates demand for enhanced mobile broadband (eMBB), ultra-reliable low-latency communications (URLLC), and massive machine-type communications (MMTC).

AiRANACULUS offers Intelligent Radio Frequency (RF) and Networking

US-based startup AiRANACULUS builds intelligent RF and networking solutions for space, defense, and smart cities. It provides algorithms, reference architectures, and products for signal processing, cross-layer analysis, cybersecurity, and networking. Its Autonomous Intelligent Reconfiguration technology enables self-driving heterogeneous wireless networks by dynamically adjusting radio and sensor systems for optimal performance in congested environments.

The startup specializes in mission-critical communications, interference mitigation, dynamic spectrum sharing, and cross-layer optimization of 5G, 6G, and non-terrestrial networks. It integrates AI and ML to enhance RF and network data analytics, zero-touch provisioning, and autonomous network reconfiguration.

AiRANACULUS also engages in defense spectrum R&D, electronic warfare, radar systems, and ISR applications, leveraging blockchain and advanced data analytics. It creates intellectual property for commercial and government use and acts as a trusted adviser while developing resilient, adaptive, and secure communication systems for complex operational environments.

Mantiswave Networks manufactures Private 5G Box

Indian startup Mantiswave Networks provides specialized 5G solutions for the defense and security sectors. Its Mantis Private 5G Box integrates essential components like the 5G Core, 5G RAN, and radio hardware into a compact, easily deployable unit. This solution supports high-speed data transmission, low-latency communication, and reliable connectivity tailored to the organization’s requirements.

The startup facilitates secure and scalable deployment to enhance operational efficiency, security, and control over network performance and data privacy. The Mantis Private 5G Box offers customizable features and management capabilities through a user-friendly interface. This enables organizations to innovate, optimize internal processes, and explore advanced applications such as IoT, automation, and real-time analytics within their private network environment.

8. Electronic Warfare

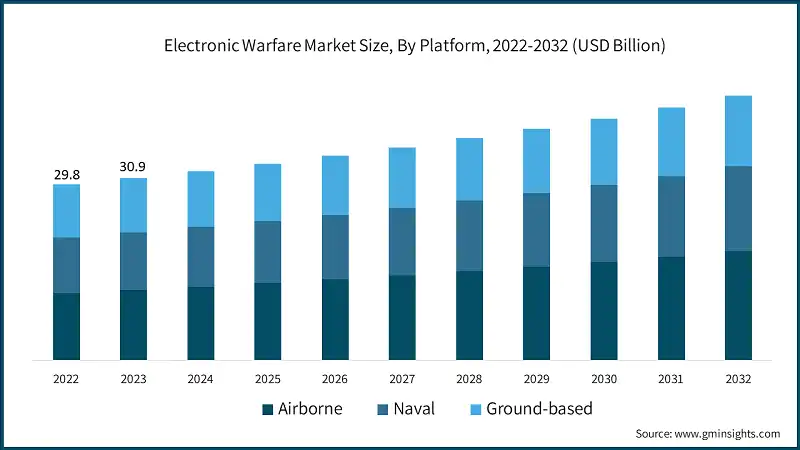

The electronic warfare (EW) market is projected to reach USD 44.8 billion by 2032, growing at a CAGR of over 4% from 2024 to 2032.

Credit: Global Market Insights

Market expansion is driven by integrating EW across air, land, sea, and space domains and ongoing military modernization efforts. The US EW market is expected to reach USD 4.8 million in 2025 and grow to USD 6.8 million by 2033, with a CAGR of 4.60%.

The key trends shaping the EW market include the development of cyber-electronic convergence and quantum technologies, which enhance signal processing, jamming, and secure communications. The shift toward network-centric warfare (NCW) emphasizes real-time data sharing and situational awareness to improve operational effectiveness across defense networks.

Further, the adoption of cognitive EW systems that utilize AI-driven threat detection and spectrum management is accelerating. With the increasing use of UAVs and counter-drone systems, military investments in EW capabilities have surged to counter the electronic threats posed by autonomous platforms.

Besides, space-based assets play a growing role in military communication and intelligence to drive demand for electromagnetic spectrum dominance technologies.

The threat landscape is also evolving as non-state actors and adversaries deploy low-cost electronic disruption tools like jammers and drones, which necessitates the development of advanced countermeasures to safeguard military and civilian infrastructure.

In response, modernization programs are integrating EW systems into next-generation platforms, including fighter jets, naval vessels, missile defense systems, and unmanned vehicles. These platforms rely on sophisticated electronic support measures (ESM) to detect, disrupt, and counter emerging threats effectively.

Pacific Defense enhances Military-use Electromagnetic Spectrum

US-based startup Pacific Defense develops EW and signals intelligence (SIGINT) solutions using open architecture technology. Its systems follow the Modular Open Systems Approach (MOSA) and align with SOSA and CMOSS standards to ensure modularity, interoperability, and rapid capability integration.

The startup’s SOSA/CMOSS 3U VPX and Small Form Factor VNX+ solutions enable simultaneous EW and SIGINT operations to support communications, UAS, radar, and navigation threat detection. These systems integrate MORA for software-defined radio (SDR) management, which allows flexible control of amplifiers and antennas. They also enhance direction-finding and geolocation capabilities. Pacific Defense delivers scalable, cost-effective, and adaptable solutions that enhance operational agility and mission effectiveness for modern defense environments.

BlueBird develops Electronic Warfare Equipment

Ukrainian startup BlueBird builds UAVs and EW solutions for defense. Its product line includes FPV-7 and FPV-8 quadcopters for reconnaissance and kamikaze missions, featuring real-time control and high maneuverability. The startup offers EW systems in trench-based, automobile-mounted, and dome-shaped configurations to disrupt enemy communications and control signals.

BlueBird provides ground control stations like the Vishchun HC1 and wireless repeaters to ensure stable UAV operations and signal transmission. It supplies high-capacity batteries, including the Genera-700 and Genera-28, to support extended field missions.

In addition, the startup offers specialized antennas, such as quadrifilar and patch designs, to enhance signal reception and transmission. Its other technical equipment includes remote controls for EW devices and landing gear for drones. BlueBird enhances situational awareness and electronic defense capabilities for modern military operations.

9. Biotechnology and Human Augmentation

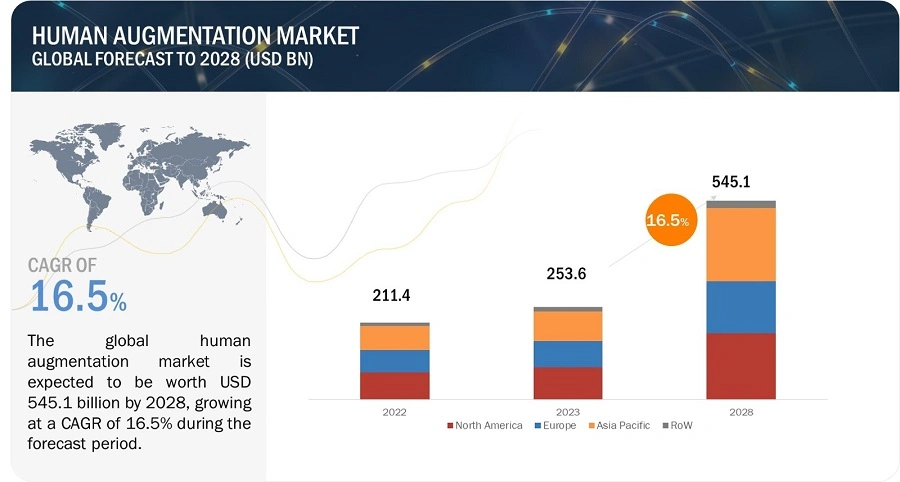

The global human augmentation market is projected to reach USD 545.1 billion by 2028, growing at a CAGR of 16.5% from 2023 to 2028.

Credit: Markets and Markets

Investments in exoskeletons, cognitive enhancement tools, and AR improve physical performance, situational awareness, and battlefield survivability.

Robotic exoskeletons enhance soldier endurance and strength, especially in demanding field operations requiring heavy loads and extended mobility.

Further, advances in synthetic biology, protein engineering, and gene editing technologies such as CRISPR-Cas9 transform military capabilities. These include sensors for detecting chemical and biological threats and programmable biomaterials for adaptive defense systems.

The biotechnology sector leads innovations in advanced therapeutic medicinal products (ATMPs), gene therapies, and tissue-engineered solutions. These have significant implications for military healthcare and trauma care. These breakthroughs enhance battlefield medical treatment, accelerate wound healing, and improve recovery rates for injured soldiers.

Looking toward 2035, the integration of genetically engineered therapies and brain-computer interfaces (BCIs) could reshape military operations. This transformation could turn soldiers into human weapons systems with enhanced physical strength, cognitive abilities, and real-time neural connectivity to defense networks.

Strike Photonics facilitates Photonics-based Diagnostics

US-based startup Strike Photonics develops photonic integrated circuits to enhance performance and security in biotechnology, telecommunications, and electronic defense sectors. Its technology miniaturizes Raman spectroscopy into compact chips to enable rapid and accurate pathogen detection without chemicals or reagents. These chips facilitate multiple tests from a single sample for providing real-time results with heatmaps. They are deployable in settings such as hospitals, urgent care, military biodefense, and remote patient monitoring.

In electronic defense, Strike Photonics introduces a shift in military communications, stealth, and anti-EMP equipment. It improves system performance, survivability, mission capability, and resistance to physical or cyber attacks to enable coordinated jamming across multiple electronic warfare platforms.

Gravity Industries produces Jet Suit

UK-based startup Gravity Industries builds jet-powered suits that enable human flight. Its technology integrates micro gas turbines into a wearable exoskeleton, which allows pilots to control vertical and horizontal movement.

The suit generates over 1000 horsepower, allowing for speeds exceeding 50 mph and altitudes up to 12 000 feet. This technology has been demonstrated in various military contexts, including NATO mountain rescue exercises and maritime boarding operations with the Royal Marines.

10. Counter-Drone Technology

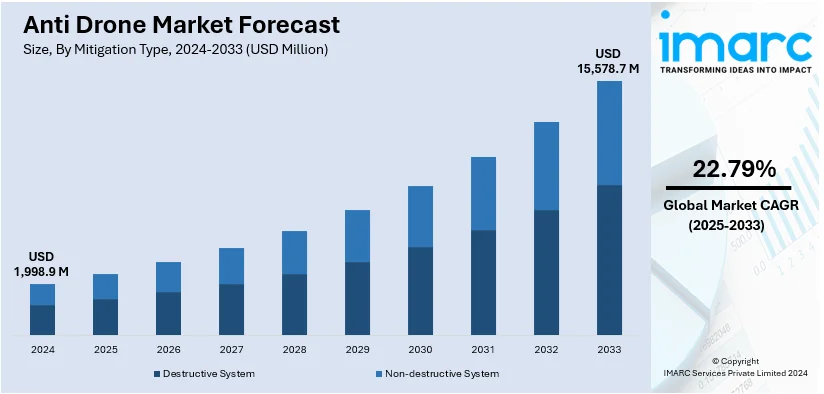

The global anti-drone market was valued at USD 1998.9 million in 2024 and is projected to reach USD 15 578.7 million by 2033, growing at a CAGR of 22.79% from 2025 to 2033.

Credit: IMARC Group

The use of UAS for reconnaissance and offensive operations drives demand for advanced counter-drone technologies to safeguard military assets and critical infrastructure. North America dominates the market, accounting for over 44.9% of the global share in 2024.

The US Department of Defense has committed USD 1 billion for the fiscal years 2024 and 2025 under its “Replicator 2” initiative, focusing on AI-enabled counter-drone technologies. Investments in the private sector are also accelerating.

Companies like D-Fend Solutions raised USD 31 million to expand counter-drone capabilities, while Vyomastra, a Mysuru-based startup, secured USD 1.5 million to develop indigenous radar systems for neutralizing drone threats.

AI and ML are transforming counter-drone technology to enable real-time detection, classification, and mitigation of aerial threats. In mid-2024, Roke launched its Agile Counter-UAS system, incorporating AI-powered sensor fusion capabilities to improve response efficiency.

As adversaries increasingly deploy swarming tactics using multiple drones simultaneously, advanced counter-drone platforms are being designed to neutralize such coordinated threats.

With geopolitical tensions rising and UAS-based warfare becoming more sophisticated, global defense agencies are scaling investments in AI-driven counter-drone solutions.

The rapid evolution of AI-enabled jamming, directed energy weapons, and electromagnetic countermeasures is expected to shape the future of anti-drone warfare, reinforcing airspace security and battlefield dominance.

PerceptView builds Counter UAS Systems

US-based startup PerceptView develops video target tracking systems for long-range surveillance, security, and counter-unmanned aerial systems (C-UAS) applications. Its technology integrates electro-optical (EO) and infrared (IR) sensors, including 550-785mm mid-wave infrared and 800mm electro-optical sensors, to detect, identify, and track aerial threats with precision.

The startup’s PV Long-Range HD, PV Mid-Range SD, and PV Mid-Range HD-SDI tracking systems offer modular and mobile configurations to ensure adaptability for various operational environments. These systems are powered by the PV-VTTR control platform and feature USB, HDMI, and RJ45 connectivity with IP66 MilSpec protection for durability.

Moreover, PerceptView’s RemoteView and AwareView software solutions provide video monitoring, remote camera control, and integration into broader defense networks. They support both standalone and multi-layered security operations.

Boresight provides CUAS Swarming Threat Emulation

Australian startup Boresight develops unmanned aerial targets (UATs) for counter-small unmanned aerial systems (C-sUAS) training and threat emulation. Its Raider Quadcopter serves as an expendable aerial target, which enables realistic engagement through kinetic or RF-based countermeasures.

The startup’s swarming capability allows a single ground control station (GCS) to manage multiple Raider quadcopters simultaneously for simulating complex aerial threats for advanced C-sUAS training.

Boresight’s Flight Management software ensures safe, repeatable flight operations while adhering to local airspace regulations. In addition, its Mission Planning software lets users execute pre-defined flight profiles and navigate evolving training scenarios.

Discover all Military Technology Trends, Technologies & Startups

Military technology is evolving quickly, driven by AI, connectivity, and autonomous systems. AI integration enhances defense strategies, while cybersecurity and cyber-warfare are crucial to national security. Meanwhile, AWS and counter-drone technology reshape modern combat. These innovations redefine defense, making military forces advanced, adaptive, and resilient.

The Military Technology Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.

![15 Top Defense Companies and Startups to Watch in Europe [2025]](https://www.startus-insights.com/wp-content/uploads/2025/03/Defense-Companies-in-Europe-SharedImg-StartUs-Insights-noresize-420x236.webp)