The 2025 3D Imaging Market Report highlights growth driven by advancements in depth sensing, sensor fusion, and pattern recognition. It explores 3D imaging’s impact on healthcare, automotive safety, entertainment, and more, with AI, IoT, and cloud technologies uncovering new possibilities for precision and scalability. This 3D imaging market outlook provides stakeholders, investors, and analysts with a snapshot of the market’s health and its growth trajectory for the coming years.

Executive Summary: 3D Imaging Market Report 2025

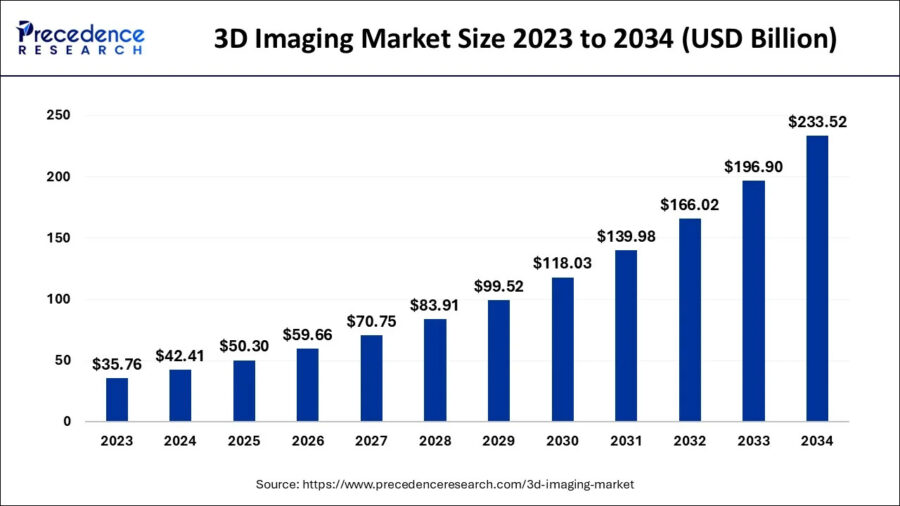

- Industry Growth Overview: The 3D imaging market has more than 3400 companies and 220+ startups. It is expected to grow by USD 50.30 billion in 2025 and is predicted to surpass around USD 233.52 billion by 2034 at a compound annual growth rate (CAGR) of 18.60% between 2024 and 2034. On a micro level, the market grew by a rate of 0.51% last year as per our platform’s latest data.

- Manpower & Employment Growth: The sector employs more than 116 300 employees worldwide, and last year, it added more than 6900 new workers.

- Patents & Grants: With an annual patent growth rate of 4.96%, the sector has approximately 250 300 patents submitted by 10 900+ distinct applicants. Further, over 900 grants encourage innovation in the domain.

- Global Footprint: The United States, United Kingdom, India, France, and Canada lead as top country hubs, while cities like New York, San Francisco, London, Tokyo, and Chicago represent innovation hotspots.

- Investment Landscape: The average investment value per funding round is USD 11 million, with over 2100 funding rounds and 570+ companies funded by 1500+ investors.

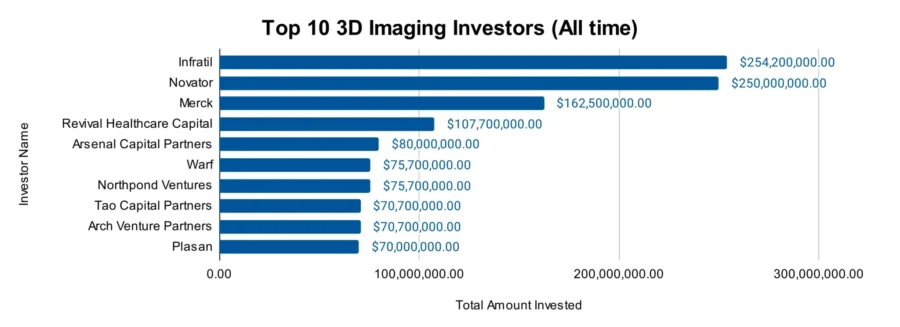

- Top Investors: Leading investors such as Infratil, Novator, Merck, and more, made a combined investment of over USD 1.21 billion in the sector.

- Startup Ecosystem: Five innovative startups, Microqubic (high-precision 3D imager), Marceda (medical 3D imaging), Microscape (collaborative tools for 3D imaging), Quvit Bio (AI-powered real-time 3D imaging) and Fruitometry (orchard scanning technology), showcase the sector’s global reach and entrepreneurial spirit.

What Data is Used to Create This 3D Imaging Market Report?

Based on the data provided by our Discovery Platform, we observe that the 3D imaging market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: With over 4600 publications in the past year, the 3D imaging market has attracted a lot of attention.

- Funding Rounds: The sector ranks high in financing activity with more than 2100 funding rounds according to our database.

- Manpower: With over 116 300 employees worldwide and over 6900 new hires in the past year alone, the market is among the leading domains in manpower growth.

- Patents: The 3D imaging sector has more than 250 300 patents, placing it very high in terms of patent activity.

- Grants: The sector has received over 900 grants which shows continuous support for the market.

- Yearly Global Search Growth: The 3D imaging market has gained public interest and search activity with an annual global search growth rate of 3.84%.

Methodology: How We Created This 3D Imaging Report

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of 3d imaging over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within 3D imaging market

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the 3D imaging market.

Explore the Data-driven 3D Imaging Market Report for 2025

According to Precedence Research, the 3D imaging market is projected to reach USD 233.52 billion by 2034 from USD 42.41 billion in 2024 with an 18.75% CAGR during the forecast year.

Credit: Precedence Market Research

The 3D imaging market outlook 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap provides a visual representation of the 3D imaging ecosystem, highlighting key metrics and growth trends.

With more than 3400 companies and more than 220 startups in the database, this sector shows consistent domain growth, with a growth rate of 0.51% over the previous 12 months.

Additionally, the global 3D imaging market size was valued at USD 41.96 billion in 2024 and is anticipated to grow at a CAGR of 18.5% from 2025 to 2030 according to Grand View Research.

Innovation is happening continuously as depicted by more than 900 grants and 250 300 patents promoting developments worldwide.

Over 116 300 employees are employed in this area, and it saw a rise in manpower of 6900+ individuals in the last year.

Notable city hubs including New York City, San Francisco, London, Tokyo, and Chicago lead contributions, and the United States, United Kingdom, India, France, and Canada are important country hubs promoting innovation.

A Snapshot of the Global 3D Imaging Market

With an annual growth rate of 0.51%, the 3D imaging sector shows consistent improvement which highlights its adaptability and continuous innovation.

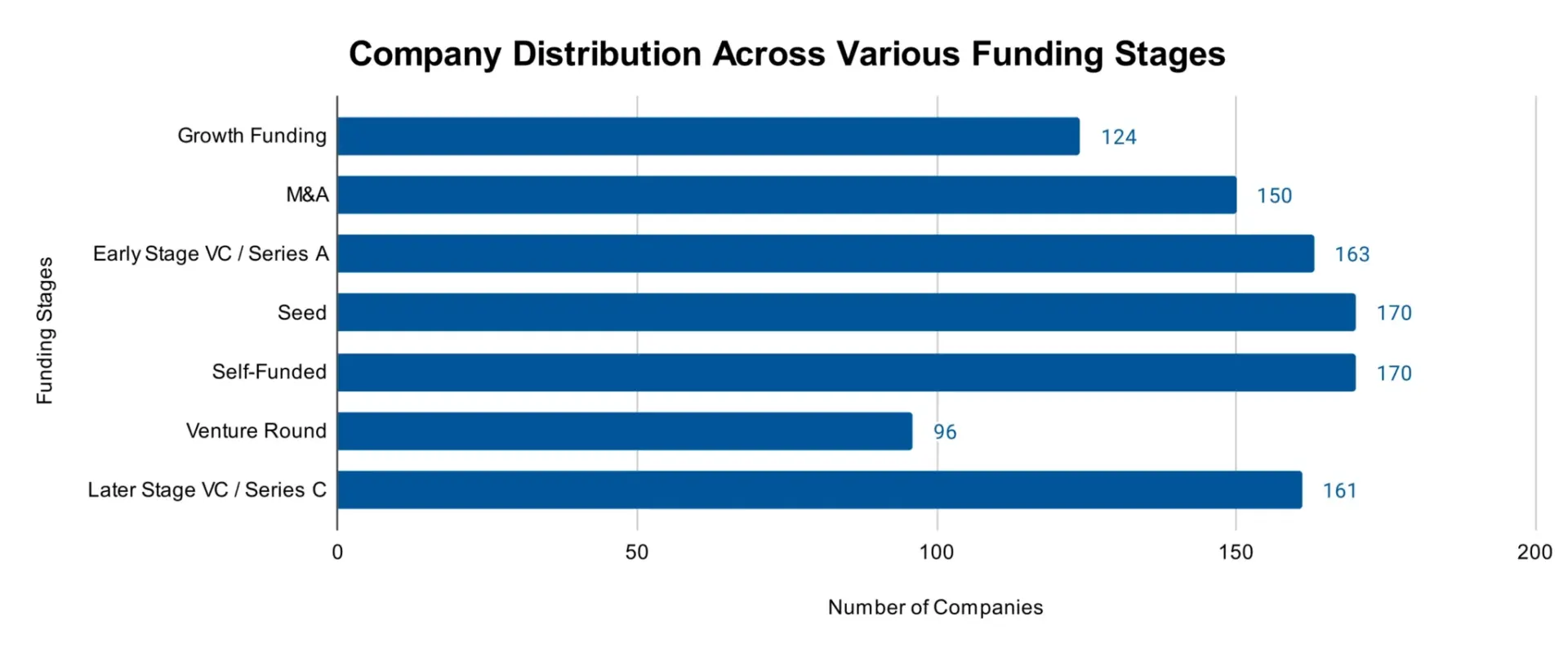

Over 220 startups make up the ecosystem, with over 160 still in the early stages of development. Additionally, more than 150 companies have merged or acquired one another.

The sector is known for its innovation, as seen by the more than 250 300 patents submitted by 10 900 distinct applicants, yielding an annual patent growth rate of 4.96%.

Global competition and leadership in technological breakthroughs are demonstrated by the fact that the United States leads in patent issuance with 87 900+ patents, followed by China with 48 100+.

Explore the Funding Landscape of the 3D Imaging Market

With an average investment value of USD 11 million per round, the sector demonstrates its ability to attract significant funding for technological advancements and growth. The domain has seen over 2100 funding rounds closed, reflecting its dynamic funding activity and investor confidence. More than 1500 investors have contributed to this ecosystem, fueling innovation across diverse applications. These investments span over 570 companies and emphasize the broad interest and opportunities within the sector.

Who is Investing in the 3D Imaging Market?

Strong financial commitment to the advancement of the 3D imaging market is demonstrated by the top investors’ combined investment worth of over USD 1.21 billion.

- Infratil invested USD 254.2 million in at least 1 company. It focuses on renewable energy through investments in Longroad Energy (USA), Gurin Energy (Asia), and Galileo Green Energy (Europe).

- Novator invested USD 250 million in at least 1 company. The company announced an investment of USD 250 million in DNEG, a leading visual effects and animation company.

- Merck invested USD 162.5 million across 2 companies. It also completed the EyeBio acquisition, including the lead candidate Restoret/MK-3000 for treating retinal diseases.

- Revival Healthcare Capital invested USD 107.7 million in at least 1 company. It participated in the series F – II funding round for Distalmotion which is a surgical robotics company.

- Arsenal Capital Partners invested USD 80 million in at least 1 company. Recently, it announced the completion of a majority investment in Polycorp, a leading manufacturer of engineered elastomer solutions.

- WARF Ventures invested USD 75.7 million in at least 1 company.

- Northpond Ventures invested USD 75.7 million in at least 1 company. The company led USD 62 million series B for Garuda Therapeutics.

- Tao Capital Partners invested USD 70.7 million in at least 1 company. It announced a USD 50 million investment in Entos, a company specializing in artificial intelligence and machine learning technologies.

- Arch Venture Partners invested USD 70.7 million in at least 1 company. It has also invested in ArsenalBio, a company developing engineered T-cell therapies for cancer treatment.

- Plasan invested USD 70 million in at least 1 company.

Top 3D Imaging Innovations & Trends

This section highlights firmographic data for top 3D imaging trends. These trends reflect the dynamic growth and diverse applications driving the 3D imaging domain’s evolution.

- Depth Sensing is a key trend in the 3D imaging sector, with over 110 companies specializing in this area. Employing more than 2300 employees, the segment saw an addition of 290+ new employees in the past year. With an annual trend growth rate of 9.25%, depth sensing is gaining traction, driven by advancements in technologies like LiDAR and time-of-flight sensors. It enables precise spatial measurements and applications in autonomous systems, immersive technologies, and robotics.

- Sensor Fusion is the fastest-growing trend, with a strong annual trend growth rate of 18.59%. Over 440 companies focus on integrating data from multiple sensors to enhance accuracy and performance. This segment employs more than 26500 professionals, with an increase of 2900+ new employees in the last year. Sensor fusion is advancing applications such as automotive safety systems, wearable devices, and 3D mapping by combining data from depth sensors, cameras, and IMUs for superior outcomes.

- Pattern Recognition remains a foundational trend in the 3D imaging sector, with 600+ companies dedicated to developing and deploying these technologies. The segment employs over 12 600 professionals, adding 1400+ new employees in the past year. Despite a modest annual growth rate of 0.8%, pattern recognition continues to play a critical role in applications such as facial recognition, medical imaging, and industrial automation.

5 Top Examples from 220+ Innovative 3D Imaging Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Microqubic provides a High-Precision 3D Imager

Swiss startup Microqubic creates high-precision 3D imaging solutions for precision manufacturing, education, and research. Its product, the MRCL700 3D Imager Pro, uses dual-axis tilting, motorized focus and zoom, and modular X-Y-rotation stages for complete imaging capabilities.

This system offers high adaptability for analyzing reflective and transparent materials by combining three LED matrix sources. This provides 3D reflected-light and transmitted-light microscopy. Its features like wireless connectivity, quick-release lenses, and programmable controls ensure versatility.

The system also offers ease of use for a range of applications, including quality control, electronics, and microfluidics. Additionally, Microqubic enables users to effectively complete complex imaging jobs, promoting creativity and accuracy in a range of sectors by providing modular and adaptable solutions.

Marceda simplifies Medical 3D Imaging

Kenyan startup Marceda develops advanced medical 3D imaging solutions that convert digital imaging and communications in medicine (DICOM) images into interactive three-dimensional anatomical models. Its product, DICOM 3D, uses segmentation algorithms and user-friendly 3D editing tools to recreate organ and tissue models from CT, MRI, and PET scans. This allows precise visualization for pre-operative planning, individualized patient care, and more.

DICOM Vision is a lightweight 2D DICOM viewer for quick and clear visualization of medical scans. It offers advanced analysis, orientation, and export capabilities for CT, MRI, and PET images. Additionally, Marceda enables medical professionals to improve patient outcomes through detailed and effective medical imaging analysis by enhancing diagnostic confidence.

Microscape offers Collaborative Tools for 3D Imaging

US-based startup Microscope provides collaborative tools for 3D imaging that enable researchers to visualize, analyze, and share complex data without any interruptions. Its platform simplifies uploading and rendering 3D image data across PCs, mobile devices, and web servers by integrating drag-and-drop features and compatibility with numerous file formats.

The startup offers a cloud-hosted database for data sharing with the larger academic community, video production for presentations, remote access, and real-time collaboration. Microscape also enables users to explore insights and advance discoveries in domains that need in-depth 3D data analysis by promoting effective teamwork and accessibility.

Quvit Bio advances AI-powered Real-Time 3D Imaging

South Korean startup Quvit Bio creates real-time AI-driven 3D imaging solutions that offer quantitative assessments of organotypic 3D cell cultures in a dynamic, spatiotemporal manner. Its light field microscopic add-on module, CHEETAH, records volumetric data at a rate of more than 30 frames per second. It provides detailed insights into neuronal, cardiac, muscular, immune, and complex biological activities.

The solution extracts single-shot 3D images in 32 stacks in each frame and analyzes mechanisms of action with high precision. It also facilitates simpler installation on wide-field fluorescence microscopes. The company’s QField is a 3D microplate reader system that enables real-time volumetric imaging for high-throughput, precise, and consistent analysis of 3D cell-based assays.

These solutions enable researchers to advance drug discovery, assess cardiotoxicity, and decode intricate biological processes with enhanced efficiency and clarity.

Fruitometry offers Orchard Scanning Technology

New Zealand-based startup Fruitometry creates digital crop estimate technology that provides growers and orchard managers with crop estimates in real time. Its technique combines field units with advanced cameras and sensors installed on quad bikes and all-terrain vehicles (ATVs) to record topographical information and 3D photographs of orchard blocks.

The technology uses AI to evaluate this data and recognize buds, blooms, and fruits to produce detailed heatmaps and reports that show crop density and row-by-row variability. It benefits growers by optimizing labor, increasing yields, and cutting costs with features like accurate pre-harvest estimations, early crop load insights, and customized management recommendations.

Gain Comprehensive Insights into 3D Imaging Trends, Startups, or Technologies

By 2025, the 3D imaging market is set to demonstrate significant advancements, driven by its expanding applications and integration with emerging technologies such as AI, IoT, and sensor fusion. Key trends, including real-time volumetric imaging, enhanced depth sensing, and multi-modal data fusion, are reshaping industries like healthcare, automotive, and industrial automation.

Get in touch to explore all 220+ startups and scaleups, as well as all market trends impacting 3400+ companies.