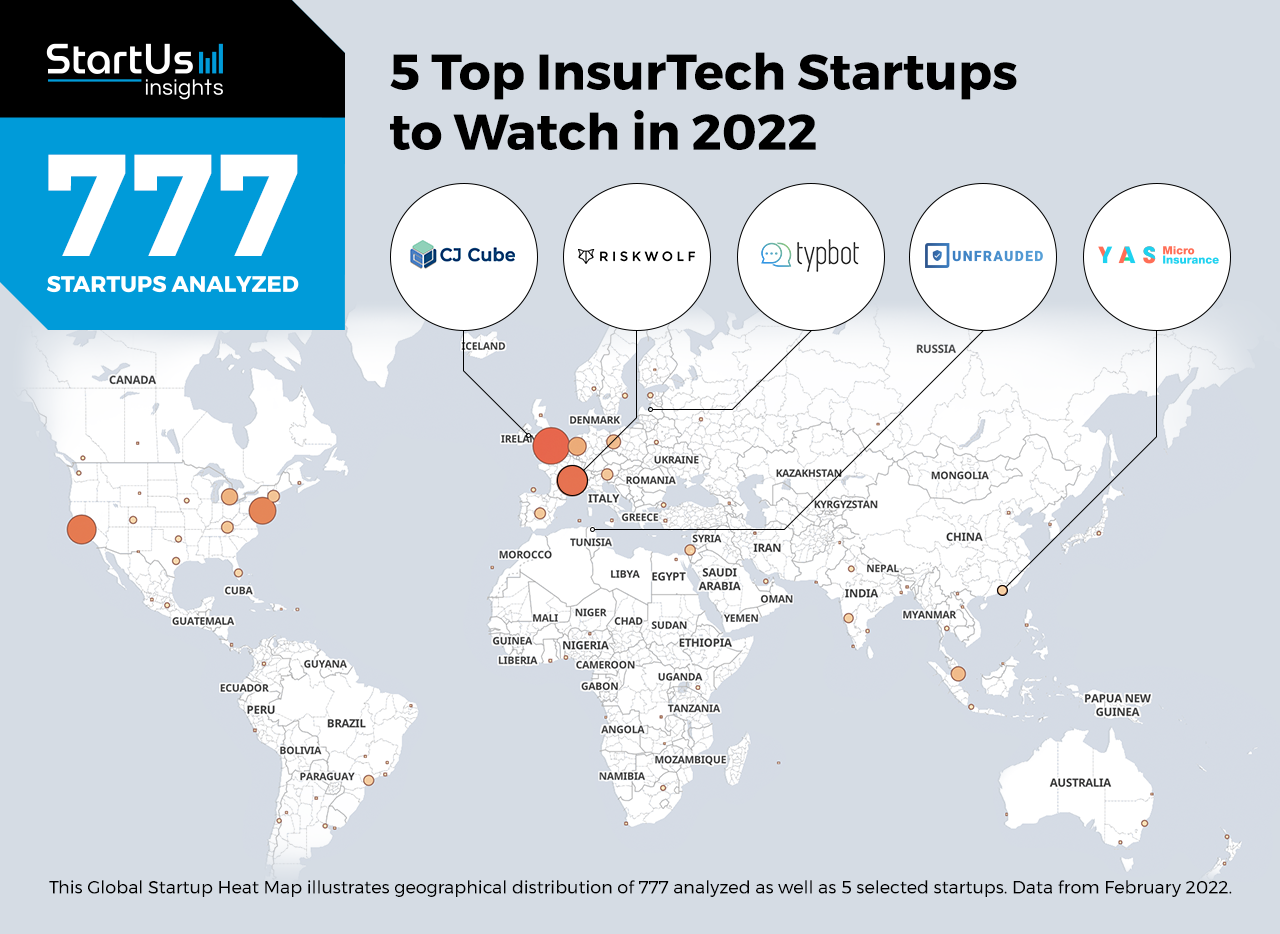

Thousands of new startups are founded every year – emerging companies with the potential to disrupt the InsurTech industry. To give you a head-start on emerging technologies and startups that will impact the InsurTech sector in 2022, we analyzed a total of 777 global InsurTech startups & scaleups. Meet 5 of the most promising startups to watch!

Global Startup Heat Map highlights 5 InsurTech Startups to Watch in 2022

Out of 777, the 5 InsurTech startups to watch are chosen through the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering over 2 093 000+ startups & scaleups globally. As the world’s largest resource for data on emerging companies, the SaaS platform enables you to scout relevant startups, emerging technologies & future industry trends quickly & exhaustively.

The Global Startup Heat Map below highlights the 5 InsurTech startups you should watch in 2022 as well as the geo-distribution of the other 772 startups & scaleups we analyzed for this research. We hand-picked the 5 highlighted InsurTech startups based on our data-driven startup scouting approach, taking into account factors such as location, founding year, the relevance of technology, and funding, among others.

YAS facilitates Decentralized Microinsurance

Founding Year: 2019

Founding Year: 2019

Location: Hong Kong

Partner for: Vehicle Insurance, Travel Insurance

YAS is a Hong Kong-based startup that provides decentralized microinsurance. It offers policies via mobile apps for different types of rides. It covers loss of personal belongings and medical expenses, including death and disablement due to traffic accidents. Apart from medical expenses, BYKE covers bike repairs as well as thefts. However, HYKE mainly focuses on medical coverage as hikers often face unexpected wildlife encounters, which could be fatal, heat strokes because of hiking in the sun, or twisted ankles due to excessive walking. Thus, YAS enables public transport passengers, car and bike owners, hikers, and runners to insure their journeys.

Riskwolf provides Network Connectivity Insurance

Founding Year: 2019

Founding Year: 2019

Location: Zurich, Switzerland

Partner for: Parametric Payouts

Swiss startup Riskwolf offers network connectivity insurance with parametric payouts. This prevents loss of income from internet disruptions due to bad weather, natural disasters, or accidental cable cuts. Riskwolf enables telecommunication, internet service, e-commerce, and other digital platform providers to raise real-time insurance claims by detecting connectivity problems and automating the payment process.

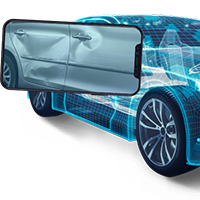

Unfrauded enables Insurance Fraud Detection

Founding Year: 2019

Founding Year: 2019

Location: Ariana, Tunisia

Partner for: False Claims Identification

Unfrauded is a Tunisian startup that offers an artificial intelligence (AI)-powered tool for car insurance fraud detection. It uses deep learning models to assess the damage to a vehicle based on a set of images. By scanning each claim for fraud based on a variety of business rules, it identifies patterns undetectable by humans and enables false claims identification. Unfrauded also checks the links between parties involved in a claim to detect hidden patterns, thus exposing fraud networks. Additionally, the solution estimates repair costs based on market prices along with the number of labor hours required for the same.

CJ Cube offers Insurance Data Management

Founding Year: 2019

Founding Year: 2019

Location: Dublin, Ireland

Partner for: Insurance Underwriting

Irish startup CJ Cube facilitates centralized insurance data management. Its software solution, Cymphony Cube, integrates with the insurance company’s existing storage systems, thus aligning data between the company and the intermediaries. It allows real-time information sharing across systems throughout the policy cycle. Its built-in authorization and authentication features ensure that only the concerned parties have access to the documents, thus establishing security. Moreover, to enable transparency in the process, the solution provides immutable historical snapshots and audit logs.

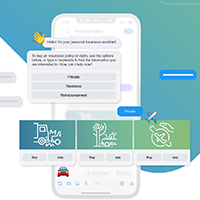

Typbot develops an Insurance Chatbot

Founding Year: 2019

Founding Year: 2019

Location: Riga, Latvia

Partner for: Automated Insurance

Typbot is a Latvian startup that builds a chatbot platform for insurance companies. It allows customers to purchase insurance products or raise a claim any time through chat. It streamlines the application process by collecting the customer’s social and sharing the invoice and payment URL. Moreover, it gathers customer information from previous interactions and automatically sends reminders about renewals without asking for the same personal data all over again. It enables insurance companies to upsell related insurance services or offer upgrades as well as improve security.

Discover All Emerging Mixed Reality Startups

The 700+ mixed reality startups showcased in this report are only a small sample of all startups we identified through our data-driven startup scouting approach. Download our free Industry Innovation Reports for a broad overview of the industry or get in touch for quick & exhaustive research on the latest technologies and emerging solutions that will impact your company in 2022!