Our Innovation Analysts recently looked into emerging technologies and up-and-coming startups working on innovative solutions for the fintech sector. As there is a large number of startups working on a wide variety of solutions, we want to share our insights with you. This time, you will discover 5 promising cryptocurrency startups.

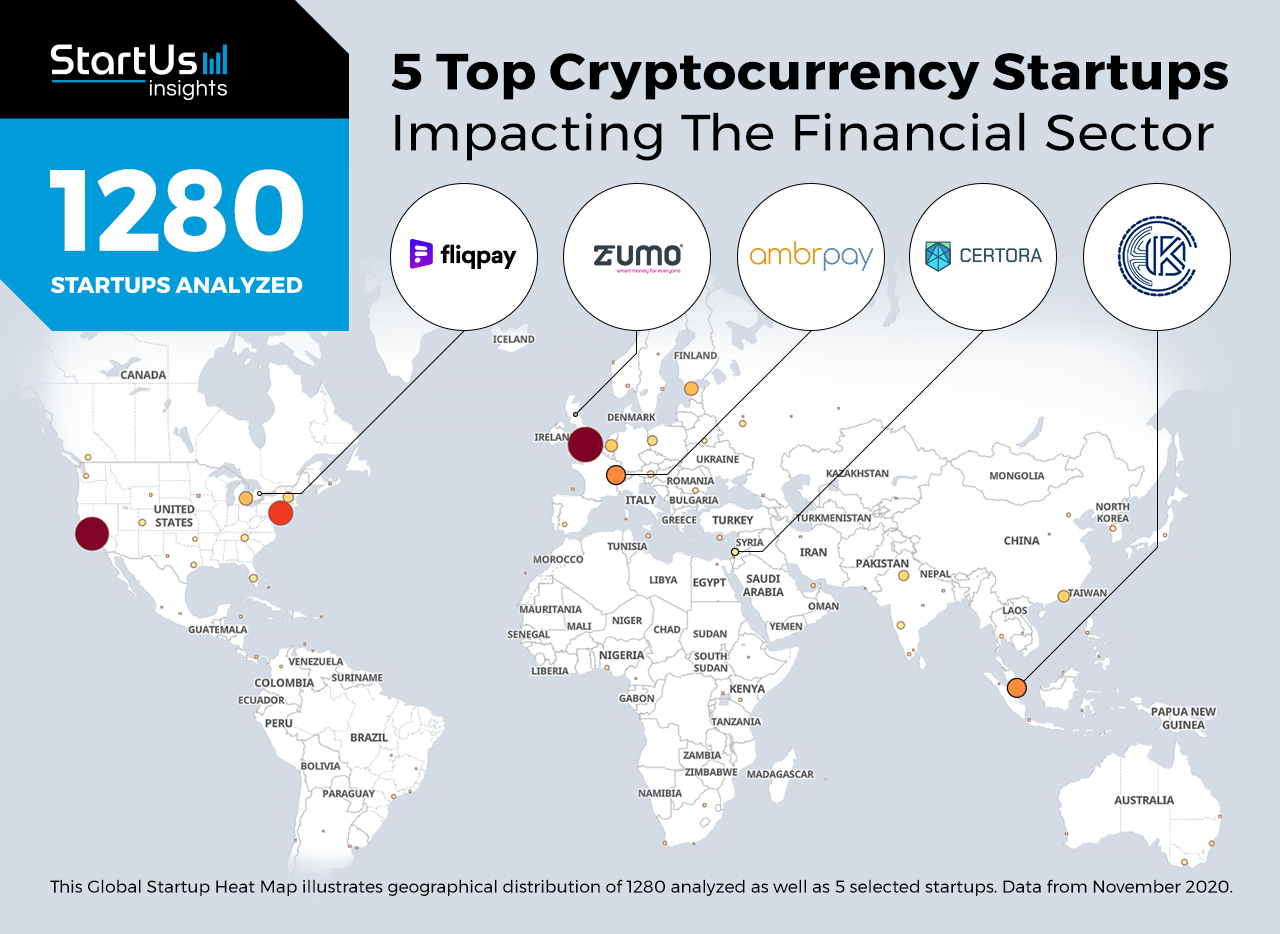

Heat Map: 5 Top Cryptocurrency Startups

Using our StartUs Insights Discovery Platform, covering 1.379.000+ startups & scaleups globally, we looked at innovation in the field of finance. For this research, we identified 1.280 relevant solutions and picked 5 to showcase below. These companies were chosen based on a data-driven startup scouting approach, taking into account factors such as location, founding year, and relevance of technology, among others. Depending on your specific criteria, the top picks might look entirely different.

The Global Startup Heat Map below highlights 5 startups & scaleups developing innovative cryptocurrency solutions. Moreover, the Heat Map reveals regions that observe a high startup activity and illustrates the geographic distribution of all 1.280 companies we analyzed for this specific topic.

Kozjin – Digital Banking

Cryptocurrencies use Blockchain technology to enable secure and tamper-proof transactions. Startups are developing cryptocurrency-based solutions as an alternative to traditional banking. Increasingly, even established banks and financial institutions are opening up to cryptocurrencies. Digital banking products enable the decentralized exchange of cryptocurrencies and other digital assets.

Kozjin is a Malaysian startup that offers a cryptocurrency for digital banking. The startup’s platform connects Kozjin crypto tokens with real estate, enabling property dealings in cryptocurrency. The startup’s mobile app enables the buying, selling, and conversion of crypto assets into multiple currencies. The solution meets the need for everyday banking while providing the security of Blockchain.

Fliqpay – Cross-Border Payments

Cross-border payments suffer from a lack of transparency due to a lack of standardization among banks across the world. These also include transaction costs owing to bank fees on both ends, as well as foreign exchange rates. The transaction speed is generally also low, with each transaction taking a few days. Blockchain-enabled cryptocurrencies address these challenges for instant, global peer-to-peer (P2P) transactions.

Canadian startup Fliqpay develops a cross-border payment infrastructure. The startup’s platform enables global businesses to make payments in cryptocurrency and receive it in their local currency. Fliqpay’s platform also allows sending money to bank accounts, mobile money accounts, and cryptocurrency wallets internationally. The solution provides an easy-to-use payment experience for crypto users and eliminates challenges involving price volatility.

Zumo – Smart Wallet

As consumers trade in both cryptocurrencies and traditional money, there is a need for smart wallet solutions. Smart wallets offer secure storage for payment information and password for cryptocurrencies, as well as associated bank accounts. This enables the use of cryptocurrencies just like fiat money, with credit and debit cards as well as online banking to promote a cashless economy.

Zumo is a British startup that provides a smart wallet for easy transactions of digital assets. The Blockchain-enabled smart wallet allows users to buy, store, transfer, and spend both cryptocurrencies and other currencies. The startup also plans to introduce a convertible debit card to facilitate spending cryptocurrency like traditional money. Zumo’s solution does not charge for P2P payments and charges a standard 0.5 % fee for exchanges.

Ambrpay – Subscription Payments

Subscription or recurring payments are typically difficult to combine with cryptocurrencies. This is because they are generally designed for single-use, where the user needs to initiate a transaction. Moreover, renewal or price raise of subscriptions needs fresh permissions, unlike traditional banking where it happens automatically. As cryptocurrencies grow in popularity, fintech startups are working on solutions that enable businesses to receive subscription payments in cryptocurrencies.

Swiss startup Ambrpay develops a solution to enable subscription payments in cryptocurrencies. The payments gateway allows users to make recurring Ethereum transactions to a specific address. The solution works for both custom and fixed models, with payments in crypto or fiat. Ambrpay’s solution is easy to integrate and serves the need of software-as-a-service (SaaS) subscriptions, as well as donations.

Certora – Smart Contracts

Blockchain is disrupting how individuals and businesses sign contracts with the introduction of highly secure smart contracts. The self-executing and self-enforcing contracts use data and explicit terms and conditions to drive both fiat and cryptocurrency transactions. A smart contract ensures complete transparency and clear communication for all parties involved. By eliminating the need to process documents manually, smart contracts also help speed up transactions.

Certora is an Israeli startup that offers a Blockchain security platform. The startup’s Prover technology is a Blockchain-independent and language-agnostic solution for cryptocurrency-based smart contracts. The tool integrates with existing compilers and debuggers for smart contracts. Further, the platform verifies the adherence of contracts to identify any bugs in smart contracts.

What About The Other 1.275 Solutions?

While we believe data is key to creating insights it can be easy to be overwhelmed by it. Our ambition is to create a comprehensive overview and provide actionable innovation intelligence and enable you to achieve your goals faster. The 5 cryptocurrency startups showcased above are promising examples out of the 1.280 we analyzed for this article. To identify the most relevant solutions based on your specific criteria, get in touch.