Accelerate Productivity in 2025

Reignite Growth Despite the Global Slowdown

Our Innovation Analysts recently looked into emerging technologies and up-and-coming startups working on solutions for the financial services sector. As there is a large number of startups working on a wide variety of solutions, we want to share our insights with you. This time, we are taking a look at 5 promising digital payment solutions.

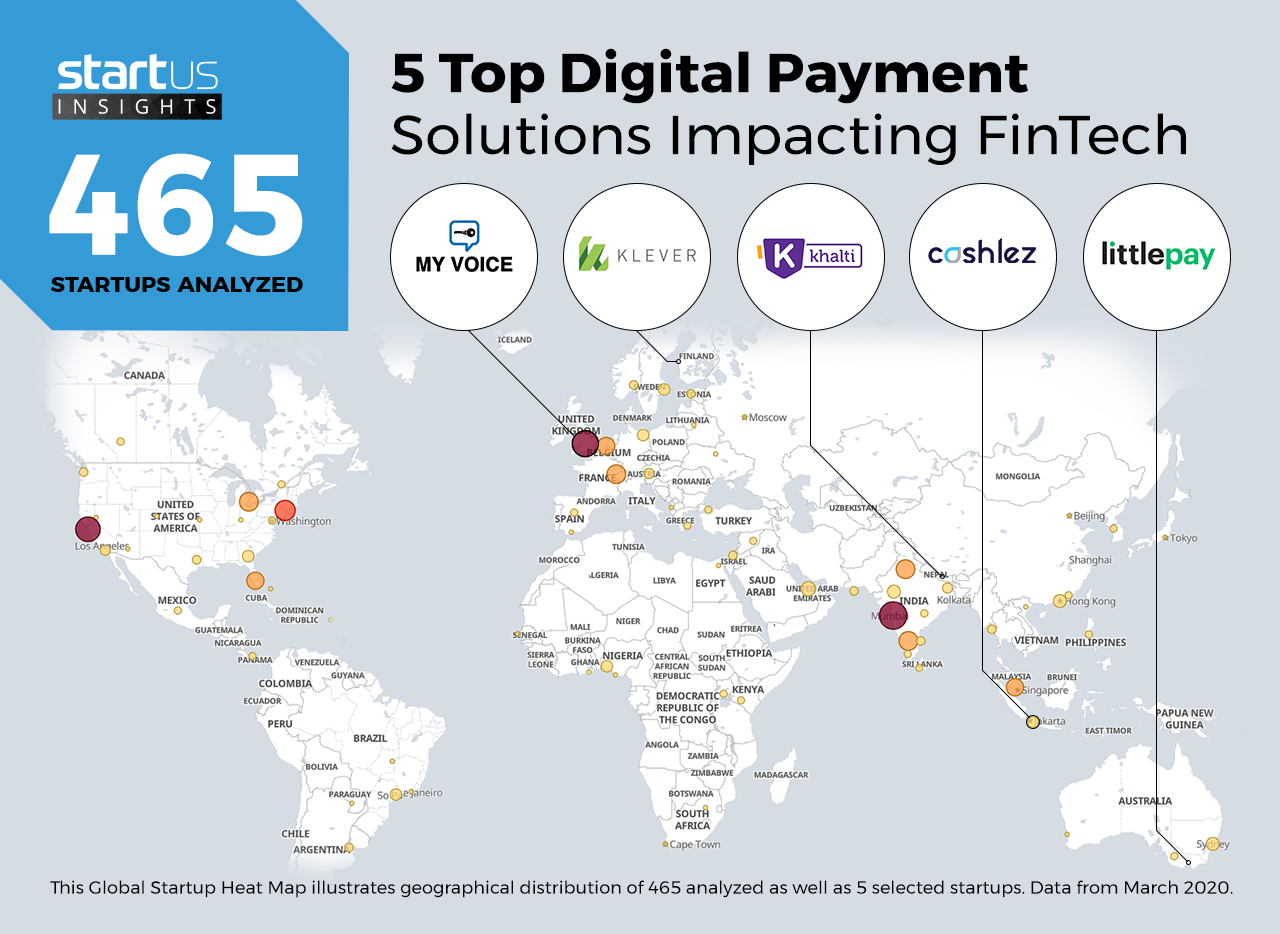

Heat Map: 5 Top Digital Payment Solutions

For our 5 top picks, we used a data-driven startup scouting approach to identify the most relevant solutions globally. The Global Startup Heat Map below highlights 5 interesting examples out of 465 relevant solutions. Depending on your specific needs, your top picks might look entirely different.

My Voice – Voice Payments

These days, financial companies, banks, and eCommerce strive to bring more personalization to their clients. Since a lot of tech-savvy consumers actively use popular virtual assistants such as Alexa, Google Home, or Siri, FinTech startups strive to offer similar services. Startups combine voice recognition, language processing, and machine learning algorithms to enable voice-mediated payments and provide an additional layer of security for authentication.

The UK-based startup My Voice utilizes machine learning, speaker identification, sentiment analysis, and emotion detection to activate advanced voice commands. One of the company’s solutions authorizes digital in-vehicle voice payments. This not only secures transactions but also allows users to drive and manage financial operations at the same time.

Klever – Digital Invoicing

Digital invoicing, also known as e-invoicing, radically transforms the area of Business-to-Consumer (B2C) and Business-to-Business (B2B) transactions. These solutions use intelligent accounting and invoice automation systems, combined with electronic signatures. They enable companies to digitize their bills, accounts, and receivables management procedures. In turn, it minimizes paperwork, saves time, and lowers costs.

Finland-based startup Klever provides an all-in-one mobile invoicing platform to decrease paper bills turnover. The solution organizes all bills, invoices, and other important documents in a single app. Further, it also grants secure access for transactions, sends reminders, and supports different payment options.

Khalti – Digital Wallets

Digital wallets replicate the structure and function of traditional physical wallets but mainly focus on the sphere of online and eCommerce transactions. Available as intuitive mobile applications, digital wallets maintain a person’s credit, debit, and loyalty cards, and banking accounts. Also, they ease contactless payments for scenarios such as paying bills, booking tickets and transferring money online between users.

Nepal-based startup Khalti creates a digital wallet and payment gateway application for the everyday needs of individuals and businesses. After a simple registration process, users access a secure FinTech environment. The environment provides services such as instant money transfer, mobile phone top-up, as well as payments for bills, tickets, taxis, hotels, and events.

Cashlez – Mobile-Point-Of-Sale (mPOS)

Mobile-Point-of-Sale aims at facilitating the transition from rigid location-based brick-and-mortar shopping environments to flexible mPOS-based purchasing experiences. The trend mainly targets small and medium businesses but applies to larger companies as well. One of the main benefits of mPOS technology is that it eliminates the need for central checkout areas and empowers location-agnostic payments.

Indonesian startup Cashlez offers Cashlez One, a comprehensive mPOS product for merchants and small business owners. The cloud-based POS system aggregates various digital payment sources and grants multi-platform location-independent access to streamline transactions and sales.

Littlepay – Contactless Payments

Conventional card payments require inserting a card in POS terminals or using chip & swipe readers. Contactless methods allow just tapping a card or waving the mobile to execute payments, thus, saving a lot of waiting and processing time. Besides, thanks to near-field communication (NFC) technology and enhanced security, contactless payments instantly handle encrypted data transfer.

Australian startup Littlepay develops a convenient, flexible, scalable, and secure digital payment platform for the transportation sector. It is easily deployable in buses, trams, or trains. Mediated by risk management algorithms, the solution smooths the path for multichannel consumer payments – via tap-on card, mobile phone, or wearables.

What About The Other 460 Solutions?

While we believe data is key to creating insights it can be easy to be overwhelmed by it. Our ambition is to create a comprehensive overview and provide actionable innovation intelligence for your Proof of Concept (PoC), partnership, or investment targets. The 5 digital payment solutions showcased above are promising examples out of 465 we analyzed for this article. To identify the most relevant solutions based on your specific criteria and collaboration strategy, get in touch.