Our Innovation Analysts recently looked into emerging technologies and up-and-coming startups working on innovative solutions for the FinTech sector. As there is a large number of startups working on a wide variety of solutions, we want to share our insights with you. This time, we are taking a look at 5 promising digital banking startups.

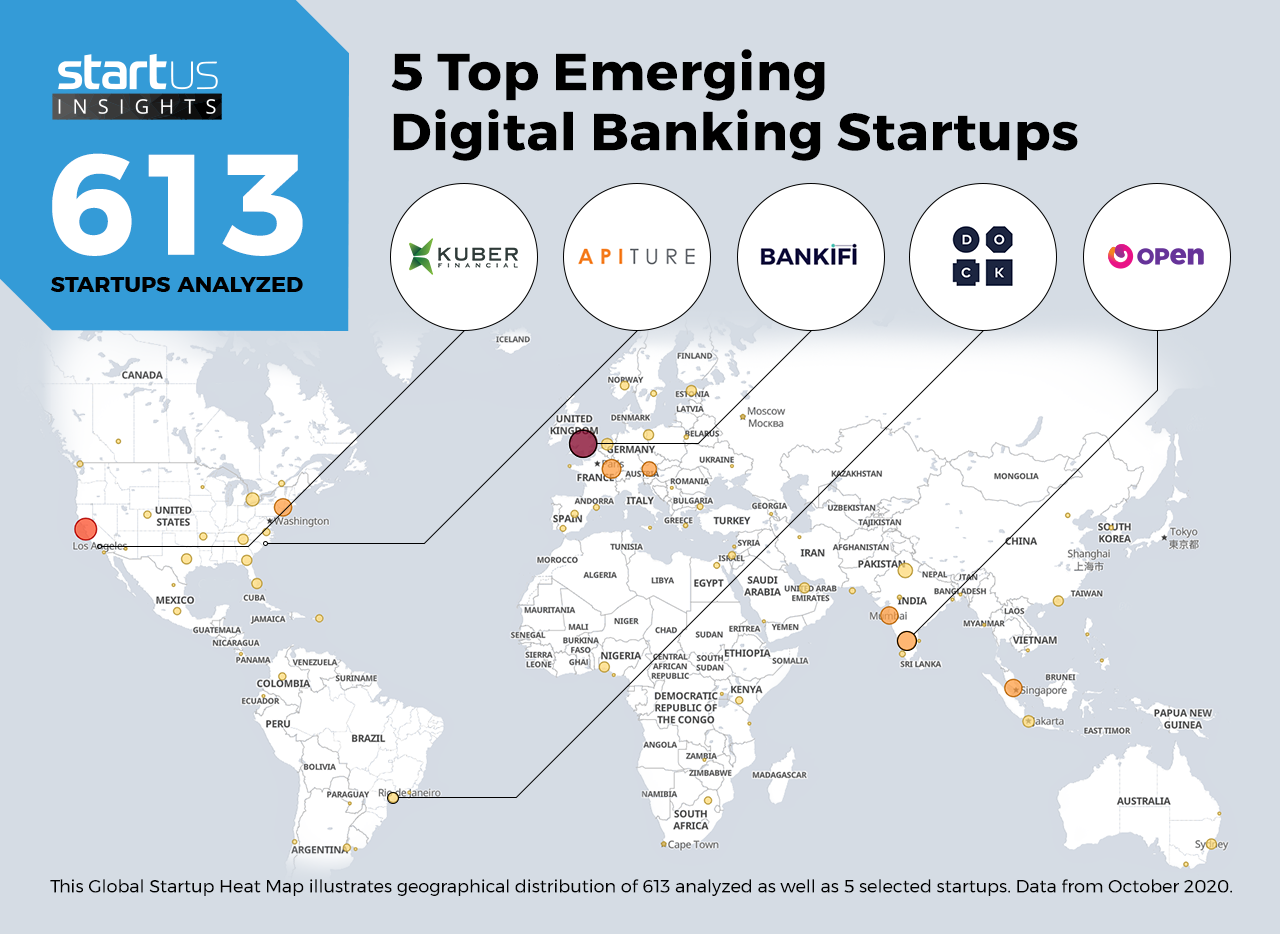

Heat Map: 5 Top Digital Banking Startups

Using our StartUs Insights Discovery Platform, covering 1.379.000+ startups & scaleups globally, we looked at innovation in the field of financial technology. For this research, we identified 613 relevant solutions and picked 5 to showcase below. These companies were chosen based on a data-driven startup scouting approach, taking into account factors such as location, founding year, and relevance of technology, among others. Depending on your specific criteria, the top picks might look entirely different.

The Global Startup Heat Map below highlights 5 startups & scaleups developing digital banking solutions. Moreover, the Heat Map reveals regions that observe a high startup activity and illustrates the geographic distribution of all 613 companies we analyzed for this specific topic.

Dock – Banking-as-a-Service (BaaS)

In the digital age, banks search for new ways to offer value propositions and generate new revenue streams. One of them is BaaS, which allows banks to license their digital banking services to third-party non-banking entities and integrate them into their products for fees, charges, or revenue sharing. Startups develop BaaS solutions to stimulate more collaboration between banking and non-banking institutions.

Brazil-based startup Dock offers a white-label banking-as-a-service platform for business-to-business (B2B) & business-to-consumer (B2C) markets in e-commerce, manufacturing, and fintech, among others. Using its dedicated application programming interface (API), Dock empowers non-banking enterprises to start their own banking product. The startup also offers a branded card. mobile, or web applications to kick-start financial products.

Bankifi – Banking-as-a-Platform (BaaP)

BaaP focuses on other financial service providers that enable banks to integrate their services under one bank account. This further helps financial institutions diversify a bank’s product offering. Emerging companies elaborate on new BaaP tools to encourage deeper cooperation between financial companies.

British startup Bankifi creates a consent-centric platform that enables banks to extend their unique selling points with additional fintech services, such as invoicing, accounting, cash management, and peer-to-peer (P2P) settlements. Bankifi’s platform utilizes a public or private cloud and also aims to bring banking institutions into the umbrella platforms of trusted third-party providers (TPP).

Kuber Financial – Lending-as-a-Service (LaaS)

Lending-as-a-service, or marketplace lending, offers a new technology-driven way for lenders and borrowers to meet outside of the traditional banking environment. Similar to banking-as-a-service, LaaS also empowers mostly non-financial enterprises to launch their own lending services within the regular list of sales offerings. Startups and innovative companies offer LaaS tools to revolutionize and widen conventional lending channels.

The US-based Kuber Financial develops a complete lending-as-a-service solution, which includes an end-to-end lending back-office engine, high-end analytics, and portfolio management suite. Kuber Financial allows companies to decrease the lending service setup and test-related development costs.

Apiture – Cloud-Native Banking

Nowadays, a cloud-native approach presents more options for banks to magnify their value proposition. Cloud-native architecture offers greater agility, scalability, and flexibility. This helps banks find opportunities to establish personalized, data-driven customer experiences and streamline compliance reporting. Startups and emerging companies intend to mitigate banks’ difficulties in establishing or moving into cloud-native systems.

The US-based startup Apiture develops Apiture Xpress, a cloud-native digital banking solution for credit unions and community banks. It possesses the features of mobile and business banking, P2P payments, data insights, and targeted marketing. In addition, Apiture Xpress also delivers a multi-channel client experience across tablets, Apple Watch, and Alexa.

Open – Neobanking

Spurred by consumer proximity trends, personalized marketing, and location-agnostic thinking, the neobanking phenomenon is receiving a lot of attention. Neobanks move beyond traditional physical branch networks to deliver internet-only digital banking experiences. Startups offer neobanking products to meet the needs of the rising group of, mostly younger, tech-savvy customers.

Indian startup Open strives to simplify banking routines for small & medium enterprises (SMEs), startups, and freelancers. Open combines the features of current account management, regular payments execution, payout management, and smart business cards, among others. Further, there is no need to visit a physical bank.

What About The Other 608 Solutions?

While we believe data is key to creating insights it can be easy to be overwhelmed by it. Our ambition is to create a comprehensive overview and provide actionable innovation intelligence and enable you to achieve your goals faster. The 5 digital banking startups showcased above are promising examples out of 613 we analyzed for this article. To identify the most relevant solutions based on your specific criteria, get in touch.