Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover 5 hand-picked startups developing automated underwriting solutions.

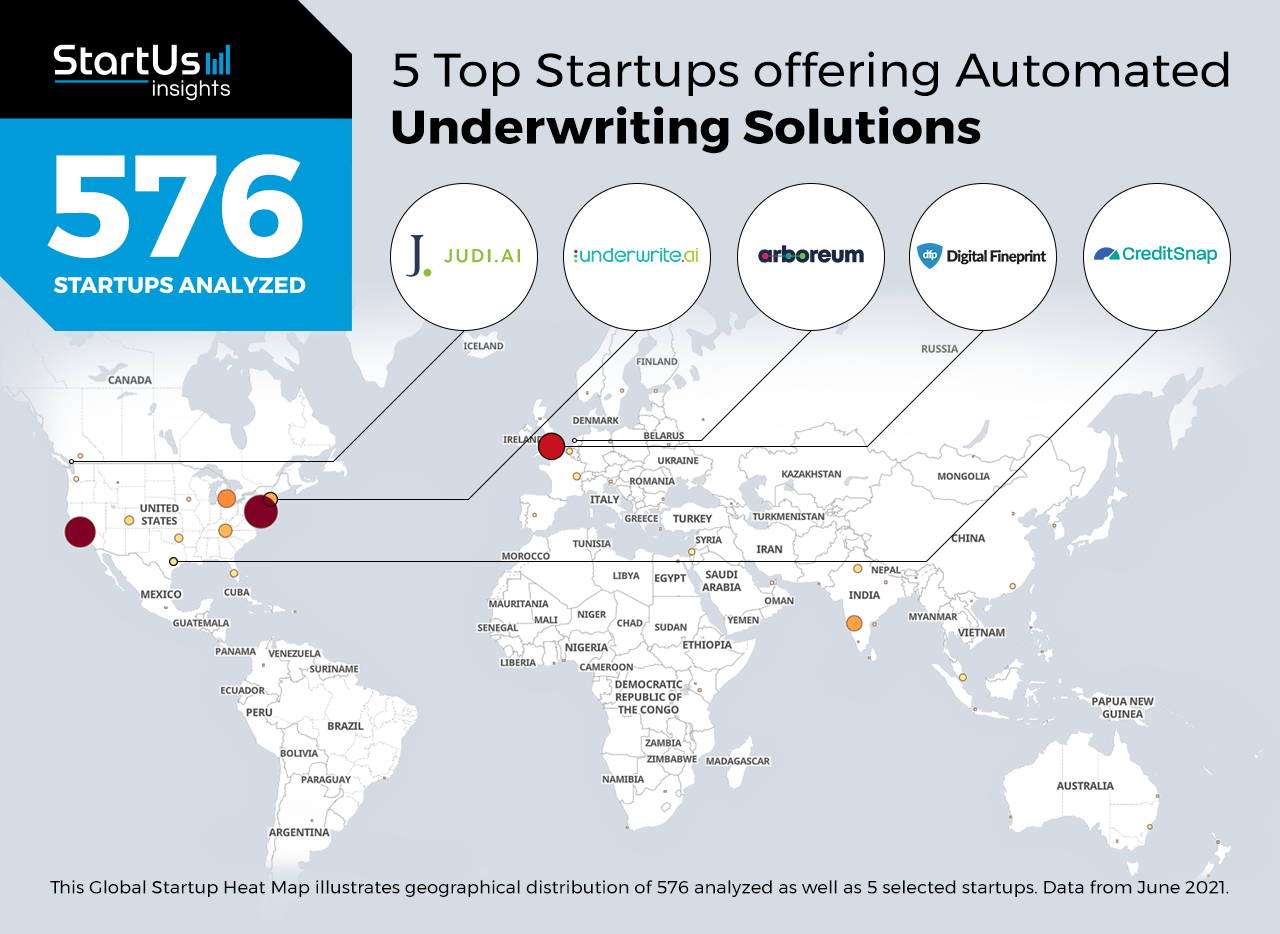

Global Startup Heat Map highlights 5 Top Automated Underwriting Solutions out of 576

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence-powered StartUs Insights Discovery Platform, covering 2.093.000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 576 exemplary startups & scaleups we analyzed for this research. Further, it highlights 5 FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these 5 startups & scaleups in this report. For insights on the other 571 automated underwriting solutions, get in touch.

JUDI.AI offers Automated Underwriting

Manual underwriting is a costly and time-consuming process. It is also prone to errors, often causing losses to lending institutions in the form of unpaid loans. FinTech startups are turning to technology-driven solutions to automate the underwriting process. Such solutions leverage advanced analytics and artificial intelligence to improve productivity and reduce the risk of loan defaults.

Canadian startup JUDI.AI develops a lending analytics platform. The startup’s AI-based platform improves revenues from loans while maintaining risk tolerance levels. It analyzes multiple datasets, such as business data, credit bureau results, and know-your-customer (KYC) information, to achieve more robust profitability of default percentage. Moreover, it integrates with relationship management systems to streamline loan applications and data flow for credit managers.

Digital Fineprint provides Small to Medium Enterprise (SME) Underwriting

Traditional banks are generally wary of lending to SMEs due to lower margins and higher underwriting costs. To address this, FinTech startups are working on underwriting solutions that gather data on SMEs from various sources. By detecting fraudulent activities early, such solutions allow lenders to distinguish between genuine and dishonest borrowers. This also allows banks to provide cash flows to SMEs through underwriters that specialize in the SME segment.

British startup Digital Fineprint provides SME data insights. The startup’s data sourcing platform delivers deep insights on SMEs to improve the underwriting process. It improves the loss ratio and finds new commercial customers while helping lenders save costs and time. The startup’s solution combines data-driven analytics and human judgment to provide creditors with risk alerts while lending to SMEs.

underwrite.ai develops Credit Risk Assessment Tools

Assessing credit risks is critical for investment bankers, insurers, and lenders. In addition to analyzing the borrower’s capability to pay back, the process also involves setting up the contractual obligations for both parties. Lack of efficient credit bureaus in many regions prevents lenders from effectively determining the lending risk. To make the process more efficient, startups use machine learning models that analyze thousands of data points.

US-based startup underwrite.ai assesses credit risks using biologically-inspired machine learning. It combines insights from genomics and particle physics to enable nonlinear algorithmic modeling of credit risks. The startup analyzes the expertise of underwriters and past performance of the creditors’ loans, as well as public datasets, to quantify the risk. It also provides solutions for predictive analysis of financial assets and automated income verification.

Arboreum enables Peer-to-Peer (P2P) Lending

With the proliferation of mobile wallets and decentralized finance (DeFi), there is a rise in P2P lending solutions. However, as entry barriers to such platforms are lower than to bank loans, there is a high risk of bad players. Therefore, keeping the loan default risk low remains a challenge for P2P lending platforms. FinTech startups are developing solutions that leverage AI and blockchain to bring the benefits of automated underwriting to P2P lending.

Arboreum is a Dutch startup that offers a trust-based lending solution. It builds credit networks of lenders, borrowers, and supporters to create socially-inclusive lending opportunities. The startup’s solution uses a distributed ledger technology (DLT) to lower transaction costs, as well as optimize interest rates and deter defaulting. By formalizing informal lending, it enables the financial inclusion of traditionally marginalized groups.

CreditSnap provides Personal Loans

Many people are unable to receive auto or home financing due to poor credit scores. To help such potential customers, FinTech startups now look at alternative credit data. This involves payment records for utilities and employment records that prove a borrower’s trustworthiness. Moreover, digital underwriting solutions automatically assign applicants to underwriting queues, approve applications, and provide consistency in override decisions.

CreditSnap is a US-based startup providing a digital banking experience for both borrowers and lenders. It offers an omnichannel platform that enables end-to-end journey from opening accounts to receiving loans. The startup’s cloud-based platform helps lenders underwrite loans without disrupting their in-house systems and processes. For borrowers, it delivers instant loan offers for accessing auto and home loans.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on big data, biometrics, blockchain as well as artificial intelligence. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore more financial technologies, simply get in touch to let us look into your areas of interest. For a more general overview, you can download our free FinTech Innovation Report to save your time and improve strategic decision-making.