This Adhesive Market Report 2025 highlights how advancements in self-adhesive materials, polyurethane sealants, and eco-friendly bonding solutions are driving innovation and sustainability in the sector. This report offers a thorough examination of the sector’s development trajectory, innovative inventions, international investment patterns, and the growing impact of startups on the direction of adhesive technology.

Executive Summary: Adhesive Market Report 2025

- Industry Growth Overview: Driven by innovation and smart consolidation efforts, the adhesives sector shows notable growth, with an annual growth rate of 8.95%. The adhesives market will also reach a market size of USD 87.04 billion by 2028.

- Manpower & Employment Growth: The sector has a global workforce of over 733 900 employees, with over 24 300 new hires in the last 12 months, indicating strong workforce growth.

- Patents & Grants: The domain shows a strong commitment to innovation with over 714 700 patents and 750 grants. In terms of patent issuance, the US leads with 169 400+ and China with 120 000+.

- Global Footprint: The top country hubs include the United States, India, the United Kingdom, China, and Germany, while city hubs such as Mumbai, Ahmedabad, Melbourne, Dubai, and Istanbul highlight its widespread activity.

- Investment Landscape: With an average funding round size of USD 36.5 million, the sector has raised over USD 1.96 billion through investments, demonstrating a strong financial environment.

- Top Investors: Prominent investors such as Axalta, U-POL, Stanley Black and Decker, Soudal Group, Avery Dennison, H.B. Fuller, and more have collectively invested around USD 1.96 billion in the sector, showcasing their commitment to advancing the sector through strategic funding.

- Startup Ecosystem: Five innovative startups Mussel Polymers (underwater bonding solution), XLYNX Materials (crosslinker for non-functionalized polymers), INNOCISE (adhesive grippers), AdapTronics (electro-adhesive interfaces), and Lauden Kleer (sustainable construction materials) highlight the sector’s entrepreneurial spirit and global innovation reach.

What data is used to create this adhesive market report?

Based on the data provided by our Discovery Platform, we observe that the adhesive market ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: In the past year, the adhesives sector has produced over 6400 publications which hints at a strong media and research involvement.

- Funding Rounds: The sector shows strong investment activity and growth potential, as seen by statistics on over 1400 funding rounds.

- Manpower: The sector now employs over 733 900 employees worldwide, and in the past year alone, it added over 24 300 new workers.

- Patents: With over 714 700 patents, the domain has a strong emphasis on intellectual property and innovation.

- Grants: With more than 750 grants documented, the sector shows a high level of support for its projects and developments.

- Yearly Global Search Growth: The adhesives sector saw a 1.43% rise in worldwide search activity, a sign of increasing relevance and interest.

Methodology: How We Created This Automation Software Report

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of automation software over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within automation software

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the software automation market.

Explore the Data-driven Adhesive Market Report for 2025

The adhesives market report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The sdhesives market heatmap offers a thorough summary of the ever-changing landscape of the domain.

With 11 800+ companies and 960+ startups, the database shows a vibrant ecosystem. Over the past year, the sector grew by 8.95% due to innovation and international expansion. The field has strong R&D activity, as seen by the more than 714 700 patents and 750+ grants. With employment growth of more than 24 300 over the past year, the workforce currently stands at 733 900+.

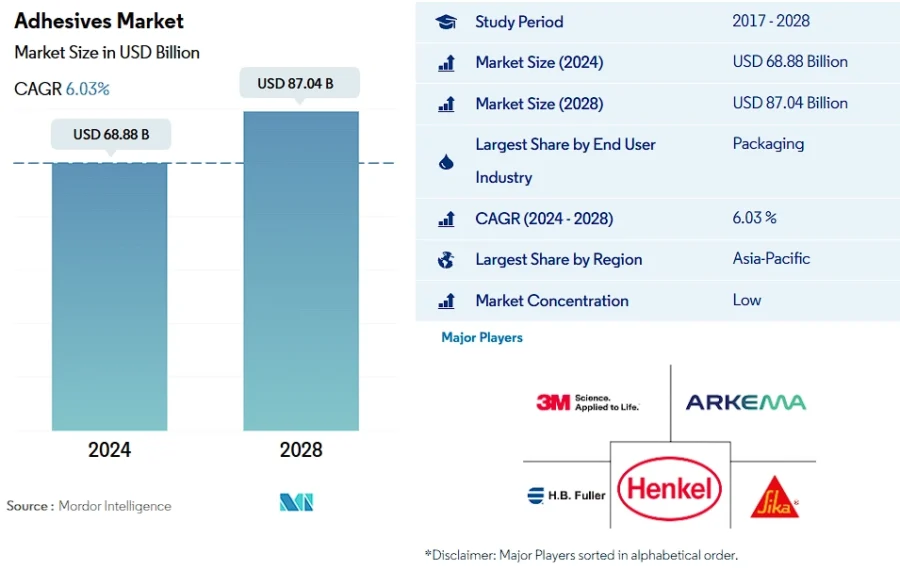

Mordor Intelligence also predicts that the adhesives market will reach a market size of USD 87.04 billion by 2028, with a compound annual growth rate (CAGR) of 6.03% from 2024 to 2028.

Source: Mordor Intelligence

Leading centers in the United States, India, the United Kingdom, China, and Germany serve as the market’s geographic pillars. Important hubs of activity include cities like Mumbai, Ahmedabad, Melbourne, Dubai, and Istanbul. This highlights the adhesives market’s worldwide influence and potential.

The Asia-Pacific region dominates the market with a 36.58% share, driven by high demand in packaging, construction, and automotive industries.

On the other hand, Taiwan News reports that China accounts for nearly 45% of global adhesive production and consumption. This reflects its dominance in manufacturing and export activities.

A Snapshot of the Global Adhesive Market

The adhesive market’s dynamic and changing terrain is reflected in its strong growth and innovation across several parameters. The domain is expanding steadily, with an annual growth rate of 8.95% due to a wide range of both established and up-and-coming companies.

With more than 960 startups, including more than 120 early-stage startups, the sector is a thriving hub for innovation. The field’s substantial consolidation and strategic alliances are indicated by more than 660 mergers and acquisitions (M&A).

With more than 714 700 patents submitted by more than 57200 applicants worldwide, the adhesives sector stands out in terms of intellectual property. It shows a 0.44% annual patent growth rate which highlights continuous innovation.

The global distribution of improvements in the field is demonstrated by patent activity where the United States is the top issuer with 169 400+ patents, followed by China with 120 000+ patents. This information positions the adhesives sector as a key player in the worldwide market by highlighting its dedication to expansion, innovation, and strategic partnerships.

Acrylic-based adhesives represent the largest resin type, accounting for around 23.05% of the market due to their pressure-sensitive applications in healthcare and construction.

Explore the Funding Landscape of the Adhesive Market

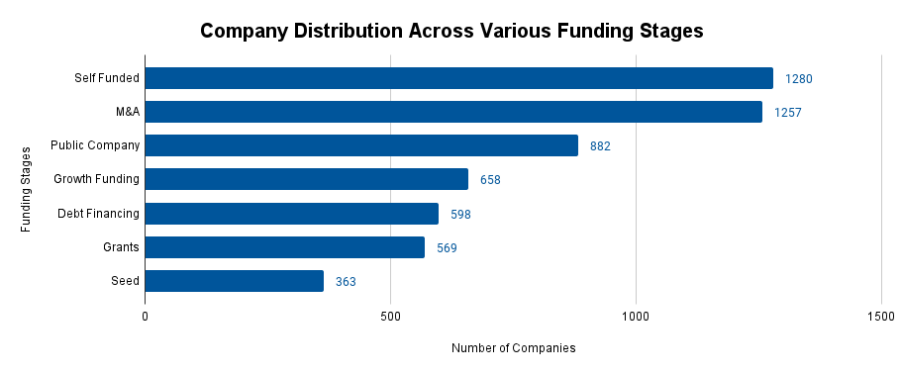

Significant financial activity and investor enthusiasm support the thriving investment environment in the adhesives sector. The high stakes and faith in the sector’s prospects are reflected in the USD 36.5 million average investment value of each round.

With more than 1000 investors actively involved in the market, the sector enjoys a wide range of financial support. With more than 1400 funding rounds completed, the market is vibrant and competitive for both new and existing businesses. Additionally, investments have been made in more than 500 startups, highlighting the sector’s widespread popularity and prospects for growth and innovation.

This thriving investment environment demonstrates the adhesive sector’s ability to draw large sums of money, driving innovations and promoting expansion throughout the market.

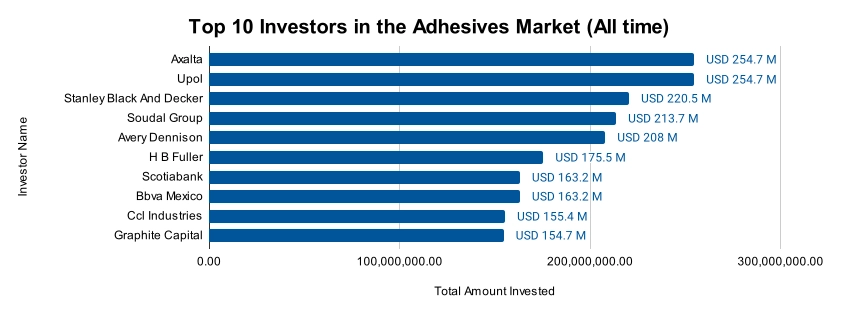

Who is Investing in the Adhesive Market?

Leading investors have made substantial contributions to the adhesives sector, totaling over USD 1.96 billion. The top investors, their investment values, and the number of companies they have backed are broken down below:

- Axalta invested USD 254.7 million in at least 1 company. Further, Axalta announced that it is acquiring The CoverFlexx Group from Transtar Holding Company for an initial cash consideration of USD 285 million.

- U-POL invested USD 254.7 million in at least 1 company.

- Stanley Black and Decker invested USD 220.5 million in at least 1 company. The company also invested USD 234 million for a 20% stake in MTD Products.

- Soudal Group invested USD 213.7 million in 2 companies. In 2023 alone, the company invested USD 96.31 million.

- Avery Dennison invested USD 208 million in 3 companies. For example, it announced a USD 100 million investment in an RFID plant in Querétaro, Mexico.

- H.B. Fuller invested USD 175.5 million in 4 companies. Another source reports that the company acquired two medical adhesive technology companies for around USD 190 million.

- Scotiabank invested USD 163.2 million in at least 1 company. It made a significant USD 2.8 billion deal for a minority stake in KeyCorp.

- BBVA Mexico invested USD 163.2 million in at least 1 company. It also acquired the remaining 50% stake in Pacman-CCL for USD 102 million.

- CCL Industries invested USD 155.4 million in at least 1 company.

- Graphite Capital invested USD 154.7 million in at least 1 company. It also sold U-POL to Axalta for approximately USD 536 million.

Top Adhesive Innovations & Trends

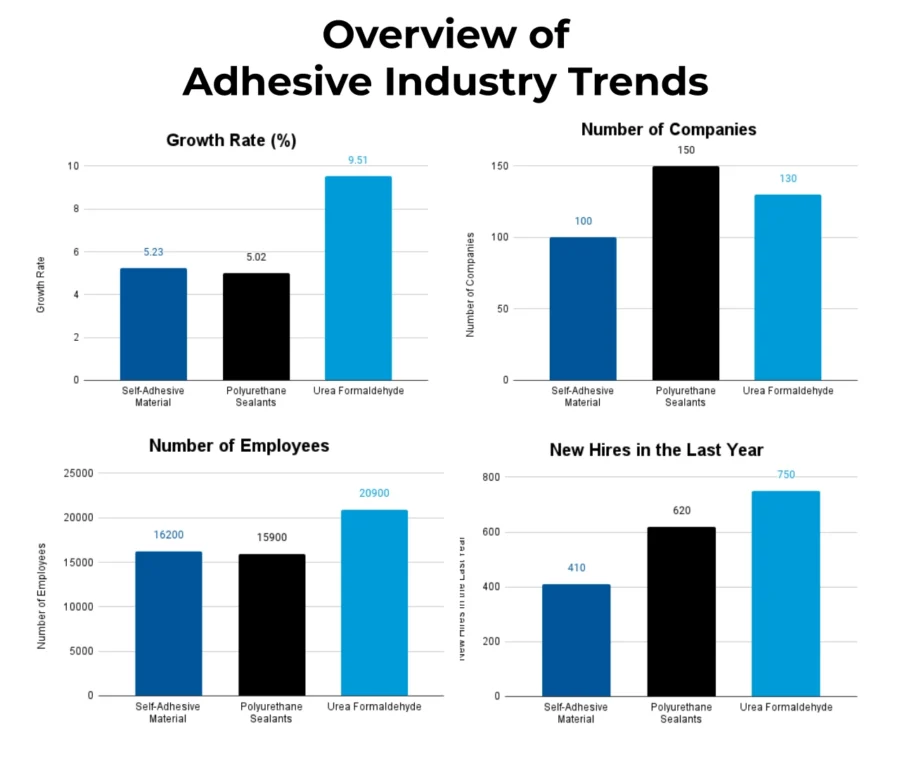

Due to market demand and technology breakthroughs, the adhesives sector is expanding significantly in several important categories. Below is the firmographic data for three trends within the sector:

- The Self-Adhesive Materials segment has over 100 companies and a workforce of 16200+ employees. It has added 410+ new employees in the last year, reflecting steady workforce expansion. The segment’s annual trend growth rate of 5.23% highlights its consistent development and adoption in various applications.

- Polyurethane Sealants domain comprises 150+ companies and employs 15 900+ people. With 620+ new employees hired in the past year and an annual trend growth rate of 5.02%, this segment is capitalizing on the growing demand for durable and versatile sealant solutions.

- The Urea Formaldehyde segment stands out with 130+ companies and a workforce of 20 900+ employees. The addition of 750+ new employees in the last year reflects its dynamic growth. Notably, this segment saw an annual trend growth rate of 9.51% which highlights its rapid expansion and critical role in adhesive innovation.

5 Top Examples from 960+ Innovative Adhesive Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Mussel creates Polymers Underwater Bonding Solution

US-based startup Mussel Polymers makes underwater bonding solutions that are inspired by the inherent adhesive qualities of mussels. Its technology uses strengthened carbon and aramid fibers to provide strong and long-lasting adhesion in damp situations, such as in the human mouth and underwater.

The startup’s adhesives improve the functionality of current systems and provide a wide range of applications in industries like electronics, dentistry, defense, and coral restoration. It also offers SeaTak, a mussel-inspired underwater adhesive for durable, non-toxic coral reef restoration and challenging aquatic applications.

Additionally, Mussel Polymers offers solutions for crucial use cases by resolving adhesion issues in water-laden environments to enable dependable, effective, and lasting bonding.

XLYNX Materials offers Crosslinker for Non-functionalized Polymers

Canadian startup XLYNX Materials creates diazirine-based crosslinkers for non-functionalized polymers that enable bonding, stabilization, and strengthening of low-surface-energy plastics such as polyethylene and polypropylene. Its products, such as BondLynx and PlastiLynx, facilitate the formation of covalent bonds between polymer chains.

BondLynx is a bis-diazirine crosslinker that forms strong covalent bonds with low surface energy polymers, ideal for electronics, textiles, and composite applications. PlastiLynx is a PFAS-free polyolefin primer using diazirine chemistry to enhance adhesion with adhesives, coatings, and dyes. It uses diazirine chemistry to produce highly reactive carbene intermediates when heated or exposed to UV light.

In addition to improving mechanical qualities and adherence to adhesives, coatings, and dyes, this crosslinking method enables the joining of different substrates such as HDPE and polypropylene. Moreover, XLYNX Materials provides beneficial solutions for advanced material design and manufacturing by advancing polymer bonding and functionalization.

INNOCISE creates Adhesive Grippers

German startup INNOCISE develops adhesive grippers based on its Gecomer technology, inspired by the natural adhesion mechanism of gecko feet. The method uses van der Waals forces to provide safe, transient adhesion to a variety of surfaces using microstructured polymers with millions of tiny hairs. When the microstructures of the grippers come into contact with a surface, the gripping process generates these forces.

By adjusting the contact area using techniques like buckling, sliding, or rotating, controlled release is accomplished. The adaptable architecture makes it possible to adjust to various automation needs while ensuring accurate and effective component handling across sectors. INNOCISE offers a creative and sustainable solution that improves automation flexibility and performance for advanced gripping applications.

AdapTronics makes Electro-Adhesive Interfaces

Italian startup AdapTronics develops electro-adhesive interfaces utilizing its Electro Active Adhesive Layer (EAAL) technology. This technology advances the way robots and automated machines handle objects. The EAAL is made of a flexible printed electronics thin film that uses electrostatics to create adhesive forces. It provides a firm grip on materials that range from hard to soft, dense to porous, planar to curved.

The device has a conformable back structure and AI-driven sensing feedback that identifies the material type, proximity, and other important information while the device is in use. Its plug-and-play design provides flexible and energy-efficient solutions for agritech, industrial automation, and space applications by eliminating the need for magnets, heat dissipation, or pneumatics. AdapTronics also improves dexterity, productivity, and flexibility in a range of operational settings with its advanced gripping capabilities.

Lauden Kleer offers Sustainable Construction Materials

Romanian startup Lauden Kleer offers Kleer polymer solutions for environmentally friendly building materials that advance rural road infrastructure. These specialized styrene-acrylic copolymers, including KleerGrip, KleerTack, KleerPrime, and KleerSeal, stabilize soil, enhance adhesion, and provide improved waterproofing.

KleerGrip ensures strong bonding with non-cohesive materials, KleerTack provides longer adhesion between layers, KleerPrime stabilizes soil for structural integrity, and KleerSeal adds hydrophobic properties for weatherproofing. The technology also creates strong linkages and penetrates non-cohesive materials to create long-lasting, weather-resistant roadways using local stones and gravel while lessening its environmental impact.

Additionally, Lauden Kleer’s solutions cover every stage of construction, from surface sealing to subgrade compaction, guaranteeing effective and economical solutions.

Gain Comprehensive Insights into Adhesive Trends, Startups, or Technologies

Emerging trends drive innovation and sustainability in the adhesive market in 2025. Self-adhesive materials, eco-friendly primers, and crosslinking technologies transform applications in manufacturing, electronics, and construction. The sector embraces sustainable solutions and novel bonding techniques, enabling stakeholders to leverage these trends for market leadership and long-term growth. Get in touch to explore all 960+ startups and scaleups, as well as all market trends impacting 11 800+ companies.