The 2025 Aerospace and Defense Industry Outlook examines how the sector adapts to new technologies, geopolitical dynamics, and sustainability priorities. Expanding defense budgets and commercial aviation recovery presents both opportunities and challenges.

Key trends include autonomous systems, next-generation aircraft, and AI integration for mission-critical decisions. Space exploration and satellite technologies reshape the market with investments in launches, space tourism, and deep-space missions.

Sustainability efforts, such as hydrogen-powered aircraft and lightweight materials, highlight the industry’s environmental focus. The report explores market trends, technological advancements, and investment patterns, providing a forward-looking view of global security, transportation, and space exploration.

Executive Summary: Aerospace and Defense Sector Outlook 2025

- Industry Growth Overview: The aerospace and defense industry grew by 12.5% annually, supported by over 450 startups and more than 6000 companies. This reflects its dynamic expansion and market potential. By 2028, the market is expected to reach USD 1.23 trillion at a CAGR of 5.8%, driven by factors such as military modernization, increased defense spending, and advancements in autonomous systems

- Manpower & Employment Growth: The sector employs 690 000 professionals globally, adding 31 000 employees last year.

- Patents & Grants: Innovation drives the market, with over 90 patents filed and 2600 grants secured. Patent activity grew by 11.68% annually, with China and the USA as leading issuers. In Q3 2024 alone, there were over 11300 patent applications globally, with the United States accounting for 26% of filings.

- Global Footprint: Key hubs include the United States, India, the United Kingdom, Canada, and France. Major cities driving growth include Bangalore, London, New York City, Los Angeles, and Chennai.

- Investment Landscape: With more than 1800 investors and over 2000 funding rounds closed, the industry attracts strong financial support. The average investment is USD 80 million per round.

- Top Investors: Key investors have contributed over USD 4 billion. Leading contributors include Veritas Capital, TransDigm, General Atlantic, and more.

- Startup Ecosystem: Innovative startups such as Wyse Light (coaxial deflectometry), Stratotegic (high-altitude platform stations), LTX (mission planning), Dark Art Composites (carbon fiber components), and Atomus (cyber-infrastructure) shape the sector.

What Data is Used to Create This Aerospace and Defense Report?

Based on the data provided by our Discovery Platform, we observe that the aerospace and defense industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The aerospace and defense industry saw more than 8000 publications recorded in the past year.

- Funding Rounds: The data on over 2000 funding rounds in our database highlights its dynamic funding activity.

- Manpower: Employing more than 690 000 workers and adding over 31 000 new employees last year, the industry shows workforce growth.

- Patents: With over 90 patents filed, it demonstrates strong innovation.

- Grants: The industry has secured more than 2600 grants and has shown consistent investment in research and development initiatives.

- Yearly Global Search Growth: The aerospace and defense topic experiences a yearly global search growth of 4.53%.

Methodology: How We Created This Aerospace and Defense Report

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of automation software over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within aerospace and defense

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the aerospace and defense market.

Explore the Data-driven Aerospace and Defense Market Report for 2025

Did you know that in 2023, the industry in the United States alone generated over USD 955 billion in sales? It also directly supported approximately 1.3 million jobs within its supply chain, highlighting its critical role in the economy.

The Aerospace and Defense Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The sector shows strong activity, supported by over 450 startups and 6000 companies globally. The industry grew by 12.5% last year. Patent filings exceeded 90, with 2600 grants underscoring ongoing innovation.

Research and Markets projects that the global A&D market grew from USD 884 billion in 2023 to USD 985.56 billion in 2024, reflecting an 11.5% CAGR. Over the 2023–2028 period, growth is expected to moderate to a 5.8% CAGR, reaching USD 1234.42 billion by 2028.

Credit: Research and Markets

The sector employs 690 000 professionals worldwide, adding 31 000 new jobs last year. Key hubs include the United States, India, the United Kingdom, Canada, and France. Hiring trends fluctuated, with a 27% drop in Q2 2024. India remains pivotal under programs like “Make in India,” increasing defense manufacturing.

Major cities contributing include Bangalore, London, New York City, Los Angeles, and Chennai. These insights, visualized through a heatmap, highlight concentrated activity and evolving trends within aerospace and defense’s global and regional ecosystems.

A Snapshot of the Global Aerospace and Defense Industry

The aerospace and defense industry grew by 12.5% annually, signaling its dynamic expansion and strong market potential.

It includes over 450 startups globally. Among these, 200 startups are in the early stages, while the industry also has 550 mergers and acquisitions, which reflects consolidation and scaling trends.

Innovation drives the sector, with over 90 patents filed by 15 applicants. Patent growth reached 11.68% annually, showcasing sustained technological advancements. China leads in patent issuance with over 60 filings, followed by the United States with over 10. It highlights these nations’ influence in shaping the industry’s trajectory.

Explore the Funding Landscape of the Aerospace and Defense Industry

The aerospace and defense industry shows strong financial support, with an average investment value of USD 80 million per funding round. It highlights investor confidence in the sector. Over 1800 investors actively participate, contributing to more than 2000 funding rounds.

This financial activity supports the industry’s innovation and growth. Investments have supported over 800 companies, emphasizing a broad distribution of capital across emerging and established firms within the aerospace and defense ecosystem. These funding dynamics reflect the industry’s strategic importance and potential for sustained technological and market advancements.

Who is Investing in the Aerospace and Defense Industry?

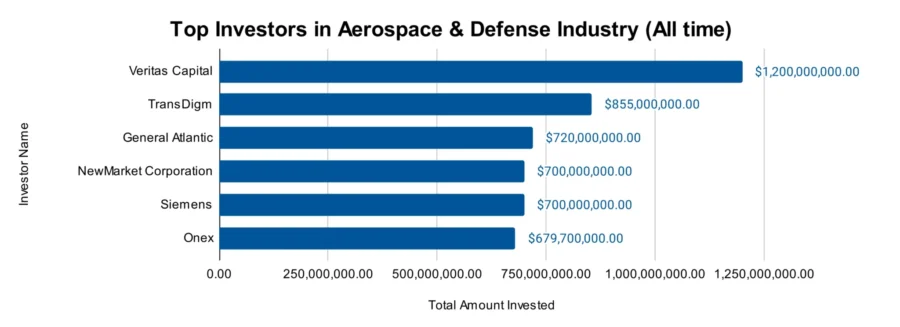

The top investors in the aerospace and defense industry have collectively contributed over USD 4 billion, demonstrating their commitment to innovation and growth.

- Veritas Capital has invested USD 1.2 billion in at least one company.

- TransDigm has supported six companies with investments totaling USD 855 million. Recent acquisitions include Raptor Scientific, SEI Industries, and CPI Electron Device Business.

- General Atlantic invested USD 720 million in at least one company.

- NewMarket Corporation has committed USD 700 million to at least one company.

- Siemens invested USD 700 million across two companies. It invests heavily in industrial software, electrification, and transportation technologies. Recent investments include expanding power transformer production to meet global electrification demand.

- Onex has allocated USD 679.7 million to at least one company.

Access Top Aerospace and Defense Innovations & Trends with the Discovery Platform

The aerospace and defense industry embraces trends driven by technological advancements, sustainability efforts, and a focus on global security initiatives.

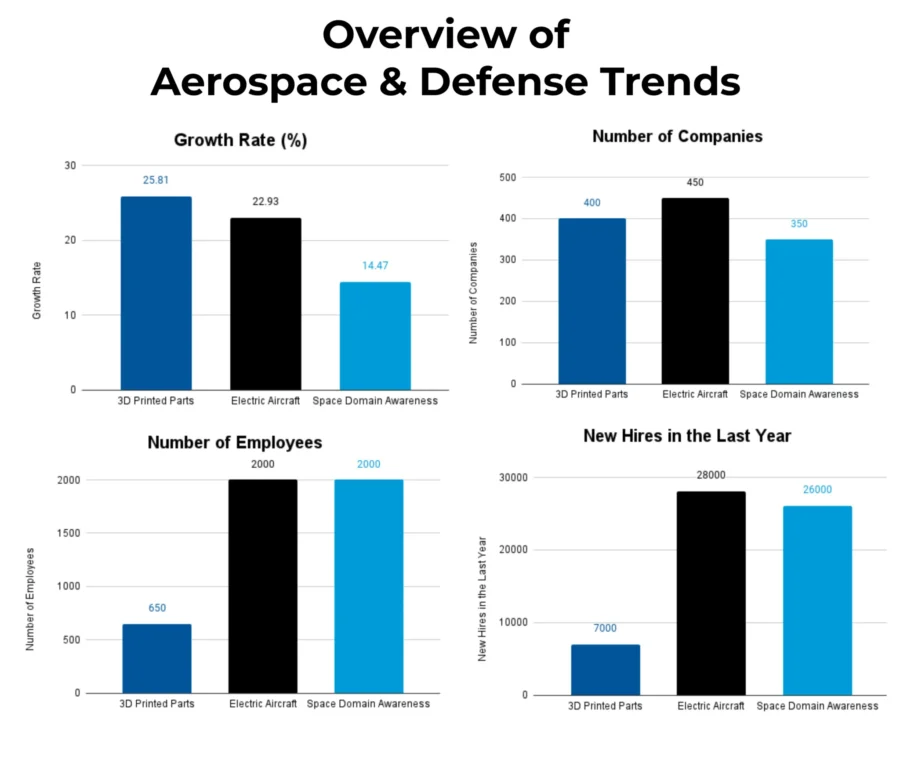

- 3D Printed Parts: Over 400 companies employ more than 7000 professionals in this area, with 650 new employees added last year. It has an annual growth rate of 25.81%, reducing production times and costs, and enabling rapid prototyping and deployment of complex aerospace components.

- Electric Aircraft: This segment includes 450 companies employing over 28 000 individuals, with 2000 new hires last year. Its annual growth rate of 22.93% reflects a focus on sustainable and energy-efficient aviation solutions to address the need for reduced emissions and align with global sustainability goals.

- Space Domain Awareness: Involving 350 companies and employing 26000 people, this area added 2000 employees last year. An annual growth rate of 14.47% highlights its role in enhancing space situational awareness and security to ensure the safe management of assets in orbit as satellite deployments grow.

5 Top Examples from 450+ Innovative Aerospace and Defense Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Wyse Light utilizes Coaxial Deflectometry

French startup Wyse Light develops optical metrology instruments using its patented coaxial deflectometry technology. This method displays reference images on a screen, captures their reflections from the object’s surface with a camera, and processes the data to reconstruct the surface shape.

Unlike traditional interferometry, coaxial deflectometry is insensitive to vibrations, requires no reference surface, and accommodates complex shapes without costly accessories.

The startup’s product, the RayMaster 10, measures various reflective surfaces, including freeform optics, with nanometric precision. Wyse Light makes high-precision optical measurements more accessible across industries such as aerospace, defense, and precision manufacturing.

Stratotegic develops High Altitude Platform Stations (HAPS)

Canadian startup Stratotegic builds Stratotegic Navigation, a flight control system for high-altitude platform stations (HAPS) like stratospheric balloons and airships. This technology integrates onboard command and control, wind modeling, path optimization, and ground control to enhance station-keeping and waypoint following.

It enables precise altitude control, autonomous operations, and reduced power consumption. Stratotegic’s solution supports expanded telecom coverage, enhanced environmental monitoring, and improved disaster response to strengthen commercial and defense capabilities.

LTX enables Mission Planning and Debriefing

Indian startup LTX delivers mission systems for the defense and aerospace sectors. Its mission planning suite integrates terrain data, imagery, sensor inputs, and weather information into a unified common operating picture (COP). This allows planners to design and rehearse flight paths for fixed-wing and rotary-wing aircraft.

The startup specializes in mission visualization, integrating multiple data streams with custom data fusion algorithms, and deploying visualizations on various endpoint platforms. These include onboard flight systems, multi-function displays, immersive 3D powerwalls, simulators, and extended reality devices.

Its mission debriefing suite facilitates time-synchronized playback of MIL-STD-1553 data, GPS, video, and audio, supporting platforms such as Indian long-range missiles, PSLV and GSLV space vehicles, LCA Tejas Mk1A, and IRIG Chapter 10 compliant sources. LTX combines visualization and planning technologies to enhance mission readiness and operational effectiveness.

Dark Art Composites manufactures Carbon Fiber Components

UK startup Dark Art Composites develops lightweight, high-strength composite components for spacecraft, satellites, and ground station applications. It uses composite materials to construct primary functional surfaces, secondary components like brackets and enclosures, and support structures, incorporating built-in heating solutions for de-icing and frost mitigation.

This reduces overall component weight and enables more efficient fuel utilization while providing durability in harsh conditions. Dark Art Composites enhances performance, increases payload capacity, and contributes to mission-critical programs’ success.

Atomus provides Cyber-Infrastructure For Aerospace and Defense

US startup Atomus offers managed security services for the aerospace and defense industries. Its Aegis platform implements, monitors, maintains, and documents cybersecurity measures to automate up to 80% of NIST 800-171 controls and generate compliance artifacts.

The platform facilitates easy onboarding and offers automated documentation, including comprehensive system security plans. Atomus allows organizations to achieve and maintain compliance with NIST 800-171, DFARS 7012, and CMMC requirements to enhance their cybersecurity posture.

Gain Comprehensive Insights into Aerospace and Defense Trends, Startups, or Technologies

The aerospace and defense industry will grow in 2025, driven by advancements in sustainability, digitalization, and space exploration. Trends like 3D printing, electric aircraft, and space domain awareness will shape its path and emphasize innovation and operational efficiency.

Get in touch to explore all 450+ startups and scaleups, as well as all industry trends impacting aerospace & defense companies.