The 2025 Agricultural Machinery & Equipment Market Report provides a detailed analysis of the changing scenario of agricultural technology that is improving farming practices across the globe. The major trends such as agriculture automation, seeding technology, and agricultural robotics are enabling more resource-efficient farming.

This farm machinery and equipment market report offers insights into how the market is creating new business models, and addressing challenges in food security and environmental sustainability.

Executive Summary: Agricultural Machinery & Equipment Market Report 2025

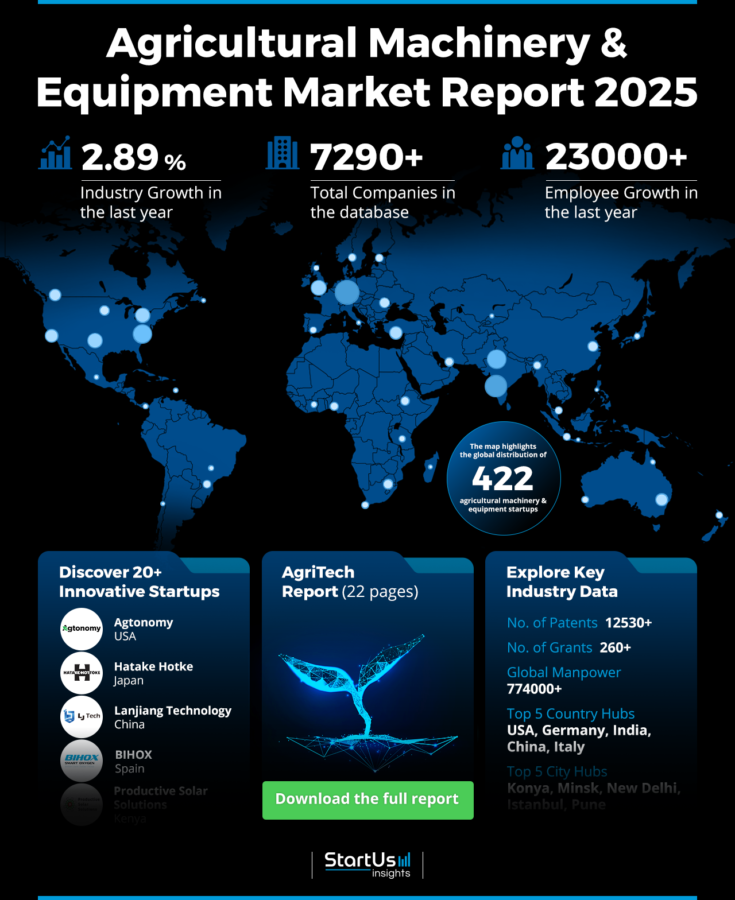

- Industry Growth Overview: The agricultural machinery and equipment market has more than 7290 companies and 420+ startups. It was valued at USD 113.60 billion in 2023 and is expanding at a CAGR of 4.8% from 2024 to 2034. On a granular level, the market grew by a rate of 2.89% last year as per our platform’s latest data.

- Manpower & Employment Growth: The market employs over 774K individuals, with an addition of 23K+ new employees in the last year.

- Patents & Grants: The agricultural machinery and equipment field has secured over 12530 patents and more than 260 grants. The patent growth rate is 16.56% yearly, with the US and Germany leading in patent issuance.

- Global Footprint: Key hubs include the United States, India, Italy, Germany, and China, while major city hubs encompass Konya, Minsk, New Delhi, Istanbul, and Pune.

- Investment Landscape: The total funding rounds closed exceeds 780, with average investment values exceeding USD 57 million per round. More than 650 investors are actively involved.

- Top Investors: Notable investors including John Deere, Deutsche Bank, Macquarie Bank, and more have collectively invested over USD 2.13 billion.

- Startup Ecosystem: Five innovative startups, Agtonomy (hybrid autonomy and tele-assist platform), Hatake Hotke (paddy field weed control device), Lanjiang Technology (orchard spraying and management), BIHOX (oxygenation for sustainable agriculture), and Productive Solar Solutions (farm mechanization with renewable energy) showcase the agricultural machinery and equipment market’s global reach and entrepreneurial spirit.

What Data is Used to Create This Agricultural Machinery and Equipment Market Outlook?

Based on the data provided by our Discovery Platform, we observe that the agricultural machinery and equipment ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The agricultural machinery and equipment market has been featured in over 2720 publications in the past year.

- Funding Rounds: More than 780 funding rounds have been recorded in our database for this agricultural machinery and equipment domain.

- Manpower: The market employs over 774K workers, with an additional 23K+ new employees added in the last year alone.

- Patents: The agricultural machinery and equipment market holds more than 12530 patents.

- Grants: Over 260 grants have been awarded to companies in this market.

Methodology: How We Created This Agricultural Machinery & Equipment Market Outlook

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of agricultural machinery and equipment over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within agricultural machinery and equipment

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the agricultural machinery and equipment market.

Explore the Data-driven Farm Machinery and Equipment Market Report for 2025

According to the GlobeNewswire report, the global demand for farm machinery and equipment is projected to grow at a compound annual growth rate (CAGR) of 3.6%, reaching USD 216 billion by 2028.

The agricultural machinery & equipment market report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Our database contains 420+ startups and 7290+ companies, which reflects the dynamic nature of the market.

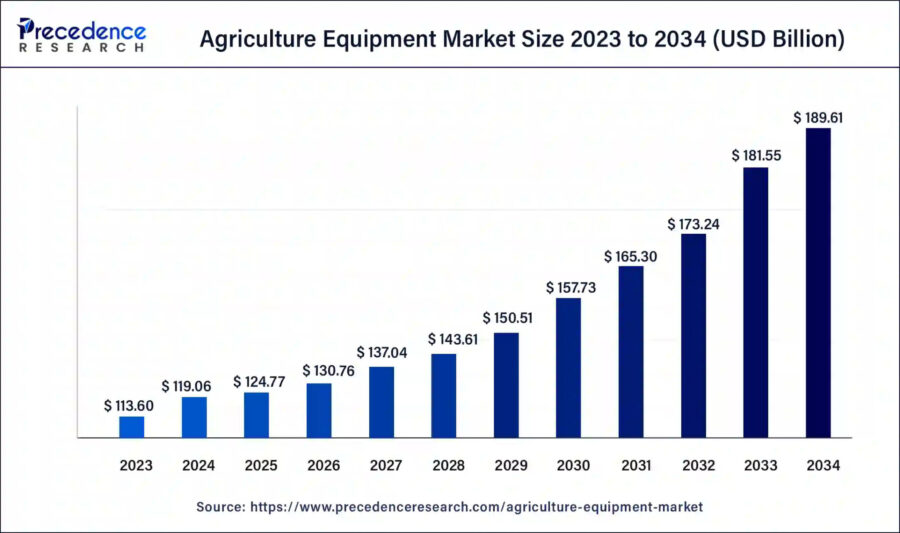

The Precedence Research report also highlights that the global agricultural machinery and equipment market was valued at USD 113.60 billion in 2023 and is expanding at a CAGR of 4.8% from 2024 to 2034. Moreover, last year, the market further grew by 2.89%, as per our platform’s latest data.

Credit: Precedence Research

According to Research and Markets, in 2023, the Asia-Pacific market held the leading position in the agricultural machinery and equipment market.

With over 12530+ patents and 260+ grants, intellectual property development in the sector is also on the rise. The agricultural machinery and equipment market currently employs 774K people worldwide and hired 23K+ more last year.

Moreover, the leading hubs for market activity include the US, Germany, India, China, and Italy, while cities like Konya, Minsk, New Delhi, Istanbul, and Pune are emerging as focal points of innovation and growth.

A Snapshot of the Global Agricultural Machinery & Equipment Market

The agricultural machinery and equipment market shows a steady trajectory of rise with an annual growth rate of 2.89%.

The market is supported by 420+ startups, which are contributing to the market’s development. In terms of mergers and acquisitions (M&A), over 380 transactions have been recorded.

Innovation remains a major part of the market, with more than 12 530 patents filed by over 2060 applicants. The yearly patent growth rate stands at 16.56%. The United States leads as the top patent issuer with more than 1270 patents, followed by Germany with over 580 patents.

Explore the Funding Landscape of the Farm Machinery and Equipment Market

The agricultural machinery and equipment market attracts over 650 investors, participating in 780+ funding rounds with an average investment of USD 57 million per round. These investments support more than 350 companies.

Who is Investing in the Agricultural Machinery and Equipment Market?

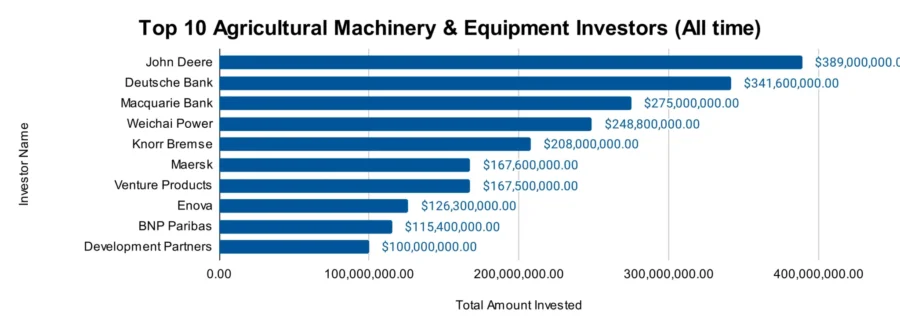

The top investors in the agricultural machinery and equipment market have collectively invested over USD 2.13 billion.

- John Deere has invested USD 389 million in 3 companies. It will invest USD 55 million in a new construction machinery plant in Nuevo León to promote sustainability and urban development.

- Deutsche Bank has contributed USD 341.6 million across 2 companies.

- Macquarie Bank has invested USD 275 million in at least 1 company. It plans to invest in India’s energy transition and digital infrastructure sectors.

- Weichai Power has invested USD 248.8 million in at least 1 company.

- Knorr Bremse has contributed USD 208 million across at least 1 company. In 2024, it signed a purchase agreement to acquire Alstom‘s rail signaling technology business in North America for approximately USD 679 million.

- Maersk has contributed USD 167.6 million across at least 1 company. Maersk also partnered with Dexory which uses robots for warehouse management, and Pactum, an AI-driven supplier contract negotiator.

- Venture Products has invested USD 167.5 million in at least 1 company.

- Enova has invested USD 126.3 million in at least 1 company.

- BNP Paribas contributed USD 115.4 million across 2 companies. French banking group BPCE and BNP Paribas announced plans to form a joint venture in the payments sector.

- Development Partners has invested USD 100 million in at least 1 company.

Top Farm Machinery and Equipment Innovations & Trends with the Discovery Platform

Discover the emerging trends in the farm machinery and equipment market along with their firmographic details:

- The Agriculture Automation trend continues to show steady growth, with over 490 companies identified in this domain and a workforce of 16K+ employees. The market added 1K+ new employees in the last year. With an annual growth rate of 20.30%, the agriculture automation market is crucial in improving farming efficiency and productivity.

- The Seeding Technology trend is seeing notable activity, with over 270 companies and 21K+ employees in the market. The addition of 1K new employees in the last year signals continued development. With an annual growth rate of 10.04%, seeding technologies are vital for improving seed placement and germination rates.

- The Agricultural Robotics market is the fastest-growing, with over 290 companies and a workforce of 10K+ employees. With 1K+ new employees in the last year, this agricultural robotics market offers an annual growth rate of 31.24%. Moreover, agricultural robotics is driving automation in farming and offering solutions for planting, harvesting, and crop monitoring.

5 Top Examples from 420+ Innovative Agricultural Machinery & Equipment Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Agtonomy delivers Hybrid Autonomy and Tele-Assist Platform

US-based startup Agtonomy delivers a next-generation solution that automates labor-intensive agricultural tasks using autonomous and AI technologies. Its solution combines an intuitive app for planning, monitoring, and managing farm operations.

The app integrates with autonomous machinery capable of executing tasks such as mowing, spraying, under-plant cultivation, and transport, even in challenging terrains. The solution uses precision navigation through Trunk Vision technology, a sensor for day and night operations, and onboard computing to automate critical tasks with centimeter-level accuracy.

Additionally, it supports multiple operation modes, autonomous, remote control, and manual improved by autonomously swappable battery systems for continuous functionality.

Hatake Hotke provides Paddy Field Weed Control Device

Japanese startup Hatake Hotke automates labor-intensive tasks and offers sustainable farming. Its Miznighall robot stirs soil in rice paddies to suppress weed growth by preventing photosynthesis. This robot eliminates the need for herbicides and reduces manual labor.

The Shikanigeru device detects animals using sensors and deters them with laser beams to protect crops from damage.

By integrating IoT, AI, and robotics, the startup improves productivity, supports pesticide-free farming, and addresses challenges like weed control and wildlife management. Further, its solutions revive natural farming practices and increase domestic food self-sufficiency while reducing the environmental impact of traditional agriculture.

Lanjiang Technology offers Orchard Spraying and Management

Lanjiang Technology is a Chinese startup that develops a range of autonomous orchard sprayers. Its product lineup includes the Unmanned Orchard Sprayer Robot S450, Orchard Autonomous Sprayer S500, and Orchard Autonomous Sprayer S1000 which performs spraying tasks in orchards.

The S450 model integrates a hybrid system combining a two-cylinder gasoline engine with a large-capacity battery pack for power and extended range. The machine operates autonomously using real-time kinematic (RTK) precision navigation and features a patented atomization system for efficient spraying.

The S500 and S1000 models build on these features with larger capacity tanks, enclosed structures for reliability, and intelligent systems for precise control and spraying.

BIHOX enables Oxygenation for Sustainable Agriculture

BIHOX is a Spanish startup that develops and manufactures oxygenation devices for sustainable agriculture, including B1, B2, B3, and B4 to B15 models.

Its patented technology uses photocatalysis to generate natural molecules from ambient humidity, which are then integrated into water as microbubbles. These molecules, including hydroxyl groups, hydrogen peroxide, and superoxides, gently oxygenate the root system and substrates without over-oxidizing.

The startup also improves water efficiency by reducing surface tension and enables the percolation of treated water. This allows efficient fertigation and reduces water and fertilizer usage. Its devices are suitable for organic farming and provide continuous oxygenation and prevention without ozone production.

Further, BIHOX’s technology stimulates root growth, increases crop yields, and prepares crops for environmental stressors.

Productive Solar Solutions supports Farm Mechanization with Renewable Energy

Kenyan startup Productive Solar Solutions (PSS) manufactures and supplies mechanized agricultural equipment and renewable energy systems. The startup’s products, such as rice mills, maize hullers, combined hammer mills, chaff cutters, grinders, and maize threshers, integrate advanced machinery to improve agricultural processes. These products also incorporate solar-powered solutions that offer efficiency and sustainability in farming.

PSS combines renewable energy with user-friendly designs to deliver reliable equipment for smallholder farmers, food processors, and sustainable agricultural projects. Its offerings withstand the demands of farm and food processing activities for ease of use, low maintenance, and adaptability for remote locations.

Additionally, PSS supports rural development by improving food processing capabilities and encouraging sustainable farming practices. This effort contributes to the growth of agriculture and renewable energy in underserved communities.

Gain Comprehensive Insights into Agricultural Machinery & Equipment Trends, Startups, or Technologies

The 2025 agricultural machinery & equipment market report underscores the sector’s important role in supporting organizations to navigate complex regulatory frameworks while driving innovation and efficiency.

As global markets evolve, the adoption of advanced technologies and data-driven approaches has become essential in addressing farming challenges and adding resilience.

Get in touch to explore all 420+ startups and scaleups, as well as all market trends impacting 7290+ companies.