The 2025 Agritech Report gives an overview of the global agritech sector and highlights how technology transforms agriculture to meet the growing demands for food security, sustainability, and efficiency.

This report explores key market trends, including the adoption of precision agriculture technologies, such as IoT-enabled sensors and AI-powered analytics, to optimize crop yields and resource management.

Vertical farming, automated irrigation systems, and robotics gain traction, addressing the need for efficient and scalable solutions in urban and rural farming.

The report also examines emerging startups, market dynamics, technological innovations, and sustainable practices.

Executive Summary: Agritech Market Outlook 2025

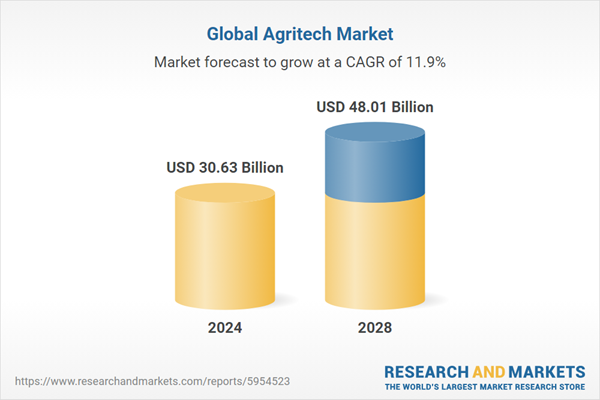

- Industry Growth Overview: The agritech sector includes over 129 000 companies, with an annual growth decline of -1.14%. However, the market is expected to grow rapidly in the next few years, reaching USD 48.01 billion in 2028 with a CAGR of 11.9%.

- Manpower & Employment Growth: The global workforce exceeds 11.9 million, with 498 000 new employees added last year. This reflects the growing scale and expansion of the industry.

- Patents & Grants: The industry holds over 1.24 million patents and has received more than 15 000 grants. It is an indication of strong innovation and substantial support for R&D.

- Global Footprint: Key hubs for agritech innovation are located in the United States, India, the United Kingdom, Canada, and Germany. Leading city hubs include London, Bangalore, New York City, Melbourne, and Sydney.

- Investment Landscape: The agritech sector has seen over 47 000 funding rounds and more than 14 000 companies receiving financial support.

- Top Investors: The key investors in agritech include International Finance Corporation, Rabobank, HSBC, and more, with combined investments exceeding USD 14 billion.

- Startup Ecosystem: Notable agritech startups include Agriculture Intelligence (precision agriculture), Orbiba Robotics (autonomous farming robots), GreenState (modular and vertical farming), Robotix Japan (agricultural drones), and Skyka Technologies (cloud-based farm management).

What Data is Used to Create This Agritech Market Report?

- News Coverage & Publications: There are over 70 000 publications related to agritech in the last year, which shows strong media presence.

- Funding Rounds: The industry has more than 47 000 funding rounds recorded in our database.

- Manpower: The agritech sector employs over 11.9 million workers and added 498 000 employees last year.

- Patents: The industry holds over 1.24 million patents, indicating robust innovation.

- Grants: The agritech market received more than 15 000 grants that support research and development.

- Yearly Global Search Growth: The industry saw a 10.46% annual growth in global searches. This shows increased interest in agritech solutions.

Methodology: How We Created This Agritech Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of agritech over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within agriculture industry

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the agritech market.

Explore the Data-driven Agritech Market Report for 2025

Globally, agriculture is the second largest employer after services, employing 27% of the labor force. In Africa, it employs 48%, and in Asia, 29.3%.

The agritech industry includes over 6800 startups and more than 129 000 companies. Last year, it saw a slight growth decline of -1.14%, as per our platform data.

According to Research and Markets, the agritech market will grow rapidly in the next few years, reaching USD 48.01 billion in 2028 with a compound annual growth rate (CAGR) of 11.9%.

Credit: Research and Markets

Further, the industry has over 1.24 million patents and more than 15 000 grants. The global workforce exceeds 11.9 million, with 498 000 new employees added last year.

Key country hubs include the United States, India, the United Kingdom, Canada, and Germany. Leading city hubs for agritech innovation are London, Bangalore, New York City, Melbourne, and Sydney.

Moreover, North America leads the market due to high investment in agritech startups and the widespread adoption of advanced technologies like drones, IoT, and AI.

A Snapshot of the Global Agritech Market

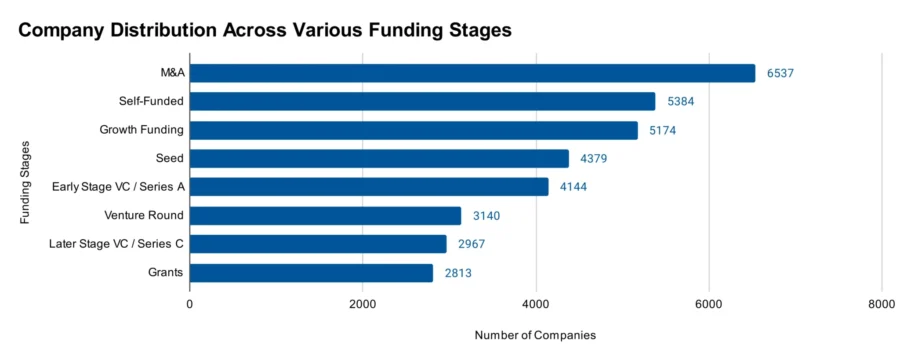

The agritech industry shows an annual growth decline of -1.14%. There are over 129 000 startups, with more than 4000 in early stages and over 6500 mergers and acquisitions.

The industry has more than 1.24 million patents, with over 202 000 applicants contributing to innovation. The yearly patent growth is 0.58%. China leads in patent issuance with more than 316 000 patents, followed by the United States with over 226 000 patents.

Explore the Funding Landscape of the Agritech Market

The agritech sector attracts substantial investment, averaging USD 30.6 million per funding round. Over 24 000 investors have participated in more than 47 000 funding rounds, which shows strong financial backing.

Additionally, more than 14 000 companies have received investment. This highlights the sector’s broad appeal and ongoing support from venture capitalists and institutional investors. It makes agritech a vibrant area for investment opportunities.

Who is Investing in the Agritech Market?

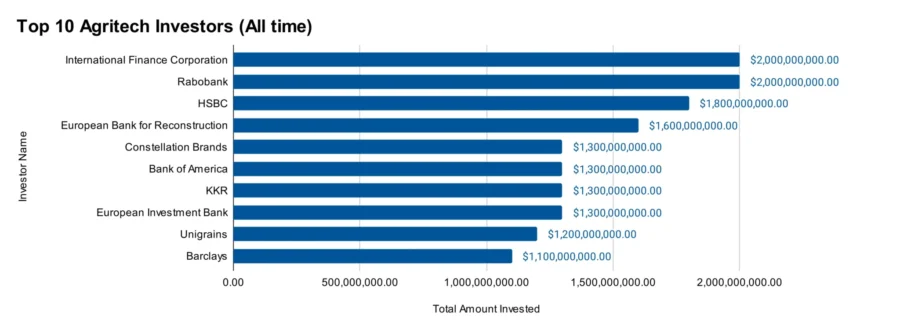

The top investors in agritech have collectively invested over USD 14 billion and show strong financial commitment.

- International Finance Corporation has invested USD 2 billion across 45 companies, including USD 37 million in Crystal Crop Protection.

- Rabobank has also invested USD 2 billion in 50 companies, including USD 24 million in Avanti Finance, an Indian NBFC.

- HSBC committed USD 1.8 billion to 31 companies and launched Climate Asset Management, raising over USD 1 billion for projects like regenerative agriculture in Australia and sustainable forestry in New Zealand.

- The European Bank for Reconstruction and Development invested USD 1.6 billion across 41 companies, including USD 100 million to support MHP, a leading Ukrainian agribusiness group.

- Constellation Brands contributed USD 1.3 billion in 5 companies and committed USD 400 000 to The Nature Conservancy for sustainable agriculture and water conservation projects in the Rio Grande Basin.

- Bank of America invested USD 1.3 billion in 11 companies, including USD 5 million in the ABC Fund, targeting smallholder farmers and rural agribusinesses in developing countries.

- KKR invested USD 1.3 billion in 11 companies, including USD 300 million for a 13.33% stake in Advanta Enterprises, focused on sustainable agriculture through hybrid seeds and advanced plant breeding technologies.

- The European Investment Bank contributed USD 1.3 billion in 26 companies, including a EUR 250 million loan to AGCO for developing precision agriculture technologies.

- Unigrains invested USD 1.2 billion in 28 companies, including an investment in Ñaming in 2024 to support product innovation and distribution channel expansion.

- Barclays committed USD 1.1 billion to 12 companies, including acquiring 238 8750 shares of ANSC, a blank-check company focusing on agriculture and natural solutions.

Top Agritech Innovations & Trends with the Discovery Platform

The agritech industry is driven by key trends and significant firmographic data.

- The Precision Agriculture sector includes 2100 companies, employing 130 000 workers, with 7000 new employees added last year. This trend grows annually at 24.3%, indicating market expansion and increased adoption of advanced technologies.

- The Vertical Farming sector consists of 1000 companies and 56000 employees, with 3000 new hires last year. This trend is growing at 22.86% annually. It reflects a rising interest in sustainable and space-efficient farming solutions.

- The Agricultural Drones sector includes 400 companies and 21000 employees, with 2000 new hires last year. With an annual growth rate of 20.53%, the use of drones in agriculture continues to gain traction, offering precision and efficiency in farming operations.

5 Top Examples from 6800+ Innovative Agritech Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Agriculture Intelligence enables Precision Agriculture

US-based startup Agriculture Intelligence develops precision agriculture software and hardware technologies.

Its product, Agroview, uses cloud-based AI to analyze data from sensors and imaging devices to provide stakeholders with accurate and repeatable crop field assessments.

Agrosense, its patent-pending in-field hardware sensor, employs on-board AI, LiDAR, and high-frame-rate cameras to evaluate inventory, tree health, and yield in real-time.

These technologies enable effective field assessments, cost reduction, disease identification, yield enhancement, and increased sustainability.

Agriculture Intelligence integrates sensor fusion, computer vision, machine learning, and automation to drive agriculture’s future through innovative AI solutions.

Orbiba Robotics develops Autonomous Agricultural Robots

Turkish startup Orbiba Robotics builds autonomous farming robots for small and medium-sized farms. Its product, the Weed Management Robot, uses sensors and AI to perform agricultural tasks autonomously, identifying and managing weeds without chemical herbicides.

The robot’s modular design allows easy switching between attachments like plows, trailers, and delta robot arms to enhance versatility in seeding, cultivating, transporting loads, and clearing field paths.

Orbiba Robotics monitors plant health and optimizes farm management through integrated AI algorithms to increase productivity while adhering to environmental and social values. This offers farmers an efficient and eco-friendly solution for sustainable agriculture.

GreenState builds Modular and Vertical Farm

Swiss startup GreenState develops modular vertical farming solutions to offer scalable systems for year-round agricultural production.

Its Single Modular Farming Unit, includes hardware, automation, irrigation systems, and software, ideal for growing fresh herbs and salads in gardens or restaurants.

Farmers manage and monitor these units through the GreenState SCADA mobile or web application.

The startup’s GreenState 2.0 multimodular solution combines 24 modular units based on the Lego principle. It features a cooling unit, packaging room, seedling room, cultivation room, and technical room, with options for indoor or outdoor installation.

The GreenState Cloud SCADA software enables precise monitoring and control of operations to manage equipment such as FanCoils, chillers, heat pumps, lighting, irrigation, and ventilation, while collecting and applying data through digital recipes. GreenState supports sustainable farming by providing tools for efficient production and management.

Robotix Japan produces Agricultural Drones

Japanese startup Robotix Japan makes agricultural and industrial drones. Its products include the DMTER M6, a compact agricultural drone for efficient pesticide application, and the DMTER M10, a 10L capacity drone that sprays approximately 1 hectare (10,000 m²) in one operation. The DMTER M30 features a 30L tank that allows extended spraying sessions for larger areas.

The startup also offers the INSPECTER MOLER, a sewer and narrow-space inspection robot that navigates pipes as small as 120 mm in diameter.

It is equipped with front and rear cameras and laser functionality for precise inspections. Robotix Japan enhances productivity and safety in agricultural and industrial operations.

Skyka Technologies offers Farm Management Software

Indian startup Skyka Technologies develops a cloud-based farm management platform. This solution lets farmers access management tools from any mobile device to facilitate real-time decision-making. The platform features an analytics dashboard that provides insights and data visualizations.

Additionally, it offers crop life cycle management, which allows precise oversight from planting to harvest and integrates data from IoT devices for comprehensive information.

Skyka Technologies also offers personalized features that enable farmers to tailor the platform to their specific needs.

Gain Comprehensive Insights into Agritech Trends, Startups, or Technologies

In 2025, the agriculture industry is set for growth, driven by innovations in precision agriculture, vertical farming, and drones.

Emerging trends show a shift towards sustainable farming practices and advanced technologies to meet global food demands.

Get in touch to explore all 6800+ startups and scaleups, as well as all market trends impacting agritech companies.

![AI in Agriculture: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Agriculture-SharedImg-StartUs-Insights-noresize-420x236.webp)