The Agrochemical Industry Report 2025 brings together the job market scenario along with the investment landscapes, major technological developments, emerging startups, and future trends. It reveals how biofertilizers, plant growth promoters, and biopesticides are taking over traditional agrochemicals.

In the current scenario, agriculturists and farmers prefer properties like targeted adsorption, balanced lipophilicity, controlled volatility, and biodegradability in agrochemicals. Green nitrogen fixation, aqueous non-dispersions, precision agriculture, target herbicides, and such technologies are enabling these progressive properties in agrochemicals.

Executive Summary: Agrochemical Market Report 2025

This agrochemical report uses data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, which covers more than 4.7 million global companies, 20K+ technologies, and emerging trends.

We also analyzed a sample of 1400+ agrochemical startups developing innovative solutions to present five examples from emerging agrochemical market trends.

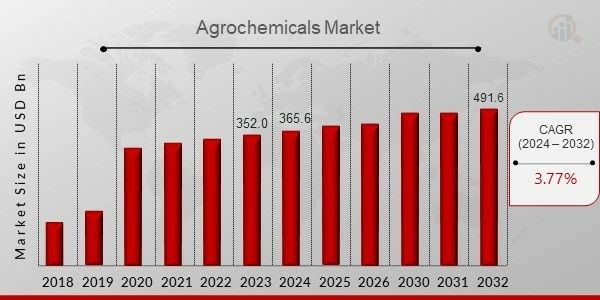

- Industry Growth Overview: The agrochemical sector has 2600+ companies and 1400+ startups. According to Market Research Future, the market size is set to reach USD 491.6 billion by 2032, growing at a compound annual growth rate (CAGR) of 3.77%. On a granular level, as per our platform’s data, the market is growing at a rate of 0.58% annually.

- Manpower and Employment Growth: Currently there are 343 000+ professionals working in the sector. 15 000 more professionals joined the workforce last year.

- Patents and Grants: More than 470 applicants from the agrochemical companies filed 4100+ patents. Additionally, the sector received 310+ grants for further research.

- Global Footprint: Countries with the maximum number of companies in the agrochemical sector are India, China, the United States, the United Kingdom, and Spain. The cities contributing the most in this domain are Mumbai, Ahmedabad, Pune, Shanghai, and Hyderabad.

- Investment Landscape: 720+ funding rounds supported 200+ companies. Each funding round raised over USD 32.3 million.

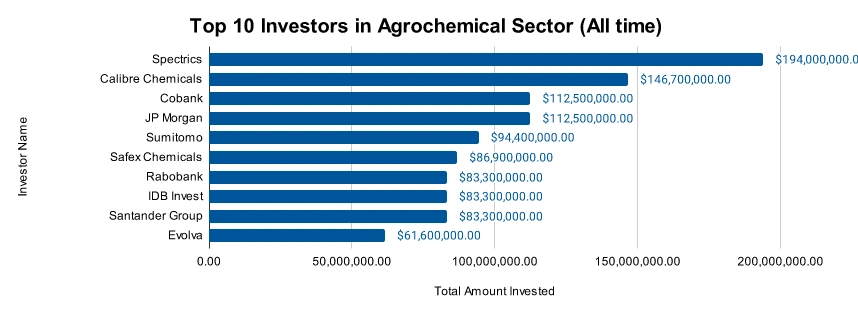

- Top Investors: Top investors like Spectrics, Calibre Chemicals, Cobank, and more invest around USD 453.2 million.

- Startup Ecosystem: Top startups like High Vision Technologies (nano fertilizers & nano pesticides), TraitSeq (AI-led agrochemical development platform), InsectBiotech (black soldier fly larvae (BSFL)-based protein), Advanced Agriscience (biological inputs for crop protection), NitroVolt (small-scale ammonia synthesis unit) represent the innovative future of the agrochemical sector.

What Data is Used to Create This Agrochemical Market Report?

Based on the data provided by our Discovery Platform, we observe that the agrochemical ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage and Publications: There are over 710+ newspaper and magazine articles covering the progress in the agrochemical sector.

- Funding Rounds: Our database records more than 720 fundraising rounds for companies in the domain.

- Manpower: The agrochemical sector has a substantial economic impact on the job market. There are 343 000+ employees working in it worldwide. Further, 15 000 more joined the workforce last year.

- Patents: There are more than 4100 patents filed by companies in the agrochemical sector.

- Grants: The domain received 310+ grants from the government for further research and development.

Methodology: How We Created This Agrochemical Report

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of compliance management over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within agrochemical

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the compliance management market.

Explore the Data-driven Agrochemical Market Report for 2025

There are 1400+ startups and 2600+ companies working towards progressing the agrochemical sector. The developments in the domain are further supported by 4100+ patents and 310+ grants.

According to Market Research Future, the agrochemical market size is set to reach USD 491.6 billion by 2032, growing at a compound annual growth rate (CAGR) of 3.77%. On a granular level, as per our platform’s data, the market is growing at a rate of 0.58% annually.

Credit: Market Research Future

343 000+ professionals are working in the agrochemical sector currently and 15 000 more joined the workforce last year. The leading countries contributing to the growth of the agrochemical sector are India, China, the United States, the United Kingdom, and Spain.

At a city level, the majority of activities are concentrated in Mumbai, Ahmedabad, Pune, Shanghai, and Hyderabad. Did you know that the Indian agrochemical sector is projected to grow at CAGR of 9% by financial sector 2028.

A Snapshot of the Global Agrochemical Market

The emphasis on sustainable agriculture is increasing and Japan is one of the top countries to contribute to that.

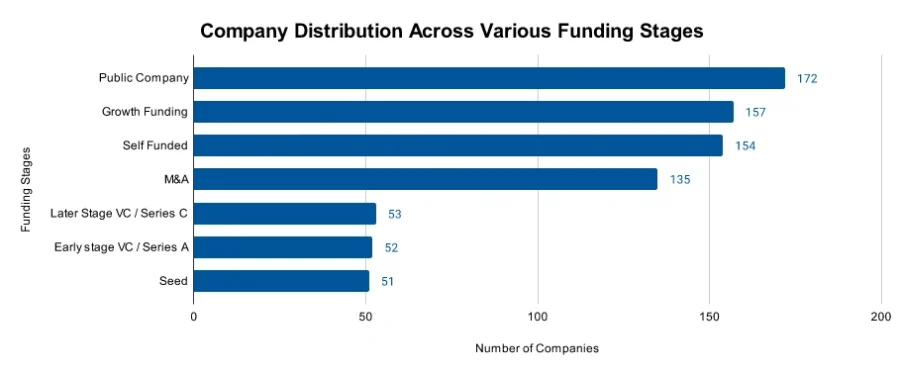

1400+ startups are focusing on building innovative agrochemicals. 120+ startups are in mergers and acquisitions along with 50 more in the early stage. The sector is growing at a rate of 0.58% annually.

More than 470 applicants filed 4100+ patents and the patent landscape is further growing at a rate of 1.44%. The USA is the leading patent issuer in the sector with 1170+ patents. The European Patent Office comes second with 610+ patents.

Herbicides dominate the agrochemical market with a 49% share, followed by fungicides (26%) and insecticides (25%).

Explore the Funding Landscape of the Agrochemical Market

With capital rounds averaging USD 32.3 million, the agrochemical sector draws significant investment. The domain further witnessed 720+ fundraising rounds where more than 590 investors took part. The raised funding assisted 200+ companies in the agrochemical sector.

Who is Investing in the Agrochemical Market?

Top investors invest USD 1.05 billion in the agrochemical sector. The investment is divided among multiple companies that are working towards developing innovative agrochemicals.

- Spectrics Solutions invested USD 194 million in at least one company.

- Calibre Chemicals invested USD 146.7 million in at least one company. Additionally, Calibre Chemicals acquired RheinPerChemie from Evonik. This makes Calibre one of the top companies that invest in green electrochemical opportunities.

- CoBank spent USD 112.5 million on at least one company.

- JP Morgan contributed USD 112. 5 million to at least one company.

- Sumitomo Corporation distributed USD 94.4 across two companies. It also invested in the Chilean biocontrol company Bio Insumos Nativa (BIN).

- Safex Chemicals provided USD 86.9 million to two companies. Safex Chemicals is set to invest USD 11.77 million in AgCare Technologies.

- Rabobank invested USD 83.3 million in at least one company. Its funding program India Agri Business Fund II invested USD 15 million in Parijat Industries, an Indian agro-chemical company.

- IDB Invest spent USD 83.3 million on at least one company. It offered a four-year committed revolving credit facility to Tecnomyl, a company specializing in agricultural inputs for soybean cultivation.

- Santander Group contributed USD 83.3 million to at least one company. It acquired a 5% stake in Grupo Kimitec and its MAAVi Innovation Center, Europe’s natural biotech hub.

- Evolva invested USD 61.6 million in at least one company. It additionally holds a license to develop and commercialize nootkatone globally for pest control.

Top Agrochemical Innovations & Trends with the Discovery Platform

Discover the major trends in agrochemicals along with their firmographic details:

- The Biofertilizers sector has over 440 companies and 35 700+ employees. Additionally, more than 1500 people joined the workforce last year. The sector records a 14.38% annual growth. Nano biofertilizers, biofilm biofertilizers, microbe-infused fertilizers, and more are a few examples of innovative biofertilizers.The

- The Biopesticides sector has 650+ companies and records an annual growth of 6.98%. The number of employees in the sector is 58 600 currently. Last year, 2600 more people joined the biopesticides sector. A few of the major areas of development in biopesticide include controlled release formulation (CRF), mixed microbial formulations, precision application technology, and insect-derived variations.

- The Plant Growth Promoter sector employs 12700+ people across 200+ companies. Last year, the sector had a strong 8.02% annual growth rate and added 690+ new employees. Farmers use plant growth promoters for crop yield improvement, stress tolerance, horticulture applications, crop management, and more.

5 Top Examples from 1400+ Innovative Agrochemical Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

High Vision Technologies produces Nano Fertilizers and Nano Pesticides

Indian startup High Vision Technologies replaces traditional chemical products with nanotechnology-driven products. The startup produces nano urea and nano zinc oxide for application in nano fertilizer.

The nano urea increases nitrogen availability due to controlled nitrogen release. It minimizes the environmental footprint of the traditional fertilizer. The use of nano zinc oxide in fertilizer increases the amount of zinc in grains, improves root development, and promotes taller, greener leaves.

The botanically derived nano pesticide comes with a controlled-release property and increases bioavailability. It plays the role of a feeding deterrent, insect growth disruptor (IGD), and sterilant. Farmers use nanotechnology-driven products to increase yield and reduce the impact of harmful chemicals on agricultural land.

TraitSeq builds an AI-led Agrochemical Development Platform

UK-based startup TraitSeq builds an AI-powered platform for precisely predicting complex agricultural traits and developing climate-resilient crop varieties. The platform further develops agrochemical, and biological input, and assists in gene discovery, livestock breeding, and gene editing.

It uses customized machine learning to recognize biomarkers suitable for training predictive models for complex agriculture. The biomarkers are also useful as novel targets in gene editing.

TraitSeq’s complex trait prediction models are customizable with environmental variation to get more accurate trait performance prediction. The AI-based pipeline speeds product development and supports breeding strategies. The platform ensures global food security through faster food production.

TraitSeq also secured significant pre-seed investment for further research and development.

InsectBiotech makes Black soldier fly larvae (BSFL)-based Protein

Spanish startup InsectBiotech converts agricultural residues into fertilizer using black soldier fly (BSF) larvae. The startup uses olive pomace as the feedstock and its proprietary pre-treatment methods to improve larvae growth and waste conversion.

The black soldier fly larvae contain essential nutrients, are rich in protein, have antimicrobial properties, and are environmentally sustainable. The BSF frass is a co-product of the BSF larvae-rearing process. It contains larval excrement, shed exoskeleton, and undigested food residue.

The frass also contains beneficial microorganisms for the soil. Farmers use the resultant sustainable fertilizer to improve plant growth and reduce carbon footprint.

InsectBiotech further also won the Malaga AgriTech Award for the best startup in 2024.

Advanced Agriscience provides Biological Inputs for Crop Protection

Canadian startup Advanced Agriscience develops biological crop input to secure agrifood productivity from frost. The crop input targets the cause of frost with sustainable and non-toxic inputs. The startup uses a biological approach to prevent molecular frost formation which mitigates injury and provides cost-effective, sustainable protection.

The passive protection formulation is sprayed on the seed. The spray solution further integrates into existing practices and reduces loss, labor required, and environmental impact.

The Packer covered the details of the research and discovery of Advanced Agriscience along with insights from the founder.

NitroVolt offers a Small-Scale Ammonia Synthesis Unit

Danish startup Nitrovolt develops a lithium-mediated ammonia synthesis reactor called Nitrolyzer. It is a container-sized, flow-cell reactor and is scalable to any farm size. The clean, green, and local ammonia production process replaces nitrogen-based, mass-produced ammonia.

The process starts by reducing lithium salt to metallic lithium, which reacts with nitrogen to form nitride. Then, hydrogen created by water splitting protonates the nitrogen resulting in ammonia formation. The used lithium is released back into the reactor for reuse.

The lithium-mediated system only requires air, water, and green electricity to synthesize sustainable ammonia at the point of use. Nitrolyzer is suitable for generating the required amount of ammonia in a farm or a greenhouse.

Further, NitroVolt closed a USD 3.6 million seed funding led by BackingMinds and the Export and Investment Fund of Denmark.

Gain Comprehensive Insights into Agrochemical Trends, Startups, or Technologies

The job market scenario and the startup ecosystem suggest more research and growth in the agrochemical sector. Major developments in biofertilizers, biopesticides, and plant growth promoters are further supporting sustainable yet efficient methods of producing food. Innovations in genetic engineering, synthetic molecules, and biodegradable additives are also set to accelerate the transformation in the agrochemical domain.

The 2025 agrochemical market report underscores the sector’s important role in supporting organizations to navigate complex regulatory frameworks while driving innovation and efficiency. As global markets evolve, the adoption of advanced technologies and data-driven approaches has become essential in addressing challenges and adding resilience in agrochemcial sector.

Get in touch to explore all 1400+ startups and scaleups, as well as all market trends impacting 2600+ companies.

![AI in Agriculture: A Strategic Guide for Industry Leaders [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/03/AI-in-Agriculture-SharedImg-StartUs-Insights-noresize-420x236.webp)