The Air Freight Report 2025 reveals the sector is utilizing innovative tracking and visibility solutions, automated robotic systems, and drone technology for the development of the sector. The report also covers the major impact of emerging trends like electric aircraft, delivery drones, and autonomous aircraft.

There are further developments in the sector for capacity and route optimization, traceability of shipments using blockchain, and temperature-controlled containers for perishable goods delivery. This report covers data on the current status of investments, workforce, and global standing

Executive Summary: Air Freight Market Report 2025

- Industry Growth Overview: The yearly growth of the air freight market is -4.96%. There are 530+ startups and 7400+ companies in the sector. According to Modor Intelligence, the air freight domain is set to grow at a compound annual growth rate (CAGR) of 5.92% from 2024 to 2029 and reach a market size of USD 201.57 billion by then.

- Manpower and Employment Pattern: 627 600+ people are working in air cargo companies. Additionally, 28 300+ professionals joined the workforce last year.

- Global Footprint: The top countries contributing the most to the air freight market are the United States, India, the United Kingdom, Germany, and the United Arab Emirates. The cities doing the same are Dubai, Mumbai, Singapore, New Delhi, and Sydney.

- Grants and Patents: More than 200 applicants from the air logistics companies filed 690+ patents. Additionally, the sector received 110+ grants.

- Investment landscape: The air cargo companies conducted 640+ funding rounds, which assisted 260+ companies. More than 650 investors participated in these funding rounds, which raised an average of USD 56.7 million per funding round.

- Top Investors: Investors like Thor Capital Group, Singapore Post, PAG, and more invest over USD 1 billion in the air freight domain.

- Startup Environment: Startups like Airblox (air freight capacity and financing platform), Grasshopper Air Mobility (flight-drive robotic cargo drones), CargoAi (air cargo e-booking and tracking solution), Jedsy (green energy drones for healthcare logistics), Quantum-South (quantum-computing-based air cargo optimization) represent the innovative landscape of the air cargo domain.

What Data is Used to Create This Air Freight Market Report?

Based on the data provided by our Discovery Platform, we observe that air freight ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The newspaper and magazines covered the developments in the air freight sector in detail last year and there were over 3500 articles about it.

- Funding Rounds: The companies in the air freight sector held over 640 fundraising rounds.

- Manpower: The domain employs over 627 600 people currently and 18 300+ people joined the workforce last year.

- Patents: More than 690 patents have been registered by companies in the air freight sector.

- Grants: The companies in the air freight sector received more than 110 grants, which assisted in the research and development of the domain.

- Yearly Global Search Growth: The public’s growing interest in the air freight field is reflected by the 6.98% annual growth in global search interest.

Methodology: How We Created This Air Freight Report

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of air freight over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within air freight

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the air freight market.

Explore the Data-driven Air Freight Market Report for 2025

The air freight sector is diversified, as seen by the 7400+ companies and 530+ startups recorded in the Discovery Platform. The air freight sector accounts for around 35% of global trade by value despite representing less than 1% of global trade by volume.

According to Straits Research, the air freight market is estimated to grow by a compound annual growth rate (CAGR) of 6% from 2024 to 2032 and reach USD 560 billion in the next eight years.

Credit: Straits Research

The Asia-Pacific region is the largest market for air cargo with China leading in terms of volume. The sector is further witnessing an annual growth rate of -4.96%. Despite the depleting growth rate, the companies in the sector received 1100+ grants and filed over 690 patents. It also employed 627 600+ people. Additionally, 28 300+ people joined the workforce last year.

The top countries leading the air freight domain are the United States, India, the United Kingdom, Germany, and the United Arab Emirates. The cities with the highest contribution to the air freight domain are Dubai, Mumbai, Singapore, New Delhi, and Sydney.

A Snapshot of the Global Air Freight Market

The air freight sector has an annual growth rate of -4.96%. Our database records more than 530 startups in operation currently. There are 100 more in the early stage and 330 more in the merger and acquisition stage.

200+ applicants filed over 690 patents. The patent activity is witnessing an annual rate of -1.94%. The USA is leading the patent activity with 188 patents, followed by Germany with 96 patents.

Explore the Funding Landscape of the Air Freight Market

The air freight companies held more than 640 funding rounds and raised an average of USD 56.7 million in each round. 650+ investors took part in the funding rounds, which assisted more than 260 companies. These investments are positive reinforcements towards innovations in the air logistics sector, which ensures more sustainable and technologically advanced innovations.

Who is Investing in the Air Freight Market?

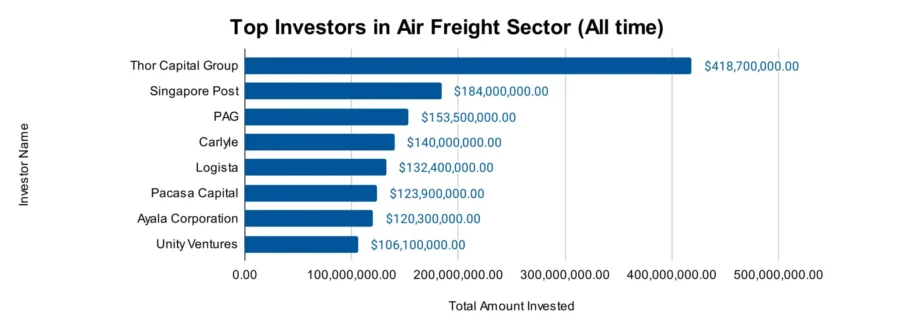

The top investors made a combined investment of USD 1.37 billion in the air cargo sector.

- Thor Capital Group invested USD 418.7 million in at least one company.

- Singapore Post invested USD 184 million in at least one company.

- PAG contributed USD 153.5 million to at least one company.

- Carlyle invested USD 140 million in at least one company. Additionally, it acquired Apollo Aviation Group, a commercial aviation investment company in 2018.

- Logista distributed USD 132.4 million across two companies. It also acquired 100% ownership of Transportes El Mosca, a Spanish logistics company in 2024.

- Pacasa Capital invested USD 123.9 million in at least one company.

- Ayala Corporation invested USD 120.3 million in at least one company.

- Unity Ventures invested USD 106.1 million in at least one company.

Top Air Freight Innovations & Trends from the Discovery Platform

Discover the emerging trends in the air freight market along with their firmographic details:

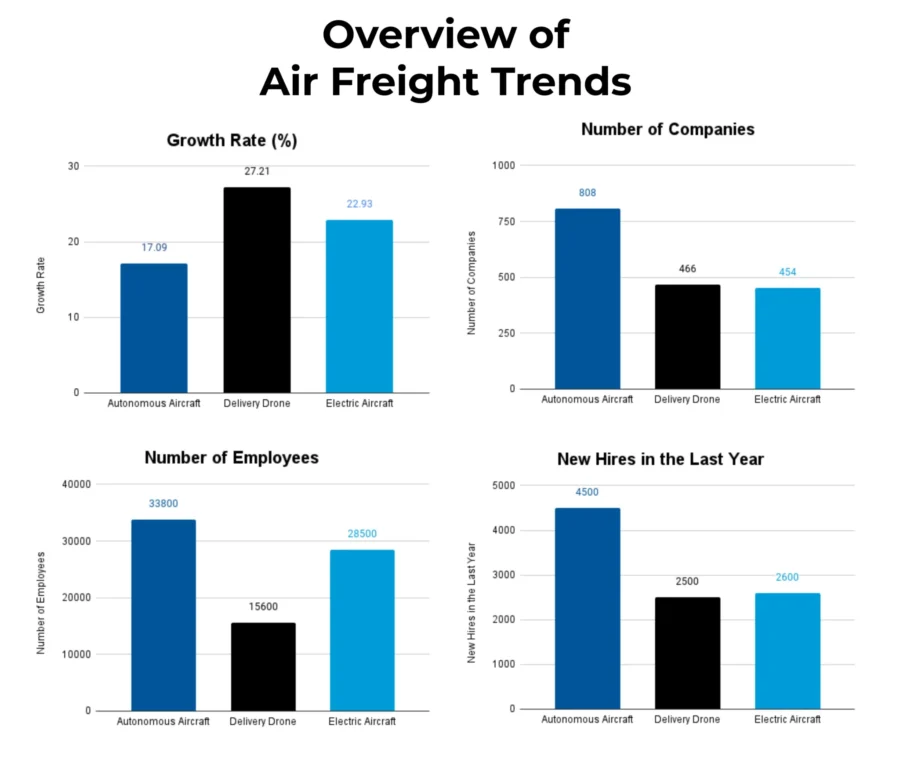

- Autonomous Aircraft are utilizing technologies like hybrid electric propulsions, GPS, inertial measurement unit (IMU), LiDAR, and ultrasonic sensors to provide sustainable and efficient air logistics. There are 800+ companies in the sector, which employ 33 800+ people. The domain is growing at an annual rate of 17.09% and hired 4500+ people in the last year.

- Delivery Drone domain is growing at an annual rate of 27.21% and has 460+ companies working in it. The companies employ 15 600+ people currently and 2500+ people joined the workforce last year. Delivery drones are equipped to deliver emergency shipments to remote areas. The drones are also used in various big-scale industries like mining, oil and gas, construction, and more.

- The Electric Aircraft sector employs 28 500+ people in 450+ companies. More than 2600 people joined the sector last year. It is additionally growing at a rate of 22.93% every year. The electric aircraft are powered by battery technology for better energy density and longer lifespan. The AI-powered flight control systems along with sensors further enable autonomous systems and remote operations in electric aircraft.

5 Top Examples from 530+ Innovative Air Freight Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Airblox provides Air Freight Capacity and Financing Platform

US-based startup Airblox builds a platform that provides information about airline capacity, financing, and mid-term contracts. The platform provides competitive prices for carrier lanes worldwide, reliable onboarding for airlines and forwarders, pay-later options, and more.

It also offers data and analytics to ensure suitable buying and selling decisions for profitability. The request for proposal/quote (RFP/ RFQ) feature further assists the users to connect faster with the airlines.

The users plan ahead as the platform provides airline capacity lists for up to six months. Airlines, general sales assistants (GSAs), and freight forwarders use the platform to ensure sustainability and reliability in financing air logistics operations.

Grasshopper Air Mobility designs Flight-Drive Robotic Cargo Drones

Spanish startup Grasshopper Air Mobility builds Grasshopper e350, a drone for autonomous aerial logistics. The ground-air integration of drive-flight technology ensures the transition between air and ground operations. The wings fold inwards to reduce the amount of space the drone covers in an indoor intralogistics environment.

Further, the automated cargo systems are connected to conveyor systems for hands-free loading systems. It ensures reduced costs, optimized delivery times, and decreased human intervention. The small ducted fans ensure quiet propulsion and make the drones suitable for use in urban environments.

The electric and hybrid-hydrogen power systems in the drone further provide a sustainable method for long-range transport. Grasshopper e350 drones make the supply chain more efficient, flexible, reliable, and sustainable.

CargoAi offers Air Cargo eBooking and Tracking Solution

Singapore-based startup CargoAi provides e-booking and tracking solutions for air cargo. The CargoMART is suitable for freight forwarders. It is used to manage the air cargo booking process like schedules, booking, Co2 tracking, and sustainable aviation fuel (SAF) purchases. The CargoCONNECT is a suite of APIs to connect the CargoMART to the forwarder’s IT environment.

Additionally, airlines and GSAs use CargoGATE to integrate CargoMART into their own cargo system. The CargoINTEL provides actionable business and revenue intelligence data to forwarders and airlines.

The Cargo2ZERO is a sustainability solution that consists of embedded tools to encourage users to be more climate-conscious. CargoAI’s solutions let the cargo professionals digitally track their operations and participate in a connected ecosystem with all cargo professionals.

Jedsy manufactures Green Energy Drones for Healthcare Logistics

Swiss startup Jedsy builds drones for healthcare logistics. The drones use renewable energy to operate which reduces carbon emissions. The software used in drones is checked with realistic simulation before it is used. It is fault-tolerant and is able to land even when a component breaks.

It also comes with a backup where pilots take over in emergencies. For privacy, the cameras on the drones are covered while landing in a station. It only has one-day data storage and operators only get to access the specific information they require.

For sensitive environments, the operators use a catapult start to minimize the noise. Using these drones, healthcare providers ensure timely medicine supply to urban or remote areas.

Quantum-South optimizes Air Cargo with Quantum Computing

Uruguay-based startup Quantum-South builds quantum computing software for optimizing air cargo. The software uses a hybrid approach with quantum annealers to optimize cargo loading. It also considers cost, standard capacity of popular aircraft models, available container parameters, and revenue restrictions to allocate loads in air and ship cargo.

The software output contains the loading plan for each aircraft. The output provides a way to maximize the loading capacity while maintaining the gravity center position and considering shear limits on the aircraft fuel usage.

The software is also suitable for ensuring net-zero operations in air logistics. Air logistics businesses use Quantum-South’s solutions to improve operational as well as financial efficiency.

Gain Comprehensive Insights into Air Freight Trends, Startups, or Technologies

The air freight sector is led by major trends like autonomous aircraft, delivery drones, and electric aircraft. The applications of air freight include e-commerce fulfillment, medicine delivery to remote areas, and even last-mile intracity deliveries. Technologies like IoT, AI, robotic automation, and more are leading the developments in the aerial delivery sector.

The 2025 air freight market report underscores the sector’s important role in supporting organizations to navigate complex regulatory frameworks while driving innovation and efficiency. As global markets evolve, the adoption of advanced technologies and data-driven approaches has become essential in addressing air cargo challenges and adding resilience.

Get in touch to explore all 530+ startups and scaleups, as well as all market trends impacting 7400+ companies.