The 2025 Airborne Vehicles Market Report examines advancements in electric propulsion, autonomy, and lightweight materials driving aviation’s shift to eco-friendly solutions. Airborne vehicles now support diverse applications, including commercial, defense, and emergency management. The report analyzes trends, investments, and innovations shaping smarter, sustainable aviation.

Executive Summary: Airborne Vehicles Market Report 2025

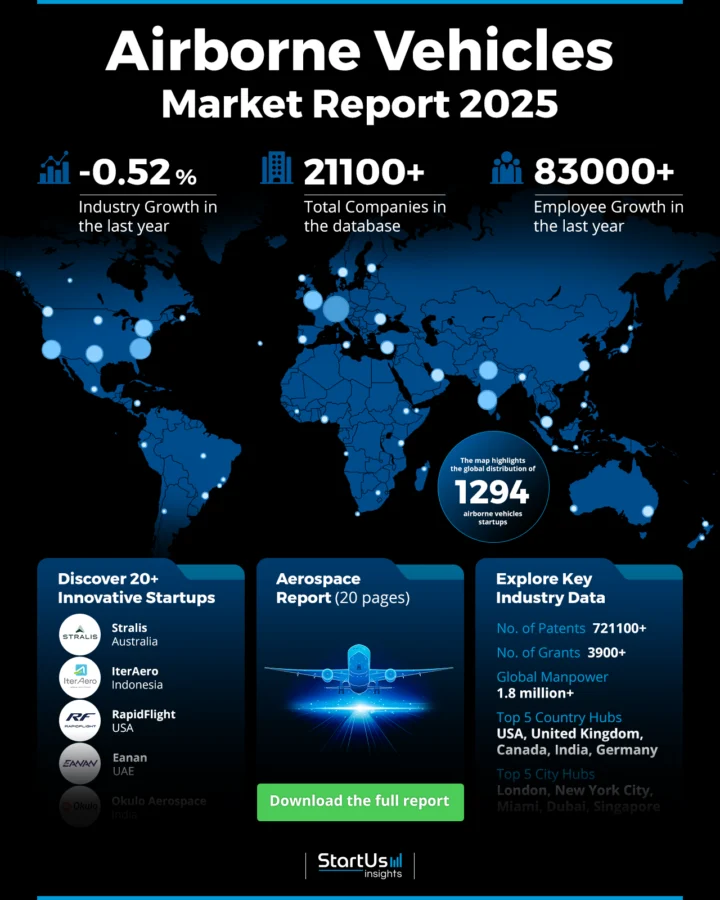

- Industry Growth Overview: The airborne vehicles market reflects a dynamic yet challenging landscape, with a slight annual growth decline of -0.52% as per our platform. The Air Powered Vehicle Market was valued at USD 936.23 billion in 2019. It is projected to grow from USD 1483.69 billion in 2023 to USD 5201.31 billion by 2031, with a CAGR of 59% from 2024 to 2031.

- Manpower & Employment Growth: The sector has more than 1.8 million employees worldwide, and in the past year, 83000+ new hires have been added, indicating consistent job creation and talent attractiveness.

- Patents & Grants: With more than 721 100 patents and 3900 grants, the sector indicates a high emphasis on R&D.

- Global Footprint: China has more than 140 300 patents, whereas the United States has more than 207 800. The United States, the United Kingdom, Canada, India, and Germany are important country hubs, and London, New York City, Miami, Dubai, and Singapore are important city hubs.

- Investment Landscape: With over 4400 investors, 6000+ funding rounds, and an average investment value of USD 59.4 million per round, the domain has demonstrated considerable financial interest.

- Top Investors: Leading investors including TransDigm, Dubai Aerospace Enterprise, China Construction Bank, and more, have collectively invested around USD 9 billion within the sector.

- Startup Ecosystem: Five innovative startups, Stralis (emission-free hydrogen-based electric aircraft), IterAero (unmanned aerial vehicle), RapidFlight (unmanned aircraft system design & manufacturing), Eanan (advanced heavy cargos and eVTOL aircraft), and Okulo Aerospace (solar-electric hybrid UAVs for aerial monitoring), showcase the sector’s global reach and entrepreneurial spirit.

What Data is Used to Create This Airborne Vehicles Market Report?

Based on the data provided by our Discovery Platform, we observe that the automation software ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: With over 1140 publications in the past year, the airborne vehicles market has received attention.

- Funding Rounds: With over 6000 fundraising rounds included in the database, the domain highlights strong investment activity.

- Manpower: The sector employs over 1.8 million employees worldwide and added over 83000 in the past year.

- Patents: With 721100+ patents, the sector shows significant innovation skills and ranks well in terms of intellectual property development.

- Grants: The sector ranks high for obtaining money for research and development, with over 3900 grants.

Methodology: How We Created This Airborne Vehicles Market Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of compliance management over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within airborne vehicles

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the airborne vehicles market.

Explore the Data-driven Airborne Vehicles Market Report for 2025

Did you know the global flying car market is projected to reach billions in valuation by 2030, driven by the demand for faster, eco-friendly transportation solutions?

The automation software outlook report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. With 1290+ startups and 21 100+ companies identified in the database, the heatmap shows the dynamic distribution and growth of the airborne vehicles sector.

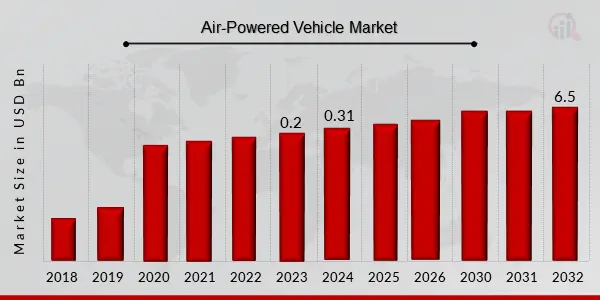

Market Research Future further reports that the Air Powered Vehicle Market was valued at USD 0.2 billion in 2023. It is projected to grow from USD 0.31 billion in 2024 to USD 6.5 billion by 2032, with a CAGR of 45.82% from 2024 to 2032.

Credit: Market Research Future

Innovation is still going strong, as seen by the 721 100+ patents and 3900+ grants issued in the last year, even if the market shrank by -0.52%. With 83000+ new hires last year, the sector now employs more than 1.8 million employees worldwide, indicating consistent job growth.

Leading nations including the United States, the United Kingdom, Canada, India, and Germany are important hubs driving this ecosystem. Regional centers of innovation and activity are further highlighted by major city hubs such as Singapore, Miami, Dubai, New York City, and London. As a visual depiction of these patterns, the heatmap provides information about the distribution of the domain and possible regions for expansion.

A Snapshot of the Global Airborne Vehicles Market

The dynamic nature of the airborne vehicles domain is reflected in its mixed environment of innovation and consolidation. With 1290+ startups, the sector is still thriving despite a minor yearly growth fall of -0.52%, indicating a strong presence of entrepreneurs.

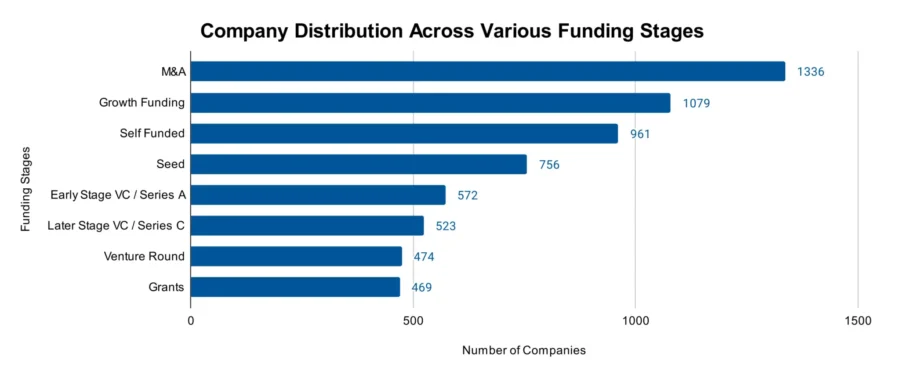

More than 570 of these are early-stage firms, indicating continued interest in and funding for novel concepts and technology. Significant market consolidation has also occurred, as seen by the 1300+ mergers and acquisitions (M&A) that have occurred, reflecting the sector’s developing ecology.

The sector’s dedication to innovation is evidenced by the 721 100+ patents it has received from 57 100+ distinct applications. The 0.69% annual patent growth rate indicates consistent technological breakthroughs.

With 207800+ patents, the United States leads the world in patent issuance. China comes in second with 140300+ patents, demonstrating its superiority in promoting innovation in this area. This data highlights the airborne vehicles sector’s innovation-led foundation and worldwide competitiveness.

Explore the Funding Landscape of the Airborne Vehicles Market

With substantial financial interest and support from the international investor community, the airborne vehicles sector exhibits a strong investment environment. More than 4400 investors have expressed interest in the domain which highlights the wide range of market leaders driving its expansion and innovation. With more than 6000 fundraising rounds closed, the sector has demonstrated steady and extensive financial activity.

The field highlights its capital-intensive character, which is indicative of the advanced technology and high-value prospects it offers, with an average investment value of USD 59.4 million every round. Further, 2000 startups received investments which shows the sector’s ecosystem’s diversity and its allure to investors looking to fund both established firms and up-and-coming entrepreneurs.

Who is Investing in the Airborne Vehicles Market?

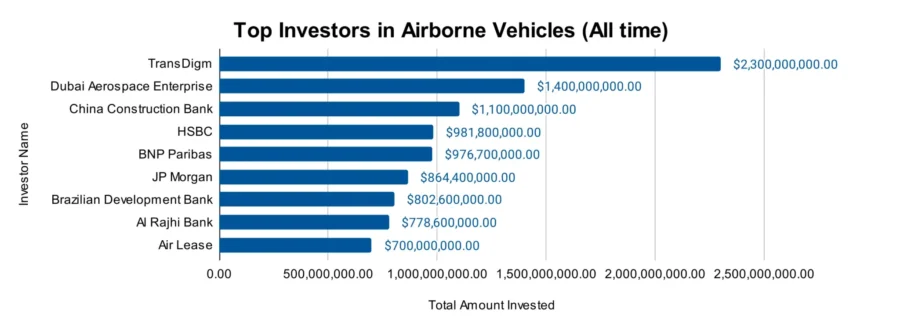

The top investors in the airborne vehicles sector have made combined investments of more than USD 9 billion which indicates a significant financial commitment to the sector’s advancement.

- TransDigm has invested USD 2.3 billion in 14 companies. It acquired Airborne Systems Inc. for approximately USD 250 million.

- Dubai Aerospace Enterprise has contributed USD 1.4 billion to at least 1 company.

- China Construction Bank has invested USD 1.1 billion in 3 companies.

- HSBC has allocated USD 981.8 million across 4 companies.

- BNP Paribas has backed 7 companies with a total of USD 976.7 million.

- JP Morgan has invested USD 864.4 million in 4 companies.

- Brazilian Development Bank (BNDES) has funded at least 1 company with USD 802.6 million.

- Al Rajhi Bank has invested USD 778.6 million in at least 1 company.

- Air Lease has provided USD 700 million to at least 1 company.

Top Airborne Vehicles Innovations & Trends with the Discovery Platform

Discover the emerging trends in the airborne vehicles market along with their firmographic details:

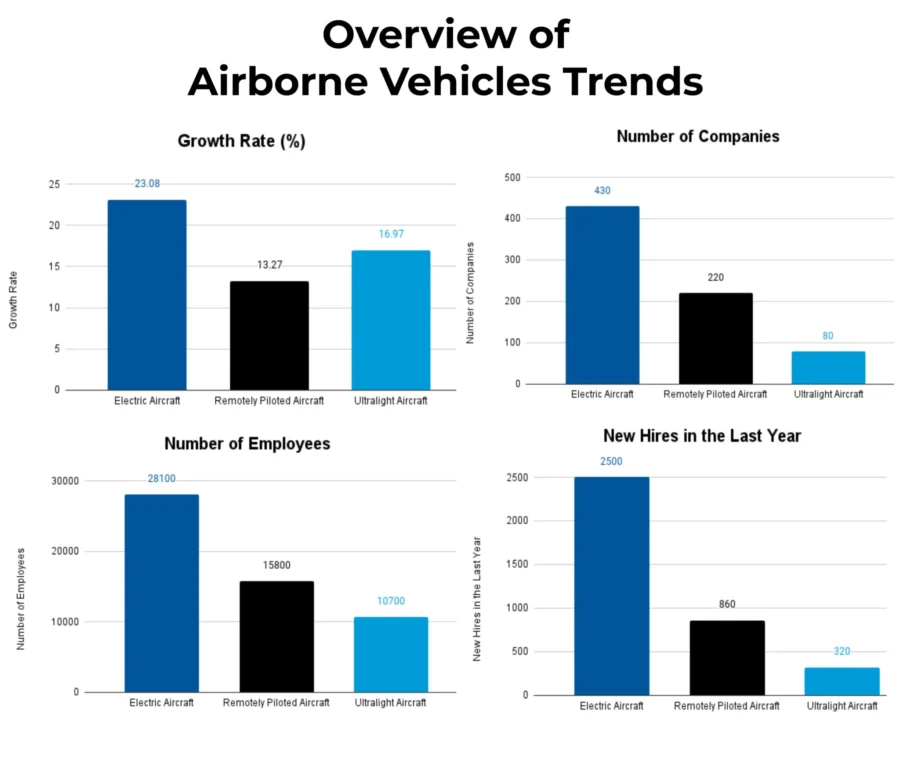

- Electric Aircraft is leading the innovation charge with 400+ companies employing 28 000+ employees, with 2000+ new hires in the last year. This sector is growing at a 23.08% annual trend growth rate. It reflects a strong focus on sustainable aviation and electrification technologies driving the sector’s future.

- Remotely Piloted Aircraft trend, encompassing drones and UAVs, includes 200+ companies employing 15 500+ employees, with 850+ added last year. This trend is growing at an annual trend growth rate of 13.27%. It highlights its significance in surveillance, logistics, and advanced aviation applications.

- Ultralight Aircraft trend is gaining traction with 80+ companies employing 10 500+ employees and 300+ new employees added last year. With an annual trend growth rate of 16.97%, this segment highlights increasing interest in lightweight and cost-efficient flying solutions, catering to personal aviation and niche markets.

5 Top Examples from 1200+ Innovative Airborne Vehicles Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Stralis creates Emission Free Hydrogen-based Electric Aircraft

Australian startup Stralis creates heavy industry and aviation hydrogen-electric propulsion systems. Its fuel cell technology, STRALIS HEPS, enables aircraft to fly farther than battery-electric models which are lighter than existing alternatives. It also combines with electric motors and liquid hydrogen tanks. This technology provides a flexible solution for a variety of industries by powering heavy-duty vehicles and long-range drones.

Stralis offers short-term, zero-emission solutions by modifying existing aircraft, like the 15-seat Beechcraft 1900D-HE, with no impact on refueling infrastructure. Additionally, the startup creates new aircraft, such as the 50-seat SA-1-HE, for hydrogen-electric technology. This results in operational costs that are lower than those of traditional aircraft. Stralis decarbonizes air transport by providing effective, sustainable propulsion solutions that lower operating costs and environmental impact.

IterAero offers Unmanned Aerial Vehicle (UAV)

Indonesian startup IterAero develops the IA-25, an unmanned aerial vehicle (UAV). The IA-25 has a composite airframe that is 248 cm long and has a wingspan of 371.1 cm. It has the capability to cruise at 43 knots. It holds equipment like thermal cameras, topographical sensors, and photography or videography cameras, or it carries up to 5 kilograms of luggage.

The solution is suitable for agriculture, project management, aerial imaging, cargo transportation, and land mapping with a five-hour flying duration and a 5000-foot service ceiling. IterAero offers flexible UAV systems that are beneficial for a range of operating requirements.

RapidFlight designs & manufactures Unmanned Aircraft System

US-based startup RapidFlight provides unmanned aerial systems (UAS) for changing operational requirements and national defense. It employs advanced 3D printing and digital engineering to create modular platforms like the M2, E2, and SPX UAS. These are optimized for scalability, long-range operations, and flexible payload integration. These systems support missions requiring endurance, autonomy, and adaptability, incorporating features like vision-based navigation, beyond-line-of-sight communication, and layered navigation technologies.

RapidFlight also delivers its Mobile Production System (MPS) which enables forward-location manufacturing and deployment while reducing logistical complexities. The startup benefits mission commanders with agile, on-demand solutions to enhance operational rates, sustainment efficiency, and responsiveness to mission-critical requirements.

Eanan offers Advanced Heavy Cargo and eVTOL Aircraft

UAE-based startup Eanan develops electric vertical take-off and landing (eVTOL) planes and large freight unmanned aerial vehicles (UAVs). Its UAV, Sa’faar, uses adaptable configurations to provide efficient delivery to remote areas. It carries payloads up to 200 kg across 25 km at speeds of up to 100 km/h. Rikaz UAV transports 50–200 kg over 40 km and performs well in challenging environments for industrial logistics.

Gaith UAV is for agricultural use with a 40-liter tank and a 10-meter-wide spray system that treats 18 hectares per hour to maximize crop care. Eanan’s eVTOL aircraft, Qadem, provides customers with effective, traffic-free city transit through urban air taxi services. The startup develops sustainable, emission-free air mobility solutions that improve urban transit, logistics, and agriculture by using advanced aeronautical technology.

Okulo Aerospace creates Solar-Electric Hybrid UAVs for Aerial Monitoring

Indian startup Okulo Aerospace creates solar-electric hybrid unmanned aerial vehicles (UAVs) for continuous aerial surveillance in a variety of sectors. These UAVs fly for up to eight hours due to a combination of solar power and battery systems. This allows for long-term, affordable monitoring that extends beyond visible line of sight.

The startup offers high-efficiency monitoring solutions for industries like oil and gas, renewable energy, and port operations. These solutions are outfitted with energy management algorithms and fully autonomous operation capabilities. Okulo Aerospace delivers advanced situational awareness and security while advancing asset monitoring with reduced operational costs and enhanced reliability.

Gain Comprehensive Insights into Airborne Vehicles Trends, Startups, or Technologies

The 2025 airborne vehicles market reflects a sector in transformation, driven by innovation, sustainability, and evolving market demands. As market leaders and investors adapt to new technologies and opportunities, collaboration and strategic investments will be key to unlocking the full potential of this dynamic sector.

Get in touch to explore all 1200+ startups and scaleups, as well as all market trends impacting airborne vehicle companies.