The 2025 Alloy Market Report examines the sector’s vital role in aerospace, automotive, construction, and energy, driven by investment, workforce expansion, and material science advancements. It highlights the market’s dynamic landscape, from high-growth superalloys to established nickel alloys.

Executive Summary: Alloy Market Outlook 2025

- Industry Growth Overview: The metal alloys market size will grow from USD 334.9 billion in 2025 to USD 430.55 billion in 2029 at a compound annual growth rate (CAGR) of 6.5%. On a granular level, the alloy market achieved a steady 6.95% annual growth rate as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: With over 984 200 employees working for the market worldwide, it added over 38K new employees in the last year.

- Patents & Grants: Supported by 173 900+ applicants worldwide, the market’s innovation ecosystem is backed by 1 407 600+ patents and 1200+ grants. With over 320 500 patents, the US leads the world in patent issuance, followed by China with over 286 800.

- Global Footprint: With major cities like Mumbai, Houston, Shanghai, Shenzhen, and Kolkata developing as engines of market innovation and activity, the top hubs are the US, India, China, the UK, and Italy.

- Investment Landscape: The market shows strong investor trust and financial support, with over 1500 fundraising rounds totaling USD 4.76 billion and an average investment value of USD 32.5 million each round.

- Top Investors: The market’s expansion and scalability have been greatly aided by top investors. Rio Tinto, HPS Investment Partners, Export Development Canada, and more contributed around USD 4.76 billion to the alloy market.

- Startup Ecosystem: Five innovative startups, Phaseshift Technologies (AI-powered advanced materials design), Neoshapes (precious metals 3D printing), ATTOMAX (amorphous metal alloy golf ball), Milvus Advanced (high-performing nanomaterials), and Green Trek (steel waste recycling) illustrate the sector’s entrepreneurial drive and global impact.

Methodology: How We Created This Alloy Market Report

This alloy report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports.

Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies, and market trends.

For this report, we focused on the evolution of alloy over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within alloy

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the alloy market.

What Data is Used to Create This Alloy Market Report?

Based on the data provided by our Discovery Platform, we observe that the Alloy market ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The alloy sector attracted a lot of attention, as seen by the more than 8200 publications it received in the previous year.

- Funding Rounds: It ranks high in terms of funding activity with information on more than 1500 funding rounds recorded in the database.

- Manpower: With over 984 200 employees, the industry shows its broad reach, having added more than 38K new employees in the last 12 months.

- Patents: A notable portfolio of 1 407 600+ patents demonstrates innovation thrives in the alloy sector.

- Grants: More than 1200 grants assist the sector financially which portrays substantial institutional and governmental support.

- Yearly Global Search Growth: The market has experienced a strong 7.24% yearly growth in global search interest which reflects its increasing public interest and importance.

Explore the Data-driven Alloy Market Report for 2025

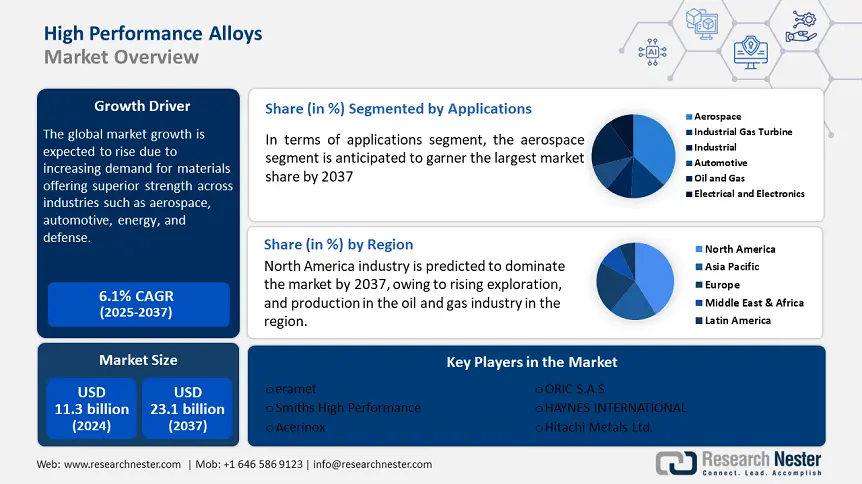

As per the report published by Research Nester, the high-performance alloy market size will grow by USD 13.17 billion between 2025 and 2037, driven by a 6.1% compound annual growth rate.

Credit: Research Nester

Our database contains more than 12 100 companies and 180 startups which demonstrates growing innovation.

It highlights significant accomplishments in the data, such as 1 407 600+ patents and 1200+ grants which emphasize the extent of investment and innovation influencing the sector.

The industry saw a 6.95% growth rate in the last year, adding more than 38000 new employees which shows strong expansion.

As per the Business Research Company reports the metal alloys market size will grow from USD 334.9 billion in 2025 to USD 430.55 billion in 2029 at a compound annual growth rate (CAGR) of 6.5%.

Credit: The Business Research Company

The global workforce now exceeds 9 84 200 employees which are distributed across key hubs.

Additionally, prominent cities like Mumbai, Houston, Shanghai, Shenzhen, and Kolkata become hubs of industry activity and innovation. The heatmap also identifies top nations like the US, India, China, the UK, and Italy.

As per Reuters, China is likely to export roughly 90 million to 100 million tons in 2025.

A Snapshot of the Global Alloy Market

The alloy market has shown persistence and expanding influence with a consistent annual growth of 6.95%. The market promotes substantial innovation and reflects a changing and dynamic business environment.

This is evident in more than 180 startups and a strong ecosystem of more than 120 early-stage startups and 580 M&A activities.

The notable 1 407 600+ patents, which were submitted by 173 900+ applicants globally, further represent the market’s innovation. With 320 500+ patents issued, the US leads the world in patent issuance, followed by China with 286 800+ patents.

Moreover, the patent’s growth rate was stable at 0.34% last year.

Explore the Funding Landscape of the Alloy Market

With an average investment value of USD 32.5 million per round, the alloy industry shows solid financial backing which indicates a high level of investor trust in the sector. The industry benefits from a committed and broad financial base, with over 1100 investors actively involved.

The sector demonstrates steady capital flow and active dealmaking with more than 1500 investment rounds being closed. More than 750 startups have received investments which depicts the industry’s wide reach and the vital role that funding plays in driving its expansion and innovation.

Who is Investing in the Alloy Market?

The top investors in the alloy industry have contributed significantly to the expansion and innovation of the sector, with a total investment value of about USD 4.76 billion. The top investors, the amount they have invested, and the number of businesses they have backed are listed below:

- HPS Investment Partners invested USD 775 million in at least 1 company. Acerinox also announced around USD 73.03 million in its high-performance alloys division, VDM Metals.

- Rio Tinto invested USD 700 million in at least 1 company. Rio Tinto has committed USD 143 million to establish a low-carbon ironmaking R&D facility in Western Australia, focusing on its BioIron technology.

- Luxfer invested USD 612 million in at least 1 company.

- Acerinox invested USD 553.3 million in at least 1 company. It is investing USD 69.92 million in its high-performance alloys division (VDM Metals).

- Export Development Canada invested USD 425 million across 2 companies.

- Rajesh Exports invested USD 400 million in at least 1 company.

- Cogne Acciai Speciali invested USD 327.6 million across 2 companies. It approved a USD 46.74 million capital increase in 2024 to support acquisitions and growth in the special steel sector.

- Trafigura invested USD 325 million in at least 1 company. It invested USD 140 million in an all-in-one nickel refinery in South Korea, to support battery materials production.

- Nyrstar invested USD 325 million in at least 1 company.

- LeafHouse Financial invested USD 313 million in at least 1 company. LeafHouse collaborated with Alta Trust to introduce the Alta Privately Managed Alts Fund, which is a collective investment trust (CIT).

Top Alloy Innovations & Trends

Discover the emerging trends in the alloy market along with their firmographic details:

- Nickel & Nickel Alloys dominate the alloy market, consisting of 7 900+ companies with over 517 800 employees, including 21 200 new employees in the last 12 months. Its critical role in a variety of applications is highlighted by its stable 2.57% annual growth rate, which is driven by strong demand and consistent workforce expansion.

- Superalloys is a rapidly expanding trend category with 650+ companies. It employs 49 400 employees, including 2600 new hires last year. The segment’s 11.58% yearly growth rate is indicative of its growing use in advanced applications, especially in the energy and aerospace industries. Straights Research’s report suggests the global superalloys market size is projected to reach from USD 7.85 billion in 2025 to USD 14.75 billion by 2033, growing at a CAGR of 8.2% during the forecast period (2025-2033).

- Corrosion-Resistant Alloys trend is growing at a 5.4% annual growth rate with more than 150 companies and 18100 employees, including 500 new employees. This growth is being driven by the growing need for durable materials in complex settings, such as the chemical and maritime industries. As per Market Research Community, the corrosion-resistant alloys market was analyzed which was worth USD 8.11 billion in the year 2024, expecting a CAGR of 6.7% during 2024-2032, and the market is projected to be valued at USD 13.6 billion by 2032.

5 Top Examples from 180+ Innovative Alloy Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Phaseshift Technologies enables AI-powered Advanced Materials Design

Canadian startup Phaseshift Technologies uses its AI-powered Rapid Alloy Design (RAD) platform to create advanced materials. The platform speeds up the process of finding and optimizing new alloy compositions by fusing machine learning with multi-scale simulations.

It reduces the requirement for intensive experimental testing by combining MatterMind for AI-driven material design and Cascade for predictive simulations. Phaseshift Technologies designs customized alloys with improved strength, resistance to corrosion, and thermal performance for a range of industrial uses, such as energy and aerospace.

The startup’s technology expedites the material development cycle and provides quicker and affordable solutions. Phaseshift Technologies closed USD 3 million seed financing to design next-generation materials using AI.

Neoshapes simplifies Precious Metals 3D Printing

Swiss startup Neoshapes offers solutions for the luxury metals sector and 3D printing of precious metals. It offers in-house and on-demand printing solutions, and customized hardware and software systems as per demands of individual clients.

The startup’s technologies enable effective prototyping, beta testing, and full-scale production without interfering with current manufacturing processes.

Neoshapes aids manufacturers in utilizing the latest 3D printing technology which enables them to produce complex designs at high speed and accuracy.

Neoshapes offers advanced technology to enable clients to innovate in industries including jewelry, watchmaking, and decorative arts.

ATTOMAX offers Amorphous Metal Alloy Golf Ball

US-based startup ATTOMAX creates high-performance golf balls using amorphous metal alloy powder, which is a non-crystalline, glass-like structure. These golf balls cater to all swing speeds with three customized options: Soft for an enhanced greenside spin, Medium for balanced control, and Hard for explosive distance.

This alloy improves the coefficient of restitution (COR) for increased speed and distance by increasing strength and elasticity. ATTOMAX’s golf balls provide performance benefits by delivering up to 20 extra yards.

The startup combines advanced materials science with advanced sports design to create items that improve golf equipment performance.

Milvus Advanced creates High-performing Nanomaterials

UK-based startup Milvus Advanced creates high-performing nanomaterials that aid applications in clean energy and green fuel. The startup produces high-performance and cost-effective catalysts by converting common metals into nanostructured alternatives to platinum-group metals.

Its Midas-touch alloys replicate the functional properties of platinum-group metals at a reduced cost, enabling high-performance catalysis crucial for the hydrogen economy. These developments promote sustainability in energy production by lowering dependency on expensive and rare metals.

Additionally, Milvus Advanced contributes to decarbonization initiatives by offering technologies that facilitate effective energy conversion and storage which promotes clean energy.

Green Trek promotes Steel Waste Recycling

Indian startup Green Trek enables sustainable recycling of steel waste by converting industrial scrap, oxides, and ores into pure molten metal with high iron content. Its processes promote resource efficiency by reclaiming valuable materials from waste while reducing environmental impact.

This metal is then alloyed to create diverse steel and alloy products, such as Hadfield manganese steel, chrome steel, heat-resistant steel, and stainless steel. This process further operates without electric power which makes it suitable for areas with limited or no power availability.

Green Trek also repurposes industrial landfills into green spaces which contribute to environmental restoration. The startup promotes a circular economy by converting waste into valuable raw materials, supporting industries in eco-friendly and sustainable practices.

Gain Comprehensive Insights into Alloy Trends, Startups, and Technologies

The 2025 Alloy Market Report highlights the sector’s resilience, innovation, and steady growth, driven by expanding applications, significant investments, and R&D. High-growth markets like superalloys and corrosion-resistant alloys, along with advancements in nickel alloys, showcase its competitiveness. Moreover, the sector prioritizes workforce development, advances materials technology, and drives sustainability to tackle challenges and seize new opportunities.

Get in touch to explore 180+ startups and scaleups, as well as all market trends impacting 12 100+ companies.