The automotive industry leads in technological innovation that will reshape vehicle design, construction, and user experience in 2025. Emerging automotive industry trends include the increased adoption of electric vehicles (EVs), advanced semiconductors, and the growing focus on vehicle cybersecurity.

What are the Top 10 Trends & Innovations in Automotive (2025)?

- Electric Vehicles

- Automotive Semiconductors

- Vehicle Cybersecurity

- Sensor Fusion

- Autonomous Vehicles

- Advanced Driver Assistance Systems (ADAS)

- Sustainable Manufacturing

- Telematics

- Connected Cars

- Regenerative Braking

Methodology: How We Created the Automotive Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, which covers and tracks nearly 5 million startups and technology companies worldwide, spanning all industries as well as 20 000 technologies and trends.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the automotive industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2024.

- Company Size: A maximum of 100 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the automotive innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 10 Automotive Trends & 20 Promising Startups

For this in-depth research on the Top Automotive Trends & Startups, we analyzed a sample of 6000+ global startups & scaleups. The Automotive Innovation Map created from this data-driven research helps you improve strategic decision-making by giving you a comprehensive overview of the automotive industry trends & startups that impact your company.

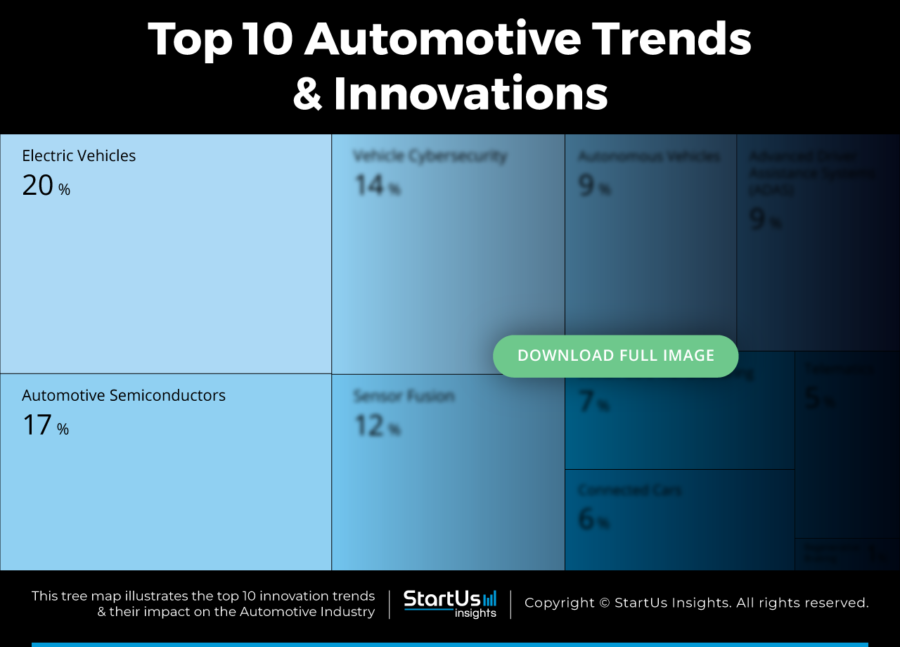

Tree Map reveals the Impact of the Top 10 Automotive Trends

The Tree Map below showcases the trends shaping the automotive industry in 2025. EVs drive the shift to greener mobility and it is aided by advancements in semiconductors for smarter and efficient vehicles.

Sensor fusion and autonomous vehicle technologies enhance safety and enable intelligent driving solutions while ADAS bridges the gap to full autonomy.

Car connectivity and telematics improve the driving experience with real-time data integration. Cybersecurity protects these connected systems, while regenerative braking and sustainable manufacturing practices reduce the environmental impact.

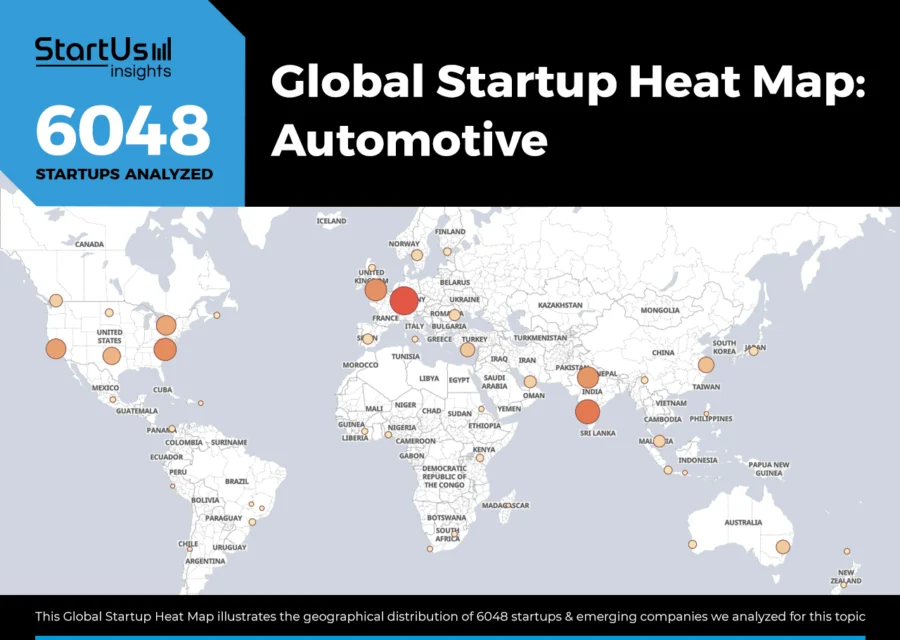

Global Startup Heat Map covers 6000+ Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 6000+ exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in Western Europe and the United States, followed by India. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Automotive Innovations & Trends?

Top 10 Emerging Automotive Industry Trends [2025 and Beyond]

1. Electric Vehicles

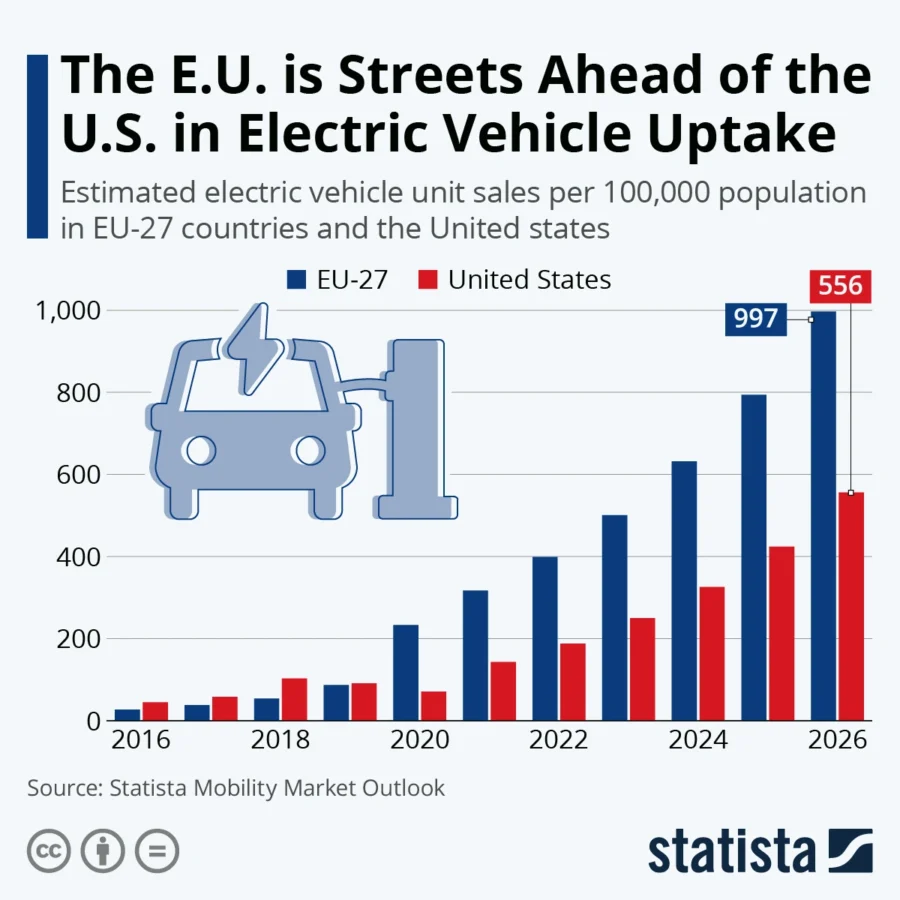

The global electric vehicle market is anticipated to reach USD 393.42 billion in 2025 and USD 2.45 trillion by 2034. It is expected to grow at a CAGR of 22.69%.

Credit: Statista

Advances in solid-state batteries promise higher energy density and faster charging times, while the expansion of ultra-fast chargers addresses key barriers to EV adoption. With the growing popularity of bidirectional charging (V2G) technology, EVs now contribute energy to the grid to improve stability.

China is expected to lead the market, with EVs reaching a 29.7% share. Europe is projected to reach a 20.4% market share, while the US is likely to reach 11.2%.

Further, as part of larger decarbonization efforts, the Intergovernmental Panel on Climate Change (IPCC) emphasizes the contribution of EVs to the reduction of greenhouse gas emissions.

ARK MOTORS builds Electric Vehicles

UAE-based startup ARK MOTORS produces electric vehicles using carbon composite materials for urban environments. Its product, FALAK, includes a curved panoramic windscreen, a spacious passenger area, and a customizable interior for taxis, businesses, and VIPs.

With zero emissions, low noise, and a range of up to 400 km, FALAK offers a sustainable urban mobility solution. The startup emphasizes comfort with electric doors, extended safety features, and panoramic views from all seats. ARK MOTORS combines a payload capacity of 500 kg and a top speed of 160 km/h.

Avvenire designs Light Electric Vehicles (LEVs)

US-based startup Avvenire develops LEVs for efficient and eco-friendly urban transportation. Its products include the Leggera, an all-electric vehicle for on-road and off-road use, and the Spiritus, a three-wheel electric car with optional autonomous driving, Wi-Fi connectivity, and solar panels.

These vehicles reduce emissions and feature innovative designs for modern commuters. Avvenire focuses on sustainable mobility to contribute to a cleaner environment and meet the demand for green transportation.

Moreover, Avvenire has a strategic agreement with Daymak International Inc., Canada’s leading LEV distributor. Daymak will assemble Avvenire’s vehicles and distribute them through its network of over 200 dealers in 25 countries.

2. Automotive Semiconductors

The global automotive semiconductor market is projected to grow from USD 53.57 billion in 2025 to USD 86.81 billion by 2033, with a CAGR of 6.22%.

Specific components like silicon carbide (SiC) and gallium nitride (GaN) power devices are expected to see growth, offering up to 60% improved efficiency over traditional silicon components.

Credit: The Business Research Company

AI-powered semiconductors drive transformation in autonomous driving systems by enabling real-time communication with road infrastructure and enhancing safety features such as emergency braking systems.

The need for high-performance processors is also growing as a result of software-defined vehicles (SDVs), which rely on semiconductors for ongoing updates and subscription-based services.

To accommodate the rising demand for EVs and autonomous vehicles, major automakers such as BMW, Hyundai, and Stellantis are investing in EV battery plants and semiconductor-related facilities.

Companies like BYD are collaborating with TSMC and MediaTek to develop advanced chips for vehicle controllers and smart cockpits.

Aeluma specializes in Scalable Silicon Manufacturing

US-based startup Aeluma develops semiconductor technology for mobile devices, AI, AR/VR, autonomous systems, and other applications. It combines compound semiconductor nanomaterials with scalable silicon manufacturing for mass-market microelectronics. This approach produces scalable and cost-effective optoelectronic devices.

The startup’s technology serves markets including mobile, automotive, AI, defense, aerospace, communication, AR/VR, and quantum computing.

Aeluma recently raised USD 3.145 million through convertible promissory notes from accredited investors to support commercialization efforts.

BOS Semiconductors develops an AI Accelerator for Vehicles

South Korean startup BOS Semiconductors builds Eagle-N, an AI accelerator for in-vehicle infotainment (IVI) and ADAS. It uses Tenstorrent’s Tensix NPU core to deliver up to 250 tera operations per second (TOPS) for efficient AI processing.

This chiplet-based architecture integrates with automotive processors via PCIe Gen5 and UCIe interfaces, which allows customizable and cost-effective system enhancements. BOS Semiconductors focuses on high-performance, energy-efficient AI solutions to drive innovation in autonomous driving and enhance in-cabin experiences.

Hyundai Motor Group invested in BOS Semiconductors through its ZER01NE open innovation platform. This investment strengthens collaboration on automotive semiconductor technologies for future mobility solutions.

3. Vehicle Cybersecurity

The automotive cybersecurity market is projected to reach USD 5.11 billion in 2025, with a CAGR of 18.14% from 2024 to 2034.

Globally, more than 400 million cars are anticipated to be connected by 2025. However, this increases the potential attack surface for cyber threats. The charging infrastructure is more vulnerable as a result of the quick uptake of EVs, which hackers may attack to obtain customer information or interfere with services.

Credit: GMI

Automakers are investing in cybersecurity technologies such as hardware security modules (HSMs), AI-based intrusion detection systems, and secure over-the-air (OTA) updates to address these challenges.

Regulatory frameworks like UNECE WP.29, effective from last year, mandate stringent cybersecurity measures to drive compliance-related investments.

Further, the Asia-Pacific region is anticipated to witness rapid growth, with a projected CAGR of 18.3%, driven by rising vehicle sales and evolving safety regulations.

Qumasoft automates Automotive Cybersecurity Management

German startup Qumasoft offers a software-driven cybersecurity management solution for vehicles and components. Its platform automates the cybersecurity management system (CSMS) and product cybersecurity evidence (PCSE) to ensure compliance with UNECE R 155 and ISO/SAE 21434.

The platform features customizable work product templates, detailed instructions, and comprehensive checklists for self-assessment. It also provides streamlined audit management, structured frameworks for continuous improvement, and intuitive escalation processes.

Qumasoft’s solution enables companies to develop, produce, and operate cybersecure vehicles and components efficiently. This reduces development costs and time while enhancing quality and analytical capabilities.

Ascent Labs builds Risk Management Platform

US-based startup Ascent Labs develops ASSURE, a risk management platform. This platform uses secured safety assurance and risk-mitigation principles to detect and address failures in assisted and self-driving systems.

It also provides real-time information for critical repair orders and ensures operational safety during and after repairs to enhance trust in the ADAS/AD repair process. The allows automotive OEMs, Tier 1 suppliers, service providers, intelligent mobility services, and fleet operators to maintain and repair advanced driver-assistance and autonomous systems.

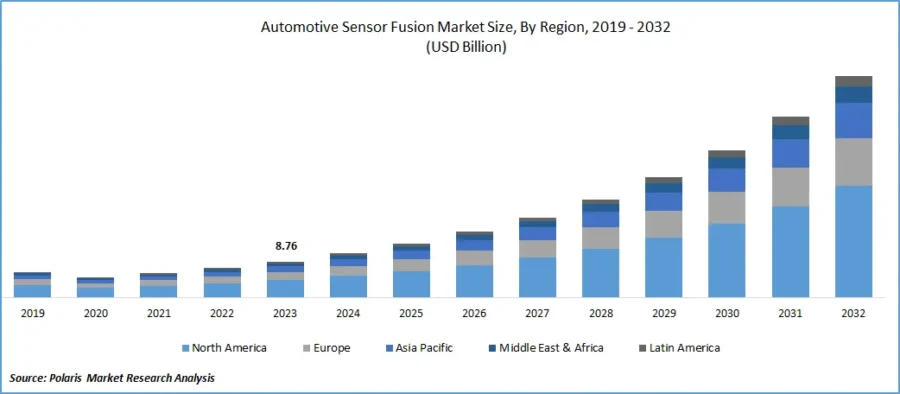

4. Sensor Fusion

With a CAGR of 25.5% from 2025 to 2037, the global sensor fusion market is expected to reach USD 7.91 billion by 2025.

Credit: Polaris Market Research

The increasing adoption of EVs globally drives the optimization of energy usage and enhances features like regenerative braking systems through sensor fusion technologies.

Miniaturization trends in automotive electronics enable the integration of multiple sensors into compact systems to improve vehicle performance while reducing costs.

Further, sensor fusion systems incorporate AI and machine learning (ML) algorithms to enhance optimization, predictive maintenance, and decision-making.

Governments also enforce stricter safety standards, pushing automakers to integrate advanced sensor systems.

SafeAD enables Large-scale Fleet Learning

German startup SafeAD develops a vision-first perception and scene-understanding pipeline for autonomous driving. It uses a full surround camera setup to analyze 3D objects and road layouts.

Its early fusion approach integrates LiDAR and radar data, while neural networks infer road elements and topology to create accurate high-definition maps. Continuous change detection triggers automatic cloud updates to ensure up-to-date navigation information.

The startup uses automotive sensors and compute platforms to offer a scalable solution for cars to enable large-scale fleet learning.

Tangram Vision offers a Perception Platform

US-based startup Tangram Vision makes MetriCal, a perception platform that integrates and manages multimodal sensors, including cameras, LiDAR, and inertial measurement units (IMUs). The platform provides scalable, maintenance-free solutions for sensor calibration, fusion, diagnostics, and fleet management to simplify perception system deployment.

The startup offers tools for real-time calibration health checks for deployed fleets to reduce time-to-market and operational risks. Further, its AI-enabled depth sensor, HiFi, enhances 3D sensing with 1.6-megapixel supersampled depth, 8 TOPS of AI compute, a 136° ultra-wide field of view, and connectivity options like PoE and USB-C.

Tangram Vision allows perception teams to focus on product-specific features by handling complex sensor tasks and accelerating development and deployment processes.

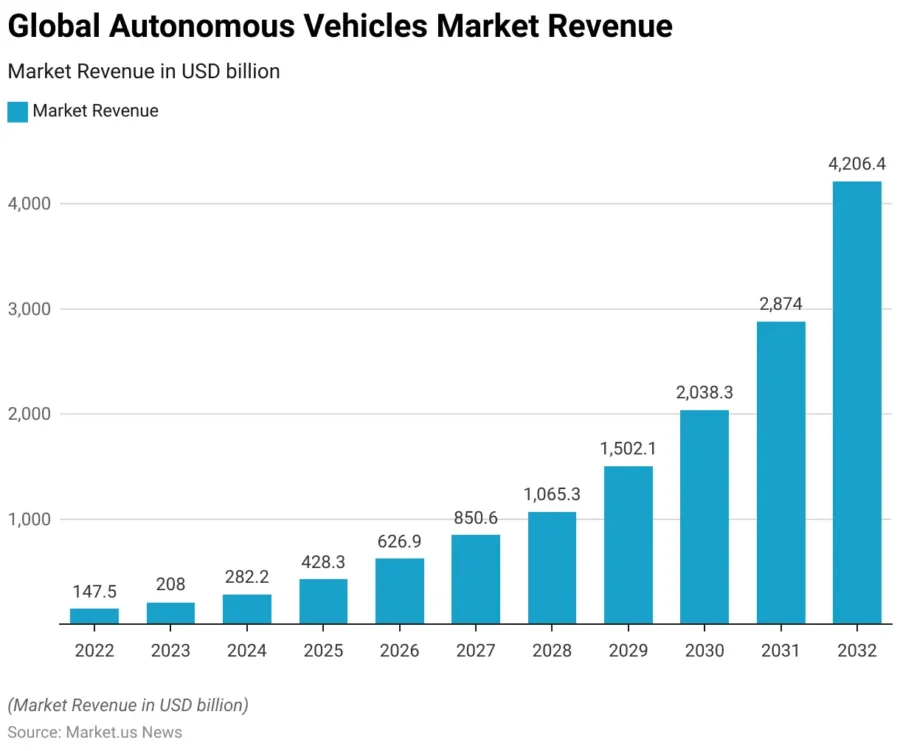

5. Autonomous Vehicles (AVs)

The AV market is projected to reach USD 1.73 trillion by 2033, growing at a CAGR of 31.85% from 2025 to 2033.

In the US, the AV market is expected to expand, rising from USD 22.6 billion in 2024 to USD 222.8 billion by 2033, with a CAGR of 28.92% starting in 2025.

Credit: market.us

Major investments drive growth, including Toyota and NTT’s USD 3.3 billion commitment by 2030 for AI in autonomous driving, and Amazon’s USD 1 billion fund for AI and AV technologies, particularly in Asia.

Level 3 (conditional automation) and Level 4 (high automation) systems are gaining traction, with broader availability expected in Europe and North America by 2025.

North America led the AV market in 2024 with over 40% revenue share, while Asia-Pacific is the fastest-growing region, with an expected CAGR of 35% from 2024 to 2033.

Companies like Nvidia innovate in AI-powered chips for AVs, partnering with automakers like Toyota, Tesla, and Aurora Innovation to enhance autonomous capabilities.

EVIE Autonomous produces Autonomous Shuttles

Singaporean startup EVIE Autonomous designs electric, autonomous shuttles for last-mile delivery, passenger transport, agriculture, and cargo movement. Its product range includes an electric modular chassis, the standard autonomous shuttle pod, and pods for other applications.

These pods use AI and machine learning algorithms for real-time perception and adaptive decision-making. The startup’s technology allows these pods to adapt across industries, enhancing efficiency and safety in transporting people and goods.

Phenikaa X provides Intelligent Transportation Solutions

Vietnamese startup Phenikaa-X creates autonomous electric vehicles with AI and multi-sensor technology for safe transportation. Its system uses functional modules, combining LiDAR, radar, cameras, and ultrasonic sensors to perceive surroundings, analyze traffic, and navigate efficiently. A 5G connection transmits data to a remote control station, which allows operators to monitor and intervene when needed.

The vehicle’s architecture includes a 3D mapping system that merges GPS and IMU data with digital maps to determine precise positioning and plan optimal routes. Front-facing LiDAR scans the road to detect objects, track pedestrians, and respond to traffic to enhance safety.

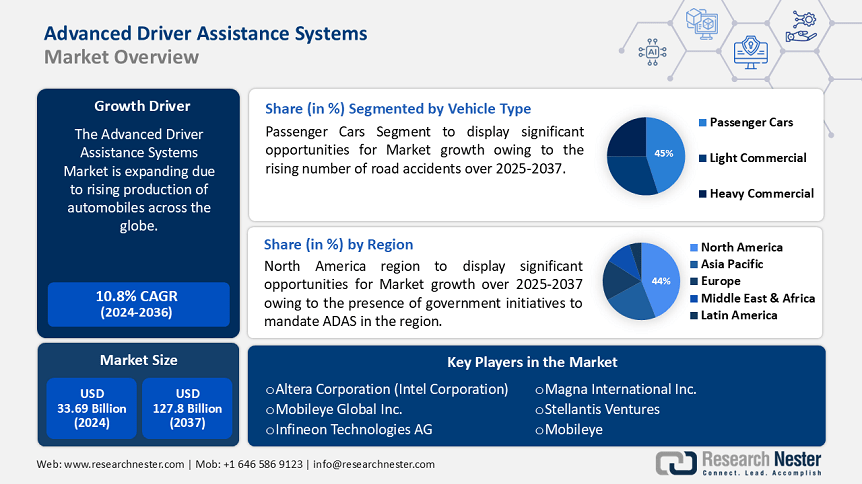

6. Advanced Driver Assistance Systems

The global ADAS market is projected to reach USD 36.6 billion by 2025, with a CAGR of 10.8% from 2025 to 2037.

Credit: Research Nester

Investments in AI and machine learning enhance ADAS capabilities. This includes driver monitoring systems, adaptive cruise control, and collision avoidance systems. Integrating vehicle-to-everything (V2X) communication further improves connectivity and safety.

The adoption of augmented reality (AR) in head-up displays and automated parking systems is expanding, which is advancing ADAS technologies.

Regulatory measures also drive market growth. The European Union’s Vehicle General Safety Regulation (GSR2), effective July 2024, mandates several ADAS features in new vehicles. The U.S. National Highway Traffic Safety Administration (NHTSA) plans to require automatic emergency braking (AEB) systems in all new light-duty vehicles by 2026.

Moreover, Asia-Pacific is the fastest-growing region, with a projected CAGR of 14.8%. This is fueled by increased vehicle production and sales in China, Japan, and South Korea.

Aviva Links advances In-vehicle Connectivity

US-based startup Aviva Links builds in-vehicle connectivity solutions that include multi-gigabit Ethernet and ASA Motion Link (ASA-ML) semiconductor products for ADAS systems. Its technology transports ultra-high-bandwidth video and data from sensors to processors with ultra-low latency. For this, it uses advanced system-on-chips (SoCs) that integrate mixed-signal analog and digital signal processing (DSP) algorithms.

The startup’s Ethernet products support precise timing synchronization with the 802.1AS Precision Time Protocol (gPTP) to ensure reliable communication for time-sensitive applications.

Starkenn leverages AI-powered ADAS

Indian startup Starkenn develops AI-powered ADAS to enhance vehicle safety and reduce road accidents. Its product suite includes a collision warning system, Starkenn Safe which uses radar to detect obstacles and alert drivers of potential collisions. The Starkenn Brake Safe, a collision mitigation system features automatic emergency braking in critical scenarios.

Further, its Starkenn Attention is a driver monitoring system that employs in-cabin vision and AI to monitor driver behavior and issue real-time alerts for drowsiness or distraction. The startup’s Stark-I, a telematics fleet management system provides analytics on vehicle location, trip data, and driver behavior.

7. Sustainable Manufacturing

At a CAGR of 11.8%, the global market for sustainable manufacturing is expected to reach USD 211.37 billion in 2025 and USD 325.37 billion in 2029. This expansion is a result of the growing use of circular economy and resource-efficient procedures.

Credit: The Business Research Company

Toyota intends to power its battery plant in North Carolina with renewable energy by 2025. This demonstrates the rapid use of renewable energy in industrial facilities.

Circular economy initiatives are also gaining momentum, exemplified by Jaguar Land Rover’s closed-loop recycling for seat foam and Michelin’s production of tires using 45% sustainable materials.

Moreover, lightweight and bio-based materials are used to reduce vehicle weight and improve fuel efficiency, which aligns with sustainability goals.

Consumer demand for eco-friendly products is rising, with 80% of US consumers concerned about the environmental impact of their purchases in April 2024, up from 68% in 2023.

Automakers are responding by integrating carbon-neutral initiatives across their value chains. This includes upstream supply chains and downstream life cycle phases like recycling.

e.Volution manufactures Sustainable Vehicles

German startup e.Volution develops application-specific electric vehicles using modular and scalable platforms. Its products include MAX, a vehicle for heavy-duty commercial applications, and GIGA for long-range logistics.

The startup also offers META, a compact shuttle for urban mobility; and SPACE for passenger transportation. These vehicles use a re-assembly factory model, which allows upgrades and updates to extend their lifecycle.

Xaba builds Industrial AI-driven Control Systems

Canadian startup Xaba develops intelligent automation solutions, materials, and processes for sustainable manufacturing. Its AI-driven control systems, xCognition and xTrude, enhance industrial robotics and additive manufacturing by automating programming and improving precision.

xCognition captures operator input or sensor data to generate execution-ready robotic programs to increase accuracy and reduce deployment time. xTrude models the physics of FDM processes to optimize parameters like flow rate and extrusion temperature to ensure large-scale 3D printing.

Xaba’s proprietary process and AI-driven large-scale 3D printer enable sustainable materials, such as fibers, fiber-reinforced polymers, and metals, to create functional car chassis.

In a seed extension round, which was led by BDC Capital’s Deep Tech Venture Fund and included participation from Hitachi Ventures and Hazelview Ventures, Xaba raised USD 2 million.

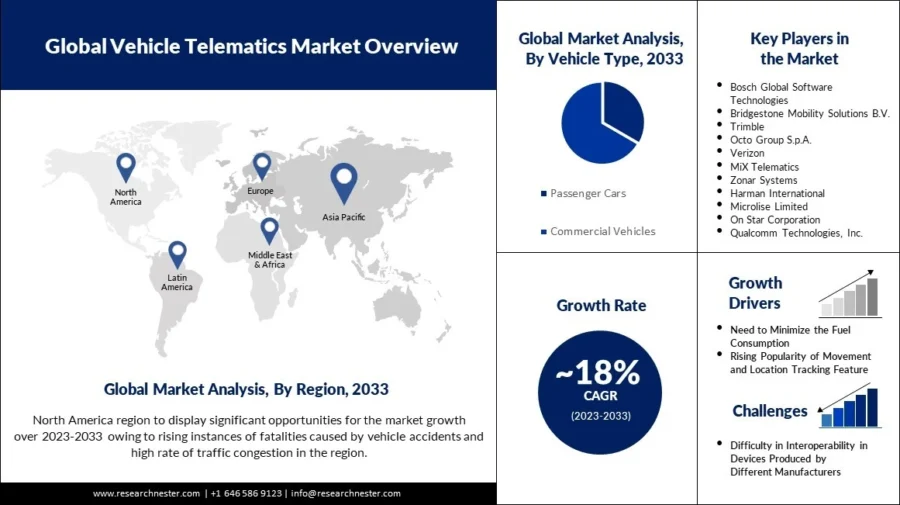

8. Telematics

The global automotive telematics market is projected to grow to USD 120.22 billion in 2025, with a CAGR of 18.3% through 2037.

The number of connected cars worldwide will likely reach 400 million by 2025 up from 237 million in 2021. This emphasizes the expanding use of telematics systems.

Credit: Research Nester

Major automakers, such as General Motors, are expanding telematics offerings by integrating subscription-based services like OnStar as standard features across models. Partnerships between telecom providers and automakers, like Targa Telematics’ collaboration with Renault, are enhancing connectivity solutions, particularly for fleet management.

Telematics adoption in logistics and transportation industries is driven by features such as real-time tracking, driver behavior analysis, and fuel consumption reduction.

Usage-based insurance (UBI) models use driving behavior data to provide customized premiums and are gaining popularity. From 2024 to 2029, the insurance telematics industry is projected to grow at a CAGR of 17.6%.

With the introduction of 5G networks, advanced telematics features like real-time diagnostics, autonomous driving, and improved safety systems are becoming even more feasible.

Further, North America dominates the market with large investments in semiconductor manufacturing and telematics integration. The focus is on safety features like fuel economy monitoring and crash warnings.

WF Telematics improves Fleet and Asset Management

UK-based startup WF Telematics offers vehicle and asset tracking solutions for businesses seeking efficient fleet management and asset monitoring. Its vehicle tracking system provides 24/7 real-time visibility, supported by self-install and engineer-fitted options, with no minimum fleet size required.

The platform includes geofencing, driver behavior monitoring, route mapping, and integrated or standalone camera options, accessible via a dashboard and mobile app. For asset tracking, the startup provides small, discrete devices with long-life batteries lasting up to five years, waterproof ratings, and location monitoring alerts for reliability in outdoor conditions.

In addition, it offers insurance-approved vehicle tracking systems with Thatcham S5 and S7 certification to meet insurer requirements and offers nationwide installation with priority police response.

Leap Business Solutions advances Fleet Management

UK-based startup Leap Business Solutions provides vehicle tracking, fleet telematics, asset management, and vehicle camera solutions. Its product, Leap Telematics, offers real-time vehicle locations, driver performance monitoring, management dashboards, bespoke reporting, and comprehensive alerts.

These features are accessible via a web-based platform and a mobile app. It includes journey replays, geofencing, and driver behavior monitoring to enhance fleet efficiency and safety. The startup also offers Leap EasyTrack, a vehicle tracking solution that allows for quick and easy self-installation, making it simple to transfer between vehicles without downtime.

For visual monitoring, Leap View provides single or multi-camera systems that integrate with vehicle tracking to offer video footage stored on tamperproof local SD cards or accessible through the telematics portal.

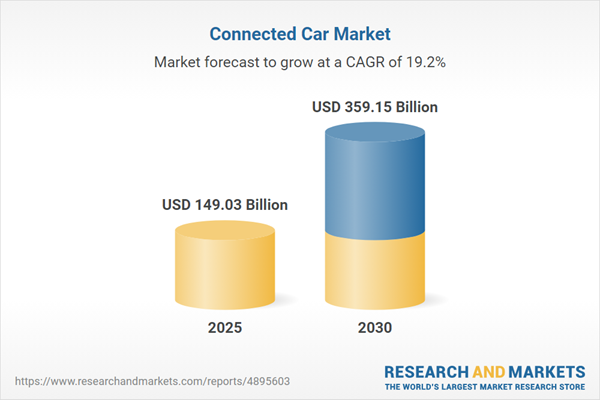

9. Connected Cars

The connected car market is projected to grow at a CAGR of 19.23%, reaching USD 359.146 billion in 2030 from USD 149.026 billion in 2025.

Credit: Research and Markets

95% of new vehicles globally will be connected by 2025. Many of these vehicles will feature over-the-air (OTA) upgrades and V2X communication.

The integration of 5G networks is accelerating advancements in vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication, supporting autonomous driving functionalities.

North America led the connected car market, holding a 39.8% share in 2024. This growth was driven by advancements in IoT and cloud computing.

SDVs prioritize software updates over hardware changes and will become mainstream in 2025. It is transforming vehicles into platforms for continuous upgrades.

Automakers are also adopting hyper-personalized features to offer customized experiences through infotainment systems, user profiles, and real-time navigation updates.

Keyvault raised USD 1 million in January 2025 to introduce smartphone-enabled car keys in the US, following the trend of incorporating smart device features into automobiles. Mercedes-Benz is also using generative AI to include conversational assistants for improving user experiences and redefining in-car interactions.

ThinkSeed transforms In-car Experience

Indian startup ThinkSeed develops middleware solutions that enhance smartphone connectivity to vehicles for secure access and infotainment. Its product, THINKey, transforms smartphones into digital keys that allow users to lock, unlock, and start their vehicles.

THINKey operates through a secure architecture using enclaves in the phone, vehicle, and cloud, adhering to the car connectivity consortium’s digital key standard. Additionally, the startup offers infotainment solutions with plug-and-play SDKs and certification-ready apps for phone mirroring and multimedia features. This facilitates the integration of Apple CarPlay, Google Android Auto, and media streaming into in-vehicle infotainment systems.

Airnity develops a Car Connectivity Solution

French startup Airnity provides a cellular connectivity platform for the automotive industry to enhance connected car operations. It builds a full-MVNO dedicated to connected car Connectivity 2.0.

The startup’s global distributed multi-cloud network platform addresses local technical, operational, and regulatory constraints, that provide automotive OEMs with smarter, more cost-effective connected services.

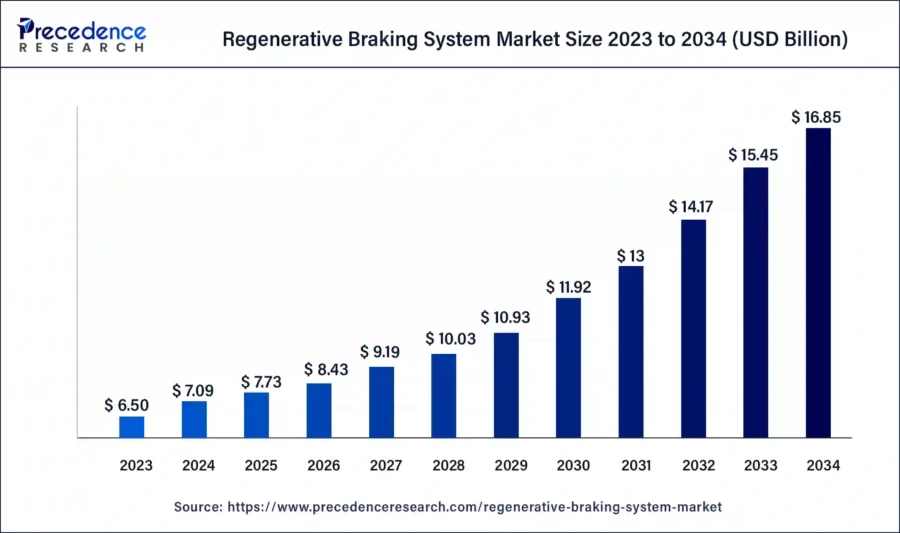

10. Regenerative Braking

The automotive regenerative braking market is expected to reach USD 13.83 billion by 2029, growing at a CAGR of 15.8%.

The Asia-Pacific region currently controls the majority of the market due to the strong uptake of electric cars (EVs) in countries like China, India, and Japan. The region’s substantial market share results from government incentives and the growth of the automobile industry.

Credit: Precedence Research

Key players like Bosch, Continental AG, and ZF Friedrichshafen AG are investing in technological advancements. They are focusing on lightweight materials and improved energy recovery efficiency.

Regenerative braking systems, crucial in EVs and hybrid cars (HEVs and PHEVs), contribute to energy recovery rates of 5% to 20%, depending on driving conditions.

In addition to enhancing energy efficiency, regenerative braking systems reduce greenhouse gas emissions by recovering energy during braking to support global efforts to meet stricter emission norms.

The technology also lowers maintenance costs by reducing wear and tear on traditional braking systems. This further drives its adoption in the automotive sector.

Apache Automotive develops Hybrid Cars

Belgian startup Apache Automotive develops the APH-01, a T3 prototype for extreme terrain. It combines a gasoline engine with an electric motor to enhance fuel efficiency and reduce emissions.

It also uses regenerative braking to capture and store energy in the car’s battery. This further improves fuel efficiency. The APH-01 incorporates flax fiber in its body shell, which reduces weight, increases impact resistance, and improves vibration damping.

Revive Earth retrofits Vehicles with the Electric Drivetrain

Nigerian startup Revive Earth develops the Revive Kit, to convert petrol vehicles into efficient EVs. It integrates electric drivetrains, transforming existing vehicles into sustainable and cost-effective alternatives to new EVs. The kit maintains original vehicle features to ensure a seamless transition and familiar driving experience.

It incorporates an intuitive infotainment system for efficient power management while minimizing driver distractions. The control system includes safeguards like automatic overheating prevention, battery depletion protection, and real-time torque and speed calibration for optimal performance on challenging terrains.

Revive Earth’s regenerative braking system captures kinetic energy during braking and converts it into stored power for the battery.

Discover all Automotive Trends, Technologies & Startups

As battery technology and charging infrastructure progress, EVs lead the push toward sustainability. Sensor fusion that combines information from various sources improves safety and autonomy by enabling accurate decision-making.

Moreover, car connectivity transforms the driving experience by integrating with real-time systems and smart gadgets. These advancements guide the automotive sector toward a more intelligent, secure, and sustainable future.

The Automotive Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.