The Aviation Industry Outlook 2025 highlights the sector’s evolution, driven by sustainability, technological advancements, and changing market demands. Key trends like autonomous aircraft, sustainable aviation fuel, and urban air mobility are transforming operations and creating growth opportunities. The report provides insights into employment, innovation, and investment, offering stakeholders a clear view of the industry’s current state and future trajectory.

This report was last updated in January 2025.

Executive Summary: Aviation Industry Outlook 2025

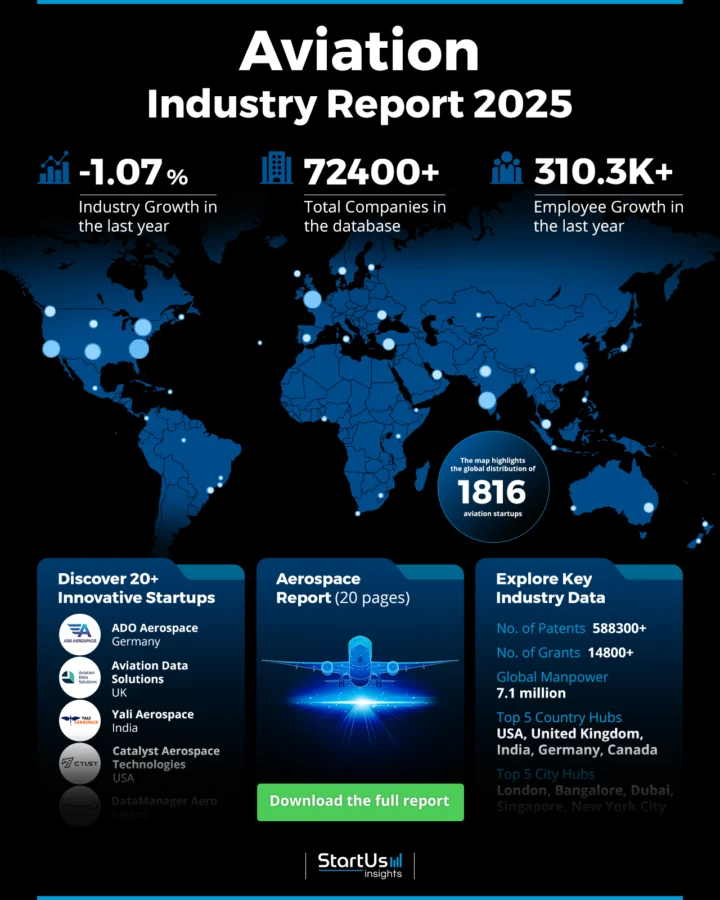

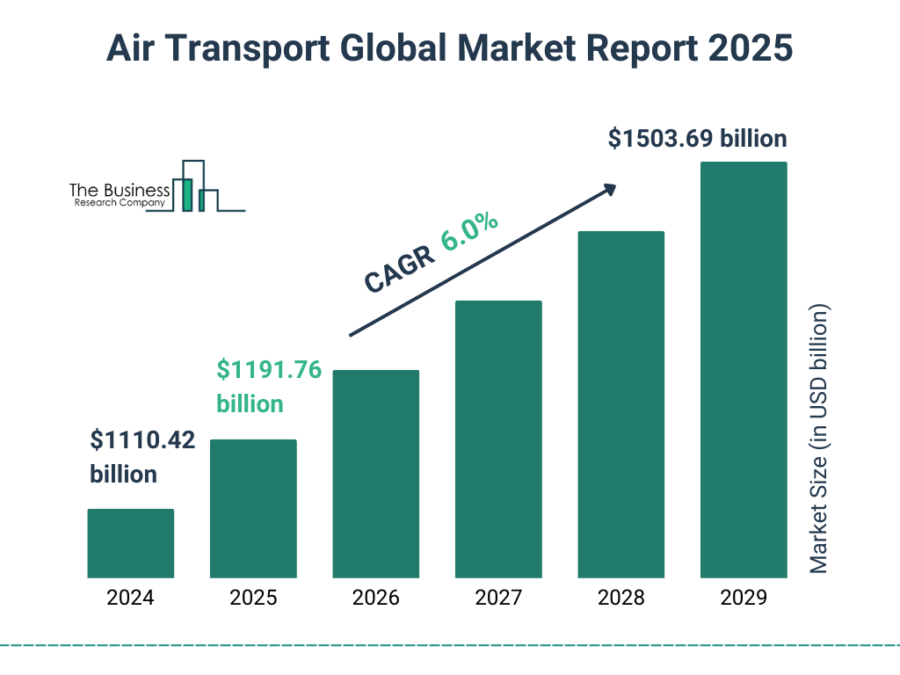

- Industry Growth Overview: The air transport size has grown from USD 1191.76 billion in 2025 to USD 1503.69 billion in 2029 at a compound annual growth rate of 7.3%. On a granular level, the Discovery Platform’s latest data shows a slight decline of 1.07% in growth rate.

- Manpower & Employment Growth: The sector employs a strong workforce of 7.1 million employees, with 310 300+ new employees added last year which hints at the ongoing growth and talent demand across key segments.

- Patents & Grants: Aviation ranks among the top industries in innovation, with 588 000+ patents filed by 65 300+ applicants globally and a yearly patent growth rate of 1.21%. The sector also secured over 14 800 grants that support technological advancement and research.

- Global Footprint: Key country hubs include the United States, United Kingdom, India, Germany, and Canada, with London, Bangalore, Dubai, Singapore, and New York City leading as prominent city hubs for aviation innovation.

- Investment Landscape: The industry recorded an average investment value of USD 60.1 million per funding round. Over 11 800 investors participated in 19 500+ funding rounds, investing in over 6650 companies worldwide.

- Top Investors: Leading contributors include TransDigm, European Investment Bank, Delta Air Lines, and more are among the key investors who invested a total of USD 14.7 billion in the industry.

- Startup Ecosystem: The industry’s global reach and spirit of entrepreneurship are demonstrated by five innovative startups: ADO Aerospace (AI-powered MRO procurement), Aviation Data Solutions (airport pricing calculator), Yali Aerospace (medical delivery drone solutions), Catalyst Aerospace Technologies (hardware and software stack for aircraft automation), and DataManager Aero (aviation assets management platform).

Methodology: How We Created This Aviation Industry Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of aviation over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within aviation

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the aviation industry.

What Data is Used to Create This Aviation Industry Report?

Based on the data provided by our Discovery Platform, we observe that the aviation industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The aviation industry is trending in news coverage and publications, with more than 34 000 publications in the last year.

- Funding Rounds: With more than 19 550 funding rounds listed in our database, it shows high growth in terms of funding activity.

- Manpower: With 7.1 million employees, the industry ranks highly in terms of manpower, and last year alone saw the addition of approximately 310 300 new employees.

- Patents: Aviation exhibits a high emphasis on innovation and intellectual property, as evidenced by its 588 300+ patents.

- Grants: With more than 14 800 grants given out worldwide, aviation is growing steadily in grant acquisition.

- Yearly Global Search Growth: With a 6.82% increase in online interest, the industry likewise ranks highly in terms of yearly global search growth.

Explore the Data-driven Aviation Industry Outlook for 2025

As per The Business Research Company report, the air transport size has grown from USD 1191.76 billion in 2025 to USD 1503.69 billion in 2029 at a compound annual growth rate of 7.3%.

The advanced air mobility (AAM) sector, encompassing next-generation transport such as electric vertical take-off and landing (eVTOL) aircraft, is projected to be worth USD 1 trillion by 2040.

Also, plans for a third runway at Heathrow Airport, estimated to cost approximately USD 25 billion, are expected to receive backing. This expansion could lead to increased airfares for passengers due to higher landing fees.

The aviation industry report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation.

Despite a slight decline of 1.07% growth in the last year, the industry displays high activity, with 1800+ startups and over 72 400 companies recorded in our database.

Credit: The Business Research Company

A strong innovation environment supports the industry, as evidenced by the more than 14 800 grants and 588 300 patents granted worldwide.

The industry, which employs 7.1 million people, saw a steady increase in workforce size last year, adding over 310 300 new employees.

The analysis identifies key centers that influence innovation in aviation. While London, Bangalore, Dubai, Singapore, and New York City emerge as important city hubs, the United States, United Kingdom, India, Germany, and Canada rank as the top nation hubs.

A Snapshot of the Global Aviation Industry

The aviation sector has a vibrant but difficult environment, with recent obstacles highlighted by an annual growth rate of -1.07%.

Despite this, the industry is still thriving with 1800+ startups and a strong emphasis on innovation and development.

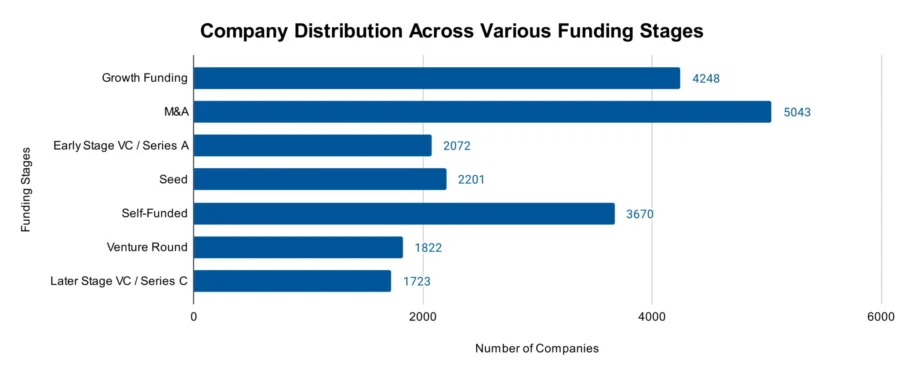

Out of these, 4440+ mergers and acquisitions (M&A) show substantial investment and consolidation activity, while over 1910 early-stage startups drive expanding technology.

With 588 300+ patents filed by 65 320+ applicants and an annual patent growth rate of 1.21%, the industry’s dedication to innovation is clear and shows consistent developments in technology.

With more than 17 1120 patents, the US tops the patent filing list, followed by China with 10 8610, solidifying their status as major centers of aviation innovation.

The International Air Transport Association (IATA) projects that airlines will achieve a global profit of USD 36.6 billion in 2025.

Moreoever, the airline industry is expected to surpass USD 1 trillion in revenue for the first time in 2025, marking a 4.4% increase from 2024.

The number of flights is anticipated to reach 40 million in 2025, with passenger demand expected to grow by 8.0%, outpacing a 7.1% increase in capacity.

Explore the Funding Landscape of the Aviation Industry

The aviation industry continues to draw significant investment activity with an average investment value of USD 60.1 million per round.

The industry has seen strong financial participation and activity, with over 11 800 investors taking part and closing over 19 550 fundraising rounds.

Over 6650 companies have benefited from these financial initiatives, which have encouraged innovation and expansion across a wide range of industries.

Who is Investing in the Aviation Sector?

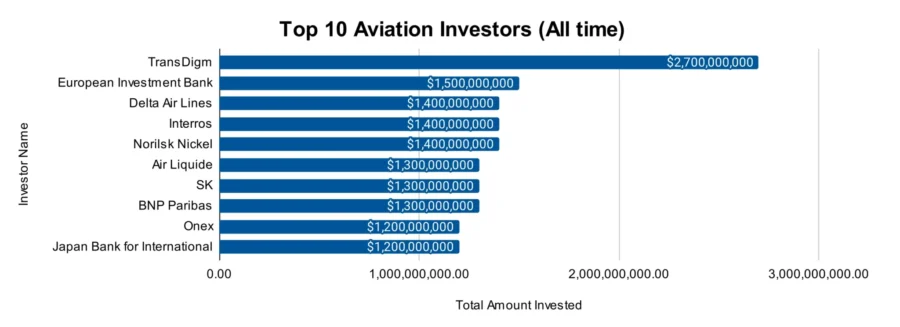

Leading investors have shown strong support for the aviation sector, with the top contributors investing a total of more than USD 14 billion. Below are the details of the key investors, the number of companies they have supported, and their respective investment values:

- TransDigm invested USD 2.7 billion across 16 companies. It also completed the acquisition of SEI Industries LTD, expanding its portfolio in specialized industrial equipment.

- European Investment Bank allocated USD 1.5 billion to 10 companies. The EIB Group and Norway’s DNB Bank ASA launched a USD 198.28 million financing initiative to support Nordic businesses in adopting green technologies.

- Delta Air Lines supported 4 companies with USD 1.4 billion in investment. Delta Air Lines and Riyadh Air announced a strategic partnership to increase connectivity and premium travel options between North America and Saudi Arabia.

- Interros invested in at least 1 company with USD 1.4 billion.

- Norilsk Nickel invested USD 1.4 billion in at least 1 company. Norilsk Nickel allocated approximately USD 25.9 million to support the indigenous peoples of the Russian North.

- Air Liquide backed at least 1 company with an investment of USD 1.3 billion. Air Liquide announced a major investment exceeding USD 250 million to build a new industrial gas production facility in Idaho, USA.

- SK Ventures funded 2 companies, contributing USD 1.3 billion.

- BNP Paribas supported 14 companies with investments totaling USD 1.3 billion. BNP Paribas entered exclusive negotiations to acquire AXA Investment Managers for USD 5.32 billion.

- Onex invested USD 1.2 billion across 4 companies.

- Japan Bank for International Cooperation allocated USD 1.2 billion to 2 companies. JBIC and the Development Bank of Kazakhstan planned to sign an agreement of intent to finance joint projects worth USD 200 million.

Did you know that Boom Supersonic’s XB-1 test aircraft is paving the way for its Overture jet to begin Mach 1.7 passenger flights by 2029, potentially halving travel times?

Top Aviation Innovations & Trends

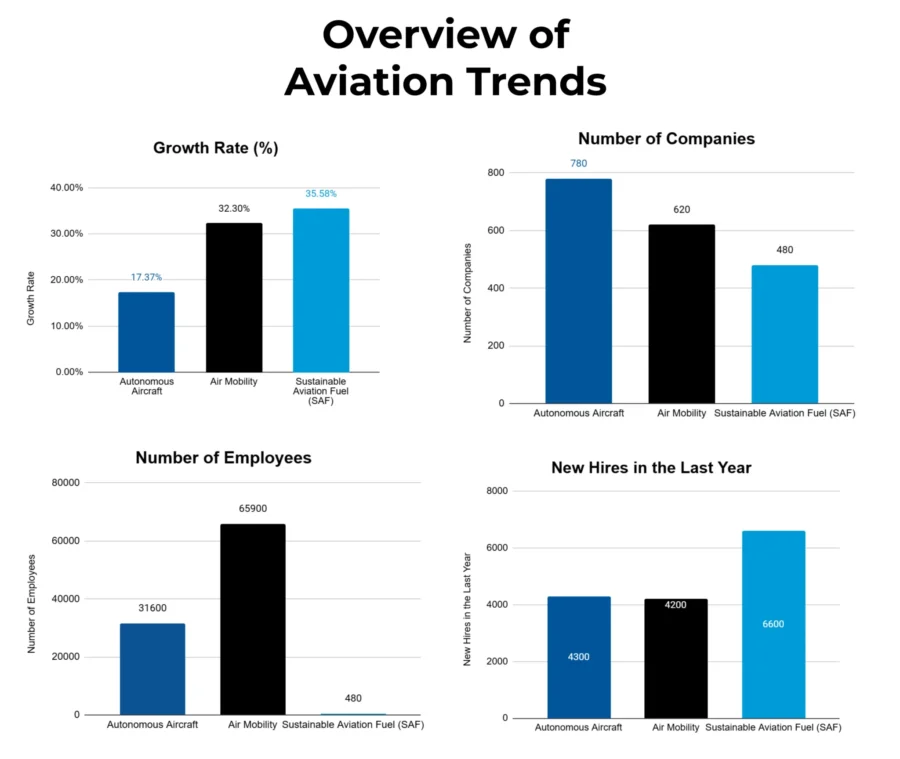

This section provides firmographic data for top trends in the aviation industry. These trends demonstrate the industry’s focus on innovation, sustainability, and innovative technologies shaping its future trajectory.

- Autonomous Aircraft: With more than 780 companies worldwide, autonomous aircraft is a quickly developing trend in aviation. With over 31 600 employees, including 4300 new employees in the past year, this industry is steadily growing its workforce. Developments in AI, sensor technology, and regulatory support are advancing the development of autonomous aircraft, which has a 17.37% annual trend growth rate.

- Air Mobility: The air mobility trend is leading the charge to advance urban transportation. With more than 620 companies and 65 900 employees, it has grown by 4200 employees in the last 12 months. With a yearly trend growth rate of 32.3%, this industry is expanding due to rising investments in electric vertical take-off and landing (eVTOL) aircraft as well as the rising need for effective, environmentally friendly urban transit options.

- Sustainable Aviation Fuel (SAF): As the aviation sector works to reduce its carbon footprint, SAF has become a key trend. With more than 480 companies in SAF, this industry employs a sizable workforce of 100 400 people, including 6600 new employees added in the previous year. In line with global sustainability goals, the industry’s dedication to lowering its carbon footprint through advancements in waste-to-energy technologies, biofuels, and synthetic fuels is demonstrated by its annual trend growth rate of 35.58%.

5 Top Examples from 1800+ Innovative Aviation Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

ADO Aerospace offers AI-powered MRO Procurement

German startup ADO Aerospace advances aerospace MRO procurement by integrating AI-powered solutions to streamline supply chain operations.

Its tool, the MRO Suite, serves as an intelligent procurement assistant by automating request for quotation (RFQ) procedures, quotation administration, contracting, and payment settlements. The platform uses real-time data and actionable insights and works independently or in synchronization with current enterprise resource planning (ERP) systems.

The startup also offers MRO Edge, a blockchain-enabled peer-to-peer marketplace that enhances parts traceability, reduces transaction costs, and opens new revenue streams from unused inventory.

ADO Aerospace drives operational efficiency, reduces costs, and enables sustainable practices by addressing inefficiencies and modernizing fragmented workflows.

Aviation Data Solutions provides Airport Pricing Calculator (APC)

UK-based startup Aviation Data Solutions provides the Airport Pricing Calculator (APC) for calculating airport and handling charges in the business aviation market.

APC integrates with flight management systems (FMS) and charter sales software or functions as a browser-based interface to provide instant and accurate cost estimations.

The platform uses proprietary datasets, including aircraft specifications, engine emissions, and operator-supplied pricing to ensure precise charge modeling and streamline financial reconciliation.

Further, APC automates request for quotation (RFQ) processes, reduces reliance on manual pricing, and enhances decision-making for operators with real-time data.

It also supports aircraft operators in optimizing trip margins, enhancing competitiveness, and reducing inefficiencies across the aviation supply chain by enabling efficient cost management and operational transparency.

Yali Aerospace offers Drones for Medical Delivery

Indian startup Yali Aerospace develops medical delivery drone solutions to advance healthcare logistics. Its drones facilitate the rapid and secure transport of essential medical supplies, including blood, emergency medications, and organs to bridge infrastructure gaps, particularly in rural areas.

The drones feature a swappable design for uninterrupted operations, integrated cold chain management for temperature-sensitive items, and GPS tracking for real-time monitoring.

It also features a temperature data logger to ensure compliance with regulatory standards. Yali Aerospace’s drones prioritize precision, safety, and efficiency with a payload capacity of up to 7 kg and a 10-liter interior.

Moreover, it advances medical logistics and improves access to critical care by improving emergency response capabilities and addressing healthcare challenges.

Catalyst Aerospace Technologies creates Hardware and Software Stack for Aircraft Automation

US-based startup Catalyst Aerospace Technologies develops a hardware and software stack for aircraft automation for certifiable unmanned systems. Its open-source autopilot, written in C, integrates with compatible hardware to offer flexibility and scalability.

The system features a no-code integrated development environment (IDE) for designing, programming, and analyzing vehicle management systems. This makes it accessible to both developers and non-programmers.

Additionally, Catalyst Aerospace Technologies provides telemetry transmission, logging, and visualization services to enhance operational insights and efficiency.

DataManager Aero offers Aviation Assets Management Platform

Irish startup DataManager Aero provides an aviation asset management platform that simplifies the oversight of assets, leases, and financial operations. It benefits airlines, lessors, and maintenance, repair, and operations (MROs).

The platform consolidates real-time data, automates workflows, and manages aircraft components. It offers comprehensive modules for asset tracking, lease management, document storage, and CRM functions.

Its design enables users to generate reports, send invoices, and access updates. The startup’s platform ensures stability, efficiency, and scalability with technologies like Angular and Sentry.

DataManager Aero enables aviation stakeholders to enhance productivity and unlock cost-saving opportunities in a competitive industry by optimizing operational efficiency and reducing administrative burdens.

Gain Comprehensive Insights into Aviation Trends, Startups, or Technologies

The aviation industry is heading toward a future defined by sustainability, automation, and urban air mobility, driven by innovations in sustainable aviation fuels, autonomous aircraft, and air mobility solutions. These trends highlight the sector’s resilience and commitment to addressing environmental and operational challenges while embracing transformative technologies.

Get in touch to explore all 1800+ startups and scaleups, as well as all industry trends impacting 72 400+ companies.

![15 Top Defense Companies and Startups to Watch in Europe [2025]](https://www.startus-insights.com/wp-content/uploads/2025/03/Defense-Companies-in-Europe-SharedImg-StartUs-Insights-noresize-420x236.webp)