A major digital shift is reshaping the financial sector, focusing on security and efficiency. AI-driven automation and cybersecurity are optimizing operations and customer interactions. The banking trends highlight the impact of digital currencies and real-time payments on traditional systems.

Innovations like Banking-as-a-Service, open banking, neobanks, and embedded finance are redefining customer experiences, while data analytics and digital identities improve personalization and security

Neobanks and embedded finance are improving customer experiences. Additionally, data analytics and digital identities are innovating personalization and security.

What are the Top 10 Banking Trends in 2025?

- Cybersecurity & Fraud Prevention

- AI-driven Banking Automation

- Digital Currency

- Real-Time Payments

- Banking-as-a-Service

- Open Banking

- Neobanks

- Embedded Finance

- Customer Data Analytics

- Digital Identities

Methodology: How We Created the Banking Technology Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 5M+ global startups, 20K technologies & trends plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the banking industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures that our reports provide reliable, actionable insights into the banking innovation ecosystem while highlighting startups driving technological advancements in the industry.

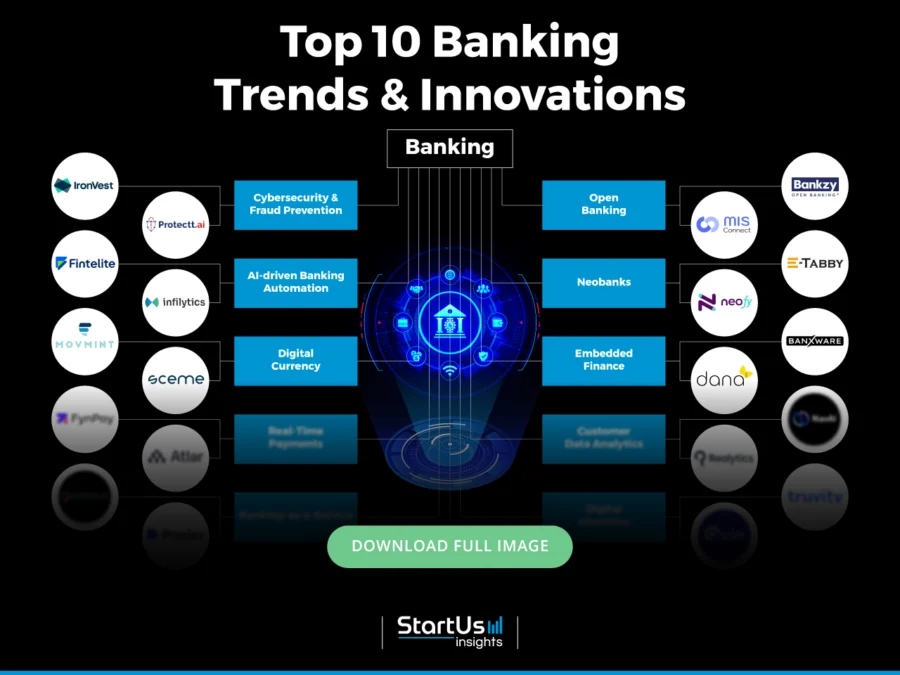

Innovation Map outlines the Top 10 Banking Trends & 20 Promising Startups

For this in-depth research on the Top Banking Trends & Startups, we analyzed a sample of 15 500+ global startups & scaleups. The Banking Innovation Map created from this data-driven research helps you improve strategic decision-making by giving you a comprehensive overview of the banking industry trends & startups that impact your company.

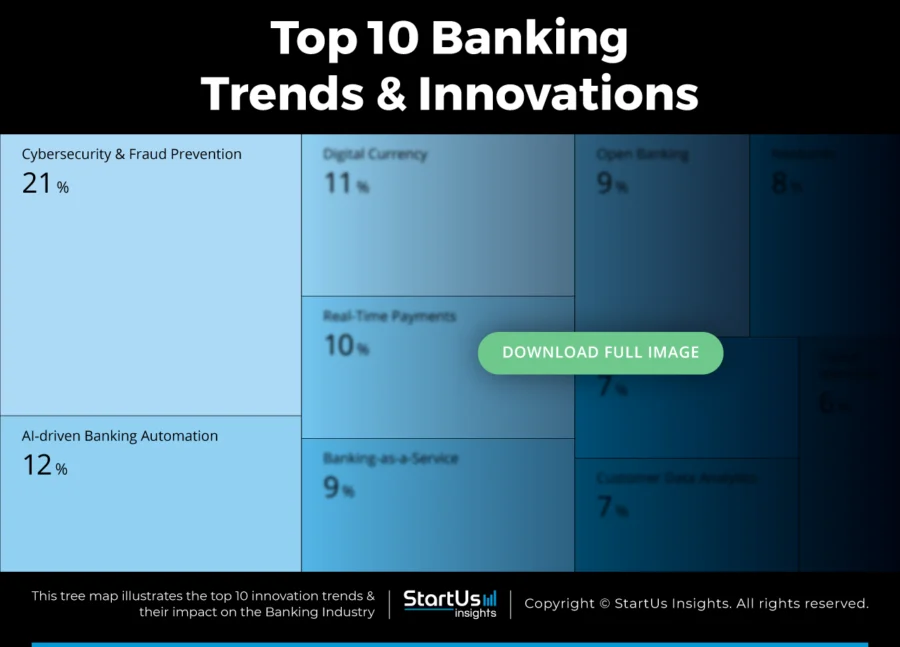

Tree Map reveals the Impact of the Top 10 Banking Trends

The banking sector is influenced by key innovation trends. Cybersecurity and fraud prevention are vital as institutions strengthen defenses against evolving threats. AI-driven automation improves operational efficiency and customer service.

Digital currencies, including central bank digital currencies (CBDCs) and cryptocurrencies, reshape the financial landscape. Real-time payments offer instant transactions, meeting the demand for speed and convenience.

Moreover, Banking-as-a-Service (BaaS) enables non-bank entities to provide financial services, expanding market reach. Open banking promotes data sharing and collaboration, leading to personalized financial products. Neobanks, operating exclusively online, deliver innovative, customer-centric solutions.

Embedded finance integrates financial services into non-financial platforms, enhancing user experiences. Customer data analytics leverages big data for personalized services and informed decision-making. Digital identities ensure secure access to banking services.

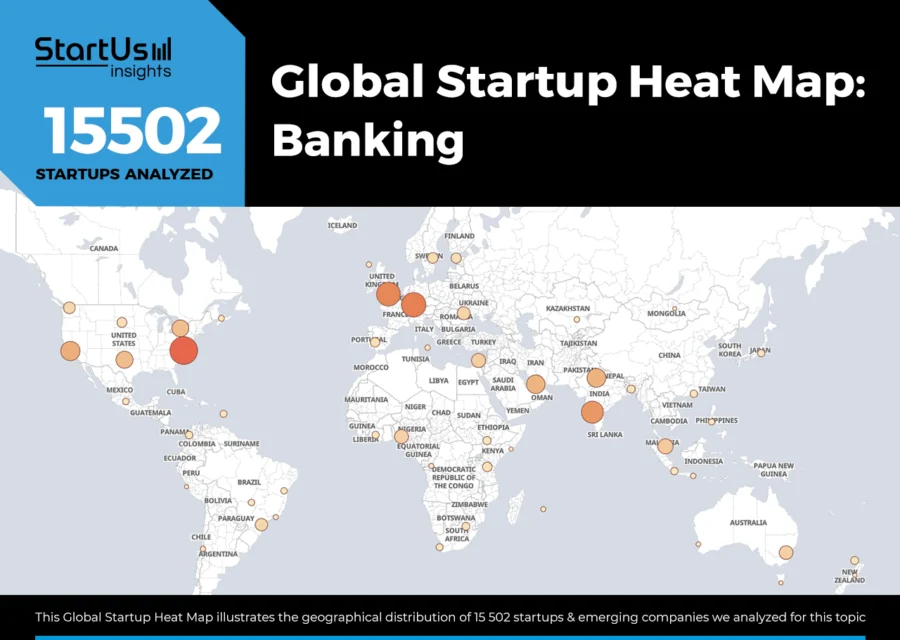

Global Startup Heat Map covers 15 500+ Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 15 500 exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in the US and India, followed by the UK. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Banking Innovations & Trends?

Top 10 Emerging Banking Trends [2025 and Beyond]

1. Cybersecurity & Fraud Prevention

The rapid adoption of digital banking services like digital payments, lending, credit services, treasury management, and more is expanding the cyber attack surface. Also, the collaboration of banks with external vendors to improve services introduces cyber risks.

Phishing is another major threat in banking, where cybercriminals use fake emails, texts, or websites to steal account details, passwords, or personal data.

In 2024, a phishing network was dismantled after it targeted thousands of Australians, including customers of major banks.

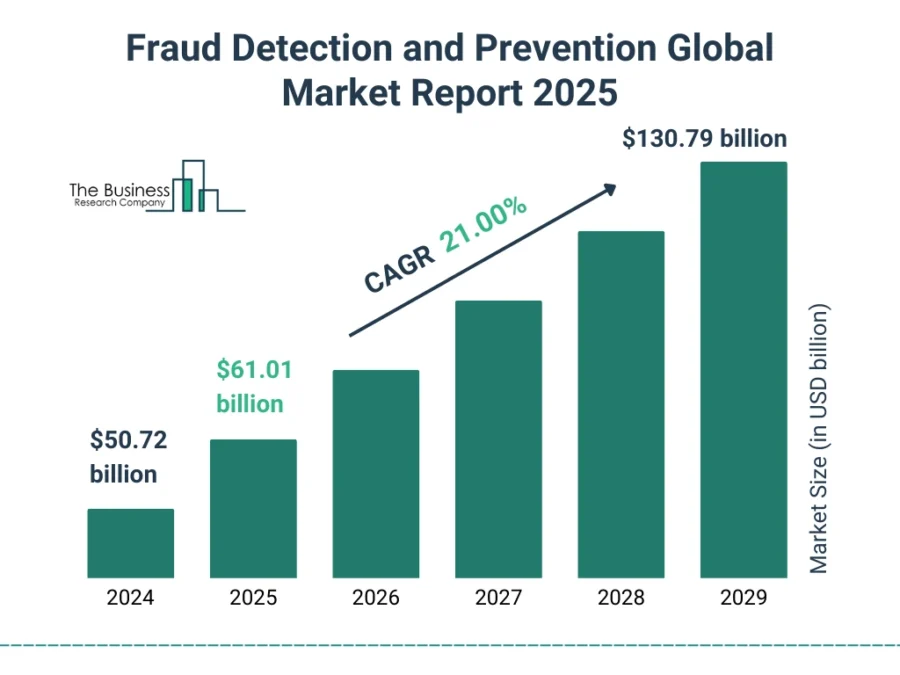

Currently, the fraud detection and prevention market size is expected to grow from USD 61.01 billion in 2025 to USD 139.79 billion in 2029 at a compound annual growth rate (CAGR) of 21.0%.

Credit: The Business Research Company

To combat these threats, banks are implementing multi-factor authentication (MFA) to add an extra layer of security beyond just passwords.

Data encryption is another effective solution that ensures that even if cybercriminals intercept sensitive data, they cannot read or use it. For instance, Proton introduced Proton Drive, which is a cloud storage solution that employs end-to-end encryption.

Security incident and event management (SIEM) systems collect and analyze security data in real-time while enabling faster threat detection and response to minimize cyberattack damage.

US federal agencies also integrated next-generation SIEM solutions to achieve unified data platforms capable of real-time threat detection and response.

Additionally, artificial intelligence (AI) is effective in detecting and responding to threats in real-time by analyzing vast amounts of data for abnormal patterns.

For example, Amazon’s daily cyber threats surged from 100 million to 750 million in six months due to AI-driven attacks. This prompted it to use AI tools like graph databases and honeypots for real-time threat monitoring.

Moreover, developing and regularly updating an incident response plan ensures that banks swiftly address security breaches.

Also, implementing a zero-trust architecture in banking processes and keeping software and systems up to date with the latest patches protects against known vulnerabilities and reduces the risk of cyberattacks.

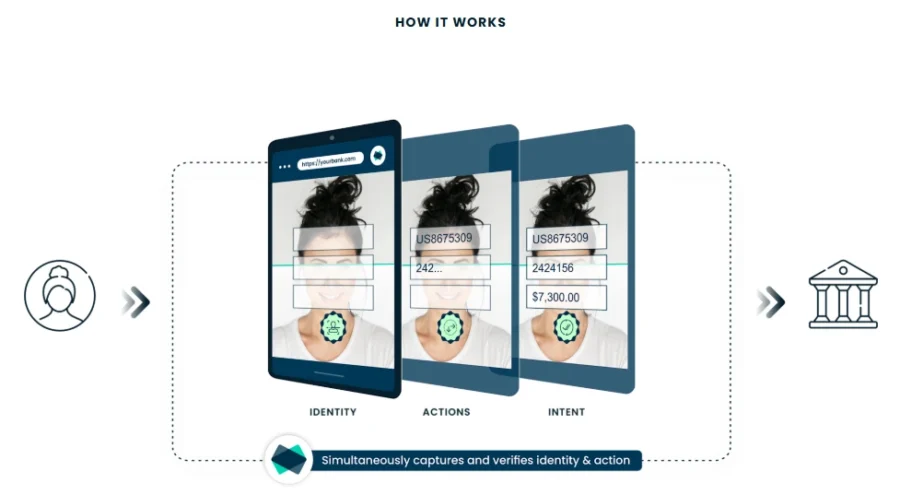

IronVest delivers Bank Security with Biometric Authentication

IronVest is a US-based startup that offers the AuthenticAction platform, which eliminates fraud and enables smooth digital banking experiences.

Fraud and digital teams at financial institutions of all sizes use this platform to enable only legitimate account holders to access and transact within their accounts.

Additionally, by fusing the account holder’s biometrics and inputs into a single, impenetrable signal, IronVest prevents account takeover attacks.

This includes SIM swaps and post-login threats like malware and phishing. Moreover, this practice reduces false positives and operational expenses associated with traditional fraud detection systems.

Protectt.ai offers Mobile Banking App Security Platform

Protectt.ai is an Indian startup that designs a mobile app security platform that safeguards financial applications from cyber threats and fraud.

Its five specialized products AppProtectt, AppBind, CodeProtectt, AppProtectt Lite, and ApiProtectt, offer protection for mobile applications.

AppProtectt integrates runtime application self-protection (RASP) and extended detection and response (XDR) to provide real-time threat monitoring.

In addition, AppBind applies zero-trust device and SIM binding to prevent identity fraud from SIM swapping, SMS spoofing, and stolen devices.

CodeProtectt also offers security by obfuscating Android and iOS code, which prevents unauthorized access and tampering. AppProtectt Lite offers a streamlined version of AppProtectt with essential security features that cater to applications requiring agile protection.

Further, ApiProtectt secures mobile APIs against threats such as app impersonation, token hijacking, and JWT theft, which provides the integrity of financial transactions.

Protectt.ai has also partnered with Finesse to improve mobile app security in the Gulf Cooperation Council (GCC) region by introducing advanced runtime security controls.

2. AI-driven Banking Automation

AI-powered chatbots and virtual assistants provide continuous customer support, handling banking-related inquiries and transactions. These technologies improve customer service by offering instant responses to common queries, such as account balances and transaction history.

For instance, Bank of America’s virtual assistant, Erica, offers personalized financial advice and assistance to customers.

Additionally, banking professionals handle vast amounts of transaction data, hence, there is a higher risk of threats and errors. AI systems are effective in analyzing transaction data in real-time and identifying unusual patterns of fraudulent activities.

JPMorgan Chase, for example, utilizes AI to monitor millions of transactions, effectively flagging suspicious activities and improving security.

Additionally, to focus on more strategic activities, bank employees are adopting Robotic Process Automation (RPA) to automate repetitive tasks such as data entry, account reconciliation, and transaction verification. For example, Blue Prism’s RPA tools are utilized by Mashreq to automate functions, including transaction processing and compliance.

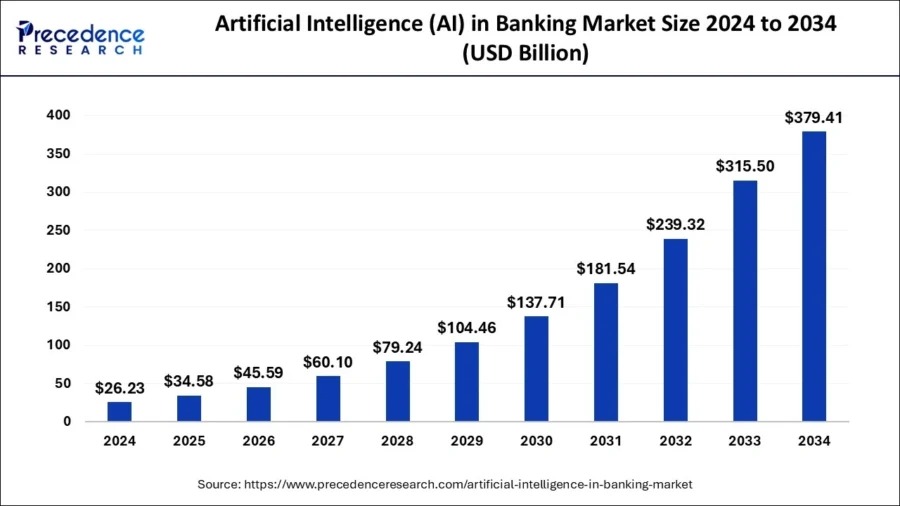

Thus, the scope of AI in banking is tremendous, with market size to grow from USD 34.58 billion in 2025 to approximately USD 379.41 billion by 2034. The market is also projected to expand at a CAGR of 30.63% from 2025 to 2034.

Credit: Precedence Research

Further, AI-driven algorithmic trading systems analyze market data to execute trades at optimal times, maximize profits, and reduce risks. Qraft Technologies, which is a South Korean fintech company, is utilizing AI to manage assets in its exchange-traded funds (ETFs).

AI also analyzes customer behavior and transaction history to predict future needs and to enable proactive service offerings. For instance, Starbucks is employing predictive AI to personalize product recommendations.

AI-powered voice and biometric authentication are other solutions that provide secure access to banking services.

Fintelite automates Banking Data Entry and Analysis

Singaporean startup Fintelite offers an AI-driven intelligent process automation platform for financial institutions. Its optical character recognition (OCR+) technology extracts essential data from various documents, including e-statements, invoices, and purchase orders, digitizing information in real time.

Additionally, the platform’s fraud verification system analyzes transaction trends to detect suspicious activities and verify document authenticity to mitigate financial risks.

Moreover, Fintelite provides a bank statement analyzer that automates the extraction and analysis of bank statements, which expedites loan approvals and financial assessments. It also has a hyper-personalized engagement tool that uses AI to deliver tailored banking experiences.

Further, Fintelite collaborated with Openbank+ to improve loan processing for rural banks and cooperatives in Indonesia.

Infilytics improves Banking through an AI-enhanced Decision Intelligence Platform

Infilytics is an Indian startup that offers an AI-driven analytics automation platform that streamlines data analysis for financial institutions. Its data integration module consolidates data from sources, including local files and business applications.

The data analysis tool provides a user-friendly interface with code-free functions for data blending, transformation, and cleansing. This tool also supports custom structured query language (SQL) for complex transformations.

AI features, such as Aira copilot, enable conversational analytics that allow bankers and authorized personnel to pose questions in natural language and receive actionable insights powered by machine learning.

Moreover, the visualization component offers different chart types, dashboards with dynamic filters, and task-tracking capabilities that facilitate effective data presentation. Automation capabilities also allow banking professionals to schedule data extraction, analyze workflows, and report distribution via email.

Further, the collaboration feature promotes teamwork by enabling the sharing of dashboards, workspaces, and analytical bots.

3. Digital Currency

Fraudulent transactions, money laundering, and other illegal activities often exploit gaps in banking security, which is why there is a need for more secure and transparent transactions.

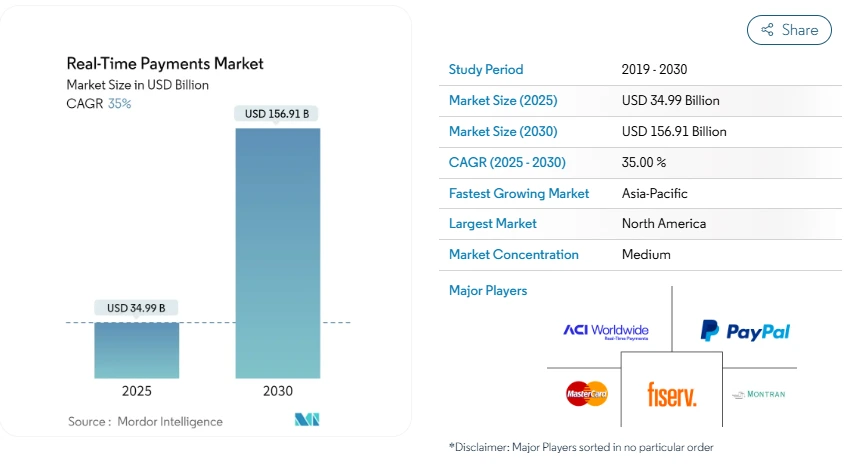

Also, there is a growing consumer demand for real-time payment solutions as the market size is estimated to grow to USD 34.99 billion in 2025 and is expected to reach USD 156.91 billion by 2030, at a CAGR of 35%.

Credit: Mordor Intelligence

The adoption of innovative technologies like blockchain, artificial intelligence, and more is offering secure and transparent transaction records while reducing fraud and operational costs. For example, the Ministry of Electronics and Information Technology (MeitY) notes that over 69% of banks are currently working with blockchain technology to improve the transparency and security of their services.

Additionally, Central Bank Digital Currency (CBDCs) is another effective solution that Central banks worldwide are implementing their own digital currencies to improve payment systems.

For instance, Cred became the first fintech platform to offer access to the digital rupee by collaborating with YES Bank to facilitate the issuance of e-rupee tokens.

Another instance suggests that the mBridge project, a collaboration between multiple central banks, is enabling real-time cross-border payments using CBDCs.

Moreover, cryptocurrencies pegged to stable assets like fiat currencies offer reduced volatility, which makes them suitable for transactions. PayPal has introduced its stablecoin, facilitating smooth digital transactions within its network.

Regulatory Technology (RegTech) is also allowing banks to efficiently comply with regulations related to digital currencies by employing innovative technology solutions.

Movmint offers Digital Bahamian Dollar

Movmint is a Canadian startup that develops central bank digital currency (CBDC) systems. It is exemplified by the successful launch of the Sand Dollar in the Bahamas. The Sand Dollar is the digital version of the Bahamian dollar, issued by the Central Bank of The Bahamas through authorized financial institutions.

The startup also provides residents with flexible access to financial services via mobile applications or physical payment cards. By enabling secure, real-time transactions, the Sand Dollar further improves financial inclusion and operational efficiency across the archipelago.

SCEME provides a Digital Currency Management Platform for Banking Institutions

SCEME is a French startup that develops a digital currency management platform for banking businesses to implement and manage digital currencies securely and in compliance with regulations.

The startup’s Sceme platform-as-a-service (SC-PaaS) platform connects to private or public blockchains and enables the easy management of digital currency accounts and their life cycles. This platform also features monitoring tools and dashboards for tracking customizable KPIs.

Additionally, the on-chain accounting (OCA) service controls and publishes accounting events related to all operations and transactions of issued digital currencies.

SCEME’s solutions cater to decentralized finance (DeFi), cryptocurrency trading, and improved payment systems. It also offers financial transparency for NGOs and local authorities, facilitates the issuance of payment methods, and supports tokenized assets or non-fungible tokens (NFTs).

4. Real-Time Payments

Consumers’ expectations for rapid and easy payment experiences, along with government initiatives promoting cashless economies, are key factors driving real-time payment solutions in the banking sector.

Additionally, businesses’ need for instant liquidity further accelerates the adoption of these solutions.

In response to these evolving needs, leading companies like PayPal have introduced PayPal Open. It is a unified platform that consolidates merchant tools and facilitates easy integration with external partners.

Governments worldwide are also playing a pivotal role in this shift. Reserve Bank of Australia Governor Michele Bullock has projected that Australia could transition to a cashless society within the next decade.

Similarly, Brazil’s central bank introduced Pix, which is an instant payment platform that enables real-time transactions and improves the country’s digital payment landscape.

To support financial institutions in adapting to these changes, companies like ACI Worldwide offer to enable banks and corporations to process digital payments efficiently.

Fiserv, another key player, provides a web-based platform that processes real-time payments and completes end-to-end wire transfers securely and efficiently.

Additionally, for interbank transactions, the Unified Payments Interface (UPI) is offering instant peer-to-peer and merchant payments via mobile devices.

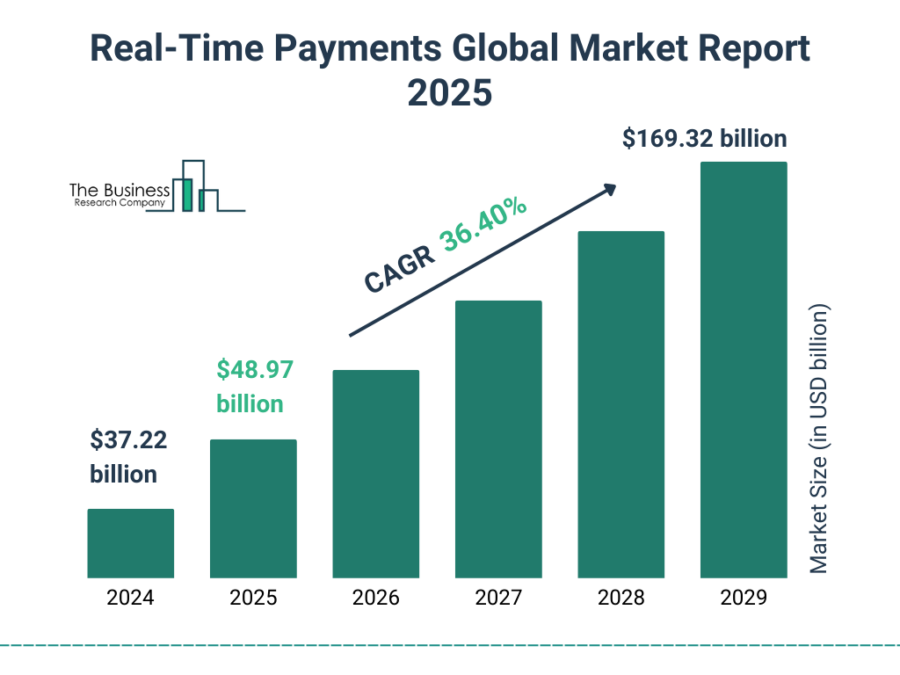

Credit: The Business Research Company

Moreover, the real-time payments market is expected to expand from USD 37.22 billion in 2024 to USD 48.97 billion in 2025, representing a CAGR of 31.6%.

FynPay delivers Banking-enhanced Payment Solutions

FynPay is a UAE-based startup that simplifies financial services by providing RESTful APIs, a Banking-as-a-Service (BaaS) platform, and more. This enables banks, fintechs, and corporations to access real-time payments through application programming interfaces (APIs).

Its PSD2-compliant RESTful APIs connect clients to major payment rails, offering secure access to payment schemes.

Additionally, FynPay offers real and virtual accounts that allow payment service providers to open accounts swiftly, safeguard customer funds, and perform frictionless reconciliation.

The startup’s Banking-as-a-Service (BaaS) platform supports the development of custom financial products backed by scalable technology and secure APIs. To improve customer engagement, FynPay also provides white-label loyalty program solutions for banking businesses to incorporate innovative white-label loyalty program solutions into their existing payment systems.

Further, FynPay introduces PeyzBank, which offers features such as three virtual cards for flexible, secure, and confidential online spending and low-cost international transfers.

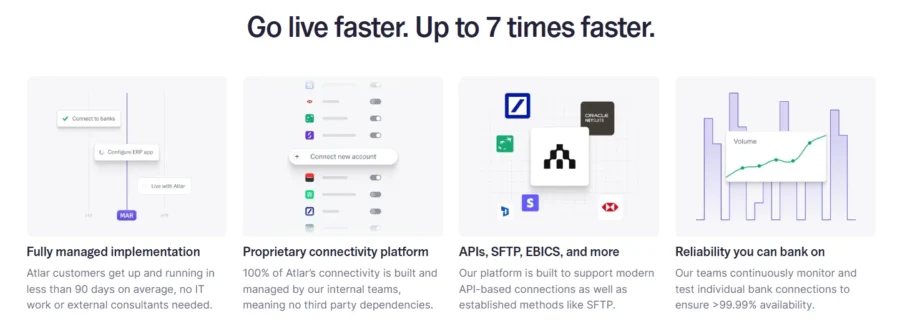

Atlar advances Banking Payment Process Automation

Atlar is a Swedish startup that centralizes and automates bank payments globally. This enables banking businesses to manage payments from any bank account while syncing with their enterprise resource planning (ERP) systems. By connecting banks, ERPs, and payment service providers (PSPs), Atlar consolidates payment files from different sources, including banks.

The startup processes outgoing payments of all types and synchronizes data between systems in real time. This integration eliminates manual file transfers and banking portal logins, streamlining payment operations and improving collaboration through custom approval workflows and role-based access controls.

Moreover, Atlar serves as a central hub that provides a real-time view of company finances and facilitates efficient and secure financial management.

5. Banking-as-a-Service

Traditional banks are facing increasing competition from agile fintech startups and digital-only banks. These new entrants offer customer-centric services that challenge the conventional banking model. A notable example is the emergence of neobanks. These are digital-only banks without physical branches that offer user-friendly interfaces and personalized services.

In the UK, neobanks like Monzo and Starling Bank have gained substantial traction, with Monzo reporting over 10 million personal customers.

Moreover, the development and adoption of application processing interfaces (APIs) and consumer demand for personalized and integrated financial solutions have prompted banks to explore more BaaS solutions.

According to the Network Magazine article, 66% of financial institution customers are comfortable with their banks or credit unions using their data to provide personalized services. To cater to these demands, open banking initiatives encourage data sharing between banks and third-party providers while offering consumers more personalized financial services. For example, the Consumer Financial Protection Bureau (CFPB) finalized new open banking rules to allow consumers to transfer their financial data between institutions.

Additionally, cloud migration enables banks to modernize their services rapidly, respond to market changes efficiently, and integrate new technologies. Citi, for instance, entered a multiyear partnership with Google Cloud to migrate multiple workloads and applications to the public cloud. Moreover, embedded finance allows consumers to access financial services more conveniently and personally.

Genetous builds Low Code Supporting BaaS Platform

Genetousis is a Turkish startup that accelerates software development by providing a Backend-as-a-Service (BaaS) platform with low code support.

It offers microservices that facilitate create, read, update, and delete (CRUD) operations, file management, and notifications. These microservices enable the rapid creation and customization of mobile and web applications.

Moreover, the BaaS platform has features such as fast front-end coding without back-end development and functionality achievable through javascript object notation (JSON).

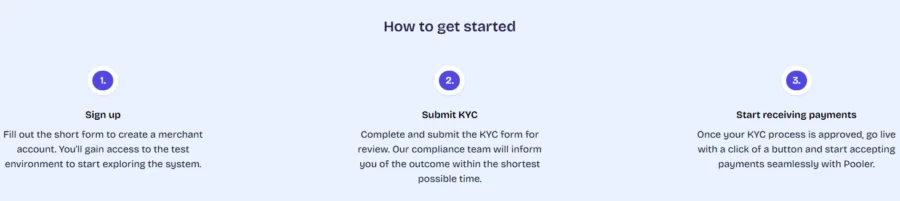

Poolerapp offers Digital Payments and BaaS Platform

Poolerapp is a Nigerian startup that offers a suite of products to simplify payment collection for businesses.

It enables merchants to receive payments via bank transfers through features like simple checkout, payment links, invoicing, and cashier services. These tools facilitate easy integration with shopping carts that allow for the generation of shareable payment links. Besides, the tools streamline the invoicing process and equip sales representatives with virtual wallets for independent payment acceptance.

Additionally, Poolerapp provides digital wallet accounts, virtual account creation, and secure fund transfers for transaction security and offers businesses a detailed view of their financial activities. Moreover, the Eureka app, a digital banking application, integrates Pooler’s wallet system to expedite development time.

6. Open Banking

Financial inclusion initiatives, such as the Indian government’s Pradhan Mantri Jan Dhan Yojana (PMJDY), are extending essential banking services to underserved regions. These efforts provide access to financial services and serve as a key driver for open banking.

Beyond financial inclusion, APIs and advancements in AI are other key factors driving open banking trends. For example, the Unified Lending Interface (ULI) streamlines credit access for small and rural borrowers, particularly in the agricultural and small business sectors in India.

Simultaneously, the way consumers and businesses make payments is evolving. Direct account-to-account transactions are reducing reliance on traditional card networks.

For example, in the UK, pay-by-bank transactions surged to 224 million in 2024, which reflects a growing preference for instant, frictionless payments.

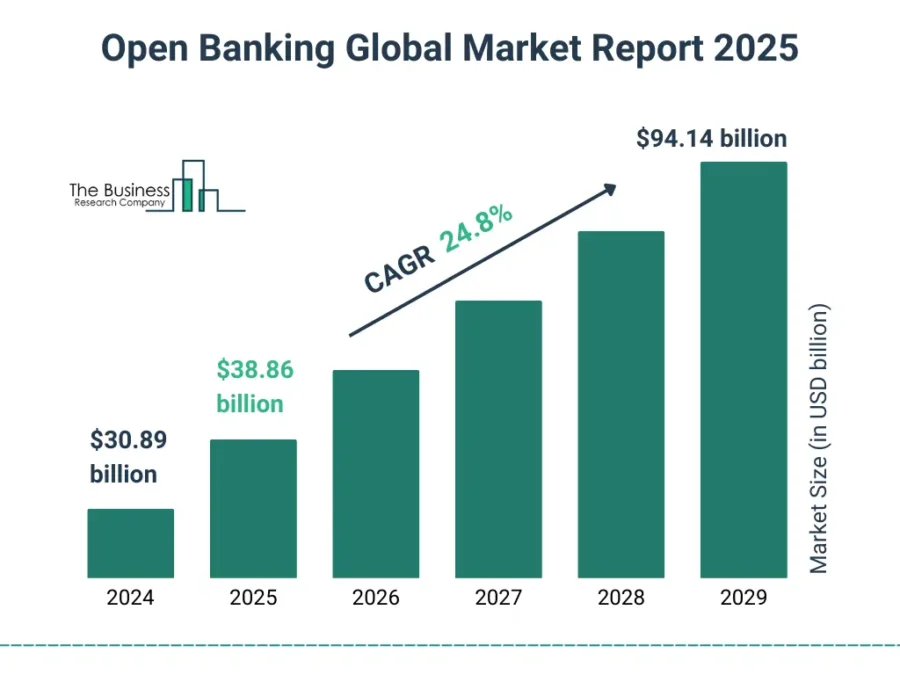

Presently, the open market size is expected to grow from USD 38.86 billion in 2025 to USD 94.14 billion in 2029 at a CAGR of 24.8%.

Credit: The Business Research Company

Additionally, variable recurring payments (VRPs) offer an innovative alternative to traditional direct debits for customers to authorize service providers to initiate payments within set parameters.

Expanding beyond open banking, the concept of open finance is extending data-sharing principles to financial products, including investments, insurance, and pensions. At the same time, the demand for immediate transaction settlements is advancing the adoption of real-time payment systems within open banking frameworks.

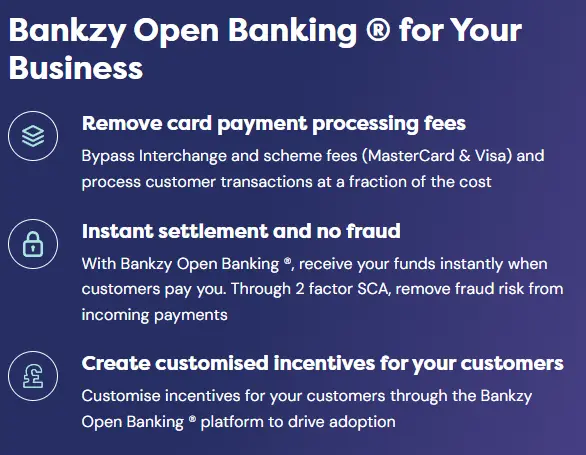

Bankzy elevates Banking Standards with Instant Payments

Bankzy is a UK-based startup that provides banking businesses with a platform to accept instant bank-to-bank payments from customers.

Through open banking technology, the startup enables secure and immediate transactions through point-of-sale terminals, online gateways, or pay-by-link options.

By bypassing interchange and scheme fees associated with card networks, Bankzy also offers cost-effective payment processing. Additionally, the platform offers instant fund settlement and mitigates fraud risks through strong two-factor customer authentication (SCA). This platform allows businesses to create customized incentives to encourage customer adoption.

MIS Connect provides Open Banking APIs

MIS Connect is a Saudi Arabian startup that delivers open banking application processing interfaces (APIs) to banks and other fintech companies..

It offers six key products, including customer onboarding, personal and business financial management, multi-banking, risk-based decisions, consumer insights and sales triggers, and affordability checks.

These solutions enable efficient account linking and authentication and provide a holistic financial overview. The solutions also allows access to and control of multiple bank accounts from a single platform.

The solutions also assess customer risk profiles using real-time data and identify specific consumer events to trigger targeted sales offers. Additionally, the solutions instantly evaluate a customer’s income and expenses for accurate affordability assessments.

7. Neobanks

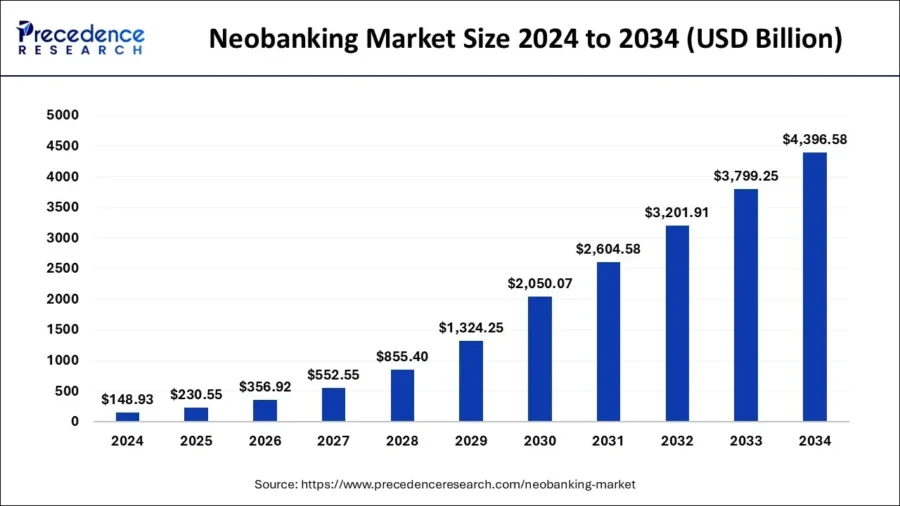

The NeoBanks market is predicted to increase from USD 230.55 billion in 2025 to approximately USD 4396.58 billion by 2034, expanding at a CAGR of 40.29% from 2025 to 2034.

Credit: Precedence Research

This surge is due to the advent of user-friendly mobile applications and web interfaces, enabling customers to manage their finances directly from their devices.

Also, the absence of physical branches reduces operational costs and appeals to budget-conscious consumers. Moreover, the implementation of multi-factor authentication, encryption protocols, and biometric identification measures increases customer trust by safeguarding sensitive financial data.

Neobanks are using artificial intelligence to deliver hyper-personalized services and to analyze data for providing financial advice and product recommendations. For instance, Bunq utilizes AI to improve its transaction monitoring and customer experience.

Additionally, through cryptocurrency services, neobanks cater to the growing interest in digital assets. Platforms like Juno facilitate connections between traditional banking and cryptocurrencies.

Further, Neobanks are embedding financial services into non-financial platforms for smooth financial transactions within banking ecosystems. For example, Cross River provides end-to-end banking solutions that other companies integrate into their services.

Environmental responsibility is also leading neobanks to adopt green banking practices. Tomorrow, for example, is a German neobank committed to sustainability. It ensures that every euro deposited is directed towards positive environmental and social initiatives.

e-Tabby develops a Blockchain-enabled Bank Account App Wallet

e-Tabby is a German startup that offers a financial platform and integrates banking, cryptocurrency, payment services, and a gold-backed stablecoin. The platform provides businesses with secure bank accounts, a mobile app, and digital wallets through blockchain technology to offer security in financial transactions.

Moreover, the platform has gold-backed stablecoin, electronic transactions, and blockchain-based currency (USDE) designed to offer a stable digital currency alternative to traditional fiat currencies.

Additionally, e-Tabby’s platform facilitates easy interaction with the crypto ecosystem through an integrated wallet and trading platform. This platform also offers a bridge to decentralized finance (DeFi) on all ethereum virtual machine (EVM) chains.

Neofy provides a Cloud-based, Composable Banking Platform

Singaporean startup Neofy has developed an AI-driven bank-in-a-box solution that enables financial institutions to swiftly establish composable neobanks.

Neofy’s cloud-based architecture offers modular components, including security and management, engagement, product, core processing, data and analytics, interactions, experience, and intelligent infrastructure management clouds.

These components come with pre-built user journeys, customizable frameworks, and multi-channel digital interfaces that offer personalization and operational efficiency.

8. Embedded Finance

The demand from banking businesses for the smooth integration of financial services and the expansion of e-commerce and digital platforms has contributed to the rise of embedded finance.

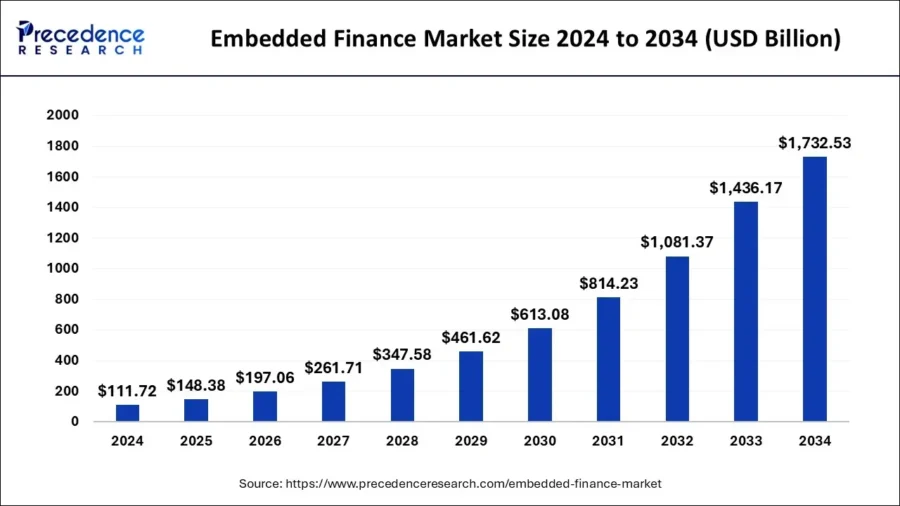

This surge is further highlighted by projections indicating that the global embedded finance market will reach approximately USD 148.38 billion in 2025. The market size is further expected to soar to around USD 1732.53 billion by 2034, reflecting a CAGR of 31.53%.

Credit: Precedence Research

This rapid growth is exemplified by different embedded finance solutions like the buy now, pay later (BNPL) system. This further offers installment payment options at the point of sale and provides consumers with flexible payment plans. For instance, Klarna allows shoppers to split purchases into interest-free installments directly through retail partners’ websites.

Additionally, embedded lending provides loans or credit facilities within a platform for immediate financing options for businesses. An example is Shopify Capital, which offers merchants funding directly through the Shopify platform, enabling quick access to business loans.

Further, embedded insurance integrates insurance offerings into purchasing processes and allows businesses to obtain coverage.

For example, Tesla offers embedded insurance, allowing customers to purchase insurance at the point of sale.

Embedded wallets also facilitate the easy storage and management of funds for transactions. A notable example is Starbucks, which offers an in-app wallet that customers preload with funds.

Banxware modernizes Bank Offerings with Embedded Finance

Banxware is a German startup that provides an embeddable lending platform and enables B2B platforms to offer business loans directly within their ecosystems.

By integrating Banxware’s solution, platforms facilitate loan applications and allow their customers to access flexible working capital, increase marketing budgets, and bridge liquidity gaps. This integration improves customer retention and loyalty while adding a new revenue stream for the platform.

Moreover, Banxware manages the entire loan process, including application handling and regulatory compliance, which offers a streamlined experience for banking businesses.

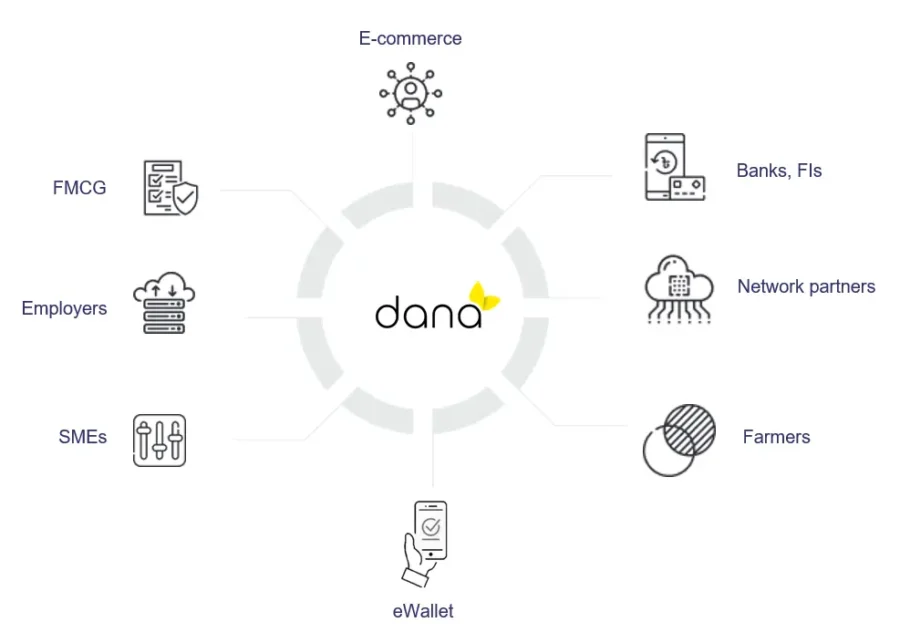

Dana Fintech delivers Banks a Digital Lending Platform

Dana Fintech is a Bangladeshi startup that provides an embedded lending platform that allows banks, financial institutions, and digital platforms to integrate lending services.

It offers an application programming interface (API) and software development kit (SDK) that connect lending partners to a digital infrastructure.

Additionally, the startup’s AI-driven credit scoring engine analyzes alternative data, digital footprints, and transaction records to evaluate borrower creditworthiness.

The platform supports loan types, including term loans and lines of credit, without collateral requirements or complex paperwork. Digital onboarding through Dana Fintech’s identity engine also accelerates customer verification and minimizes operational delays.

By automating underwriting and loan processing, Dana Fintech reduces sourcing costs and expands financial access for banks and lenders to scale small and medium enterprises (SME) and retail loan portfolios efficiently.

9. Customer Data Analytics

Banks and financial technology companies analyze customer data to determine if individuals are likely to repay loans. They also monitor transactions to spot unusual activities that might indicate fraud. This allows businesses to make informed lending decisions and protect against fraudulent activities.

Banks also need to adhere to regulatory requirements by monitoring transactions and must comply with financial laws. For example, the UK’s financial conduct authority is investigating Barclays for potential failures in its anti-money laundering controls.

Additionally, over 60% of banking customers expect banks to understand their specific needs, and more than half would consider switching providers if personalization is lacking.

To address this, hyper-personalization is adopting data analytics, artificial intelligence, and machine learning to deliver individualized banking experiences.

Additionally, through predictive analytics, banks anticipate customer needs and behaviors. This allows for personalized service offerings and improved customer retention. Market Force Information highlights that predictive analytics allow banks to understand customer behavior, leading to tailored services and increased satisfaction.

Real-time data analytics also allow banks to respond swiftly to market changes and customer needs. For instance, Hitachi Solutions emphasizes that real-time analytics enables banks to create timely marketing campaigns and make informed decisions.

Navigators offers AI-driven Analytics and BI Software for Banking and Finance

US-based startup Navigators has developed NavAI, an AI-driven data analytics and business intelligence platform tailored for the banking sector. NavAI allows financial institutions to analyze customer data, generate actionable insights, and forecast market scenarios.

By integrating with enterprise systems such as ERP, CRM, and data warehouses, NavAI extracts, cleanses, and structures datasets for predictive analysis. This integration enables banks to gain a deep understanding of customer behaviors and preferences.

NavAI‘s large language model (LLM) allows banking professionals to interact with complex data using plain English queries. This user-friendly method allows businesses to access analytics.

Moreover, by incorporating customer data analytics, NavAI assists banks in identifying high-value clients, predicting customer needs, and optimizing product portfolios.

Additionally, in banking, NavAI improves fraud detection, automates claims processing, streamlines underwriting, and improves anti-money laundering compliance. It also personalizes customer experiences through tailored financial recommendations and segmentation.

Further, its predictive analytics optimize marketing strategies, resource allocation, and risk assessment, equipping financial institutions with the foresight to navigate rapid market changes.

Realytics analyzes AI-Powered Performance and Banking Analytics

Realytics is a US-based startup offering AI-powered performance and consumer analytics for offline businesses, including the banking sector.

Its platform integrates market, location, and experience analytics to assess foot traffic, competitor positioning, and brand perception across various regions.

By analyzing consumer behavior and operational performance, Realytics enables financial institutions to identify growth opportunities, optimize branch locations, and improve customer experiences.

The platform’s AI-driven insights support trade area analysis, geographic pricing, and customer segmentation, allowing banks to align strategies with real-time demand shifts and improve risk management.

10. Digital Identities

Cyber threats and identity fraud have compelled banks to adopt digital identity solutions like multi-factor authentication (MFA), behavioral analysis, biometric verification, real-time monitoring, and AI integration.

Additionally, customers expect quick access to banking services. Digital identities like digital identity wallets and open banking integration facilitate smooth onboarding and personalized services. For example, AMP‘s introduction of numberless debit cards, with details stored securely in their banking app, offers customers greater control and reduces the risk of data breaches.

Technological advancement related to biometrics, such as facial recognition and fingerprint scanning in banking authentication processes, offers security and a smooth user experience. For example, DEMIA has developed biometric payment cards that utilize fingerprint recognition.

Further, banks are adopting decentralized identity verification systems that allow customers to control their identity data. For instance, China’s Real-Name Decentralized Identifier System (RealDID) enables businesses to access services using blockchain-based identifiers.

Digital-only banks, or neobanks, are also offering mobile-first banking experiences. Moreover, banks are integrating their services into non-financial platforms through APIs, allowing third parties to offer banking services. This trend necessitates digital identity verification to ensure secure and compliant transactions across platforms.

Truvity develops Self-sovereign Digital Identity Management for Banking Security

Truvity is a Dutch startup offering a secure document management platform that streamlines document exchange and compliance across the banking sector. Its API-driven platform enables banking businesses to digitize and automate document processes while replacing manual workflows with tamper-proof, machine-readable documents.

Truvity integrates with existing systems, provides tools for digital wallet and credential lifecycle management, and supports KYC/AML automation. Moreover, built on advanced standards like eIDAS 2.0 and the W3C VC data model 2.0, the banking platform offers secure data exchange and compliance with privacy regulations.

Its flexible, scalable API architecture allows banking businesses to streamline operations, verify documents, and establish secure digital identities.

Quin Labs enhances Bank Client Experience and Lifecycle Management

Quin Labs is a UK-based startup that offers an end-to-end solution for managing digital identity, onboarding clients, ongoing monitoring, decision-making, and regulatory compliance for financial institutions.

Its platform assigns a proprietary Quin ID to each banking customer after successful verification, which is used across departments to increase efficiency and security.

Additionally, Quin Labs automates and digitizes the client lifecycle by reducing paperwork and optimizing data capture through digital forms and API integrations. The platform continuously monitors clients, tracking life events, changes in circumstances, and suspicious activity while ensuring compliance with evolving KYC/AML regulations.

Further, Quin Labs’s AI and machine learning algorithms conduct risk assessments in real time and enable timely interventions.

Discover all Banking Trends, Technologies, & Startups

The banking industry is evolving with a focus on digitalization, efficiency, and security. AI-driven automation streamlines operations, while cybersecurity measures and fraud prevention technologies protect financial assets.

The adoption of digital currencies and real-time payments improves transaction speed and convenience. Additionally, open banking and Banking-as-a-Service (BaaS) models offer customers personalized financial solutions.

The Banking Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process.

Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.