The Biofuel Report 2025 provides insight into the efforts of startups, investors, and the government to develop biofuel technology. The focus is on biofuel to solve major global warming issues, waste management, rising energy demands, and more. Research towards making biofuel more available to everyone is also underway. Trends like cellulosic ethanol, compressed natural gas (CNG), and renewable diesel are a few results of these efforts in research and development. Industries like mining, construction, manufacturing, oil and gas, which use a lot of energy to run their operations, are further replacing traditional fuel with biofuel.

This biofuel report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Biofuel Report 2025

- Executive Summary

- Introduction to the Biofuel Report 2025

- What data is used in this Biofuel Report?

- Snapshot of the Global Biofuel Technology

- Funding Landscape in the Biofuel Market

- Who is Investing in Biofuel Market?

- Emerging Trends in the Biofuel Market

- 5 Innovative Biofuel Startups

Executive Summary: Biofuel Report 2025

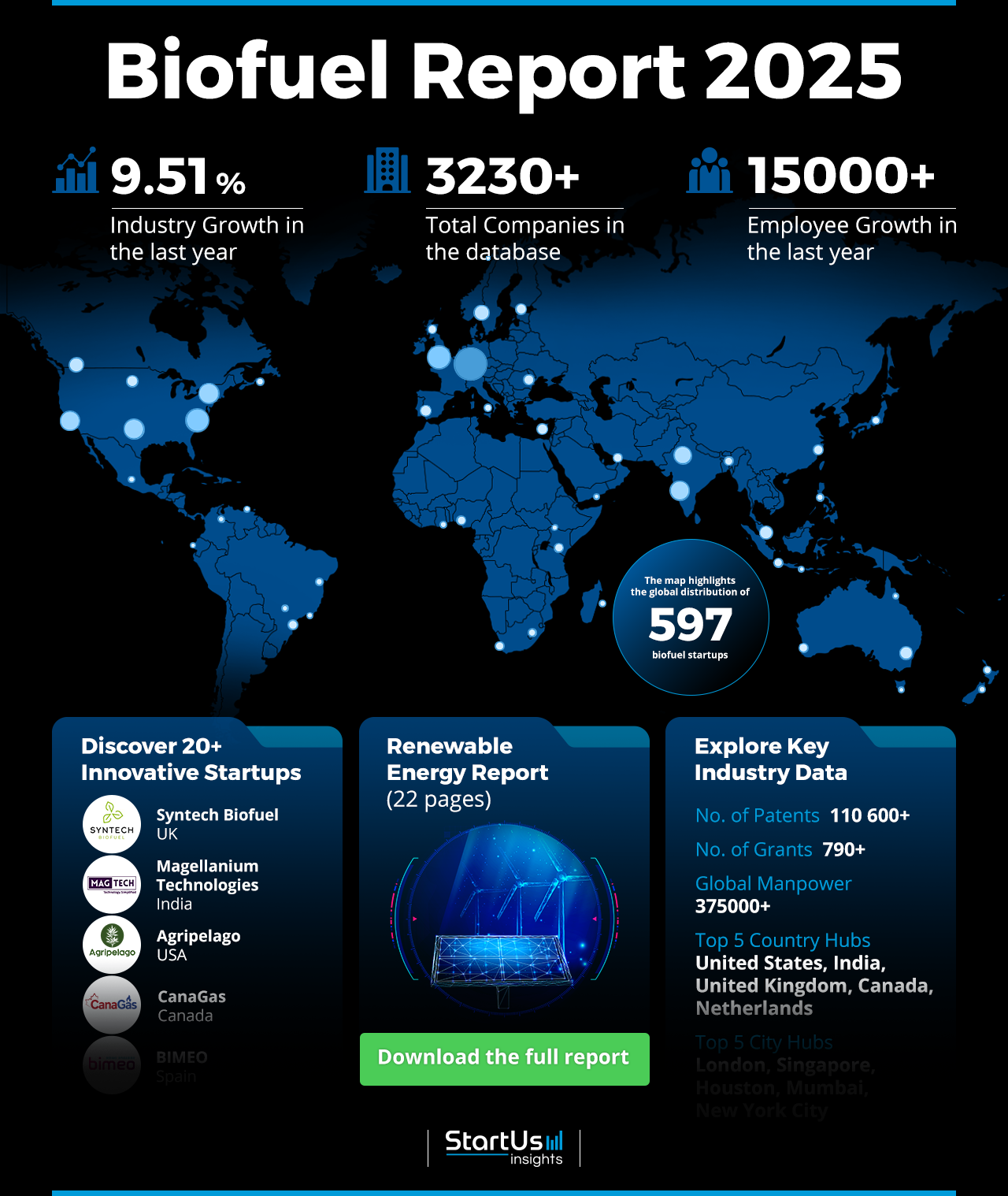

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 590+ biofuel startups developing innovative solutions to present five examples from emerging biofuel trends.

- Industry Growth Overview: The biofuel market is growing at a rate of 9.51% every year. Currently, there are 3200+ companies and 590+ startups in the field.

- Manpower and Employment Pattern: The current number of people working in the biofuel sector exceeds 375 000. Last year, more than 15 000 people joined the workforce.

- Patents and Grants: The biofuel sector receives 790+ grants and there are currently more than 110 600 patents in the field.

- Global Footprint: The top 5 countries researching and developing the biofuel sector include the United States, India, the United Kingdom, Canada, and the Netherlands. The cities doing the same are London, Singapore, Houston, Mumbai, and New York City.

- Investment landscape: The sector closes more than 1600 funding rounds with an average of USD 48.8 million per round. More than 480 companies receive support because of the funding.

- Top Investors: Top investors like European Investment Bank, Encap Flatrock Midstream, and Rabobank make a combined investment of USD 2.79 billion.

- Startup Ecosystem: Emerging startups like Syntech Biofuel (waste-to-fuel solutions), Magellanium Technologies (sustainable biodiesel & bioethanol production), Agripelago (biofuel from hemp), CanaGas (intermodal transportation for natural gas), BIMEO (membrane system for biogas upgrading) represent the innovations in the biofuel market.

- Recommendations for Stakeholders: The government should fund and encourage research in biofuel technology as it is an important step towards addressing the climate crisis. Established multi-national corporations should invest in biofuel technologies including large-scale biorefineries to generate the required energy for running the operations. Startups and small businesses should focus on innovations in second and third-generation biofuels.

Explore the Data-driven Biofuel Report for 2025

The Biofuel Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The growing landscape of the sector is evident in 3200+ companies and over 590 startups working in the field. Last year, the sector grew by 9.51%, a sign of growing interest in sustainable energy solutions. The biofuel sector holds 700+ grants and over 110 600 patents.

There are 375 000 people working in the biofuel sector and 15 000 more joined the workforce last year. Geographically, the leading biofuel technological hubs are the United States, India, the United Kingdom, Canada, and the Netherlands. These countries are at the forefront of biofuel innovation research, development, and commercialization. At a city level, the leading locations are New York City, London, Singapore, Houston, and Mumbai.

What data is used to create this biofuel report?

Based on the data provided by our Discovery Platform, we observe that the biofuel market ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage and Publications: More than 700 publications in the last year show growing interest in the biofuel technology sector.

- Funding Rounds: Our database records over 1600 funding rounds for the field.

- Manpower: There are 375 000 employees currently in the biofuel technology sector and 15 000 more joined last year.

- Patents: 110 600 patents in biofuel technology signal a future of more developments and research.

- Grants: The domain receives over 700 grants which represents significant support from the government for its innovations.

A Snapshot of the Global Biofuel Market

Our database reveals the yearly growth of the biofuel technology sector is 9.51%. There are 500+ startups currently operating in the field. More than 120 startups are additionally in the early stage and 250 in merger and acquisitions.

The field has 110 600+ patents from over 7600 applicants and the annual patent growth rate is 4.19%. With 24 500+ patents, the United States tops the world in patent issuance, closely followed by China with 21 700+ patents.

Explore the Funding Landscape of the Biofuel Market

The average investment value raised in every funding round is USD 48.4 million. This expanding sector has over 1200 investors, which represents a wide range of interest from corporate investors, private equity firms, and venture capitalists. More than 1600 funding rounds support over 400 companies working in the biofuel technology field.

Who is Investing in Biofuel Technologies?

The biofuel tech market receives an investment of USD 6.3 billion from top investors.

- European Investment Bank distributes USD 1.3 billion across 5 companies.

- EnCap Flatrock Midstream invests USD 800 million in at least one company.

- Rabobank contributes USD 698.2 million to three companies.

- Bank ABC invests USD 600 million in at least one company.

- ING Group contributes USD 592.5 million to two companies.

- SACE invests USD 502.5 million in at least one company.

- Microsoft spent USD 486 million on at least one company.

- Deutsche Bank invests USD 478.3 million in two companies.

- Citi spent USD 474.2 million across four companies.

- Koch Equity Development invests USD 400 million in at least one company.

Access Top Biofuel Innovations & Trends with the Discovery Platform

Explore the emerging trends in biofuel technology, including the firmographic data:

- Compressed Natural Gas (CNG) companies employ more than 220 300 people across 680+ companies. With 7000 new employees created last year, the trend shows annual growth of 6.92%. CNG reduces emissions, improves air quality, optimizes cost savings, and is suitable for a wide range of applications.

- Renewable Diesel has 260+ companies and about 70 900 professionals working in them. 3000 new employees joined the workforce last year. The trend is growing steadily at an annual rate of 9.92%. Renewable diesel increases the compatibility, combustion, and cold weather performance of the engine along with improving lubricant and flexibility in engine operations.

- Cellulosic Ethanol has 60+ companies with 3700 employees. 200+ employees joined the workforce last year. The trend is expanding at a rate of -1.42% annually and still has a lot of room for development and research. Cellulosic ethanol stands out by acting as a fuel additive, which reduces the carbon footprint left by traditional fuels.

5 Top Examples from 590+ Innovative Biofuel Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Syntech Biofuel provides Waste-to-Fuel Solutions

UK-based startup Syntech Biofuel builds waste-to-energy solution Syntech Advanced Smart Biofuel (Syntech ASB). It is a drop-in fuel that ensures greenhouse gas (GHG) savings and meets BS EN 14214 standard. The fuel is made using UK-sourced ISCC-accredited feedstock and waste organic oil. It is suitable for powering vehicles, generating energy, and heating homes and commercial establishments.

Magellanium Technologies produces Sustainable Biodiesel & Bioethanol

Indian startup Magellanium Technologies offers bioethanol and biodiesel. The bioethanol plant converts biomass into biofuel using second-generation bioethanol technology, which uses inedible agricultural residue. The lignocellulosic biomass is pretreated to break down the complex structure. It then goes through hydrolysis and controlled fermentation by microorganisms to create ethanol.

The resultant ethanol contains other conventional fuels. It is distilled to eliminate the remaining water, which produces anhydrous ethanol ready for mixing with gasoline. The biodiesel plant uses feedstock, which goes through preprocessing, transesterification, washing, and refining to result in the final product. Sustainable solutions solve the fuel requirement while taking care of the ongoing climate crisis.

Archipelago converts Hemp to Biofuel

US-based startup Archipelago creates fuel from hemp. Regenerative farming techniques produce climate-smart hemp. It is then processed in the biorefinery to produce biofuel. The biorefinery utilizes non-food biomass to create renewable natural gas (RNG) using a combination of advanced biofuel processing methods

The process also involves anaerobic digestion with a technology readiness level (TRL) of 9. Moreover, it acts as a bioenergy with a carbon capture utilization and storage (BECCUS) system. The byproduct CO2 is captured and liquified while producing RNG, which leads to a carbon-negative RNG.

CanaGas supports Intermodal Transportation for Natural Gas

Canadian startup CanaGas provides type-4 composite tanks for natural gas transportation within intermodal shipping containers. It uses a proprietary method to load its intermodal transport modules ( ITMs). As the cold gas is pumped into an ITM, the pressure increases and converts a large proportion of the gas into a liquid state. The type-4 pressure vessels are manufactured by winding a band of high-strength filament fibers over a proprietary high-density polyethylene (HDPE) liner.

The filament on the liners is wound using high-fiber carbon fiber or fiberglass rovings, depending on the pressure requirement. The tank is ready for installation and service once the resin cures. The filament winding ensures the container is lightweight and low-temperature compatible. The helical winding further decreases any crack progression, which may result in rupture.

BIMEO offers a Membrane System for Biogas Upgrading

Spanish startup BIMEO builds a biomethane production system, where the biogas is generated using industrial, agricultural, livestock, and urban waste. The valorGas provides a biogas upgrading system using membrane technology and a patented 3-stage separation process. The system utilizes Sepuran hollow fiber membranes. The membranes use polyamide to ensure permeability and selectivity. Waste digestion generates biogas, which requires the removal of impurities.

The Sepuran three-stage separation process ensures the optimal removal of impurities from the biogas. It uses two new membrane units arranged in series. This arrangement ensures the recirculation of the low-quality waste gas does not hamper the performance of the resultant biogas. The resultant mixture contains high-purity biomethane and CO2. The removal process uses pressure between 12 and 20 bar along with a temperature between 5 to 90 degrees Celsius. It also integrates with existing control systems and provides automation along with stability.

Gain Comprehensive Insights into Biofuel Trends, Startups, and Technologies

The biofuel report reveals how trends like renewable diesel, cellulosic ethanol, and compressed natural gas are becoming a replacement for traditional fuel. The requirement to be more sustainable and environmentally friendly is driving the research and developments in the biofuel field. Further, population increment and fuel demand in transportation and urban city maintenance are encouraging researchers to innovate more eco-friendly methods of fuel production. Get in touch to explore all 590+ startups and scaleups, as well as all industry trends impacting biofuel companies.