The Biometrics Industry Report 2025 analyzes the sector’s current landscape, focusing on innovation, growth, and investment trends. As biometric technologies become integral to security, authentication, and identity management across various sectors, we present this report that covers key developments in 3D facial recognition, biometric cryptography, and AI-driven continuous authentication.

The report was last updated in January, 2025.

This Biometrics Report also serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

Executive Summary: Biometrics Market Report 2025

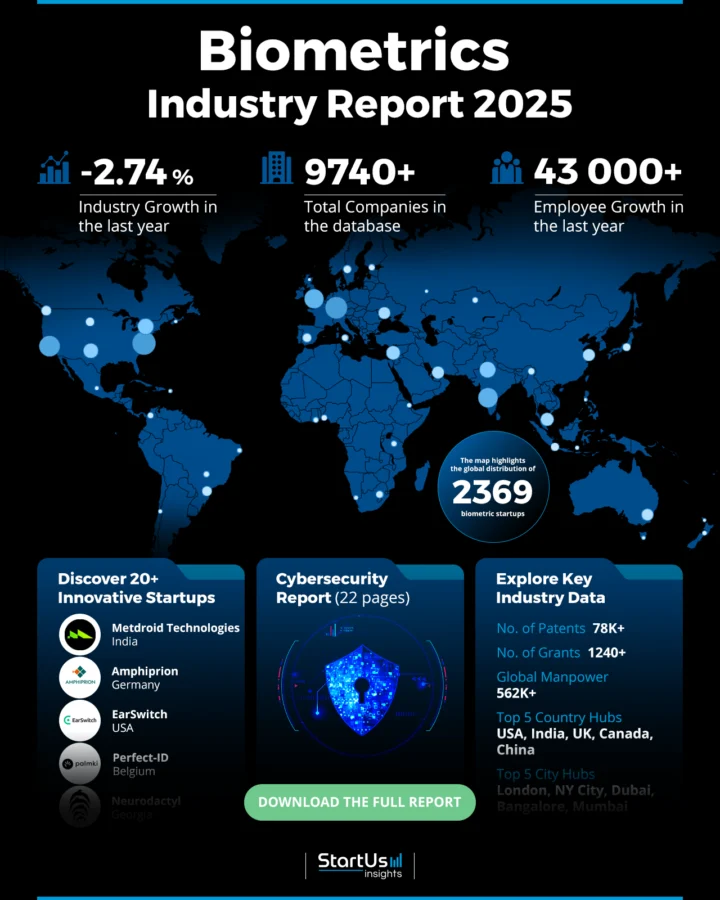

- Industry Growth Overview: The biometrics industry experienced an annual growth rate of -2.74%. 2360+ startups are contributing to innovation and development. By 2025, 671 million people are expected to be making payments using facial biometrics, up from 1.4 billion in 2020.

- Manpower & Employment Growth: The industry employs more than 562 000+ workers globally. It added over 43 000 new employees in the last year.

- Patents & Grants: Over 78 000 technologies in the industry filed for patents. The industry received more than 1200 grants.

- Global Footprint: The top five country hubs include the USA, India, the UK, Canada, and China. Leading city hubs are London, New York City, Dubai, Bangalore, and Mumbai. The U.S. biometrics market size was USD 11.73 billion in 2024 and is projected to reach USD 44.70 billion by 2034.

- Investment Landscape: The average investment value per funding round is USD 15.5 million. It attracted over 1200 investors, with more than 4550 funding rounds closed. Investments span 1340+ companies, showing diverse financial backing.

- Top Investors: A few of the top investors include Techstars, Y Combinator, and Softbank Vision. The combined investment of these top investors exceeds USD 370 million.

- Startup Ecosystem: Five innovative startups include Metdroid Technologies (singular biometrics), Amphiprion (authentication security), EarSwitch (ear sensor), Perfect-ID (hand palm vein technology), Neurodactyl (biometric deduplication).

Methodology: How we created this Biometrics Report

This report is based on proprietary data from our AI-powered Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports. Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies and market trends.

For this report, we focused on the evolution of biometrics over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within biometrics sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the biometrics market.

What data is used to create this biometrics report?

Based on the data provided by our Discovery Platform, we observe that the biometrics industry ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the industry’s key metrics and inform the industry’s short-term future direction.

- News Coverage & Publications: Over 12 000 news articles were published about biometrics in the last year.

- Funding Rounds: Our database includes data on over 4550 funding rounds.

- Manpower: The industry employs more than 562 000 workers globally. It added over 43K new employees in the last year.

- Patents: Over 78 000 technologies in the industry filed for patents.

- Grants: The industry received 1240+ grants.

- Yearly Global Search Growth: Yearly global search growth for the industry stands at 5.82%.

Explore the Data-driven Biometrics Report for 2025

The heatmap section of the report provides a detailed visual representation of the biometrics industry. Our database includes 2300+ startups, contributing to a total of over 9740 companies within the sector. Despite experiencing a slight decline in industry growth of -2.74% in the last year, the field remains active and innovative.

The global biometric market is projected to grow from USD 36.57 billion in 2024 to reach USD 113.22 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 15.2% during the forecast period.

Credit: Fortunate Business Insights

Additionally, the behavioral biometrics market is projected to reach USD 3.92 billion by 2025, growing at a (CAGR) of 23.71%.

The industry demonstrates a commitment to technological advancements with over 78K patents. Additionally, more than 1240 grants awarded further support the research and development efforts. The global workforce in the biomedical engineering industry exceeds 562K individuals, with a notable employee growth of 43K in the past year.

The heatmap also identifies key geographical hubs in the industry’s ecosystem. The top five country hubs include the USA, India, the UK, Canada, and China. Leading city hubs such as London, New York City, Dubai, Bangalore, and Mumbai highlight innovation and activity in biomedical engineering.

A Snapshot of the Global Biometrics Industry

The first significant biometric system, the Henry System of Fingerprint Classification, began in British India in the late 1800s for criminal identification.

The industry experienced an annual growth rate of -2.74%. Despite this, the sector shows growth, with 2369 startups contributing to innovation and development.

The report reveals several early-stage startups, exceeding 830, which underscores the sector’s innovative potential. Additionally, there have been more than 150 mergers and acquisitions, reflecting a market environment with consolidation activities.

The industry includes over 78K patents with more than 27K applicants. With this, the yearly patent growth rate stands at 7.63%. The USA leads as the top issuer with over 28K patents, followed by China with more than 16K patents. Additionally, multimodal biometrics, which combines several biometric sources, is gaining traction to increase security and accuracy.

Explore the Funding Landscape of the Biometrics Industry

The average investment value per funding round within the biometrics industry stands at USD 15.5 million. The industry attracted over 1.2K investors, with more than 4550 funding rounds closed, spanning 1340 companies.

This diverse investment landscape underscores the sector’s attractiveness to financial backers and its growth potential.

Who is Investing in Biometrics?

The top investors in the biometrics industry collectively committed more than USD 370 million, showcasing financial support for the sector’s growth and innovation. Here is a detailed list of these leading investors, the number of companies they backed, and their respective funding values:

- Techstars funded 14 companies, with a total backing of USD 1 million.

- Y Combinator financed 11 companies, contributing USD 7 million.

- SOSV supported 7 companies, allocating USD 525K.

- Khosla Ventures sponsored 5 companies, providing USD 25 million. Khosla Labs, a branch partnered with Unitus Seed Fund to incubate and fund startups working on the Aadhaar project.

- Softbank Vision endorsed 3 companies, with a substantial investment of USD 332 million. In July 2021, AnyVision secured a USD 235 million investment from SoftBank Vision Fund 2 and Eldridge.

- Intel Capital financed 3 companies, contributing USD 4.6 million.

Access Top Biometrics Innovations & Trends with the Discovery Platform

Discover the emerging trends in the biometrics sector along with their firmographic details:

- The Data Security trend includes over 5200 companies. These firms employ approximately 205 900 individuals, with 24 400 new hires in the last year. The annual trend growth rate of 9.44% highlights the importance of safeguarding data against breaches and unauthorized access.

- The Identity Management trend involves over 1900 companies in this space, employing around 109 000 people. It added 9900 new employees in the last year. This segment’s annual trend growth rate of 5.5% underscores its role in enhancing security and streamlining access across various sectors.

- Image Recognition has over 1200 companies and more than 56 200 people involved. It included 4700 new hires in the last year with an annual trend growth rate of 12.28%.

5 Top Examples from 2360+ Innovative Biometrics Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Metdroid Technologies provides Singular Biometrics

Indian startup Metdroid Technologies develops UBX, a singular biometric system for paperless identity validation. It streamlines the verification process by using facial recognition, iris and voice patterns, fingerprints, and other biometric markers.

This system serves multiple industries, including banking, healthcare, and government. The startup’s technology enhances user experience through user-friendly processes while safeguarding sensitive information with robust biometric protection.

Furthermore, its modular design allows customization to meet specific needs.

Amphiprion develops Authentication Security

German startup Amphiprion builds a biometric authentication technology that leverages eye movements. The startup creates a secure method for unlocking mobile devices, accessing online accounts, and controlling access to secured facilities.

Amphiprion’s AI-driven technology extracts a digital fingerprint from eye movement patterns to defend against spoofing and coercion attacks. By offering such secure authentication solutions, Amphiprion assists original equipment manufacturers in enhancing security across unimodal or multimodal biometric systems.

EarSwitch makes Ear Sensor

US-based startup EarSwitch makes EarMetrics, an in-ear biometric sensor technology suite. It captures real-time, medical-grade data on vital signs such as heart rate, temperature, heart rate variability, oxygen levels, respiration rate and pattern, and blood pressure. This data assists patient-centered care by informing clinical decisions and enhancing personal health management.

The technology’s integrated system provides interoperability with medical devices, wearables, and hearing aids. Also, EarControl technology transforms human-to-environment interactions while introducing functionalities like an ear click using the tensor tympani muscle for augmented control. The startup’s EarMetrics Cloud stores and manages this data for remote patient monitoring, and clinical research.

Perfect-ID uses Hand Palm Vein Technology

Belgium startup Perfect-ID builds Palmki, a digital biometric identity verification system that uses palm vein patterns to authenticate access to buildings, machines, and data. The technology captures more than 5 million reference points in the palm to convert the data into a cryptographic hash code.

This system requires only a registration unit, Palmki sensor, and installation software. The startup’s solutions cater to sectors, including housing, data centers, and logistics, providing secure access control, time and attendance management, and cybersecurity.

Neurodactyl offers Biometric Deduplication

Georgian startup Neurodactyl provides a biometric deduplication solution that identifies and eliminates duplicate fingerprints in large-scale databases. Its system works by importing fingerprint images along with associated IDs and finger positions. It then extracts biometric templates to facilitate all-to-all matching.

Neurodactyl algorithm’s deduplication method identifies full duplicates, errors within records, and partial duplicates. Its technology minimizes hardware requirements and time while maximizing error detection to ensure data integrity and accuracy in biometric systems.

Gain Comprehensive Insights into Biometrics Trends, Startups, or Technologies

The biometrics industry demonstrates innovation, driven by investments and a focus on research and development. Emerging technologies in the sector, such as advanced facial recognition, fingerprint scanning, and iris recognition, enhance security and authentication processes. Despite recent challenges, the industry’s patent activity and financial backing highlight its potential for sustained growth and technological breakthroughs. Connect with us to explore all 2360+ startups and scaleups, as well as all industry trends impacting biometric companies.

![AI Implementation | A Comprehensive Strategic Guide for Enterprises [2025-2030]](https://www.startus-insights.com/wp-content/uploads/2025/04/AI-Implementation-SharedImg-StartUs-Insights-noresize-420x236.webp)