The 2025 Blockchain Outlook highlights its expansion beyond cryptocurrency into finance, supply chain, healthcare, and governance. The top trends include enterprise blockchain platforms, smart contracts, and integration with IoT and AI. This report provides insights into startups, investments, and technology shaping blockchain’s role in creating secure and decentralized systems globally.

Executive Summary: Blockchain Market Report 2025

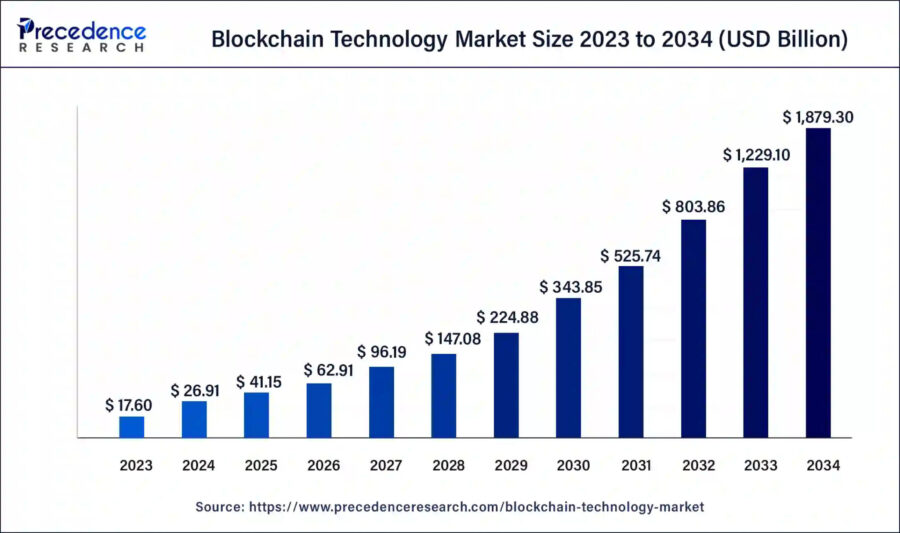

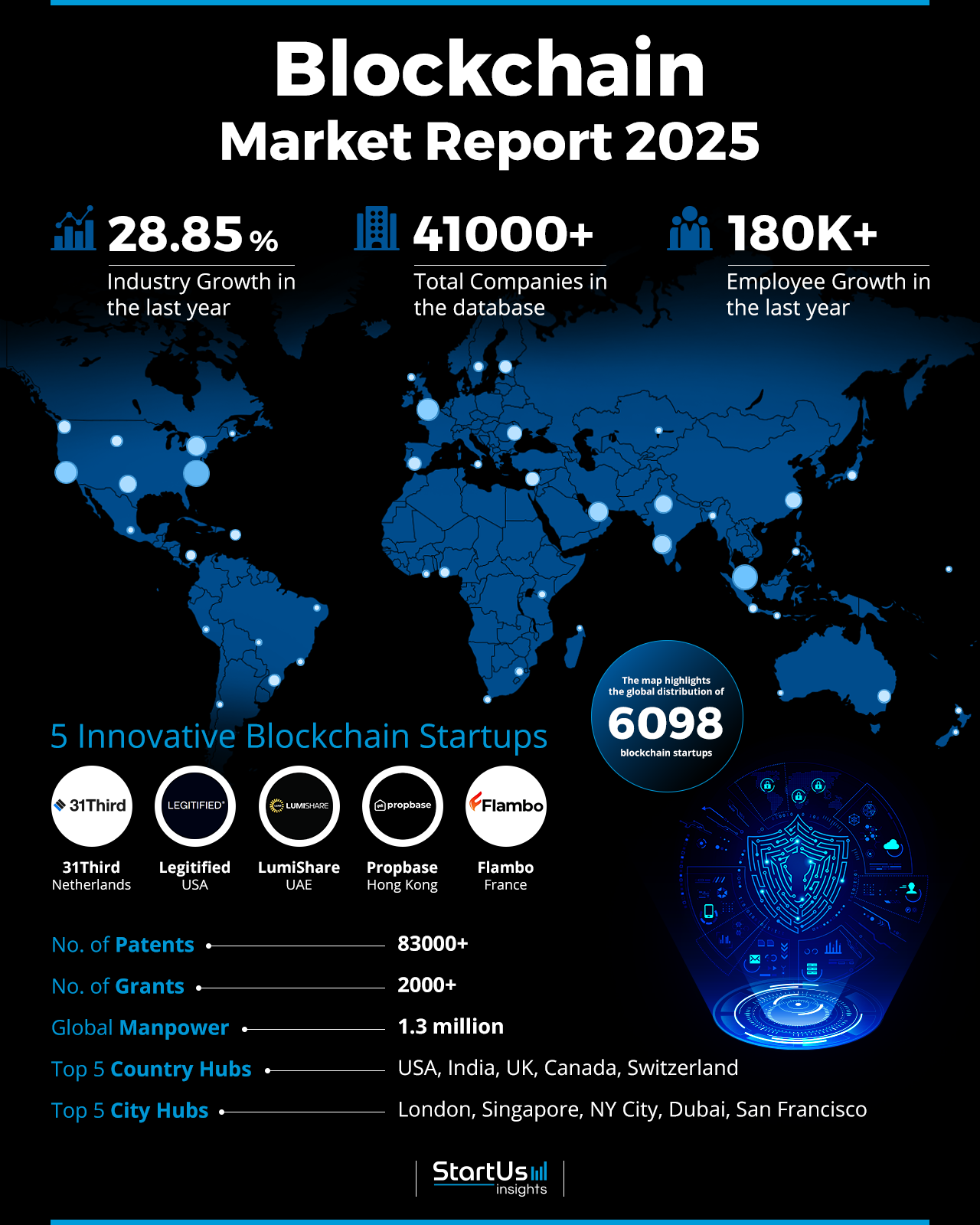

- Industry Growth Overview: The blockchain market has more than 41 000 companies and 6000 startups. It is expected to grow from USD 26.91 billion in 2024 to around USD 1.87 trillion by 2034 with a CAGR of 52.9% from 2024 to 2034. On a micro level, the market grew by a rate of 28.85% last year as per our platform’s latest data.

- Manpower & Employment Growth: The sector employs 1.3 million professionals globally. Last year, 180 000+ new employees were added, expanding the sector’s talent pool.

- Patents & Grants: The blockchain sector holds over 83 000 patents from more than 1800 applicants and secured over 2000 grants, which showcases innovation-driven growth.

- Global Footprint: Key country hubs include the USA, India, the UK, Canada, and Switzerland. Major city hubs are London, Singapore, New York City, Dubai, and San Francisco.

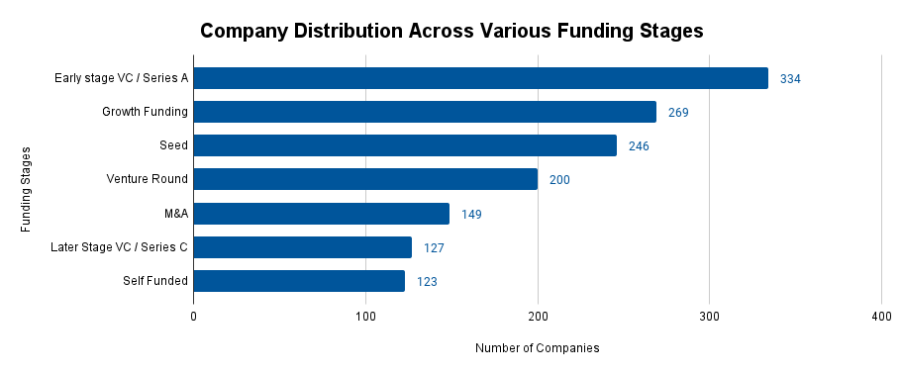

- Investment Landscape: Blockchain companies have seen over 28 000 funding rounds, supported by over 17 000 investors. The average investment value is USD 17.2 million per round.

- Top Investors: Key investors include Andreessen Horowitz, Global Emerging Markets, Sequoia Capital, and more, contributing to a combined investment value exceeding USD 5 billion.

- Startup Ecosystem: Five innovative startups include 31Third (asset management and trade execution), Legitified (medical data security), LumiShare (tokenization of renewable energy assets), Propbase (real estate tokenization), and Flambo (blockchain-native advertising).

What data is used to create this blockchain report?

Based on the data provided by our Discovery Platform, we observe that the blockchain market ranks among the top 5% in the following categories relative to all 20K topics in our database.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: The blockchain market saw over 74 000 publications last year. This reflects extensive news coverage and active knowledge dissemination.

- Funding Rounds: Our database records more than 28 000 funding rounds. It is an indication of strong investor interest and financial activity.

- Manpower: The sector employs over 1.3 million workers globally, with 180 000+ new employees added last year.

- Patents: The field holds over 83 000 patents, showing its commitment to innovation and intellectual property development.

- Grants: Blockchain secured over 2000 grants and supports research, development, and advancements.

- Yearly Global Search Growth: The yearly global search growth for blockchain reached 78.06%, which highlights its growing public and professional interest.

Methodology: How We Created This Extended Reality Report

This report is based on proprietary data from our AI-powered Startus Insights Discovery Platform, which tracks 25 million companies and 20 000 technologies and trends globally, including detailed insights on approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on emerging technologies and market trends.

For this report, we focused on the evolution of blockchain over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within blockchain technology

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the blockchain market.

Explore the Data-driven Blockchain Technology Report for 2025

According to Precedence Research, the global blockchain technology market size accounts for USD 26.91 billion in 2024 and expects to reach around USD 1879.30 billion by 2034, expanding at a CAGR of 52.9%.

Credit: Precedence Research

The Blockchain Report 2025 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. With over 6000 startups and 41 000 companies, blockchain has robust market activity. The sector grew by 28.85% last year and is driven by innovations supported by 83 000 patents and over 2000 grants.

Market Data Forecast, on the other hand, report anticipates to be worth USD 23.55 billion in 2024 and to reach USD 465.29 billion by 2032, growing at a CAGR of 45. 2% during the forecast period.

Further, the global manpower exceeds 1.3 million professionals, with 180 000 new employees added last year.

According to Industry Arc, the Asia-Pacific (APAC) region leads as the fastest-growing market in the blockchain sector, fueled by government support, particularly in China, Singapore, and South Korea.

This reflects the expansion of talent within the field. Top country hubs include the United States, India, the United Kingdom, Canada, and Switzerland. Major city hubs feature London, Singapore, New York City, Dubai, and San Francisco.

A Snapshot of the Global Blockchain Market

The blockchain market is growing at an annual rate of 28.85%, supported by over 6000 startups.

More than 4000 of these are early-stage companies and highlight a strong pipeline of innovators. There have been over 800 mergers and acquisitions, indicating ongoing market consolidation.

The domain values innovation, with over 83 000 patents from more than 1800 applicants and a yearly patent growth rate of 23.25%. China leads with over 28 000 patents, followed closely by the USA with 27 000.

Explore the Funding Landscape of the Blockchain Market

The blockchain sector shows strong financial activity, with an average investment value of USD 17.2 million per funding round. The domain has attracted over 17 000 investors and contributed to more than 28 000 funding rounds. These investments have supported over 8000 companies, indicating broad investor confidence and a dynamic funding environment.

Who is Investing in Blockchain Companies?

Top blockchain investors have invested over USD 5 billion.

- Andreessen Horowitz has invested USD 1.3 billion across 107 companies. It raised USD 7.2 billion across five funds to invest in growth-stage companies, AI, infrastructure, and tech sectors.

- Global Emerging Markets has invested USD 953.4 million across 17 companies.

- Sequoia Capital has provided USD 904.6 million to 52 companies. It led a series B funding round for Fireworks AI, raising USD 77 million.

- GEM Digital has invested USD 762.5 million in 21 companies. It formed a strategic partnership with VSG, committing up to USD 10 million via a token subscription agreement.

- IDG Capital has contributed USD 752.5 million to 29 companies.

- Tiger Global Management has invested USD 749.2 million across 51 companies. In 2024, the company invested in OpenAI.

Top Blockchain Innovations & Trends

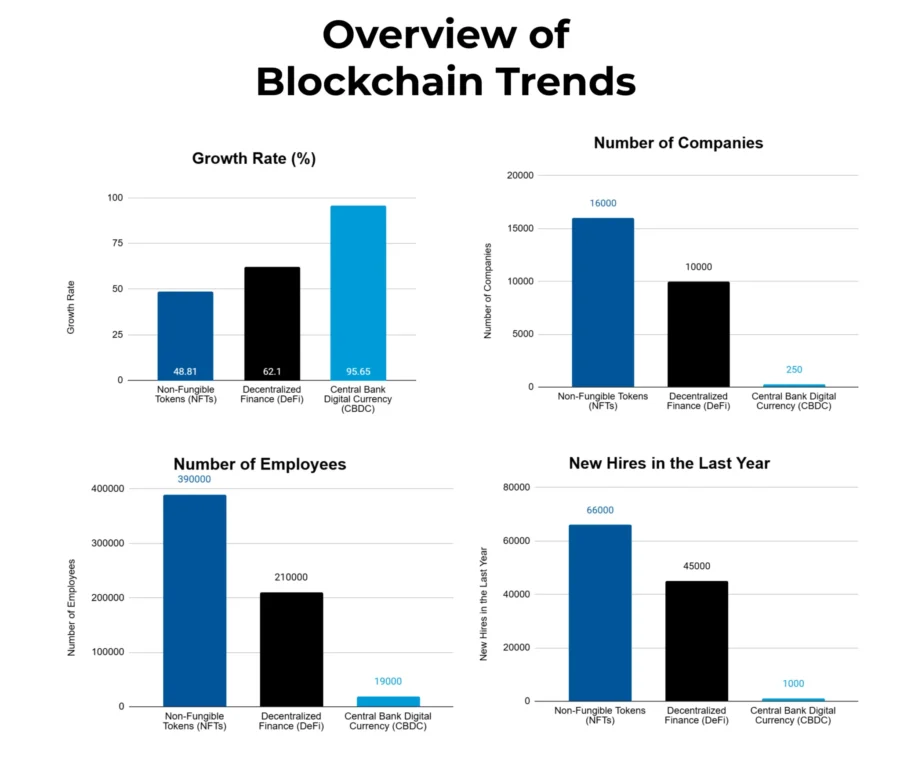

The blockchain market is witnessing major activity in three top trends, as reflected by their firmographic data:

- Non-Fungible Tokens (NFTs) trend includes over 16000 companies and employs more than 390K individuals globally, with 66K new employees added last year. NFTs have an annual growth rate of 48.81%, driven by adoption in art, gaming, and collectibles.

- Decentralized Finance (DeFi) features over 10000 companies and employs more than 210K people, with 45K new hires last year. Advances in smart contracts and decentralized applications power its 62.1% annual growth rate.

- Central Bank Digital Currency (CBDC) has over 250 companies and employs 19K people, including 1K new employees last year. Its 95.65% annual growth rate is driven by governmental and institutional focus on digital currency development and regulation.

5 Top Examples from 6000+ Innovative Blockchain Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

31Third optimizes Asset Management & Trade Execution

Dutch startup 31Third offers a blockchain-based asset management platform to streamline on-chain trade execution and portfolio management. The company’s Batch Trading smart contracts enable users to execute multiple token interactions in a single transaction to reduce transaction costs and execution time.

The platform’s Algorithmic Smart Order Router (ASOR) identifies optimal prices and liquidity across various exchanges and market makers to enhance trade efficiency. It also integrates with protocols like 0x, Aave, and Compound and provides a solution for efficient portfolio rebalancing and management.

Legitified ensures Medical Data Security

US-based startup Legitified uses blockchain to enable secure and efficient transfers of medical records and imaging. Its platform automates data transfers to preserve patient confidentiality and data integrity.

The startup offers tailored security solutions that meet healthcare providers’ specific needs, ensuring easy and safe data exchanges. Legitified simplifies the transfer of medical data to enhance security and operational efficiency for medical data management.

LumiShare enables Tokenization of Real-world Assets

UAE startup LumiShare develops LumiPlace, an asset-backed NFT marketplace that tokenizes renewable energy assets for fractional ownership. The platform converts physical renewable energy projects into digital tokens, which allows investors to participate with lower entry barriers.

The $LUMI token acts as a gateway to returns from renewable energy investments and as a payment method in selected marketplaces. The startup’s tokenomics, LumiNomics, integrates mechanisms like burning and locking to ensure long-term sustainability and value stability. LumiShare uses real-time data from solar panel providers to offer insights for investor decisions and democratize renewable energy investments.

Propbase streamlines Real Estate Investment

Hong Kong-based startup Propbase offers a blockchain-based marketplace for fractional ownership of real estate assets through tokenization. The platform’s six-step process includes application, due diligence, LLC incorporation, live property auction, funding, and token distribution. This ensures compliance with legal and regulatory frameworks.

The platform uses the $PROPS token for all smart contract interactions, including purchase orders, listings, and yield transfers.

Investors purchase property tokens via a mobile app, representing shares in an LLC holding the underlying asset, and verify transactions on the public blockchain registry. Propbase focuses on resilient property types, such as residential, condominiums, and commercial real estate, to offer monthly rental cash flow and long-term asset appreciation.

Flambo develops a Blockchain-native Ad Platform

French startup Flambo provides a blockchain-native advertising platform for NFT projects and brands to acquire qualified web3 users. It uses blockchain data to analyze user interests and behaviors to create lookalike audiences from NFT holders with similar traits.

The platform delivers sponsored content through temporary NFTs and provides limited-time engagement. The startup monitors campaign performance and tracks attribution with on-chain data to ensure transparency and effectiveness. Flambo uses blockchain insights to enable businesses to target and engage web3 users, promote community growth, and enhance user acquisition strategies.

Gain Comprehensive Insights into Blockchain Trends, Startups, or Technologies

The blockchain market is set for sustained growth, driven by innovation in decentralized finance, non-fungible tokens, and central bank digital currencies. Emerging trends such as blockchain interoperability, regulatory advancements, and environmental sustainability will shape the market’s evolution.

Get in touch to explore all 6000+ startups and scaleups, as well as all industry trends impacting blockchain companies.

![10 Top Startups and Companies to Watch in Barcelona [2025]](https://www.startus-insights.com/wp-content/uploads/2025/02/Top-Tech-Companies-in-Barcelona-SharedImg-StartUs-Insights-noresize-420x236.webp)