Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the FinTech industry. This time, you get to discover five hand-picked blockchain startups impacting FinTech.

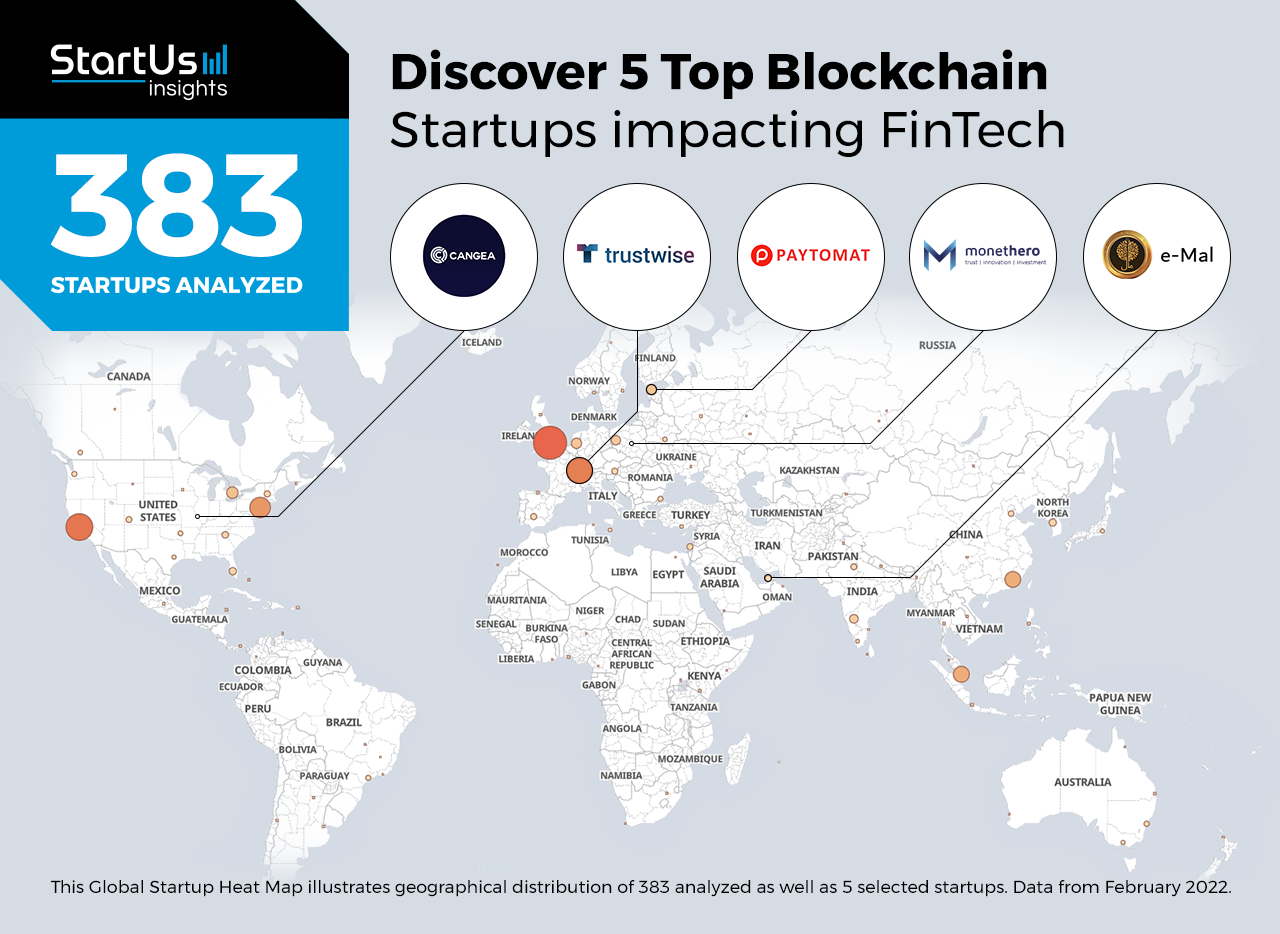

Out of 383, the Global Startup Heat Map highlights 5 Top Blockchain Startups impacting FinTech

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 383 exemplary startups & scaleups we analyzed for this research. Further, it highlights five FinTech startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 378 blockchain startups impacting FinTech, get in touch with us.

Trustwise enables Digital Share Transfer

Founding Year: 2017

Location: Pratteln, Switzerland

Partner with Trustwise for Enterprise-grade Blockchain Solutions

Swiss startup Trustwise utilizes blockchain technology to provide enterprise solutions for corporate finance management. Its TWEX app reduces the dependence on banking and media intermediaries by securely accelerating financial activities like dividend issuances and share transfers. TWEX is built on the TrustnetONE blockchain and assures legally compliant issuance and transfer of ledger-based securities. TWEX empowers investment companies, small and medium-sized enterprises (SMEs), and startups with functionalities such as automatic share register update, share beneficiary reporting, and shareholder meeting organization, among other corporate governance tasks.

e-Mal offers a Digital Wallet

Founding Year: 2018

Location: Dubai, UAE

Use this solution for Peer-to-Peer (P2P) Transactions

UAE-based startup e-Mal advances financial inclusion with P2P transactions and digital currency exchange in one platform using blockchain smart contracts. The startup’s digital wallet enables storage and transaction of digital assets using its e-Mal tokens. Individuals and small businesses use this platform to execute bill payments, lend and borrow digitally, salary payments, and cross-border remittances. e-Mal is a regulated exchange that ensures all transactions in its platform are legal and valid.

Cangea generates Smart Contracts

Founding Year: 2018

Location: St. Charles, US

Reach out for Multi-party Payment Protocol

US-based startup Cangea develops a decentralized finance (DeFi) platform for automating payments to multiple parties, including government entities such as tax authorities. The startup provides a software suite where users define custom rules to make multi-layer multi-party payments. Based on the user input, the platform generates smart contracts and payment algorithms that are deployable on the startup’s blockchain. The startup enables businesses and traditional financial institutions to process digital payments through its platform more efficiently and transparently.

Monethero provides Small & Medium Enterprise (SME) Borrowing

Founding Year: 2018

Location: Lodz, Poland

Reach out to Monethero for Commercial Financing

Polish startup Monethero is a platform to provide working capital for commerce and trade and software services to financial service providers. The blockchain-powered platform enables SME borrowing with the use of smart contracts directly drawn between the borrower company and the investor. The platform also provides its platform-as-a-service to investment firms and other commercial service providers to manage their clients. The startup brings transaction transparency for investors and business growth for SMEs.

Paytomat builds Payment Gateways

Founding Year: 2016

Location: Tallinn, Estonia

Use this solution for Crypto Payments

Estonian startup Paytomat builds a payment platform that enables businesses to accept payments for their products and services in fiat and cryptocurrencies. The blockchain-enabled platform provides an extension that is integrable in the existing point-of-sale (POS) terminals, websites, and other online platforms of merchants. The platform incentivizes merchants and their customers in Paytomat Tokens for making payments specifically in cryptocurrencies and waving fiat-to-crypto conversion charges. The startup empowers small businesses such as restaurants and salons to gain the benefits of decentralized payments networks and facilitates both storing and encashing their earnings.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on smart contracts, customer verification, and asset tokenization. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore financial technologies in more detail, simply let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.