The 2025 Chemical Industry Report provides an overview of the global sector that examines how innovation, regulatory developments, and sustainability are driving transformation. As industries focus on reducing their environmental footprint, the chemicals market adapts to meet demands for cleaner, safer, and more efficient solutions across agriculture, manufacturing, healthcare, and consumer goods. This report highlights key trends, including the rise of green chemistry practices, the adoption of bio-based and recycled feedstocks, and advancements in process optimization through digitalization and automation. Innovations such as chemical recycling technologies, sustainable solvents, and biodegradable materials are reshaping the sector to align with global sustainability goals and circular economy principles.

The report was last updated on January 2025.

This chemical report serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years. The report also examines major players, emerging startups, investment patterns, patent activities, and market dynamics that are shaping the competitive landscape.

Executive Summary: Chemical Market Outlook 2025

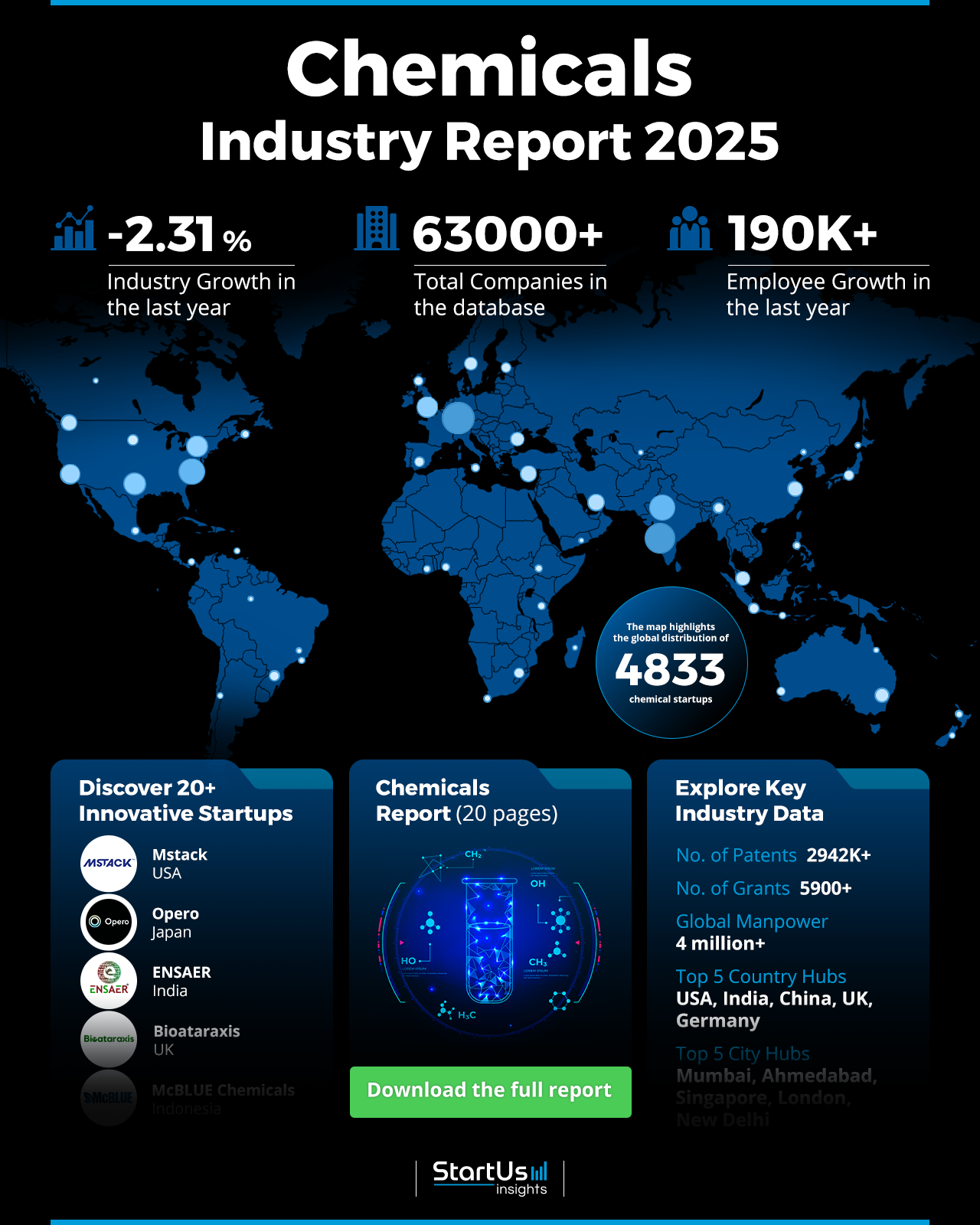

- Industry Growth Overview: The chemical industry includes over 63 000 companies, with 4800+ startups. The sector faces challenges with an annual growth rate of -2.31%, reflecting market shifts and consolidation trends. The global chemical industry is projected to grow from USD 6182 billion in 2024 to USD 6324 billion in 2025, representing a 2.3% year-over-year increase.

- Manpower & Employment Growth: The industry employs over 4 million people globally, with 190 000 new hires recorded last year.

- Patents & Grants: The sector shows significant innovation with 2.94 million patents filed by over 271 000 applicants. It has also secured more than 5900 grants, which emphasizes support for research and development.

- Global Footprint: Top country hubs include the USA, India, China, the UK, and Germany. Key city hubs driving regional and global growth are Mumbai, Ahmedabad, Singapore, London, and New Delhi. The Indian chemical industry is expected to reach USD 304 billion by 2025, registering a compound annual growth rate (CAGR) of 9.3%,

- Investment Landscape: The industry recorded an average investment value of USD 41.1 million per funding round, with over 16000 funding rounds and 4600 companies securing financial backing.

- Top Investors: Leading investors including the European Investment Bank, Curaleaf, Apax Partners, and more have a combined investment value exceeding USD 5 billion.

- Startup Ecosystem: The chemical industry promotes innovation through startups like Mstack (specialty chemicals & intermediates), Opero (AI-powered chemical plant operations), ENSAER (digital solutions for the chemical industry), Bioataraxis (biobased surfactants), and McBLUE Chemicals (diesel exhaust fluid and radiator coolants).

Methodology: How We Created this Chemical Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports. Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies and market trends.

For this report, we focused on the evolution of the chemical sector over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within the chemical sector

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the chemical market.

What data is used to create this chemical report?

Based on the data provided by our Discovery Platform, we observe that the chemicals industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The chemical industry had over 67 000 news publications last year. This shows its relevance and presence across global media platforms.

- Funding Rounds: The industry recorded 16 000 funding rounds, which reflects investor interest and capital inflow into various segments.

- Manpower: Employing over four million workers, the chemical industry added more than 190 000 new employees last year.

- Patents: With over 2.94 million patents, the sector shows significant innovation and research activities across multiple domains.

- Grants: The industry secured more than 5900 grants, which highlights continuous financial support for scientific and industrial advancements.

- Yearly Global Search Growth: The global search interest in the sector grew by 6.33% annually. This is an indication of rising awareness and engagement with chemical industry-related topics.

Explore the Data-driven Chemical Sector Outlook for 2025

Our database includes 4800+ startups and over 63 000 companies that reflect significant market activity. The industry shows an annual growth rate of -2.31% ,which indicates challenges in maintaining expansion across key sectors. Patents in this space exceed 2.94 million, while over 5900 grants have been issued. It signifies substantial innovation efforts worldwide.

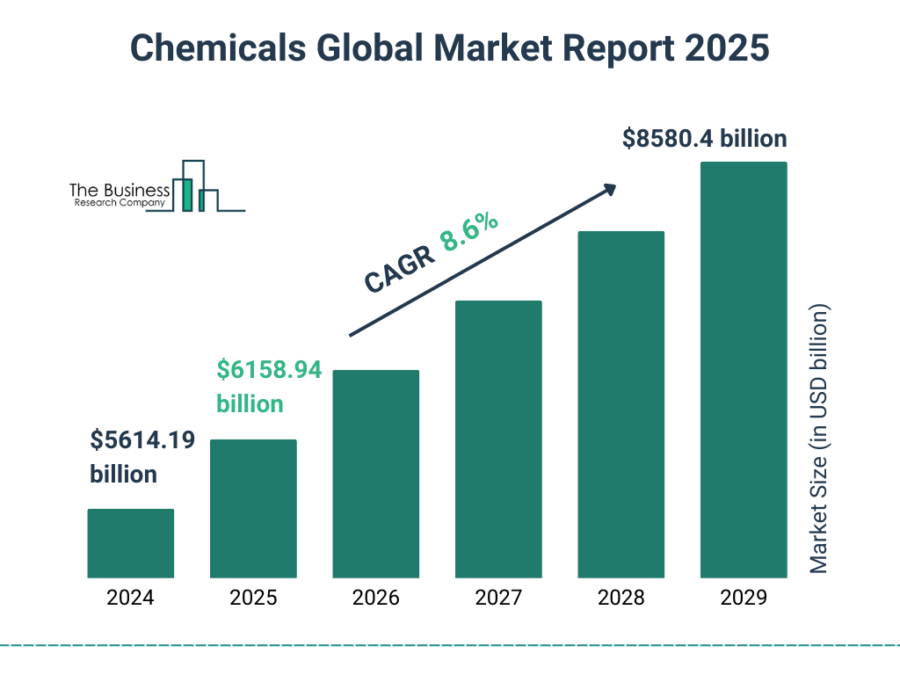

The chemical industry is growing at a CAGR of 8.6% to reach USD 8580.4 billion in 2029.

Credit: The Business Research Company

The global manpower surpasses four million employees, with 190 000 new hires recorded last year which emphasizes the industry’s role as a major employment generator. The top country hubs include the USA, India, China, the UK, and Germany, demonstrating geographic diversity in chemical production and innovation. City hubs like Mumbai, Ahmedabad, Singapore, London, and New Delhi drive industrial activity.

A Snapshot of the Global Chemical Industry

Studies show that sustainability and green chemistry, digital transformation, circular economy, and advanced materials are going to be major trends shaping the industry in 2025.

Currently, the industry includes over 4800 startups, with 1400 early-stage ventures. More than 3100 mergers and acquisitions indicate active consolidation. Patent activity is strong, with over 2.94 million patents filed globally by 271 000+ applicants. While yearly patent growth is modest at 0.20%, the industry continues to innovate.

The United States leads in patent issuance with over 675000, followed by China with over 547 000. However, the annual growth rate for the industry is -2.31%, suggesting challenges in expansion or market shifts affecting growth.

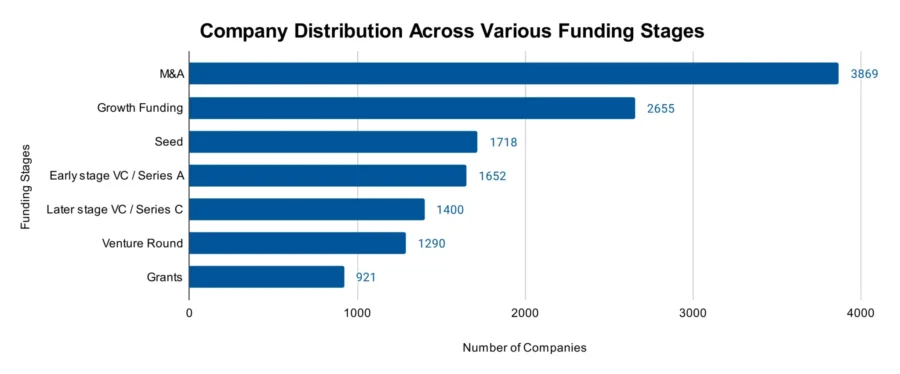

Explore the Funding Landscape of the Chemical Industry

The average investment value per round is USD 41.1 million, which shows strong investor confidence. Over 9000 investors have participated in funding rounds, indicating diverse and widespread interest. Our database records more than 16 000 funding rounds that provide consistent access to capital for industry companies.

Further, over 4600 companies have secured investments, showing a dynamic and well-supported ecosystem. These figures emphasize financial backing’s role in driving innovation and growth across the chemical sector.

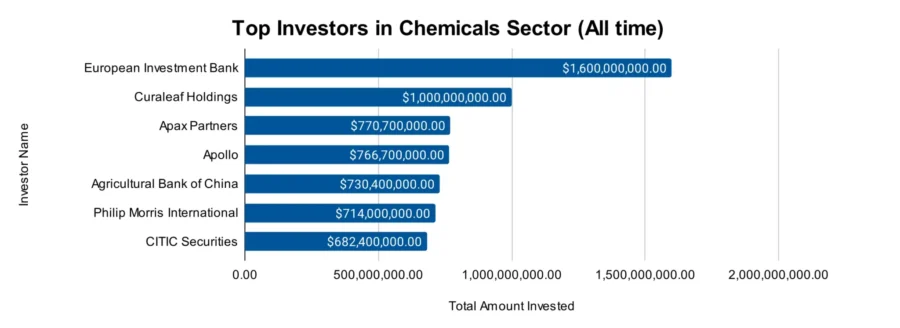

Who is Investing in Chemical Solutions?

The top investors in the chemical industry have invested over USD 5 billion, showing a strong financial commitment to the sector’s growth and innovation.

- The European Investment Bank leads with investments in nine companies, contributing USD 1.6 billion. It provided USD 515 million loan to Evonik to support the company’s European research and development activities in energy-efficient, bio-based, and circular solutions.

- Curaleaf Holdings has invested USD 1 billion across two companies.

- Apax Partners has allocated USD 770.7 million across three companies.

- Apollo has also invested in three companies, contributing USD 766.7 million.

- The Agricultural Bank of China has invested USD 730.4 million in two companies.

- Philip Morris International has backed two companies with a total investment of USD 714 million.

- CITIC Securities has funded three companies with USD 682.4 million. It has a subsidiary CITIC Metal, which produces titanium dioxide and titanium alloys.

Access Top Chemical Innovations & Trends with the Discovery Platform

Explore the emerging trends in the chemical industry, including the firmographic data:

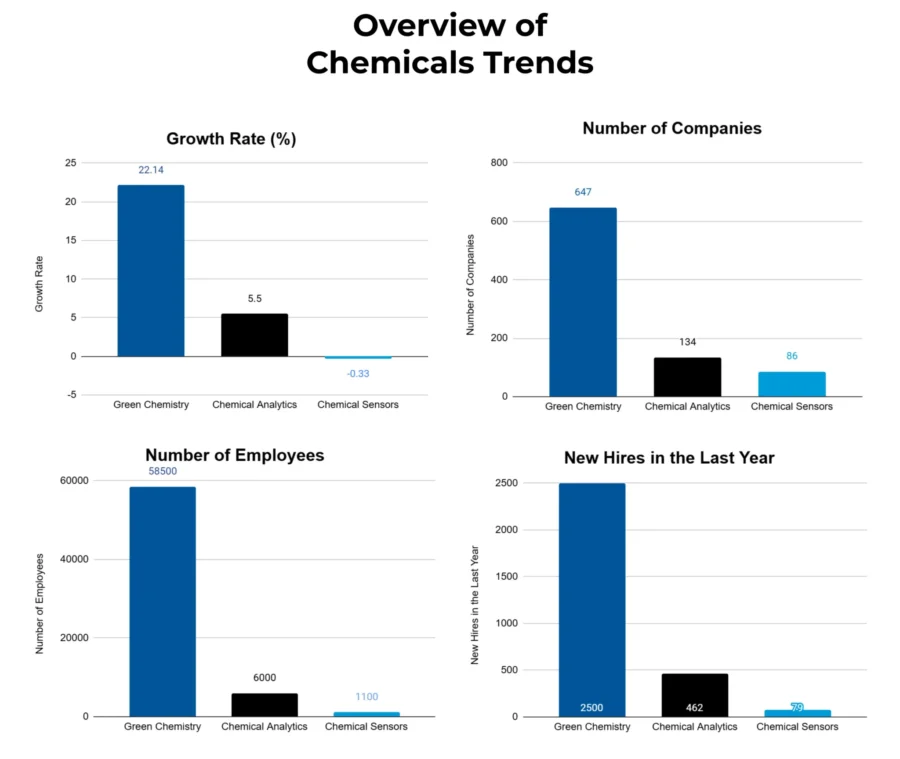

- Green Chemistry leads as a dynamic trend, with over 600 companies employing more than 52 000 individuals. The sector added 2000 new employees last year and achieved an annual growth rate of 21.25%. This trend reflects the industry’s focus on sustainable practices and eco-friendly solutions to meet regulatory and market demands.

- Chemical Analytics represents a niche yet growing area, with 110 companies employing 3500 professionals. The sector added 270 new employees last year, maintaining an annual growth rate of 5.16%. This highlights the rising importance of data-driven insights and advanced analytics in optimizing chemical production and performance.

- Chemical Sensors remain an emerging trend, comprising over 80 companies and employing around 700 individuals. With 60 new hires last year and a growth rate of 1.48%, this sector addresses the increasing need for precision monitoring and measurement in industrial applications.

5 Top Examples from 4800+ Innovative Chemical Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Mstack provides Specialty Chemicals & Intermediates

US startup Mstack delivers customized specialty chemicals through a platform that integrates R&D, custom manufacturing, and efficient supply chain management. It collaborates with global production facilities to develop tailored chemical formulations to ensure rigorous quality control and timely delivery.

The startup offers solutions across industries such as oil and gas, pharmaceuticals, and water treatment, focusing on sustainability and operational efficiency. Mstack enables businesses to access high-quality, cost-effective chemical products to enhance their competitiveness in the market.

Opero optimizes Chemical Plant Operations

Japanese startup Opero develops on-premises software solutions to optimize chemical plant operations through real-time monitoring and AI-driven recommendations. Its product, Opero Copilot, analyzes operational data to suggest control actions that enhance efficiency, reduce carbon emissions, and minimize labor requirements.

The software’s capabilities include anomaly detection, predictive maintenance, and demand forecasting, applicable across various chemical processes such as petroleum refining, petrochemical production, and water treatment. Opero integrates AI technologies to aid chemical plants achieve higher operational efficiency and sustainability.

ENSAER delivers Digital Solutions for the Chemical Industry

Indian startup ENSAER offers digital solutions to the fertilizer and chemical industries to enhance efficiency, productivity, and profitability through technology. It provides ENSAER-RCM, which optimizes maintenance strategies by analyzing risk, cost, and availability, and ENSAER-AHM, which offers advanced analytics and predictive maintenance to minimize downtime and maximize productivity.

The solutions use artificial intelligence, machine learning, and the Industrial Internet of Things to improve asset health monitoring, streamline supply chain operations, and enable precise fertilizer application. ENSAER allows chemical companies to achieve near-zero equipment breakdowns and maintain peak operational performance.

Bioataraxis produces Bio-based Surfactants

UK startup Bioataraxis develops sustainable, bio-based surfactants for cleaning products and industrial applications. It uses agricultural waste as feedstock, converting biomass into furan-based building blocks through its proprietary EcoSaf chemical process.

This method yields surfactants that match the performance of traditional, oil-based detergents while offering environmental benefits. The process emphasizes energy efficiency, low carbon emissions, minimal waste, and reduced purification steps that result in lower operating costs.

Bioataraxis transforms waste biomass into valuable chemical products and contributes to a circular economy.

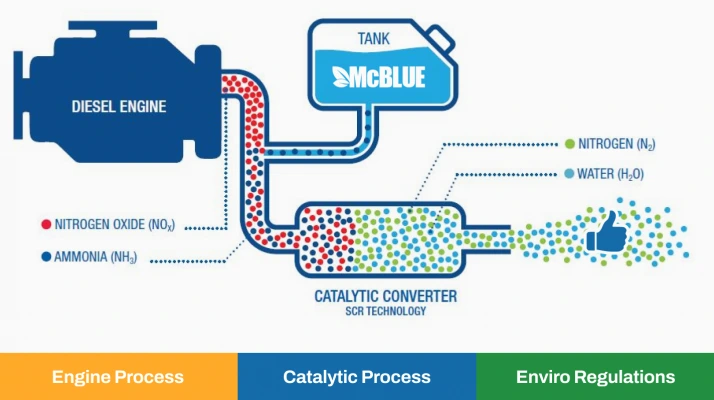

McBLUE Chemicals supplies Diesel Exhaust Fluid (DEF) & Radiator Coolant

Indonesian startup McBLUE Chemicals manufactures chemical products for the automotive sector, focusing on diesel exhaust fluid (DEF) and radiator coolants. Its McBlue DEF, a 32.5% synthetic urea solution, reduces nitrogen oxide emissions in diesel engines with selective catalytic reduction (SCR) technology by converting harmful gases into nitrogen and water.

McCoolant, radiator coolant, a ready-to-use propylene glycol solution, prevents engine overheating, rust, and scaling in closed-circulation systems. McBLUE Chemicals provides certified chemicals that support cleaner emissions and enhanced engine performance in the automotive industry.

Gain Comprehensive Insights into Chemical Trends, Startups, or Technologies

The 2025 chemical industry outlook marks a transformative period with innovation and sustainability amid growth challenges. Emerging trends like green chemistry, advanced analytics, and precision sensors will drive efficiency and environmental responsibility. Get in touch to explore all 4800+ startups and scaleups, as well as all industry trends impacting chemical companies.