The Cold Chain Market Report 2025 explores how the sector is evolving to meet rising demand, technological advancements, and sustainability goals across biotechnology, food, and pharmaceuticals. By improving supply chain visibility and optimizing transportation, the market continues to improve efficiency and resilience in a rapidly changing global market.

Executive Summary: Cold Chain Market Outlook 2025

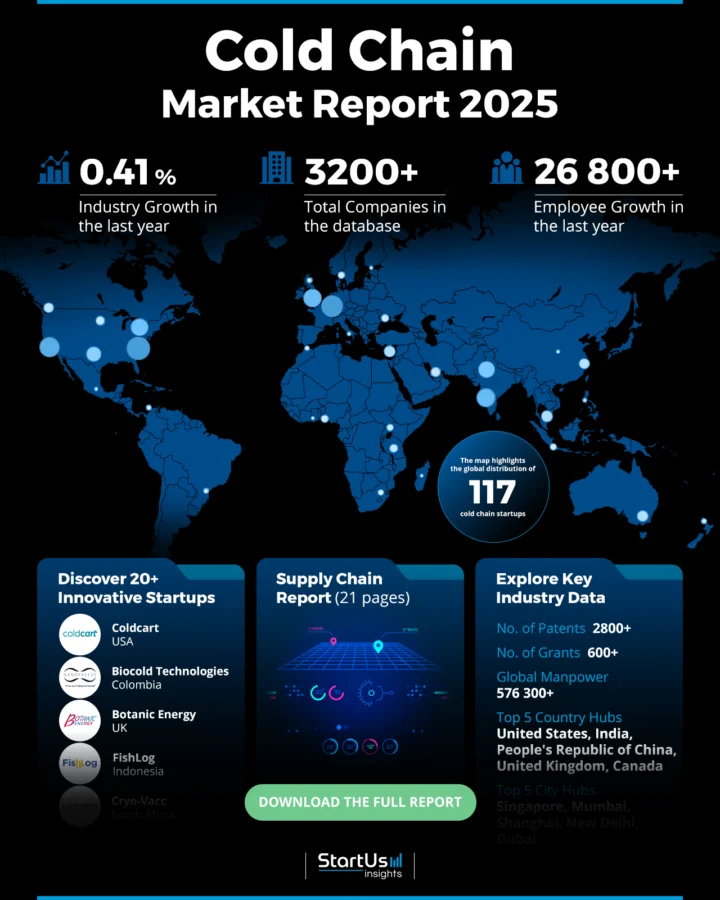

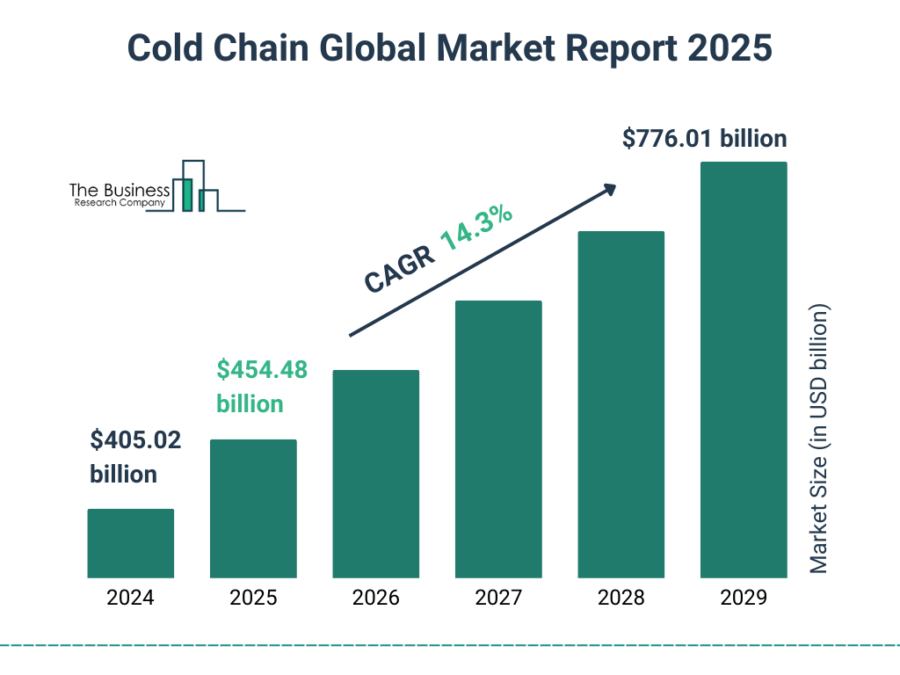

- Industry Growth Overview: The cold chain market size will grow from USD 454.48 billion in 2025 to USD 776.01 billion in 2029 at a compound annual growth rate of 12.2%. On a micro level, the cold chain sector has a steady annual growth rate of 0.41% as per the Discovery Platform’s latest data.

- Manpower & Employment Growth: In the past year, the market added over 26 800 new employees, bringing its total workforce to over 576 300.

- Patents & Grants: The sector is driven by innovation, as seen by the 2800+ patents submitted by 640+ applicants, which represents a 36.6% yearly growth in patents. Additionally, the market’s emphasis on technological developments is highlighted by the 600+ grants it has received.

- Global Footprint: The market’s global importance is highlighted by the establishment of hubs in important nations such as the US, India, China, the UK, and Canada. Notable city hubs include Singapore, Mumbai, Shanghai, New Delhi, and Dubai.

- Investment Landscape: The market has concluded 1880+ funding rounds with an average investment value of USD 56.2 million per round. These rounds were backed by 1600+ investors who have invested in 470+ companies.

- Top Investors: Leading investors, including Newmark Group, Oxford Properties, and BentallGreenOak, among others, have collectively invested over USD 5.32 billion which indicates strong confidence in the industry’s potential.

- Startup Ecosystem: Five innovative startups Coldcart (perishable parcel shipping), Biocold Technologies (cold chain natural refrigeration), Botanic Energy (logistical networks thermodynamic technology), FishLog (fisheries cold chain), and Cryo-Vacc (vaccines storage and tracking) highlight the entrepreneurial spirit and technological advancement within the sector.

Methodology: How We Created This Cold Chain Report

This report is based on proprietary data from our AI-powered StartUs Insights Discovery Platform, which tracks 25 million global companies, 20K+ technologies and trends as well as 110M patents and business reports.

Our data includes detailed firmographic insights into approximately 5 million startups, scaleups, and tech companies. Leveraging this extensive database, we provide actionable insights on innovation, emerging technologies, and market trends.

For this report, we focused on the evolution of cold chains over the past 5 years, utilizing our platform’s trend intelligence feature. Key data points analyzed include:

- Total Companies working on the trend

- News Coverage and Annual Growth

- Market Maturity and Patents

- Global Search Volume & Growth

- Funding Activity and Top Countries

- Subtrends within cold chains

Our data is refreshed regularly, enabling trend comparisons for deeper insights into their relative impact and importance.

Additionally, we reviewed trusted external resources to supplement our findings with broader market data and predictions, ensuring a reliable and comprehensive overview of the cold chains market.

What Data is Used to Create This Cold Chain Market Report?

Based on the data provided by our Discovery Platform, we observe that the cold chain market ranks among the top 5% in the following categories relative to all 20K+ technologies and trends we track.

These categories provide a comprehensive overview of the market’s key metrics and inform the short-term future direction of the market.

- News Coverage & Publications: Over 1700 publications were published in the last year which shows the cold chain market’s strong media presence.

- Funding Rounds: Our database contains information on more than 1880 funding rounds which highlights that the market has seen a significant amount of investment activity.

- Manpower: The cold chain business employs over 576 300 employees, and in the past year alone, it has added 26 800+ new workers.

- Patents: With more than 2800 patents registered, innovation is consistent within the sector.

- Grants: The market has received more than 600 grants to promote innovations which indicates the broad backing it has received.

- Yearly Global Search Growth: The cold chain sector saw a 19.06% yearly global search growth which ensures growing interest in the sector.

Explore the Data-driven Cold Chain Market Report for 2025

As per The Business Research Company report, the cold chain market size will grow from USD 454.48 billion in 2025 to USD 776.01 billion in 2029 at a compound annual growth rate of 12.2%.

The heatmap demonstrates the thriving cold chain market ecosystem with 110+ startups out of the 3200+ companies in the database.

Innovation is still a major driver with a steady 0.41% industry growth over the past year, as seen by the 2800+ patents and 600+ grants that have been issued.

Credit: The Business Research Company

Additionally, the sector employs more than 576 300 employees worldwide, and in the last year, it has grown by 26 800 new employees.

The US, India, China, the UK, and Canada are important centers influencing the market.

As per Global Times, China’s demand for cold chain logistics in 2024 reached 365 million tons, a year-on-year increase of 4.3%. Singapore, Mumbai, Shanghai, New Delhi, and Dubai are major cities driving momentum.

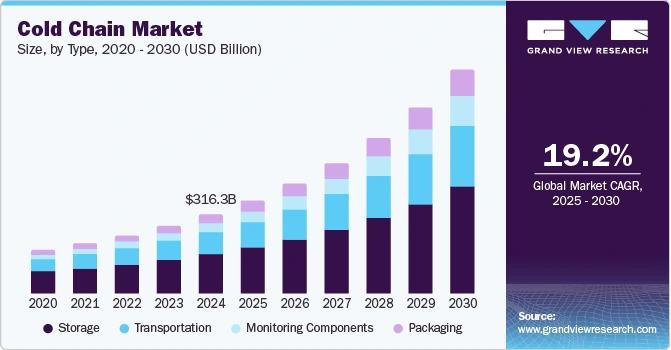

Further, as per Grand View Research’s report, the global cold chain market size was estimated at USD 316.34 billion in 2024 and is projected to grow at a CAGR of 19.2% from 2025 to 2030.

Credit: Grand View Research

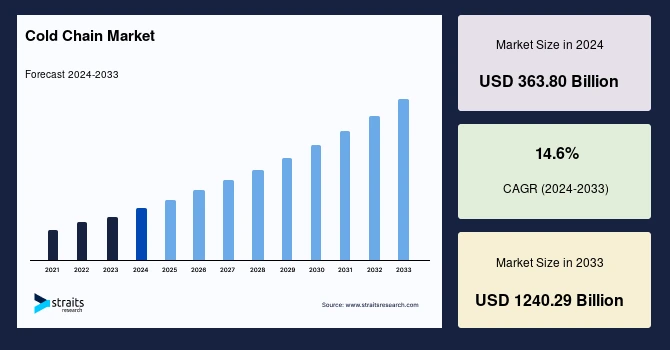

Moreover, the global cold chain market size is expected to grow from USD 416.91 billion in 2025 to reach USD 1240.29 billion by 2033, growing at a CAGR of 14.6%.

Credit: Straits Research

A Snapshot of the Global Cold Chain Market

The cold chain sector is expanding consistently with an annual growth rate of 0.41%, representing its durability and continued growth.

The sector’s dynamic ecosystem of 140+ early-stage startups indicates a strong innovation pipeline.

Additionally, with over 230 mergers and acquisitions documented so far, the industry has seen significant consolidation activity.

Innovation in the cold chain industry is flourishing as reflected by the 2800+ patents submitted by 640+ applicants worldwide.

Moreover, the market has seen a 36.6% annual growth in patent filings which emphasises the pace at which technology is developing.

Explore the Funding Landscape of the Cold Chain Market

With an average investment round value of USD 56.2 million, the industry shows a high scope for scalable and creative solutions.

With the help of a strong network of more than 1600 investors, the market has concluded more than 1880 investment rounds to date.

Moreover, the broad interest and confidence in the market’s potential for expansion and profitability is demonstrated by these investments received by 470 companies.

Who is Investing in the Cold Chain Market?

Leading international investors have made large investments in the cold chain sector, the total value of these investments by top investors exceeds USD 5.32 billion.

- Oxford Properties invested in at least 1 company, contributing USD 674.2 million. It also partnered with AustralianSuper, which acquired a 50% stake in its USD 871.6 million European logistics portfolio and M7 Real Estate.

- CenterSquare Investment Management invested in at least 1 company, with an investment of USD 674.2 million. It funded a USD 22.8 million mezzanine loan for a student housing development at Florida State University.

- Cohen and Steers invested in at least 1 company, contributing USD 674.2 million.

- BentallGreenOak supported 2 companies, with investments totaling USD 674.2 million. BGO and Starlight Investments acquired Fourteen75, a 227-suite residential property in Pickering, Ontario with over USD 600 million in assets under management.

- Newmark Group invested in at least 1 company, contributing USD 500 million. It arranged USD 2.3 billion in construction financing for a 206MW data center in Abilene, Texas, for Blue Owl Capital, Crusoe Energy Systems, and Primary Digital Infrastructure.

- Stonepeak invested in 2 companies, totaling USD 475 million. Stonepeak announced the final close of its Opportunities Fund, securing USD 3.15 billion in commitments.

- OP Trust invested in at least 1 company, contributing USD 474.2 million. Also, OPTrust, along with PGGM and USS, committed an additional USD 1.22 billion to Globalvia, a Madrid-based infrastructure concession management company.

- Azenta Life Sciences invested in at least 1 company, with an investment of USD 426.4 million.

- Morgan Stanley invested in at least 1 company, contributing USD 411.1 million. Morgan Stanley Expansion Capital, its sub division invested USD 20 million in NovoPayment to support digital banking and payment solutions.

- Gree Electric Appliances has invested USD 342.6 million in at least 1 company. It also partnered with FORVIA’s MATERI’ACT to sell 150K tons of recycled plastics by 2030.

Top Cold Chain Innovations & Trends

Discover the emerging trends in the cold chain market along with their firmographic details:

- Temperature Sensors are essential for preserving product integrity throughout the cold chain with more than 2300 companies operating in this sector. With 122 900+ employees and 4400+ new workers in the last year, the workforce supporting this trend is steadily growing. The growing need for real-time analytics and precision monitoring to ensure adherence to strict safety regulations is driving the segment’s 6.94% annual trend growth rate. Further, according to the Straits Research report, the global temperature sensor market was valued at USD 8.5 billion in 2024 and is projected to grow from USD 9.3 billion in 2025 to reach USD 18.3 billion by 2033, exhibiting a CAGR of 8.75% during 2025-2033.

- Supply Chain Visibility is one important trend that addresses efficiency and transparency in cold chain operations. With more than 2100 companies involved, this trend supports a huge workforce of 986 100+ employees, including more than 35 500 new employees in the past year. Real-time tracking, predictive analytics, and supply chain transparency are improving the domain’s annual growth by 22.62%.

- Route Optimization is changing the efficiency of logistics by cutting expenses and delivery times. With more than 1000 companies and 42 300 employees, this trend shows substantial workforce expansion. Last year, more than 6000 new employees were added. Moreover, AI and machine learning optimize routes, reduce fuel use, and increase efficiency, driving a 13.51% annual growth rate.

5 Top Examples from 110+ Innovative Cold Chain Startups

<p>The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Coldcart improves Perishable Parcel Shipping

US-based startup Coldcart creates a technological platform to streamline the logistics of perishable goods to ensure safe and efficient delivery.

It incorporates real-time data analytics to improve performance tracking, automate routing, and monitor shipment problems throughout the delivery lifecycle.

In addition, the platform includes cost analysis dashboards, predictive analytics, and dynamic routing algorithms to reduce spoiling and increase delivery dependability.

Further, Coldcart provides a complete solution for companies handling delicate items by emphasizing operational effectiveness and reducing waste associated with travel.

Coldcart also bagged USD 6.5 million in funding to grow its installed base of perishable shippers and logistics providers.

Biocold Technologies offers Natural Cold-chain refrigeration

Colombian startup Biocold Technologies uses its NanoFreeze bio-nanotechnology to produce natural refrigeration solutions. It makes materials called NanoFreeze to sustain low temperatures for lengthy periods without the need for electricity.

It offers products made from this NanoFreeze technology like Cold Coats, FOLDABLE COOLERS, Ice Bricks, and customizable NanoFreeze Panels. The eco-friendly technology utilizes nanostructures that efficiently maintain freezing points while providing longer cooling cycles.

It supports uses such as cold storage of food, medications, and medical supplies, especially in places with limited access to conventional refrigeration infrastructure.

Further, Biocold Technologies provides a sustainable alternative to traditional cooling, ensuring reliable and efficient refrigeration.

Botanic Energy creates Logistical Networks Thermodynamic Technology

UK-based startup Botanic Energy utilizes thermodynamic technology to decarbonize refrigeration, heating, and cooling operations in supply chains.

Its solutions capture heat from the environment and reduce the need for fossil fuels by using technologies like thermoelectric assemblies and active thermal cladding.

In addition, the solutions function well in a variety of environmental settings to meet a wide range of logistical needs. Botanic Energy lowers carbon emissions while preserving ideal thermal regulation by combining sustainability with technological precision.

Moreover, Botanic Energy was among the recipients of the UK government’s Freight Innovation Fund in 2024.

FishLog creates Fisheries Cold Chain

Indonesian startup FishLog‘s integrated technology platform links buyers and suppliers in the fishing sector. It provides a full ecosystem that includes quality assurance facilities, inventory finance options, and a business-to-business marketplace.

The platform monitors supply chains, reduces food waste in transit, and improves seafood transaction transparency. Additionally, FishLog offers funding solutions to assist suppliers in efficiently scaling their businesses. Its technology also builds a reliable, efficient cold chain for seafood logistics, benefiting producers and consumers.

Cryo-Vacc simplifies Vaccines Storage and Tracking

South African startup Cryo-Vacc offers vaccine storage and transportation systems that perform without electrical power to maintain extremely low temperatures.

Its Cryo-Vacc technology is beneficial in remote and resource-constrained areas due to its use of advanced materials to maintain vaccination integrity for longer periods. The startup’s tracking system provides real-time monitoring to ensure adherence to safety regulations.

Additionally, Cryo-Vacc aids healthcare organizations increase access to immunization programs by solving vaccine distribution issues. This ensures that life-saving medications are securely and effectively delivered to underprivileged groups.

Gain Comprehensive Insights into Cold Chain Trends, Startups, and Technologies

The cold chain market in 2025 demonstrates resilience, innovation, and a pivotal role in global supply chains. The market is tackling important issues in sustainability, efficiency, and logistics as technology continues to drive developments. This market is meeting the changing needs of a connected and increasingly perishable-driven world by emphasizing expansion and agility.

Get in touch to explore 110+ startups and scaleups, as well as all market trends impacting 3200+ companies.

![10 Top Startups and Companies to Watch in Barcelona [2025]](https://www.startus-insights.com/wp-content/uploads/2025/02/Top-Tech-Companies-in-Barcelona-SharedImg-StartUs-Insights-noresize-420x236.webp)