The construction industry is undergoing a technological transformation in 2025. The need for efficiency, sustainability, and innovation drives this change. AI and automation streamline project management. Building Information Modeling (BIM) and virtual construction improve planning and collaboration to reduce costs and delays. Sustainability remains a key focus, with construction industry trends like modular construction, prefabrication, and sustainable building materials reducing waste and carbon footprints.

What are the Top 10 Construction Industry Trends in 2025?

- AI & Automation

- Sustainable Construction

- Construction Management Software

- Construction Robots

- Virtual Construction

- Building Information Modeling

- Modular Construction

- 3D Printing

- Worksite Safety

- Prefabrication

Methodology: How We Created the Construction Trend Report

For our trend reports, we leverage our proprietary StartUs Insights Discovery Platform, covering 5M+ global startups, 20K technologies & trends plus 150M+ patents, news articles, and market reports.

Creating a report involves approximately 40 hours of analysis. We evaluate our own startup data and complement these insights with external research, including industry reports, news articles, and market analyses. This process enables us to identify the most impactful and innovative trends in the construction industry.

For each trend, we select two exemplary startups that meet the following criteria:

- Relevance: Their product, technology, or solution aligns with the trend.

- Founding Year: Established between 2020 and 2025.

- Company Size: A maximum of 200 employees.

- Location: Specific geographic considerations.

This approach ensures our reports provide reliable, actionable insights into the construction innovation ecosystem while highlighting startups driving technological advancements in the industry.

Innovation Map outlines the Top 10 Construction Trends & 20 Promising Startups

For this in-depth research on the Top Construction Trends & Startups, we analyzed a sample of 8000+ global startups & scaleups. The Construction Innovation Map created from this data-driven research helps you improve strategic decision-making by giving you a comprehensive overview of the construction technology trends & startups that impact your company.

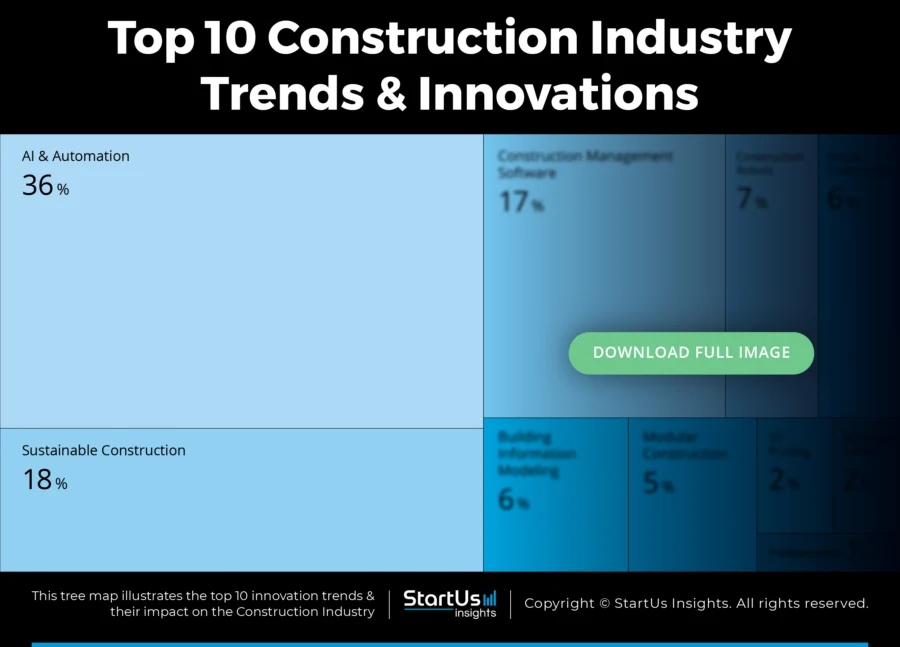

Tree Map reveals the Impact of the Top 10 Trends in the Construction Industry

The Tree Map below highlights the trends shaping the construction industry in 2025. These innovations drive efficiency, sustainability, and safety across the sector.

AI and automation transform project management, optimize workflows, and reduce costs. Construction robots and 3D printing enhance precision and productivity. Virtual construction and BIM also improve planning and collaboration.

Sustainable construction gains traction, with modular construction and prefabrication reducing material waste and environmental impact. Worksite safety technologies ensure compliance and minimize hazards. Moreover, construction management software streamlines operations.

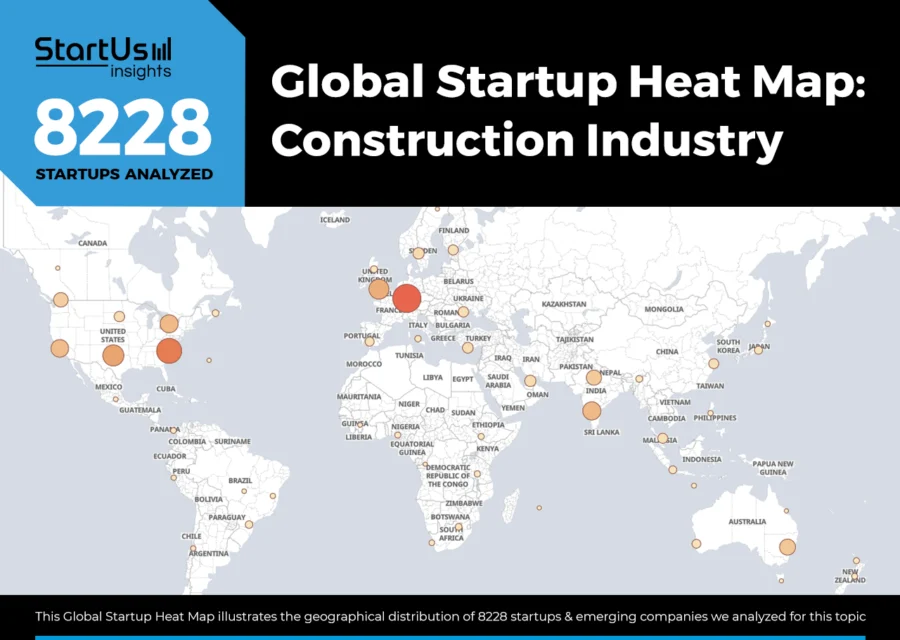

Global Startup Heat Map covers 8000+ Construction Startups & Scaleups

The Global Startup Heat Map showcases the distribution of 8000+ construction exemplary startups and scaleups analyzed using the StartUs Insights Discovery Platform. It highlights high startup activity in Europe and the United States, followed by India. From these, 20 promising startups are featured below, selected based on factors like founding year, location, and funding.

Want to Explore Construction Innovations & Trends?

Top 10 Emerging Construction Industry Trends [2025 and Beyond]

1. AI & Automation

The AI in the construction market is growing rapidly. It is projected to reach USD 2.29 billion in 2025 at a CAGR of 30.0% and expand to USD 7.21 billion by 2029 at a CAGR of 33.2%.

Credit: The Business Research Company

In 2024, over 64% of construction firms used or piloted AI technologies to improve efficiency and reduce costs.

AI applications are expected to deliver cost savings of 10-20% on construction projects by optimizing scheduling, resource allocation, and risk management.

AI-driven robotics and autonomous equipment address labor shortages and rising costs to enable faster project completion with fewer resources. AI-powered computer vision and IoT sensors are deployed for real-time safety monitoring, automatically detecting hazards and significantly reducing accidents on construction sites.

Moreover, generative design tools integrated with AI improve architectural designs by reducing material waste and enhancing buildability.

Nicky AI builds Construction Team AI Assistant

US-based startup Nicky AI offers an AI-powered assistant for construction teams to streamline project management tasks. It uses voice-enabled technology to manage submittals, RFIs, and tasks that allow users to delegate administrative duties efficiently.

The startup offers features such as automated cover sheet generation, workflow automation, and task assignment for general contractors, subcontractors, and designers. Nicky AI saves construction professionals hours daily to enhance productivity and focus on core activities.

Tri OM Adaptive Solutions makes AI Structural and Urban Analysis System

Indian startup Tri OM Adaptive Solutions integrates construction technologies with AI-driven systems to develop adaptable urban environments. Its AI structural and urban analysis system, TRICOSMOS, aids in planning and designing buildings and cities by detecting defects in materials and design reactions to climate change and natural disasters.

It provides necessary alterations to enable rapid responses to challenges such as climate change, population growth, traffic congestion, and pollution. The startup’s patented innovations allow structures and city planning to adjust to future requirements and growth to ensure resilience under adverse conditions.

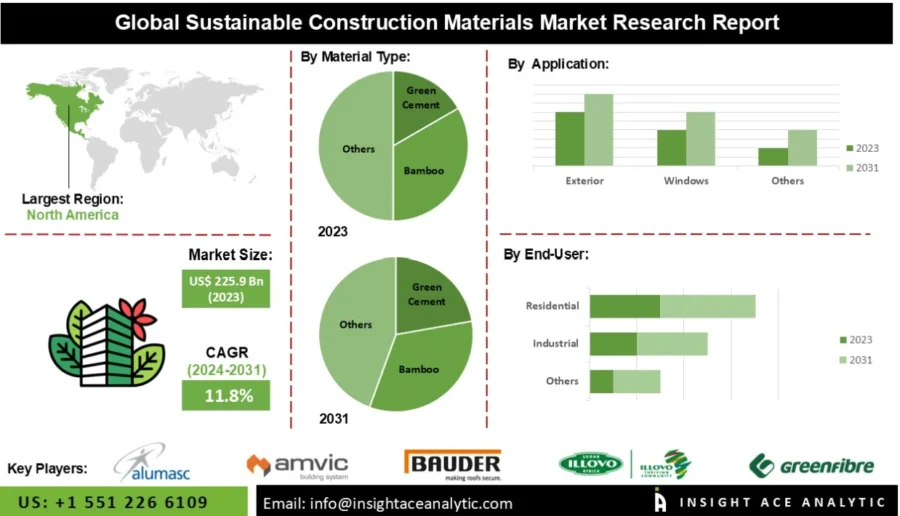

2. Sustainable Construction

The sustainable construction materials market is projected to reach USD 512.39 billion by 2029, growing at a CAGR of 12.2%.

Credit: InsightAce Analytic

Emerging technologies like carbon-negative concrete, self-healing bio-materials, and nano-cellulose products are reshaping construction practices to drive innovation and efficiency.

Net-zero energy buildings are becoming the industry standard, with increasing demand for energy-efficient designs that incorporate renewable energy systems like solar panels and geothermal heating.

Bio-based materials, especially cross-laminated timber (CLT), are witnessing accelerated adoption. It is growing at an annual rate of 30% due to its sustainability and structural benefits.

Green financing mechanisms, such as green bonds, support large-scale sustainable projects. In 2025, global green bond issuances are expected to exceed USD 1 trillion for the second consecutive year. This is a reinforcement of the financial commitment to eco-friendly initiatives.

WasteXpert provides Construction Waste Management Tools

New Zealand-based startup WasteXpert offers WasteX and the Waste Calculator to enhance construction waste management efficiency. WasteX provides real-time tracking, detailed reporting, and advanced analytics.

Organizations monitor waste levels, optimize collection schedules, and generate reports with customizable templates. They also analyze waste patterns and compare data across multiple sites for informed decision-making.

The Waste Calculator, allows businesses to estimate waste production based on industry studies and trial sites. It supports bin planning, promotes landfill diversion by connecting users with recyclers, and enhances waste management strategies to meet tender requirements.

TRIQBRIQ builds Timber Construction System

German startup TRIQBRIQ develops a micro-modular timber construction system using precision-engineered wooden building blocks called BRIQs. These blocks are produced from industrial and calamity wood with robotics.

They are assembled on-site by stacking and securing them with beechwood dowels to eliminate the need for artificial fasteners. This method enables rapid and flexible erection of load-bearing exterior walls. At the end of a building’s lifecycle, the BRIQs are disassembled and reused to promote sustainability.

The startup system includes TRIQBRIQ WS30, known for heat storage and CO₂ retention to enhance energy efficiency. TRIQBRIQ WS25 is a wall system that offers improved static properties, easier installation, and optimized space utilization.

Lastly, TRIQBRIQ WS16 is designed for breathable interior walls that provide a healthy indoor environment and separate terraced houses. With its solution, the startup supports forest conversion and counteracts climate change.

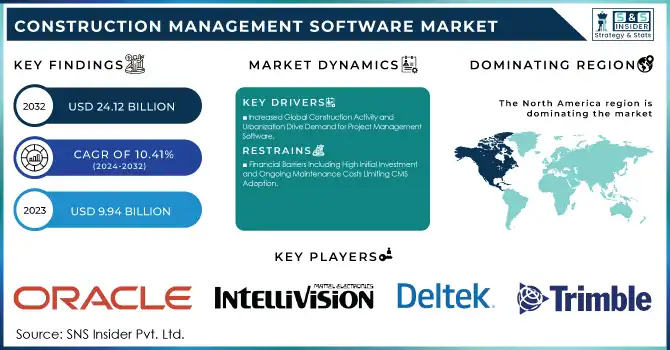

3. Construction Management Software

The construction management software (CMS) market is projected to reach USD 24.12 billion by 2032, growing at a CAGR of 10.41% from 2024 to 2032.

The Asia-Pacific region will see the fastest growth, with a CAGR of 13.6% from 2024 to 2031. This is driven by large-scale infrastructure projects in countries like China and India.

Credit: SNS Insider

Cloud-based solutions are becoming the industry standard. 60% of construction firms are expected to adopt cloud-based CMS by 2025 to enhance real-time collaboration and scalability.

The builders and contractors segment dominated the market in 2023, holding a revenue share of about 50%. Construction managers are projected to grow at the fastest CAGR of 11.73% from 2024 to 2032 due to increasing project complexity.

Mobile applications for field management are gaining traction. By 2025, they are expected to account for 40% of the CMS market as on-site teams rely more on real-time updates and communication tools to streamline operations.

Jack App develops a Construction Management Platform

Australian startup Jack App offers a construction management platform that simplifies project workflows for builders and tradespeople. It centralizes client management, estimating, job scheduling, and financial tracking which allows professionals to manage operations efficiently.

The client management module includes a construction CRM that tracks leads, automates follow-ups and facilitates communication with homeowners. The estimating module streamlines cost calculations through digital takeoffs, customizable templates, and integrated supplier pricing to ensure accuracy in bids and project budgeting.

Further, the job management module provides template schedules, task assignments, and real-time progress tracking to keep projects on schedule and reduce delays. The billing and finance tools automate invoicing, track payments, and use AI-powered bill processing to improve cash flow visibility.

Gongsae-ro enables Material Procurement & Data Analysis

South Korean startup Gongsae-ro develops a SaaS-based procurement platform that digitizes procurement processes in the construction industry to improve efficiency, transparency, and ESG compliance.

It connects construction sites with suppliers and facilitates the procurement of materials, equipment rentals, and surplus asset transactions through a centralized system.

The startup’s platform enables users to manage orders, competitive bidding, settlements, and financial transactions while integrating real-time data analytics for cost optimization. Its construction equipment sharing (CES) service allows businesses to lease, share, and manage heavy machinery efficiently to reduce idle resources and lower costs.

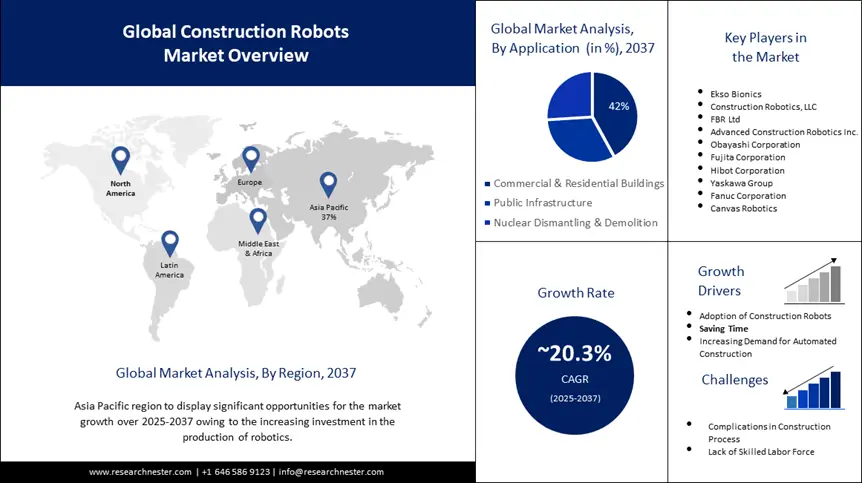

4. Construction Robots

The construction robots market will reach USD 3.63 billion by 2037, growing at a CAGR of 20.3% from 2025 to 2037. The market size in 2025 is estimated at USD 382.06 million, reflecting the rise of automation in construction.

Moreover, the robotic arm segment holds the largest revenue share at 45%, driven by its versatility in tasks like material handling and assembly.

Credit: Research Nester

Severe labor shortages challenge the industry, with some regions needing over half a million additional workers annually. Robots fill this gap by performing repetitive and hazardous tasks to enhance safety and efficiency.

The US Green Building Council reports that building construction accounts for 30% of total waste in the US, with global estimates between 25-40%. This accelerates the adoption of construction robots, especially in non-residential projects where precision and efficiency are critical.

Innovations in robotic arms, drones, autonomous vehicles, and exoskeletons reshape construction workflows. Further, bricklaying robots lay up to 3000 bricks daily, significantly reducing project timelines.

In addition, drones are used widely for site surveys and safety monitoring. Autonomous vehicles are also deployed for excavation and material transport.

Nextera Robotics builds Site Management Robot

US-based startup Nextera Robotics develops AI-native autonomous robots to optimize construction site management. Its robot, Didge, navigates job sites autonomously to capture high-resolution 360-degree images at scheduled intervals for real-time site visibility. It uses sensors and onboard processing to stop at predefined locations to ensure consistent image quality, even in varying lighting conditions.

The startup’s system integrates AI-driven analytics to detect deviations, track work progress, and enhance quality control, which allows construction managers to make data-driven decisions. Further, it offers cloud-based remote access to site data that enables collaboration among stakeholders.

ARAV provides Remote Control of Construction Machinery

Japanese startup ARAV manufactures robotics solutions that automate and digitize operations in the construction, forestry, and maritime sectors.

It offers Model V/E, a remote-control solution for operating legacy construction machinery using a smartphone, tablet, or laptop. This setup allows operators to manage equipment from over 1000 kilometers away to enhance flexibility and reduce the need for on-site labor.

The startup also uses the Open Construction Simulator (OCS) to replicate real-world machinery and site environments to enable safe and rapid validation of autonomous vehicle systems. Its autonomous solutions facilitate tasks like digging, transporting, and loading while incorporating obstacle detection for safety.

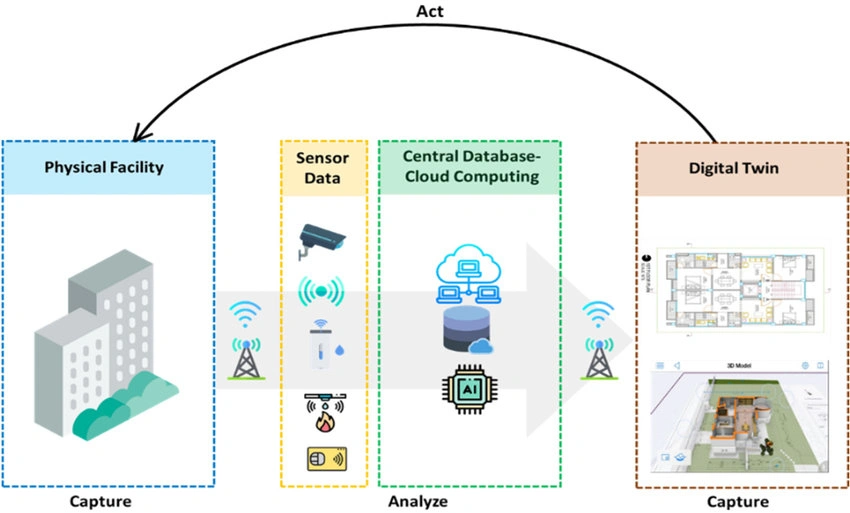

5. Virtual Construction

Rework accounts for nearly 30% of construction costs, making virtual design crucial for reducing inefficiencies by identifying design flaws before construction begins.

Credit: ResearchGate

Virtual design and construction (VDC) enhances project planning by incorporating time (4D) and cost (5D) dimensions into digital models. This improves visualization of construction sequencing, scheduling, and cost management.

Further, digital twins and extended reality (XR) tools drive efficiency by enabling real-time data sharing and predictive analytics. Augmented reality (AR)/Virtual reality (VR) tools are increasingly used for virtual walkthroughs, safety training, and real-time comparisons between as-built conditions and design plans to improve accuracy.

Energy modeling through VDC supports sustainable building practices by optimizing material use and reducing carbon footprints.

Investment in digital tools like VDC has surged as firms seek to enhance project outcomes. Companies like Autodesk have invested significantly in AR technologies to improve on-site efficiency, reflecting the industry’s shift toward advanced digital solutions for better construction management.

qapture builds Digital Twin for Construction

Austrian startup qapture makes digital twin solutions that transform physical assets into precise virtual representations. This enhances efficiency and sustainability in construction, existing buildings, and operations.

The startup uses laser scanning and robotics to capture 3D data and create virtual models that are accessible to browser-based viewers on any device.

qapture’s technology documents all phases, which allows stakeholders to monitor progress remotely, compare plans with as-built data, and make informed decisions. This further reduces follow-up costs.

For existing structures, digital as-built recordings facilitate planning for renovations to avoid unexpected issues and optimize budgets.

In operational settings, virtual object recording enables remote management, process optimization, and new business area development through data analysis and simulation.

Getafeel creates 3D Virtual Tours

Serbian startup Getafeel provides a 3D virtual tour platform that enhances the visualization of properties under construction. The platform offers an immersive experience for investors, architects, and real estate professionals. It allows them to explore spaces interactively from any device, gaining a comprehensive overview from multiple angles.

All virtual tours are stored on a cloud server to ensure constant accessibility with maintenance. The platform also allows project embedding on websites for marketing and sales integration.

Getafeel offers four distinct 3D tour styles—French, Modern, Scandinavian, and Minimalist—each designed to reflect unique interior themes, including textures, furniture, woodwork, and decorative details.

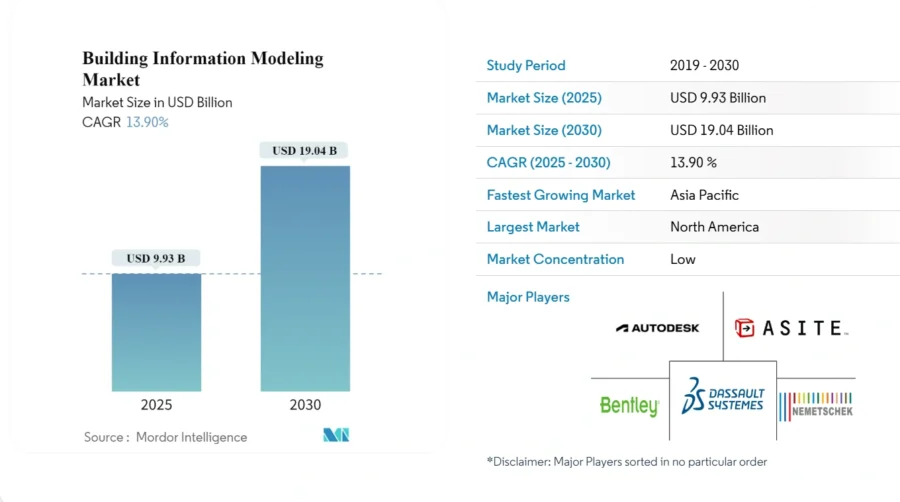

6. Building Information Modeling (BIM)

The BIM market will reach USD 9.93 billion in 2025 and is projected to grow to USD 19.04 billion by 2030 at a CAGR of 13.9%. BIM adoption continues to accelerate due to government mandates, efficiency improvements, and sustainability benefits.

Credit: Mordor Intelligence

Over 50% of government infrastructure projects mandated BIM usage in 2023, a trend expanding globally. Government regulations play a pivotal role, particularly in Europe and North America. Countries in the Asia-Pacific region, such as China and Japan, have also integrated BIM into national construction policies, especially for large-scale infrastructure projects.

BIM has reduced construction delays by an average of 30% and cut rework costs by an estimated USD 8 billion globally in 2023. The integration of IoT with BIM has increased project efficiency by 35%, and 25% of users leverage AI-powered tools for predictive modeling.

BIM-enabled sustainability modeling has contributed to an average energy savings of 15% per project, aligning with global green building initiatives.

Beyond individual projects, BIM plays a critical role in smart city development to enable efficient urban planning and infrastructure management through data-driven decision-making.

RDS-BIM enables Construction Design Automation

Polish startup RDS-BIM automates construction design by integrating with Autodesk Revit to streamline planning for fire protection systems, LANs, and electrical systems within a unified BIM environment.

The platform automatically places equipment like fire detectors and network components based on application, room size, legal requirements, and related technical systems.

It also automates wiring processes, creating control zones, selecting optimal topology, and performing calculations like cable lengths and power supply assessments.

RDS-BIM uses a single equipment database ensures consistency across device families and generates essential documentation, including structural and wiring diagrams. This automation reduces human errors and saves design time to provide a more efficient and cost-effective solution for construction design projects.

Anker provides Construction Information Modeling

Norwegian startup Anker offers a cloud-based application that lets users create, manipulate, and analyze BIM data with AI and automation. The platform integrates with Revit via a live plugin, connects with BIM360 and BIMsync, and supports IFC, XLS, and CSV file formats.

Users apply pre-configured validation rules on IFC or Revit models to visualize outcomes within Anker or business intelligence tools and automate feedback loops for design applications. The startup’s rule-based automation fills in missing parameters, updates existing values, and ensures consistent data quality.

In 2024, Anker partnered with Multiconsult, a Norwegian engineering consultancy that also acquired a minor stake in the company. This collaboration enhances digital solutions in the Architecture, Engineering, Construction, and Operations (AECO) sector.

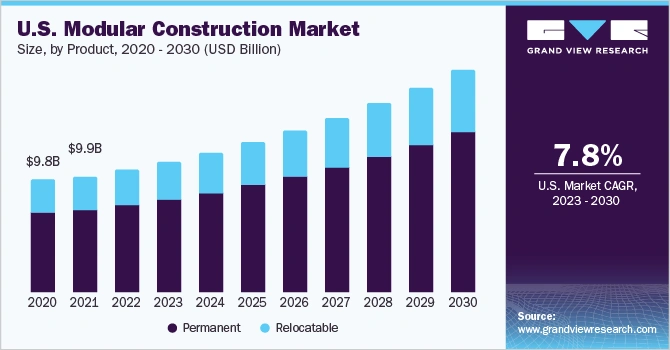

7. Modular Construction

The modular construction market is expected to reach USD 189.1 billion by 2032, growing at a CAGR of 6.9% from 2025 to 2032.

Credit: Grand View Research

Labor shortages, rising demand for faster project execution, and the need for sustainable construction drive the adoption of modular methods across residential, commercial, and institutional sectors.

Modular construction reduces project timelines by up to 50% compared to traditional methods. It leverages off-site prefabrication and streamlined processes to enhance efficiency.

Further, modular construction sites reduce vehicle movements by 80%, significantly lowering environmental impacts. Technological advancements, including BIM, automation, and digital design tools, further improve precision, quality control, and customization.

Governments also support modular construction initiatives. In late 2024, the Colorado Office of Economic Development allocated USD 24 million to modular housing projects, emphasizing affordability and sustainability.

Leading companies like Bouygues Construction, Skanska AB, and Lendlease Corporation invest in modular technologies to address housing shortages and improve efficiency in the sector.

Fero International delivers Volumetric Modular Buildings

Canadian Fero International designs, fabricates, delivers, and installs volumetric modular buildings through a process that integrates design, permitting, and construction in a controlled environment.

It develops modular structures in its manufacturing facility to ensure precision and efficiency while site development progresses.

The startup schedules fabrication based on project milestones, including approvals for long-lead items and building permits to reduce overall project timelines. After fabrication, it prepares the modules for secure transportation to ensure compliance with logistics and regulatory requirements across jurisdictions.

Upon arrival at the site, Fero International inspects, offloads, and assembles the modules to integrate internal and external systems while coordinating landscaping and paving.

Further, Fero International received USD 3.5 million in February 2024 from the Federal Economic Development Agency for Southern Ontario. This funding expands its manufacturing capabilities for modular healthcare infrastructure.

CYME accelerates Off-site Timber Frame Construction

French startup CYME develops modular timber-frame constructions using a patented system that offers architects and project owners cost-effective, customizable solutions for permanent and transferable projects.

It employs an assembly method by extrusion, where rigid rings are juxtaposed like a boat hull or airplane fuselage to ensure high structural rigidity without extra supporting elements.

This allows modules to be pre-finished in the workshop before transport and craning to optimize installation efficiency. The system supports stacking up to R+15, enabling design flexibility, drilling options, and architectural customization.

The startup prioritizes sustainability by using bio-sourced materials, primarily wood sourced locally from forests near its production workshop. Its buildings are insulated with wood fiber and cellulose wadding to enhance energy efficiency and environmental responsibility.

8. 3D Printing

The 3D printing building construction market is expected to reach USD 14.34 billion by 2029, growing at a CAGR of 94.9%.

This growth is driven by the technology’s ability to reduce labor costs by 50–80%, minimize material waste through precision usage, and enable the creation of complex architectural designs that are hard to achieve with traditional methods.

Credit: The Business Research Company

Onsite 3D printing is gaining traction as it streamlines construction processes, reduces costs, and enhances design flexibility.

Advances in material science are further driving the adoption of eco-friendly materials such as recycled plastics, geopolymer concrete, and bio-based composites.

Investment and government support are also fueling market growth. Amazon’s Climate Pledge Fund has invested in 14Trees, a company specializing in sustainable 3D printing for housing.

In the US, Virginia Tech received a USD 1.1 million grant to build affordable housing using 3D concrete printers.

As urbanization accelerates, particularly in the Asia-Pacific region, which held a 41% market share in 2024, 3D printing is crucial in constructing infrastructure for smart cities and addressing housing shortages efficiently.

3D QUANTER manufactures 3D Construction Printer

UK startup 3D QUANTER builds 3D printers for the construction industry to offer fast, affordable, and eco-friendly alternatives to traditional building methods. Its printers use additive manufacturing to construct structures layer by layer, enabling precise and efficient building processes.

The startup’s 3D printer supports two print fields for simultaneous printing to enhance productivity. The printer’s compact design, with folded dimensions of 4.5 x 1.2 x 1.6 meters and a maximum raised height of 3.2 meters, facilitates easy transportation and setup.

Aridditive advances Concrete 3D Printing

Spanish startup Aridditive develops autonomous concrete 3D printing technology. Its closed-loop control system ensures process stability to deliver a consistent 3D printing experience. The extruder features a removable silicone casing for easy maintenance, preventing the need for disassembly during clogs.

It also supports customizable nozzle sizes for precise control over layer and bead dimensions. Aridditive offers a sustainable alternative to traditional construction methods, minimizing waste and using eco-friendly materials.

Moreover, Aridditive raised EUR 500 000 in a pre-seed funding round led by BeAble Capital, with participation from Suma Capital. The funds are for advancing its 3D concrete printing technology, conducting proof-of-concept trials by the end of 2024, and preparing for a market launch in spring 2025.

9. Worksite Safety

In 2023, the construction industry recorded 1075 fatalities, the highest since 2011. Falls accounted for 39.2% of these deaths. The fatal injury rate stood at 9.6 per 100 000 full-time workers, highlighting the urgent need for enhanced safety measures.

Coming to the construction market trends, the worker safety market was valued at USD 3.1 billion in 2023 and is projected to grow at a CAGR of over 7% from 2024 to 2032, driven by increased adoption of advanced safety technologies.

Credit: Global Market Insights

Companies are increasingly implementing wearable devices that monitor vital signs and environmental conditions in real time. AI-powered systems predict risks and enhance site safety. Autonomous machinery and drones are deployed for high-risk tasks like heavy lifting and site surveying, reducing human exposure to hazardous conditions.

Digital transformation tools like BIM and AR are gaining traction for immersive safety training to improve hazard awareness and preparedness.

Predictive analytics using AI is central to identifying potential risks before they occur, improving both safety outcomes and project efficiency.

Investments in safety training programs have demonstrated measurable success in reducing workplace incidents. Companies integrating advanced personal protective equipment (PPE) with IoT sensors remotely monitor worker health to ensure proactive intervention and accident prevention.

Need2Say provides Communication & Training Platform

US-based startup Need2Say offers a communication and safety platform for the construction industry. It provides tools such as real-time speech translation, multilingual chat, and location tracking to enhance on-site collaboration and safety.

The platform’s real-time speech translator converts spoken language into text across multiple languages and facilitates communication among diverse teams.

The multilingual chat feature offers instant message translation and transcription to reduce miscommunication and promote inclusivity. Further, the real-time location tracking tool monitors worker presence, improving safety measures and emergency response efficiency.

Safe At Site makes Secure Construction Site Solutions

Swedish startup Safe At Site develops safety solutions for construction and roadwork sites to prevent serious accidents. It offers the ProGuard CB series for heavy traffic and high-speed closures, tested to EN 1317-2 standards. The ProGuard City barrier provides flexibility and rapid deployment to meet capacity class T2 requirements.

For unprotected road users, the ProGuard GC system creates protected areas for pedestrians and cyclists around work zones. The StaySafe Panel features robust, powder-coated steel panels, balancing strength and weight. The adjustable StaySafe Post allows for various height configurations.

The startup also provides various StaySafe Brackets for mounting on different projects. It also offers modular solutions for basement entrances and construction stairs, complying with EN12811 standards, to ensure safe access across various site conditions.

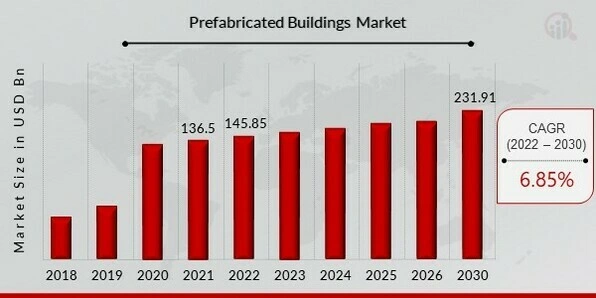

10. Prefabrication

The global prefabricated building system market is expected to reach USD 12.22 billion in 2025 and grow at a CAGR of 6.3%, reaching USD 22.64 billion by 2035.

Credit: Market Research Future

Labor shortages worldwide are driving the adoption of prefabrication, as it requires fewer on-site workers compared to traditional construction methods.

Prefabrication enhances efficiency, reducing construction time by 30 to 50% and minimizing material waste by up to 90% due to controlled factory environments.

The industry is integrating energy-efficient processes and eco-friendly materials, such as cross-laminated timber (CLT), aligning with global sustainability goals.

In February 2023, EPACK Prefab invested USD 23.62 million in a new manufacturing facility in Andhra Pradesh to meet rising demand in southern India.

Wells acquired GATE Precast in July 2024 expanding its prefabrication capabilities and reflecting the trend of industry consolidation. These advancements highlight prefabrication’s role as a faster, more sustainable alternative to conventional construction methods.

Grhya builds Prefabricated Cabin and Pod

Indonesian startup Grhya manufactures prefabricated modular cabins and pods to provide housing solutions for homebuyers, businesses, and various destinations. The startup uses proprietary designs to create modern, mobile structures that ensure high levels of comfort and quality.

Each module includes layers of materials like plywood, biodegradable insulation, vinyl, waterproof membranes, and steel frames, resulting in robust cabins with thermal and sound insulation, and termite resistance. Modules assemble laterally, which allows for flexible layouts and the option to disassemble and relocate structures as needed.

Grhya integrates smart home systems into its cabins, featuring smart door handles, light switches, electrical outlets, and IR remotes connected to Alexa or Google Assistant. These systems are controllable via mobile apps and voice commands.

Rubera Prefabbricati manufactures Prefabricated Concrete Structures

Italian startup Rubera Prefabbricati develops prefabricated building systems for commercial, industrial, logistical, and agricultural applications. It uses concrete to create modular elements to ensure durability and structural integrity.

The Zephir system features micro shed tiles and flat quay beams to provide technical-functional characteristics and architectural value. The Pegaso system includes flat reinforced concrete tiles and beams for effective rainwater disposal and options for indirect or zenithal lighting. Further, the Argo system also uses flat reinforced concrete tiles and beams with variations in dimensions and capacities.

The startup’s PW 3500 system offers a modern aesthetic and visual impact, suitable for roofs and floors with strong spans and significant load-bearing capacity. The Areabase system consists of double-slope beams combined with double-ribbed or flat intrados tiles. This provides a tested structure with various insulation and waterproofing options.

Lastly, the Areapiana system features flat beams combined with flat or double-ribbed intrados prestressed concrete floors to meet requirements for large-capacity decks and significant fire resistance.

Discover all Construction Trends, Technologies & Startups

The construction industry is advancing with improvements in efficiency, sustainability, and safety. AI and automation streamline project management and enhance decision-making. Modular construction reduces material waste and speeds up project timelines. Whereas, BIM transforms planning and collaboration to ensure smarter and more cost-effective processes. These innovations are reshaping construction, making it faster, greener, and more precise.

The Construction Trends & Startups outlined in this report only scratch the surface of trends that we identified during our data-driven innovation & startup scouting process. Identifying new opportunities & emerging technologies to implement into your business goes a long way in gaining a competitive advantage.