The 2024 Cosmetics Report provides a detailed analysis of the trends, innovations, and firmographic data influencing the future of beauty products. This report explores the changes in the industry, with a focus on sustainable practices, technological advancement, and consumer-driven customization. It also includes an analysis of important trends such as organic, medical, and personalized cosmetics that contribute to the sector’s growth.

This report was last updated in July 2024.

This cosmetic industry report serves as a reference for various stakeholders in the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Cosmetics Industry Report 2024

- Executive Summary

- Introduction to the Cosmetics Report 2024

- What data is used in this Cosmetics Report?

- Snapshot of the Global Cosmetics Industry

- Funding Landscape in the Cosmetics Industry

- Who is Investing in Cosmetics?

- Emerging Trends in the Cosmetics Industry

- 5 Cosmetics Startups impacting the Industry

Executive Summary: Cosmetic Industry Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 2500+ cosmetics startups developing innovative solutions to present five examples from emerging cosmetics industry trends.

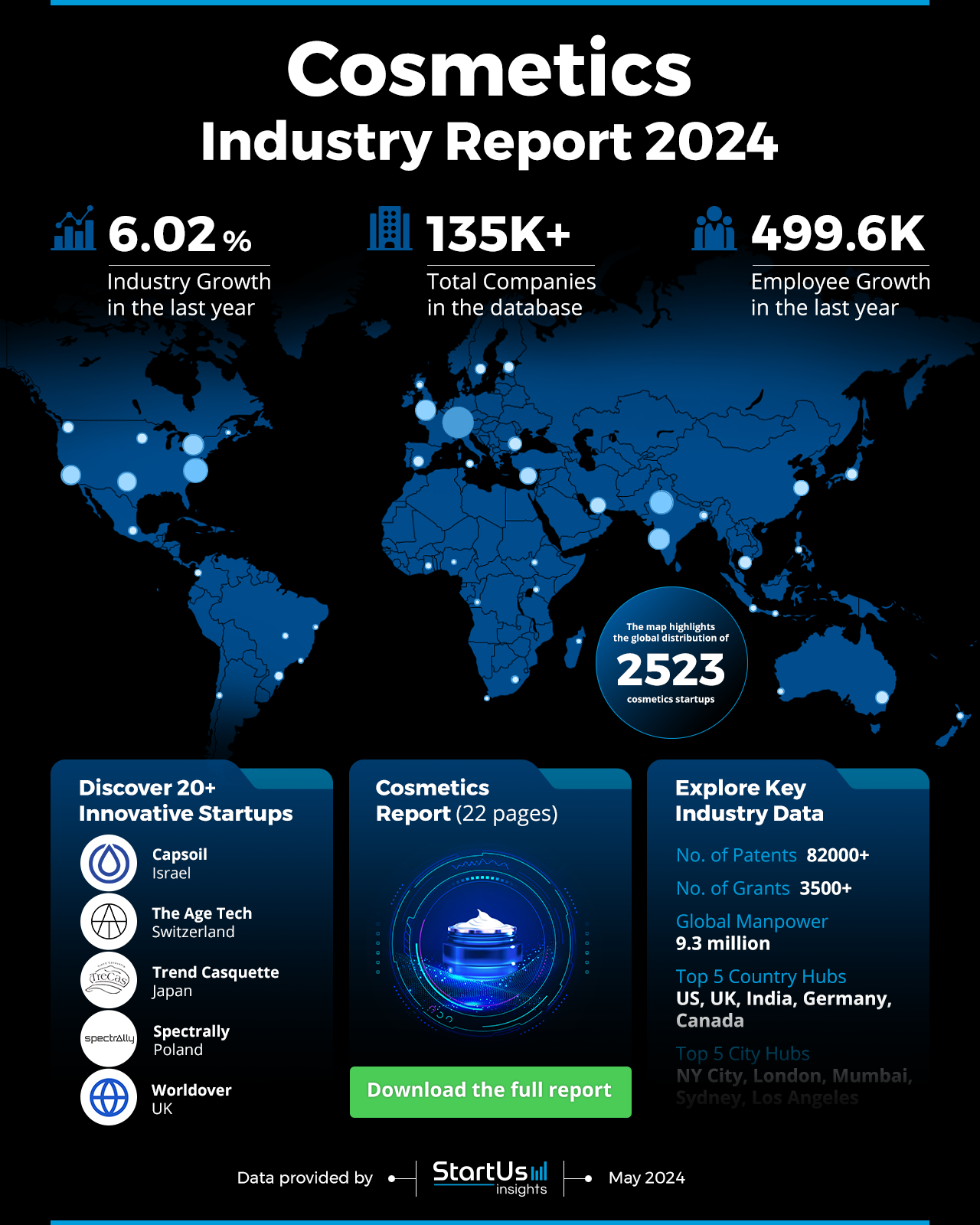

- Industry Growth Overview: The cosmetics industry has grown, with an annual trend growth rate of 6.02% and more than 135000+ companies listed.

- Manpower & Employment Growth: The sector provides employment to over 9.3 million individuals globally, and added more than 490K new employees in the past year.

- Patents & Grants: The industry holds more than 82000 patents and has received over 3500 grants, indicating its focus on innovation and research.

- Global Footprint: Major business hubs are located in the US, UK, India, Germany, and Canada, with top cities including New York City, London, Mumbai, Sydney, and Los Angeles.

- Investment Landscape: The industry has an average investment value of USD 34 million per funding round, with over 19000 funding rounds closed and more than 9000 companies receiving investment.

- Top Investors: Investors such as Tiger Global, SoftBank Vision Fund, General Atlantic, and more have invested a total of over USD 10 billion into the industry.

- Startup Ecosystem: Five innovative startups include Capsoil (Nanometric Powder), The Age Tech (Epigenetic-based Anti-aging Serum), Trend Casquette (Cosmetics RaaS), Spectrally (Real-time Quality Control), and Worldover (Product Lifecycle Management).

- Recommendations for Stakeholders: Stakeholders should focus on sustainable and health-focused products. Investing in emerging technologies like AI and biotechnology is beneficial. Engaging in or supporting startups with innovative approaches will provide competitive advantages and opportunities for market expansion.

Explore the Data-driven Cosmetics Report for 2024

The Cosmetic Industry Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. Our database contains details on a substantial number of cosmetics companies, precisely 135000, which includes 2500+ startups. The industry has experienced a growth rate of 6.02% in the previous year. The global workforce involved in these companies is around 9.3 million, with an increase of close to 500000 employees over the past year.

Several countries, including the US, UK, India, Germany, and Canada are the main hubs for the cosmetics industry. Cities that are recognized as active hubs are New York City, London, Mumbai, Sydney, and Los Angeles. In addition, the sector shows a significant number of patents, around 82000, and more than 3500 grants.

What data is used to create this cosmetics report?

Based on the data provided by our Discovery Platform, we observe that the cosmetics industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The cosmetics industry is often featured in news coverage and publications, with a significant number of publications, around 17000 in the past year.

- Funding Rounds: Our database holds data on over 19000+ funding rounds.

- Manpower: The sector employs a workforce of more than 9 million workers, and it added close to 499000 new employees last year.

- Patents: The industry is innovative and holds around 82000 patents.

- Grants: It has secured a significant number of grants, more than 3,500.

- Yearly Global Search Growth: The sector has seen consistent interest with a yearly global search growth of 10.44%.

A Snapshot of the Global Cosmetics Industry

The cosmetics industry is a notable participant in the global market and employs a workforce of over 9.3 million individuals. There was an increase of close to 499000 employees in the past year. This industry encompasses more than 135000 companies which highlights its broad reach and impact.

Explore the Funding Landscape of the Cosmetics Industry

The investment dynamics within the industry are noteworthy. The average investment per funding round is exceeds USD 34 million, which shows the financial commitments investors make. More than 6000 investors are actively participating, and the industry has completed over 19000 funding rounds.

These investors have directed their resources into a large number of companies, over 9000, which shows confidence in the growth potential and stability of the cosmetics sector. This highlights the industry’s vitality and its important role in promoting economic growth and innovation.

Who is Investing in Cosmetics?

The cosmetics industry has attracted considerable investment from global investors and amassed over USD 10 billion in combined contributions.

- Tiger Global Management has made a notable investment of USD 1.4 billion across 20 companies, showing a commitment to promoting growth and innovation within the industry.

- SoftBank Vision Fund has placed USD 1 billion into 7 companies, focusing on impactful investments that offer considerable returns.

- General Atlantic has invested USD 977.9 million in 12 companies, using its expertise to identify and scale ventures with potential.

- Summit Partners has invested USD 951.1 million in 9 companies, indicating a focused approach toward nurturing promising cosmetic ventures.

- DST Global has invested USD 932.8 million in 6 companies, reflecting its selective and impactful investment strategy.

- Temasek Holdings has committed USD 906.6 million across 8 companies, focusing on sustainable and profitable growth within the industry.

- L Catterton has invested USD 863.3 million in 23 companies, indicating its broad reach and confidence in the industry’s diverse opportunities.

- Sequoia Capital has invested USD 807.9 million in 16 companies, emphasizing its role in supporting companies with potential for growth.

- Accel has invested USD 800.9 million in 14 companies, aiming to accelerate the growth of startups with potential.

- Goldman Sachs has made a strategic investment of USD 737.3 million across 9 companies, focusing on ventures that contribute to the evolution of the cosmetics landscape.

These investors provide financial resources and bring valuable expertise, networks, and strategic guidance to the companies they invest in. This is influencing the dynamics and future direction of the cosmetics industry.

Gain Access to Top Cosmetics Innovations & Industry Trends with the Discovery Platform

The cosmetics industry continues to thrive, demonstrating robust growth and innovation, and enhancing global beauty standards and consumer experiences. Here are a few trends at a glance:

- Organic cosmetics are a significant part of the cosmetics industry, with 1100+ companies adopting this sustainable approach. These companies employ over 45300 workers, and the sector has seen an addition of 2700 new employees in the past year. This trend is noticeable and is also growing at a steady pace, as shown by an annual trend growth rate of 8.46%.

- Medical cosmetics combine beauty with health, with 1700+ companies currently active in this area. This trend employs a large workforce of 96200, with 5300 new hires in the last year. This indicates industry growth and development. The annual trend growth rate is at 9.7%, which shows a consistent and increasing interest in cosmetics that enhance therapeutic benefits. This trend serves a demographic that values skincare and cosmetic products with medical-grade standards.

- Personalized cosmetics respond to the desire for custom-made beauty solutions, with 148 companies pioneering this trend. The sector employs 3500 individuals and has added over 360 new employees in the last year. This indicates a positive growth trajectory with an annual trend growth rate of 7.26%. Personalization in cosmetics reflects the industry’s initiative to provide consumers with products specifically designed to meet their unique preferences and needs.

5 Top Examples from 2500+ Innovative Cosmetics Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

Capsoil leverages Nanometric Powder

Israeli startup Capsoil develops a unique process to convert oil and other food-grade materials into nanometric powders. This patented technique transforms oil into powder which results in uniform particle sizes that boost solubility and absorption in a variety of products. The process accommodates up to 50% oil content in powder form and preserves its original characteristics. The nanometric powders have several benefits, including increased bioavailability, stability, and shelf life. These powders have applications in the formulation of skin care products, such as retinol for better absorption and hyaluronic acid for anti-aging purposes.

The Age Tech develops Epigenetic-based Anti-aging Serum

Swiss startup The Age Tech develops innovative anti-aging cosmetic solutions. The startup’s serum, created with Swiss precision, combines various active ingredients for skincare. The serum provides several benefits, including reduced wrinkles and improved skin firmness. The formulation reprograms skin cells to display properties similar to younger skin using advanced pharmaceutical methods. The serum is designed for easy application and is suitable for daily use to combat aging signs efficiently.

Trend Casquette offers Cosmetics RaaS

Japanese startup Trend Casquette provides a Retail as a Service (RaaS) platform with a focus on cosmetics and daily goods. The platform features Tierland, a store that allows consumers to engage with online-exclusive D2C brands and new beauty products. The Tierland experience includes esthetic treatments and skin diagnosis machines. Customers avail of these services by using in-store products and filling out surveys. The store hosts daily events that involve collaborations with anime and celebrities, which enhances consumer engagement.

Spectrally enables Real-time Quality Control

Polish startup Spectrally focuses on real-time optical monitoring of chemicals and offers analytical capabilities for smart manufacturing in the cosmetics industry. Its product, Spectrally X1, includes a carousel that holds up to 10 glass vials, aiding in sample management and diagnostics. The device is equipped with a 10.8-inch touchscreen that provides easy access and control over diagnostic functions. Its connector layouts facilitate integration with other laboratory tools and contribute to operational efficiency. The device also features a safety flap to prevent accidental interference during use and maintains safety standards.

Worldover enhances Product Lifecycle Management

UK startup Worldover automates product lifecycle management and compliance for the cosmetics industry. Its platform, Formulation Designer, includes a database that covers global regulations and certifications. The platform is equipped with AI tools that automate the import of ingredients and compliance checks. This technology keeps all formulations in line with international standards and enables users to manage and track various product versions effectively. The system is designed to foster collaboration and simplify the formulation process across teams.

Gain Cosmetics Industry Data, Trends, Startups, or Technologies

The 2024 Cosmetics Report shows an industry with promising innovations focused on sustainability and health taking center stage. Growing trends include the use of biotechnology in stem cell cosmetics and AI-driven personalization in beauty products. These advancements improve the effectiveness of cosmetics and offer a more personalized consumer journey. Contact us to explore all 2500+ startups and scaleups, as well as all industry trends impacting cosmetics companies.