The 2024 Dairy Industry Report provides a detailed analysis of the sector’s current landscape, highlighting trends, technological advancement, and financial metrics. As the industry navigates through challenges such as sustainability demands and market fluctuations, this report offers insights into how companies adapt and thrive. It highlights topics from livestock management to practices like milking robots to give an overview of the opportunities and challenges faced by the industry.

This report was last updated in July 2024.

This dairy outlook serves as a reference for stakeholders within the industry, investors, policymakers, and economic analysts, providing a snapshot of the industry’s health to map its trajectory for innovation and growth in the coming years.

StartUs Insights Dairy Industry Report 2024

- Executive Summary

- Introduction to the Dairy Industry Report 2024

- What data is used in this Dairy Industry Report?

- Snapshot of the Global Dairy Industry

- Funding Landscape in the Dairy Industry

- Who is Investing in the Dairy Industry?

- Emerging Trends in the Dairy Industry

- 5 Dairy Startups impacting the Industry

Executive Summary: Dairy Industry Outlook 2024

This report is created using data obtained from the Big Data and AI-powered StartUs Insights Discovery Platform, covering more than 4.7 million global companies, as well as 20K+ technologies and emerging trends. We also analyzed a sample of 700+ dairy startups developing innovative solutions to present five examples from emerging dairy industry trends.

- Industry Growth Overview: The dairy market report shows that the industry includes about 13700 companies and showed an annual growth rate of about 11.89%.

- Manpower & Employment Growth: This sector involves a workforce of over 246.7K across various domains and reflects a total increase of over 9100 employees.

- Patents & Grants: The industry maintains an innovation trajectory with over 2680 patents and more than 130 grants. It signals the ongoing developments and the support for the newest advances.

- Global Footprint: The dairy industry’s global reach spans major country hubs across the US, India, UK, New Zealand, and Canada, alongside leading city hubs like Pune, Singapore, New Delhi, Bangalore, and Melbourne.

- Investment Landscape: Investment activity highlights over 310 funding rounds and an average investment value of USD 120.6 million per round.

- Top Investors: Investors like KKR, TPG, Definity Financial, and more invested collectively over USD 1.1 billion.

- Startup Ecosystem: Top startups in this industry include DairyLife (filtration membrane technology), Future Cow (alternative proteins), Dvara E-Dairy (dairy intelligence platform), Eden Brew (precision fermentation), and BIOSMART Milk Solutions (ruminant productivity).

- Recommendations for Stakeholders: Entrepreneurs should develop scalable, environmentally conscious dairy substitutes and enhance supply chain effectiveness. Companies need to implement sustainable production techniques, prioritize animal welfare, and work towards minimizing their environmental impact. Investors are encouraged to support sustainable farming practices and technology-based dairy solutions.

Explore the Data-driven Dairy Industry Report for 2024

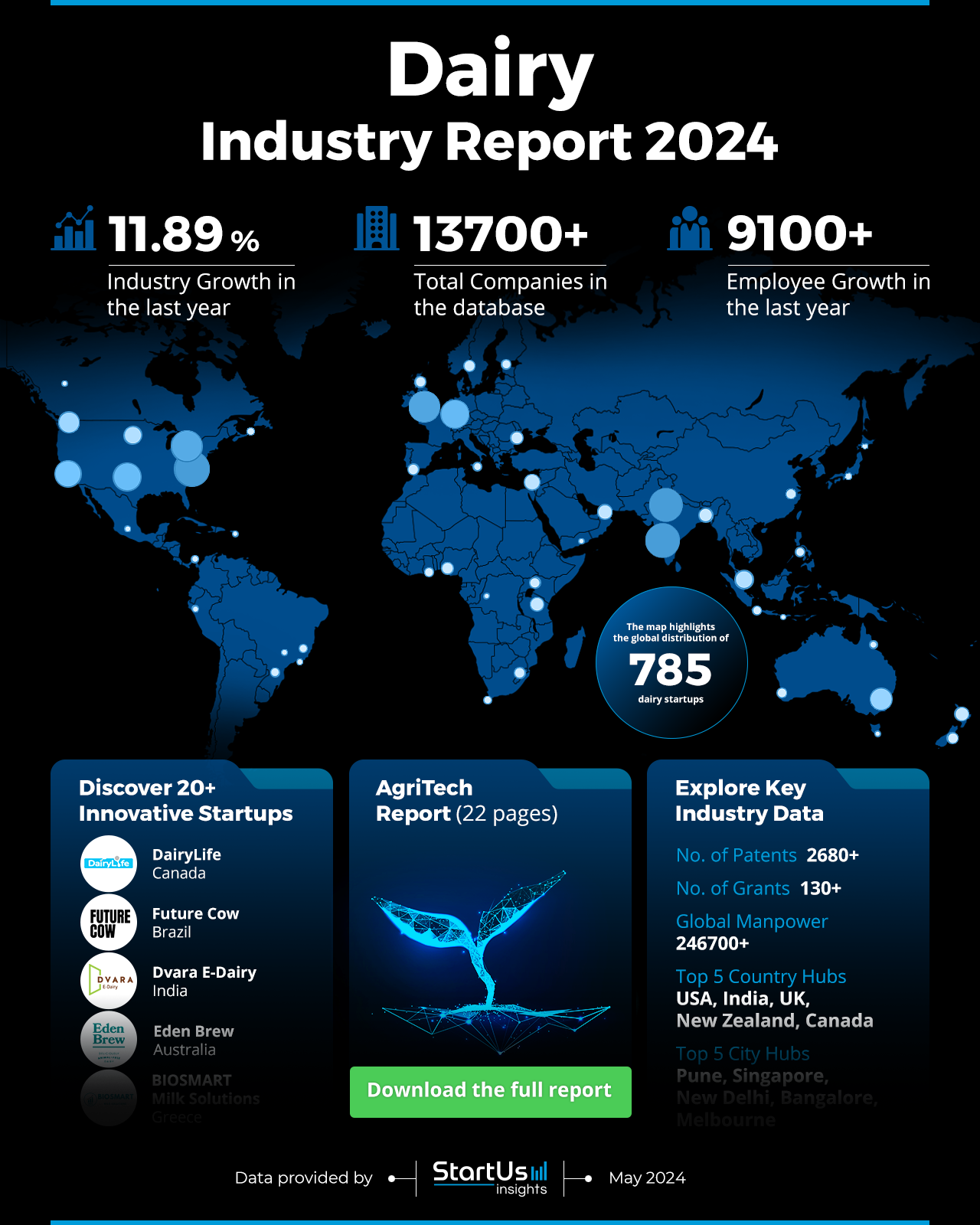

The Dairy Report 2024 uses data from the Discovery Platform and encapsulates the key metrics that underline the sector’s dynamic growth and innovation. The heatmap above highlights key metrics and trends. It includes information on over 13700 companies and 785 startups, showcasing the expansive nature of the industry.

Over the last year, industry growth stood at 11.89%. Our database further includes more than 2680 patents and over 130 grants. Globally, the companies from this industry employ over 246700 people, with an increase of more than 9100 employees in the past year.

The dairy heatmap also identifies the US, India, UK, New Zealand, and Canada as the top five country hubs. Pune, Singapore, New Delhi, Bangalore, and Melbourne emerge as the leading city hubs.

What data is used to create this dairy industry report?

Based on the data provided by our Discovery Platform, we observe that the dairy industry ranks among the top 5% in the following categories relative to all 20K topics in our database. These categories provide a comprehensive overview of the industry’s key metrics and inform the short-term future direction of the industry.

- News Coverage & Publications: The dairy industry showcased itself in 1500+ publications in the last year.

- Funding Rounds: It involved more than 310 funding rounds.

- Manpower: With over 246.7K workers, the dairy industry added more than 9.1K new employees in the last year alone.

- Patents: It holds over 2680 patents.

- Grants: The industry received support with more than 130 grants awarded.

- Yearly Global Search Growth: The yearly global search growth rate for the dairy industry stands at 77.82%.

A Snapshot of the Global Dairy Industry

The dairy market report reflects growth and activity across various metrics. It highlights that the industry employs 246.7 thousand workers, with an addition of 9000+ employees over the last year. This indicates an expansion in the workforce capacity. Further, the sector demonstrates its scope and market presence by including 13700+ companies operating within the industry.

Explore the Funding Landscape of the Dairy Industry

The average investment value of the sector stands at USD 120.6 million per funding round. In addition, the data reveals that more than 180 investors actively participated, with over 310 funding rounds closed. This financial activity further illustrates the investments in more than 145 companies and points to a spread of funding across the sector. These figures collectively portray the industry’s capital flow.

Who is Investing in the Dairy Industry?

The combined investment value by the top investors in the industry surpasses USD 1.1 billion.

- KKR allocates USD 254 million to at least 1 company.

- TPG follows with an investment of USD 168.3 million, also in a minimum of 1 company.

- Definity Financial committed USD 162.8 million to a minimum of 1 company.

- McDougall Insurance and Financial invested USD 156 million in at least 1 company.

- CITIC Private Equity places its bet by investing USD 73 million in at least 1 company.

- Growtheum Capital Partners contributes USD 70 million to at least 1 company.

- Regions Bank offers USD 60 million to a minimum of 1 company.

- Square Peg invests USD 58.3 million in at least a single company.

- Emtek also follows by investing USD 58.3 million in a minimum of 1 company.

- Nuveen Investments rounds out the investors list with a USD 55.6 million investment in a minimum of 1 company.

Access Top Dairy Innovations & Trends with the Discovery Platform

The following are the key trends in the dairy industry along with the firmographic insights:

- The livestock management sector encompasses 11151 companies and supports a workforce of 1.4 million employees. Over the past year, this sector welcomed 51200 new employees. It indicated an influx of talent despite a slight annual trend growth rate decline of -0.22%.

- Animal feed manufacturing includes 763 companies and 211600 employees. In the last year, it saw an addition of 8700 new employees and reflected an annual trend growth rate of 2.99%.

- The milking robot sector, though smaller with 56 companies, demonstrates an annual growth rate of 7.45%. It employs 15700 individuals, with 224 new employees added last year.

5 Top Examples from 700+ Innovative Dairy Startups

The five innovative startups showcased below are picked based on data including the trend they operate within and their relevance, founding year, funding status, and more. Book a demo to find promising startups, emerging trends, or industry data specific to your company’s needs and objectives.

DairyLife develops Filtration Membrane Technology

Canadian startup DairyLife enhances milk processing with a membrane filtration technology. This technology uses a special silver-based coating that alters the surface chemistry of the filtration membranes to increase the shelf life of dairy products. By integrating corona air plasma and engineered silver nanoparticles, DairyLife’s technology reduces bacterial activity during filtration. This process doubles the shelf life of dairy products and saves increased preservation time costs. The startup caters to dairy farms and processing plants.

Future Cow provides Alternative Proteins

Brazilian startup Future Cow produces animal-free dairy protein using precision fermentation. By employing yeast, fungi, or bacteria encoded with cow DNA sequences, the startup creates real dairy proteins without using animals. The fermentation process mimics traditional methods used in beer and wine production. After fermentation, these proteins undergo separation, precipitation, and drying to form a versatile base for dairy products like ice cream and cheese. This method reduces environmental impacts, greenhouse gas emissions, water use, and energy from non-renewable sources. Moreover, this approach ensures a lactose-free, cholesterol-free, hormone-free, and antibiotic-free product and offers a cruelty-free alternative to conventional dairy.

Dvara E-Dairy creates a Dairy Intelligence Platform

Indian startup Dvara E-Dairy provides cattle loan finance and insurance to small and marginal dairy farmers. Its platform Dairy Intelligence Platform (DIP) leverages AI across banking, insurance, and e-commerce for the dairy industry. It includes know your customer (KYC) for farmers and know your cattle (KYC) for cattle, uniquely identifying each animal based on muzzle identity, health status, and estimated cash flow. The startup’s Surabhi Score enables accurate and scalable cattle underwriting. Dvara E-Dairy provides access to financial and value chain markets and reduces operational costs.

Eden Brew offers Precision Fermentation

Australian startup Eden Brew produces sustainable and nutritious animal-free dairy products using precision fermentation. This startup utilizes gene mapping techniques to replicate cow milk genes and create dairy proteins that match the nutrition and sensory experience of traditional milk. The fermentation process involves natural yeast without animal involvement. Moreover, the startup uses micelles to transport and release nutrients in the products. Additionally, the products undergo heat, pasteurization, and ultra-heat treatment (UHT) processing while leveraging existing dairy infrastructure for production.

BIOSMART Milk Solutions enhances Ruminant Productivity

Greek startup BIOSMART Milk Solutions develops a supplementary compound feed that regulates rumen microbiota to enhance dairy production and animal health. This feed increases lactic acid utilization into propionate and enhances propionic short-chain fatty acids (SCFA) production. It maintains acetate/propionate/butyrate ratios to support higher milk yields. By redirecting hydrogen from methane-generating archaea to propionic SCFA production, the technology increases propionate levels, a precursor for blood glucose in gluconeogenesis. Thus, it improves overall dairy productivity and health. The supplementary feed also features immunizing properties to mitigate energy deficits and decrease risks of conditions like mastitis and endometritis.

Gain Comprehensive Insights into Dairy Trends, Startups, or Technologies

The 2024 Dairy Industry Report highlights a sector despite facing challenges such as environmental concerns and economic fluctuations, advances through technological integration, and sustainable practices. The adoption of automation, such as milking robots, and the expansion of feed manufacturing, demonstrates improvement in productivity and sustainability. Get in touch to explore all 700+ startups and scaleups, as well as all industry trends impacting dairy companies.