Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. This time, you get to discover five hand-picked startups developing data management solutions for FinTech companies.

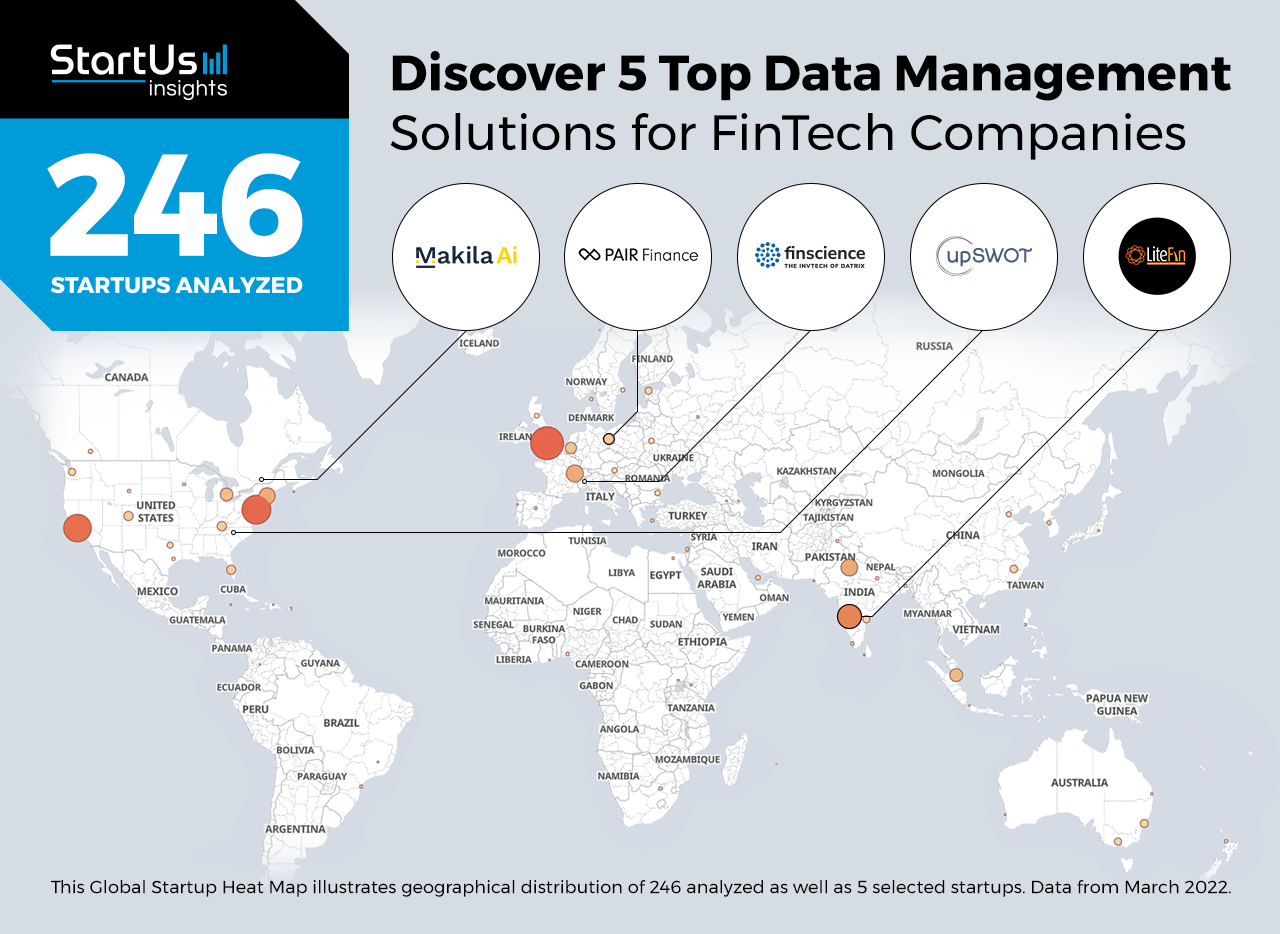

Out of 246, the Global Startup Heat Map highlights 5 Top Data Management Solutions for FinTech Companies

The insights of this data-driven analysis are derived from the Big Data & Artificial Intelligence (AI)-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & relevant startups within a specific field in just a few clicks.

The Global Startup Heat Map below reveals the distribution of the 246 exemplary startups & scaleups we analyzed for this research. Further, it highlights five startups that we hand-picked based on criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 241 data management solutions for FinTechs, get in touch with us.

LiteFin simplifies Financial Data Acquisition

Founding Year: 2020

Location: Hyderabad, India

Partner with LiteFin for Multi-Source Finance Data Collection

LiteFin is an Indian startup that offers an application programming interface (API)-based data acquisition solution. Businesses integrate the startup’s API into in-house or other software solutions to collect data from multiple sources. It enables fintech companies, banks, and personal finance management providers to source financial data such as savings, credit cards, transactions, and tax data through a single tool, facilitating data management.

PAIR Finance offers AI-based Claims Management

Founding Year: 2016

Location: Berlin, Germany

Funding: USD 9,1 M

Reach out to PAIR Finance for Customer Behavior Analytics

PAIR Finance is a German startup that develops an automated and data-driven claims management platform. The startup’s AI-based debt collection utilizes reinforcement learning to assess the characteristics and behavior patterns of defaulting customers. The platform analyzes customer data from clients, third-party data as well as data from social media platforms, and behavioral data to offer a personalized action plan. This solution allows businesses to recover lost revenue more easily.

Makila enables Automated Financial Data Modeling

Founding Year: 2018

Location: Montreal, Canada

Collaborate with Makila for Financial Planning & Analysis

Canadian startup Makila builds an AI-based cloud solution for financial data management. It allows the distribution of data integration tasks over multiple platforms, enables real-time data quality monitoring, and optimizes enterprise data management to make operations and semantic referencing easier. Makila allows banks and non-banking financial companies (NBFC) to automate data collection and modeling.

FinScience provides Alternative Finance Market Data

Founding Year: 2017

Location: Milan, Italy

Funding: USD 2,2 M

Work with FinScience for Portfolio Optimization

FinScience is an Italian startup that enables financial institutions to collect and extract vital information regarding companies and markets to enhance their investment portfolios. The startup’s AI platform uses proprietary algorithms to collect and analyze large amounts of unstructured alternative data. It is useful for institutional and private investors, as well as enterprises, to develop long-term investing models and strategies that maximize returns.

UpSWOT facilitates Sales Data Management

Founding Year: 2018

Location: Charlotte, USA

Funding: USD 28 000

Innovate with UpSWOT for Financial Data Verification

US-based startup UpSWOT builds a platform that allows banks to integrate data from different sources. Its automated, plug-and-play platform provides banks with real-time insights into the performance trends of their business clients. The platform also offers high-value data to relationship managers on the back end, allowing them to upsell products and services while developing more meaningful and long-lasting connections with businesses.

Discover more FinTech Startups

FinTech startups such as the examples highlighted in this report focus on financial process automation, open banking, and multi-source data acquisition. While all of these technologies play a major role in advancing the financial services industry, they only represent the tip of the iceberg. To explore financial technologies in more detail, simply let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.