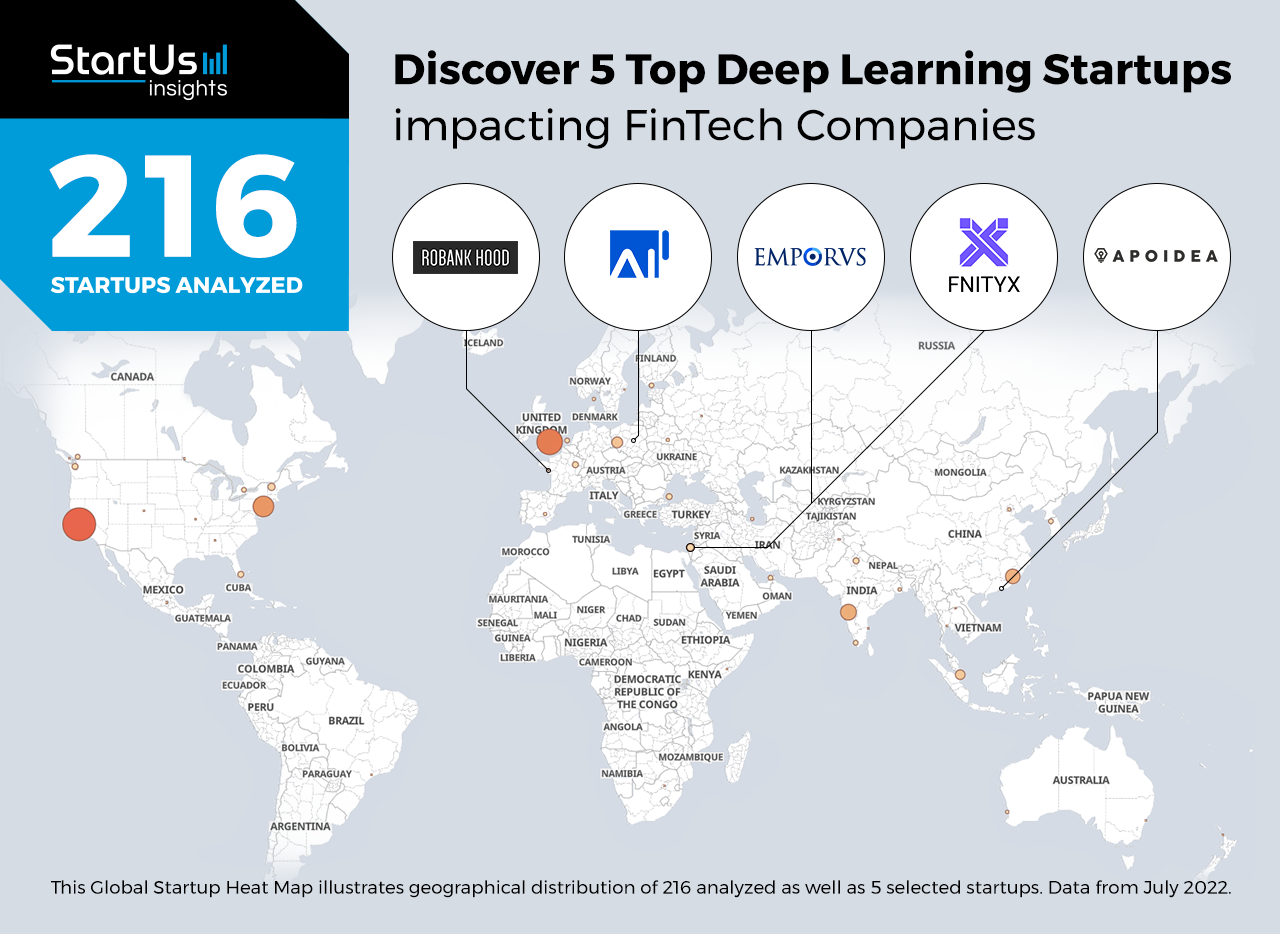

Out of 216, the Global Startup Heat Map highlights 5 Top Deep Learning Startups impacting FinTech Companies

Startups such as the examples highlighted in this report focus on automated investing, crypto trading, financial risk management, and stock market analytics. While all of these technologies play a significant role in advancing FinTech, they only represent the tip of the iceberg. This time, you get to discover five hand-picked deep learning startups impacting FinTech companies.

The Global Startup Heat Map below reveals the geographical distribution of 216 exemplary startups & scaleups we analyzed for this research. Further, it highlights five FinTech startups that we hand-picked based on scouting criteria such as founding year, location, funding raised, and more. You get to explore the solutions of these five startups & scaleups in this report. For insights on the other 211 deep learning solutions impacting FinTech companies, get in touch with us.

Emporus provides Investment Decision Analysis

Founding Year: 2019

Location: Tel Aviv, Israel

Partner with Emporus for Investment Portfolio Analysis

Israeli startup Emporus develops a platform for professional stock market investing. It uses proprietary deep learning algorithms to perform customer portfolio analysis and predict risks. The platform also provides alerts for unexpected stock activities, runs simulations of scenarios, and more. Through this solution, the startup enables retail and commercial investors to quickly analyze stock data from multiple sources and enable data-driven investing.

Robank Hood aids Cryptocurrency Trading

Founding Year: 2018

Location: Nice, France

Collaborate with Robank Hood for Trading Decision Support

French startup Robank Hood creates AI-based decision support software for crypto trading. It uses pair trading strategies and a proprietary artificial intelligence (AI), ANA, to facilitate trading decisions. The software connects to the Binance trading platform to provide deep learning assistance during the user’s trading sessions. Additionally, ANA features autonomous self-learning, trade management, and trading risk management. This allows crypto traders to quickly analyze market trends and minimize risks.

AI Investments offers Financial Portfolio Management

Founding Year: 2018

Location: Warsaw, Poland

Use this solution for Financial Risk Assessment

Polish startup AI Investments provides a platform to optimize financial portfolio management. It leverages reinforced learning models and neural networks, such as ResNet, Densenet, LSMT, and GAN autoencoders, for risk control and position sizing. Moreover, it uses neural networks to generate transaction signals based on historical price data, seasonality, volatility, and chart pattern recognition. Through these transaction signals, the platform provides traders and investors with optimal investment and trading strategies.

FinityX enables Autonomous Investment Decision-Making

Founding Year: 2018

Location: Tel Aviv, Israel

Work with FinityX for Automated Investing

Israeli startup FinityX offers a deep learning-based autonomous research platform. It combines AI and automatically generated deep learning algorithms for investment decisions. The platform’s components include database warehousing, automated data quality control, and cloud-based deep learning with automatic upload and model training. Through these, the platform allows investors to either buy auto-generated investment strategies or use the platform to build their own portfolios.

Apoidea advances Financial Information Extraction

Founding Year: 2017

Location: Hong Kong

Innovate with Apoidea for Financial Reporting

Hong Kong-based startup Apoidea develops a solution to extract insights from financial texts. It leverages natural language processing (NLP) and contains semantic embedding with pre-trained language models, recognition of language patterns, and knowledge structures. The solution also analyzes the structure of tables and charts within documents. This enables stock traders and investors to quickly extract financial statements from documents, generate key insights from annual reports, and generate automated market summaries.

Where is this Data from & how to Discover More FinTech Startups?

Staying ahead of the technology curve means strengthening your competitive advantage. That is why we give you data-driven innovation insights into the financial services industry. The insights of this data-driven analysis are derived from our Big Data & AI-powered StartUs Insights Discovery Platform, covering 2 093 000+ startups & scaleups globally. The platform gives you an exhaustive overview of emerging technologies & lets you scout relevant startups within a specific field in just a few clicks. To explore financial technologies in more detail, let us look into your areas of interest. For a more general overview, download our free FinTech Innovation Report to save your time and improve strategic decision-making.